"Organic Growth Point" or "Top-tier PUA": How to Evaluate the Pros and Cons of Points Incentive Models?

TechFlow Selected TechFlow Selected

"Organic Growth Point" or "Top-tier PUA": How to Evaluate the Pros and Cons of Points Incentive Models?

This article explores the advantages and disadvantages of points systems from multiple perspectives and attempts to identify corresponding solutions.

Author: Pzai, Foresight News

Throughout the long evolution of the cryptocurrency industry, economic models built on decentralized consensus have brought the dawn of the crypto holy grail to countless users. However, as the industry rolls forward, projects are increasingly contemplating how to balance protocol longevity against user retention amid the tides of crypto innovation. Points systems—sitting relatively "middle-ground" between news-driven hype and token distribution—have become an increasingly adopted incentive model. Many believe that attention aggregated through point-based incentives can organically boost key protocol metrics and strongly drive project growth.

Recently, however, TGE (Token Generation Event) allocations from projects like Blast have sparked waves of outrage, particularly over elongated incentive periods paired with low returns. Some large holders have vocally declared that such airdrops have evolved into top-tier "PUA" (Pick-Up Artist-style manipulation) for all participants. This article therefore examines the advantages and disadvantages of points-based incentive models from multiple angles, aiming to identify potential solutions.

Early Incentive Models

In the earliest days of the crypto wave, during the peak of Ethereum ICOs, airdrops were relatively simple and blunt—users only needed to submit a 0x address to receive substantial token payouts. Since the ICO era was primarily driven by conceptual speculation and featured almost no on-chain interaction infrastructure, holding a wallet address itself became a valid metric for incentives.

At the beginning of DeFi Summer, both Balancer and Compound adopted liquidity mining as their primary incentive mechanism. Unsurprisingly, for early DeFi protocols, the scale of on-chain liquidity directly determined their development trajectory, and given urgent market demand for liquidity, direct token incentives were widely used. While effective in boosting TVL (Total Value Locked), this approach also gave rise to the notorious "farm-sell-dump" cycle.

Uniswap’s airdrop then sent shockwaves across the ecosystem, truly introducing the paradigm of interaction-based airdrops to crypto and giving birth to professional airdrop hunters. Many subsequent DeFi projects followed suit. Meanwhile, with technological rollouts from various Layer 2s and public chains, discussions around ecosystem governance began gaining momentum. As governance is often a subset of a protocol's tokenomics, participants naturally developed expectations of receiving related airdrops. From this point onward, incentive models centered on tokens and user interactions became deeply embedded in the fabric of crypto economics.

To summarize, early-stage incentive models in crypto shared several key characteristics:

-

Direct Token Incentives: In less saturated competitive environments, early projects enjoyed sufficient room for growth, allowing them to expand scale while generously sharing value with users via token rewards.

-

Low Interaction Barriers: With immature on-chain ecosystems and simple product designs, user interactions required minimal effort.

-

Immediate Rewards (Synchronicity): Prior to Uniswap, many projects used mining mechanisms that offered instant token returns for deposits—what you did, you immediately received.

Origins of Points-Based Incentives

Before the rise of points systems, booming ecosystems left projects struggling with the dual challenge of user retention and effective incentivization. Platforms like Galxe offered a solution: breaking down incentives into specific on-chain tasks and using NFTs—not tokens—to mark progress. This approach introduced asynchronicity into incentives, lengthening the time between user action and final token reward. Points-based incentives, much like task platforms, are thus products of the increasing granularity of on-chain interactions within crypto.

