Can Bitcoin survive without Core?

TechFlow Selected TechFlow Selected

Can Bitcoin survive without Core?

Core's role is similar to a "chief maintainer," but not irreplaceable.

By Liu Jiaolian

Bitcoin developer Jimmy Song posed a thought-provoking question: Can Bitcoin survive without Core (note: referring to the Bitcoin Core client software, widely regarded as the "orthodox" successor to Satoshi Nakamoto's original codebase)? Prominent Bitcoin developer Luke Dashjr responded: Currently, Bitcoin’s chances of surviving without Core are far greater than its chances of surviving with dependence on Core.

As is well known, since Bitcoin's inception in 2009, its underlying protocol and operational mechanisms have always revolved around "decentralization." As the original reference implementation, Bitcoin Core has taken on responsibilities such as maintaining protocol rules, fixing vulnerabilities, and upgrading the network. However, is Bitcoin’s survival necessarily dependent on Core?

From a technical architecture standpoint, the protocol takes precedence over implementation. The essence of Bitcoin is not any specific software, but rather a protocol defined by mathematical rules and cryptographic algorithms.

While Bitcoin Core, as the first implementation of this protocol, provides a standardized node program, its code is not irreplaceable.

Theoretically, any client that complies with Bitcoin's consensus rules can join the network. As long as a new implementation is compatible with existing transaction validation rules and block generation logic, the Bitcoin network can continue to operate.

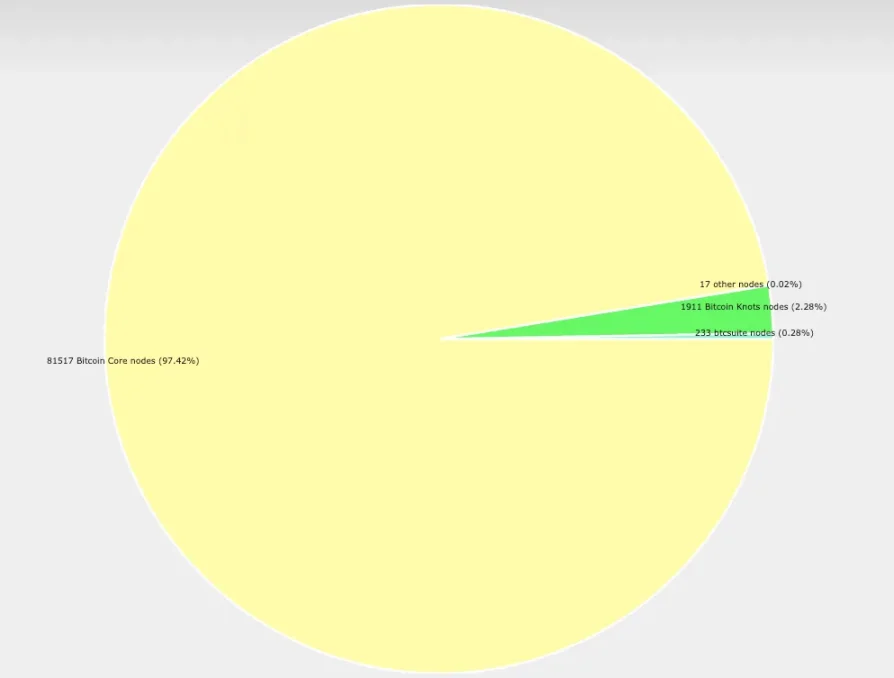

However, according to statistics from Luke Dashjr, Bitcoin Core currently holds an absolute dominant position, with a market share exceeding 97%.

As for why, Jiaolian believes it may be because the so-called consensus of the majority needs a carrier. Choosing the most "orthodox" codebase as this vehicle for consensus appears to be the simplest approach.

Similar to miners’ choice of the longest chain, the selection of Core software also resembles a "Schelling Point" in game theory.

