Grayscale's Latest Research Report: Tariffs, Stagflation, and Bitcoin – A Global Economic Transformation

TechFlow Selected TechFlow Selected

Grayscale's Latest Research Report: Tariffs, Stagflation, and Bitcoin – A Global Economic Transformation

In the coming years, Bitcoin's widespread adoption could benefit from the dual drivers of rising demand for scarce commodities and an improved investor environment.

Author: Zach Pandl

Translation: Asher (@Asher_0210)

Editor's Note: This article analyzes the impact of recent changes in U.S. global tariff policy on financial markets, particularly highlighting Bitcoin’s unique performance during this period. It explores the long-term economic effects of tariffs, especially asset allocation choices during stagflation, and compares Bitcoin and gold under such conditions. The analysis also examines how current trade tensions may affect the U.S. dollar and Bitcoin adoption, concluding with an outlook for the coming years—suggesting that scarce commodity assets like Bitcoin and gold could attract growing attention and demand amid high inflation.

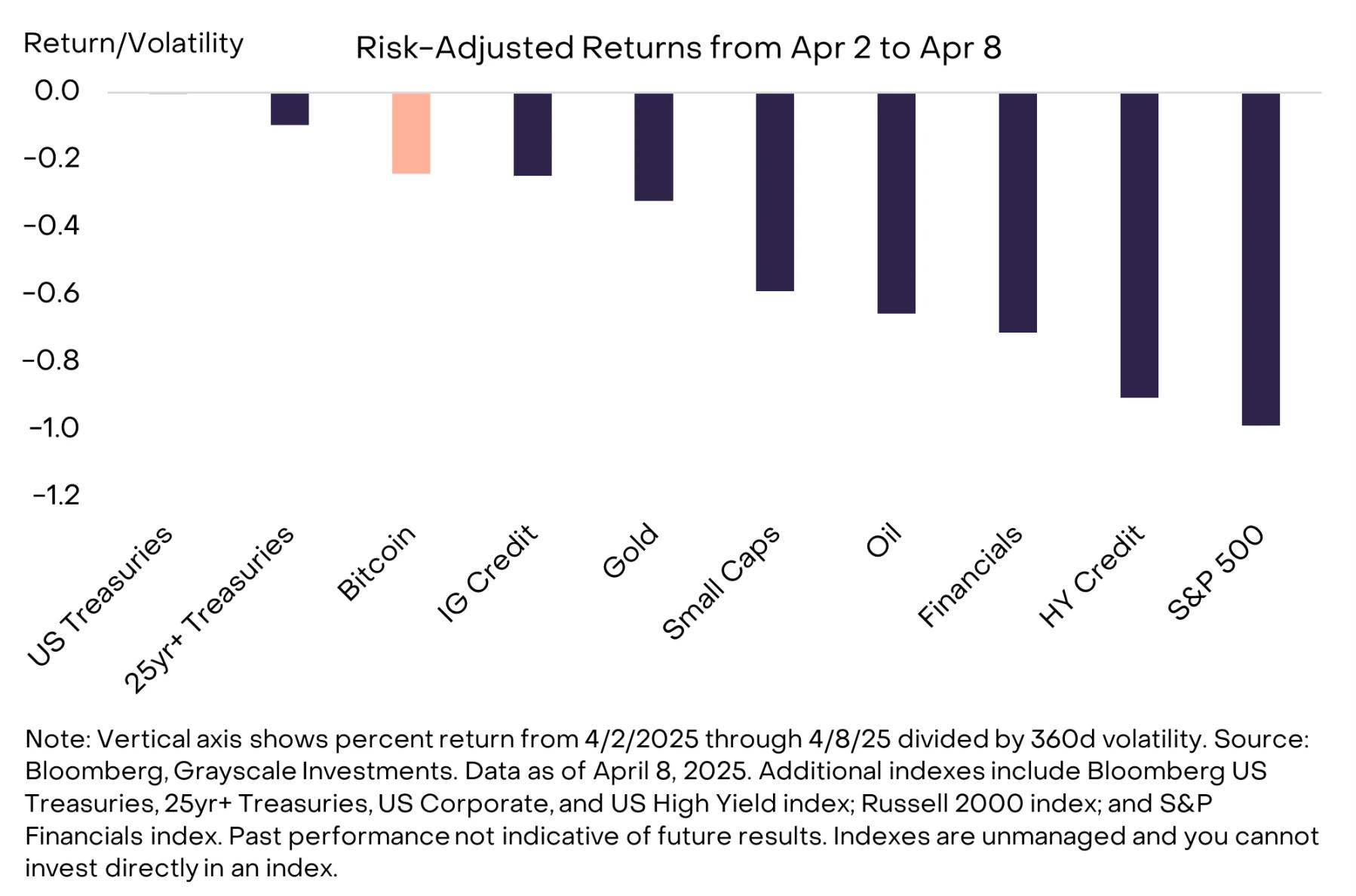

Since the U.S. announced new global tariff policies on April 2, global asset prices have sharply declined, only beginning to recover after Trump announced a pause in tariff implementation (excluding China) early this morning. However, the initial tariff announcement affected nearly all asset classes. During this period, Bitcoin experienced relatively smaller drawdowns on a risk-adjusted basis. For instance, if Bitcoin had a 1:1 correlation with stock market returns, the S&P 500's decline would imply a 36% drop in Bitcoin. In reality, Bitcoin fell only 10%, underscoring that even during significant market corrections, holding Bitcoin as part of an investment portfolio can offer meaningful diversification benefits.