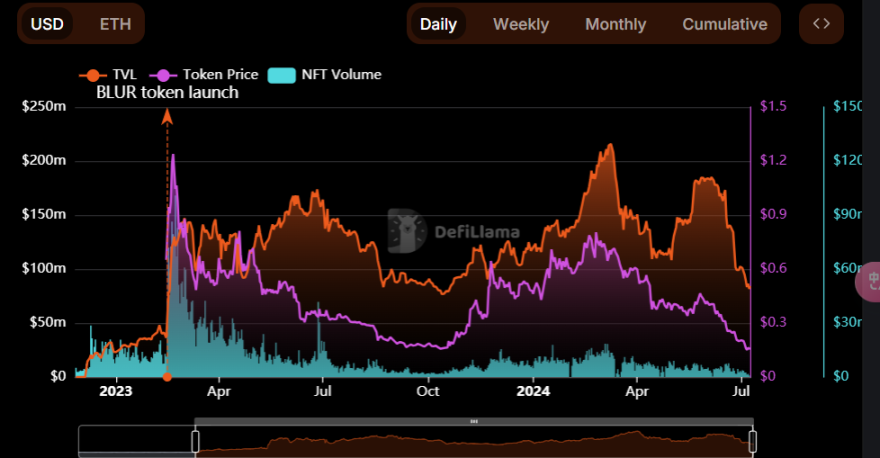

The first project to widely adopt a points model was Blur. Pacman innovatively used points to calculate NFT trading incentives, a move that significantly boosted protocol growth—especially in liquidity and trading volume. Analyzing Blur’s growth data in Figure 1 reveals three primary functions of points:

-

Boosting Confidence: Points give users early gratification, increasing confidence in future airdrops and positively influencing initial token price momentum.

-

Extending Cycles: Points spread out user expectations around airdrops, prolonging the overall incentive timeline. A clear example is that even after launching its token, Blur continued offering points—reducing sell pressure while creating a sustainable engagement environment reflected in sustained trading volume and TVL.

-

Tangibility: Compared to post-task NFT badges, points provide users with a stronger sense of having already earned something akin to real tokens, enhancing perceived value. This is evident in the correlation between early mining activity, trading volume, and eventual token pricing.

Figure 1: Blur Key Metrics (DefiLlama)

From these functions emerge several core advantages of points-based incentives:

-

Improved Retention: Under the prevailing "farm-sell-dump" culture, user loyalty tends to be low. Points encourage ongoing cash flow and repeated on-chain engagement.

-

Reduced Token Costs: Using points instead of tokens lowers issuance and market-making costs for projects and may reduce compliance risks.

-

Greater Flexibility: Organic adjustments enabled by points give teams more operational freedom, insulating them from short-term token price fluctuations and letting them focus on product development.

Confidence Created by Points

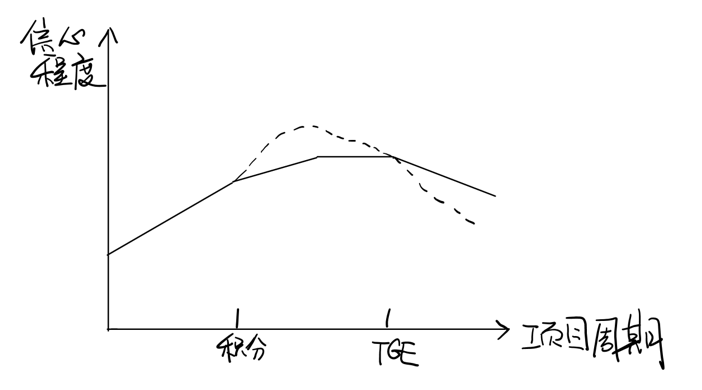

In a typical crypto project lifecycle using points as the main incentive, we can identify three phases, with two critical junctures: the start of points accrual and the TGE (Token Generation Event). Figure 2 illustrates how user confidence evolves throughout the project cycle.

Figure 2: User Confidence Across Project Lifecycle

Before points are introduced, confidence grows linearly, as users generally hold optimistic views about the project during early stages, supported by positive narrative developments. After points launch, confidence receives a temporary boost due to the psychological satisfaction of earning points. However, as the long incentive cycle unfolds, user expectations around airdrops get smoothed out. Simultaneously, external markets begin pricing in these expectations, causing overall confidence to revert to levels seen in non-points scenarios. Post-TGE, users who participated through the points phase experience greater disappointment. The extended duration means they face mounting opportunity costs, leading many to sell upon token release—resulting in heavier sell pressure.

In summary, the confidence boost from points is largely confined to the initial phase of the incentive program. For users, it essentially offers an entry point into the ecosystem. But when it comes to long-term retention, the decisive factor remains what the project team actually delivers. Points merely open up new avenues for manipulation by project teams.

Manipulation Space in Points Systems

Today, points-based incentives have fundamentally become tools for expectation management. Because the process spans a long duration, users accumulate sunk costs. These costs create passive retention—so long as the project maintains basic incentives over time, key metrics appear stable. Beyond baseline incentives, project teams gain increasing leeway in allocation decisions.

