Survive Until Low-Risk DeFi Arrives: Retail Investors' Bear Market Survival Strategy

TechFlow Selected TechFlow Selected

Survive Until Low-Risk DeFi Arrives: Retail Investors' Bear Market Survival Strategy

War. War never changes.

Author: Zuoye

The immediate triggers of the 10·11 and 11·3 events were not yield-bearing stablecoins, yet they dramatically impacted USDe and xUSD in succession. Aave’s hardcoding of USDe to peg USDT prevented Binance's on-exchange crisis from spreading onto the blockchain, while Ethena's minting/redeeming mechanism remained unaffected.

However, the same hardcoding caused xUSD to avoid immediate collapse, instead陷入 a prolonged period of stagnation. The issuer Stream was unable to clear bad debt promptly, and its affiliate Elixir—and its YBS (yield-bearing stablecoin) product deUSD—faced scrutiny.

Beyond this, multiple Curators (“managers”) on Euler and Morpho accepted xUSD assets, leading users’ funds to randomly implode across various Vaults. With no emergency responder akin to the Fed during SVB, the next phase could be a liquidity crisis.

A single point of failure amplifies into industry-wide turmoil when xUSD, having passed through compromised managers, declares war on eternity.

Managers + Leverage: Source of Crisis?

Leverage itself did not cause the crisis. Private arrangements between protocols led to information opacity, lowering users' psychological defenses.

During a crisis, responsibility can be assigned based on two key understandings:

1. Stream and Elixir created xUSD through leveraged loops without sufficient issuance backing—their management teams are primarily at fault;

2. Lending platforms like Euler/Morpho allowed xUSD—a “toxic asset”—into their Curated Markets; both platforms and managers should bear joint liability.

We’ll withhold judgment for now and examine how YBS works. Compared to USDT/USDC, where dollars (including Treasuries) are held in banks while Tether/Circle issue equivalent stablecoins and earn interest or Treasury yields—where stablecoin usage inversely supports Tether/Circle’s profit margins—YBS operates slightly differently.

