Unveiling Alibaba's AI Strategy: Never Officially Announced, But Already Racing Ahead

TechFlow Selected TechFlow Selected

Unveiling Alibaba's AI Strategy: Never Officially Announced, But Already Racing Ahead

Alibaba may have realized that self-iteration requires not only a return to user value and entrepreneurial spirit, but more importantly, a productivity revolution.

Author: Zhang Peng

During the 2025 Spring Festival, the entire Chinese tech industry probably didn't have a peaceful holiday. DeepSeek overturned the large model industry in a way no one saw coming.

Although this happened several months ago, its ripple effects have been far-reaching. The public and media have mostly focused on startups—such as the "AI little dragons"—and their transformations, but the impact on China's domestic "tech giants" has also been profound.

For example, Baidu quietly shifted toward an open-source model strategy, eliminated subscription fees for ERNIE, and integrated DeepSeek-R1 to further strengthen its core business of search. Tencent, usually laid-back and cautious, moved swiftly to deeply integrate DeepSeek-R1 across its entire app ecosystem, including WeChat. ByteDance is reportedly undergoing deep reflection, asking how it can better balance technological advancement with business needs—even after making a firm commitment to go "All in on large models."

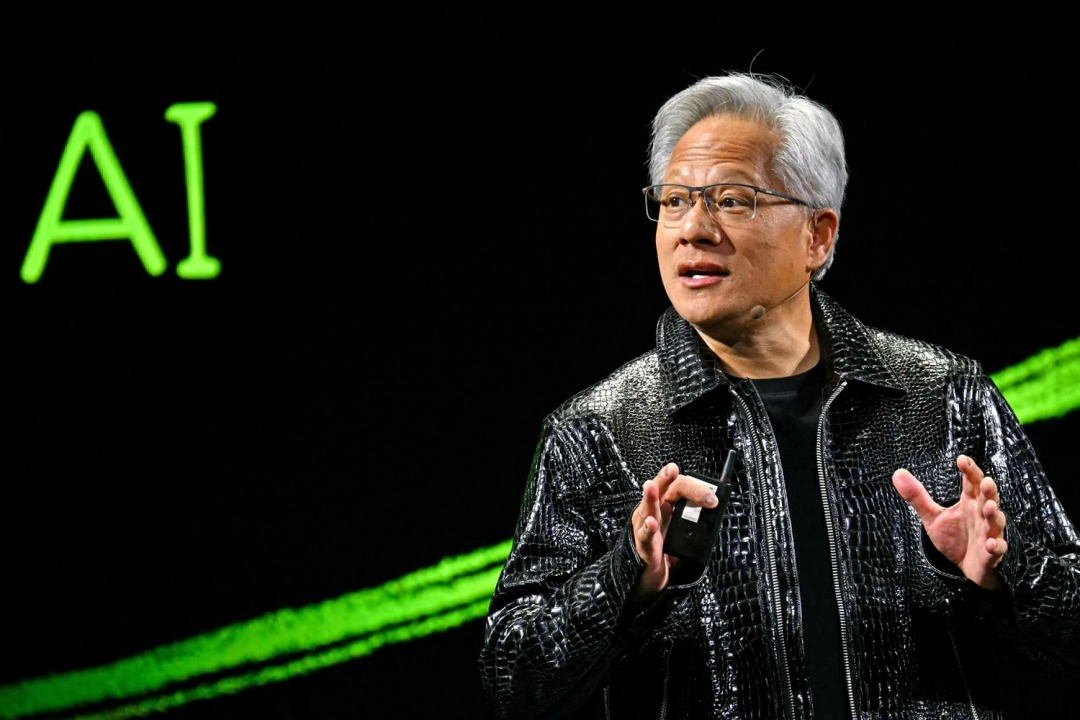

In the past two years, constant upheaval in AI has become routine. I recall at NVIDIA’s appreciation dinner in Beijing earlier this year, Peak (Ji Yichao), chief scientist at Manus, asked Jensen Huang what development in AI would surprise him. Huang’s answer was “nothing”—this phase of the industry is simply unpredictable.

Small companies thrive on agility and speed; the recent shockwaves haven’t affected them too severely. But for big tech firms, I believe the challenge is greater. No matter how large your “strategy department” is, defining a strategic direction for a massive organization amid such unpredictability is an intensely difficult task.

