Overview of Web3 Consumer Application Paradigms and Investment Theory Considerations

TechFlow Selected TechFlow Selected

Overview of Web3 Consumer Application Paradigms and Investment Theory Considerations

Alliance DAO believes that the ecosystem's foundational tools are becoming increasingly mature, and more application-layer projects are needed to bring real value-capturing capabilities to the ecosystem.

Author: IOSG

Over the past period, Alliance DAO has gained significant influence due to its successful incubation of Web3 consumer applications such as Pump.fun and Moonshot. This article first summarizes Alliance DAO’s investment philosophy in the Web3 consumer sector, presents our own observations on this space, provides an overview of mainstream paradigms, challenges, and potential opportunities for current Web3 consumer applications, and concludes with reflections on our investment theory regarding Web3 consumer apps.

Alliance DAO's Incubation of Web3 Consumer Projects

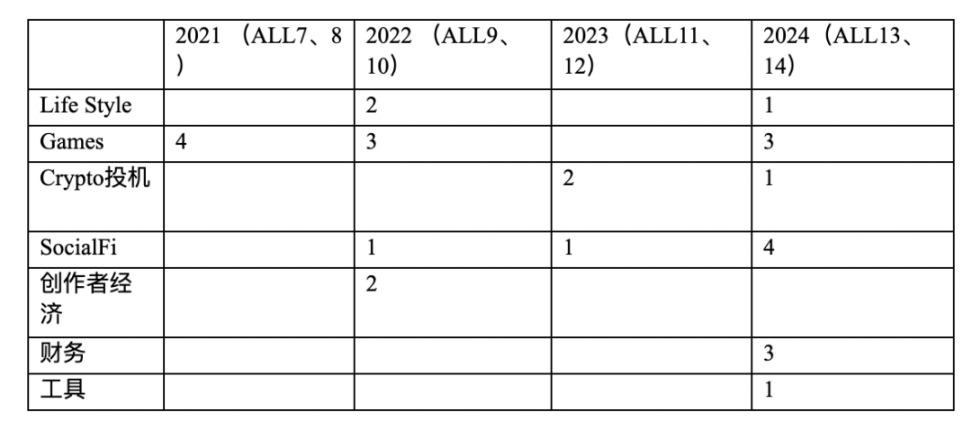

Since its launch, the Alliance DAO Accelerator has incubated or invested in 28 Web3 consumer applications. These can be broadly categorized into seven types:

1. Lifestyle

-

Definition: Projects aiming to cultivate novel, healthy lifestyles through Web3;

-

Count: 3;

-

Projects:

-

StepN: A Web3 lifestyle app with the core innovation mechanism "Move to Earn," where users purchase NFT running shoes that track physical activity and reward tokens.

-

Sleepagotchi: A mobile sleep-monitoring and Sleep-to-Earn gamified sleep aid app featuring gacha card collection mechanics—users earn tokens during sleep and use them for gacha draws.

-

GM: A Web3 AI agent for health management that leverages AI to improve well-being while generating income.

2. Games:

-

Definition: Web3 games or GameFi;

-

Count: 10;

-

Projects:

-

Axie Infinity: A card game developed by Sky Mavis allowing players to breed, raise, battle, and trade Axie creatures.

-

Genopets: A Move-to-Earn NFT mobile game on Solana that makes active living fun and rewarding. A Genopet is a digital pet whose evolution closely mirrors the player’s real-world activities. As players explore, fight, and evolve, their daily steps power progress in the Genoverse—earning cryptocurrency within the game.

-

Nine Chronicles: A decentralized card-based fighting RPG game.

-

Chibi Clash: Builds a Web3 gaming universe centered around its flagship auto-battler game. Inspired by Hearthstone Battlegrounds' gameplay and MapleStory’s art style, Chibi Clash Auto Battler is an asynchronous PvP game where players recruit, upgrade, and deploy troops into battles.

-

Primodium: Building a fully on-chain, open-source, composable game where players aim to gain map control, research technologies, and expand factories.

-

Starbots: An NFT robot combat game where players create fantasy robots to battle others and collect NFT items and tokens.

-

Legends of Venari: A blockchain gaming startup creating an exploratory creature-collecting RPG. In Legends of Venari, players trap, tame, and collect Venari creatures in a player-driven sandbox, competing for territory and rare resources.

