Arthur Hayes' new article: The market will reward altcoins with products, and Bitcoin will surpass $1 million by 2028

TechFlow Selected TechFlow Selected

Arthur Hayes' new article: The market will reward altcoins with products, and Bitcoin will surpass $1 million by 2028

Trend is your friend.

Author: Arthur Hayes

Translation: TechFlow

(The views expressed in this article are those of the author and should not be taken as investment advice, nor should they be interpreted as recommendations or guidance for trading.)

Surprisingly, singer Lizzo, an advocate of "fat positivity," shares many similarities with the economic imbalances of Pax Americana. Don't get me wrong—whether or not you believe “plump bodies” constitute a form of aesthetics is irrelevant. However, while the metabolic issues triggered by obesity may sometimes appear "beautiful," they remain ultimately fatal. Similarly, although the U.S. economy benefits some, extreme societal disharmony could eventually spark revolution.

The waistlines and economic conditions during the Pax Americana era were not always so unbalanced. In the mid-20th century, Americans were neither generally obese nor economically unbalanced. But over time, problems worsened.

The food system was hijacked by Big Ag, which promoted its processed, lab-made "delicious" but nutritionally deficient foods through fabricated nutritional guidelines. As Americans consumed these nutrient-poor foods, they became increasingly obese and developed chronic diseases, while Big Pharma stepped in to profit by offering drugs that treated only the symptoms—not the root causes—of these metabolic disorders (like diabetes). Rather than confronting corporate control over the food supply, public discourse shifted toward narratives like "fat positivity" or "fat is beautiful," telling obese individuals it wasn’t the corrupt system’s fault, but rather something to take pride in regarding their “beautiful figures.” Thus, stars like Lizzo were elevated to icon status; despite her talent as a singer, the message she promotes endorses a lifestyle that could lead to premature death. Lizzo represents the current state of obesity—one that proves highly profitable for a few corporate giants.

The U.S. economy has similarly been captured by the "printing press." Before the Federal Reserve's creation in 1913, financial panics would erupt whenever credit expansion outpaced cash flow support. Some bad companies—and even some good ones—would go bankrupt, resetting the economy, clearing credit, and revitalizing the system. Yet since the Fed’s inception, every credit bubble has been met with massive money printing. Since the Great Depression of the 1930s, U.S. economic imbalances have never truly been corrected.

This is precisely why trade and financial capital imbalances persist under Pax Americana—not because of high or low tariff policies (Daniel Oliver wrote an excellent piece explaining how excess credit is the true source of trade imbalance, making tariffs a red herring). The status quo creates inequality, despair, and addiction among ordinary people, while those who control stocks, bonds, and real estate—the so-called "masters of the universe"—enjoy unprecedented wealth in human history.

Not all hope is lost; change remains possible—but there are hard ways and easy ways.

For decades, the pharmaceutical industry has marketed miracle drugs promising to melt fat away. Remember Fen-Phen? None actually worked. So the only viable solution is complex, unpopular, expensive, and less profitable: go to the gym, reduce consumption of cheap processed foods, switch to fresh organic produce. Even then, these measures may still fall short, because once someone enters an "obese state," the body adjusts hunger and metabolism to maintain that state. According to some scientists, it might take up to seven years to reprogram metabolism to support a leaner physique.

Then came Denmark’s "easy button": GLP-1 agonists—drugs originally developed for diabetes—were found to reduce cravings not just for food, but also for addictive substances like alcohol and nicotine. Medications like Ozempic, Wegovy, and Mounjaro rapidly led to significant weight loss. These drugs are now considered safe enough that some believe many formerly obese individuals may need to take them for life. Thanks to modern medicine, if you can afford it, these injections or pills offer a simple “off switch” for obesity.

Even Lizzo ultimately opted for these "miracle slimming drugs" to avoid preventable metabolic disease and early death. Bravo! Though she probably won’t be invited to campaign for Kamala Harris in 2028…

There are painful and painless solutions to America's trade imbalance. For American politicians, implementing policies that cause pain or discomfort to swing voters undoubtedly leads to electoral defeat.

Previously, the Trump administration tried the difficult and painful route, quickly realizing median voters couldn’t tolerate waiting ten years for domestically produced goods to become affordable again, nor empty store shelves due to American manufacturers’ inability to replace the vast volume of goods previously supplied by China.