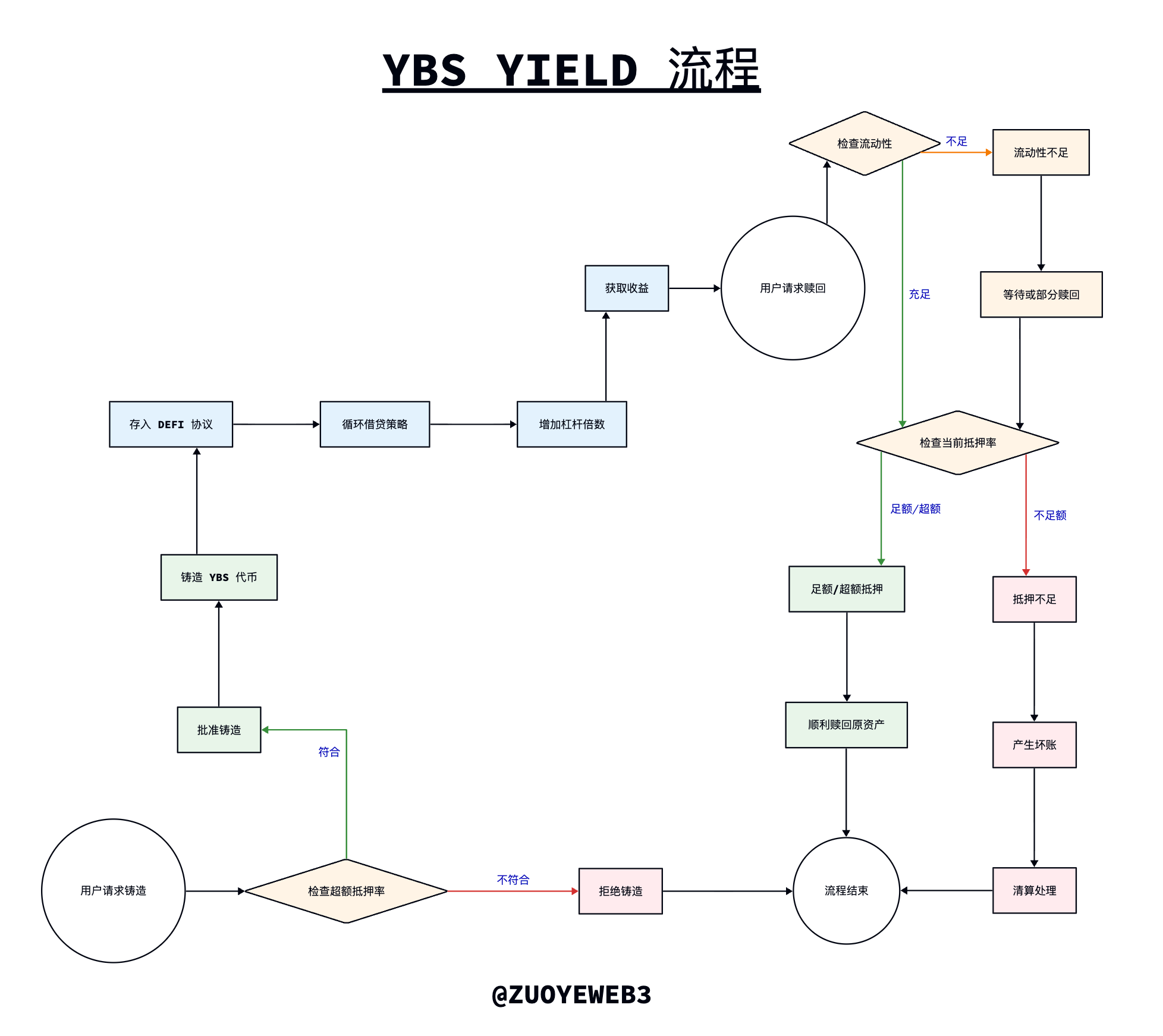

In theory, YBS uses over-collateralization: more than $1 in collateral is used to issue $1 of stablecoin, which is then deployed into DeFi protocols. After distributing yield to holders, the remainder becomes profit—this is the essence of its yield.

Image caption: YBS minting, yield generation, and redemption process

Image source: @zuoyeweb3

Theory diverges from reality. Under pressure to deliver high yields, YBS projects developed three "cheating" methods to boost profitability:

1. Converting over-collateralization into under-collateralization. Simply reducing collateral value is foolish and ineffective, but strategies have evolved:

• Mixing “high-quality” and “low-quality” assets as backing—cash (and Treasuries) are safest, BTC/ETH relatively safe, but TRX backing USDD holds less value;

• Combining on-chain and off-chain assets as backing—this isn’t a bug, it’s time arbitrage: ensuring assets appear in place only during audits. Most YBS use this mechanism, so no separate example is needed.

2. Enhancing leverage capacity. Once minted, YBS tokens are injected into DeFi protocols, mainly lending platforms, ideally mixed with mainstream assets like USDC/ETH:

• Maximizing leverage—using $1 as if it were $100—increases potential returns. For instance, the Ethena and Aave/Pendle circular lending combo conservatively achieves ~4.6x supply leverage and 3.6x borrow leverage after five cycles;

• Using fewer assets to generate leverage. Curve’s Yield Basis once planned direct crvUSD issuance, effectively reducing capital required for leverage.

Thus, xUSD executed a combined strategy: leveraging upfront, cyclically reissuing—essentially building leverage into the issuance mechanism. As seen in the diagram, YBS enters a yield “strategy” post-minting, which is fundamentally a leverage-increasing step. But xUSD and deUSD coordinated to shift this process into issuance itself. Users see both over-collateralization ratios and yield strategies—but this is entirely Stream’s sleight of hand. Stream acts as both referee and player, making xUSD an under-collateralized YBS.

xUSD uses leverage from step two during step one of issuance. Relying on Elixir’s deUSD to generate ~4x leverage isn’t extreme—the real issue lies in Stream retaining control over 60% of issuance. When profitable, profits stay internal; when collapsing, losses remain internal too. This fails the most critical aspect of liquidation mechanisms: loss socialization.

