The best crypto stories are often told in numbers

TechFlow Selected TechFlow Selected

The best crypto stories are often told in numbers

Investing is essentially the art of storytelling.

Author: Byron Gilliam

Translation: TechFlow

"The social purpose of skilled investment should be to defeat the dark forces of time and ignorance that envelop our future."

——John Maynard Keynes, renowned economist

Storytime for Crypto Investors

Despite involving large amounts of numbers, investing is widely considered more of an art than a science.

"The selection of common stocks is a difficult art," Benjamin Graham once warned.

And Warren Buffett, Graham’s lifelong student, further clarified, "Investing is an art... putting cash in now in anticipation of getting more cash out in the future."

Almost all investing boils down to forecasting future cash flows.

But Peter Lynch reminded us that investors "trained to rigidly quantify everything are at a great disadvantage."

Yet this does not mean, as some financial nihilists claim, that "valuation is just a meme."

Rather, it means applying and interpreting quantifiable valuation metrics is itself a creative act.

Choosing which valuation metric applies to which investment is a subjective decision—and knowing how to interpret those results even more so.

For example, low valuation doesn't necessarily mean a stock is cheap, nor does high valuation necessarily mean it's expensive (often the opposite is true).

A stock might appear extremely cheap on certain metrics yet extremely expensive on others.

And there is no obvious correlation between these valuations and actual returns.

This is often frustrating—if cheap stocks don't go up and expensive stocks don't go down, why bother figuring any of this out?

I believe it's worth studying precisely because this is what makes investing interesting and compelling—and if so, the fun for crypto investors has only just begun.

Until recently, crypto investors had very limited data options beyond token price and market cap.

This turned everything in crypto into a "story"—but that's not necessarily bad!

Investing is inherently the art of storytelling.

However, the best investment stories are often told with numbers, and crypto is gradually gaining that capability as more protocols generate revenue, and an increasing portion of that revenue is distributed to token holders.

Moreover, thanks to efforts by institutions like Blockworks Research , these numbers are becoming easier to access. Their analysts package the data into digestible charts and reports for our reference.

This helps crypto move toward a higher level of narrative: telling stories with numbers.

Let’s look at some current figures.

Ethereum vs. Solana

Judging from crypto Twitter and podcasts, Ethereum’s market sentiment appears to have hit a new low, especially compared to Solana.

But a newcomer from traditional finance (TradFi) looking directly at the data might reach a completely different conclusion.

According to Blockworks Research, Solana recorded $36 million in "net income to token holders" in April, giving SOL an annualized earnings multiple of 178x—high, but perhaps reasonable if one believes current activity levels are low.