-

Force Prime: A fully on-chain strategy Web3 gaming platform offering multiplayer hero combat experiences. Players can train and customize heroes to battle global opponents.

-

Amihan: The first game from game studio FARM FRENS—a casual farming mini-game on Telegram.

-

Wildcard: A Web3-based collectible card game targeting gamers, fans, and collectors.

3. Crypto Speculation:

-

Definition: Products focused on fulfilling users’ crypto speculation needs;

-

Count: 3;

-

Projects:

-

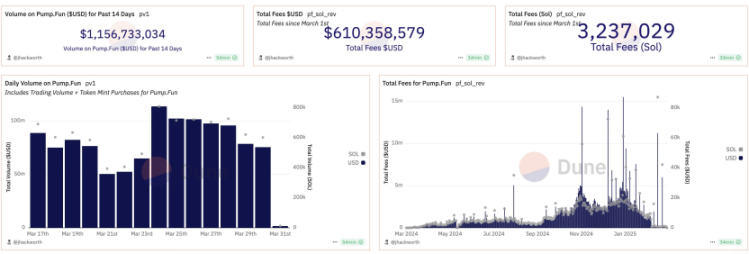

Pump Fun: A meme coin launchpad enabling users to instantly trade newly issued tokens without providing liquidity.

-

Moonshot: A platform for discovering, buying, and selling meme coins, supporting credit/debit card deposits and instant cash-outs via bank transfers.

-

Candlestick: A crypto opportunity radar powered by actionable trading signals and predictions, offering extensive data on top gainers, losers, and highest-volume tokens.

4. SocialFi:

-

Definition: Projects tokenizing users’ influence on social media platforms, creating new speculative assets;

-

Count: 6;

-

Projects:

-

fantasy.top: A SocialFi trading card game (TCG) where players compete using tradable cards representing influential figures in the crypto Twitter sphere, monetizing their social capital and research expertise.

-

0xPPL: A decentralized social network for native crypto users aggregating content from Lens, Farcaster, and Twitter, while integrating various crypto functions.

-

time.fun: A time-tokenization platform enabling time holders to connect with fans. As holders provide more value to fans, the market demand increases the value of their time. Time holders earn ETH from transaction fees and redemptions whenever their time is traded.

-

fam.: A web3-native community hub for discovering, organizing, and enjoying activities among web3 families. fam. uses on-chain identity to help users easily locate and gather fellow holders regardless of location.

-

Tribe.run: A Solana-based crypto social protocol. SocialFi with private groups requiring tokens for entry—speculative features included—supporting live video/audio streaming.

-

EarlyFans: A SocialFi product on Blast L2 where creators make public commitments and auction them; fans can also initiate bribes and auction bribery rights. If creators decline or time out, all funds are refunded.

5. Creator Economy:

-

Definition: Web3 content distribution platforms providing new economic models for creators (text, video, art, etc.);

-

Count: 2;

-

Projects:

-

Koop: Enables any creator, collector, or community to organize and fundraise via NFT art or collector passes. Funds from collector passes form each community’s treasury (or bank) to support on-chain projects and missions. Communities then directly manage finances, leverage member skills, and govern organizations in engaging, social ways.

-

CreatorDAO: A decentralized autonomous organization (DAO) focused on accelerating creators’ careers and granting shared access to capital, technology, and community. CreatorDAO offers mentorship, professional tools for brand development, and a community investing in each other’s success.

6. Finance:

-

Definition: Products aimed at reducing user costs associated with using and managing crypto, e.g., fiat on/off ramps;

-

Count: 3;

-

Projects:

-

Hana Network: A hyper-casual financial system with social network effects launching Hana Gateway—a fiat on/off ramp solution. Hana Network aims to achieve user-driven distribution through existing open social networks.

-

P2P.me: A decentralized Indian fiat on/off ramp platform enhancing security via off-chain reputation systems and privacy via zero-knowledge (ZK) proofs.

-

Offramp: A decentralized fiat channel protocol enabling anyone worldwide to quickly onboard/exit cryptocurrencies with full self-custody, no KYC, and low fees.