Why did Stream and Elixir do this?

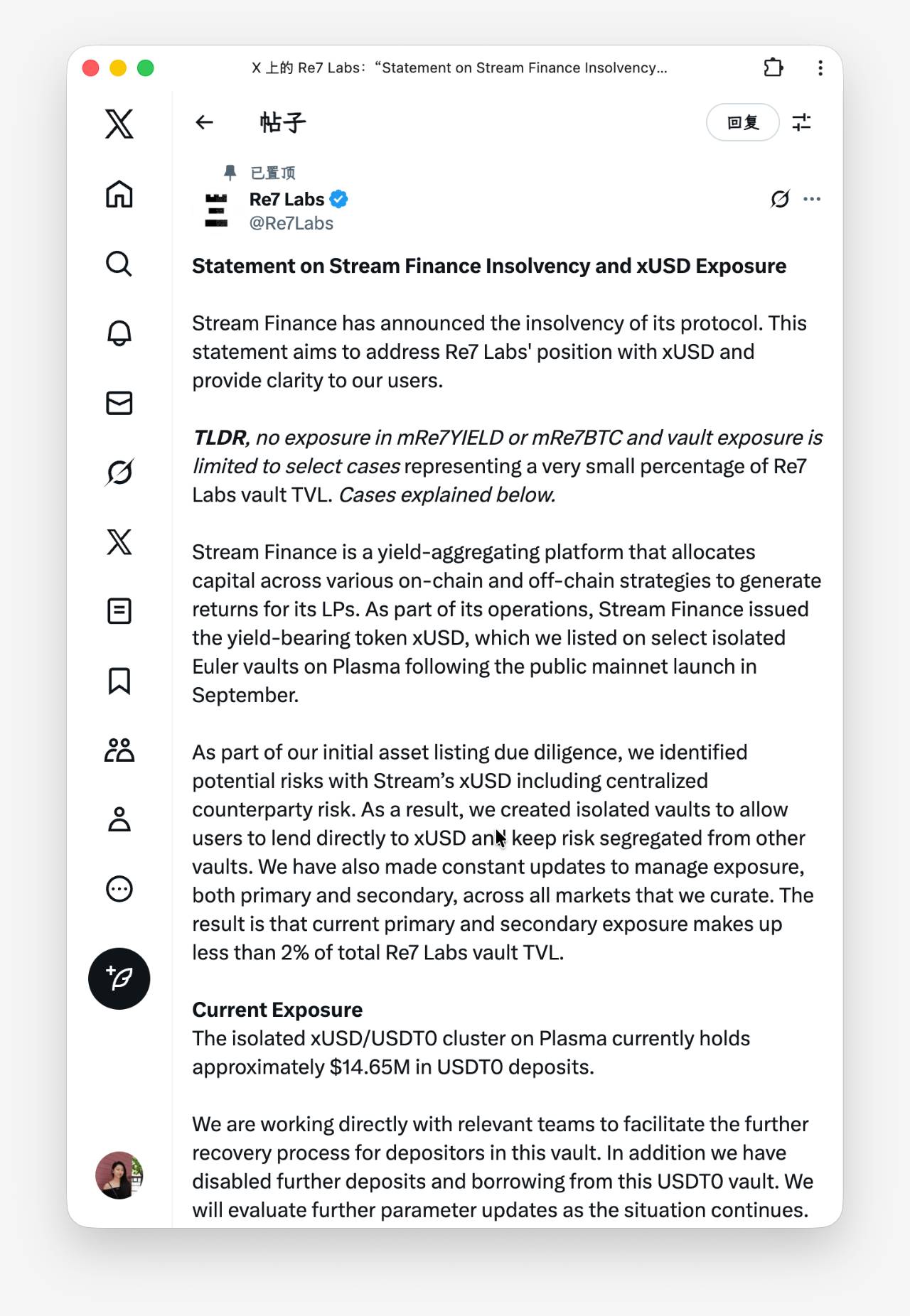

In truth, direct protocol-to-protocol deals are nothing new. While Ethena brought in CEX capital, it also gained partial exemptions during ADL liquidations. Returning to xUSD, among responses from vault managers, Re7’s stands out: "We identified the risk, but due to strong user demand, we listed it anyway."

