The State of Copycat ETF Mania: A Closer Look at 2025's Crypto ETF Filings

TechFlow Selected TechFlow Selected

The State of Copycat ETF Mania: A Closer Look at 2025's Crypto ETF Filings

Funds for cryptocurrency assets such as Litecoin, XRP, Solana, and Dogecoin may emerge this year and next, significantly expanding the influence of crypto assets in traditional markets.

Written by: Coingecko

Translated by: Felix, PANews

With a more crypto-friendly U.S. administration taking office and the departure of SEC Chair Gary Gensler, asset management firms are now launching a broader range of exchange-traded funds (ETFs) covering altcoins, memecoins, and even NFTs.

Key Takeaways

-

BTC and ETH spot ETFs have attracted billions in institutional inflows, legitimizing cryptocurrencies within TradFi.

-

Asset managers are actively filing for ETFs on Solana, XRP, Litecoin, Cardano, and others.

-

ETF applications have also been submitted for memecoins such as DOGE, TRUMP, BONK, and PENGU.

-

Bloomberg and Polymarket estimate approval odds between 75% and 90% for assets like SOL, XRP, and LTC, while chances remain very low for SUI, APT, and meme-based funds.

The crypto space is divided—on liquidity, on L1 supremacy, and many other fronts. But if there’s one thing that unites all crypto enthusiasts, it's the hope for mainstream acceptance.

Between 2024 and 2025, as crypto ETFs gain approval and rapidly expand, the dream of mainstream adoption took a giant leap forward.

For the first time, investors can directly access various digital assets through traditional brokerage accounts—without needing complex crypto wallets or exchanges.

Institutional investors, previously hesitant due to regulatory uncertainty, poured in billions of dollars within weeks of Bitcoin and Ethereum ETF launches. The impact was immediate. Bitcoin surged to new all-time highs, and Ethereum ETFs were swiftly approved. These ETFs provided traditional financial participants with easier access and deeper market liquidity—and set a precedent for future crypto ETF approvals.

Now, with Gary Gensler stepping down as SEC Chair and a more crypto-friendly U.S. government in power, asset managers are seizing the opportunity to file for additional altcoin ETFs—ranging from Solana and Ripple to Dogecoin, BONK, and Trump-themed memecoins.

This article provides a comprehensive overview of the current state of the crypto ETF boom.

Bitcoin ETFs Lay the Foundation

Bitcoin has long been the face of cryptocurrency, and in 2024, it officially entered the mainstream financial system with the approval of the first U.S. spot Bitcoin ETFs. While Bitcoin futures ETFs have existed since 2021, the launch of spot ETFs marked a watershed moment—investors could now directly hold actual Bitcoin assets rather than derivative contracts.

Within days of trading, spot Bitcoin ETFs attracted billions in inflows. This massive capital influx significantly boosted Bitcoin’s liquidity and solidified its status as a legitimate asset class, comparable to traditional commodities like gold.

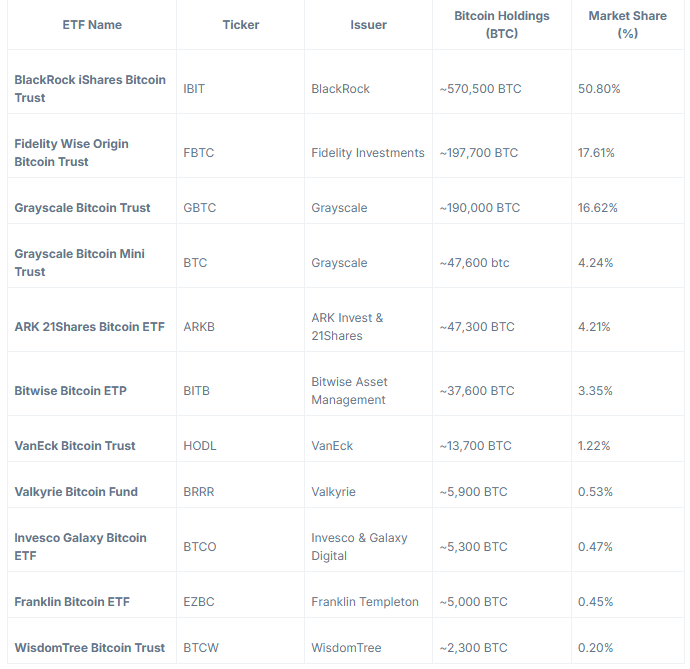

As multiple asset managers launched competing Bitcoin ETFs, the market quickly became a battleground for investor attention. While BlackRock’s iShares Bitcoin Trust dominated early inflows, companies like Fidelity, ARK Invest, and VanEck also secured substantial participation.

