WOO X Research: Did Bitcoin Break $100,000 Again Due to U.S. State Governments Accumulating BTC?

TechFlow Selected TechFlow Selected

WOO X Research: Did Bitcoin Break $100,000 Again Due to U.S. State Governments Accumulating BTC?

Launching at the state level, two states have already added Bitcoin to their reserves.

Author: WOO X Research

For cryptocurrency users, the most anticipated policy after Trump's election was undoubtedly the U.S. adopting Bitcoin as a strategic reserve. However, more than three months have passed without any action from the federal government—does this mean hopes for a Bitcoin strategic reserve are dashed? Not quite. In fact, within just one week recently, two U.S. states have formally added Bitcoin into their state treasuries, with another five on the verge of passing similar legislation. The funding sources, allocation caps, and custody models vary significantly across states, reflecting differing levels of tolerance among local governments toward "highly volatile, decentralized assets." This article critically examines who is making genuine moves versus political theater, where potential black swans may lurk, and analyzes how this wave of "official HODL" could impact market liquidity and narrative-driven premiums.

How Are New Hampshire and Arizona Doing It?

Within just 48 hours, both New Hampshire and Arizona completed legislative processes and received gubernatorial signatures, marking the beginning of state-level Bitcoin holdings. Their approaches and risk management mechanisms are almost diametrically opposed, clearly revealing different political and economic priorities.

New Hampshire HB 302 | Active appropriation, BTC-only, with a cap

New Hampshire’s approach most closely resembles “Treasury-level asset diversification.” The bill authorizes the state treasurer to convert up to 5% of its general fund and rainy day fund into digital assets that have maintained a market capitalization above $50 billion for 12 consecutive months—effectively qualifying only Bitcoin.

Lawmakers emphasize that the 5% cap acts as a safety valve: if the size of the fund grows or shrinks, the holding amount adjusts proportionally, avoiding an oversized initial position. However, the law is unclear on whether forced proportional selling would occur during fund contractions, leaving gray areas in accounting treatment.

In terms of custody, HB 302 offers three options:

-

The state treasury self-custodies via multi-signature cold wallets;

-

Assets are entrusted to licensed “special purpose depository institutions (SPDI)” or other regulated banks;

-

Holding through SEC- or NFA-approved Bitcoin ETFs

If choosing cold wallets, self-custody must meet seven technical standards including geographic dispersion, hardware isolation, and annual penetration testing to minimize private key leakage risks. But if using ETFs, the state only holds custodial receipts—transparency reverts to traditional financial ledgers, contradicting the blockchain advantage of being “visible and traceable.”

On disclosure, the state treasurer must report quarterly holdings, cost basis, and unrealized gains/losses in fiscal reports. Supporters verbally promised to publish on-chain addresses to enhance transparency, but this is not mandated in the law. The bill also completely bans leverage, lending, or pledging, aiming to eliminate credit risk at the cost of forfeiting all yield-enhancing strategies.

New Hampshire follows a “Treasury-level asset diversification” path—small allocation, single asset, extremely conservative—but still directly ties taxpayer funds to Bitcoin’s price volatility.

Arizona HB 2749 | Passive inclusion, tax-free, allows staking

Arizona makes “not spending a single dollar of tax revenue” its core selling point. The new law allows the state government to transfer unclaimed crypto assets (including those with incomplete private keys but identifiable ownership) into a newly established “Bitcoin and Digital Asset Reserve Fund” after a three-year dormancy period.

The Arizona State Legislature. From then on, the fund can legally collect all derived airdrops and staking rewards, creating a compounding cycle without requiring additional budget approvals from the legislature.

Even bolder is the scope of eligible assets—the law sets no market cap or liquidity thresholds. As long as digital assets come into state possession, they can be included. Theoretically, everything from Bitcoin to meme coins with daily trading volumes of just tens of thousands of dollars could be absorbed. While the state relies on portfolio diversification to manage risk, it also exposes itself to high explosion risks from small-cap coin price manipulation.