Image caption: Re7 response

Image source: @Re7Labs

Managers on platforms like Euler/Morpho certainly could identify YBS risks, but under APY and profit pressures, some actively or passively accept them. Stream doesn’t need all managers on board—just enough to avoid universal rejection.

These managers who accepted xUSD bear responsibility, but this is part of a natural selection process. Aave wasn’t built in a day—it evolved through crises. Would relying solely on Aave make markets safer?

Not necessarily. If Aave were the only lending platform, Aave itself would become the sole source of systemic risk.

Platforms like Euler/Morpho serve as decentralized alternatives or “over-the-counter” mechanisms, offering flexible configurations and lower entry barriers—crucial for DeFi adoption.

Yet opacity remains the issue. Managers (Curators) on Euler/Morpho effectively allow third-party sellers, whereas Aave/Fluid operate like JD.com’s self-operated model. Interacting with Aave means Aave assumes security responsibility, but certain Euler vaults fall under manager responsibility—while the platform intentionally or unintentionally blurs this line.

In other words, Euler/Morpho lower users’ expectations for due diligence. If these platforms adopted Aave-style friendly forks or HL-style backend liquidity aggregation while maintaining absolute front-end and brand separation, they’d face far less criticism.

How Should Retail Investors Protect Themselves?

Every dream in DeFi ultimately rings the retail investor’s doorbell.

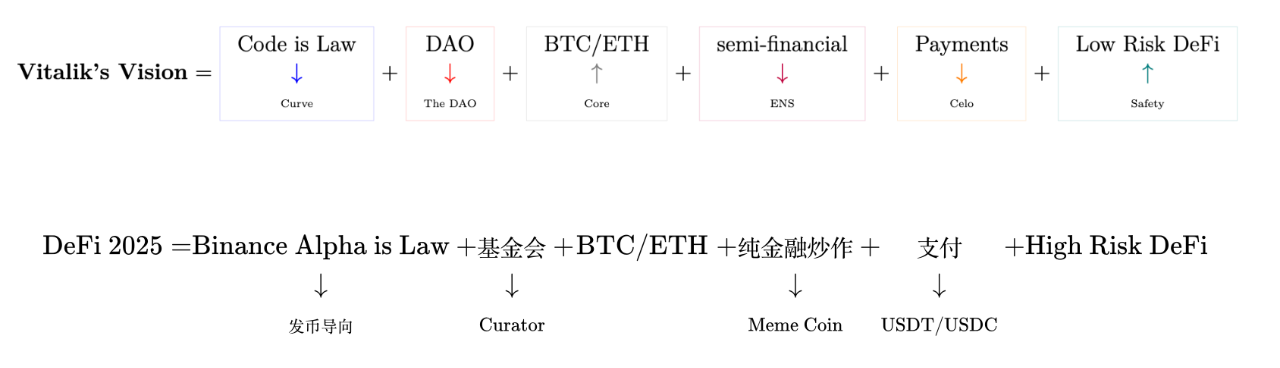

Vitalik, despite Ethereum being the primary public chain for DeFi, doesn’t particularly favor DeFi. He long advocated for non-financial innovations on Ethereum—yet he genuinely cares about retail users. Since eliminating DeFi is impossible, he now promotes Low-Risk DeFi to empower the world’s poor.

