Futarchy: When Prediction Markets Become Governance Weapons, a Revolutionary Experiment to Upend DAO Decision-Making Paradigms

TechFlow Selected TechFlow Selected

Futarchy: When Prediction Markets Become Governance Weapons, a Revolutionary Experiment to Upend DAO Decision-Making Paradigms

MetaDAO's proposed Futarchy, in simple terms, works as follows: when someone proposes a governance goal (e.g., "airdrop tokens to incentivize users"), Futarchy defines two conditional token markets—"pass" and "reject."

Author: Loxia

In March 2025, Optimism launched a landmark on-chain governance experiment. By allocating 500,000 OP tokens through a futarchy mechanism, this 21-day social experiment not only tested the feasibility of prediction markets in public chain ecosystem governance but also revealed the complex tensions inherent in the evolution of decentralized decision-making mechanisms.

01 Futarchy Governance Experiment

In March, Optimism rolled out a novel futarchy governance experiment. The term "futarchy" literally translates to "prediction-based governance." In blockchain contexts, futarchy is a governance model that uses prediction markets to guide decisions—leveraging financial markets' forecasting power and participants’ real monetary stakes to incentivize more accurate predictions and analysis. In this experiment, Optimism applied futarchy to distribute a total of 500k OP (100k × 5) in incentives, exploring new models for disbursing public chain ecosystem rewards. Most of the experiment has concluded, and Loxia, a member of LXDAO who participated in the trial, remains cautiously optimistic about the future of this governance approach.

MetaDAO’s version of futarchy works as follows: when someone proposes a governance goal (e.g., “airdrop tokens to users”), futarchy sets up two conditional token markets—“pass” and “reject.” Participants must stake real assets to obtain corresponding tokens for trading—if they believe in the proposal, they buy into the “pass” market; otherwise, they bet on the “reject” market. Ultimately, the proposal's fate is determined by comparing the weighted average prices of the two markets. Participants can redeem their staked assets, but the outcome directly affects the value of their holdings. This design elegantly aligns individual incentives with collective goals:

To profit, one must deeply analyze how a proposal impacts the organization’s token price over the long term—rather than voting based on intuition or herd behavior. MetaDAO’s practice shows that even if malicious actors attempt to manipulate the market, they would need to pay high prices to acquire “pass” tokens, making such manipulation counterproductive. MetaDAO believes that when every decision undergoes rigorous, real-money market testing, collective wisdom stands a chance of overcoming human weaknesses.

02 Origins of Futarchy

Futarchy is a form of governance proposed by economist Robin Hanson. Under this model, elected officials define metrics for national well-being, while prediction markets determine which policies are most likely to achieve positive outcomes. The New York Times listed “futarchy” as a buzzword in 2008. Later, the concept was adopted into discussions around blockchain and DAOs.

The slogan for futarchy is:

“Vote on values, bet on beliefs.” This means:

Citizens should use democratic processes to express what they want (“values”).

Prediction markets then decide which policies are most likely to achieve those goals (“beliefs”—judgments about cause and effect).

Economist Tyler Cowen commented: “I’m skeptical about futarchy’s prospects, or whether it could succeed if implemented. Robin says, ‘vote on values, bet on beliefs,’ but I think values and beliefs cannot be so easily separated.”

Cowen argues that human values and beliefs are deeply intertwined, making it difficult to cleanly separate “goals” from “means to achieve them.” For example, someone may claim to value social equality (“value”), yet support certain policies due to ideological preferences rather than rational assessment of policy effectiveness (“belief”).

In other words, prediction markets cannot fully filter out emotional biases, cognitive distortions, and value-driven influences. As such, futarchy may fall short of its theoretical ideals of rationality and efficiency.

03 Futarchy for Optimism

The designers of the Optimism futarchy experiment believed that:

-

When decision-makers are rewarded or penalized based on accuracy (accurate → reward, inaccurate → penalty), they are incentivized to make more thoughtful, less biased decisions;

-

A permissionless futarchy model can attract broader participation (the wisdom of the crowd), rather than relying solely on centralized decision bodies.

To increase openness and gather more data, the experiment allowed broad access: anyone with a Telegram or Farcaster account could join. All predictors received 50 OP-PLAY tokens as starting capital (OP-PLAY is non-transferable play money used only for the experiment). Actual OP governance participants received additional OP-PLAY tokens.

So, what was the central prediction question?

If a project receives 100k OP in incentives, which protocol(s) will achieve the greatest TVL growth three months later?

