Bitcoin is becoming a "Swiss Army knife" asset

TechFlow Selected TechFlow Selected

Bitcoin is becoming a "Swiss Army knife" asset

Can open a bottle, and also "open the market."

Author: TechFlow

Here’s a ghost story: Bitcoin is about to reclaim $100,000.

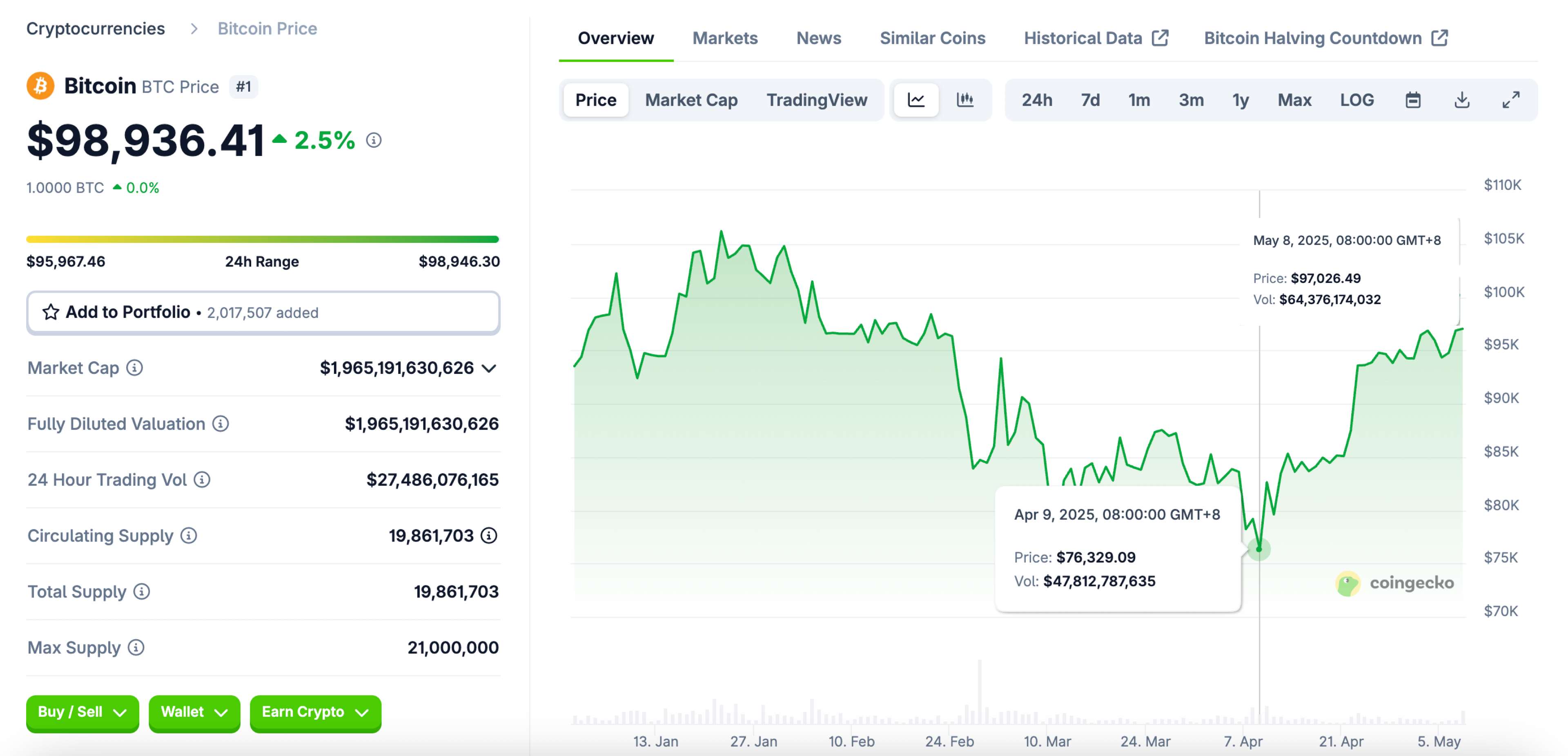

After breaking $100,000 in early 2025, Bitcoin’s price dropped to around $76,000 amid shifting global economic and political landscapes—particularly changes tied to the U.S. election and tariff policies.

And just when you screamed “My crypto journey is over” after witnessing altcoins collapsing, liquidity drying up, and one scam after another during this crime season—Bitcoin came back.

Seemingly unaffected by the turbulence in the broader crypto market, Bitcoin remains, as always, Bitcoin.

