The Ceiling of "Fiat-on-Chain": Network Effects of Stablecoins

TechFlow Selected TechFlow Selected

The Ceiling of "Fiat-on-Chain": Network Effects of Stablecoins

Payment is dead, long live payment.

Author: Nathan

Translation: zhouzhou, BlockBeats

Editor's Note: Stablecoins break the traditional payment trilemma of "better, faster, cheaper," offering users worldwide a 24/7, low-cost, permissionless open payment network. They are evolving from mere intermediaries into mainstream value carriers. Despite existing bottlenecks such as fiat on/off ramps, stablecoins are poised to reshape the global financial landscape as their network effects grow.

The following is the original content (slightly edited for clarity):

These three characteristics distinguish stablecoins from traditional payment systems and overcome an age-old rule: you can't have all three at once. Any upgrade comes at a cost. Improve quality, delivery slows down; speed up production, costs rise; reduce costs, excellence declines. Builders typically optimize just one dimension—better, faster, or cheaper.

Historically, innovators could usually solve only two out of the three. Stablecoins resolve this innovation trilemma.

This matters greatly for retail users. Now they can access an open payment network that operates 24/7, settles in seconds, and charges fees in cents rather than percentages.

Stablecoins are better. They represent the logical next step in fund transfers. As the world becomes fully digital, it’s natural for value itself to take on an inherently digital form. Stablecoins accelerate this evolution. Operating on open networks around the clock, they store and exchange value more elegantly than fiat currency. Anyone can access them, and as I've previously written, they are programmable.

Read more: The What and Why of Programmable Money

Stablecoins are faster. Settlement speed depends on the blockchain, but even the slowest networks far surpass traditional systems. Ethereum transactions settle in about 12 seconds, Tron in about 3 seconds, and Plasma aims for millisecond-level confirmation. Traditional payments take hours to multiple business days. Faster settlement reduces opportunity costs, minimizes currency risk, and enables rapid fund delivery during emergencies—without delay.

Stablecoins are cheaper. Regardless of which blockchain they operate on, their cost structure is light. Fixed fees for global transfers are almost always more favorable than the percentage-based fees charged by card networks or international bank wires. On Plasma, USD₮ transfers incur no gas fees, driving marginal costs nearly to zero and unlocking true on-chain micropayments.

Better, faster, cheaper. Stablecoins solve the innovation trilemma mentioned earlier. But why does this matter, and who benefits?

Why This Matters

Stablecoins attract significant attention, yet the “why” is often overlooked. The answer is simple: because they are better, faster, and cheaper, they directly serve retail users worldwide.

So far, we’ve analyzed stablecoins through the lens of the innovation trilemma. Now let’s shift perspectives.

Mikey Kremer brilliantly summarized crypto’s significance in the digital world:

“The crypto ecosystem didn’t invent a new financial system; it invented a new venue. By moving familiar services—payments, lending, market-making—into nominally ‘permissionless’ code, projects filled the void left by the over-regulated post-2008 framework.”

Stablecoins operate within an open venue where anyone can participate—this is their greatest unlock for retail users.

In a sense, stablecoins are merely tokenized dollars—not particularly radical. But as Mikey astutely noted: “The real innovation isn’t the service itself, but the ability to deliver it permissionlessly.”

This is precisely where stablecoins shine: they overcome the “trilemma” while remaining fully open and permissionless. Throughout history, true breakthroughs often stem from transformations in how humans collaborate—and money, as the core collaborative tool, has co-evolved with society for centuries.

Yet each monetary upgrade has brought value transfer closer under state control. Today’s payment systems are regulated, owned, and maintained by government-affiliated institutions.

One core idea behind Bitcoin is libertarianism. As increasing numbers of people globally seek to detach themselves from state control, they turn to Bitcoin.

Today, this pursuit of freedom also leads them toward stablecoins.

For retail users, the simplest reason stablecoins are superior is this: they exist for everyone. In this sense, the blockchains underlying stablecoins are fundamentally permissionless payment systems. People everywhere can connect freely and transfer funds in ways that are better, faster, and cheaper.

But Stablecoins Aren’t Perfect

Bottleneck Challenges

It would be overly idealistic to assume any new system is flawless. Stablecoins certainly have shortcomings. The most critical bottleneck lies in the “last mile”—the final settlement between stablecoins and fiat currencies. Key obstacles include, but are not limited to:

· Liquidity and settlement issues: Converting large amounts of stablecoins to fiat, or vice versa, still heavily relies on fragmented banking channels and partnerships;

· Cash-out and real-world spending challenges: Using stablecoins conveniently for daily purchases or converting them to fiat remains friction-filled and less convenient compared to traditional money;

· Local regulations and capital controls: Many countries lack clear rules on stablecoins, and strict capital controls in some nations directly limit citizens’ access to U.S. dollars.

Because the “last mile” still depends on traditional financial infrastructure, global capital flows at this stage remain inevitably constrained by legacy frameworks.

I believe stablecoins will eventually become the default medium for value transfer. As that day approaches, these frictions will gradually disappear, allowing consumers to fully enjoy the benefits stablecoins offer.

To reach that future, the network effect of stablecoins must continue to expand.

Network Effects

Stablecoins thrive on network effects. Tom Blomfield, co-founder of Monzo, explains the essence of network effects: “Network effects differ from other types of growth—the product gets better as more people in your network join. WhatsApp and Skype are good examples: the more friends you have using them, the easier and freer communication becomes.”