In terms of distribution, manipulation arises mainly from off-chain tracking and lack of rule transparency. Unlike tokens, points are typically not recorded on-chain, giving projects far greater discretion. Regarding clarity of rules, teams control how different activities are weighted and rewarded. As seen in Blast’s incentive design, the long cycle allows strong flexibility in adjusting rules mid-way, helping absorb user backlash and minimizing confidence erosion. Yet, Blast’s second-phase allocation diluted pre-launch depositors’ points, shifting benefits toward active on-chain participants. For large depositors, this dilution meant potential airdrop rewards might not cover capital costs, while increased on-chain activity demands raised later expenses. However, withdrawing funds would mean abandoning accumulated points—a sunk cost dilemma. Ultimately, the linear vesting imposed on大户 confirmed that the team had deliberately shifted value from whales to retail users.

On secondary markets, platforms like Whales Market provide off-chain trading venues for points, generating market-driven valuations. Projects can use these prices—via market makers—to fine-tune expectations around future token value. The low liquidity before TGE also makes market manipulation easier. However, such trading exacerbates the premature exhaustion of user expectations.

In conclusion, the manipulation space inherent in points systems leads to several disadvantages:

-

High Manipulation Potential: Whether in distribution or market valuation, project teams have significant room for maneuver.

-

Expectation Exhaustion: Long cycles combined with speculative secondary markets deplete user anticipation prematurely.

-

Diluted Returns: Due to prolonged release schedules, value created by early contributors gets averaged with that of latecomers, eroding incentives for pioneers.

How to Maximize Strengths and Minimize Weaknesses

Having analyzed the pros and cons of points-based incentives, we now explore how to refine this model to better serve the future of crypto incentives.

Allocation Design

During the extended points accrual period, the design of point allocation is crucial to protocol health. Unlike task platforms where actions map clearly to rewards, most projects do not transparently define the relationship between on-chain behavior and points earned—creating a black box. Users are left uninformed. Yet fully transparent rules risk enabling bot farms and Sybil attacks, increasing anti-griefing costs. One possible solution is decentralizing the incentive flow—distributing points indirectly through ecosystem partners. This obscures exact reward logic while spreading allocation costs, further refining behavioral incentives. Decentralized allocation also grants dynamic adjustment capabilities and enables users to maximize returns via composability ("eat the same fish multiple times").

Balancing Stakeholder Interests

Many current protocols must balance competing metrics like TVL and on-chain activity. In points systems, this translates to weighting different behaviors appropriately. For trading-centric platforms like Blur or TVL-focused DeFi protocols, these metrics often reinforce each other in a virtuous cycle, so points can effectively target one dominant KPI. But when applied to Layer 2s, participant motivations diverge. Project goals shift from single-metric growth to diversified expansion, demanding more sophisticated points mechanisms. Blast’s Gold Points attempted to reconcile this split, but ultimately underperformed due to imbalanced allocations. To date, few alternative designs exist. Future systems should consider finer-grained differentiation between interaction and deposit incentives.

Trading Space for Incentive Leverage

Currently, many projects adopt points solely to delay TGE while maintaining engagement—unlike traditional use cases, these points lack intrinsic utility. This functional void is precisely why users perceive points as mere placeholders for future tokens. Addressing this gap could unlock significant value. For instance, allowing points to offset fees on cross-chain bridges or derivative platforms gives users immediate utility, encouraging continued usage. It also frees up allocation bandwidth, reducing inflationary pressure and stabilizing expectations. However, this requires precise calibration between actual user activity and fee structures.

Moreover, whether in traditional or crypto domains, demand should always outweigh incentives. Much of this demand stems organically from the protocol itself. Consider meme-related projects that thrive without any formal points system—they inherently command strong user demand, with participants deriving value externally. Therefore, builders must ask: does my product achieve PMF (Product-Market Fit)? Is user participation driven by genuine utility rather than vague hopes of token rewards? That is the true path forward.

Consensus-Based Incentives

For users, consensus-based incentives create transparent environments where individuals can independently contribute to collective value creation. For example, within communities, projects can establish decentralized frameworks where users compete freely and earn rewards through PoW-like organic distributions. Such competition helps mitigate resentment over airdrop timelines while improving loyalty and retention. However, consensus evolves slowly and lacks agility, making it less suitable for rapidly scaling ecosystems.

On-Chain Points

Publishing points on-chain differs from issuing tokens: it removes liquidity while adding immutability and composable functionality. Linea’s LXP program provides an excellent case study. When all addresses and point balances are verifiable on-chain, manipulation becomes visibly constrained. Furthermore, smart contracts enable programmable, composable use cases, greatly enhancing the metric value of points within the ecosystem. Native protocols can then dynamically adjust incentives based on verified on-chain data.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News