7. Tools:

-

Definition: Products solving practical life problems, such as Web3 maps;

-

Count: 1;

-

Projects:

-

proto: India’s version of Google Maps—an incentivized, user-generated map platform aiming to transform the geospatial data industry. Through decentralized data collection, Proto delivers high-quality real-time map data at a fraction of traditional costs. Its unique approach allows easy penetration into dense, complex areas, providing businesses accurate, up-to-date data tailored to their needs.

In terms of investment trend evolution, Alliance DAO began investing in and incubating consumer projects starting in 2021. From 2021 to mid-2023, its primary focus was on Games and Creator Economy projects. Since late 2023 through 2024, preferences shifted toward Crypto Speculation, SocialFi, and Finance categories.

The author reviewed publicly available articles, podcasts, and other materials published by Alliance DAO to summarize its investment philosophy in the Web3 consumer space, outlined below:

1. It believes foundational ecosystem tools are maturing and that more application-layer projects are needed to bring real value to the ecosystem.

2. Founding teams should prioritize Product-Market Fit (PMF). Market validation typically involves two risks: product risk and market risk. For consumer projects, market risk tends to be higher, so avoiding premature token introduction is critical to prevent distorted PMF validation results.

3. Target users of Web3 consumer applications can be mapped along a spectrum based on their acceptance of Web3: non-Web3 general users on the left, Web3-native users on the right. For applications targeting the former, Web3 elements mainly serve as “ad tokens” to lower customer acquisition costs and capture market share. For the latter, the focus should center on assetizing new assets to generate additional investment/speculation demand or addressing unique needs of Web3-native users. In practice, Alliance DAO shows stronger preference for the latter group.

4. Clear differences exist between Solana and EVM ecosystem user profiles, with the former being more conducive to consumer app success, for four reasons:

-

More vibrant community: Solana users show high enthusiasm for new projects, especially those with speculative potential—likely tied to wealth effects;

-

Stronger and more efficient ecosystem support: Core members of the Solana ecosystem are highly community-oriented, possess strong mobilization capabilities, and respond rapidly to new project needs;

-

Faster and lower-cost infrastructure: Designed as an “on-chain NASDAQ,” Solana offers low transaction costs, fast confirmation times, and simpler onboarding due to consolidated base components and emphasis on usability;

-

Higher product competitive moat: Due to its non-EVM tech stack, the cost of copying Solana DApps is significantly higher.

What Are Web3 Consumer Applications?

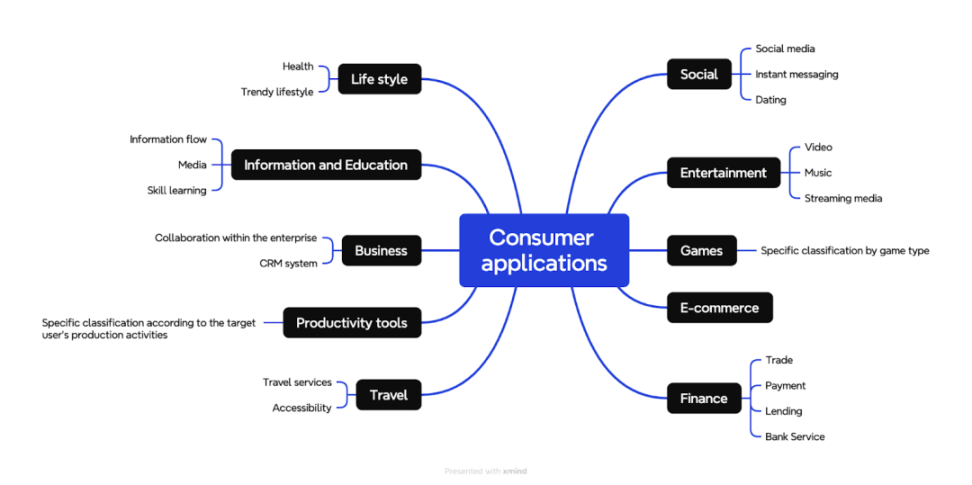

Consumer applications refer to To-C apps in Chinese context—meaning target users are ordinary consumers rather than enterprise clients. Open your App Store: every app there belongs to this category. Web3 consumer applications specifically denote software面向 consumers with distinct Web3 characteristics.

Typically, following standard App Store classifications, the entire consumer app landscape can be roughly divided into 10 major categories, each further subdivided. As markets mature, many new products combine multiple features to differentiate themselves, but we can still categorize them simply based on core value propositions.

