The Monetary Trio of the Entropy Age: The Golden Ark, the Twilight of the Dollar, and the Babel Tower of Computing Power

TechFlow Selected TechFlow Selected

The Monetary Trio of the Entropy Age: The Golden Ark, the Twilight of the Dollar, and the Babel Tower of Computing Power

The current capital market is experiencing a triple variation of "dollar de-anchoring - gold soaring - Bitcoin awakening."

By: Musol

When first reading "Love, Death, Bitcoin"—a monumental essay condensing three centuries of monetary history into ten thousand characters—and seeing the curves of gold and Bitcoin rising in tandem on my phone screen, I momentarily glimpsed the wreckage of currencies floating through the river of history: the Dutch guilder's tulip bubble had yet to fully dissipate, the echoes of British naval guns still reverberated, and the American dollar’s stars and stripes were fading within the torrent of data.

This reminded the author of Braudel’s insight in *The Mediterranean and the Mediterranean World in the Age of Philip II*: the twilight of every hegemonic currency is a metaphor for civilizational entropy. Today, gold awakens in central bank vaults, Bitcoin whispers within computational matrices, and the dollar hovers at the edge of a debt cliff. Within this spacetime fold formed by the three lies a capital allegory deeper than Keynes’ “animal spirits.”

After rereading William Engdahl’s secret history of banking families late one night, it suddenly struck me that the shadows cast by the thirteen stone pillars at the Federal Reserve’s founding in 1913 have, a century later, extended into Vanguard’s ETF matrix and BlackRock’s spot Bitcoin funds. This fateful cycle resembles Spengler’s depiction of civilizational seasons in *The Decline of the West*—as gold flowed from South African dictators’ secret rooms into London vaults, as the dollar climbed from the ruins of Bretton Woods onto the throne of petrodollars, and as Bitcoin evolved from Nakamoto’s cryptographic puzzle into “digital gold” listed on institutional balance sheets—humanity’s pursuit of absolute value has always oscillated between the heavy curtains of power and the cracks of freedom.

Offering a humble stone to invite jade, let me use personal experience and limited insights, along with fragments of financial history as torches, to illuminate this eternal theater of the collapse and reconstruction of the Tower of Babel of money:

Pt.1. Hegemonic Metamorphosis: From Gold Anchors to Petro-Monarchy Evolution

Tracing back from Hamilton’s vision of a central bank in 1790 to the secretive birth of the Federal Reserve in 1913, the DNA of dollar hegemony has always been inscribed with the capitalist will of the “giants of the steel age.” The establishment of the Bretton Woods system elevated the dollar to divine status, just as Keynes warned—the “golden fetters” ultimately became sacrificial offerings to the Triffin Dilemma. Nixon’s “default Sunday” in 1971 declared the end of the gold standard, yet paradoxically gave rise to the new order of petrodollars.

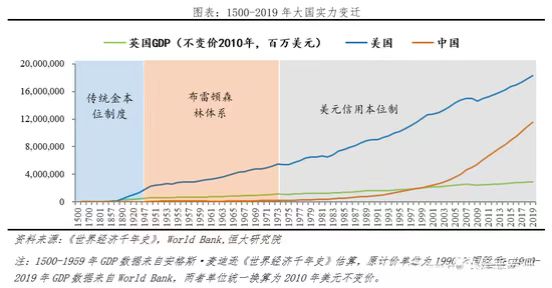

This process mirrors Braudel’s depiction of hegemonic transitions in *Civilization and Capitalism, 15th–18th Century*: Dutch financial dominance yielded to British industrial supremacy, culminating in America’s ultimate consolidation through its oil-military complex. The tech boom of the Clinton era and Greenspan’s loose monetary policies pushed dollar hegemony to its peak, but also sowed the seeds for the 2008 subprime crisis, as Soros’ theory of reflexivity reveals:

Prosperity itself nurtures the seeds of destruction.

Pt.2. The Millennium Paradox: From Barbaric Relic to Harbinger of Collapse

From Roman gold coins to the anchor of Bretton Woods, gold has always served as the “Noah’s Ark in times of crisis.” The price surge triggered by the dollar’s detachment from gold in 1971 (from $35 to $850 per ounce) was essentially an emergency reaction to the collapse of fiat credit systems, confirming Keynes’ assertion that “gold is the last sentinel and reserve for times of urgent need.”