Bitcoin declined less than other assets on a risk-adjusted basis

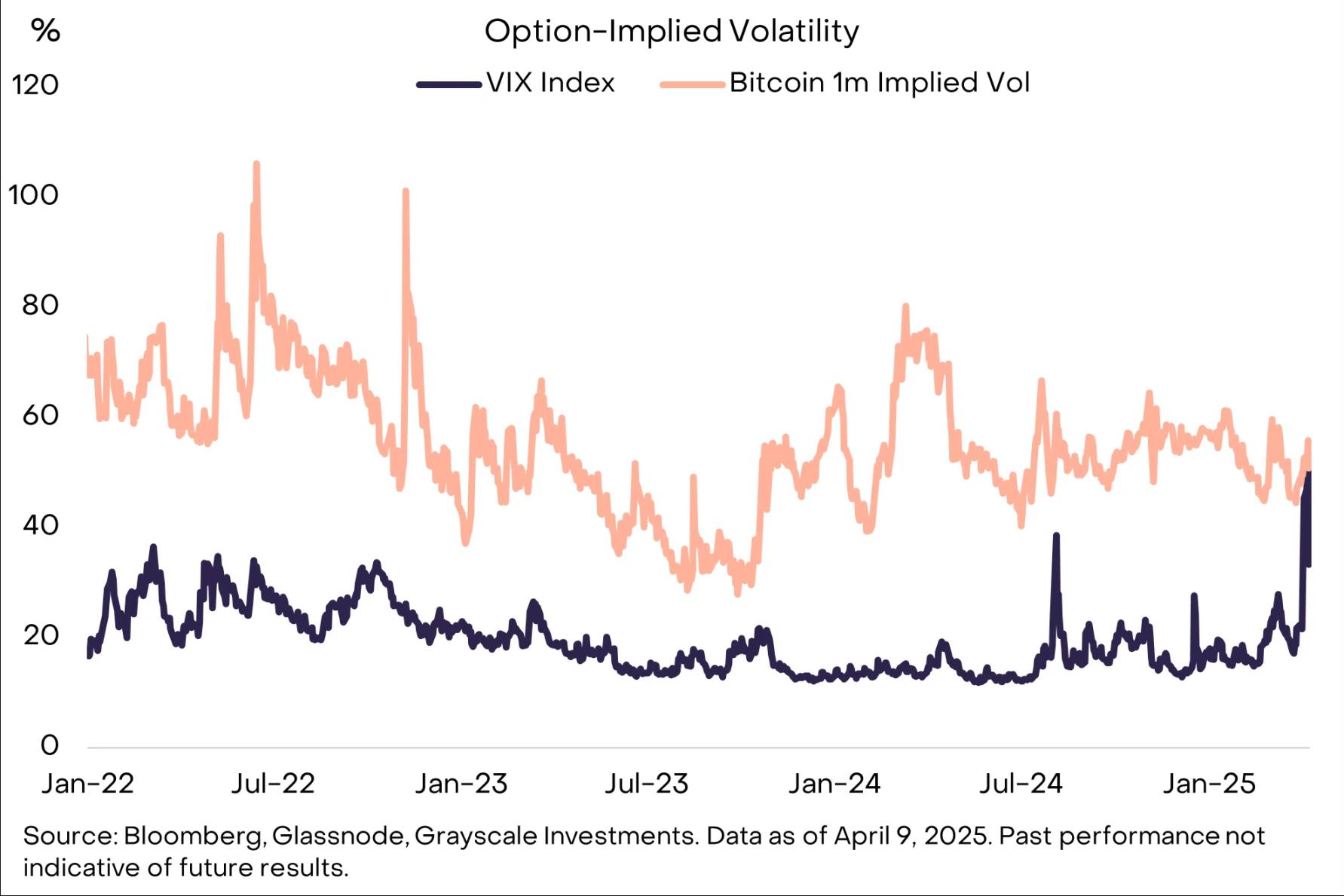

In the short term, the global market outlook will likely depend on trade negotiations between the White House and other countries. While these talks could lead to reduced tariffs, setbacks may trigger further retaliatory measures. Actual and implied volatility in traditional markets remain elevated, making it difficult to predict how trade conflicts might evolve over the coming weeks. Investors should therefore cautiously adjust their positions in this high-risk environment. Moreover, Bitcoin’s price volatility has increased far less than that of equities, and multiple indicators show relatively low speculative positioning in the cryptocurrency market. If macro risks ease in the coming weeks, crypto market capitalization should be well-positioned for a rebound.

Equity implied volatility approaches Bitcoin levels

Regarding Bitcoin, despite its price decline over the past week, its longer-term implications hinge on how tariffs affect the broader economy and international capital flows. Tariffs—and associated non-tariff trade barriers—could contribute to stagflation and potentially weaken structural demand for the U.S. dollar. In this context, rising tariffs and shifts in global trade patterns may serve as net positive catalysts for Bitcoin adoption over the medium to long term.

Asset Allocation During Stagflation

Stagflation refers to an economic condition marked by sluggish or slowing growth alongside high or accelerating inflation. Tariffs raise import prices, thereby increasing inflation—at least in the short run. At the same time, they may slow economic growth by reducing real household incomes and imposing adjustment costs on businesses. Over the longer term, some of these negative effects could be partially offset by increased domestic manufacturing investment. Nonetheless, most economists expect these new tariffs to weigh on the economy for at least the next year.

