AM Management: The Most Transparent Quantitative Trading Investment Program

TechFlow Selected TechFlow Selected

AM Management: The Most Transparent Quantitative Trading Investment Program

Only by seizing opportunities and finding relatively reliable strategies can one have the chance to become a long-term winner.

Introduction

In the volatile and risky cryptocurrency market, securely and effectively managing assets has always been a major challenge for investors. In the past, many platforms have caused user asset losses due to lack of transparency or risk management capabilities.

This article introduces AM Management, a South Korean cryptocurrency quantitative trading company, exploring how it provides stable returns while ensuring fund safety through an innovative asset management model, offering investors a reference option in this high-risk market.

What is AM Management?

AM Management was established in South Korea in December 2021, focusing on providing cryptocurrency quantitative trading investment solutions as its core product. During its initial phase, the company concentrated on building effective quantitative trading strategies. After three years, AM successfully validated the stability of its investment solutions and secured seed, pre-A, and Series A funding rounds. Investors include J-cam, Japan’s largest BTC lending company; DeSpread, a South Korean GTM consulting firm; and well-known Korean startup venture capital firms such as Mashup Angels and D.CAMP Investment.

With so many asset management firms, what sets AM Management apart?

Existing asset management companies face three main issues:

-

Custodial management – Users must fully entrust their assets to operators, lacking real-time visibility into operational processes and only receiving periodic updates on asset status.

-

Outsourcing to third parties – Most asset managers further delegate asset operations to third parties, losing control over risk management.

-

Lack of long-term experience managing large-scale assets – Most Korean CeFi platforms such as Haru Invest, Heybit, and Delio went bankrupt within recent years.

AM Management addresses these three key challenges with distinctive advantages not offered by others:

-

API-based management – Assets are managed via API, allowing users to monitor all asset statuses in real time.

-

100% proprietary algorithm operation – AM Management executes trades using its own quantitative algorithms, enabling effective risk control.

-

Proven experience managing large-scale assets – Successfully managed assets exceeding $140 million over the past three years.