The pattern of gold being suppressed then rebounding during the 2008 financial crisis exposed the fundamental contradiction of modern finance: when liquidity black holes consume all assets, only gold can transcend monetary illusion to become the “ultimate settlement tool.” Now, Trump’s tariff salvos and ballooning debt (a $36 trillion national debt, 124% of GDP) are replaying historical scripts. The fact that global central banks have consecutively broken 1,000-ton gold-buying records for three years straight echoes Mundell’s “impossible trinity” in the digital age—the tripod supporting sovereign fiat currencies (exchange rate stability, free capital flow, independent monetary policy) is collapsing, making gold once again the ultimate choice as “stateless money.”

Pt.3. Three Shadows: From Obsidian Cocoon to Gilded Transformation

Satoshi Nakamoto planted the seed of blockchain amidst the ashes of the 2008 financial crisis, which underwent three phases of value discovery:

As a darknet payment tool in 2013, a vehicle for ICO mania in 2017, and an institutional asset allocation target in 2020, Bitcoin ultimately completed its ultimate transformation into “digital gold” amid the global credit crisis of 2025. This evolutionary trajectory aligns with Schumpeter’s theory of “creative destruction”—the collapse of old systems clears ecological space for new species. BlackRock CEO Larry Fink’s declaration that “Bitcoin is gold in an international version,” along with MicroStrategy’s aggressive strategy of holding 500,000 BTC, marks traditional capital’s formal coronation of Bitcoin’s store-of-value属性. Meanwhile, the Trump administration’s executive order incorporating Bitcoin into strategic reserves reenacts the historical mirror of Nixon Shock in 1971:

When the foundation of fiat credibility trembles, decentralized assets emerge as candidates for a new order.

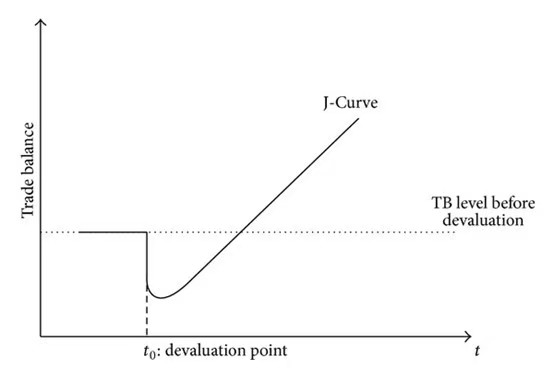

Pt.4. J-Curve Sanctification: Chronicles of Paradigm Rebirth Pains

Today’s capital markets are undergoing a triple variation of “dollar de-anchoring, gold surging, Bitcoin awakening.” The essence of this structural shift is a generational transition in monetary paradigms. As economic historian Kindleberger noted in *A Financial History of Western Europe*, changes in monetary systems often lag behind technological revolutions by 50–100 years.

The J-Curve dilemma currently facing Bitcoin—constrained in the short term by tech stock valuation logic, yet poised for long-term gains through consensus as digital gold—resembles gold’s dormant phase before breaking free from the gold standard in the 1970s. Viewed through Kondratieff’s long-wave theory, we stand at the historical intersection of the sixth technological revolution (digital civilization) and monetary order reconstruction. Bitcoin may play the same role in this era that gold played during the Industrial Revolution of the 19th century:

Both gravedigger of the old system and cornerstone of the new civilization.

Looking back across three centuries of monetary history—from Hamilton’s blueprint for a central bank to Nakamoto’s cryptographic utopia—humanity’s quest for value storage has always oscillated between centralization of power and decentralization. The twilight of dollar hegemony, gold’s renewed coronation, and Bitcoin’s wild growth together form the monetary trilogy of our age.

As Marx stated: “Money is not a thing, but a social relation.” As globalization’s bonds of trust begin to fray, the rise of digital currencies may signify a real-world projection of Hayek’s ideal of “denationalization of money.” In this uncertain era, one thing is certain: the evolution of money never ceases, and each of us is both witness and scribe to this thousand-year monetary epic.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News