WOO X Research: Bitcoin Reclaims $90K, Which Altcoins Are Worth Watching?

TechFlow Selected TechFlow Selected

WOO X Research: Bitcoin Reclaims $90K, Which Altcoins Are Worth Watching?

Bitcoin recovers, altcoins remain at lows.

Author: WOO X Research

Bitcoin reclaimed the $90,000 mark on April 23, driven in part by increasing clarity around the tariff dispute. U.S. Treasury Secretary Bessent stated that the current tariff deadlock is unsustainable and expects conditions to ease in the near future.

On another front, Trump has recently intensified public pressure on Federal Reserve Chair Powell, strongly demanding rate cuts and even suggesting Powell could be fired if rates aren't lowered—remarks that have raised global concerns about the Fed's independence and triggered skepticism toward the U.S. dollar. The latest development came when Trump was asked by media about these comments; he replied: "I have no intention of firing him. I just hope he becomes more proactive on rate cuts."

During earlier episodes when Trump called for Powell’s removal, Bitcoin demonstrated its rare but notable function as “digital gold”—a safe-haven asset—moving closely in tandem with physical gold. Now that the immediate threat to Powell’s position has eased and U.S. equities are rebounding sharply, Bitcoin continues to rise, benefiting this time from liquidity premium. It has gained 12% over the past seven days.

As mentioned in our previous article, this recent Bitcoin rally has not been accompanied by a broad surge in altcoins. Bitcoin’s market dominance currently stands at 64.2%, the highest level in four years. While it remains uncertain when the next altcoin season will begin, we can already identify which altcoins are outperforming Bitcoin during periods of market volatility—revealing where capital is flowing and potentially indicating which projects may sustain strong momentum going forward.

