Sifting Gold from Sand: Finding Long-Term Investment Opportunities That Survive Bull and Bear Markets (III)

TechFlow Selected TechFlow Selected

Sifting Gold from Sand: Finding Long-Term Investment Opportunities That Survive Bull and Bear Markets (III)

Even in a "copycat bear market," betting on projects with strong fundamentals can generate alpha returns that outperform BTC and ETH.

Authors: Alex Xu, Lawrence Lee

In the first and second parts of our previous article series "Finding Long-Term Investment Gems Across Market Cycles (2025 Edition)", we reviewed and introduced Aave, Morpho, Kamino, and MakerDAO in the lending sector; Lido and Jito in the staking sector; as well as Cow Protocol, Uniswap, and Jupiter in the trading sector. This final installment continues the series by exploring additional projects with strong fundamentals and long-term potential.

PS: The views expressed in this article represent the authors' current thinking at the time of publication, which may evolve over time. These perspectives are highly subjective and may contain factual inaccuracies, data errors, or logical flaws.

All opinions presented here are for informational purposes only and should not be construed as investment advice. We welcome feedback, criticism, and further discussion from industry peers and readers.

4. Crypto Asset Services: Metaplex

Business Overview

Scope of Operations

Metaplex is a digital asset creation, sales, and management protocol built on Solana and other blockchains supporting SVM (Solana Virtual Machine). It provides developers, creators, and enterprises with tools and standards to build decentralized applications. Supported asset types include NFTs, FTs (fungible tokens), real-world assets (RWA), gaming assets, DePIN assets, and more.

Metaplex's services fall into two main categories: Digital Asset Standards and Program Libraries for asset issuance, sale, and management. The former offers token issuance standards optimized for compatibility, low cost, and ease of use within the SVM ecosystem. The latter provides a suite of tools enabling issuers to create, sell, and manage their own digital assets.

The majority of NFTs and FTs issued on Solana are created using Metaplex.

In recent months, Metaplex has expanded horizontally into other foundational services in the Solana ecosystem through its new business line, Aura Network—offering solutions such as digital asset indexing and data availability (DA) services.

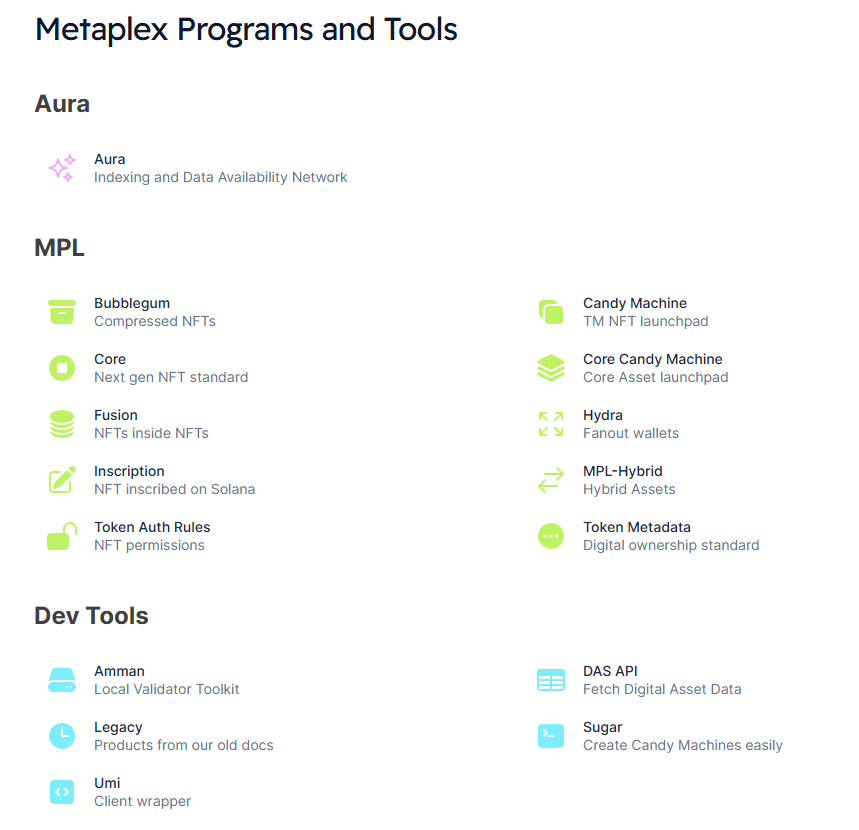

Metaplex product and service matrix, source: developer documentation

Long-term, Metaplex aims to become one of the most important multi-domain infrastructure providers in the Solana ecosystem.

Beyond Solana, Metaplex currently also operates on Sonic and Eclipse.

Revenue Model

Metaplex’s business model is straightforward: it generates revenue by charging fees for on-chain services related to digital assets—including minting, indexing, and data availability services.