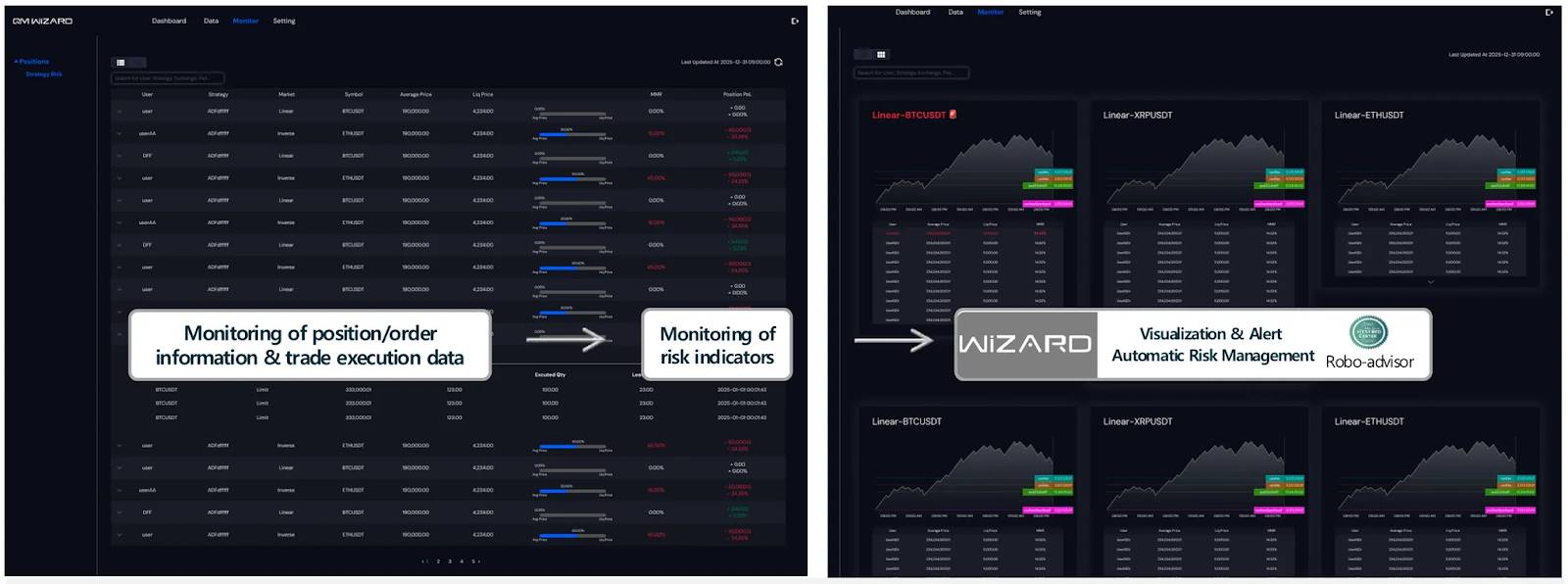

Beyond this, AM Management adopts a conservative risk management system, using visualization tools to assess liquidation risks and implementing early warning mechanisms. The core feature of this system is a dashboard that intuitively displays the safety margin ratio between current prices and liquidation prices, complemented by in-depth risk management via the MMR (Margin Maintenance Ratio) indicator based on margin levels. AM Management has obtained Robo-Advisor certification from South Korea’s Financial Services Commission (FSC), verifying the reliability of its trading algorithm.

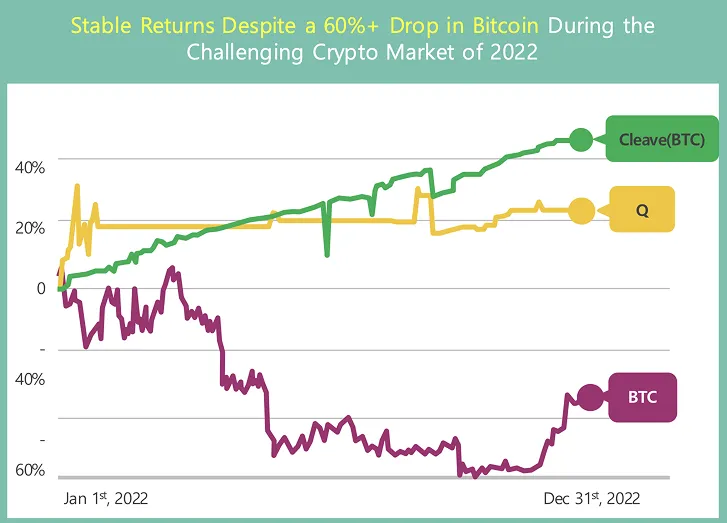

Of course, strong risk management must also deliver stable returns. Based on actual asset performance data, AM’s quantitative trading solutions have consistently outperformed the broader market during previous bear markets. Notably, in 2022, despite BTC prices dropping 60%, AM Management’s investment strategy continued to deliver strong performance, proving the profitability of its trading approach.

What products does AM Management offer?

AM Management offers two primary investment products, tailored to meet different client needs.