In recent months, during earnings calls and similar events, major Chinese tech firms have gradually revealed fragments of their AI strategies—but these remain largely piecemeal. I recently studied Alibaba in depth and found that these fragments can now be effectively assembled into a relatively clear picture. Strategic intentions are beginning to emerge clearly.

To be objective, Alibaba hasn’t officially “announced” its AI strategy. Yet I believe it may be the first Chinese tech giant to have formed a clear three-year plan and ten-year vision for AI. More importantly, it appears that internally, Alibaba has already aligned all divisions around shared goals and begun coordinated execution across the organization.

The goals and actions of such a “big tech” player in the AI era will inevitably influence the broader industry. Let’s take this reconstructed “Alibaba strategy” and discuss it together.

Let me start with a brief outline. If we use the framework of “mission, vision, values” to define Alibaba’s “goals, outcomes, and methods” in the AI era, it might look like this:

-

AGI must be Alibaba’s primary goal

-

Alibaba must become Asia’s largest AI-era infrastructure provider and best-in-class AI practitioner

-

Open source! Open source! Open source!

01

Why AGI Must Be Alibaba’s Top Priority

In the AI Era’s Most Critical Strategic Goal

Many people likely noticed Alibaba’s return to high growth during this year’s earnings season. Alibaba Cloud’s AI-related products have maintained triple-digit percentage growth for six consecutive quarters. At this earnings call, CEO Eddie Wu systematically outlined the opportunities Alibaba aims to seize based on its own capabilities and strengths in the AI era.

First, let’s examine Alibaba’s current position in the AI landscape: today, Alibaba Cloud, the Qwen model family and its open-source ecosystem, along with ToC applications such as Taobao/Tmall and Quark, make Alibaba at least one of the most formidable players in Asia’s AI arena. This reality forms the starting point from which Alibaba assesses its AI opportunities—both over the next three years and the next decade.

On the other hand, the AI-era extension of Alibaba’s founding mission—“making it easy to do business anywhere”—must continue to provide foundational infrastructure for AI innovation and transformation across industries. This means continuous evolution across every layer of platform opportunity: from computing power to models, to applications—Alibaba Cloud, the Qwen model family and its open-source ecosystem, and application platforms all need ongoing advancement.

At this earnings call, Wu clearly identified the most critical task bridging existing advantages and future industrial goals. His exact words were: “The first goal must be pursuing AGI realization, continuously pushing the boundaries of model intelligence.”

It’s not surprising or unprecedented for a company at Alibaba’s level to say it will “strive for AGI,” and indeed, it has the credentials to make such a claim. But how serious is Alibaba really about this statement? That depends on understanding what AGI truly means for Alibaba.

In fact, since this wave of AI began, the psychological impact of this technological shift has varied among China’s major tech firms. Without delving into ByteDance or Tencent’s “mental state” today, I believe for Alibaba, AGI represents the key direction for shifting from defense to offense—that’s why it must firmly prioritize AGI, with no room for retreat.

Over the years, with the rise of Pinduoduo and TikTok E-commerce, Alibaba’s e-commerce domain has been under constant attack—clearly on the defensive. Its other major business, cloud computing, has faced similar challenges. Alibaba Cloud once lost its way, with growth stuck in single digits for extended periods, giving rivals like Volcano Engine and Baidu Intelligent Cloud space to chip away incrementally.

What does “defense” mean? What does being “cut piece by piece” feel like? Few understand this sense of passive helplessness better than Alibaba. On November 29, 2023, as Alibaba’s market cap neared being overtaken by Pinduoduo, threads flooded Alibaba’s internal network—filled with the melancholy, frustration, and不甘 (unwillingness to accept defeat) of former proud youths. That night, Jack Ma rarely spoke out: “I believe Alibaba will change. Alibaba will reform.”

His next sentence was: The AI e-commerce era has just begun—it presents opportunities and challenges for everyone.

You can’t hold the line by defending. So how do you launch an offensive? Precisely at this moment, history handed Alibaba a new variable: AGI. To put it more directly, general artificial intelligence represents a fundamental upgrade in productivity. All business competition, industrial structures, profits, and business models are ultimately “relations of production.” Only a fundamental shift in productivity can serve as the most crucial breakthrough to alter the status quo.

Many remember Alibaba co-founder and Chairman Joe Tsai reflecting internally on “why Alibaba fell behind in recent years.” He pointed to losing sight of who the real customers were—failing to deliver the best experience for users shopping via apps, failing to genuinely focus on creating user value.