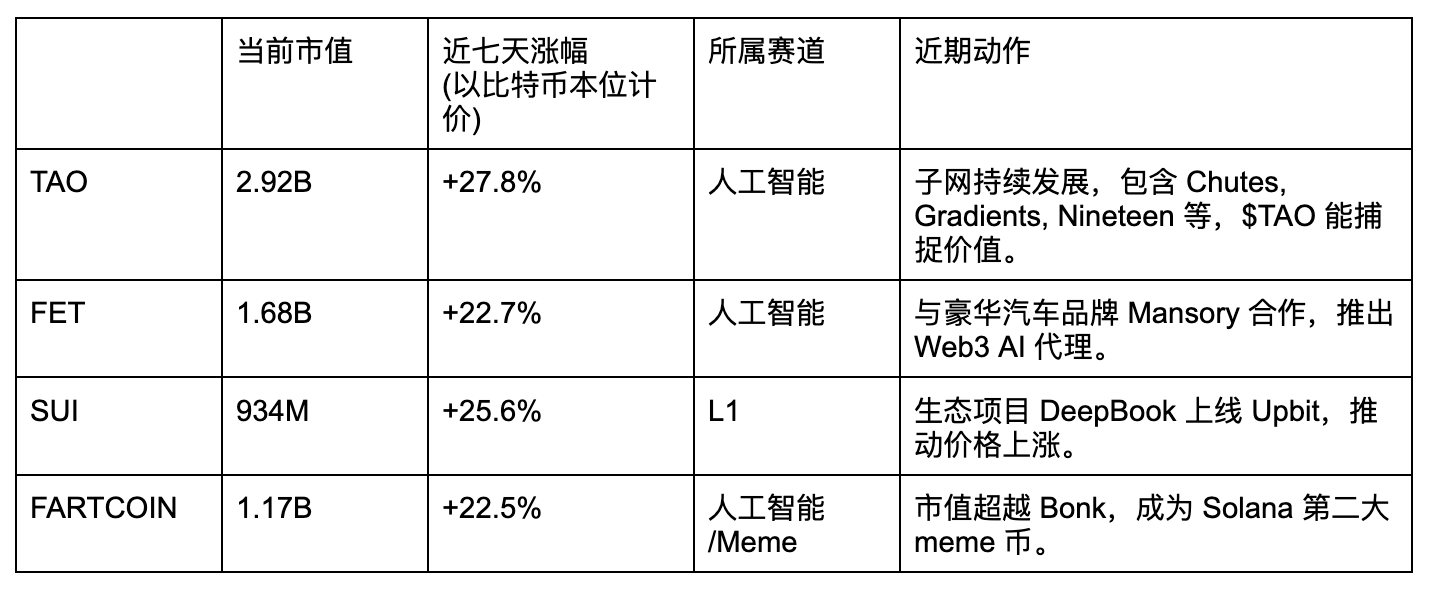

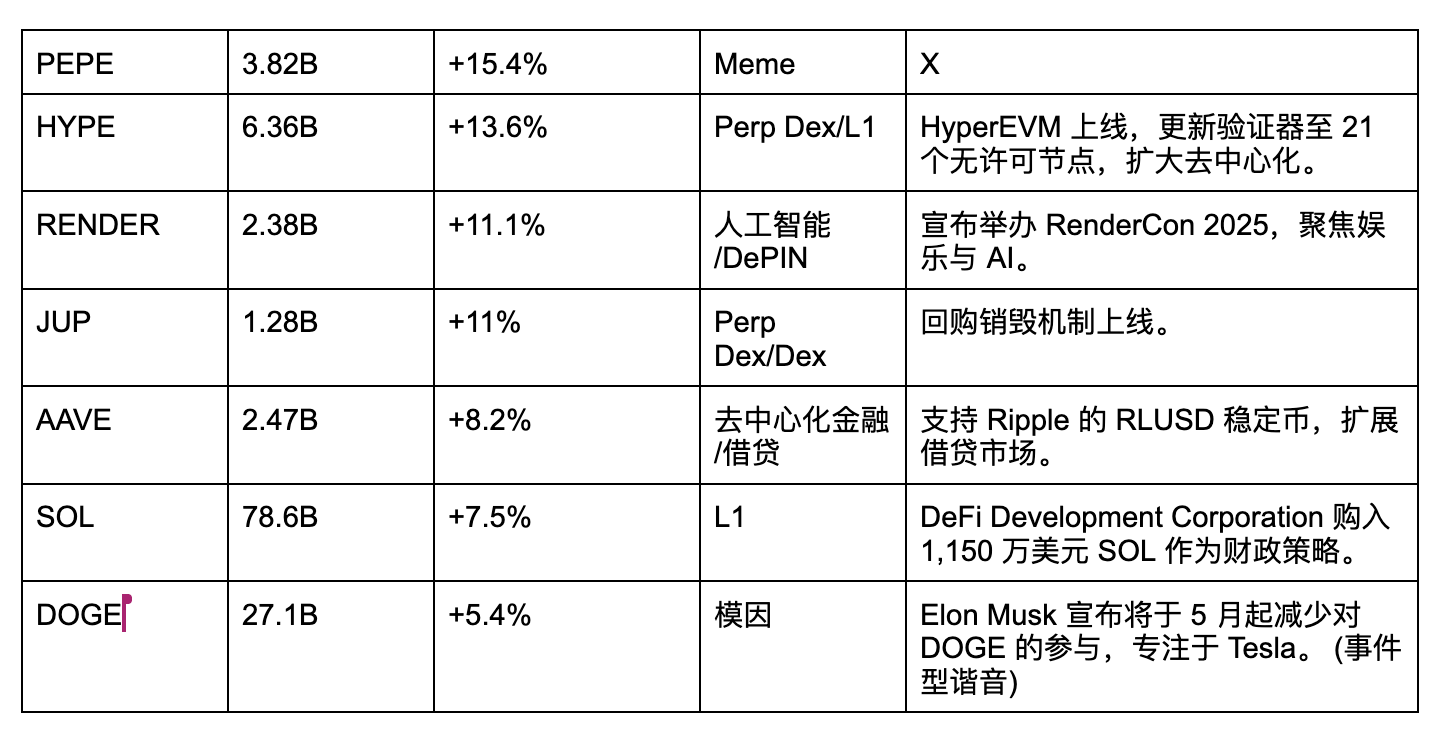

Top 100 Market Cap Tokens That Outperformed BTC Over the Past 7 Days

The table below lists tokens within the top 100 by market cap that have outperformed Bitcoin over the past seven days. In fact, there were more than the 11 listed here. On April 23, as Bitcoin surged, its market dominance saw a slight dip (by 0.2%), indicating that many altcoins experienced broad-based gains. Several long-dormant tokens even surpassed Bitcoin’s weekly return overnight.