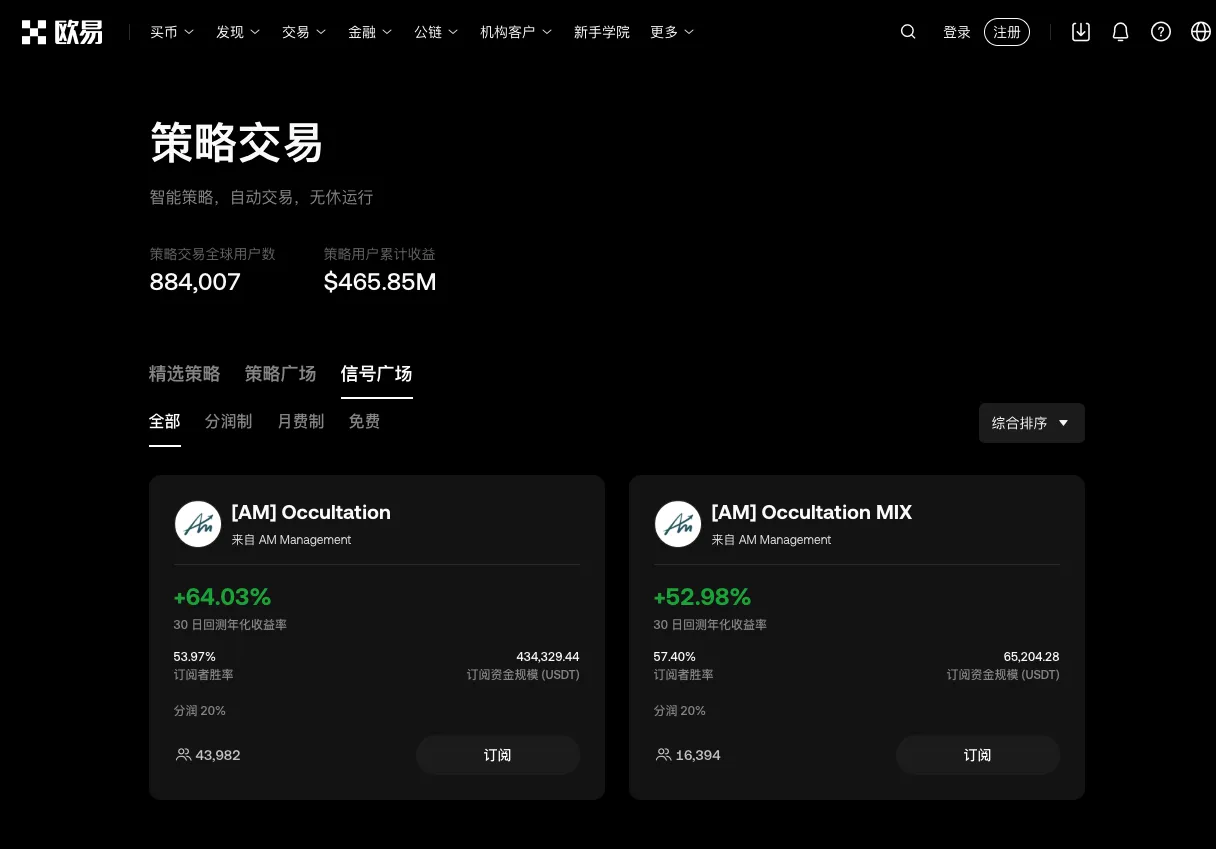

1. OKX Trading Bot: Ideal for retail investors

As an official partner of OKX, AM Management has provided two quantitative trading strategies to OKX users since November 2023. After about one and a half years, the service has attracted over 60,000 subscribers, with AUM reaching $500K.

-

Occultation: 4 currency pairs (BTC, ETH, XRP, DOGE) | 5x–25x leverage | 1,000 USDT minimum

-

Occultation MIX: 8 currency pairs (DOGE, OP, ADA, MINA, IMX, XCH, ICP, ATOM) | 2x–20x leverage | 500 USDT minimum