Paradigms, Opportunities, and Challenges of Web3 Consumer Applications

Based on analysis of Alliance DAO’s investment philosophy and personal observation, three common paradigms of Web3 consumer applications emerge:

1. Leveraging technical advantages of Web3 infrastructure to optimize issues present in traditional consumer apps:

This is a relatively common paradigm. Much investment in the Web3 industry focuses on infrastructure, and creators adopting this approach aim to leverage Web3’s technical traits to strengthen competitive advantage or offer new services. Benefits from these innovations generally fall into two categories:

Ultimate privacy protection and data sovereignty:

Opportunity: Privacy has long been a central theme in Web3 infrastructure innovation—from early asymmetric encryption identity systems to integration of hardware/software technologies like ZK, FHE, and TEE. Leading Web3 technologists seem to operate under extreme pessimism about trust, striving to build networks fully independent of third-party reliance, enabling secure information and value exchange. This directly benefits users through data sovereignty—personal data stays locally hosted on trusted devices, minimizing leakage risks. Many Web3 consumer apps follow this path, particularly those branding as “decentralized XX”—e.g., decentralized social platforms, AI models, video sites.

Challenge: Years of market testing show little competitive edge when privacy is the sole core selling point. Two reasons: First, consumer concern over privacy usually arises only after large-scale breaches or violations. However, robust legal frameworks often mitigate such concerns effectively. Thus, if enhanced privacy comes at the cost of worse UX or higher usage costs, competitiveness suffers. Second, most consumer apps today rely on extracting value from big data—e.g., targeted advertising. Overemphasizing privacy fragments user data across silos, undermining mainstream business models. Designing sustainable revenue streams becomes difficult, often forcing reliance on “tokenomics.” This introduces unnecessary speculation, diverting team resources and complicating PMF efforts, discussed further below.

Low-cost, global, 24/7 trustworthy execution environment:

Opportunity: The emergence of numerous L1s and L2s provides developers with a new globally accessible, always-on, multi-party trusted execution environment. Traditionally, software providers maintain programs independently—on private servers or cloud infrastructures—creating trust costs in multi-party collaboration scenarios, especially when parties are equal in size or handling sensitive data (e.g., cross-border payments). Such trust costs translate into high development and user expenses. Web3’s execution environment helps reduce these costs significantly. Stablecoins exemplify this application.

Challenge: While cost reduction and efficiency gains are compelling, identifying suitable use cases remains difficult. As noted, benefits arise only when a service involves multi-party collaboration, independent actors of comparable scale, and highly sensitive data—a stringent condition. So far, most such applications reside in financial services.

2. Using crypto assets to design new marketing strategies, loyalty programs, or business models:

Similar to the first paradigm, developers here seek to enhance competitiveness in established, market-validated scenarios by introducing Web3 elements—but they emphasize leveraging crypto assets’ high financial attributes to innovate marketing, loyalty, or monetization.

All investment assets have two values: commodity value (usefulness in real-world contexts, e.g., housing utility of real estate) and financial value (trading value in financial markets, often driven by volatility and speculation in crypto). Crypto assets lean heavily toward financial value.

For such developers, introducing crypto assets typically brings three benefits:

Reducing customer acquisition cost via token-based marketing (e.g., Airdrops):

Opportunity: Low-cost user acquisition in early stages is crucial for most consumer apps. Tokens, with high financial attributes and zero marginal creation cost, significantly reduce early-stage risk. Compared to paying cash for ads or exposure, using free tokens for user acquisition offers better ROI. In this sense, such tokens act like “ad tokens.” Many projects adopt this model—especially those in the TON ecosystem and casual mini-games.

Challenge: This method faces two key issues. First, converting seed users acquired this way is extremely costly. These users are mostly crypto speculators who care less about the product itself and more about potential rewards. With many professional airdrop hunters or “labor farms,” converting them into genuine product users proves highly challenging—and may distort PMF assessment, leading to misdirected investments. Second, widespread adoption of this model reduces its marginal returns, meaning increasingly higher costs are required to attract attention within the crypto speculator crowd.

X-to-Earn user loyalty programs:

Opportunity: Retention and engagement are another key concern. Maintaining consistent user activity demands significant effort and cost. Similar to marketing, leveraging token financial attributes can lower retention costs. The representative model is X-to-Earn—rewarding predefined key user behaviors with tokens to build loyalty programs.