Custody must be assigned to compliant institutions licensed in Arizona; during custody, assets are allowed to participate in full-chain staking to earn yield. This makes the state treasury an active on-chain participant for the first time—if validators face slashing penalties or smart contracts fail, losses will fall directly on public accounts.

In terms of liquidity management, HB 2749 only allows the state treasurer to convert up to 10% of non-Bitcoin holdings into cash to subsidize general fund expenditures; BTC holdings are legislatively locked and cannot be touched unless new laws are passed. Disclosure follows a dual-control mechanism of “annual reporting + appropriation approval by legislature,” but there is no requirement to publicly disclose on-chain addresses, falling short of decentralized transparency standards.

Arizona treats BTC as “found money earning interest,” amplifying idle value through staking and airdrops, cleverly sidestepping taxpayer scrutiny—but placing the treasury at the frontline of on-chain operational risks.

What Should Investors Pay Attention To?

-

Buy-side scale: Even fully allocated, NH amounts to only $300–400 million, having limited impact on BTC liquidity; AZ’s initial volume is even smaller.

-

Narrative boost: Official endorsement plus the “tax-free” story can lift short-term sentiment, but actual cash inflows won’t follow immediately.

-

Risk control comparison: NH trades low returns for “caps + cold wallets”; AZ exchanges “zero-cost staking” for higher technical/smart contract risks—neither model is a panacea.

-

Black swan: If BTC suffers a >20% daily drop, NH may face mandatory write-downs due to accounting rules; AZ would need to confront staking slashing or custody failures, giving opponents grounds to overturn the law in state legislature.