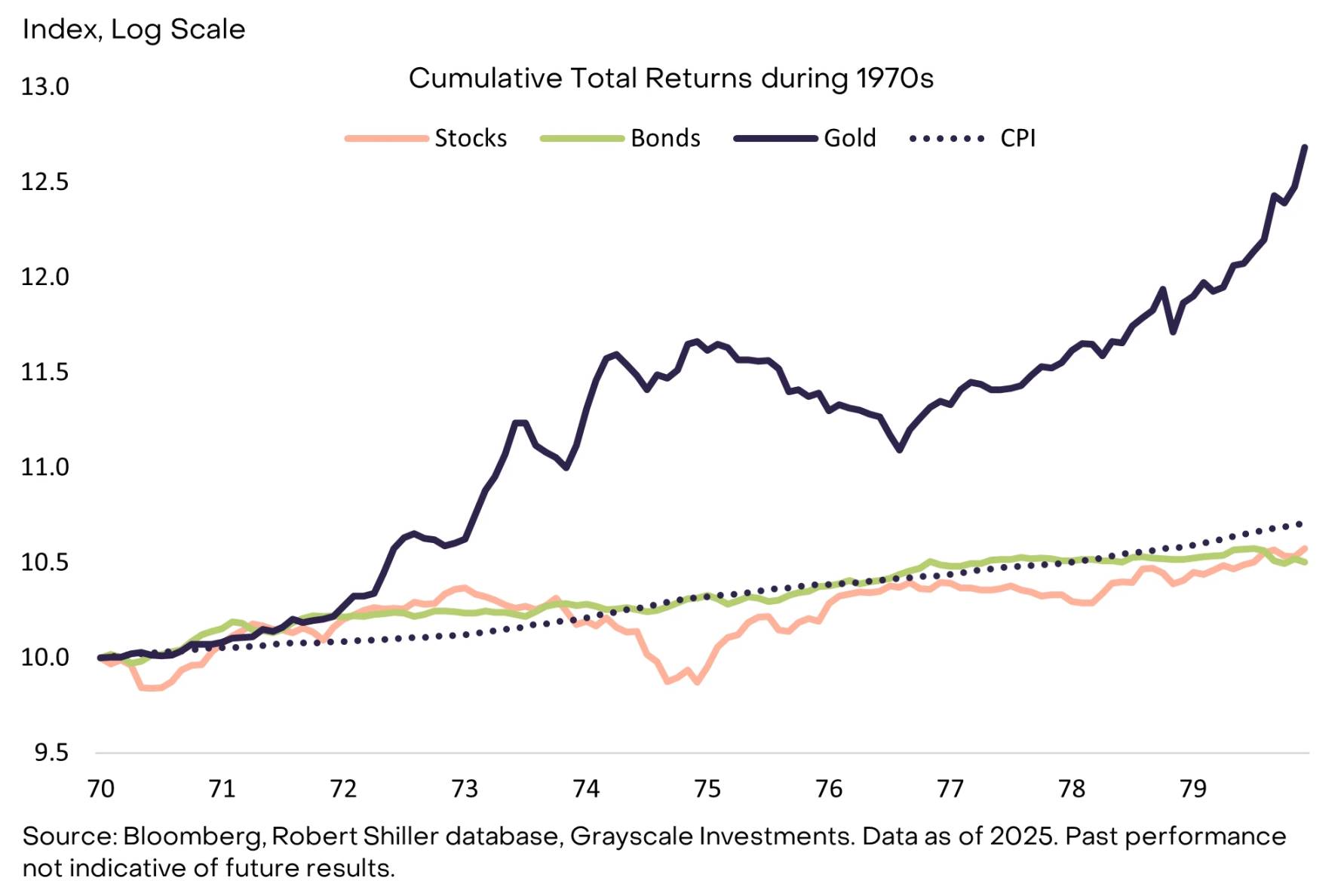

Historically, asset returns during the 1970s provide the clearest illustration of how stagflation impacts financial markets (Bitcoin’s history is too short for reliable backtesting). During that decade, U.S. equities and long-term bonds delivered annualized returns of about 6%, falling short of the 7.4% average inflation rate. In contrast, gold appreciated at an annualized rate of approximately 30%, significantly outpacing inflation.