This discontent reached congressional representatives and senators, especially in Republican districts, forcing the Trump team to back down and seek alternative paths to rebalancing. The rollback of maximum tariffs is already underway—evidenced by the recent announcement that U.S.-China tariffs will be bilaterally reduced to around 10% within 90 days.

A successful general knows when to retreat from a flawed strategy and still win the war.

Another politically easier method for U.S. trade rebalancing involves targeting capital account surpluses via various forms of capital controls. These controls would effectively tax foreigners purchasing and holding U.S. financial assets. If high taxes deter foreign purchases of U.S. financial assets, they’d also stop flooding America with cheap goods. If foreigners continue selling cheap goods while buying assets, the tax revenue could be returned to median voters via stimulus checks or lower income taxes. This way, Trump can claim he cracked down on "evil foreigners" while delivering lower taxes to Americans. Such a strategy wins midterm and presidential elections and achieves the same goal: reducing the flood of cheap foreign goods into U.S. consumer markets and reshoring manufacturing capacity.

The ultimate consequence of Trump shifting from hard solutions to easy ones is that foreign capital will gradually, then suddenly, flee U.S. stocks, bonds, and real estate. Subsequently, the dollar will depreciate against currencies of surplus nations. The problem facing the U.S.—especially Treasury Secretary Bessent—is who will finance the exponentially growing U.S. national debt if foreigners shift from net buyers to net sellers. Meanwhile, surplus-country governments and corporations face the question of where to "store" their surpluses if they keep running them. The answer for the former is printing money; for the latter, it’s buying gold and Bitcoin.

This article focuses on the mathematical identity of trade, how capital controls operate—the "boiling frog" theory—how such taxes affect capital flows in surplus countries, how Bessent prints money both explicitly and implicitly to fund the Treasury market, and why Bitcoin will emerge as the top-performing asset during this global monetary transition.

Trade Accounting Identity and Geopolitical Issues

Let’s use this satirical example to illustrate the relationship between trade accounts and capital accounts.

It’s 2025. Trump’s re-election reaffirms boys' right to play with action toys again. Mattel is relaunching He-Man action figures complete with plastic AR-15 rifles. Masculinity is back, baby… And the brand ambassador? Andrew Tate! Mattel needs to produce one million units quickly at the lowest cost. With nearly no U.S. manufacturing base left, Mattel must buy these toys from Chinese factories.

Mr. Zhou owns a factory in Guangdong province that manufactures cheap plastic toys. He agrees to Mattel’s terms, including payment in U.S. dollars. Mattel wires the money to Mr. Zhou, and a month later, the toys arrive. Wow, fast shipping.

Mr. Zhou’s profit margin is 1%. Competition in China is fierce. Given his large order volume—from Mattel and similar clients—his total revenue reaches $1 billion in export earnings.

Now Mr. Zhou must decide what to do with these dollars. He doesn’t want to bring them back to China by converting them into yuan, because given low yields on government and corporate bonds, yuan offers no productive use. Plus, banks pay almost zero interest on deposits.

Mr. Zhou dislikes all the anti-China rhetoric—he felt unwelcome during his last U.S. visit. His daughter attends UCLA and gets side-eye for driving a new Phantom convertible, while average Americans take the LA Metro—or rather, Uber—to class. Even though U.S. Treasury yields are among the highest globally for sovereign debt, he’d prefer not to buy them if possible. Mr. Zhou likes Japan, whose long-term government bond yields are much higher than before. He asks his banker to help him purchase Japanese Government Bonds (JGBs). The banker explains Japan doesn’t want foreigners buying large amounts of its debt, as it would push up the yen’s value, undermining export competitiveness. If Mr. Zhou sells dollars to buy yen for JGBs, the yen would appreciate.

The JGB market is the only one large enough to absorb his surplus, yet Japan doesn’t want foreigners pushing up its currency. Mr. Zhou accepts reality and reluctantly uses his dollar export earnings to buy U.S. Treasuries.

What impact does this have on America’s trade and capital accounts?

U.S. Trade Account:

-

Trade deficit: $1 billion

-

Mr. Zhou’s bank account: $1 billion in cash

Purchase:

$1 billion in Treasury bonds.

Since this surplus isn’t repatriated to China, Japan, or elsewhere, but instead recycled into U.S. Treasuries:

U.S. Capital Account:

-

Capital account surplus: $1 billion

The moral of this story: if other countries refuse to let their currencies appreciate, trade deficits automatically become capital account surpluses. This is today’s reality: apart from the U.S., no market is big enough or willing to absorb global trade imbalances. That’s why the dollar remains strong even as the U.S. issues trillions annually to fund its government. Incidentally, years ago, China asked Japan whether it could buy JGBs. Japan replied: “No, unless you let us buy CGBs (Chinese Government Bonds).” China responded: “No, you can’t buy CGBs.” So both countries continue dumping their surplus capital into U.S. financial assets.