Twenty-three projects participated in the futarchy experiment. Each participant had to predict the TVL increase of these 23 projects after they hypothetically received 100k OP. At the start, all projects were assigned the same initial predicted TVL (equal starting point, used for reference during test selection). Over time, users staked OP-PLAY to trade upside options (UP tokens) and downside options (DOWN tokens) across different projects. The top five projects with the highest predicted TVL gains each received 100k OP in real incentives.

At the end of the experiment, the prediction market selected five projects via OP-PLAY. For comparison, the Grants Council also selected its own five funded projects:

The top five 100K OP-funded projects selected by futarchy after 21 days of market dynamics:

-

Rocket Pool: $59.4M

-

SuperForm: $48.5M

-

Balancer & Beets: $47.9M

-

Avantis: $44.3M

-

Polynomial: $41.2M

Meanwhile, the five projects selected by the Grants Council (duplicates receive funding only once):

-

Extra Finance

-

Gyroscope

-

Reservoir

-

QiDAO

-

Silo

04 Limitations of Futarchy in Governance

Limits of the TVL metric in this experiment:

"If ETH price rises, protocols holding large amounts of ETH will appear to have huge TVL growth—even if they did nothing." — @joanbp, March 13

"We seem to be using futarchy to decide who gets grants, but if TVL growth merely reflects market price changes, then this metric fails to reflect whether projects actually used the grants effectively." — @joanbp, March 13

The choice of prediction metric is critically important:

"We should choose metrics where—no matter how hard participants try to 'manipulate'—they can only 'win' by doing things beneficial to the ecosystem." — @Sky, March 17

Bias introduced by simulated tokens (bias would also occur if real tokens lacked sufficient value):

"This is 'play money,' not 'real money.' Many people will hedge both sides at the last minute just to avoid losses."

— @thefett, March 19

*41% of participants hedged risk (betting both sides to avoid loss) near the end

"I feel I didn’t contribute any unique insight—instead, I diluted the influence of those who truly understand the projects."

— @Milo, March 20

Poor user experience undermined market effectiveness:

The success of a prediction market heavily depends on depth of user engagement. However, this experiment had high entry barriers, opaque information, and cumbersome operations—greatly impairing participants’ judgment and willingness to engage.

Common user complaints included:

-

Unclear total token supply.

-

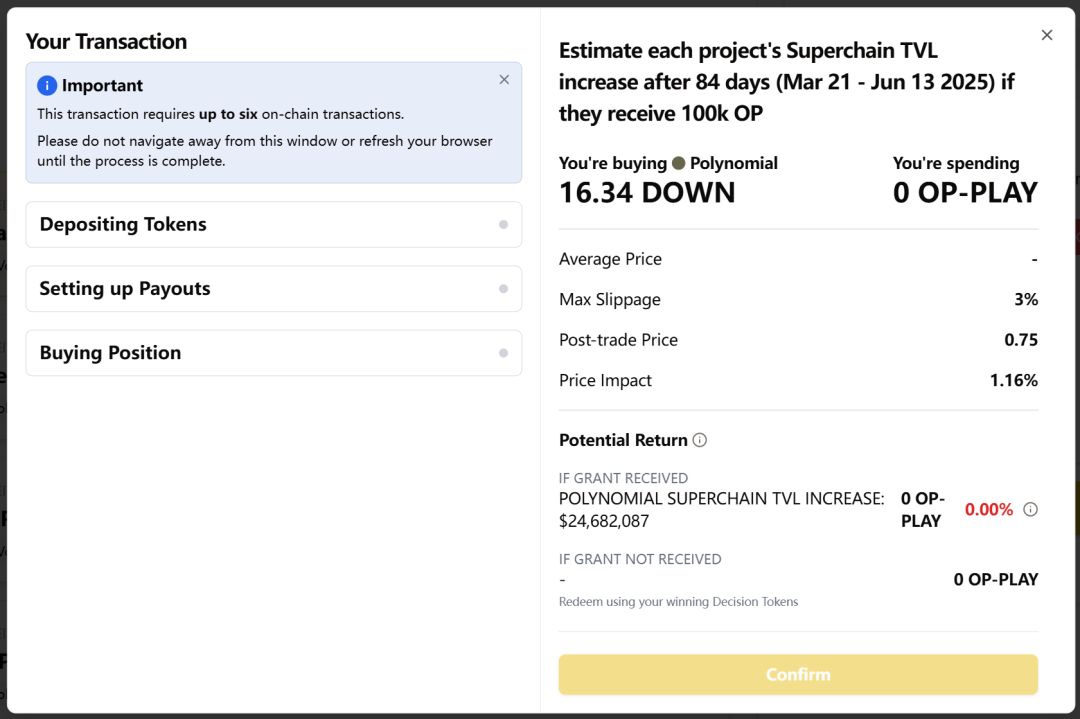

Each bet required six on-chain interactions. (Hence I made very few trades—the interface was too complex.)

