Is Bitcoin decoupling from traditional markets?

TechFlow Selected TechFlow Selected

Is Bitcoin decoupling from traditional markets?

Bitcoin, as a unique asset class, will follow its own market trend.

Authors: Tanay Ved, Victor Ramirez, Coin Metrics

Translation: Luffy, Foresight News

Key Takeaways:

-

The correlation between Bitcoin and equities and gold has recently dropped to near zero, suggesting that Bitcoin is undergoing a decoupling phase from traditional assets—a pattern typically observed during periods of major market catalysts or shocks.

-

Although Bitcoin has low correlation with interest rates, shifts in monetary policy still affect its performance. During the tightening cycle from 2022 to 2023, Bitcoin showed a strong negative correlation with rate hikes.

-

Despite being labeled "digital gold," historically Bitcoin has exhibited a higher beta and stronger upside sensitivity relative to equities, especially during optimistic macroeconomic conditions.

-

Since 2021, Bitcoin’s volatility has steadily declined, and its current volatility trend more closely resembles that of popular tech stocks, reflecting a maturing risk profile.

Introduction

Is Bitcoin decoupling from broader markets? Its recent outperformance relative to gold and equities has reignited this debate. Over its 16-year history, Bitcoin has been assigned many labels—from “digital gold” to “store of value,” to “risk-on asset.” But does it truly possess these characteristics? Is Bitcoin fundamentally different as an investment asset, or is it merely a leveraged version of existing risk assets in the market?

In this edition of the Coin Metrics Network State Report, we examine Bitcoin’s behavior across different market environments, focusing on the catalysts and conditions behind periods of low correlation with traditional assets like equities and gold. We also analyze how shifts in monetary policy regimes influence Bitcoin’s performance, assess its sensitivity to broader markets, and study its volatility characteristics in relation to other major assets.

Bitcoin Across Interest Rate Regimes

The Federal Reserve is one of the most influential forces in financial markets due to its control over interest rates. Changes in the federal funds rate—whether during tightening or easing cycles—directly impact money supply, market liquidity, and investor risk appetite. Over the past decade, we’ve transitioned from the zero-interest-rate era, through unprecedented monetary easing during the pandemic, to aggressive rate hikes in 2022 aimed at curbing rising inflation.