By 2025, several major asset managers had launched spot Bitcoin ETFs. Below are the key funds and their Bitcoin holdings:

Source: Blockworks Bitcoin ETF Tracker

Key differences between futures and spot Bitcoin ETFs:

-

Futures Bitcoin ETFs (e.g., BITO): Hold Bitcoin futures contracts from the CME, not actual Bitcoin. Prone to tracking error due to contract rollovers.

-

Spot Bitcoin ETFs (e.g., IBIT): Directly hold Bitcoin, enabling precise tracking of Bitcoin’s market price.

Ethereum ETFs

Following the success of Bitcoin ETFs, the next major milestone in the crypto ETF landscape was the launch of Ethereum ETFs. While Bitcoin is often seen as “digital gold,” Ethereum serves as the backbone of DeFi and smart contract ecosystems.

Initially, regulators hesitated to approve an Ethereum ETF. However, after the SEC approved spot Bitcoin ETFs in early 2024, Ethereum’s path became clearer.

By May 2024, multiple Ethereum futures ETFs received regulatory approval—a further inflection point in crypto adoption. Spot Ethereum ETFs were approved in July 2024. In the months leading up to approval, Ethereum broke above $4,000, mirroring Bitcoin’s rally earlier in the year.

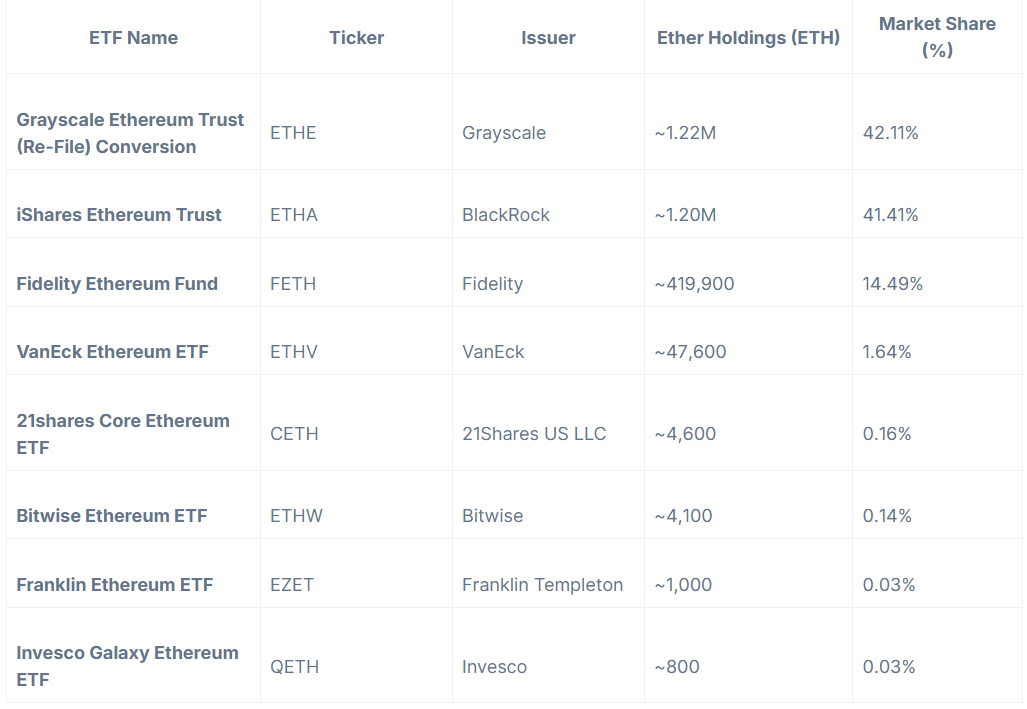

As of 2025, spot Ethereum ETFs collectively hold a significant amount of ETH, making them among the largest institutional vehicles for the asset.

