When airdrop points stop working, where will the next token issuance hotspot emerge?

TechFlow Selected TechFlow Selected

When airdrop points stop working, where will the next token issuance hotspot emerge?

The launch of high FDV tokens leaves little room for new buyers, signaling the decline of the points mechanism.

Author: Ignas | DeFi

Translation: TechFlow

Every bull market brings new token distribution methods, and understanding these trends could be the most profitable strategy.

This cycle was defined by the rise of point-based airdrops, led by projects like Jito and Jupiter.

However, as speculators actively accumulated points, the returns they received from airdrops failed to cover their costs, causing return on investment (ROI) to quickly turn negative.

(Tweet reference here)

Yet, the points mechanism is merely one evolution in our ongoing search for optimal token distribution.

From Litecoin BTC forks requiring PoW mining rigs, to ICOs, to DeFi’s liquidity mining—these patterns are clear: with each cycle, token issuance becomes easier and valuations continue to rise.

The launch of high FDV tokens leaves little room for new buyers, signaling the decline of the points era.

Now, I believe the market is self-correcting.

Valuations of low-floating-supply tokens have dropped due to lack of interest from new buyers, yet new tokens continue to launch just as they did in 2023—raising funds via old mechanisms and designing their TGEs accordingly.

Vesting terms limit their growth potential. TGEs that fail to adapt to new models will underperform.

The slower new token issuance adapts, the longer the meme coin frenzy will last. Meme coins are the antithesis of VC-backed tokens—they have no utility, no revenue, and no future product.

Besides meme coins, a notable shift is the market reverting to pre-points-era models: protocols like Eigenlayer are returning to "programmable incentives," signaling a comeback of liquidity mining.

We’re also seeing the rise of so-called private-to-public sales: platforms like @echodotxyz and @legiondotcc allow participation in VC-backed deals.

This means lower valuations and lock-up periods—similar to the ICO days—but accessing these deals requires some social capital:

-

On @echodotxyz, you need an invitation or approval to join exclusive groups.

-

On @legiondotcc, you can participate based on your social or on-chain reputation. Your speculative activity can prove you're "worthy" of joining influencers and VCs.

However, due to limited participant pools, these models don't solve all token distribution challenges.

@CoinList “solved” this by randomizing access to ICO allocations. Interestingly, CoinList launched years ago—we’ve come full circle!

Still, I believe merit-based access is superior, as it incentivizes building your on-chain or off-chain reputation.