And “forgetting” essentially meant “insufficient resource allocation” toward those goals. The truth in business is that sustained innovation and leadership come less from some visionary, godlike decision, and more from consistently allocating sufficient resources—including even “meaningful waste”—toward the right direction over the long term.

Any company has finite resources. In an environment where multiple forces are “cutting flesh with small knives,” stubbornly defending territory inch by inch, reacting passively or chasing reflexively, cannot reverse the situation. It’s a death trap of fragmentation and encirclement. Today, Alibaba needs a collective breakout—one that returns it to the energy field of its founding days. Just as it once leveraged internet technology as advanced productive force to gain “infinite resources,” future gains in user experience, operational efficiency, and expanded benefits for users, merchants, and the platform alike all require new increments of productive force. Only by upgrading productivity can real problems be solved.

In essence, the reason “pursuing AGI” must be Alibaba’s top priority in this era is that Alibaba realizes the revolution it started is far from complete. It must reinvigorate itself, return to its origins, and continue driving that revolution forward with “advanced productive forces.”

Because only by remaining a revolutionary can you avoid being revolutionized.

02

What Goals Should Be Achieved During the Three-Year AI Infrastructure Phase?

With the overarching logic clarified, let’s examine Alibaba’s visible, concrete goals. For the next three years, Alibaba will enter a crucial phase of AI infrastructure building.

Combining Alibaba’s business characteristics with its AI strategy, Wu also presented a clearer strategic roadmap at the February earnings call. Most explicitly, Alibaba will increase investments in three areas over the next three years:

-

AI and cloud computing infrastructure;

-

AI foundation model platforms and AI-native applications;

-

AI-driven transformation and upgrading of existing businesses.

Among these, AI infrastructure represents the most certain opportunity. Wu provided a clear expectation for investment: the next three years will mark the largest, most concentrated period of cloud and AI infrastructure construction in Alibaba Group’s history. Over 380 billion yuan will be invested in cloud and AI hardware infrastructure—exceeding the total investment of the previous decade combined.

This clear investment outlook stems from signals observed behind Alibaba Cloud’s AI-related product revenues, which have grown at triple-digit rates for six consecutive quarters. Customer demand continues to rise—and faster than previously anticipated. Especially after this year’s Spring Festival, DeepSeek-R1 triggered a surge in industry-wide AI inference demand. Over 60–70% of Alibaba Cloud’s newly added customer demand is for inference workloads.

Zooming out, as AI expands from training to inference phases, the demand space and opportunity for AI cloud computing are only beginning.

Over the past two and a half years, from generative AI computation sparked by ChatGPT, to agent computing represented by Deep Research and Manus, to future embodied intelligence and autonomous driving that transform the physical world, each migration and maturation of AI technology leads to exponential increases in computational demands.

Take a closer look: querying ChatGPT once costs nearly zero in inference cost, but asking Manus costs $2—because it continuously feeds prior tokens as contextual input for generating the next token, performing perception, planning, action, and step-by-step reasoning. A single query involves dozens or hundreds of inference model calls and computations.

The new opportunities brought by AI inference mean we’re now in a pivotal window of transformation for AI cloud computing—a time to optimize and upgrade infrastructure-layer computing architectures. In other words, existing computing solutions from the previous era may not be optimal choices for the new era. There’s enormous room for innovation.

For instance, DeepSeek’s achievements in infrastructure are as significant as the release of DeepSeek-R1 itself. DeepSeek’s approach sets a goal for AI-era infrastructure optimization: achieving extreme utilization through software-hardware co-design—not by buying the most expensive hardware—thereby increasing token throughput per unit time and reducing computational latency. This directly determines lower inference costs and deeper penetration of AI applications.

Two years ago, when I visited SambaNova in Silicon Valley, CEO Rodrigo Liang explained designing holistically across software and hardware to meet AI-era computing needs. At that time, optimizing inference computation wasn’t yet so urgent. Now, SambaNova, along with other cloud providers, chipmakers, inference algorithm companies, and model firms, are all racing to advance AI infrastructure. Amid this surge, new companies like Fireworks, Groq, and Cerebras are gaining increasing adoption among AI application developers.

The same is true in China. AI infrastructure startups have been among the hottest ventures over the past two years, with chips, interconnects, inference algorithms, and heterogeneous computing clusters all seeing upgrade opportunities under new AI technologies.