Bitcoin perfectly embodies the leading-man narrative of “You ignored me yesterday, now you can’t reach me today.” Looking back, it still stands at the top when comparing returns across all asset classes over the past decade.

Along the way, it has had no rivals—but also no friends.

No friends because, for a long time, the general public and mainstream finance remained puzzled and cautious toward it—mostly they just “don’t get it.”

Meanwhile, within the crypto space, there have always been more volatile, high-return projects and narratives that made insiders look down on Bitcoin’s returns during bullish cycles.

But now, everyone wants to be friends with Bitcoin.

From an investment standpoint, having weathered multiple cycles, Bitcoin is one of the few assets capable of thriving both in good times and bad (provided you have patience). Just compare ETH maximalists (E Guards) and other altcoins.

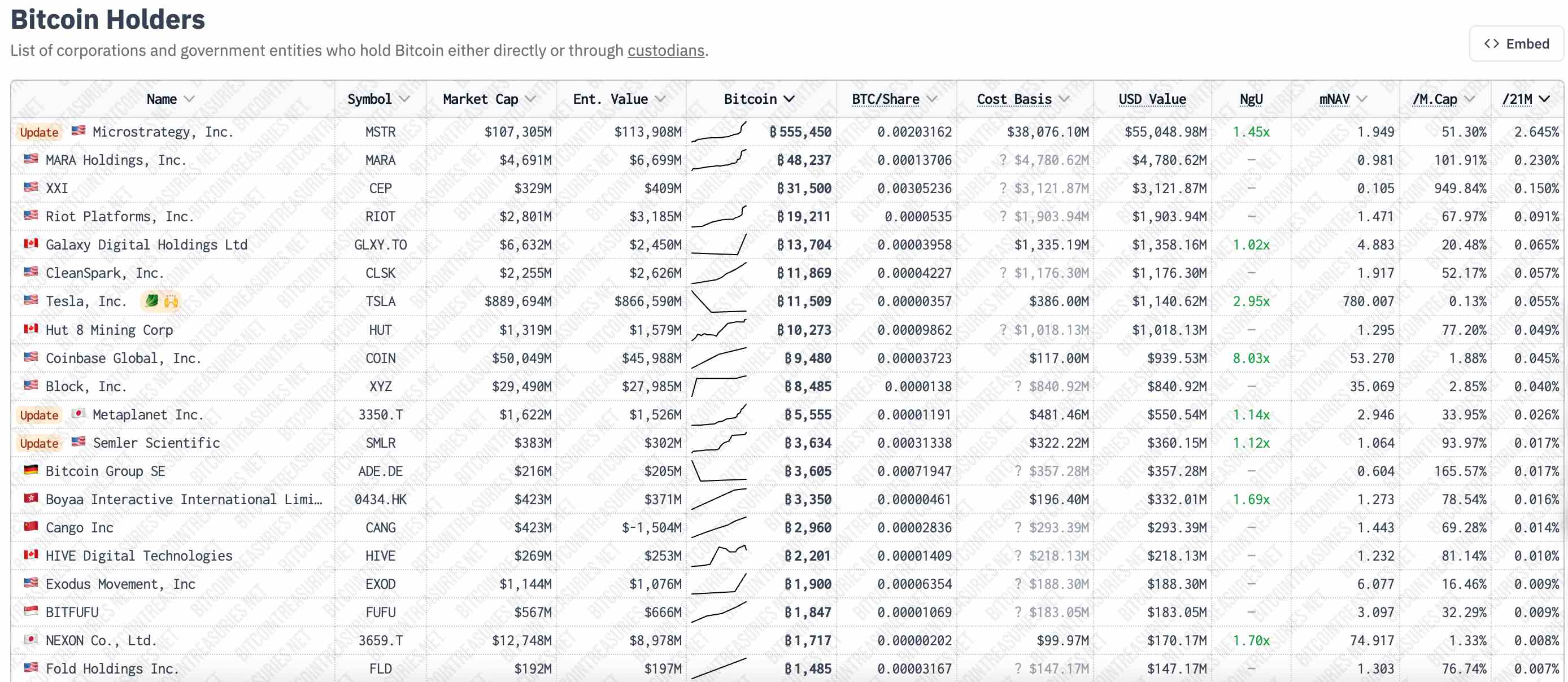

It's not only those in the space who understand this—increasingly, major corporations and government bodies worldwide are adding Bitcoin to their balance sheets and strategic reserves.

Today, Bitcoin is becoming more and more like a “Swiss Army knife” for navigating shifts in the global economy.