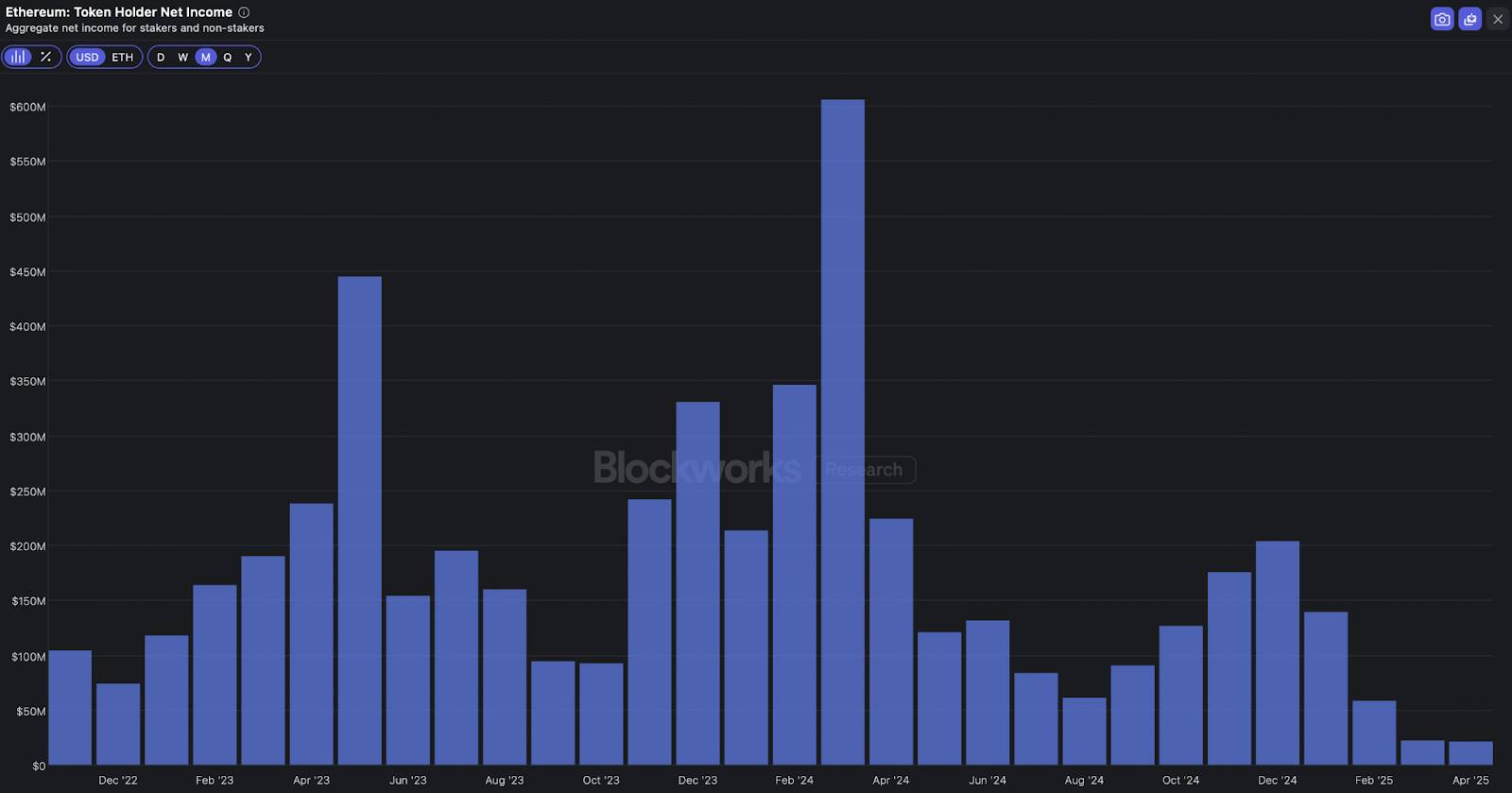

In contrast, Ethereum generated $21 million in net income to token holders in April, resulting in an earnings multiple of 841x for ETH.

A TradFi investor seeing ETH valued at five times the multiple of SOL wouldn’t immediately think, “Wow, why is everyone so pessimistic about Ethereum?”

Nor would they instantly assume the market views Solana five times more favorably than Ethereum.

Instead, they might conclude that Solana’s lower revenue valuation stems largely from “low-quality” memecoin trading activity, while Ethereum’s higher valuation may be partly due to higher-quality activities, such as revenue linked to real-world assets (RWAs).

Now we have angles to analyze: if you believe memecoin trading isn’t so low-quality, SOL may be undervalued; if you believe RWAs represent the future, then ETH may not be overvalued.

Of course, you can dig deeper.

