Bear Market Survival Guide: How to Avoid Falling Into the Yield Trap?

TechFlow Selected TechFlow Selected

Bear Market Survival Guide: How to Avoid Falling Into the Yield Trap?

In rising markets, crypto market-neutral rates become severely dislocated, offering alpha higher than their true risk, but the opposite occurs during downturns.

Author: Santisa, Crypto KOL

Translation: Felix, PANews

Before diving into this article, consider the following story (or perhaps reality).

An "endless" tariff list is announced. The market crashes, altcoins collapse.

Your original low-risk "mining" yield drops from 30% to nearly Treasury bill levels.

This is unacceptable to you. You had planned to retire on $300,000 with $90,000 in annual mining income. So the yield must be high.

Thus, you begin moving down the risk curve, chasing imagined returns as if the market will favor you.

You swap blue-chip projects for obscure new ones; boost yields by deploying assets into riskier new fixed-term protocols or AMMs. You start feeling quietly triumphant.

A few weeks later, you wonder why you were ever so risk-averse. This clearly feels like a "safe and reliable" way to make money.

Then comes the surprise.

The custodied, leveraged, L2-wrapped hyper-liquid staking project you entrusted with your life savings collapses. Now your PT-shitUSD-27AUG2025 has lost 70%. You receive some vested governance tokens, but months later the project is abandoned.

This story may sound exaggerated, but it reflects a recurring reality when bear market yields get squeezed. Based on this, this article attempts to offer a survival manual for yield-starved bear markets.

People struggle to adapt to new realities. Faced with market collapse, they take on more risk to close the yield gap, while ignoring the potential costs of these decisions.

Market-neutral investors are also speculators—their edge lies in finding unadjusted rates. Unlike directional traders, these speculators face only two outcomes: either earning a little every day, or losing big all at once.

In my view, crypto market-neutral rates become severely distorted during rate hikes, offering alpha above their true risk, but the opposite happens during downturns—providing returns below the risk-free rate (RFR) despite taking on substantial risk.

Clearly, there are times to take risk, and times to avoid it. Those who fail to see this become someone else's Thanksgiving dinner.

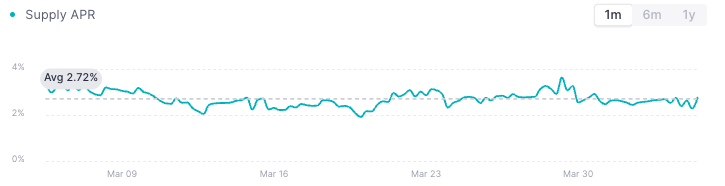

For example, at the time of writing, AAVE offers a 2.7% yield on USDC, while sUSDS yields 4.5%.

-

AAVE USDC earns 60% of RFR while assuming smart contract, oracle, custody, and financial risks.

Source

-

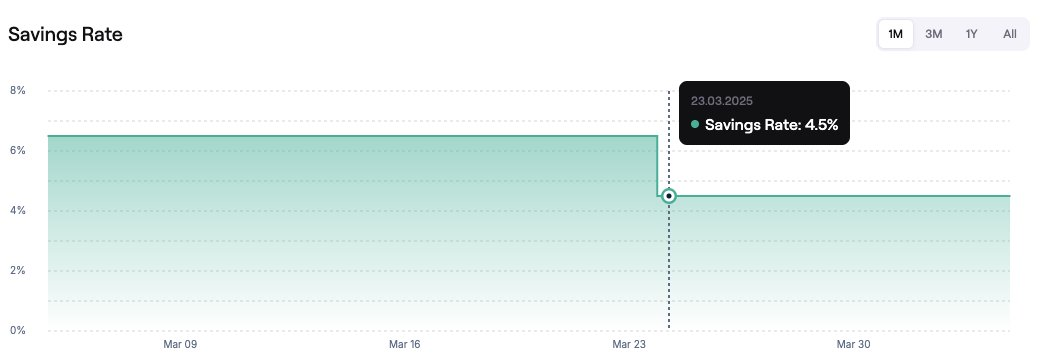

Maker charges 25 basis points above RFR while assuming smart contract, custody, and active investment risks in higher-risk projects.

Source

When analyzing interest rates for DeFi market-neutral investments, consider:

-

Custody risk

-

Financial risk

-

Smart contract risk

-

Risk-free rate (RFR)

You can assign an annual risk percentage to each risk type, add it to RFR, and derive the required "risk-adjusted return" for each investment opportunity. Anything above that rate is alpha; anything below is not.

Not long ago, I calculated the risk-adjusted return required for Maker and arrived at a fair compensation of 9.56%.

Maker’s current rate is around 4.5%.

Both AAVE and Maker hold junior capital (about 1% of total deposits), but even with substantial insurance, yields below RFR should not be acceptable to depositors.

In the era of Blackroll T-bills and regulated on-chain issuers, such sub-RFR yields are the consequence of inertia, lost keys, and foolish money.

So what should you do? It depends on your scale.

If your portfolio is small (under $5 million), there are still attractive options. Explore safer protocols across all chain deployments—they often provide incentives on lesser-known chains with lower TVL, or conduct basic trading on high-yield, low-liquidity perpetuals.

If you manage large capital (over $20 million):

Buy short-term Treasury bills and wait. Favorable market conditions will eventually return. You can also seek OTC deals; many projects are still hunting for TVL and willing to heavily dilute their existing holders.

If you have LPs, inform them of this—even let them exit. On-chain T-bills still trade below real rates. Don’t be blinded by unadjusted yield. Good opportunities are obvious. Keep it simple, avoid greed. You should aim to stay in the game long-term—manage your risk-adjusted returns wisely. If you don’t, the market will do it for you.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News