Traditional assets delivered negative real returns in the 1970s

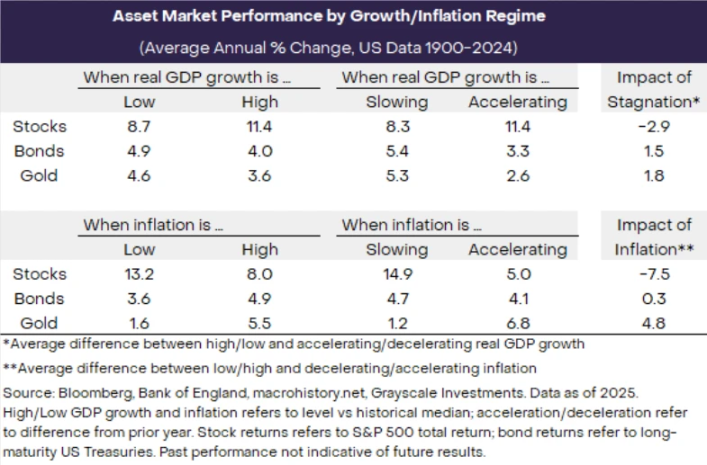

While extreme stagflation episodes are rare, their effects on asset returns have been broadly consistent over time. The chart below shows the average annual returns of U.S. stocks, government bonds, and gold across different economic growth and inflation regimes from 1900 to 2024.