Challenge: Relying on earning incentives shifts user focus from product functionality to yield. When yields drop, user attention quickly dissipates—particularly damaging for apps relying on UGC. If yields depend on the project’s own token price, it creates pressure for market cap management, especially during bear markets, resulting in high maintenance costs.

Direct monetization via token financial attributes:

Opportunity: Traditional consumer apps typically monetize in two ways: freemium (monetizing traffic post-adoption) or paid access (charging for Pro features). The former takes time; the latter is hard to execute. Tokens introduce a new model: direct monetization through token sales—effectively selling tokens for immediate cash flow.

Challenge: Clearly, this is unsustainable. After the initial high-growth phase, lack of incoming capital turns this zero-sum model against users, accelerating churn. Without solid operating revenue, teams must rely on fundraising to sustain operations—a precarious dependence on volatile market conditions.

3. Fully serving Web3-native users by solving their unique pain points:

The final paradigm refers to consumer apps exclusively serving Web3-native users. Innovation directions fall into two broad categories:

Creating new narratives and monetizing previously untapped value elements among Web3-native users, forming new asset classes:

Opportunity: By offering new speculative assets to Web3-native users (e.g., in SocialFi), projects gain pricing power from day one, capturing monopoly profits—an achievement that in traditional industries requires intense competition and strong moats.

Challenge: Frankly, this model heavily depends on team resources—specifically, whether they can secure endorsement from individuals or institutions with strong influence or “pricing power” in the Web3-native community. This poses two difficulties: First, as markets evolve, crypto asset pricing power dynamically shifts—from early Crypto OGs to VCs, CEXs, KOLs, and recently even politicians, entrepreneurs, or celebrities. Recognizing these transitions and partnering with emerging influencers demands exceptional market sensitivity and connections. Second, securing cooperation with “pricers” often requires substantial cost and compromise—not just competing for market share in a niche, but vying with *all* crypto asset creators for limited influencer attention—a fiercely competitive game.

Providing new tooling products to meet unmet needs of Web3-native users or improving UX with better, more convenient offerings:

Opportunity: As crypto adoption grows, user bases expand, enabling finer segmentation. Focusing on authentic user needs makes PMF easier to achieve, fostering more robust business models—e.g., trading analytics platforms, trading bots, news aggregators.

Challenge: Although this path leads to stronger product development, it takes longer to build. Since these projects are driven by actual needs rather than narratives, PMF is easier to validate—but early-stage funding is harder to secure. Staying patient and mission-focused amid a landscape filled with “launch-and-get-rich” myths fueled by token launches or sky-high valuations is exceptionally difficult.

Reflections on Investment Theory for Web3 Consumer Applications

Next, we outline our thoughts on investment theory for Web3 consumer applications, summarized in five core views:

1. How to transcend speculative cycles should be the top priority for Web3 consumer apps

As one of the most successful Web3 consumer apps in the last cycle, Friend.Tech offers valuable lessons. According to Dune data, Friend.Tech has accumulated $24,313,188 in protocol fees and 918,888 total users (traders). For a Web3 app, these numbers are impressive.

Yet the project now faces significant challenges, stemming from multiple factors. First, its product design introduced bonding curves, adding speculative properties to a social app—short-term wealth effects attracted massive users. But medium-to-long term, this raised barriers to community entry, contradicting how most Web3 projects or KOLs build influence via public reach. Moreover, Friend.Tech overly tied tokens to product utility, attracting too many speculators and shifting focus away from practical use—leading to its current困境.

Hence, after accumulating users, most Web3 consumer apps must carefully consider how to find PMF, maintain engagement, move beyond speculative phases, and build sustainable business models. Only by solving these can true mass adoption be achieved.

2. How to evaluate Web3 consumer applications during investment?

Overall, evaluating Web3 consumer apps involves two main aspects. The first is analyzing operational data to assess market potential, broken down into two dimensions:

User Data: For most consumer apps, user metrics remain paramount—large user bases are prerequisites for exploring business models. Like traditional Web2 evaluations, indicators such as active users, growth rate, and retention help determine PMF. Emphasis varies by category and stage. For example, in Web3 social apps, retention is especially important. Investors often start from niche markets—when an app shows strong retention among uniquely profiled users, it signals investment potential. Careful data scrutiny is essential to filter out bot traffic and avoid false PMF signals.