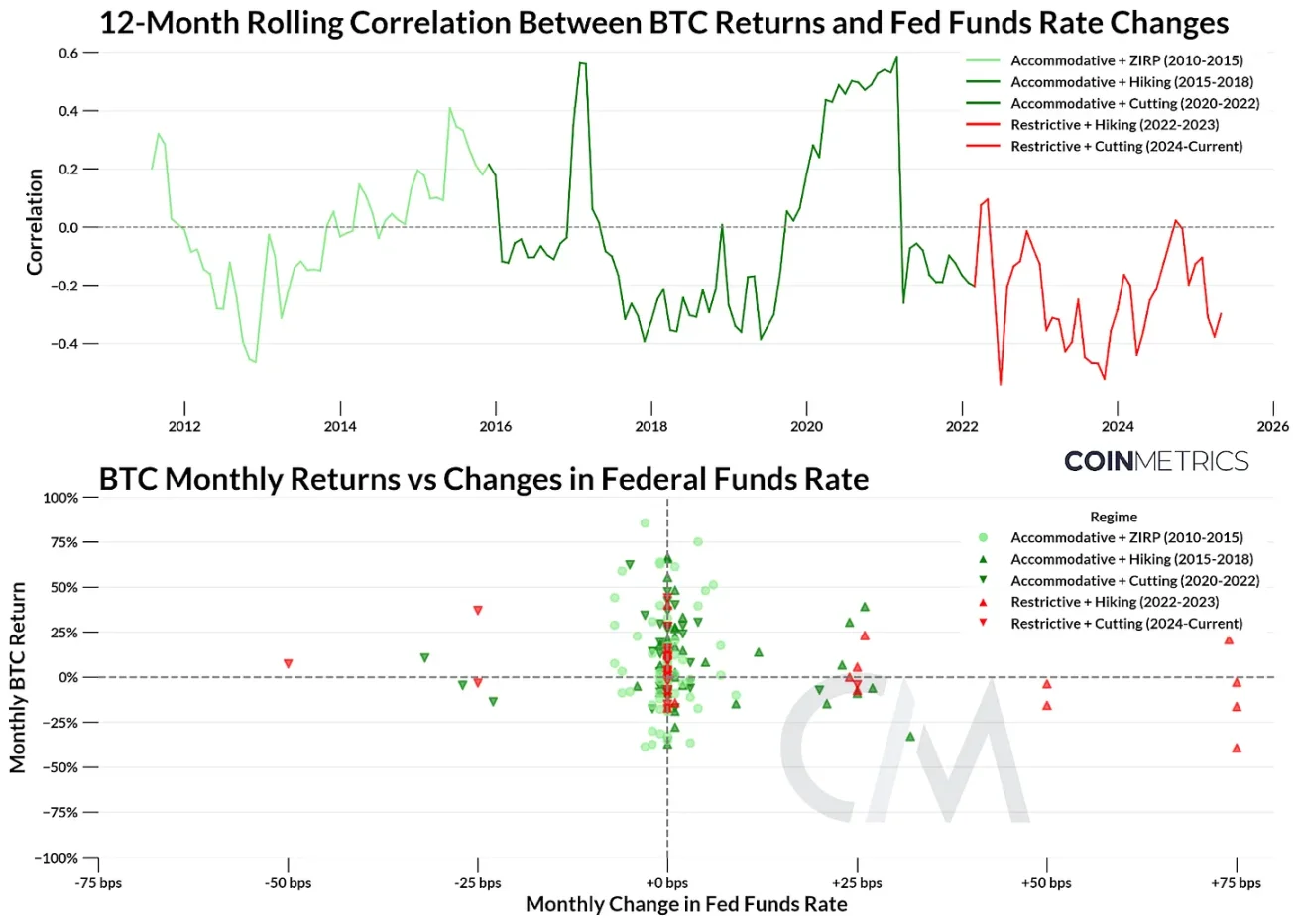

To understand Bitcoin’s sensitivity to changes in monetary policy, we divide its history into five key interest rate regimes. These regimes consider both the direction and level of rates, ranging from accommodative (federal funds rate below 2%) to restrictive (above 2%). Given that interest rate changes are infrequent, we compare Bitcoin’s monthly returns against monthly changes in the federal funds rate.

Data source: Coin Metrics and Federal Reserve Bank of New York

While Bitcoin’s overall correlation with interest rate changes is low and centered around neutral levels, distinct patterns emerge during regime shifts:

-

Accommodative + Zero Rates (2010–2015): Following the post-2008 financial crisis zero-rate policy, Bitcoin delivered its highest returns. Correlation with rates was roughly neutral, consistent with Bitcoin’s early growth phase.

-

Accommodative + Rate Hikes (2015–2018): As the Fed raised rates toward 2%, Bitcoin’s returns fluctuated. Although correlation spiked in 2017, it remained generally low, indicating some disconnection between Bitcoin and macro policy.

-

Accommodative + Rate Cuts (2018–2022): This period began with aggressive rate cuts and fiscal stimulus in response to the pandemic, followed by nearly two years of near-zero rates. Bitcoin’s returns varied widely but leaned positive. Correlation swung dramatically, falling below -0.3 in 2019, peaking at +0.59 in 2021, then returning to near-neutral.

-

Restrictive + Rate Hikes (2022–2023): To combat surging inflation, the Fed executed one of its fastest tightening cycles, pushing the federal funds rate above 5%. Under this regime, Bitcoin showed a strong negative correlation with rate changes. Risk-off sentiment weighed on performance, exacerbated by crypto-specific shocks such as the collapse of FTX in November 2022.

-

Restrictive + Rate Cuts (2023–Present): With three high-level rate cuts completed, Bitcoin’s performance has shifted from neutral to moderately positive. This period has also seen catalytic events such as the U.S. presidential election and trade war developments, which continue to influence Bitcoin’s trajectory. Correlation remains negative but appears to be trending toward zero, suggesting Bitcoin is in a transitional phase as macro conditions begin to ease.

While interest rates shape the market backdrop, comparing Bitcoin’s relationship with equities and gold offers clearer insight into its relative performance across major asset classes.