Core Differences

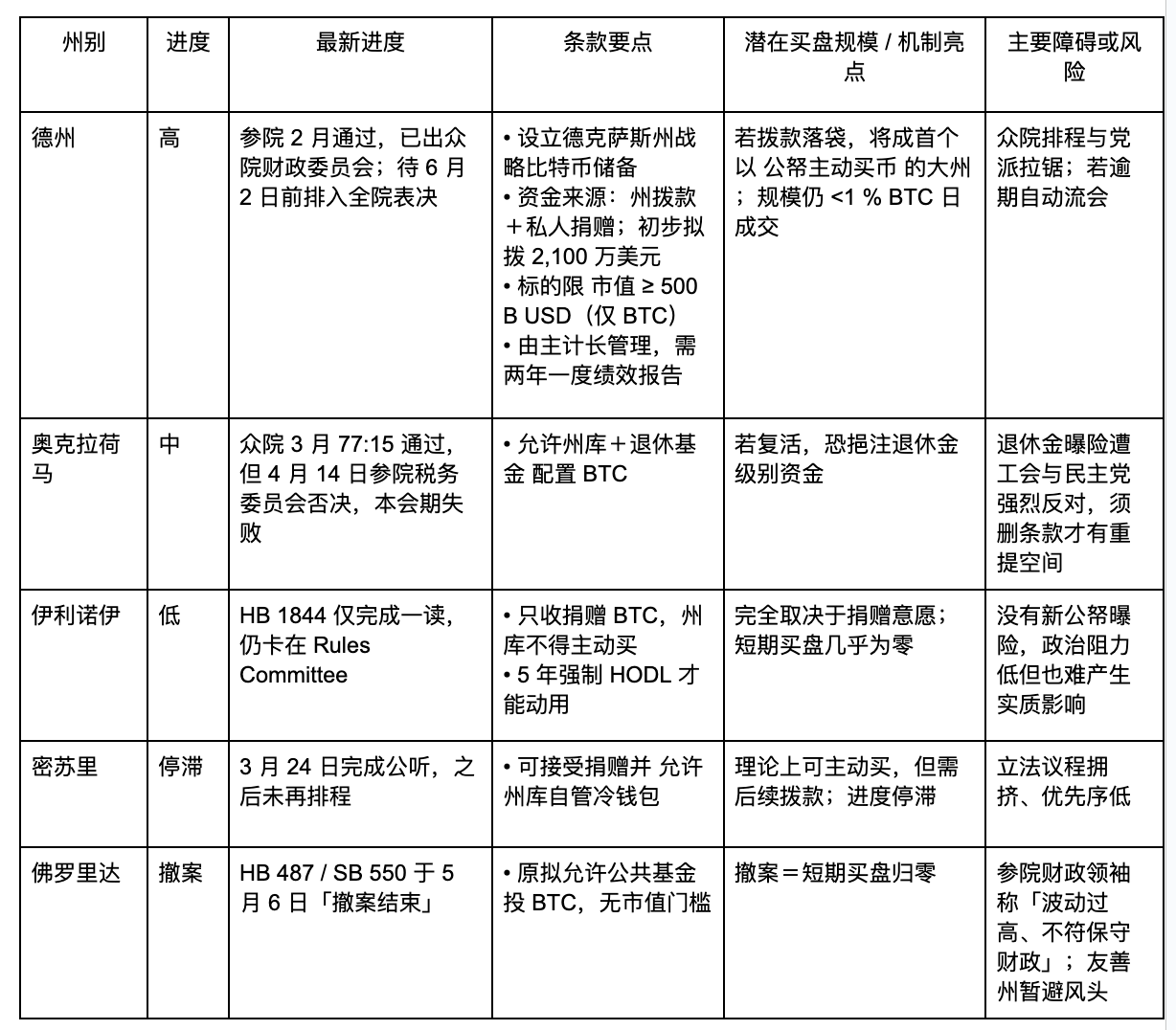

What About Other States?

-

Texas is key: If successfully scheduled and funded before June 2, it would mark the first case of “large-scale public funds buying crypto,” significantly amplifying the narrative. Conversely, if even Texas stalls, momentum in other states will falter.

-

Legislation ≠ buying: Even if bills pass, appropriations require separate approval. Investors should continue tracking appropriation bills and public on-chain wallet disclosures.

-

Huge variation in terms: From Texas’ “active appropriation + BTC-only” to Illinois’ “pure donations + five-year lockup,” risk/reward profiles differ widely, with future states likely to mix and match optimal features.

Conclusion: Do These Purchases Have Real Impact? Sentiment First, Then Reality

New Hampshire allows converting up to 5% of its general and rainy day funds into Bitcoin. With a fiscal budget under $7 billion, even a full allocation would amount to roughly $300–400 million. Arizona merely “passively absorbs” unclaimed crypto assets held for over three years—its short-term scale hardly reaches hundreds of millions. By comparison, Bitcoin’s 24-hour spot trading volume consistently stays between $60–70 billion. Even if all state purchases entered the market at once, they would represent less than 0.1% of daily liquidity—the legislative noise outweighs actual capital flow. Price reactions are driven more by sentiment trading than real supply-demand imbalances.

The two bills were signed on May 6 (NH) and May 8 (AZ); Bitcoin rose from 96K to nearly 100K within 48 hours, gaining about 3% weekly. Axios reported a weekly surge of over 240% in social media discussions related to “Bitcoin Reserve.” Yet trading volume did not expand accordingly, indicating a “headline rally” rather than substantial physical absorption.

Additionally, Glassnode notes that 30-day realized annualized volatility has dropped to 45–50%, the lowest since 2021. Still, long-term historical ranges often exceed 60%, making Bitcoin far more volatile than traditional assets. If a Black Swan event triggers a >20% intraday drop, New Hampshire’s 5% holding faces immediate impairment pressure, while Arizona bears additional risks from staking slashing or custody contract failures.

The “official HODL” narrative has already been partially priced in by the market. What truly determines price movement is the speed of legislative implementation and actual appropriation amounts. Only when legislation, funding, and on-chain addresses are all confirmed can we credibly attribute Bitcoin’s price rise to state strategic reserves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News