Can open bottles—and markets

Have you seen this thing? A small, yet incredibly versatile red pocketknife.

Born in the late 19th century as a tool for Swiss soldiers, it became synonymous with “solving multiple problems with one tool” thanks to its integration of blade, screwdriver, bottle opener, scissors, and even tweezers.

Whether opening packages or surviving in the wild—lighting fires, cutting materials—it gets the job done.

Today, Bitcoin serves as a financial instrument capable of handling diverse and complex economic environments. In many ways, it’s just like that Swiss Army knife:

It can act as a store of value, preserving wealth like gold during turmoil; serve as a hedge against inflation and currency devaluation; and even function as a growth asset deliveringexcess returns in high-risk, high-reward scenarios.

It may not be the most specialized investment, but it’s the ultimate multi-tool in volatile markets.

This versatility has been especially evident in 2025—a year defined by uncertainty.

Since the beginning of 2025, the global economic and political climate has felt like a rollercoaster ride—constantly surging and plunging.

Economically, inflation pressures remain elevated across regions like Europe and the U.S., supply chain disruptions linger, and central bank policies swing between tightening and hesitation—leaving markets anxious. At key moments, the U.S. Dollar Index (DXY) appeared particularly weak, raising concerns about the stability of traditional monetary systems.

Politically, bombshells keep dropping. Most notably, on April 2, 2025, Trump unveiled his “Liberation Day” tariff policy, igniting the fuse of a global trade war. Markets widely interpreted this as escalating geopolitical tensions, triggering rapid fear. The S&P 500 dropped 6.5% within a single month.

The crypto market wasn’t immune either. This cycle saw altcoins crashing one after another, liquidity crunches recurring, and questionable practices—some of which would warrant legal consequences in traditional finance—eroding trust in many projects.

Of course, elite P-generals and ever-profitable KOLs did make money—but likely only if you were exiting liquidity.

In this chaotic environment marked by overlapping uncertainties, what asset can ordinary people actually rely on? One answer points clearly to Bitcoin.

Data doesn’t lie. Amid market chaos, Bitcoin remained “rock solid.”