Bitcoin Returns in Relation to Gold and Equities

Correlation

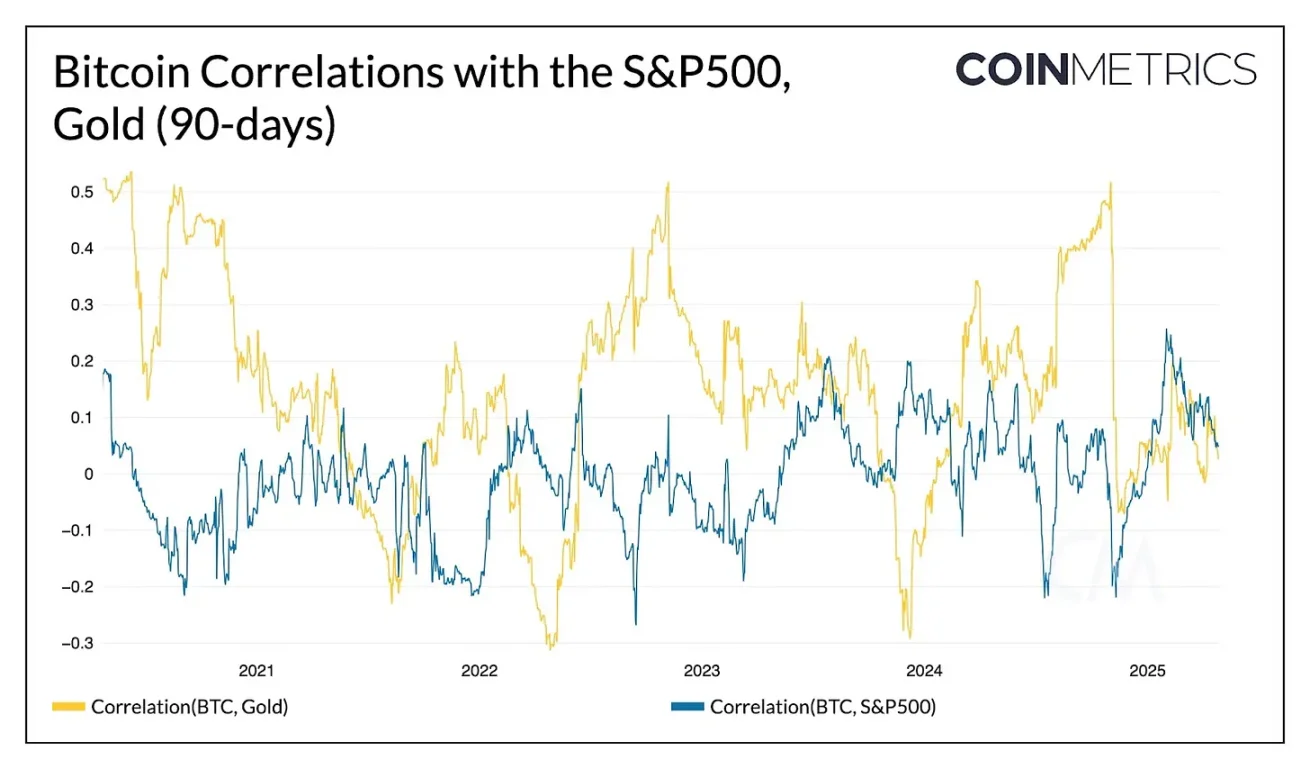

The most direct way to assess whether an asset is decoupled from another is to examine return correlations. Below is a chart showing the 90-day rolling return correlation between Bitcoin and the S&P 500 index and gold.

Data source: Coin Metrics

Indeed, Bitcoin’s historical correlations with both gold and equities have generally been low. Typically, Bitcoin’s returns oscillate between higher correlation with gold versus equities, often showing a slightly stronger link with gold. Notably, Bitcoin’s correlation with the S&P 500 rose during heightened market sentiment in 2025. However, starting around February 2025, Bitcoin’s correlation with both gold and equities has trended toward zero, indicating a unique “decoupling” phase not seen since the peak of the previous cycle in late 2021.

When correlations fall this low, what typically happens? We identified periods when Bitcoin’s rolling 90-day correlations with the S&P 500 and gold fell below a significant threshold (approximately 0.15) and annotated the most notable events during those times.

Periods of Low Correlation Between Bitcoin and the S&P 500

Periods of Low Correlation Between Bitcoin and Gold

Unsurprisingly, past instances of Bitcoin’s decoupling occurred during significant shocks within the crypto market, such as China’s Bitcoin ban and the approval of spot Bitcoin ETFs. Historically, low-correlation periods last about 2 to 3 months, depending on the chosen threshold.

These periods were indeed accompanied by modestly positive returns. However, given the uniqueness of each episode, careful consideration should be applied before drawing conclusions about Bitcoin’s recent behavior. That said, for investors seeking substantial Bitcoin allocation in a diversified portfolio, Bitcoin’s current low correlation with other assets is an ideal feature.

