The Fed pauses rate cuts again, warns of stagflation risks, reiterates "uncertainty" is increasing

TechFlow Selected TechFlow Selected

The Fed pauses rate cuts again, warns of stagflation risks, reiterates "uncertainty" is increasing

Economic uncertainty has "further" increased, and the risks of rising unemployment and inflation have also increased.

Author: Wall Street Horizon

Key Points:

The Federal Reserve paused rate cuts for the third consecutive meeting, in line with market expectations.

The statement noted that "further" uncertainty has increased, adding a new sentence stating that "risks of both rising unemployment and rising inflation have increased."

The statement reiterated that recent indicators show economic activity continues to expand robustly, but pointed out that fluctuations in net exports have affected the data.

Continuation of balance sheet reduction.

This decision received unanimous support from all FOMC voting members, unlike the previous meeting where one member dissented.

"The New Fed Whisperer": Fed officials are weighing whether risks to employment or inflation should be their primary focus.

U.S. President Trump is disappointed again. Despite repeated calls for rate cuts, the Fed chose to hold steady and not cut rates, while also suggesting that Trump's policies carry a risk of stagflation.

On Wednesday, May 7, Eastern Time, the Federal Reserve announced after its Federal Open Market Committee (FOMC) meeting that the target range for the federal funds rate would remain unchanged at 4.25% to 4.5%. This marks the third consecutive monetary policy meeting where the Fed has decided to pause action. The Fed had cut rates three times consecutively since September last year, totaling a 100 basis point reduction. Since Trump took office in January this year, the Fed has remained on hold.

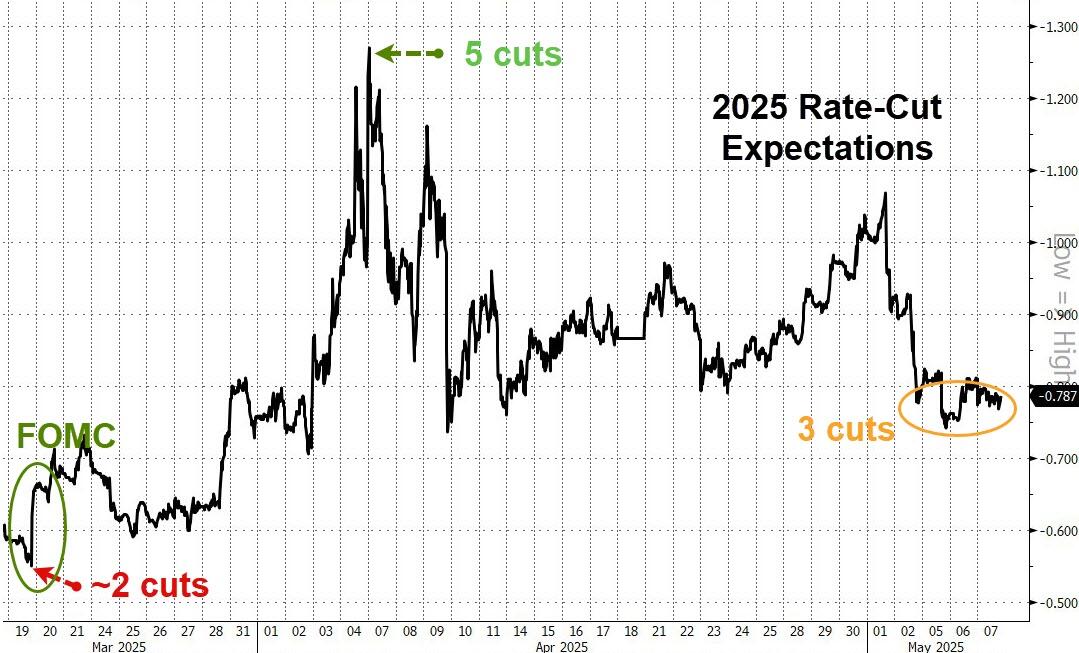

The Fed's decision to pause rate cuts was fully anticipated by markets. By Tuesday’s close, CME Group tools showed futures markets priced in over a 95% probability the Fed would keep rates unchanged this week, over 68% probability no cut in June, and about 77% chance of a cut in July. Ahead of the Wednesday announcement, derivatives markets indicated traders had reduced bets on rate cuts, now expecting roughly three 25-basis-point cuts starting in July.