Image caption: DeFi in Vitalik’s eyes vs. the real world

Image source: @zuoyeweb3

Unfortunately, his vision has never been reality. People long viewed DeFi as high-risk, high-return. During DeFi Summer 2020, double-digit APYs were common. Today, even 10% raises suspicions of Ponzi schemes.

Bad news: there’s no high yield. Good news: there’s no high risk.

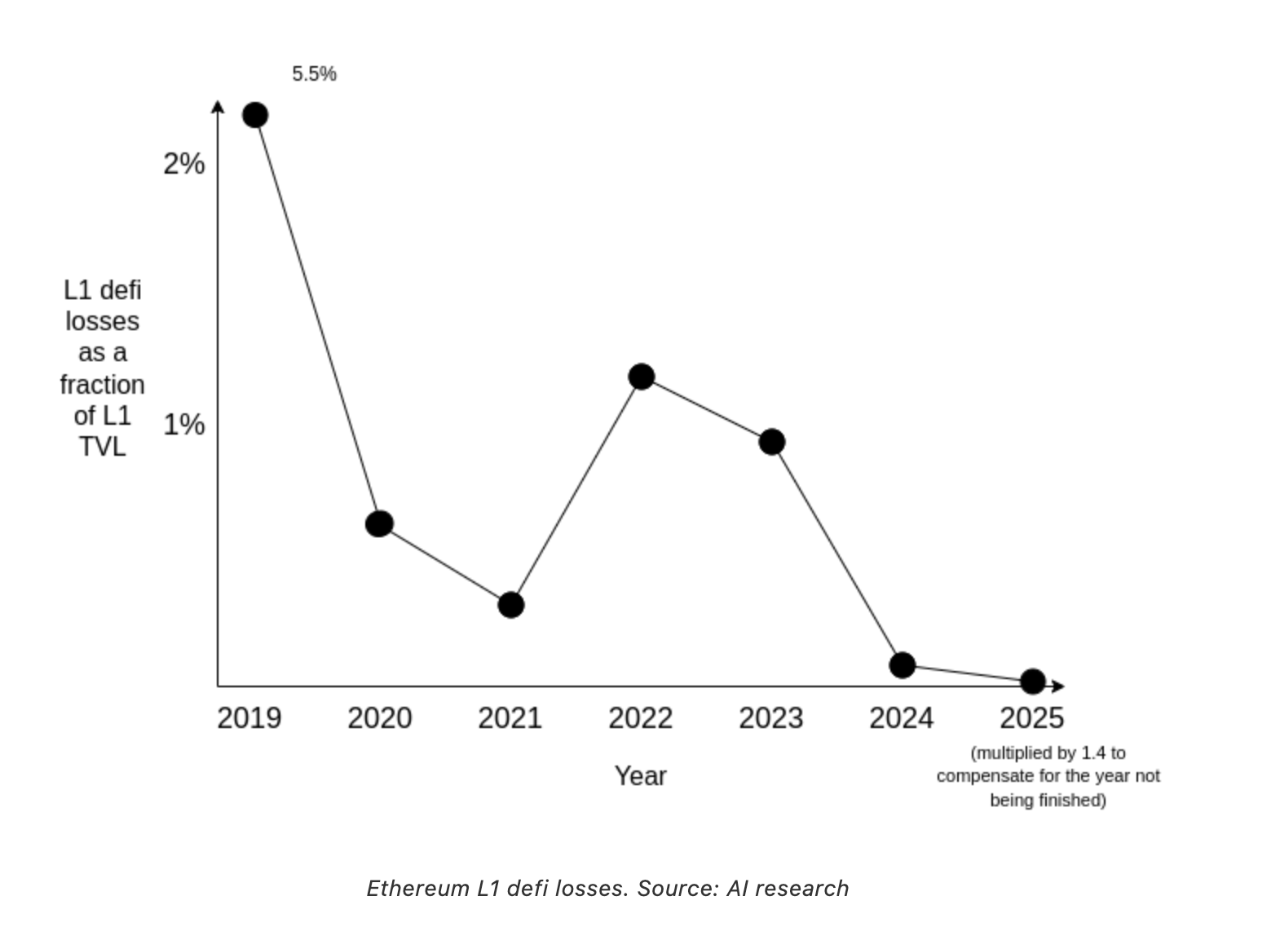

Image caption: Ethereum loss rate

Image source: @VitalikButerin

Whether using Vitalik’s data or professional research institutions’, DeFi’s security level is indeed rising. Compared to Binance’s 1011 liquidation data or Bybit’s massive theft, DeFi—especially YBS blowups and losses—are negligible.