In the current global trade landscape, any discussion about the RMB, yen, or euro replacing the dollar as the world’s reserve currency is nonsense—unless China, Japan, or the EU open their capital accounts and their financial markets grow large enough to absorb surplus nations’ incomes.

Next, Trump announces the U.S. must revitalize manufacturing and reverse the trade deficit. His current tool of choice is tariffs. But let’s analyze why tariffs are politically unfeasible.

Take Mattel, selling cheap toy dolls to little boys. Most families live paycheck to paycheck, lacking even $1,000 in emergency savings. If the doll price rises from $10 to $20 due to tariffs, little Jonny can’t afford it. Without tariffs, Mattel sells the doll for $10 thanks to low-cost Chinese production. Now, Trump imposes a 100% tariff on Chinese goods. Mr. Zhou can’t absorb the tariff cost, so passes it to Mattel. With only a 10% profit margin, Mattel passes the full cost to consumers.

The result? The doll price jumps to $20. Too expensive for most families, who choose not to buy. Little Jonny doesn’t understand why his parents won’t buy him his favorite toy gunfighter. His parents drive Uber and deliver food, barely scraping by—and now Trump made toys more expensive, so the kid throws tantrums at home. At the next election, will the parents vote Republican or Democrat?

Before the election, they might diagnose Jonny with ADHD and medicate him to keep him quiet. Meanwhile, Democrats campaign on “making toys and other goods affordable again,” advocating a return to “free trade” policies allowing China to keep dumping cheap goods into the U.S. market. Democrats will claim all smart economists agree “free trade” lets Americans enjoy cheap goods and maintain lifestyles, while Trump and his advisors are ignorant fools. If trends continue, Democrats could make a comeback in the 2026 midterms.

Can Mr. Zhou bypass tariffs by moving production to lower-tariff countries? Of course.

Since the early 2000s, Mr. Zhou has built wealth by investing in factories across Mexico, Vietnam, and Thailand. He begins producing dolls there and shipping them to the U.S. Effective tariffs drop, allowing him to sell the doll for $12 instead of $20. Parents can accept spending $2 extra to avoid tantrums—and spare their child early dependence on prescription drugs.

Because Trump hasn’t imposed uniform tariffs across all markets, but instead pursued fragmented bilateral deals, savvy manufacturers like Mr. Zhou can always find low-tariff entry points into the U.S. The Trump team knows this well, but for geopolitical reasons—such as whether a country hosts U.S. military bases, supplies key goods to America, or sends troops to fight in America’s prolonged wars—they can’t fully shut out allies, or those countries might withdraw cooperation from the “American world police.”

Without uniform tariffs, certain nations or regions will always serve as “transshipment arbitrage points.” Just as China accesses advanced semiconductors and AI chips via TSMC and NVIDIA, Chinese goods—or factories owned by Chinese entities—can circumvent high tariffs on direct exports to the U.S.

In the end, tariffs fail to meaningfully reduce the U.S. trade deficit. The American public won’t wait five to ten years for manufacturing to return and shelves to refill with affordable goods. And if the trade deficit doesn’t shrink significantly within the next 12 months, Trump’s policy will merely exacerbate goods inflation without delivering tangible benefits to struggling citizens.

Ultimately, the issue isn’t tariffs themselves, but that for tariffs to work, every country must face identical rates—no exceptions or exemptions. But this is impossible in practice, especially when surplus nations aren’t just “evil China,” but also staunch allies like Japan and Germany. Expecting Japan to continue constraining China and Russia at sea, host tens of thousands of U.S. troops and over 120 military bases, while simultaneously having its manufacturing crippled by tariffs, is absurd.

Therefore, this 90-day pause on tariffs will likely become permanent suspension.

Tax Me, Baby

If attacking the trade deficit faces heavy domestic political and geopolitical hurdles, what about targeting the capital account surplus? Is there a way to make foreign investors less eager to accumulate U.S. financial assets? Yes. But this method may seem dirty and distasteful to those deeply devoted to free-market ideals—it’s capital controls. Specifically, I don’t mean banning or severely restricting foreign ownership of financial assets (which most countries do), but taxing foreign holdings of such assets. Foreigners can still hold most U.S. financial assets at any scale, but their holdings will be subject to an ongoing tax based on value.