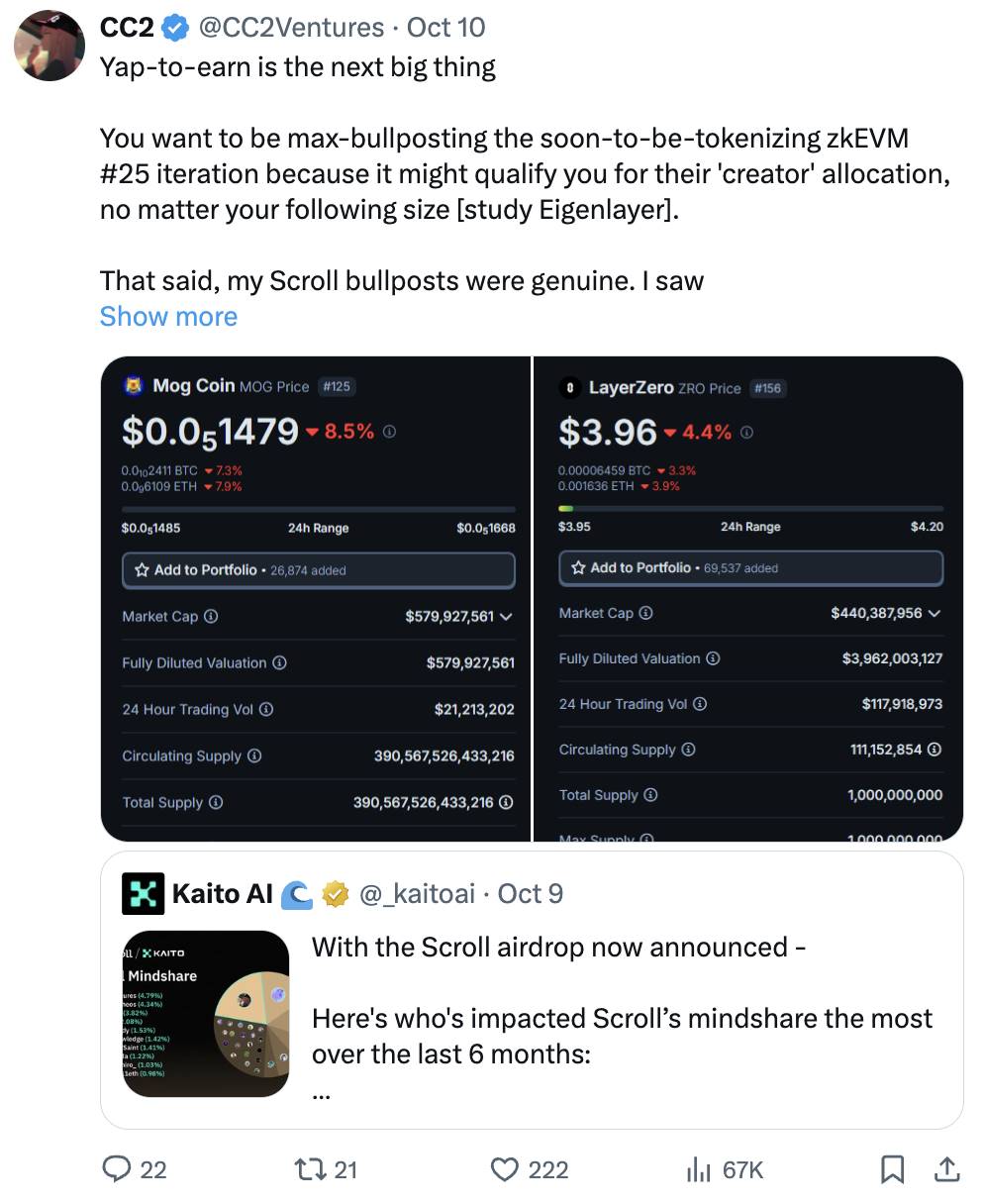

So make sure to actively share your favorite projects on social media—it might earn you token allocations. Eigenlayer and Avail are just two examples of the growing yap-to-earn model.

(Tweet references here)

Another emerging trend is “Patron Sales,” introduced by @infinex_app. Infinex combines the points system with merit-based ICO access—you must earn points to qualify for the ICO.

Notably, for the first time in recent years, participating in token sales is becoming harder, marking a shift away from liquidity mining, fair launches, and points systems.

It seems we’ve finally realized that simply handing out free tokens doesn’t truly build a community!

Yet, other trends remain open to everyone. Bitcoin’s Runes protocol allows token minting for just a transaction fee, maintaining transparency even with (optional) pre-mining.

Runes address the opacity seen in VC rounds, presales, low-floating-supply tokens, and meme coin launches.

Runes may offer the fairest token distribution model. You only pay a Bitcoin transaction fee, and Bitcoin’s slower speed naturally prevents over-minting and wallet centralization—unlike other blockchains.

An example is the GIZMO•IMAGINARY•KITTEN token, which was minted for free and now trades at 26x its initial listing price.

Clearly, Runes lack smart contract capabilities, limiting their use as functional tokens—but more BTC L2s are emerging to add such features.

We’re also experimenting with other minting models:

-

Tap-to-earn: Popular in many developing countries, but appears to be losing momentum.

-

Community/social tokens: Pioneered by Friend Tech, monetizing communities via tokens on Farcaster/Lens is an emerging trend (e.g., $DEGEN).

-

Active validation services (AVS): AVS powered by restaking protocols increases token utility (e.g., rsENA x Symbiotic and restaked MKR), though most AVS tokens are currently launched as VC tokens. Hopefully, innovation in token distribution will follow soon.

More models are emerging—this is a positive sign!

Our goal is to identify and participate in these new token distribution events. Try them all and see which ones generate returns relative to the effort invested.

One of these models (perhaps one not mentioned here, or not yet invented) will become the next big trend—and when it does, it might be the perfect time to invest.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News