At such a transformative moment in AI infrastructure, a giant like Alibaba may lack the agility of startups. But it should fulfill its role as a large corporation—when everything is uncertain and undefined, investment becomes the most certain action. Moreover, Alibaba’s inherent ToB DNA as Asia’s largest cloud provider gives it distinct advantages in exploring AI-era cloud computing. In my view, this is the underlying logic behind Alibaba’s resolute 380-billion-yuan investment over three years.

Naturally, Alibaba likely sees clear pathways through which this concentrated three-year investment will simultaneously transform and advance its business.

First: Embedding Agent capabilities into industries.

For SaaS and enterprise software clients served by Alibaba Cloud, they are transitioning from providing tools to delivering productivity. AI Agents allow these software companies to directly deliver reliable results. In the foreseeable future, many internal enterprise systems will gradually evolve into networks of numerous interconnected, mutually invoked AI Agents, enhancing corporate efficiency and even assisting in critical decision-making. This transition opens substantial opportunities for upgrades across SaaS software and underlying PaaS layers.

Meanwhile, in the AI era, DingTalk can become a new entry point and interface across the enterprise software and collaboration markets, effectively collaborating with other software ecosystems or AI Agents—further increasing demand for cloud computing. Of course, this requires DingTalk to sharpen its product transformation from “providing tools” to “delivering productivity.”

It’s foreseeable that DingTalk will refocus on product excellence in the near future. Driving cloud value isn’t the goal—the improved product is the result.

Second: Accelerating model technology and establishing open-source leadership to unlock ecosystem and cloud value.

This growth path has already been validated by past performance at Alibaba Cloud. Many entrepreneurs and developers in the GeekPark community have shared with me that although open-source models may seem unprofitable and pursued mainly for technical branding, Qwen series open-source models have actually driven tangible revenue growth for Alibaba Cloud—they’ve arguably been Alibaba Cloud’s best sales engine over the past year.

The Qwen open-source model family enjoys high adoption rates. Compared to generic model APIs, most enterprises prefer to build upon open-source models using their own scenario-specific data. High-efficiency, high-quality Qwen models are among the most popular choices for enterprises and developers. According to data from Hugging Face—the world’s largest AI open-source community—as of February 2025, derivative models based on Alibaba Cloud’s Tongyi Qianwen (Qwen) open-source large model surpassed 100,000, firmly securing the top spot among global open-source models.

If a company chooses the Qwen open-source model, where will it deploy it? A natural choice is Alibaba Cloud—since running the full Tongyi suite and its derivatives achieves optimal efficiency there.

Additionally, in the post-training phase, significant market potential exists for model customization and adaptation to various industries or private datasets—creating abundant value creation opportunities. In the future, many specialized or vertical models will be hosted on the cloud, another benefit of a thriving Qwen open-source ecosystem.

Now, as open-source model iteration accelerates, differences among base large models are gradually narrowing, making open-source models increasingly usable. Combined with mainstream adoption of inference models like OpenAI o1, DeepSeek-R1, or QwQ-32B, demand for cloud computing will only grow. Regardless of whether models are open or closed source, most will eventually be hosted on the cloud—given the massive computational requirements, only cloud networks offer maximum efficiency. Through globally distributed data centers, models can be delivered rapidly to developers worldwide.

Third: MaaS (Model-as-a-Service) will become a vital component of cloud business models.

While most enterprise customers customize and fine-tune Qwen open-source models, many developers still opt for “Model-as-a-Service” via Tongyi API. Looking at Alibaba Cloud’s growth over the past six quarters, customers using Tongyi API tend to adopt many other cloud products—a clear sign of cross-selling. Thus, while Tongyi API may not generate massive direct revenue, it plays a crucial role in Alibaba Cloud’s business model. As model capabilities improve and customer demands grow, API monetization will remain a foundational revenue stream for models.

Therefore, regardless of how model capabilities and AI applications evolve, AI and cloud infrastructure have a clear business model: the cloud computing network. If artificial intelligence becomes the world’s largest commodity—akin to electricity—then the cloud computing network is analogous to today’s power grid.

Moreover, in the AI era, cloud computing remains a game of scale and network effects. Scale effects are particularly important at this stage. These three clear pathways will drive Alibaba Cloud to expand further—bringing more customers and use cases while improving overall cost efficiency.

03

To Change the World, First Change Yourself:

Alibaba Must Become a Role Model in the AI Era

Large foundational AI models and native applications represent Alibaba’s top strategic priority in the AI era, while AI infrastructure is a clear, committed investment. Currently, Alibaba also faces internal transformation: its e-commerce and other internet platform businesses must shine as exemplars in the face of new AI-era opportunities.