Source: Blockworks Ethereum ETF Tracker

At the time of writing, nearly 3 million ETH are held by ETFs, marking record-high institutional participation in ETH.

The Altcoin ETF Season Is Here

With spot Bitcoin and Ethereum ETFs firmly established, asset managers have turned their sights toward the broader crypto ecosystem.

Encouraged by the SEC’s increasingly open stance toward crypto and improving market infrastructure, asset managers have filed a wave of altcoin ETF proposals targeting popular tokens such as Litecoin, XRP, Solana, Dogecoin, and Cardano.

While no altcoin ETF has yet been approved in the U.S., several are under active review, and the regulatory tone is shifting. Analysts and industry insiders believe that once the first is approved, others will quickly follow—a domino effect similar to what occurred with Bitcoin and Ethereum.

Solana (SOL) ETF

Solana’s popularity has surged over the past year, making it one of the most anticipated candidates for an altcoin ETF. With a strong DeFi ecosystem, Solana is widely viewed as Ethereum’s fiercest competitor in the smart contract arena.

However, a key regulatory hurdle remains: whether Solana qualifies as a security. Ongoing litigation and classification debates may delay the SEC’s decision. Nonetheless, infrastructure is already forming—DTCC has listed two Solana futures ETFs (SOLZ, SOLT), and the CME is preparing to launch SOL futures contracts in 2025.

VanEck Solana Trust Fund

Filing Date: June 2024

Details: VanEck submitted an S-1 registration statement to the SEC, proposing a spot Solana ETF designed to track the price of SOL directly. This marks the first-ever U.S. application for a spot Solana ETF.

21Shares Core Solana ETF

Filing Date: June 2024

Details: Following VanEck, 21Shares filed an S-1 with the SEC for a spot Solana ETF, planned for listing on the Cboe BZX Exchange.

Bitwise Solana ETF

Filing Date: November 2024

Details: Bitwise initially filed to establish a legal trust for a Solana ETF in Delaware, later withdrew it, and resubmitted an S-1 filing with the SEC.

Grayscale Solana ETF (Spot ETF Conversion)

Filing Date: January 2025

Details: Grayscale filed with the SEC to convert its existing Solana Trust (GSOL)—with $134 million in AUM—into a spot ETF to be listed on NYSE Arca.

Canary Solana ETF

Filing Date: Late 2024 to early 2025

Details: Canary Capital filed an S-1 for a spot Solana ETF with the SEC, amid rising interest in altcoin ETFs following Trump’s election victory.

Franklin Templeton Solana ETF

Filing Date: March 2025

Details: Franklin Templeton, managing over $1.5 trillion in assets, filed S-1 and 19b-4 forms with the SEC to launch a spot Solana ETF on the Cboe BZX Exchange, becoming the sixth major institution to apply for a U.S. spot SOL ETF.

According to Bloomberg Intelligence analysts, the approval likelihood for a Solana ETF is high (75%).

Potential Impact: Analysts project $3–6 billion in inflows if approved.

XRP ETF

XRP faces a unique challenge: legal uncertainty. Despite Ripple achieving partial legal victories in 2023, the SEC’s final stance on whether XRP is a security remains unclear. However, the surge of filings in early 2025 suggests growing optimism that clarity is near—or at least sufficient for ETF approval.

Bitwise XRP ETF

Filing Date: October 2024

Details: Bitwise Asset Management submitted an S-1 registration statement—the first formal U.S. proposal for an XRP ETF.

Canary Capital XRP ETF

Filing Date: October 2024

Details: Canary Capital, founded by former Valkyrie Funds co-founder Steven McClurg, filed an S-1 for a spot XRP ETF with the SEC.

21Shares Core XRP ETF

Filing Date: November 2024

Details: Swiss-based crypto investment firm 21Shares filed an S-1 with the SEC for a spot XRP ETF.