-

Unclear explanation of whether losing a bet results in actual loss.

-

Leaderboard profit/loss logic was incomprehensible.

"I initially thought PLAY tokens were consumed, but they reset per project—I couldn't figure out how much I'd actually spent." — @Milo, March 20

"Having to sign six transactions per prediction is excessive." — @Milo, March 20

"I can't understand the leaderboard—sometimes I thought I was profitable, but it showed a 46% loss." — @joanbp, March 19

According to Butter’s official data report, key findings from the experiment:

-

Total transaction count: 5,898, but 41% of addresses joined in the final three days—indicating high learning costs.

-

Each prediction required six on-chain interactions (see interface screenshot), resulting in an average of only 13.6 trades per user.

-

Despite 2,262 visitors, conversion rate was only 19%, and OP governance contributors participated at just 13.48%.

-

45% of projects did not disclose their plans to predictors, leading to information asymmetry and prediction bias (e.g., Balancer’s predicted gain exceeded its self-estimated target by $26.4M).

05 Conclusion

1. Metric Design Is Decisive in Futarchy Experiments

Good metrics should have:

-

Measurability: clear data that is easy to verify;

-

Proper alignment: guiding participants to do things that advance system health—even when acting in self-interest;

-

Resistance to gaming: hard to inflate via pure financial tricks or price volatility.

In this futarchy experiment, USD-denominated TVL was highly sensitive to fluctuations in ETH and other major token prices, making predictions resemble “betting on coin prices” rather than assessing genuine growth potential.

Butter’s official report, citing mid-term TVL data as of April 9, 2025, exposed the metric’s limitations:

-

Rocket Pool (predicted +$59.4M) actually saw $0 TVL growth

-

SuperForm (predicted +$48.5M) actually declined by $1.2M

-

Balancer & Beets (predicted +$47.9M) actually declined by $13.7M

All projects selected by futarchy collectively lost $15.8M in TVL, while among Grants Council-selected projects:

-

Extra Finance (predicted +$39.7M) actually grew by $8M

-

QiDAO (predicted +$26.9M) actually grew by $10M

This confirms community concerns—that the TVL metric is strongly correlated with market prices and fails to reflect true project performance.

2. The “Best Predictor” Outcome Was Not Fully Objective

-

The experiment reflected participants’ OP-PLAY trading skill more than pure “prediction ability,” as all assets experienced significant daily swings, offering ample room for tactical trading (e.g., anonymous user @joanbp topped the leaderboard via high-frequency trading—406 trades over 3 days).

-

In the final OP-PLAY trading leaderboard, badge holders—recognized experts in the OP ecosystem—had the lowest win rate.

-

Only 4 of the top 20 predictors held OP governance identities (e.g., skydao.eth, alexsotodigital.eth).

3. The Paradox of Prediction Influencing Outcomes:

A key feature of futarchy is that prediction determines action—collective expectations directly shape outcomes (e.g., which project receives funding). Unlike traditional prediction markets that forecast external events, this creates unique dynamic challenges. As discussed on the OP forum, a voter in a futarchy system faces two choices:

First, follow the crowd and back popular projects to ensure they get funded (this guarantees correct prediction but offers low personal returns, since many others made the same bet);

Second, go against the consensus and back undervalued projects—offering maximum personal gain if the minority view proves right. This dual role of voting and betting leaves participants conflicted. Moreover, when the prediction itself shapes the future (because fund allocation affects project development), futarchy risks creating self-fulfilling or self-defeating cycles: if everyone bets on a project’s success, it receives resources and thus becomes more likely to succeed; conversely, overlooked projects—even potentially successful ones—may fail simply due to lack of support. This feedback loop means futarchy experiments must be interpreted carefully, and designs should incorporate mechanisms to mitigate such self-reinforcing biases.

In this futarchy experiment, we witnessed not only how governance can become “gamified,” but also glimpsed the potential of degens within prediction markets—they are no longer mere profit-seekers, but potential professional governors. Only when institutional design anchors degen energy toward public goals—turning speculation into contribution and betting into judgment—can futarchy unlock regenerative governance (Regen) for Web3. This experiment awakened a possibility: governance does not have to be puritanical rational deliberation—it can also be deeply gamified consensus formation. Awakening the regenerative spirit within degens may well be the evolutionary path forward for future DAO governance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News