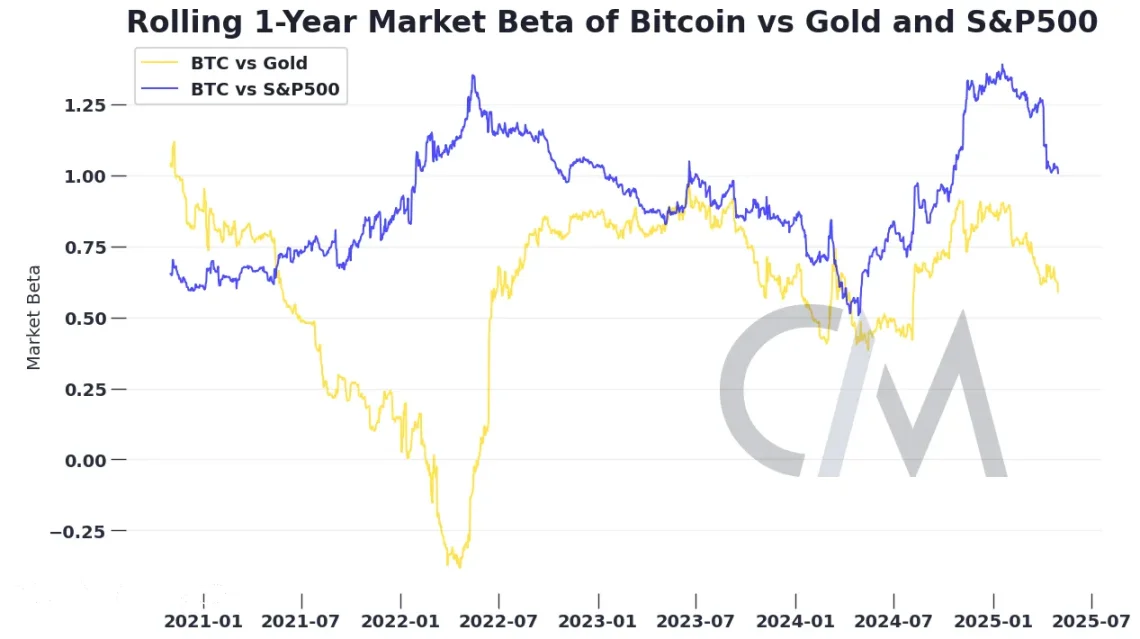

Market Beta

Beyond correlation, market beta is another useful metric for measuring the relationship between an asset’s returns and market returns. Market beta quantifies how much an asset’s return is expected to change in response to movements in the market benchmark, calculated as the sensitivity of the asset’s excess return (over the risk-free rate) to the benchmark. While correlation measures the direction and strength of the linear relationship between an asset and the benchmark, beta measures the direction and magnitude of an asset’s sensitivity to market fluctuations.

For instance, Bitcoin is often said to trade at a “high beta” relative to equity markets. Specifically, if an asset like Bitcoin has a market beta of 1.5, a 1% move in the benchmark (e.g., S&P 500) implies an expected 1.5% move in the asset’s return. A negative beta means the asset tends to deliver negative returns when the benchmark delivers positive ones.

For much of 2024, Bitcoin’s beta relative to the S&P 500 was well above 1, indicating high sensitivity to equity market swings. In optimistic, risk-on environments, investors holding a portion of Bitcoin achieved higher returns than those holding only the S&P 500. Despite its “digital gold” label, Bitcoin’s low beta relative to physical gold suggests that holding both assets can hedge against downside risks in either.

As we enter 2025, Bitcoin’s beta relative to both the S&P 500 and gold has begun to decline. While its dependence on these assets is decreasing, Bitcoin remains sensitive to market risk, and its returns continue to correlate with broader market movements. Bitcoin may be evolving into a distinct asset class, but it still trades largely like a risk-on asset. There is currently little evidence supporting its classification as a “safe-haven asset.”

