The "Meituan War" in the Crypto Circle: The Traffic Game Behind Alpha Points

TechFlow Selected TechFlow Selected

The "Meituan War" in the Crypto Circle: The Traffic Game Behind Alpha Points

In the seemingly bustling "exchange subsidy war," points become increasingly competitive and thresholds rise, leaving ordinary users more like background extras just tagging along.

Author: Scof, ChainCatcher

The food delivery market has suddenly become lively.

Jingdong is stepping up, Alibaba is entering, and Meituan is fighting back—setting off a three-way battle. Waves of "free bubble tea," "hundred-billion subsidies," and "quality goods delivered in 30 minutes" are emerging one after another. The underlying logic, however, is simple: bind users through high-frequency consumption scenarios (food delivery) to lay the foundation for their instant retail businesses.

This is essentially similar to the fierce competition among crypto exchanges. Binance's Alpha Points system is the most typical example—points for new token offerings, airdrop rankings, trading volume rankings—in other words, it's also a "subsidy war" within the digital asset space. It’s not about acquiring new users, but capturing user attention, trading behavior, and loyalty.

Other exchanges aren't idle either. Bybit quickly followed with its staking-based Alpha Points airdrop, mirroring Binance's model to compete for the same highly active users; OKX announced it will launch a million-token airdrop program.

This is a classic case of zero-sum game.

Alpha Points Race Reaches New Heights, Ordinary Users Marginalized

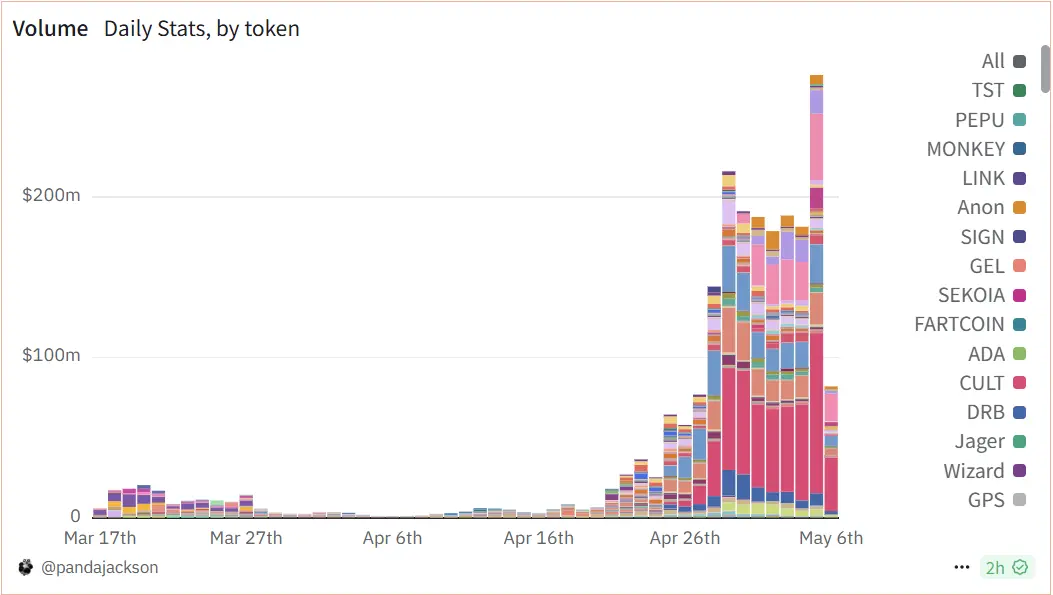

The热度 around the Alpha zone continues to rise. On May 5, Binance Alpha's trading volume surpassed $274 million, with daily transactions exceeding 1 million for the first time. The key driver behind this surge is the continuously rising threshold for "Alpha Points."

Data source: Dune, @Pandajackson

In the initial phase, just 50 points might have secured eligibility for an airdrop. But in the latest round, the qualifying score has surged to 142 points—requiring nearly 10 points per day over the past 15 days, equivalent to $1,024 in trading volume. Many regular users were caught off guard.

Crypto KOL Xia Xueyi shared that she lost over $10,000 in a month yet still remained "ineligible." Under this mechanism, only large traders and professional teams who maintain continuous, high-frequency activity can stay competitive in accumulating points.

Meanwhile, although Binance introduced consolation rewards such as "lucky airdrops based on UID last digits," these offers have limited appeal to genuine retail users. Most subsidies ultimately flow to institutional users and point-farming groups.

This closely resembles the "羊毛党" (coupon hunters) in food delivery wars: they flood into new platforms chasing short-term subsidies, but once price advantages disappear, most return to the platforms they know and trust.

Binance's Open Strategy: Designing Rules, Generating Traffic

Looking at the strategy behind the Alpha Points system: the Stakestone project allocated 5% of its tokens for IDO, 1.5% for main-site airdrops, and 3.93% for rewarding existing users—totaling 10.43% of its token supply. At a price of $0.06, these tokens created over $5 million in potential sell pressure, nearing $9 million at peak valuation.

Yet instead of immediately dumping these tokens, the project team guided trading volume and stabilized the token price to meet Binance's listing requirements. This isn't just market behavior—it's a coordinated "game played with the algorithm."

In other words, rather than waiting for projects to grow organically, the exchange has designed an access system that says: "If you want to list, you must dance to my rhythm." Alpha Points filter users, trading volume filters projects, and price performance tests market cap management capabilities.

The loop is thus completed: traffic flows in, metrics look good, trading volume spikes, and the platform wins.

Who Wins? Who Can Hold On?

The war among exchanges is just like the food delivery platform battles: spend money to attract users, subsidize to capture market share, create traffic peaks. But after all the excitement, what truly remains for users? Many people struggle to farm points under the Alpha Points system, losing money for qualification, only to find they didn’t get the airdrop or participate in the offering—merely contributing bricks to the platform's data edifice.

Platforms can keep changing strategies, but users' choices are always grounded in reality. Many may switch platforms for short-term subsidies, but once pricing advantages vanish and rules grow complex, most will return to where they're familiar. Subsidies bring traffic, but cannot retain trust.

This raises a practical concern: Alpha is defined as a place to "incubate quality projects," yet post-listing performance is not always ideal. Some projects start strong but fade quickly, failing to enter Binance's main spot market, leading users to see Alpha as a "temporary project zone." Over time, could frequent low-quality listings damage Alpha's reputation—and even undermine user confidence in Binance's entire listing system?

From a broader perspective, does an "incremental market" still exist in the crypto world? If everything has turned into a fight over existing users, how should user value ultimately be measured?

In this era of zero-sum competition, exchanges need user loyalty and activity; users need platform trust and long-term returns. If this relationship becomes unbalanced, that would be a far greater cost than missing out on a single airdrop.

At least during food delivery wars, users get a "free bubble tea," so many hope the subsidy battles last longer to save some money. Likewise, seeing Binance, OKX, and Bybit taking turns to fight for users, retail participants also hope other exchanges will intensify their efforts—not just making users "work hard farming points," but genuinely passing benefits to users, turning competition into a virtuous game that favors them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News