The tax revenue will be returned to average Americans via reduced income taxes or other government subsidies, ensuring voter support. The outcome could be: foreigners continue generating surpluses by selling goods to the U.S., but their profits get taxed; or they reduce exports to the U.S. to avoid taxation; or they shift toward non-national financial assets like gold or Bitcoin.

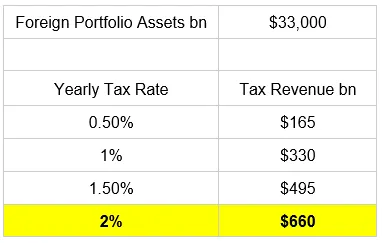

There are multiple ways to implement such a tax on foreign capital. To simplify illustration, assume a flat 2% annual tax on all foreign capital. We’ll focus primarily on Foreign Portfolio Assets—liquid stocks, bonds, and real estate—not illiquid assets like foreign automakers’ factories in Ohio.

Currently, the total value of foreign portfolio assets is approximately $33 trillion. Assuming constant prices and no capital flight due to taxes, here’s the annual tax yield:

Note: In 2022, the bottom 90% of U.S. income earners paid roughly $600 billion in income taxes. Thus, Trump could entirely eliminate income taxes for the vast majority of voters simply by imposing a 2% capital tax on foreign-held stocks, bonds, and real estate—a highly attractive political strategy.

Now compare capital taxes vs. tariffs:

Enforcement capability:

The U.S. Treasury has full control over the banking system and financial markets. While they may not know the exact owner of every asset, they can distinguish between U.S. and foreign entities. Therefore, taxing only non-U.S. entities’ holdings of stocks, bonds, and real estate is relatively straightforward for financial institutions or local governments.

In contrast, collecting tariffs is far more complex, as accurately tracing each product’s origin or value-added stage in the supply chain is difficult—making tariff policies easier to exploit.

Uniform rate: One tax to rule them all

The purpose of a capital tax is to eliminate net capital account surpluses—and this requires only one uniform rate. If foreigners don’t want to pay the tax, they shouldn’t buy U.S. financial assets. They can reinvest export earnings domestically. This tax won’t immediately stop exporters from selling cheap goods to the U.S., so the impact on trade volumes won’t be immediate.

While capital controls generate revenue usable for cutting income taxes, do they help bring manufacturing back to America?

Assume exporters don’t want to pay 2% annually to hold U.S. financial assets. Believing post-tax expected returns are too low, they turn to domestic investment opportunities. They sell assets, receive dollars, then convert dollars into local currency. The result: the dollar weakens, and surplus-country currencies (like the yen) strengthen. Over time, the dollar gradually depreciates, while surplus currencies rise sharply. Eventually, even without tariffs, Japanese-made goods priced in dollars become more expensive—that’s the point.

American-made goods become cheaper, while foreign goods grow more expensive over time. This process may take decades, but either way, American voters benefit: either foreign capital stays, pays taxes, and funds tax cuts for most voters; or foreign capital exits, boosting U.S. manufacturing, creating high-paying jobs, and improving voter incomes. Either way, store shelves won’t empty overnight, nor trigger goods inflation.

Smooth Capital Controls

I’m a global macro “DJ,” enjoying remixing others’ ideas with my own language, rhythm, and flair. Just as every house track follows standard beats—kick, snare, clap, off-beat syncopation—my “beat” revolves around the “printing press” rhythm, aiming to layer fun “basslines,” “harmonies,” and “effects” into a Solomun-style epic “breakdown” and “drop.”

I say this to emphasize that using capital controls instead of tariffs to correct U.S. trade and capital account imbalances isn’t novel or original. During post-WWII Bretton Woods negotiations, economist Maynard Keynes advocated charging “user fees” on surplus nations’ capital and recycling it into deficit nations’ capital markets to balance trade and capital flows. More recently, Stephen Miran (current Chair of the Council of Economic Advisers) discussed in his paper *A Guide to Restructuring the Global Trading System* how specific fees on foreign holdings and transactions of U.S. financial assets could force capital flow rebalancing. Another influential macro analyst (requesting anonymity) has published multiple articles over the past year arguing capital controls are necessary and that aspiring U.S. allies must pay the price. Additionally, Michael Pettis speculated in a recent webinar that tariffs won’t materially reduce America’s trade deficit and capital account surplus globally—his conclusion: capital controls are coming, as governments realize it’s the only way to truly redirect capital flows.