But! I must say it again: this doesn’t mean we should recklessly dive into DeFi. CEXs are becoming more transparent, while DeFi grows increasingly opaque.

The era of regulatory arbitrage for CEXs has ended, but DeFi’s lightly regulated phase returns. This brings benefits, but “DeFi” often masks growing centralization. Between protocols and managers, countless undisclosed terms lurk beneath the surface.

We assume on-chain collaboration means code, but it’s actually TG-based rebate percentages. This time, many xUSD managers leaked TG screenshots—their decisions directly shape retail investors’ futures.

Demanding regulation from them is futile. The core lies in building modular solutions from on-chain components. Don’t forget: over-collateralization, PSM, x*y=k, and Health Factor are sufficient to support macro DeFi activities.

In 2025, the entire yield ecosystem supported by YBS boils down to just a few elements: YBS assets, leveraged yield strategies, and lending protocols—not uncountable in number. Platforms like Aave/Morpho/Euler/Fluid and Pendle meet 80% of interaction needs.

Opaque management leads to failed strategies. Managers haven’t demonstrated superior strategy-setting abilities. Elimination must follow every incident.

Beyond that, retail investors must strive to see through everything—but frankly, it’s difficult. In theory, both xUSD and deUSD are over-collateralized upon minting. But when combined, the leverage process normally occurring post-minting gets pulled forward into issuance, rendering xUSD effectively under-collateralized.

When a YBS is minted based on another YBS, the resulting collateral ratio becomes nearly impossible to discern.

Until truly transparent products emerge, retail investors can only rely on the following beliefs for self-protection:

1. Systemic crises aren't crises (due to socialization). Participate in mainstream DeFi products—assume safety by default. Unsafe moments are unpredictable and unavoidable. Only if Aave fails will we witness DeFi’s demise or rebirth;

2. Don’t rely on KOLs/media. Project participation is a subjective choice (all judgments originate from us). News merely alerts us “this product exists.” Regardless of whether KOLs warn, alert, pump, or disclaim via DYOR, final judgment rests with you. Professional traders shouldn’t even read news—they should base decisions solely on data;

3. Pursuing high-yield products isn’t inherently riskier than low-yield ones. This counterintuitive insight can be analyzed via Bayesian thinking: high-yield without collapse implies low risk; low-yield without collapse implies even lower risk. We cannot quantify the ratio to calculate odds. More simply, they’re independent events.

Use external data to update your beliefs—don’t seek data to justify existing beliefs.

Additionally, don’t over-worry about market self-correction. It’s not that retail investors chase volatility—it’s that capital seeks liquidity. When all capital retreats to Bitcoin or USDT/USDC bases, the market automatically incentivizes pursuit of volatility. Stability breeds new volatility; volatility crises renew demand for stability.

Consider the history of negative interest rates. Liquidity is finance’s eternal hum—volatility and stability are two sides of the same coin.

Conclusion

Going forward in the YBS market, retail investors must do two things:

1. Seek data—deep,穿透-level data—that reveals leverage ratios and reserves. Transparent data doesn’t lie. Don’t rely on opinions to assess facts;

2. Embrace strategy—endless cycles of leveraging and deleveraging. Simply reducing leverage doesn’t guarantee safety. Always ensure your strategy includes exit costs;

3. Control losses—not by fixed ratios, but by setting mental position limits. Based on points 1 and 2, take full responsibility for your own understanding.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News