WisdomTree XRP ETF

Filing Date: December 2024

Details: Global asset manager WisdomTree filed an S-1 with the SEC for a spot XRP ETF, planned for listing on Cboe BZX.

Grayscale XRP ETF (Spot ETF Conversion)

Filing Date: January 2025

Details: Grayscale Investments filed to convert its existing XRP Trust ($16.1 million AUM as of Jan 2025) into a spot ETF, to be listed on NYSE Arca.

CoinShares XRP ETF

Filing Date: January 2025

Details: European crypto investment firm CoinShares filed an S-1 with the SEC for a spot XRP ETF.

ProShares XRP ETF

Filing Date: January 17, 2025

Details: ProShares filed an S-1 for a spot XRP ETF, along with three other undisclosed XRP-related products.

Teucrium XRP ETF

Filing Date: January 21, 2025

Details: Teucrium filed an S-1 with the SEC for a spot XRP ETF.

MEMX XRP ETF

Filing Date: February 2025 (exact date undisclosed)

Details: U.S.-based securities exchange MEMX filed an application to launch an XRP ETF under a commodity trust structure.

Volatility Shares XRP ETF

Filing Date: March 10, 2025

Details: Volatility Shares filed an S-1 with the SEC for a spot XRP ETF designed to track XRP’s price directly.

Franklin Templeton XRP ETF

Filing Date: March 11, 2025

Details: Franklin Templeton (managing over $1.5 trillion) filed S-1 and 19b-4 forms with the SEC for a spot XRP ETF, with Coinbase Custody as custodian.

Will an XRP ETF be approved? Unlikely but possible (Bloomberg analysts estimate 65% chance). However, Polymarket data shows higher odds—at 81%.

Potential Impact: JPMorgan analysts estimate $4–8 billion in ETF inflows if approved, significantly boosting XRP’s market cap and credibility.

Litecoin (LTC) ETF

If Bitcoin is “digital gold,” Litecoin is “digital silver.”

One of the oldest and most actively traded cryptocurrencies, Litecoin was launched in 2011 by Charlie Lee to offer faster transactions and lower fees than Bitcoin—making it ideal for everyday payments.

Canary Capital Litecoin ETF

Filing Date: October 2024

Details: Filed an S-1 with the SEC—the first U.S. proposal for a spot Litecoin ETF.

The Canary Litecoin ETF is currently considered the most likely altcoin ETF to be approved. LTC’s long history dating back to 2011 meets multiple SEC criteria related to liquidity, maturity, and market depth.

Grayscale Litecoin Trust (ETF Conversion)

Filing Date: January 2025

Details: Grayscale Investments filed to convert its existing Grayscale Litecoin Trust (LTCN), managing $127.4 million in assets, into a spot ETF to be listed on NYSE Arca.

Grayscale’s move reinforces market expectations that Litecoin may be among the first altcoins to receive ETF approval.

CoinShares Litecoin ETF

Filing Date: January 2025

Details: European digital asset manager CoinShares filed an S-1 with the SEC for a spot Litecoin ETF, offering exposure without direct custody. The ETF will issue baskets of 5,000 shares and trade on Nasdaq.

Will an LTC ETF be approved? Highly likely (analysts estimate a 90% chance of approval in 2025).

Potential Impact: Increased visibility, liquidity, and price appreciation for LTC via the ETF channel.

Cardano (ADA) ETFs

Cardano ranks among the top ten cryptocurrencies by market cap, with a large and loyal community. Its focus on peer-reviewed development and environmental sustainability appeals to ESG-conscious investors. However, the lack of a U.S. futures market may delay SEC approval.

Grayscale Cardano Trust (ETF Conversion)

Filing Date: February 2025

Details: NYSE Arca filed a Form 19b-4 on behalf of Grayscale Investments to list and trade shares of the Grayscale Cardano Trust under ticker GADA on NYSE Arca.

Will an ADA ETF be approved? Polymarket data shows positive sentiment, with a 65% approval probability.

Potential Impact: Higher staking participation, increased validator count, and long-term price stability.