This mechanism applies perfectly to stablecoins. As user numbers grow, more merchants accept them, more businesses integrate them, and overall trust in the system accumulates.

Adoption typically unfolds in two phases: initially, people accept stablecoins while mentally anchoring to cash; over time, they actively choose stablecoins because they truly are better, faster, and cheaper. At that point, network effects kick in fully.

As stablecoin network effects grow, they naturally become more suitable for broader retail use. Although entry barriers are already low and the networks are permissionless, global adoption progresses gradually. Two key forces drive this adoption:

-

Organic diffusion of network effects

-

Innovative applications making stablecoins more practical for daily life

The future of stablecoins is being shaped slowly but steadily by these dynamics.

Shhhigurh accurately captures the current state of this transformation in *The Stablecoin Paradox*:

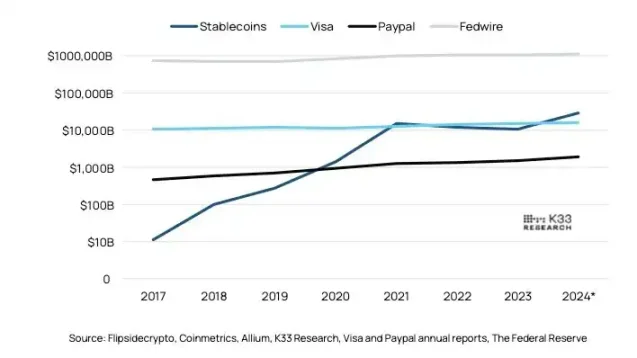

“The stablecoin ecosystem handles fewer transactions than Visa or PayPal, yet its average transaction size is vastly larger. In 2023, Visa processed 276 billion payments averaging $54 each; PayPal handled 25 billion at $61 per transaction. Fedwire processed only 193 million transactions, but averaged $5.6 million each. By comparison, stablecoins processed 2.6 billion transactions in 2023, with an average of $4,200—right in the middle ground between retail and institutional activity.”

This reveals a key trend: stablecoins currently occupy a “middle tier”—between everyday retail swipes and institutional-scale wire transfers. They have not yet become the default layer for small, high-frequency payments—Visa swipes and PayPal clicks still dominate here.

However, given their clear advantages in cost, speed, and openness, deeper penetration into consumer payment scenarios is only a matter of time.

A World Where Stablecoins Are Ubiquitous

I’ve long pondered and written about how the future stack of a stablecoin-based payment network might look.

If stablecoins truly become mainstream payment tools, we may witness an entirely new paradigm of financial interaction:

Wallet = Account: No need to open a bank account—any global user can send and receive payments with just a wallet address;

Smart Contracts = Routers: Fund allocation, payment splits, supply chain settlements, and automated execution of financial products—all happen on-chain;

On-chain Identity = Trust Layer: Social graphs, reputation systems, and payment systems converge—identity becomes credit;

Open APIs = Application Interfaces: Any product can directly integrate stablecoin payments without requiring permission from intermediaries;

Micropayments unlock long-tail use cases—from content tipping and creator monetization to real-time payroll and IoT device settlements—becoming commonplace.

In short, stablecoins aren’t just “digital dollars”; they are the key to unlocking a permissionless, real-time, globally interconnected financial world.

The journey from today’s “$4,200 average transaction” to tomorrow’s “$0.42 content tip” will be bridged by improvements in infrastructure, regulation, user experience, and growing network effects.

We’re witnessing the construction of a new era. Are you ready?

Still, I rarely delve into the most ideal ultimate vision.

If retail adoption continues exponential growth, we’ll eventually reach a point where:

Stablecoins no longer need seamless conversion to cash as a foundation—they become the default form of money. Everyone treats stablecoins as the base payment layer, replacing fiat for daily settlements.

In this future world:

-

Value natively flows on-chain,

-

People routinely use stablecoins for transfers, receiving payments, salary disbursements, and shopping,

-

Merchants, enterprises, and even governments adopt stablecoins as primary currency,

-

Traditional fiat becomes an “off-chain asset,” while stablecoins become the dominant form of “money” in real life.

In this “ideal utopia,” stablecoins achieve full victory. This isn’t merely a change in monetary form—it’s a vision of a decentralized, borderless, real-time, programmable financial infrastructure fully replacing the old financial system.

Of course, we haven’t reached that future yet. But you can feel the direction of the trend:

From niche players to mainstream adoption, stablecoins are redefining the ancient question: “What is money?”

Clearly, I’ve ventured quite far ahead. That ideal future remains distant from our present reality. The current fiat system still feels “safe and reliable” to many, despite its long-standing shortcomings in cost, speed, and accessibility. The key to reaching that future lies in one thing: whether network effects can keep expanding.

Traditional network effects usually occur within “walled gardens” like Facebook, Instagram, Monzo, or Revolut—more users improve the experience, but the platform remains closed.

Stablecoins disrupt this model: they operate on open, permissionless blockchains rather than closed systems.

Even so, as more people use stablecoins for payments, the overall experience continuously improves: more merchants accept them, broader adoption, faster transfers, lower fees, friendlier wallets, infrastructure, and interfaces—all while trust and liquidity accumulate.

Imagine: if every person on Earth could instantly access a borderless, permissionless, low-cost payment network, then “fast and cheap remittances” would no longer be a privilege—but a basic human right.

Final Thoughts

All of this is happening because stablecoins genuinely benefit ordinary users worldwide: easier to use, faster to send, cheaper to transact—and most importantly: accessible to anyone, without needing permission.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News