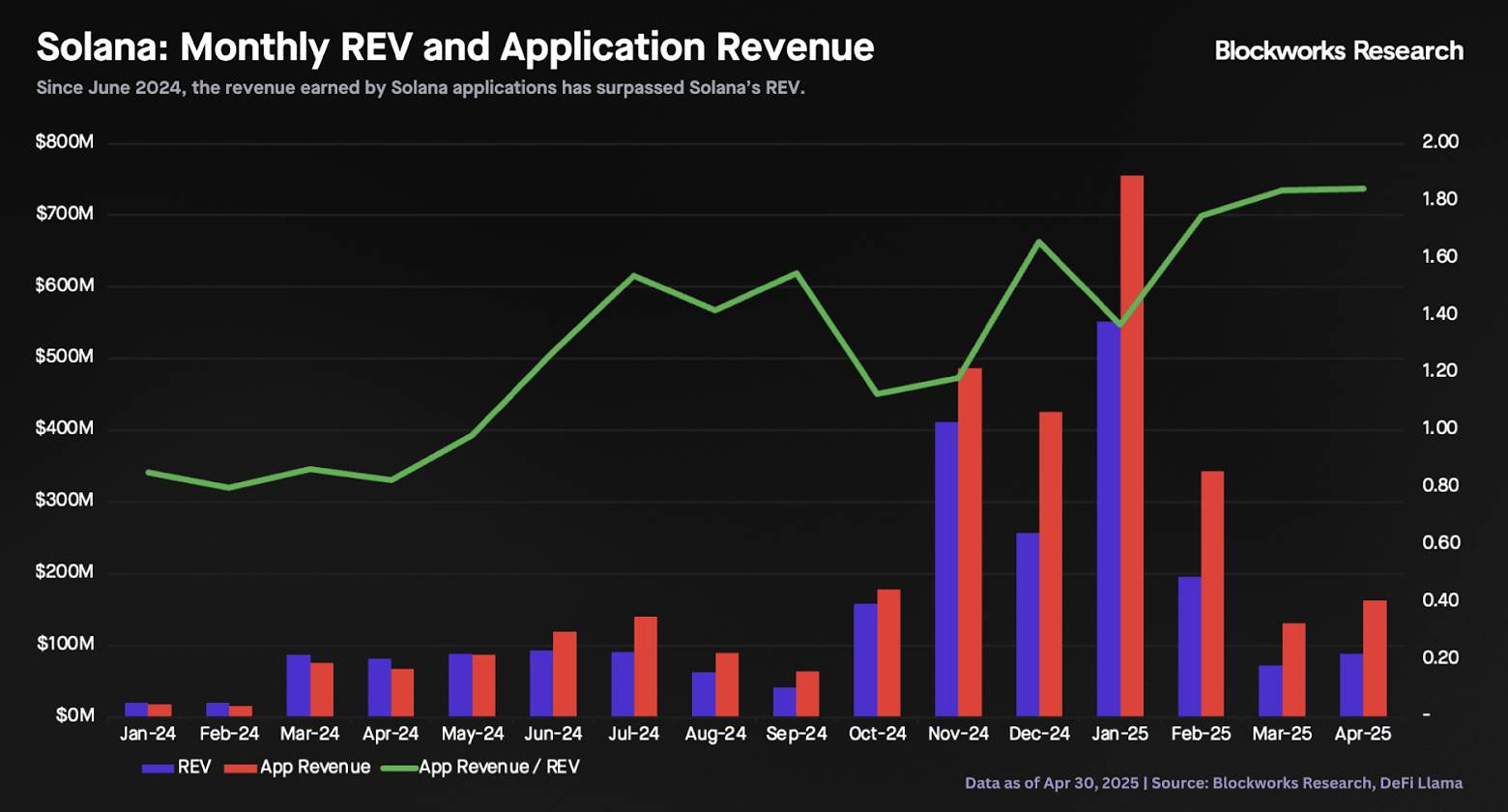

According to Blockworks Research, the total revenue across all Solana applications is only about 1.8 times Solana’s own revenue.

For a platform business, this is an extremely high take rate—far above Apple’s 30% cap, which the U.S. government already considers monopolistic.

This could mean Solana’s revenue is too high, so its token valuation multiple should be lower; or it could indicate Solana has a strong business moat, so its valuation multiple should be higher.

Either way, it’s a story worth watching.

Hyperliquid

Hyperliquid is a semi-decentralized crypto exchange with a somewhat unusual story: the protocol generated $43 million in revenue in April and distributed nearly all of it to token holders.

Unsurprisingly, this model has helped its token perform well recently. As Boccaccio of Blockworks Research noted in a recent report: "The treasury uses trading fees to repurchase tokens every 10 minutes, creating constant buy-side pressure."

Every 10 minutes!

It’s hard to make a clear judgment here, as no company in traditional finance returns 100% of its revenue to shareholders—let alone every 10 minutes.

Judging by its valuation, the crypto market also seems somewhat hesitant.

The HYPE token trades at around 17x annualized revenue (based on market cap), which under normal circumstances would be considered expensive.

But in this case, revenue and profit are practically the same thing, so if you believe HYPE can continue capturing business from centralized exchanges, this valuation looks quite reasonable.

Boccaccio notes that HYPE’s valuation multiple is significantly higher than its decentralized peers, but those peers may not be appropriate comparables.

"Hyperliquid’s L1 needs only a tiny fraction of Binance’s daily volume to meaningfully boost its own… capturing just 10-15% of Binance’s BTC/USDT pair volume could increase HyperCore’s volume by 50%."