I mention these figures to show today’s financial intellectuals advocate capital controls, not tariffs. The benefit for investors is we can observe in real-time how the hardline tariff faction led by Commerce Secretary Howard Lutnick executes plans to reduce U.S. imbalances. However, due to April’s financial market crash, the rushed tariff execution suggests internal battles have ended. Capital control advocates like Bessent are now taking over. My description of capital control effectiveness might sound as optimistic as SBF’s “pie-in-the-sky” presentation of FTX/Alameda finances to investors. Yet implementing capital controls in Pax Americana financial markets could carry serious consequences. I predict capital controls will accelerate Bitcoin’s price surge. This is the core of my “boiling frog” theory.

The Crash That Never Happened

Due to capital controls’ negative impact on U.S. financial assets, these measures will be implemented gradually. Global financial markets will slowly accept U.S. capital controls as normal, not heresy. Like a frog in slowly heating water unaware it’s being boiled, capital controls will quietly become the new normal.

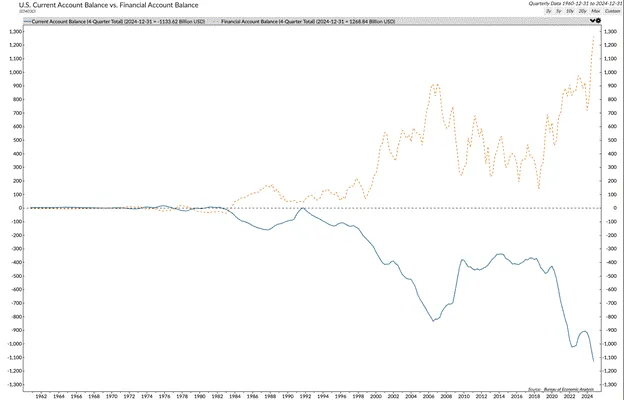

Foreigners earn large amounts of dollars by selling goods to Americans, leaving them no choice but to reinvest those dollars into U.S. stocks, bonds, and real estate. Below are charts showing the strong performance of U.S. financial markets driven by inflows of foreign capital.

The chart below is foundational to all my analysis. If you’re a reserve currency issuer and must keep your capital account open, trade deficits equal capital account surpluses.

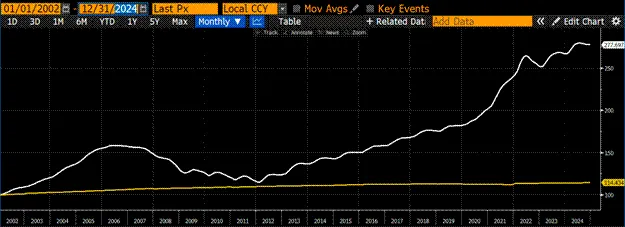

The next three charts use data from 2002 to early 2025, as China joined the WTO in 2002, and early January 2025 marked peak optimism in U.S. markets about “Trump fixing the world.”

Since 2022, the MSCI U.S. Index (white) has outperformed the MSCI World Index (gold) by 148%: exceptional U.S. equity performance.

Total tradable U.S. Treasury debt (gold) grew 1000%, yet 10-year Treasury yields slightly declined: exceptional U.S. bond market performance.

U.S. working-age population (15–64 years, gold) grew only 14%, yet the Case-Shiller National Home Price Index (white) surged 177%: exceptional U.S. real estate performance. This is astonishing, considering it includes data from the 2008 global financial crisis.

If foreign capital is taxed and they marginally decide U.S. investments are no longer viable, mathematically, stock, bond, and real estate prices must fall. This poses several problems. Falling stocks reduce capital gains tax revenue—the government’s marginal income driver. If bond prices fall and yields rise, government interest expenses increase, as it must keep issuing new bonds to fund massive deficits and roll over existing $36 trillion debt. If housing prices fall, the middle class and wealthy baby boomers—who own most real estate—see their net worth collapse just when they need it to fund retirement. These voters will oppose the incumbent Republicans in the November 2026 midterms.

Pax Americana depends on foreign capital. If capital controls cause foreign capital to leave, that’s bad news for the economy. Can politicians, the Fed, and Treasury step in to replace foreign capital and stabilize financial markets?

Remember the four-on-the-floor beat—the Brrr button. Everyone knows the answer. It’s the same as always. If foreigners don’t provide dollars, the government will print them.

