Reviewing Trump's First 100 Days in Office: Gains and Losses for the Crypto Market

TechFlow Selected TechFlow Selected

Reviewing Trump's First 100 Days in Office: Gains and Losses for the Crypto Market

The past 100 days have brought earth-shaking changes, but there are still 1,361 days ahead.

Author: Connor Sephton, CryptoNews

Translation: Felix, PANews

Donald Trump has now been back in the White House for 100 days—a period marked by global market turmoil, uncertainty, and chaos.

When Trump secured re-election, the crypto market was filled with hope. Yet despite several bullish statements on Bitcoin made after taking office, the crypto community remains disappointed.

Just before his inauguration, Trump launched his official token $TRUMP, sparking both frenzy and controversy. Critics argued the move posed clear conflicts of interest and could even threaten national security.

The $TRUMP token has since fallen 82% from its all-time high of $75.35 on January 19. But $MELANIA has fared even worse, plunging nearly 97%.

Source: CoinGecko

After Trump's return to power, speculation ran rampant that he would sign a series of pro-crypto executive orders on day one—including establishing a strategic Bitcoin reserve. But those orders never materialized. On January 20, Bitcoin surged to a record high of $109,000—never to return to that level again.

Trump did quickly fulfill some campaign promises made at the 2024 Bitcoin Conference in Nashville. Ross Ulbricht, founder of the darknet marketplace Silk Road, received a full and unconditional pardon. Photos circulated online showing him smiling for the first time after serving 11 years in prison. Reports suggest Sam Bankman-Fried (SBF) is also lobbying for a pardon, but this has yet to happen.

Meanwhile, several members of Trump’s cabinet known for their pro-Bitcoin stance were swiftly confirmed by the Senate. This includes Treasury Secretary Scott Bessent, who declared: “Crypto is about freedom, and the crypto economy is here to stay.”

Others faced intense scrutiny. Commerce Secretary Howard Lutnick came under sharp criticism during his confirmation hearing but downplayed questions about his company’s relationship with the Tether stablecoin.

The White House appointed David Sacks as the first-ever "czar" for artificial intelligence and cryptocurrency. Before taking office, he sold off his holdings in BTC, ETH, and SOL. The appointment earned widespread praise—even from Anthony Scaramucci, founder of SkyBridge Capital and a critic of Trump.

In addition, Trump’s business ventures are increasingly moving into digital assets. Trump Media & Technology Group has amassed a significant crypto treasury and launched a series of exchange-traded funds (ETFs).

With Trump, one simple rule applies: always expect the unexpected. On March 2, he suddenly announced on Truth Social his intention to create an “American Crypto Reserve” containing XRP, Solana, and Cardano. Upon the news, these altcoins surged—some by as much as 70%. Initially, BTC and ETH weren’t mentioned, but a follow-up statement clarified that both flagship digital assets would also be “central to the reserve.”

The idea of lumping Bitcoin together with altcoins sparked immediate backlash. Experts called the proposal “absurd” and “confusing.” Concerns emerged over feasibility, including whether congressional approval would be required. Details such as funding sources, allocation mechanisms, and implementation timelines remained unclear.

All these concerns soon became irrelevant. Trump reversed course and quickly signed an executive order to establish a strategic Bitcoin reserve—alongside reserves of other cryptocurrencies.

Although this marked one of the biggest adoption milestones in Bitcoin’s history, BTC was heavily sold off as investors digested the news. Why? Because the executive order stated that no new BTC could be purchased for the reserve unless it could be acquired without impacting the federal budget—except for Bitcoin seized from criminals. This was also bearish for XRP, SOL, and ADA, as the U.S. currently holds none of these tokens.

Bitcoin advocates had widely expected the U.S. to become a major buyer—fulfilling Senator Cynthia Lummis’ ambitious goal of accumulating 1 million BTC within five years. But using taxpayer money for such purchases would be deeply hypocritical, especially given Elon Musk’s push to drastically cut federal spending.

