How can stablecoins change global trade by bypassing sanctions?

TechFlow Selected TechFlow Selected

How can stablecoins change global trade by bypassing sanctions?

Silent flow, tremendous transformation.

Authors: Chi Anh, Ryan Yoon

Translation: Baihua Blockchain

TL;DR

Russia's use of stablecoins in oil trade shows that stablecoins are no longer fringe tools—they have become real financial infrastructure in high-risk cross-border commerce.

Despite domestic restrictions on cryptocurrency in China and India, both countries benefit from stablecoin transactions with Russia, quietly experiencing the efficiency of decentralized finance at the national level.

Governments around the world are responding in different ways, but all acknowledge that stablecoins are reshaping how value moves across borders.

1. The Rise of Stablecoins as Strategic Currencies Under Sanctions

The global significance of stablecoins is growing—not just as speculative instruments, but as practical financial tools first for individuals, then institutions, and now entire nations.

The rise of stablecoins began in crypto-native environments, where traders used USDT and USDC to trade, transfer capital efficiently, and access liquidity across centralized and decentralized platforms. In markets with limited banking infrastructure or capital controls, stablecoins enhanced access to the U.S. dollar.

This adoption then expanded into institutional and B2B use cases. Businesses began using stablecoins for cross-border payments, supplier settlements, and payroll—especially in emerging markets where traditional banking services are unreliable or expensive. Compared to wire transfers via SWIFT or correspondent banks, stablecoin transactions settle nearly instantly, without intermediaries, and at significantly lower cost. This makes stablecoins not only efficient but increasingly essential for companies operating in politically or economically unstable regions.

Now, stablecoins are being tested at the national level, shifting their role from convenience to strategic importance. Countries facing sanctions or seeking alternatives to the U.S.-dominated financial system, such as Russia, have turned to stablecoins.

As stablecoins evolve from corporate tools to instruments of national trade, their function shifts from operational convenience to political necessity. This report explores, through real-world case studies, how stablecoins are being used to bypass restrictions, reduce costs, and open new trade routes.