Below are the policies the Fed, Treasury, and Republican lawmakers will adopt to replace foreign capital:

Federal Reserve:

-

Halt Quantitative Tightening (QT) on Mortgage-Backed Securities (MBS) and Treasuries.

-

Restart Quantitative Easing (QE) on MBS and Treasuries.

-

Exclude MBS and Treasuries from the Supplementary Leverage Ratio (SLR).

Treasury:

-

Increase quarterly Treasury buyback volumes.

-

Continue issuing large volumes of short-term bills (<1 year maturity) instead of long-term bonds (>10 years).

Republican lawmakers:

-

End conservatorship of Fannie Mae and Freddie Mac (the two major U.S. mortgage finance agencies).

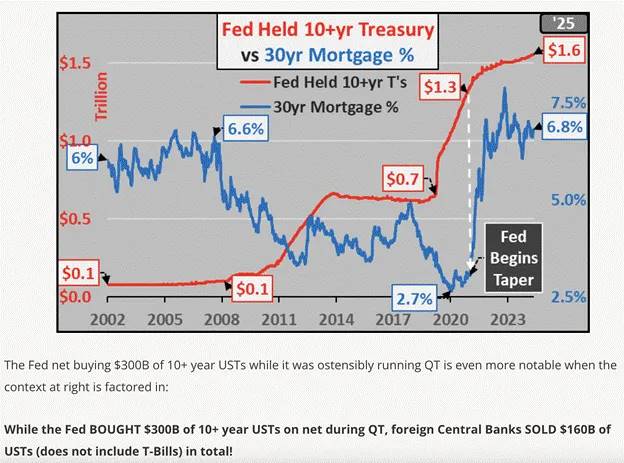

No need to strain imagining Treasury and Republican lawmakers following Trump’s orders—but why would the Fed comply? The answer is: it’s the wrong question. The Fed has already been acting behind the scenes per Trump and Bessent’s demands. Consider Luke Gromen’s brilliant example:

The Fed is shrinking its balance sheet. Yet it retains discretion in how to achieve this, especially since the mandate is net reduction—not uniform reduction across all maturities. Yellen and now Bessent need to fund massive government debt. Foreign and U.S. private investors love Treasury bills—they’re short-term, pay interest, and serve as high-yield cash equivalents, far preferable to low-yield bank deposits. But no one wants to buy long-dated (10+ year) Treasuries. To help Yellen and now Bessent raise funds, the Fed provides massive support by conducting QE on 10-year Treasuries. Powell cites government deficits as the problem, yet continues printing money to suppress 10-year yields to politically acceptable lows—an act of profound dishonesty.

Given Powell is already conducting covert Treasury QE, he’ll readily heed requests from Congress and powerful commercial banks (like JPMorgan CEO Jamie Dimon) to halt QT, restart QE, and grant SLR exemptions. I don’t care how stubbornly he reacts at press conferences to Trump demanding looser monetary conditions. Powell’s position is locked in. He won’t leave. Now, move forward.

These measures will channel printed money through various channels to replace foreign capital lost to capital controls, lifting stock, bond, and real estate prices in the following ways:

Bond prices will rise, yields will collapse. Due to Fed QE, it will buy bonds. Banks will buy bonds too—using unlimited leverage—and will front-run the Fed.

Stock markets will rise overall due to lower discount rates applied to future earnings. Certain sectors will benefit more. Manufacturing firms will gain most, as lower credit costs and greater availability boost investment. This is a direct result of falling government bond yields and banks having more balance sheet capacity to lend to the real economy.

Housing prices will rise as mortgage rates decline. Fed QE purchases of MBS will lower mortgage rates. With Fannie Mae and Freddie Mac rushing to re-enter loan underwriting, leveraging their implicit government guarantee, credit availability will expand.

Don’t expect these policies to roll out overnight. It’s a multi-year process—but it must happen; otherwise, U.S. financial markets will collapse. Given politicians can’t handle a week of post-Liberation Day financial distress, they’ll always find a way to hit the printing button.

Will They Withdraw?

Before concluding my Bitcoin price forecast, we must address a critical question: Will foreign capital exit? If so, are there signs this assumption is becoming reality?

My view—shared by many other analysts—is that the recent rapid appreciation of certain Asian export-driven currencies (like the New Taiwan Dollar and Korean Won) suggests capital flows are reversing. This lends credibility to the idea that capital controls are coming and indicates forward-looking market participants are exiting early. Moreover, finance ministers responsible for monetary policy are allowing their currencies to appreciate, signaling this specific carry trade is unwinding.