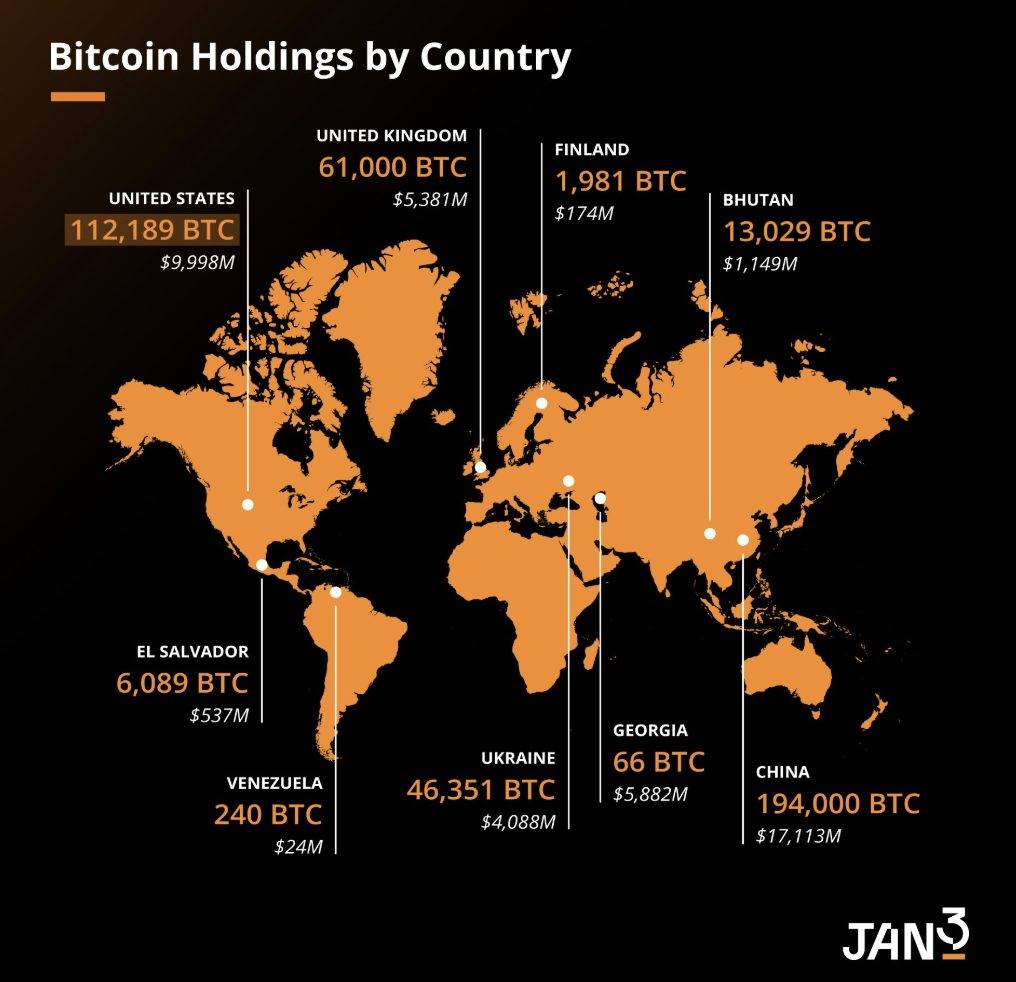

Data from Arkham Intelligence shows the U.S. currently holds around 198,000 BTC, worth approximately $18.8 billion. However, as JAN3 CEO Samson Mow pointed out, the actual size of the strategic Bitcoin reserve may be much smaller—since 95,000 BTC are ultimately set to be returned to Bitfinex. Still, Mow remains optimistic, calling the policy “significant” in encouraging other major economies to follow suit.

Shortly after announcing the Bitcoin reserve, the White House hosted its first-ever crypto summit on March 7, attended by industry leaders including Michael Saylor of MicroStrategy and Brian Armstrong of Coinbase. But outside observers offered mixed reviews, with some analysts calling it “more of a political stage than a meaningful policy forum.”

Investors soon faced more pressing issues. Trump faced accusations of deliberately suppressing the stock market to pressure the Federal Reserve into cutting rates. The S&P 500 and tech-heavy Nasdaq 100 suffered sharp declines, and their tight correlation led to even larger sell-offs in Bitcoin.

Conditions worsened after “Liberation Day,” when the president announced sweeping and punitive tariffs on some of America’s closest trade partners, sharply increasing import costs. As recession risks rose and rhetoric between Washington and Beijing intensified, Bitcoin dropped to around $80,000 in early April.

BTC一度 faced the risk of breaking below $75,000—down 30% from its inauguration-day peak. But markets found temporary relief when Trump confirmed a 90-day pause on reciprocal tariffs for most countries, while raising tariffs on China again to 145%. Optimism grew further when smartphones and computers were exempted from these aggressive trade measures. However, the White House’s constant flip-flopping left investors anxious and exhausted, prompting many to reduce exposure to U.S. assets and shift toward gold.