Bitcoin Performance During High Volatility Periods

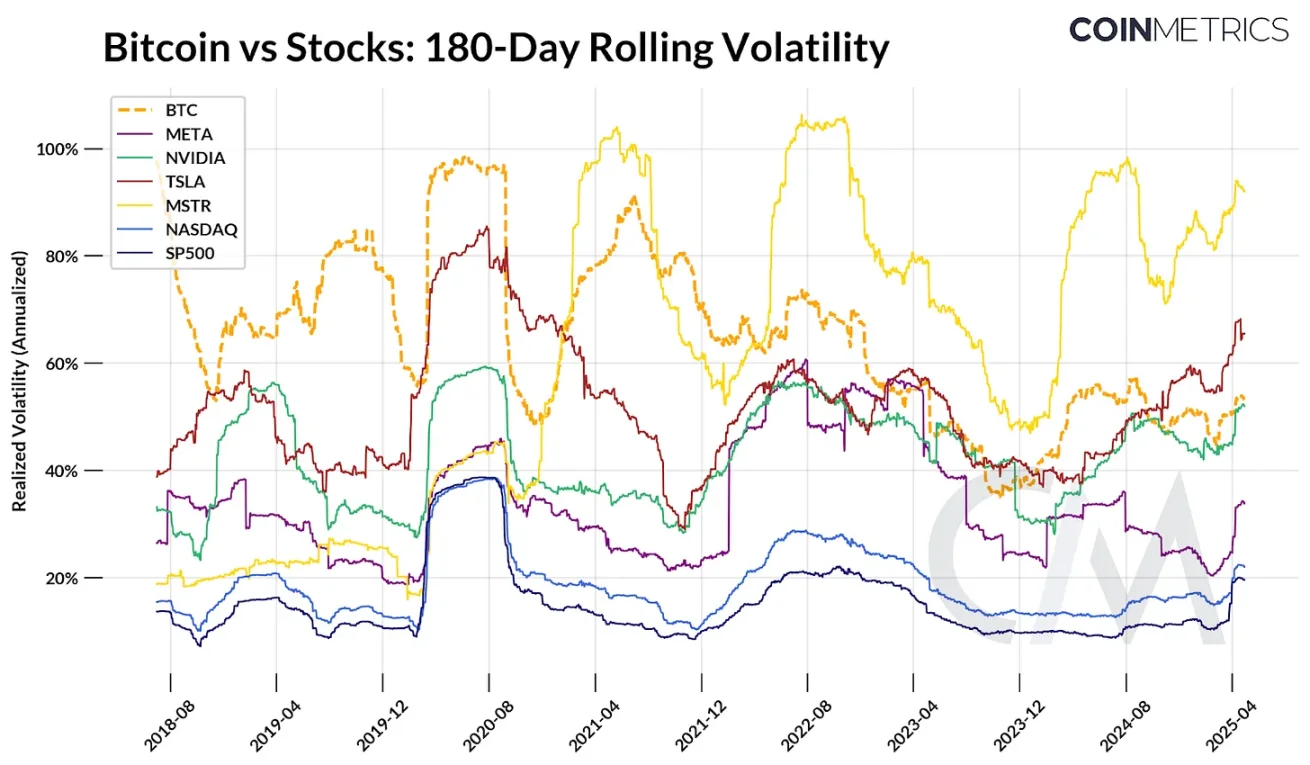

Realized volatility provides another dimension for understanding Bitcoin’s risk profile, measuring the magnitude of price fluctuations over time. Volatility is often considered a core characteristic of Bitcoin—both a driver of risk and a source of return. The chart below compares Bitcoin’s 180-day rolling realized volatility with that of major indices such as the Nasdaq, S&P 500, and select tech stocks.

Data source: Coin Metrics and Google Finance

Over time, Bitcoin’s volatility has trended downward. In its early stages, driven by sharp price rallies and drawdowns, Bitcoin’s realized volatility frequently exceeded 80%-100%. During the pandemic, Bitcoin’s volatility rose alongside equities and also spiked independently during certain periods in 2021 and 2022 due to crypto-specific shocks like the collapses of Luna and FTX.

However, since 2021, Bitcoin’s 180-day realized volatility has gradually declined, recently stabilizing around 50%-60% even amid elevated market volatility. This brings Bitcoin’s volatility in line with many popular tech stocks—lower than MicroStrategy (MSTR) and Tesla (TSLA), and very close to that of Nvidia (NVIDIA). While Bitcoin remains susceptible to short-term market swings, its improved relative stability compared to past cycles may reflect its maturation as an asset.

Conclusion

Has Bitcoin truly decoupled from the rest of the market? That depends on how you measure it. Bitcoin is not entirely immune to real-world forces. It remains subject to the same market dynamics affecting all assets: interest rates, specific market events, and returns on other financial instruments. Recently, we’ve seen Bitcoin’s returns become uncorrelated with the broader market—but whether this is a temporary trend or part of a lasting structural shift remains to be seen.

This decoupling raises a bigger question: What role does Bitcoin play in a portfolio designed to diversify risk? Bitcoin’s risk-return profile can be puzzling—one week it behaves like a leveraged Nasdaq, the next like digital gold, and the week after as a hedge against fiat depreciation. But perhaps this variability is a feature, not a flaw. Rather than forcing imperfect analogies between Bitcoin and other assets, a more constructive approach may be to understand why Bitcoin increasingly follows its own path as it evolves into a unique asset class.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News