"Thus, the growth multiple is justified," Boccaccio concludes.

Of course, the size of that multiple depends on how much you believe in this story.

Jupiter

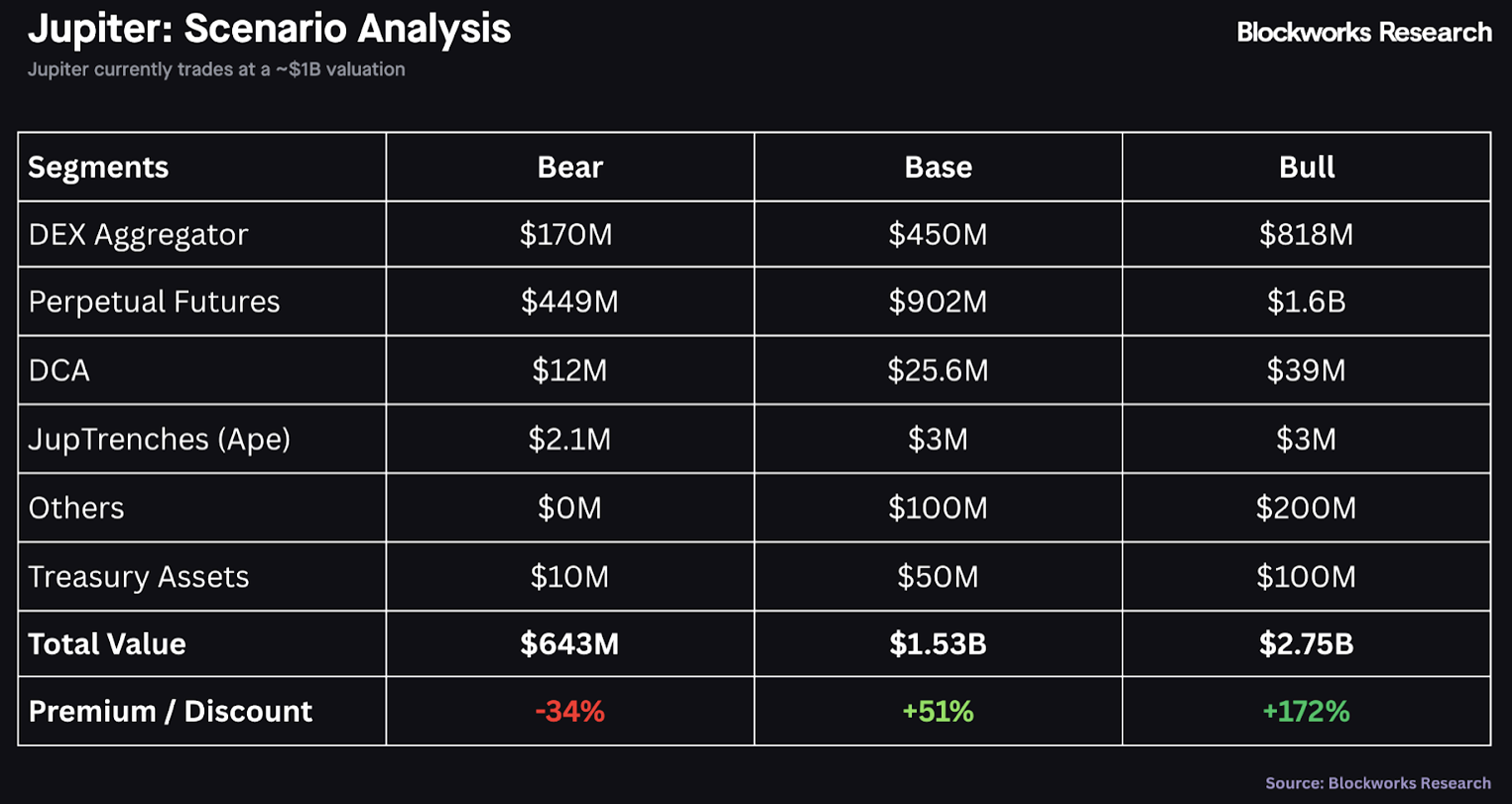

Jupiter, a DEX aggregator on Solana, returns a relatively modest 50% of its revenue to token holders (also via buybacks)—but its revenue is still substantial.