2. Real-World Applications of Stablecoins: How Global Trade Adapts Behind the Scenes

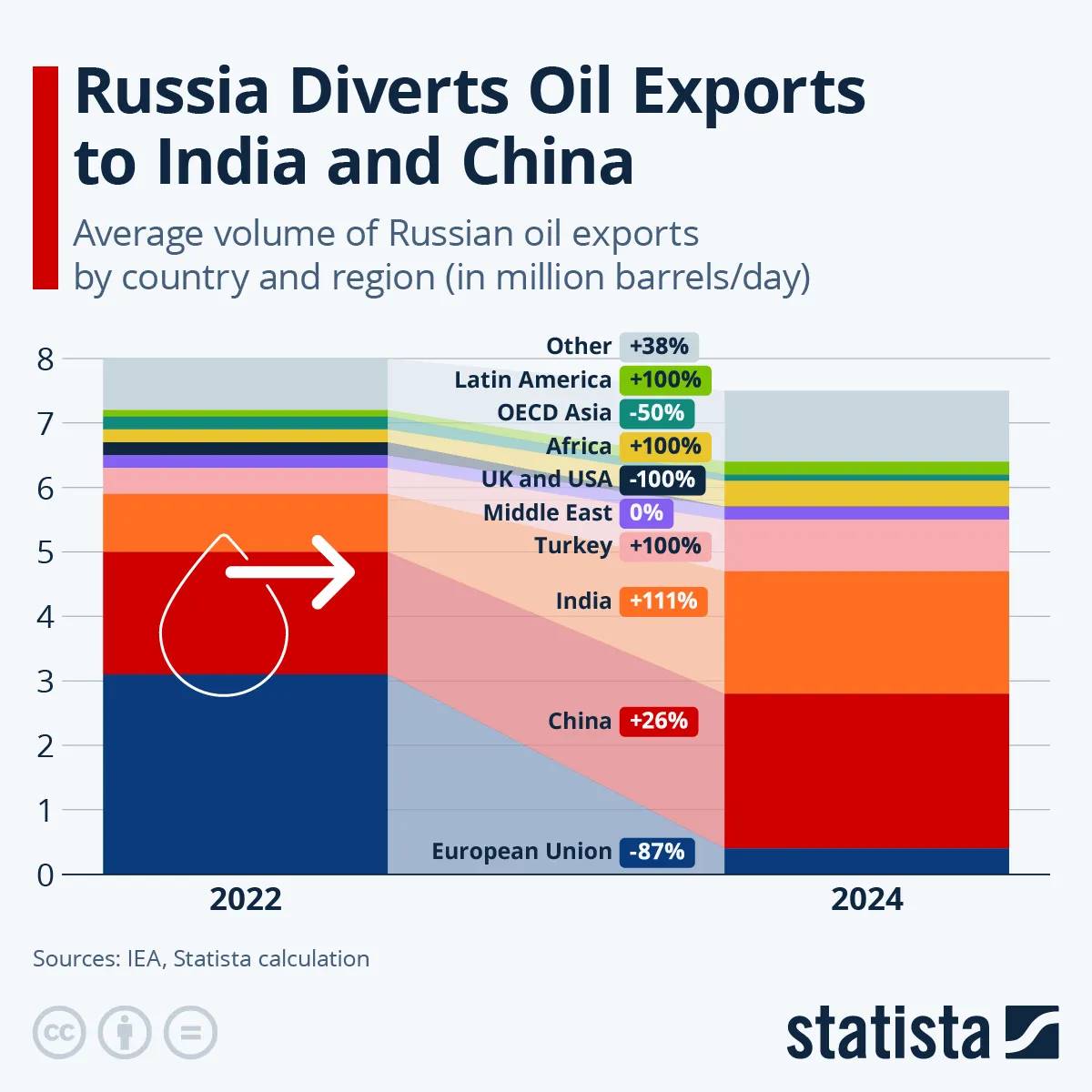

Source: Statista

Russia is increasingly incorporating stablecoins like USDT, along with major cryptocurrencies such as Bitcoin and Ethereum, into its oil trade with China. According to a Reuters report from March 2025, this represents a strategic effort to circumvent Western sanctions.

The transaction model is relatively simple. Chinese buyers transfer domestic currency (e.g., RMB) to an intermediary, who converts it into stablecoins or other digital assets. These assets are then transferred to Russian exporters, who convert them into rubles. By excluding Western financial intermediaries, this process reduces sanction risks and enhances transaction resilience.

Among the digital assets used in these transactions, stablecoins play a particularly critical role. While Bitcoin and Ethereum are occasionally used, their price volatility makes them unsuitable for large-scale transactions. In contrast, stablecoins like USDT offer price stability, high liquidity, and ease of transfer—qualities that support their growing role in cross-border settlements under constrained conditions.

Notably, China continues to impose strict limits on domestic cryptocurrency use. However, in the context of energy trade with Russia, authorities appear tolerant of stablecoin transactions. While there is no formal endorsement, this selective tolerance reflects pragmatic priorities—particularly the need to maintain commodity supply chains under geopolitical pressure.

This dual stance—combining regulatory caution with practical engagement—highlights a trend: even within officially restrictive regimes, digital assets are quietly adopted for their operational utility. For China, stablecoin-based settlement offers a way to bypass traditional banking systems, reduce reliance on the U.S. dollar, and ensure trade continuity.

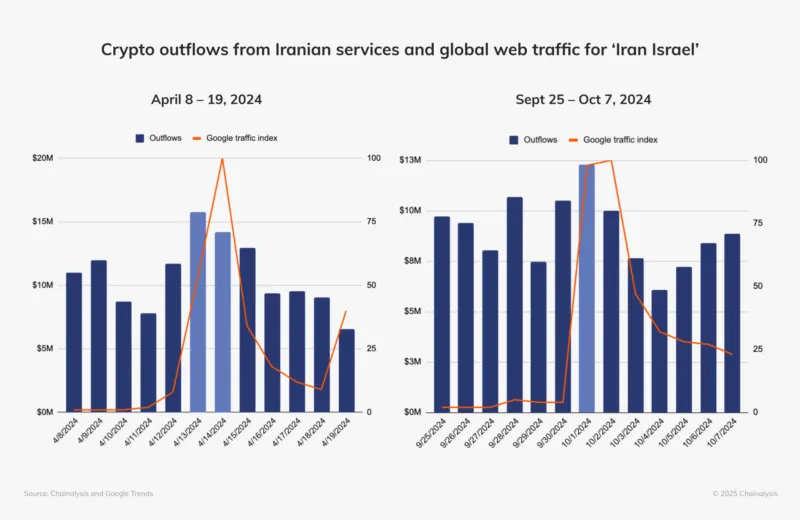

Source: Chainalysis

Russia is not alone. Other sanctioned nations, such as Iran and Venezuela, are similarly turning to stablecoins to sustain international trade. These examples indicate a growing pattern of stablecoin usage as tools to maintain commercial functionality in politically restricted environments.

