The era of getting rich quickly through crypto is over: advice for retail investors in a bear market

TechFlow Selected TechFlow Selected

The era of getting rich quickly through crypto is over: advice for retail investors in a bear market

Don't quit your job, save money, live frugally.

Author: Picolas Cage

Compiled by: TechFlow

Some thoughts on the market, and suggestions on how to profit from or navigate it.

Over the past two years, the market has changed significantly. It has matured gradually and attracted more institutional capital and adoption.

1) As a retail "small fish," you probably won't make life-changing fortunes from Bitcoin. I believe Bitcoin no longer has much radical upside potential. It's now too large in asset scale. I once bought Bitcoin at $6,000 and had the chance for a 20x return in 2018.

To get another 20x from here? That would mean Bitcoin reaching $1.8 million—something that, in my view, would take far longer than eight years.

I think retail investors should instead see Bitcoin as a store of value with sustained demand. The downside is that you can't simply buy the "safest" assets in crypto (like top-ranked Bitcoin) and expect life-changing returns from a few thousand dollars.

But the good news is, when I first entered the market, holding Bitcoin was pure torture. March 2020? A 40% crash in one day. Imagine Bitcoin dropping to $54,000 in a single day. That kind of volatility made it incredibly hard to stay exposed to the crypto market long-term.

So here's the good news (this might sound risky), such extreme one-day drops in Bitcoin are now very unlikely—it might take a week instead, giving you enough time to adjust and rethink your strategy.

2) Because of point one, making money from cryptocurrency has become harder, so you must extend further along the risk curve. This means investing in altcoins, or more recently, memecoins. Memecoins are this cycle's altcoins—the memecoin frenzy is what I refer to as "alt season."

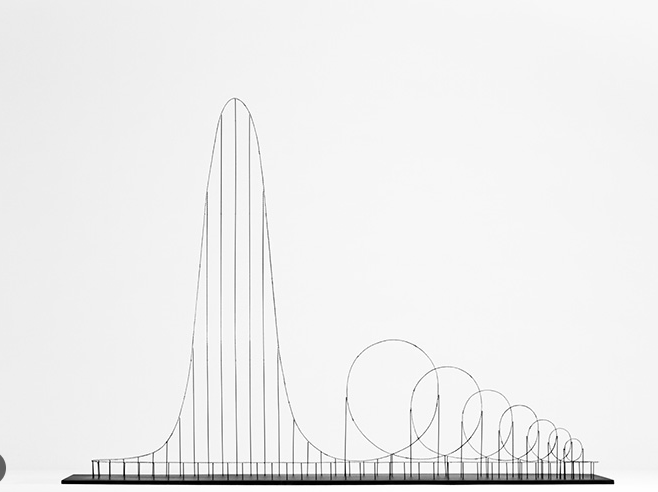

The problem is, by definition, memecoins aren't meant to be trusted or held long-term, so they complete their notorious "rollercoaster" cycle much faster.

The explosion of meme culture, combined with the reality that Bitcoin can no longer generate massive wealth, has fueled widespread short-term thinking among retail investors and young people.

I believe this short-termism is further amplified among Gen Z or younger generations by a "high-dopamine culture." TikTok, YouTube Shorts, Instagram Reels—plus modern gaming—all chase instant dopamine hits.

When this pleasure-seeking mindset is applied to investing or trading, the result is that 99% of people get "rekt" (heavily lose)—and evidence shows memecoins have indeed rekt most people.

Even popular coins like ETH (Ethereum) and SOL (Solana) haven't performed well unless you perfectly timed the bear market bottom. These factors together have pushed the "get rich quick" mentality into the mainstream.

3) The era of getting rich quickly is over—it likely doesn't work anymore.

As I've explained, previously there was real potential to get rich fast by trading major coins like BTC or ETH, but with institutional investment entering, that possibility has largely disappeared. I've outlined both the pros and cons of this shift and how it inevitably leads to short-termism, instant gratification, gambling-like investments, blind following, etc.

So what should we do now? As a boring old "uncle," let me tell you: slowly getting rich over the next 5–10 years is completely worthwhile.

For reference, true wealth isn't owning over $5 million and living on a yacht; true wealth isn't escaping some so-called "government oppression," but having more free time to pursue interests and hobbies on Earth, spending high-quality time with friends, partners, or children, rather than suffocating under financial stress—that's real wealth.

For example, having manageable small loans or a mortgage—these things genuinely improve your quality of life. Don't fall for the nonsense about "Rolexes and luxury sports cars"—those are designed to keep you poor and trapped in the system. If you think owning luxury cars, watches, and material goods is the key to happiness, then you're still stuck in the Matrix. (@Tate brothers)

Enough said. Here are some practical guidelines:

Laddering In: Yes, Bitcoin’s volatility has decreased, but it's still volatile. Be patient, watch market sentiment, and buy in stages when the market "blows up." I'm not telling you to perfectly time the bottom—that's too hard and risky. I’m saying: be patient, keep cash ready, and invest more as prices go lower, using a step-by-step accumulation strategy.

Dollar-Cost Averaging (DCA):

Invest a fixed amount monthly that you can afford, say $250—buying equal amounts of Bitcoin each month (buying $62.5 weekly is even better).

This is a boring but effective strategy because you’re essentially always buying low. When Bitcoin rises, you don’t even need new all-time highs (ATHs) to achieve solid returns. And as discussed earlier, Bitcoin will almost certainly still exist in ten years, making holding it as an asset increasingly easier—that’s what Cobie means by “the easy path is $100k to $250k.”

Farm Airdrops:

Yes, airdrops are fewer now, but they still happen occasionally. This is free money—just remember to set aside part of it for taxes.

Learn Crypto & Do Research Continuously:

Use your spare time to study crypto and build your account. Once your account grows, look for InfoFi (information finance) collaboration opportunities (if any remain) or KOL partnerships with reputable and trustworthy projects. But don’t promote trash projects just for quick profits—this is not only unethical but also harms your personal brand long-term. Remember, your friends aren’t your exit liquidity.

Don’t Quit Your Job:

I cannot emphasize this enough. Investing is like a rollercoaster—you can’t get off mid-ride until it ends. If your money is in long-term, multi-year investments (like ETH or BTC), you can’t pull it out just because you need cash halfway through.

Treat invested money as already "gone"—so only invest what you can afford to lose. Don’t over-invest, don’t emotionally invest or trade. Build your investment logic, cultivate resilience (avoid panic selling). Don’t do stupid things like building a 5–10 year investment plan around something like AIDogecoinNFTclubwifhat, please.

Save Money, Live Frugally:

If you spend newly earned money on flashy things, you’re doing this:

"We use things we don’t need, with money we don’t have, to impress people we don’t like."

"Oh, but I actually have money." Believe me, bro, you don’t. You’ll need it later. I’m 36—trust me, you’ll need it. Life is expensive, really expensive—especially when you have a family to support.

Most young men buy luxury items to impress girls or friends because they lack confidence—it’s totally understandable. I’ve been that age; it was tough and not easy—but it’s not an acceptable excuse.

The smartest thing I did back then to tackle this was to get strong and fit. I leveraged my high testosterone levels at the time and focused on training. It gave me confidence—and even superiority—walking into any room, because my physique was always strong and well-proportioned.

I don’t need an expensive watch to prove anything—my body already does. I don’t need designer clothes. Even if you wear a $10,000 shirt and I wear a plain T-shirt, I’ll still look better because it fits my frame and shows off my athletic build.

In short, these are just my two cents and personal views—some may disagree, which is fine. I’ve said enough and could keep going, but I’ll stop here.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News