Private capital from Asian corporations, insurers, and pension funds typically follows market trends. Since the 1997–1998 Asian Financial Crisis, when Asian exporters devalued their currencies and adopted policies manipulating their exchange rates downward against the dollar, Asian private capital has engaged in the following:

-

Capital earned overseas remains overseas.

-

Domestic capital is transferred abroad, primarily into U.S. financial markets for higher returns.

Essentially, this is a massive carry trade. Ultimately, this capital must either be returned to local shareholders in local Asian currency or used to meet liabilities denominated in local Asian currency. Thus, Asian private capital is effectively short their own currencies. In some cases, they even borrow domestically, as central banks—seeking to keep currencies weak—create abundant domestic bank deposits, resulting in very low domestic interest rates. Meanwhile, Asian private capital holds long positions in high-yield dollar-denominated assets (stocks, bonds, real estate). They don’t hedge these dollar longs because state-supported policy itself manipulates their currencies downward.

This carry trade unwinds under two conditions:

-

The yield differential between U.S. and local financial assets narrows.

-

Asian currencies begin appreciating against the dollar.

Capital controls reduce the net return on U.S. financial assets. If net returns fall—or if market expectations grow that rising foreign capital tax rates will sustain this trend—then Asian private sector capital will begin unwinding its carry trade. They’ll sell stocks, bonds, and real estate, convert dollars into local Asian currencies. Marginally, this will push down certain U.S. financial asset prices while strengthening Asian currencies against the dollar.

In U.S. assets, the first and most critical battlefield will be the U.S. Treasury market—especially 10-year and longer bonds. This market is most vulnerable to foreign selling, as almost no one wants to hold these “junk bonds.” The corresponding currency battlefield will be certain Asian export-driven currencies.

When USDKRW declines, the Korean Won appreciates against the dollar.

Many sovereign and private foreign investors run similar carry trades. If Asian private capital flows are reversing, these investors must unwind their positions too. Therefore, even before the scale and scope of U.S. capital controls are clear, foreign investors holding U.S. assets and bearing local currency liabilities must begin selling stocks, bonds, and real estate and buying back their local currencies.

Ultimately, it will be the slow, irreversible rise in 10-year Treasury yields that forces the Fed, Treasury, and politicians to implement partial or full money-printing measures. As capital repatriation intensifies, yields rise. With massive embedded leverage in the system, the financial market’s strike price for yields lies between 4.5% and 5% on the 10-year Treasury. As yields climb, bond market volatility increases—observable via the MOVE index. Remember, when that index exceeds 140, policy action is immediate and inevitable. Thus, even as rising yields constrain equity rebounds, Bitcoin will see through this weakness to accelerating money printing.

Bloomberg Asia Dollar Index (gold) vs. U.S. 10-Year Treasury Yield (white). When the dollar index rises, Asian local currencies strengthen, and we see corresponding increases in 10-year yields.

Lifeboats

As U.S.-China relations gradually fracture, global financial markets will Balkanize. Nation-first monetary policies will require capital controls—implemented everywhere, including the U.S. No one can guarantee their capital access to the highest-return, lowest-risk fiat financial systems globally. In the past, gold was the only fluid link between different financial systems—but now Satoshi has given believers Bitcoin!

As long as there’s internet, you can convert fiat into Bitcoin.

Even if centralized exchanges are banned and banks prohibited from processing Bitcoin-related transactions, you can still convert fiat into Bitcoin. I’m confident because this is how it works in China. Since 2017, China has effectively banned centralized exchanges from operating spot order books. Yet if private parties wish to send fiat via the banking system in exchange for Bitcoin outside the banking system, the state cannot stop it. OTC Bitcoin markets in mainland China remain highly active. Even China hasn’t banned private Bitcoin ownership, knowing doing so would be counterproductive and impossible. For Europeans living under even less effective regimes than Chinese communism, don’t expect the ECB to learn this lesson without trying. So withdraw your money now! Listen to my speech at an early 2025 crypto finance conference to understand why capital controls are coming to the EU.

A major question: Will the Trump team try to sink both gold and Bitcoin—the two lifeboats for global capital? I don’t think so. Because he and his deputies believe the post-1971 arrangement making U.S. Treasuries the world’s reserve asset did not benefit the Americans who put them in power. They believe U.S. financialization caused declines in military readiness, manufacturing capacity, and social harmony. To fix this, gold and/or Bitcoin will be elevated as neutral global reserve assets. National imbalances will be settled in gold; private imbalances in Bitcoin.