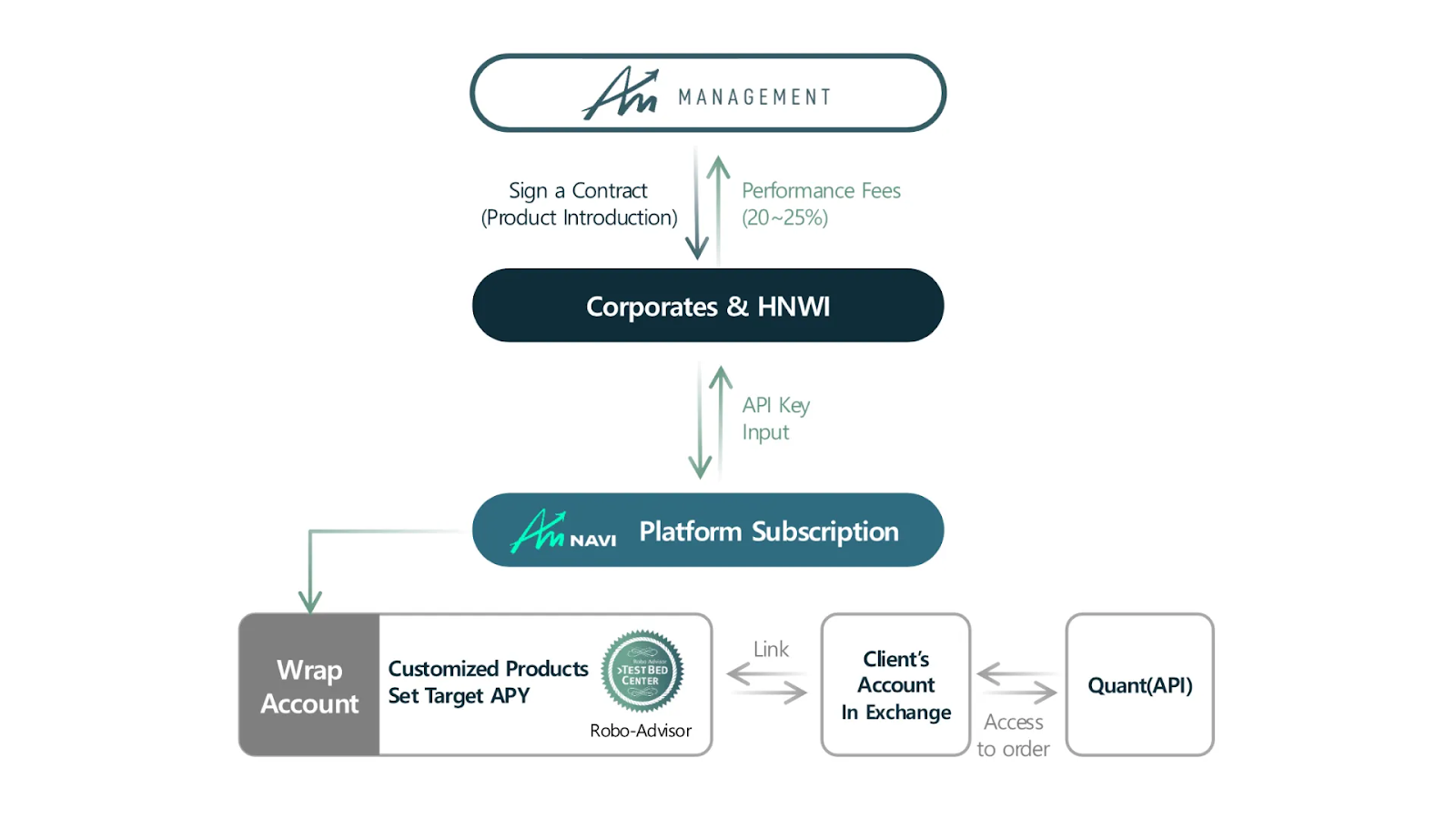

2. Navi: Designed for institutional clients and high-net-worth individuals

Navi is an investment product targeting B2B clients and high-income individuals. Its key difference from other asset managers is that users do not need to deposit or custody their assets on the platform. Instead, they simply connect their API keys from supported exchanges (Binance, OKX, Bybit) to start using the service. This allows users to monitor asset operations in real time—enhancing transparency—while ensuring security, as AM has no ability to withdraw user funds.