Today, AI technological upgrades present significant opportunities to enhance user value across Alibaba’s many internet platforms. From this perspective, Alibaba will continue increasing R&D and computing investments in AI applications, deeply transforming and upgrading each business to seize new development opportunities in the AI era.

Within Alibaba’s ecosystem, the "+AI" initiatives have always been active. Even before OpenAI o1 emerged last year—during a period when the industry questioned whether pre-training had slowed and AI capabilities had hit a ceiling—applications never paused their AI integration. Instead, they continued embedding AI from the perspective of serving users better. Take DingTalk: from the 2023 intelligent assistant “Slash” to this year’s enterprise AI search and Agent capabilities, it’s clearly helping me complete tasks more smoothly.

Given current AI capabilities, Alibaba has identified three clear directions for AI application breakthroughs:

First is the gateway to daily consumer life—the very foundation of Alibaba.

In February,蒋凡 (Jiang Fan), CEO of Alibaba’s E-Commerce Division, stated during the earnings call that domestic e-commerce aims to improve user experience and engagement, boost business efficiency, and achieve healthy, stable market share in the medium to long term.

According to internal sources, AI is already playing a role in these goals. Recently, AI-powered upgrades have significantly enhanced Taobao’s interaction with consumers and transaction efficiency. Numerous internal projects are underway, expected to roll out gradually in 2025. Overall, Alibaba believes AI technology holds tremendous potential to elevate user value in consumption areas related to shopping decisions.

The second “outpost” is Quark—a product many haven’t fully appreciated. It could be considered the first AI product from within Alibaba Group to reach mass consumers. Over the past year and a half, Quark has accelerated iterations targeting millions of the internet’s youngest users, with a likely goal of “upgrading itself into a national-level tool using AI capabilities.”

Currently, Alibaba defines its main AI-to-C products as Quark and Tongyi apps. The Quark division was established in 2021, one of the most prioritized businesses within the then-smart information group. In 2023, under an AI-driven strategy, Quark was elevated to one of Alibaba’s first strategic-level innovative businesses.

Quark now likely has the highest user volume in China’s AI search sector. AI large models offer vast room for improvement in user search, creative productivity, and work efficiency. For example, Quark’s recently launched “AI Super Box” showcases its early form as a super-productivity tool and agent—already offering personalized services by integrating memory functions and various tool capabilities.

As Quark’s business opportunity becomes clearer, it has visibly risen from a group innovation project to a strategic product. Evidence lies in the latest March organizational adjustment: 吴嘉 (Wu Jia), President of Alibaba Group’s Smart Information Unit and CEO of Quark, now reports directly to CEO Eddie Wu—reinforcing Quark’s positioning as Alibaba’s flagship AI application.

The third likely AI-to-C application is Gaode (AutoNavi), aiming to explore using AI to create new lifestyles in local services.

With over 170 million DAUs, Gaode currently serves users primarily as a navigation tool—but it hopes to leverage AI to become an entry point for local services.

Take the recently popular MCP (Model Context Protocol), introduced by Anthropic in 2024. Like USB-C for devices, MCP bridges AI models with external data sources and tools, enabling different AI models, software tools, and data sources to understand each other’s intent in real time and automatically form collaborative task networks.

Few know that Gaode API was among the first in China to fully support MCP and launch an MCP Server. Leveraging this protocol, Gaode integrates its mapping services with intelligent algorithms into easy-to-use interfaces. Since then, many enterprises and developers have directly invoked Gaode’s location-based services via MCP Server within various AI Agent applications.

Of course, Taobao, Quark, and Gaode are just the first batch of Alibaba’s internet platform products seizing AI-era opportunities. As large models grow increasingly intelligent, Alibaba’s ToC platform prospects may diversify significantly. Undoubtedly, ToC platforms remain a strategic focus where Alibaba must maintain its competitive edge in the new AI era.

Beyond internal development, I believe Alibaba may also pursue external channels through investments and acquisitions. Alongside proactive players like ByteDance, this could create two “new engines” within the industry—potentially benefiting China’s AI startup ecosystem.

Thus, Alibaba’s first version of an “unannounced but actively executed” comprehensive strategy in the AI era is now largely visible. Objectively speaking, this strategy isn’t particularly surprising—it follows logically from inevitable reasoning.

Yet for Alibaba, a shift from “passive response” to “proactive construction” is taking shape. Getting a vast organization to unify around a forward-looking vision as early as possible may be the best posture for embracing a new era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News