Marc Arjoon estimates Jupiter could generate $280 million in revenue over the next 12 months, implying a yield of approximately 11.5% for the JUP token based on its market cap.

In equities, an 11.5% yield usually signals a distressed business, but that doesn’t seem to be the case here.

"Jupiter is the default router on Solana," Arjoon writes, "unrivaled in aggregation today," and "the fourth highest revenue-generating application among all crypto dapps."

More importantly, it’s run like a real business: "Jupiter’s strategic moves in 2024–2025 suggest an organization actively entering a high-growth phase, ambitiously positioning itself as Solana’s top-tier crypto super app."

This doesn’t sound like a company that should carry an 11.5% yield at all.

Certainly, many risks remain, which Arjoon details thoroughly in his latest report.

But his conclusion is that "Jupiter currently trades at a valuation multiple attractive relative to peers, suggesting significant upside potential even without multiple expansion."

He even quantified this through a sum-of-the-parts valuation analysis, which my TradFi instincts appreciate:

This looks like a solid story.

Helium

Helium, a decentralized telecom provider, has long been a popular topic in crypto—it was founded as early as 2013.

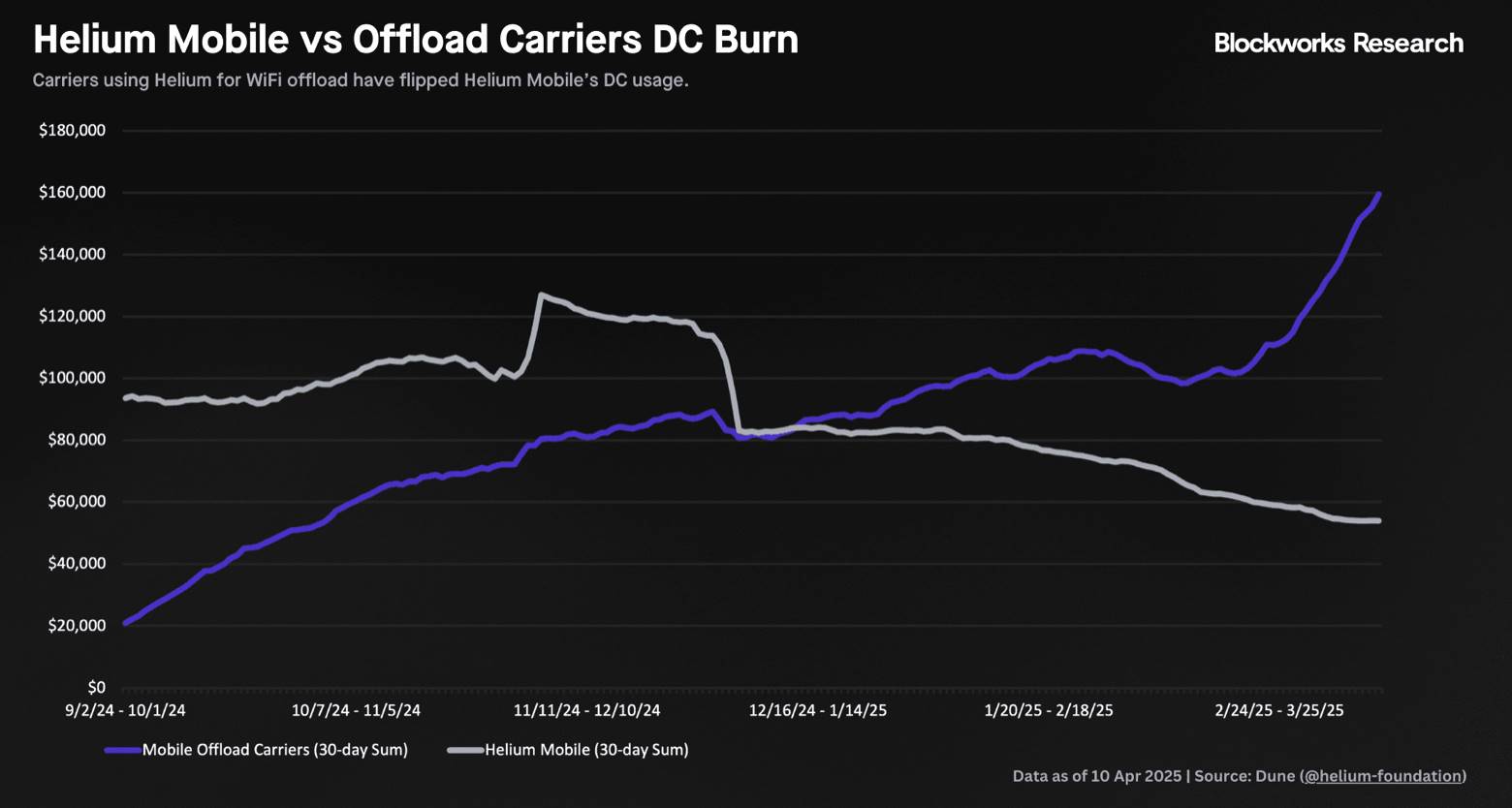

But now, it’s no longer just a story, but a data-backed one: "Revenue measured by Data Credit Burn is accelerating, with 43% quarter-over-quarter growth," wrote Nick Carpinito of Blockworks Research in a recent report.

"More importantly, Helium’s revenue is shifting from Helium Mobile to Mobile Offload, which now accounts for roughly three times the Data Credit Burn and is growing nearly 180% quarter-over-quarter—an astonishing growth rate for a DePIN protocol selling into enterprise budgets."

"Mobile Offload" is the blue line in the chart above, with quarterly growth reaching 180%—a staggering figure by any standard.

