From Candy Vendor to Crypto Millionaire: The Coinbase Founder's Startup Secrets and Industry Predictions

TechFlow Selected TechFlow Selected

From Candy Vendor to Crypto Millionaire: The Coinbase Founder's Startup Secrets and Industry Predictions

The people who get rich are not the gold diggers, but those who sell shovels.

Author: TRACER

Translation: Tim, PANews

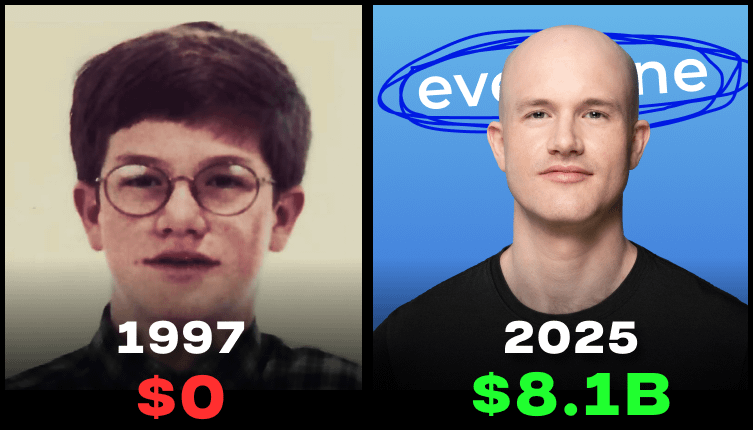

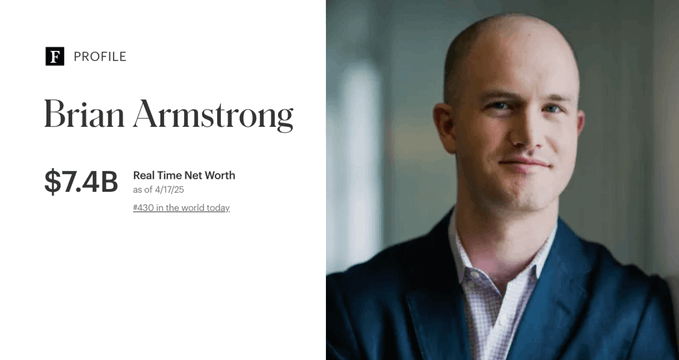

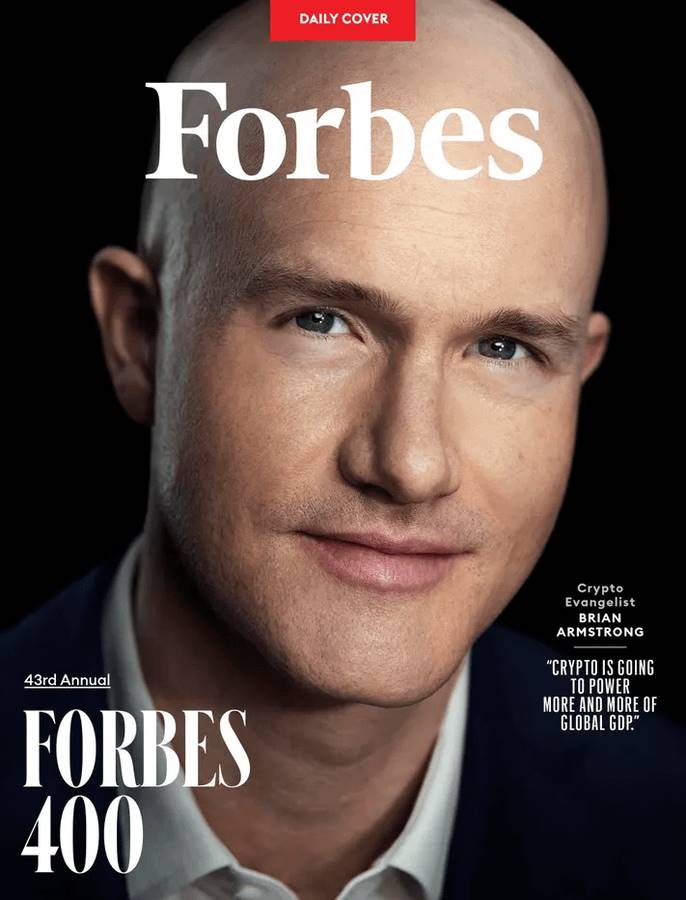

Brian Armstrong is one of the wealthiest figures in the cryptocurrency space. He founded Coinbase and amassed $8 billion in just five years, earning him a spot on Forbes' list of the world's top investors.