Even if sanctions ease over time, stablecoin-based settlements may continue. Their operational advantages—faster transaction speeds and lower costs—are too significant to ignore. As price stability becomes an increasingly crucial factor in cross-border trade, more countries are expected to accelerate discussions on adopting stablecoins.

3. Global Stablecoin Momentum: Regulatory Updates and Institutional Shifts

Russia, in particular, has gained firsthand experience of stablecoin utility. After the U.S. froze wallets associated with the sanctioned platform Garantex, Russian Ministry of Finance officials called for the development of a ruble-backed stablecoin—a domestic alternative to reduce dependence on foreign issuers and protect future transactions from external control.

Beyond Russia, several other countries are accelerating exploration of stablecoin adoption. While Russia’s primary motivation is to bypass external sanctions, many others see stablecoins as tools to strengthen monetary sovereignty or respond more effectively to geopolitical shifts. Their appeal also lies in the potential for faster, cheaper cross-border transfers, highlighting stablecoins’ role as drivers of financial infrastructure modernization.

-

Thailand: In March 2025, Thailand’s Securities and Exchange Commission approved trading of USDT and USDC.

-

Japan: In March 2025, SBI VC Trade partnered with Circle to launch USDC, receiving regulatory approval from Japan’s Financial Services Agency (JFSA).

-

Singapore: In August 2023, established a regulatory framework for single-currency stablecoins (pegged to the Singapore dollar or G10 currencies), allowing both banks and non-banks to issue them.

-

Hong Kong: Announced a stablecoin bill in December 2024 requiring issuers to obtain licensing from the Hong Kong Monetary Authority; regulatory sandbox is ongoing.

-

United States: No comprehensive legislation yet. In April 2025, the SEC stated that fully reserved stablecoins like USDC and USDT are not securities. In March 2025, the Senate Banking Committee passed the GENIUS Act aiming to regulate payment stablecoins. USDC and USDT remain widely used.

-

South Korea: Major domestic banks are preparing to jointly issue the country’s first won-backed stablecoin.

These developments reveal two key trends. First, stablecoin regulation has moved beyond conceptual discussion—governments are actively shaping legal and operational parameters. Second, geographic divergence is emerging. Countries like Japan and Singapore are pushing for regulated stablecoin integration, while others like Thailand are taking stricter measures to protect domestic monetary control.

Despite this divergence, there is broad global recognition that stablecoins are becoming a permanent part of global financial infrastructure. Some nations view them as a challenge to sovereign currencies, while others see them as tools for faster, more efficient global trade payments. As a result, the importance of stablecoins in regulatory, institutional, and commercial domains is rising.

4. Stablecoins Are Not a Stopgap—They Are a New Layer of Financial Infrastructure

The growing role of stablecoins in cross-border transactions reflects a fundamental shift in financial infrastructure—not merely an attempt to circumvent regulations. Even historically skeptical countries toward cryptocurrency, such as China and India, are beginning to indirectly leverage stablecoins in strategic commodity trade, gaining firsthand experience of their practical utility.

This development goes beyond sanction evasion. Initial retail-level experiments have evolved into institutional and even national-level integration, making stablecoins one of the few blockchain innovations to demonstrate real product-market fit. As such, stablecoins are increasingly seen as legitimate components of modern financial systems—not tools for illicit activity.

Institutions that view stablecoins as structural elements of future financial architecture—not temporary solutions—are likely to lead the next wave of financial innovation. Conversely, those delaying participation risk being forced to adapt passively to standards set by others. Therefore, policymakers and financial leaders must understand the nature and long-term potential of stablecoins and develop strategies aligned with the evolving direction of the global financial system.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News