We know the Trump team is pro-gold, as it was exempted from tariffs from the start. We know they’re pro-Bitcoin, given regulatory shifts. While I believe these measures may fall short of what’s needed for Bitcoin’s fair scaling under Pax Americana, you can’t deny the retreat of enforcement agencies marks a crucial step in the right direction.

Given we know foreign portfolio assets total $33 trillion, the next question is how much capital will exit the U.S. and flow into Bitcoin. Depending on how fast this happens, it determines what percentage of assets flee to Bitcoin.

What if 10% of these assets ($3.3 trillion) flowed into Bitcoin over the next few years? Currently, exchange-held Bitcoin is worth about $300 billion. If tenfold capital tries to squeeze into the market, the price won’t merely rise tenfold. Prices are set at the margin. Of course, if prices surge to $1 million, long-term holders will emerge to sell Bitcoin for fiat—but as these portfolio assets migrate, an epic short squeeze will follow.

Bitcoin is superior for capital movement in a Balkanized global financial landscape because it’s a digital bearer asset. Storing and transferring wealth requires no intermediaries. Gold, despite 10,000 years of stateless capital history, can only circulate digitally in paper form. This means trusting financial intermediaries to warehouse your physical gold, then trading a digital receipt. These intermediaries will be constrained by financial regulations designed to keep capital domestic for taxation to fund national priority industrial policies. Unless you’re a nation-state or quasi-state actor, physically held gold cannot move quickly in the global digital economy. Bitcoin is the perfect—and only—lifeboat for global capital fleeing the U.S. and elsewhere.

Additional bullish momentum will come from America’s de facto default on its massive national debt. A $1,000 bond pays $1,000 at maturity—nominal principal repayment. But that future $1,000 will buy fewer energy units. The U.S. began seriously defaulting on the real value of its debt after the 2008 global financial crisis, choosing to print money instead. After COVID, the pace accelerated. This trend will speed up again as the Trump team revives the U.S. economy by devaluing Treasuries relative to hard money like gold and Bitcoin. This is the true lesson from the Liberation Day tariff spectacle. As businesses rebuild domestically, nominal growth will surge; yet high-digit nominal GDP growth won’t match high-digit yields on Treasuries and bank deposits. This inflation will manifest—as before—in future gold and Bitcoin prices.

This chart shows the performance of the U.S. Long-Term Treasury ETF (TLT) priced in gold (gold) and Bitcoin (red), indexed to 100 starting in 2009. From 2021 to present, Treasuries have lost 64% and 84% against gold and Bitcoin, respectively.

Foreign capital repatriation and the depreciation of America’s massive Treasury stock will be the two catalysts driving Bitcoin to $1 million between now and 2028. I mention 2028 because it’s the next U.S. presidential election, where outcomes and policies are unknown. Perhaps, through divine intervention, the American public will be ready to accept the “monetary hangover” from a century of excess and eliminate the rotten credit destroying society. Of course, I don’t hold much hope—but it’s not impossible. So now is the time to seize the opportunity. When the “Sun King” shines favorably on Bitcoin, don’t miss it.

Trading Strategy

From a macro perspective, I’ve completed my job as CIO of Maelstrom. By late January, I reduced risk and increased fiat holdings. Then, from late March to early April, I gradually re-entered the market. During the one-week financial market crash around Liberation Day, we maxed out our crypto exposure. Now it’s time to pick which quality “shitcoins” will outperform Bitcoin in the next bull market leg.

I believe this cycle will reward “shitcoins” with real users, where users pay real money for products or services, and protocols return part of profits to token holders. Two projects stand out—Maelstrom bought them at lows: $PENDLE and $ETHFI. Pendle will dominate crypto fixed-income trading, which I see as the largest untapped opportunity in crypto capital markets. Ether.fi will become crypto’s “American Express”—a proto-financial institution for wealthy token holders. I’ll comment further on these “shitcoins” in upcoming articles.

Though I believe Bitcoin will reach $1 million, that doesn’t mean tactical shorts aren’t possible. Capital controls and money printing are coming—but the road from here to there is bumpy. The Trump team hasn’t fully committed to capital controls, so expect voices pushing for a different imperial direction to resurface. Trump lacks fixed ideology; he adapts to environmental constraints, zigzagging toward goals. So the trend is your friend—until it isn’t.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News