Stagflation reduces stock returns, boosts gold returns

Historical data reveal three key points:

-

Stock returns tend to rise when GDP growth is strong or accelerating and inflation is low or declining. Therefore, during stagflation, equity returns typically fall as expected, suggesting investors may want to reduce stock exposure;

-

Gold tends to perform well when economic growth is weak and inflation is rising—especially during stagflation—making it a primary hedge against inflation. This indicates gold is often a more attractive investment under such conditions;

-

Bond performance closely tracks inflation trends. Bonds generally deliver stronger returns in low-inflation environments but suffer when inflation rises. Thus, bond investors face declining returns during periods of rising inflation.

-

In summary, different asset classes behave differently across economic cycles, and investors should adapt their allocations accordingly. This is especially critical during stagflation, which typically harms stocks while benefiting gold.

Bitcoin and the U.S. Dollar

Tariffs and trade tensions may support Bitcoin adoption over the medium term, partly due to pressures on dollar demand. Specifically, if overall trade volumes with the U.S. decline—and most global trade is conducted in dollars—transactional demand for the dollar would decrease. Furthermore, if tariff escalations lead to conflicts with major economies, those nations might reduce reliance on the dollar as a store of value.

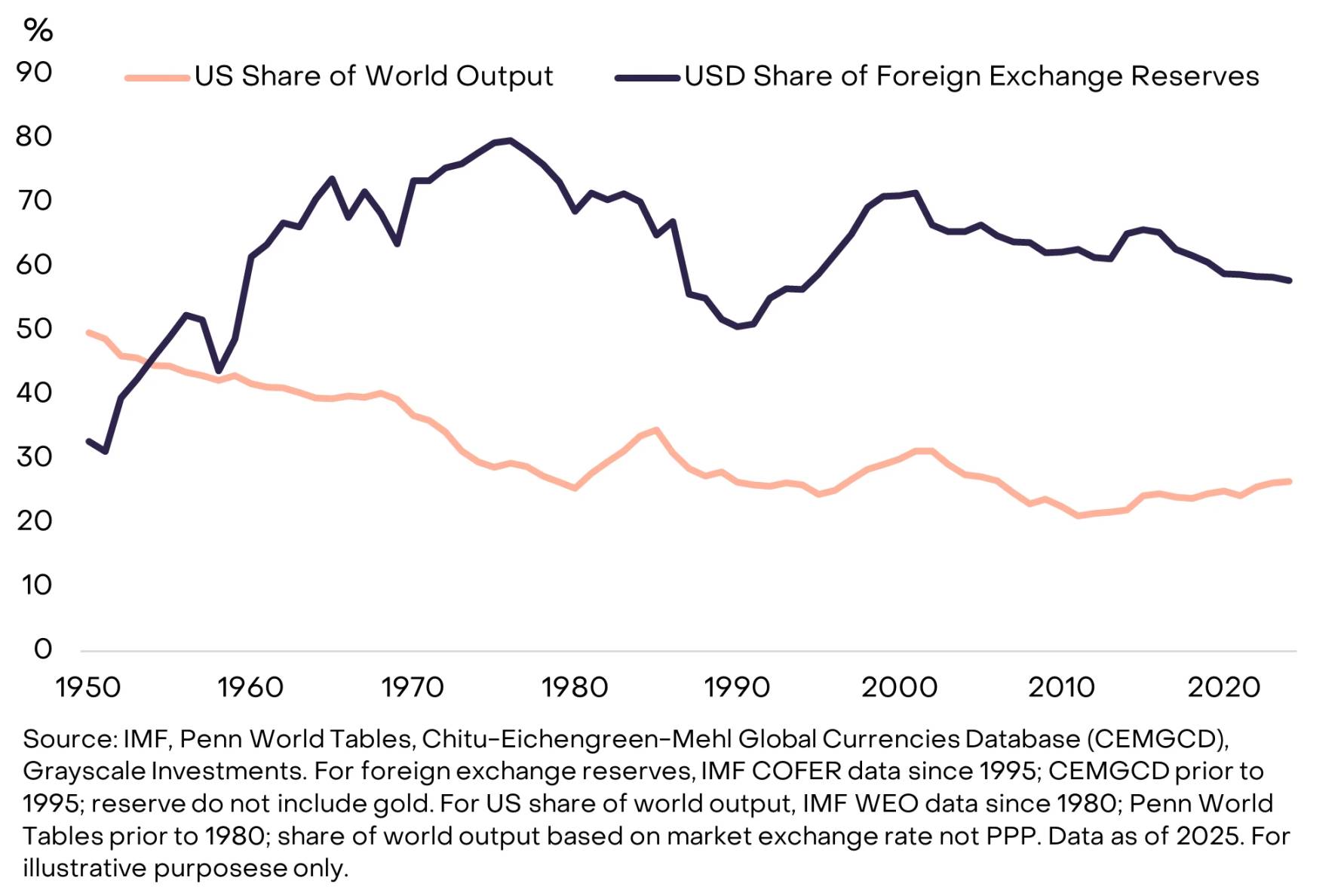

The U.S. dollar’s share of global foreign exchange reserves far exceeds America’s share of global economic output. There are many reasons for this, but network effects play a crucial role: countries trade with the U.S., borrow in dollar-denominated markets, and often price major commodities in dollars. If trade tensions weaken ties to the U.S. economy and dollar-based financial systems, nations may accelerate efforts to diversify their foreign reserves.