Today, keeping up with Washington’s relentless news cycle feels nearly impossible. Amid all this, Trump intensified his attacks on Federal Reserve Chair Jerome Powell, posting on Truth Social: “The faster Powell gets fired, the better!”

While presidents typically lack authority to dismiss heads of independent federal agencies, a Supreme Court case could potentially overturn this precedent—opening the door for Trump to interfere with the Fed. Critics across the political spectrum warn this could trigger another market crash, with the S&P 500 once coming close to entering bear market territory.

One key appointment was delayed: the confirmation of Paul Atkins as SEC Chair, chosen to replace anti-crypto regulator Gary Gensler. That confirmation finally went through last week, and one of his top priorities will be deciding whether to approve ETFs tracking altcoins like XRP.

In the meantime, despite falling prices, the team behind $TRUMP devised a novel way to generate buzz. They announced an “exclusive” dinner for the 220 largest holders of the token, triggering a hoarding frenzy leading up to May 12. Following the news, $TRUMP’s value surged 64%.

Yet some voices on Crypto Twitter expressed unease, calling the event “a trap designed to dump tokens and profit from FOMO buyers.” One analyst urged those who bought $TRUMP at peak prices to exit immediately.

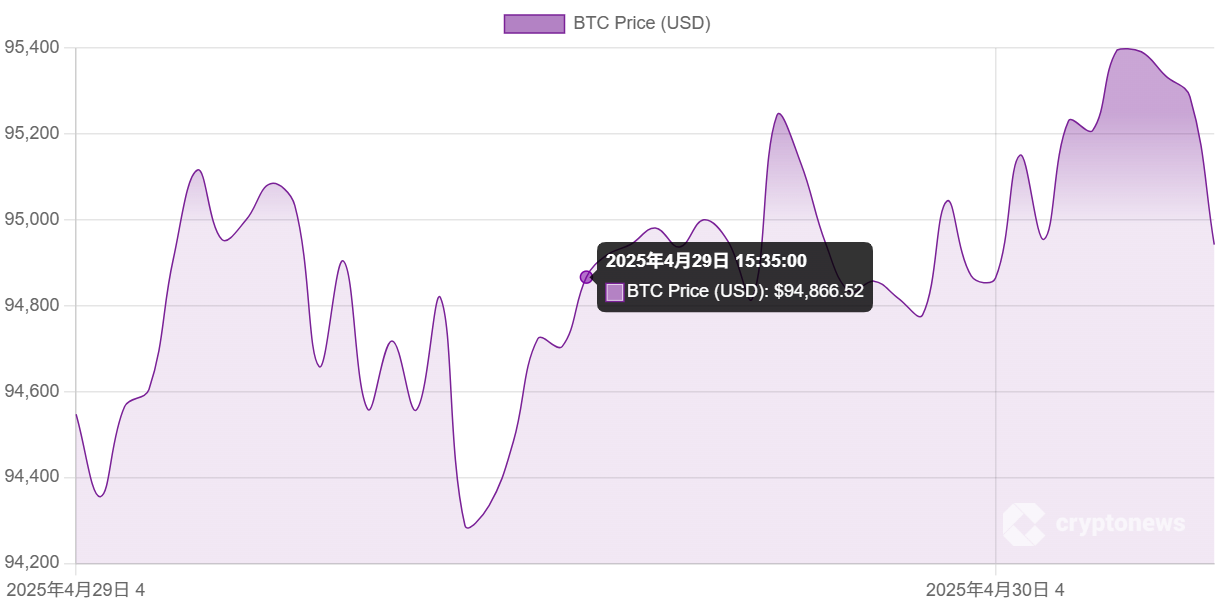

Over the past 100 days, Bitcoin has declined 12%, while the S&P 500 fell 8.6%. Tariff threats remain ever-present. A recent CNN poll found that 59% of Americans believe Trump’s policies have worsened the U.S. economy. About 60% think he has exacerbated the cost-of-living crisis, and a growing number of consumers fear a recession may be imminent.

Meanwhile, hopes that Bitcoin will reach new highs this year are rapidly fading. On the Polymarket platform, only 67% believe BTC will surpass $110,000 by the end of 2025. Probabilities drop to 54%, 40%, and 30% for reaching $120,000, $130,000, and $150,000, respectively. In January, these targets were considered quite conservative—highlighting how quickly sentiment has shifted.

Trump’s political unpredictability makes it nearly impossible to forecast what will happen next week, let alone next month or next year. This adds immense difficulty to predicting Bitcoin’s future path. Extreme caution should be exercised toward any bold or confident price forecasts.

A lot has changed in the past 100 days—but there are still 1,361 days ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News