This explains why, despite 16 years since Bitcoin's creation and the existence of numerous alternative clients besides Core, none have managed to capture significant market share.

Moreover, the second-largest client shown in the chart above, Bitcoin Knots, is actually based on Core—it is a personally modified version of Core developed by Luke Dashjr himself.

During Bitcoin’s most divisive period—the 2017–2018 scaling debate between large-block and small-block factions—proponents of larger blocks attempted to seize Core's orthodox status and briefly mobilized mining power nearly matching Core’s supporters, yet ultimately failed. This outcome significantly reinforced Core’s seemingly unshakable leadership position.

Without Core—and particularly without Wladimir van der Laan, Core’s lead maintainer from 2014 to 2022—standing firm on principles and tirelessly coordinating disputes, it is hard to imagine how severe community conflicts might have escalated, or whether mining cartels could have taken control of the development team and established a kind of "military junta."

The key difference between Core and mining cartels lies in power structure: mining groups control computational power, and once they gain authority to modify code (legislative power), they could alter rules at will. In contrast, Core can only attempt to change rules through code updates by persuading the community to voluntarily adopt them; otherwise, their code changes remain ineffective, never leaving GitHub, amounting to nothing more than waste paper.

Currently, Bitcoin protocol upgrades rely on the BIP (Bitcoin Improvement Proposal) process. Any developer can submit proposals, but they must undergo coordination among multiple stakeholders—including miners, node operators, and exchanges—to take effect. The Bitcoin Core repository is publicly hosted on GitHub, allowing developers worldwide to review, modify, or propose alternatives.

The mechanism of protocol evolution is essentially a social experiment. An upgrade cannot succeed if it fails to accommodate the interests of miners. If it fails even more broadly to serve the interests of the wider user base holding BTC, the consequences are dire: users vote with their feet, selling off their BTC and abandoning the network entirely—ultimately leading to zero value.

Bitcoin without Core faces two primary risks. First is protocol fragmentation. If multiple clients interpret rules differently—such as block size limits or script opcodes—it could lead to network splits. The 2017 fork wave demonstrated this risk, though history shows that markets typically select the chain with the strongest network effects and stability as the "main chain." Second is fragmented development resources. Core has accumulated over a decade of technical debt management and optimization experience. Any new implementation would need to rebuild equivalent code robustness, placing higher demands on community collaboration efficiency.

Nevertheless, as long as core rules—proof-of-work, 21 million supply cap, UTXO model—remain unchanged, any compatible implementation can inherit Bitcoin’s store-of-value properties.

In extreme scenarios where Core disappears, miners still have strong incentives to switch to other clients to protect their asset values, while exchanges and wallet providers will adapt to new protocols to ensure business continuity.

Bitcoin’s resilience lies in the social consensus and decentralized architecture at the protocol layer—not in any particular development team or software implementation. Core functions like a "lead maintainer," but it is not irreplaceable.

At this stage, Core’s role as a Schelling Point—acting as the scribe of global consensus—is effectively writing Bitcoin’s rules on behalf of all coin holders. This represents the most natural choice humanity has evolved toward thus far.

As for the "decentralization" of Core itself—splintering into numerous client software variants and independent maintenance teams, no longer relying on traditional coordination models—this marks yet another milestone in exploring, pioneering, and innovating new forms of decentralized governance and self-organized collaboration, especially in an era when humans are still accustomed to state rule and corporate management.

Perhaps we should remain optimistic about this.

Past crises have proven that when code flaws threaten the system, the community can quickly collaborate to fix them; when disagreements arise over development direction, the market votes via hash power to determine the main chain. This rule-based, dynamically balanced governance model suggests that even without Core, Bitcoin could sustain its network effects through its open-source ecosystem and global participation.

Perhaps its true survival threshold lies in whether the majority of participants still believe in mathematical rules over human authority—and whether they are willing to bear the costs and sacrifices required to uphold that belief.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News