The dollar's share in global reserves greatly exceeds U.S. share in global GDP

Following Western sanctions on Russia, many central banks have already increased gold purchases. To date, aside from Iran, no other country’s central bank holds Bitcoin on its balance sheet. However, the Czech National Bank has begun exploring the option, the U.S. has established a strategic Bitcoin reserve, and several sovereign wealth funds have publicly announced Bitcoin investments. In our view, disruptions to the dollar-centric global trade and financial system could prompt further central bank diversification, including into Bitcoin.

The closest historical parallel to President Trump’s “Liberation Day” announcement may be Nixon’s “shock” on August 15, 1971. On that evening, President Nixon imposed a 10% across-the-board tariff and ended the convertibility of the dollar into gold—a cornerstone of the post-WWII global financial system. The move triggered diplomatic negotiations, culminating in the Smithsonian Agreement in December 1971, where other nations agreed to revalue their currencies upward against the dollar. Ultimately, the dollar depreciated by 27% between Q2 1971 and Q3 1978. Over the past 50 years, several rounds of trade tensions have led to (partially negotiated) dollar depreciation.

We expect recent trade tensions to again result in sustained dollar weakness. Indicators suggest the U.S. dollar is currently overvalued, the Federal Reserve has room to cut rates, and the White House aims to reduce the U.S. trade deficit. While tariffs alter effective import/export prices, market-driven dollar depreciation may gradually rebalance trade flows and achieve desired outcomes.