Below are his insights, strategies, and five key predictions regarding memecoins.

A few individuals deserve credit for the massive growth of the cryptocurrency industry—and Brian Armstrong

is undoubtedly one of them.

He entered this field driven by technological conviction, and his belief in Bitcoin completely transformed his life path.

Brian Armstrong’s personal journey and industry insights are worth revisiting for inspiration:

Brian was born in San Jose, California, showing entrepreneurial potential from an early age.

In an interview, he admitted that he was once called into the principal’s office for selling candy on the school playground.

During high school, he developed a passion for internet technology and began learning to code.

He later attended Rice University, where he earned a master’s degree.

After graduation, he spent a year living in Buenos Aires, Argentina, where he personally experienced hyperinflation.

The solution to such economic instability—cryptocurrency—became the focus of his future work.

After college and a series of jobs, he co-founded a marketplace platform connecting private tutors with students.

The platform allowed teachers to post profiles and offer services to prospective students.

Brian served as CEO of the project for eight years before selling it for 21 times his annual salary.

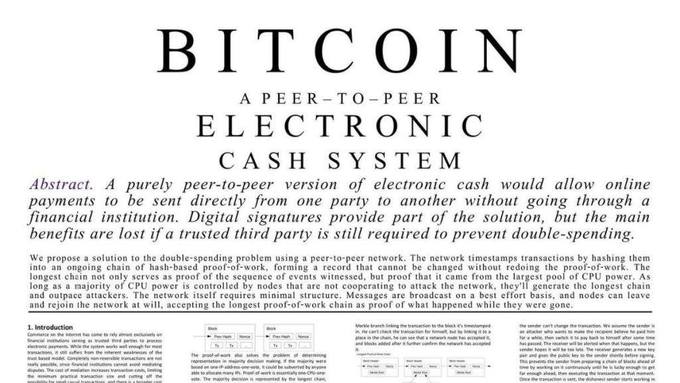

Brian first learned about Bitcoin during Christmas 2010 while staying at his parents’ home in San Jose, when he stumbled upon Satoshi Nakamoto’s foundational whitepaper—“Bitcoin: A Peer-to-Peer Electronic Cash System.”

From that moment on, he began contemplating launching a major venture.

He adopted a guiding principle for entrepreneurship: “The people who get rich aren’t the gold miners—they’re the ones selling shovels.”

At the time, there was a direct competitor in the space—Mt. Gox—but it suffered from serious transaction delays.

In 2011, Brian Armstrong and Fred Ehrsam officially launched Coinbase.

Coinbase quickly attracted significant investment, reaching a valuation more than eight times higher than Brian’s original target. Initially, he aimed to build a $1 billion company.

Today, Brian Armstrong lives his ideal life, a billionaire many times over.

He actively shares his views and advice—perspectives you should absolutely take seriously:

Currently, Brian Armstrong strongly believes that cryptocurrency regulation needs reform.

The previous administration severely hindered the industry’s development; now is the perfect time to correct that.

There is ongoing discussion about appointing a crypto-friendly SEC chair and establishing a clear, stable legal framework—an important positive signal for the crypto market.

Brian Armstrong holds a notably positive view of memecoins and believes they have promising potential.

In his opinion, just as GIFs and internet memes have become part of the digital economy, memecoins could evolve into significant cultural—and even economic—phenomena.

This is a weighty perspective worthy of deep consideration.

Brian also shared a media consumption tip: never listen to promoters on YouTube.

When analyzing projects, focus on these three core factors:

-

Number of GitHub code contributions

-

Team activity levels on Twitter and Discord

-

Responses to criticism—if the team stays silent, that’s a red flag

Policies under the new Trump administration could significantly boost institutional capital inflows into the market, driven by government actions that strengthen confidence among financial institutions. The key catalyst lies in advancing legislation around stablecoins and digital dollars.

Brian Armstrong believes cryptocurrencies will never replace the traditional financial system, but they will serve as a powerful complement.

Exchange-traded funds (ETFs), asset custody services, and deeply integrated products with banks and fintech platforms will define future trends.

This is essentially a practical directive: be sure to develop products that can interface seamlessly with traditional financial infrastructure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News