Last Friday’s release of U.S. nonfarm payrolls for April far exceeded expectations, reflecting continued resilience in the labor market and cooling investors’ rate-cut expectations. Nick Timiraos, known as "the New Fed Whisperer," commented that strong jobs data reduce the likelihood of a June rate cut; facing a dilemma between recession risks and inflation pressures, the Fed will likely prioritize avoiding an inflation spiral, thus possibly delaying rate cuts.

Following the Fed's announcement on Wednesday, Timiraos commented that the Fed's warning about increasing risks of both higher unemployment and higher inflation indicates officials are debating whether to focus more on the risk of rising prices or weakening employment. In other words, the Fed must decide whether to prioritize protecting jobs or fighting inflation.

Economic Uncertainty "Further" Increases; Risks of Rising Unemployment and Inflation Have Increased

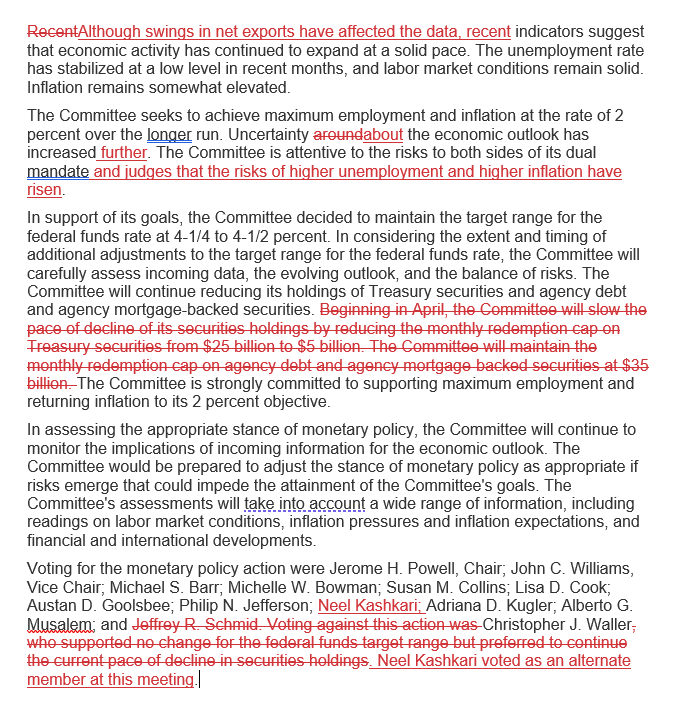

Compared to the FOMC statement released in late March, the Federal Reserve's latest statement includes three main changes. The first relates to economic assessment.

The previous statement removed the phrase "risks to achieving both employment and inflation goals are broadly balanced," and added "uncertainty about the economic outlook has increased." The current statement adjusts this further to "uncertainty about the economic outlook has further increased," adding the word "further" to emphasize the growing level of uncertainty.

Immediately following this revised sentence, the statement reaffirms that the FOMC committee remains focused on the balance of risks to achieving maximum employment and price stability, and then adds half a sentence:

"and judges that risks of both rising unemployment and rising inflation have increased."

In addition, there is a slight change in the opening paragraph assessing the economy. The previous statement began with: "Recent indicators suggest that economic activity has continued to expand at a solid pace." The current version adds a clause before that, resulting in the following opening: "Although fluctuations in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace."

Balance Sheet Reduction Continues; Full FOMC Voting Support for Decision

The prior decision indicated that the Fed decided to further slow the pace of its balance sheet reduction (quantitative tightening, QT), following the adjustment made in June last year.

The specific measure was to reduce the monthly cap on maturing Treasury securities rolled off the balance sheet from $25 billion to $5 billion starting in April, while maintaining the monthly cap on agency debt and agency mortgage-backed securities (MBS) at $35 billion.

The current statement does not mention the April adjustment to the Treasury roll-off cap and simply omits the sentence regarding this adjustment, instead reiterating that the Fed will continue reducing its holdings of U.S. Treasuries, agency debt, and agency MBS.

This means that after slowing the pace of balance sheet reduction in April, the Fed has not made any further changes to its QT guidance.

Another key difference compared to the previous meeting is that all FOMC voting members supported this decision—both to leave interest rates unchanged and to maintain the current pace of balance sheet reduction.

At the previous meeting, one FOMC member dissented. Governor Christopher Waller voted against the decision. While he supported continuing the pause on rate cuts, he opposed slowing the pace of balance sheet reduction and preferred to maintain the existing runoff speed.

The red text below highlights additions and deletions in the current statement compared to the previous one.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News