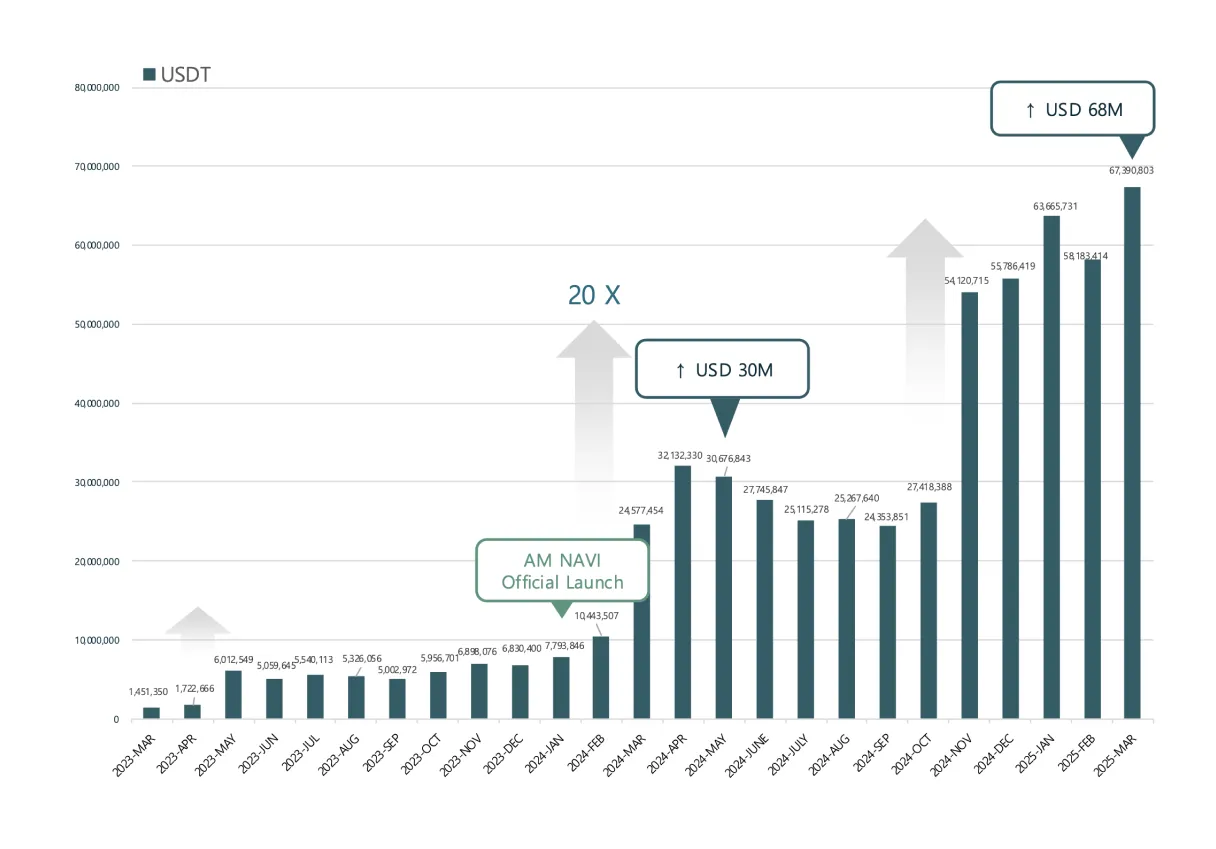

AM Management's AUM continues to grow steadily, surpassing $90 million by May 8, an increase of nearly 12 times since the official launch of AM NAVI.

Conclusion

Cryptocurrency investment is widely recognized as high-risk, yet in such markets, risk and return often go hand in hand. Seizing opportunities and identifying relatively reliable strategies is key to becoming a long-term winner.

The greatest strength of AM Management lies in eliminating the need for asset custody, ensuring users retain full control over their funds at all times. This approach enhances trust and enables AM to provide real-time asset reporting in the most transparent manner possible. While cryptocurrency asset managers have experienced ups and downs in the past, demand for professional asset management remains strong in the fast-growing crypto industry. AM Management’s future development warrants ongoing attention.

References

AM Management Official Website:

OKX Trading Bot by AM (Occultation):

https://www.okx.com/zh-hans/trading-bot/signal/647567187825397760

OKX Trading Bot by AM (Occultation MIX):

https://www.okx.com/zh-hans/trading-bot/signal/648997092438056960

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News