However, such sudden spikes should be interpreted as results of liquidity spillover rather than deliberate capital allocation. Therefore, in selecting candidates, we excluded tokens that surged abruptly overnight and focused instead on those that consistently outperformed Bitcoin throughout the seven-day period.

Which Sectors Should You Watch?

-

AI: The last major narrative cycle was fueled by AI, beginning with GOAT and its fusion with meme culture, followed by broader exploration of applications. The resulting AI frenzy created a bubble, which eventually burst amid a series of token launches by the Trump family. Most AI tokens subsequently dropped over 90%, resetting valuations.

A burst bubble does not mean the end of the sector—it serves as a mechanism to eliminate weaker projects. With Web2 AI continuing to advance, Web3 AI projects have undergone a significant shakeout. If one believes that progress in Web2 AI will translate into Web3, then today’s AI sector offers relatively attractive valuations. Surviving projects have proven their fundamentals. When the altcoin season finally arrives, this sector is well-positioned to absorb liquidity spilling out from Bitcoin.

Other notable AI tokens beyond the list: VIRTUAL, ARC, ALCH, SWARMS, Zerebro

-

L1: Layer 1 tokens have historically been a reliable bet during altcoin seasons. The logic is straightforward: a blockchain’s development defines the ceiling for its ecosystem, while also capturing the most liquidity.

But unlike in 2021, investors are no longer willing to pay for simple “EVM copy-paste” chains. Instead, they’re seeking L1s with high TPS and developer tools capable of enabling truly novel applications. Once concrete catalysts emerge—such as exchange listings or institutional adoption—these emerging L1s tend to exhibit greater price elasticity compared to established ones.

Promising upcoming but yet-to-launch L1s: Monad, MegaETH

-

Meme: Bitcoin itself is the largest meme coin in crypto. Meme coins have become a dominant force in this cycle and are highly likely to persist. Their strength lies in being carriers of consensus and culture. Top meme coins on various blockchains can even be seen as leveraged versions of their native chain tokens. Most meme coins are natively built on-chain, meaning pricing power isn’t monopolized by centralized exchanges, creating room for wealth effects. In crypto, wherever there is a wealth effect, liquidity and participation follow.

-

DeFi: DeFi remains one of the few sectors in crypto with real business models. Perpetual DEXs and spot DEXs earn trading fees; lending protocols capture interest rate spreads; yield farming generates deposit/withdrawal fees; launchpads charge token issuance fees. HYPE, JUP, and AAVE—all featured in the table—are leaders in their respective DeFi niches. More importantly, they all feature token buyback mechanisms. As altcoin season heats up and liquidity returns, driving higher trading volumes, leading DeFi protocols benefit from network effects, boosting revenues. Higher revenue enables stronger buybacks, increasing demand for their tokens and raising the probability of sustained price appreciation.

Conclusion: Monitor Bitcoin Dominance Closely

An emerging altcoin season signifies capital rotation from Bitcoin into riskier, smaller-cap altcoins. Two key indicators should be watched: first, whether Bitcoin can hold above $90,000 to provide a stable confidence anchor; and second, more importantly, whether Bitcoin dominance (BTC.D) begins to decline, signaling a broadening of capital appetite.

On April 23, Bitcoin surged to $90,000, yet BTC.D only dipped slightly by 0.2%, indicating the market remains in a phase of “BTC-centric, steady growth.” However, if BTC.D starts to fall more significantly—retracing toward early-year levels around 57%—that would signal meaningful capital outflow into altcoins, marking the true start of a rotation-driven rally.

In short, the real beginning of the altcoin season won’t just be defined by Bitcoin making new highs, but by rising risk appetite and capital spreading from BTC into thematic sectors. When both occur simultaneously, we may witness a fully energized market. Right now is the time to observe, filter, and position accordingly. Whether an altcoin boom materializes, BTC.D’s trajectory will tell us.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News