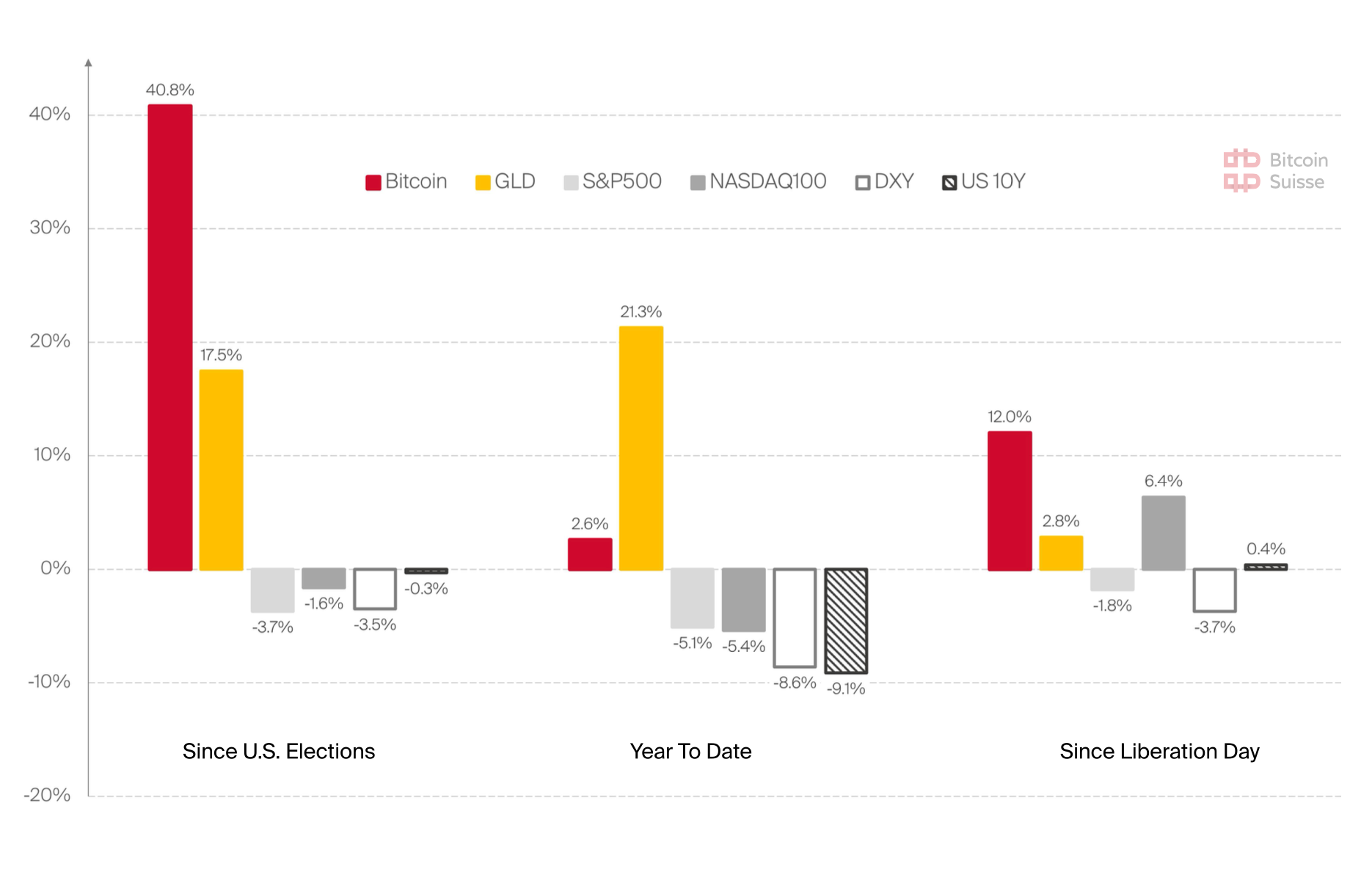

Recently, crypto asset manager Bitcoin Suisse released its April 2025 industry report, analyzing returns across asset classes following several key events this year:

-

Since the U.S. presidential election, Bitcoin rose 40%, gold increased 17.5%;同期 the S&P 500, Nasdaq 100, DXY, and 10-year U.S. Treasury returned -3.7%, -1.6%, -3.5%, and -0.3% respectively;

-

Since the announcement of the “Liberation Day” tariff policy, Bitcoin gained 12%, gold rose 2.8%;同期 the S&P 500, Nasdaq 100, DXY, and 10-year U.S. Treasury returned -1.8%, +6.4%, -3.7%, and +0.4% respectively;

-

Since January 1, 2025, Bitcoin increased 2.6%, gold surged 21.3%;同期 the S&P 500, Nasdaq 100, DXY, and 10-year U.S. Treasury fell by -5.1%, -5.4%, -8.6%, and -9.1% respectively;

In comparison, risk assets tied to the U.S. economy and dollar underperformed relative to Bitcoin and gold.

Granted, gold remains in the top tier—but isn’t that expected? Gold has long been accepted as a safe haven. For investors, it’s more about “preserving floor value” than “delivering surprises.”

The surprise comes from Bitcoin—the once-dismissed outlier.

It demonstrated clear safe-haven characteristics, weathered market volatility caused by policy shocks, and potentially gained additional upside due to rising demand for alternative assets—proving itself again and again despite endless skepticism and repeated declarations of its death.

At this point, we must bring out that classic meme image—perfectly capturing the evolution of public perception toward Bitcoin:

People carry biases, make mistakes, and miss opportunities—but the best among us adapt. Savvy politicians and profit-driven companies cannot ignore the data.

Over the past couple of years, we’ve seen increasing crypto-friendly moves in the U.S.—from mining and regulation to strategic reserve discussions, even presidential-level engagement. You can question their sincerity, but not their sharp sense for profitable opportunities.

And MicroStrategy (now renamed Strategy), aggressively buying BTC every month like a brute force machine, has gradually shown traditional firms that this move might not only boost short-term stock prices but could also be a serious and rational decision.

A Swiss Army knife—everyone should have one. It won’t hurt; being ready for any scenario is good.

Drop the shame, embrace Bitcoin

Crypto从业者 often carry a sense of secrecy and shame.

Except for the already successful elites, most tend to hide behind cartoon avatars in group photos—citing “anonymous culture”; when introducing their jobs, they prefer polished, compliant-sounding titles to mask what they actually do.

There’s a lack of genuine pride and confidence in their work, coupled with deep anxiety about being exposed or questioned.

Ultimately, some struggle with internal dissonance—believing their jobs create no real value, knowing their work may indirectly enable harmful activities, and feeling profoundly disconnected between their professional lives and reality.

If you’re tired of conspiracies, try embracing Bitcoin—the biggest open game in town.

No matter your role, gradually accumulating Bitcoin through various means might offer the optimal balance of energy, identity, and security.

Next time a从业者 feels hesitant to speak up, try a new title:

Who am I? I’m a Bitcoin holder.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News