Avalanche (AVAX) ETF

Avalanche is another Ethereum competitor in the L1 space. VanEck’s trust setup signals intent, but the absence of a formal SEC application means it remains in early stages.

VanEck Avalanche ETF

Filing Date: March 2024

Details: Global asset manager VanEck filed an S-1 with the SEC to launch a spot Avalanche ETF.

Will an AVAX ETF be approved? According to Bloomberg ETF analyst James Seyffart, the likelihood is relatively low now—but could rise significantly later this year.

Potential Impact: Will largely depend on the regulatory environment set by SOL and ADA approvals.

Aptos (APT) ETF

Aptos is an L1 blockchain built by former Meta engineers. Bitwise’s ETF filing is seen as a bold move to capture the next wave of altcoin growth.

Bitwise Aptos ETF

Filing Date: March 2025

Details: Bitwise Asset Management filed an S-1 with the SEC. Previously, Bitwise registered a “Bitwise Aptos ETF” trust entity in Delaware on February 25, 2025—an initial administrative step. The S-1 filed on March 5 formally confirmed the proposal, naming Coinbase Custody as the proposed custodian.

Will an APT ETF be approved? Low to moderate (more likely after SOL, XRP, and ADA approvals).

Potential Impact: If approved after other altcoin ETFs, short-term impact may be limited—but would represent a symbolic win for emerging blockchains.

Sui (SUI) ETF

Like Aptos, Sui is an emerging L1 blockchain with a growing ecosystem. Current ETF filings are largely speculative, signaling long-term confidence rather than imminent approval.

Canary Sui ETF

Filing Date: March 2025

Details: Canary Capital filed an S-1 with the SEC. The filing does not specify an exchange or ticker. Previously, Canary registered a trust entity for a Sui ETF in Delaware on March 6, 2025—a preliminary step before S-1 submission.

Will a SUI ETF be approved? Extremely unlikely (not expected before 2026).

Potential Impact: Shortly after news of the application, SUI’s price surged over 10%. If momentum continues, the potential price impact could surpass previous all-time highs.

Move (MOVE) ETF

The MOVE ETF aims to track the native token of Move Network, an Ethereum L2 protocol built on MoveVM (originally developed by Facebook’s Diem team). Focused on faster, gas-efficient smart contracts, Move positions itself as next-generation blockchain infrastructure.

The MOVE ETF follows the application strategy of earlier L1 ETFs (like Aptos and Sui), but emphasizes technology and developer engagement.

Rex-Osprey MOVE ETF

Issuer: Rex Shares and Osprey Funds

Details: Rex Shares partnered with Osprey Funds to file an S-1 for the “REX-Osprey MOVE ETF” with the SEC on March 10, 2025. The ETF awaits SEC confirmation of its 19b-4 filing to enter formal review.

Will a MOVE ETF be approved? MOVE is still a relatively new asset, lacking deep institutional liquidity or a derivatives market. Approval prospects are therefore not optimistic.

Potential Impact: If approved, MOVE could serve as a blueprint for ETFs based on infrastructure tokens (e.g., Optimism, StarkNet).

Memecoin ETFs

Though memecoins are outliers in crypto—often dismissed as valueless internet jokes (sometimes rightly so)—their staying power and cultural relevance are undeniable.

Now, asset managers are testing regulatory boundaries by filing ETF proposals for some of the most prominent memecoins, including Dogecoin, TRUMP, and BONK.

Can meme-based assets be issued as regulated financial products? And if so, how will regulators distinguish satire from securities?

Dogecoin (DOGE) ETF

Few memecoins have transcended their “meme status” to become real-world impactful tokens. Dogecoin is one of them.

DOGE has consistently ranked among the top cryptocurrencies by market cap, surviving multiple market cycles with remarkable resilience. Its strong liquidity, broad exchange support, and high user activity make it an increasingly attractive asset for institutional products.

Rex Shares Osprey Dogecoin ETF

Filing Date: January 2025

Details: Part of a broader wave of applications targeting memecoins and other cryptos.