Conversion Data: Beyond user metrics, conversion data reveals commercial potential—e.g., AUM (assets under management) and user spend. High user counts with low AUM or minimal per-user spending suggest limited monetization capacity. Not all revenue is equal—quality matters. Revenue built on genuine usage (users paying for product value, not token mining) indicates more sustainable business models.

The second aspect is team evaluation, focusing on three areas: technical capability—the foundation for building product moats and competitive advantages; market acumen and openness—ability to spot unmet needs and pivot quickly; and network resources—relationships with other apps or KOLs, which impact launch success.

3. How to define a successful Web3 consumer application?

From an investor perspective, defining success in Web3 consumer apps raises interesting questions: Is success revenue-driven or token-price-driven? Generally, both are linked. If a project cannot generate ongoing revenue, its token ultimately holds little long-term value. However, evaluation criteria depend on investment horizon. Short-term investors prioritize token price and tokenomics. Long-term value investors focus more on revenue performance and sustainability of revenue structure.

4. The "app factory" model may offer greater certainty for Web3 consumer app ventures

Drawing from China’s Web2 evolution, ByteDance launched many successful consumer apps through continuous experimentation—building diverse products, letting the market select winners, then doubling down. Their success stemmed from vast accumulated user resources lowering trial costs. This model applies to Web3.

Thus, projects like Friend.Tech still hold promise this cycle—at least demonstrating short-term appeal, drawing large user bases and showing solid revenue. These strengths could enable them to become Web3 app factories, making future developments worth watching.

5. What characteristics will the next successful Web3 consumer app exhibit?

We believe the next wave of successful Web3 consumer apps will emerge in three forms. First, apps gaining traction through sheer fun—initially adopted by crypto KOLs, then leveraging their influence to bring followers onboard, completing cold starts. A prime example is Kaito. Through strong technical execution and innovative incentives, the team captured significant mindshare across crypto communities, achieving deep cross-community penetration. By addressing Web3 projects’ pain point of effective user acquisition, Kaito amassed a large base of end-users and built precise profiles for each, enabling Web3 companies to run targeted campaigns via its platform—creating a sustainable business model beyond short-term speculation.

The second paradigm wins via product excellence rooted in real user needs. Avoiding early token introduction shields PMF validation from speculator noise, boosting retention—examples include Polymarket and Chomp.

The third involves business model innovation. Grass offers inspiration—using users’ idle computing resources to capture value in fields like AI, then monetizing via tokens. Though Grass leans more B2B, its “sharing economy” mindset can inspire Web3 consumer app designs.

6. Which categories are most likely to produce the first Web3 consumer apps achieving PMF in the crypto industry?

Considering current trends and investor sentiment, the following categories are most likely to yield early PMF breakthroughs:

First, Web3 social apps remain highly promising. Web3 projects heavily rely on social media for marketing, and crypto investors prefer social platforms for information and network formation. Hence, the importance of Web3 social apps is clear. By assetizing influence or tapping niche demands, learning from Friend.Tech’s pitfalls, and introducing sustainable monetization with stronger retention, these apps can overcome excessive speculation critiques and achieve PMF.

Second, on-chain trading tools show strong potential. With memes continuing to drive market interest, demand for on-chain trading tools grows—evidenced by the popularity of OKX Wallet and GMGN. As dominant tools see mass adoption, homogenized trading strategies will yield diminishing returns, increasing demand for customization. Offering differentiated on-chain tools or investment strategies presents solid market opportunities.

Third, payment apps are a promising future category. Recent passage of legislation around payment stablecoins has eased prior regulatory pressures. Given blockchain’s advantages in low cost and high settlement efficiency, Web3 payment apps are poised to build moats in cross-border payments and idle fund management.

Finally, DeFi development deserves attention. As one of the few sectors already achieving PMF, DeFi has become indispensable in Web3. Hyperliquid’s success shows enduring demand for decentralization. As infrastructure improves, performance constraints of decentralized apps will lift. In high-frequency trading and other latency-sensitive financial applications, DeFi can match CeFi performance—opening doors for more products like Hyperliquid to challenge the CeFi status quo.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News