Helium’s HNT token appears to already reflect this, currently trading at around 120x annualized sales.

But Carpinito mentioned on the 0xResearch podcast that he expects revenue acceleration to continue, driven by "AT&T allowing its U.S. users to connect to the Helium network, causing a surge in Data Credit usage."

Therefore, "over the next 12 months, we’re likely to see unprecedented price increases in HNT, and this rise will be far more stable than previous speculative spikes in Helium’s price."

In crypto, it’s rare to hear someone make a price prediction based on non-speculative factors.

And refreshingly so.

Pendle

Finally, Pendle is a "yield trading" protocol whose new product, "Boros," will allow users to speculate on any on-chain or off-chain yield, starting with funding rates.

"This setup resembles the classic interest rate swap market, where traders can pay floating to receive fixed, or pay fixed to receive floating, with leverage support," explained Luke Leasure of Blockworks Research.

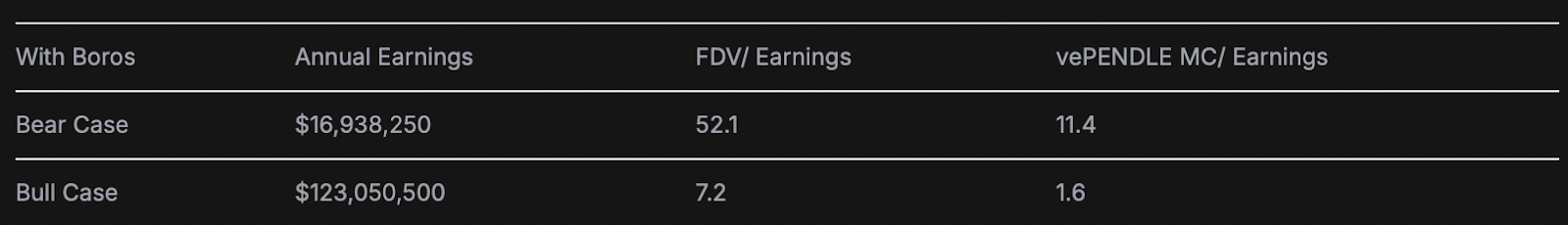

To someone like me from traditional finance, this sounds complex—but clearly it addresses a massive market: "Perpetual futures markets settle close to $60 trillion annually, with hundreds of billions in open interest. Boros is entering a vast, untapped market." Leasure expects Boros could double Pendle’s revenue.

This is rarely heard in traditional finance.

In an optimistic scenario, Leasure estimates Pendle’s vote-escrowed token version might trade at just 1.6x yield:

1.6x!

In equities, a 1.6x earnings multiple only occurs when a company is near collapse—but clearly that’s not Pendle’s situation.

Still, this is not investment advice (at least not from me), as Pendle’s story is quite complex—like most projects in crypto.

But at least now, these stories can be told with numbers.

——Byron Gilliam

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News