Grayscale Dogecoin Trust (ETF Conversion)

Filing Date: January 2025

Details: Grayscale Investments filed on January 31, 2025, to convert its existing private Dogecoin Trust into a spot ETF, to be listed on NYSE Arca under Rule 8.201-E (commodity-based trust shares).

Bitwise Dogecoin ETF

Filing Date: Entity registered, full application pending

Details: As a preliminary step, Bitwise Asset Management registered a “Bitwise Dogecoin ETF” trust entity in Delaware on January 23, 2025. It then filed an S-1 with the SEC on January 28, 2025, to launch a spot DOGE ETF. On March 3, 2025, NYSE Arca filed a 19b-4 form with the SEC to approve the ETF’s listing, advancing the review process.

Will a DOGE ETF be approved? Bloomberg ETF analyst Eric Balchunas estimates a 75% chance.

Potential Impact: Approval could catalyze mainstream recognition of memecoins.

Trump Memecoin ETF

In late 2024, as political discourse merged with meme culture, the TRUMP token gained rapid popularity.

Rex Shares Trump ETF

Filing Date: January 21, 2025

Among all 2025 ETF applications, this is undoubtedly the most controversial—marking the first serious attempt to package a politically branded memecoin as an ETF.

The proposal commits to investing 80% or more of assets in the token or related derivatives.

Will it be approved? Due to the political nature of the underlying asset (the Trump memecoin), the ETF is highly likely to be rejected. Even seasoned ETF experts like Bloomberg’s Eric Balchunas called the filing “absurd.” Most analysts view it as a test case or publicity stunt rather than a viable path to approval.

Potential Impact: If approved, it would pose a significant reputational risk to the SEC.

BONK ETF

The BONK ETF application was filed alongside the TRUMP ETF, part of Rex Shares’ strategy to expand into the memecoin space.

Given BONK’s strong traction on Solana and robust retail engagement, it could emerge as a more “serious” memecoin ETF candidate.

Rex Shares BONK ETF

Filing Date: January 21, 2025

Issuer: Rex Shares / Osprey

Asset: BONK – Shiba-inspired memecoin on Solana

Will a BONK ETF be approved? Very unlikely in the near to medium term.

Potential Impact: If approved, it could open the floodgates for other memecoin ETFs (e.g., PEPE, FWOG).

PENGU ETF

PENGU is the official token of the Pudgy Penguins NFT collection.

Canary Capital PENGU ETF

Filing Date: March 2025

Details: The Canary PENGU ETF application is still in early stages, with only an S-1 filed. Next, an exchange (e.g., Nasdaq or Cboe) must submit a 19b-4 form and gain SEC approval.

Unlike other NFT-focused crypto ETFs, this fund plans to hold both cryptocurrency and NFTs. Specifically, its asset allocation will be:

-

80% to 95% allocated to PENGU, the native token of the Pudgy Penguins ecosystem.

-

5–15% allocated to Pudgy Penguins NFTs.

-

The remainder allocated to ETH and SOL for liquidity purposes.

If approved, it would become the first ETF in the U.S. to directly hold NFTs.

Significance:

-

First inclusion of NFTs in a regulated investment vehicle.

-

Opens the door for other NFT collections (e.g., Bored Apes, Azuki).

-

Creates a new investment pathway for speculators and cultural investors alike.

Will a PENGU ETF be approved? Low to uncertain. The SEC has never approved an ETF holding non-fungible assets, and questions remain about valuation, storage, and liquidation of such NFTs.

Potential Impact: First regulated NFT-inclusive ETF could significantly boost PENGU and Pudgy Penguins visibility, driving up floor prices.

Conclusion

2024–2025 marks a pivotal era for crypto ETFs.

Bitcoin and Ethereum funds are now part of the financial fabric, and a second wave of crypto assets awaits SEC decisions. This year and next may see the arrival of ETFs for Litecoin, XRP, Solana, Dogecoin, and others—significantly expanding crypto’s footprint in traditional markets.

The approval of each pending ETF hinges on regulatory openness and market maturity. If most are approved, by 2026 we may witness a far deeper integration of the crypto industry with mainstream finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News