The Child of the Era—Bitcoin

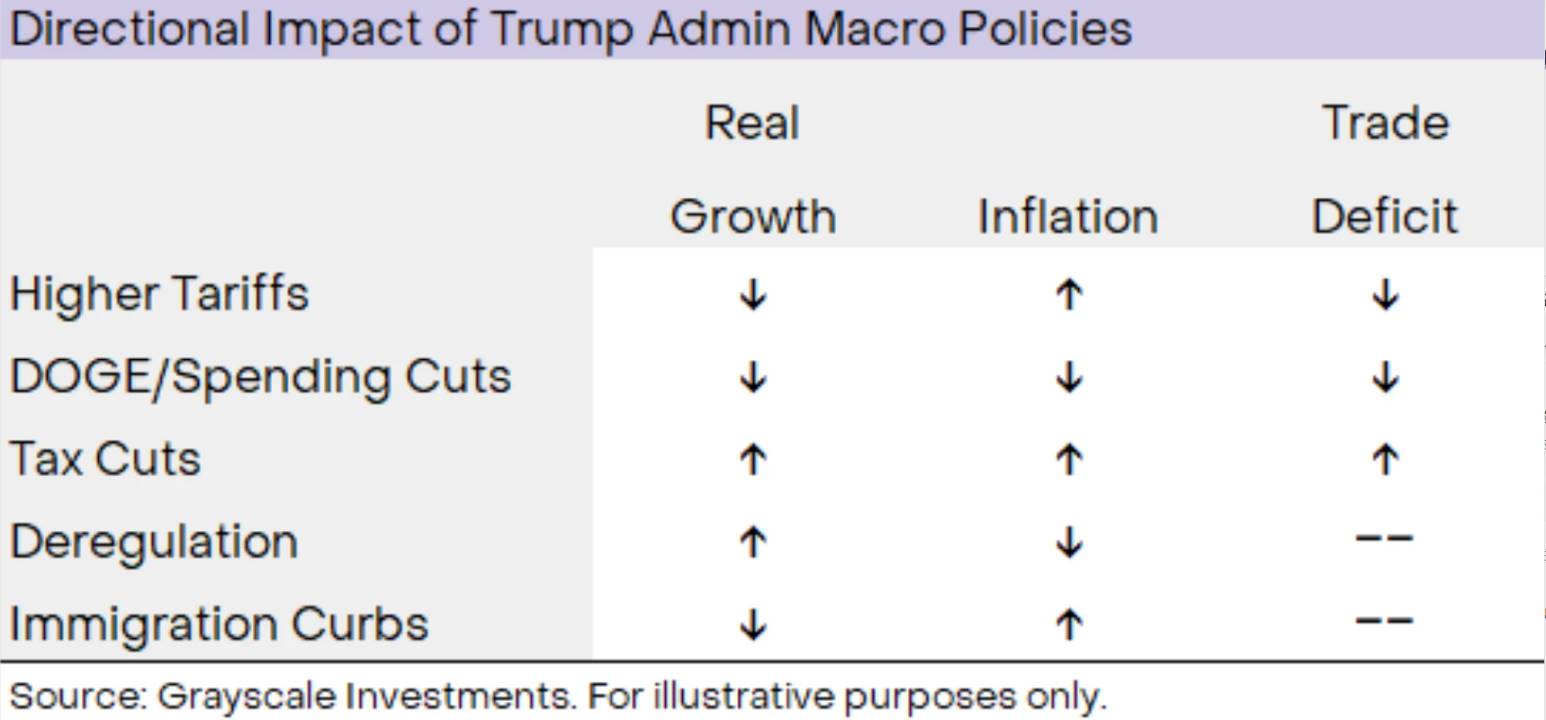

Sudden shifts in U.S. trade policy are forcing financial markets to adjust, creating near-term economic headwinds. However, the market conditions seen over the past week are unlikely to define the next four years. The Trump administration is enacting a range of policy measures that will exert varying influences on GDP growth, inflation, and the trade deficit. For example, while tariffs may slow growth and boost inflation (i.e., cause stagflation), certain deregulatory actions could stimulate growth and reduce inflation (i.e., alleviate stagflation). The ultimate outcome depends on the extent to which the White House advances its policy agenda across these domains.

U.S. macroeconomic policies will exert diverse effects on growth and inflation

Despite uncertainty, the best estimate is that U.S. policies will lead to persistent dollar weakness and above-target inflation over the next 1–3 years. Tariffs themselves may dampen growth, but this effect could be partially offset by tax cuts, deregulation, and dollar depreciation. If the administration actively pursues additional pro-growth policies, GDP growth may remain relatively resilient despite initial tariff shocks. Regardless of whether actual growth proves strong, history suggests that prolonged inflationary pressure tends to benefit scarce commodity assets like Bitcoin and gold.

Moreover, much like gold in the 1970s, Bitcoin today enjoys rapidly improving market infrastructure—supported by shifts in U.S. government policy. So far this year, the White House has enacted broad policy changes favorable to digital asset investment, including dismissing key lawsuits, affirming the applicability of digital assets to traditional banking, and permitting regulated institutions (such as custodians) to offer cryptocurrency services. These developments have sparked a wave of mergers, acquisitions, and strategic investments. While the new tariffs are a short-term headwind for digital assets like Bitcoin, the Trump administration’s crypto-specific policies remain supportive. Taken together, rising macro demand for scarce commodity assets and an improved operating environment for investors could form a powerful combination driving widespread Bitcoin adoption in the years ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News