Not all of Metaplex’s products and services are fee-based. Below is a detailed breakdown of pricing:

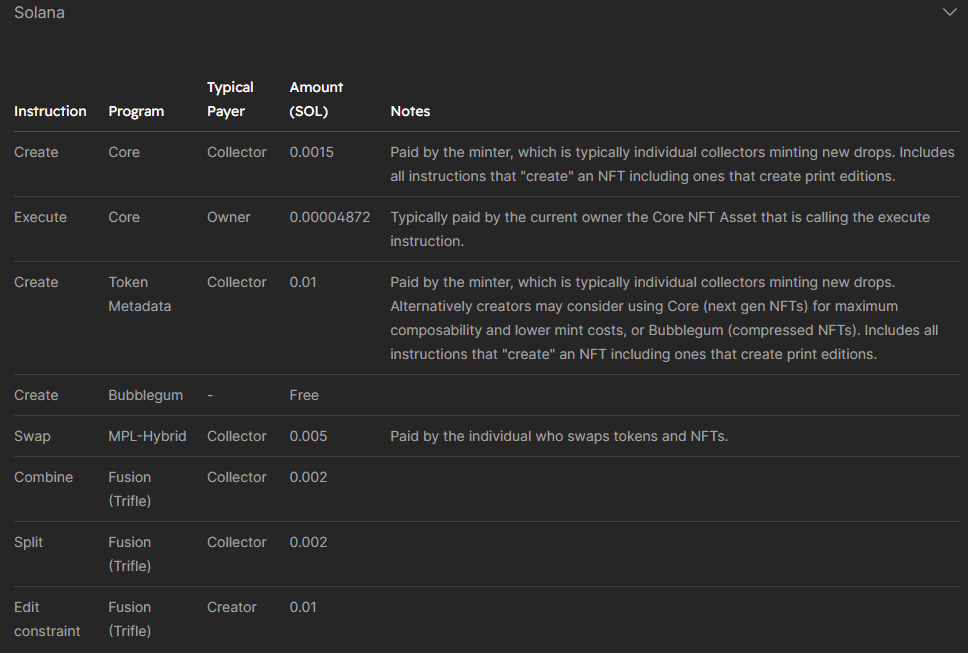

MPL asset service pricing, source: developer documentation

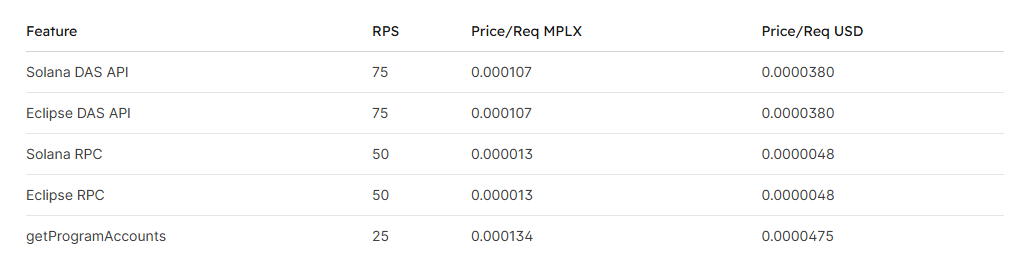

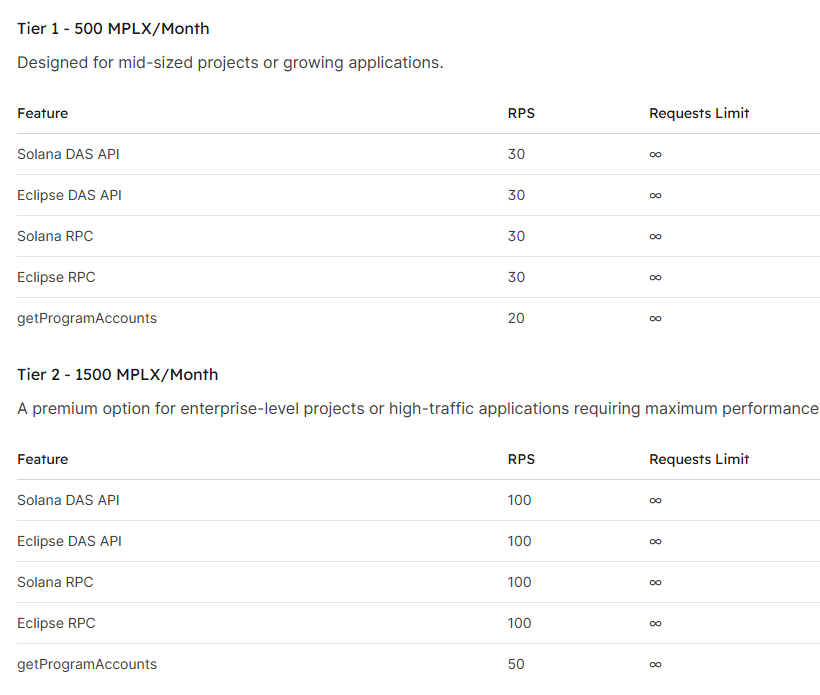

Aura service pricing, source: developer documentation

The Aura business line is still in early stages. Most of Metaplex’s current revenue comes from asset minting and management services (MPL).

Business Metrics

We will focus on two core metrics: number of assets minted and protocol revenue.

Before analyzing these metrics, let's first examine the distribution of asset types issued via Metaplex.

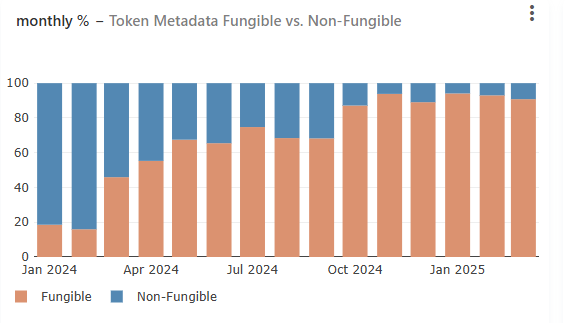

Source: Metaplex Public Dashboard (same below)

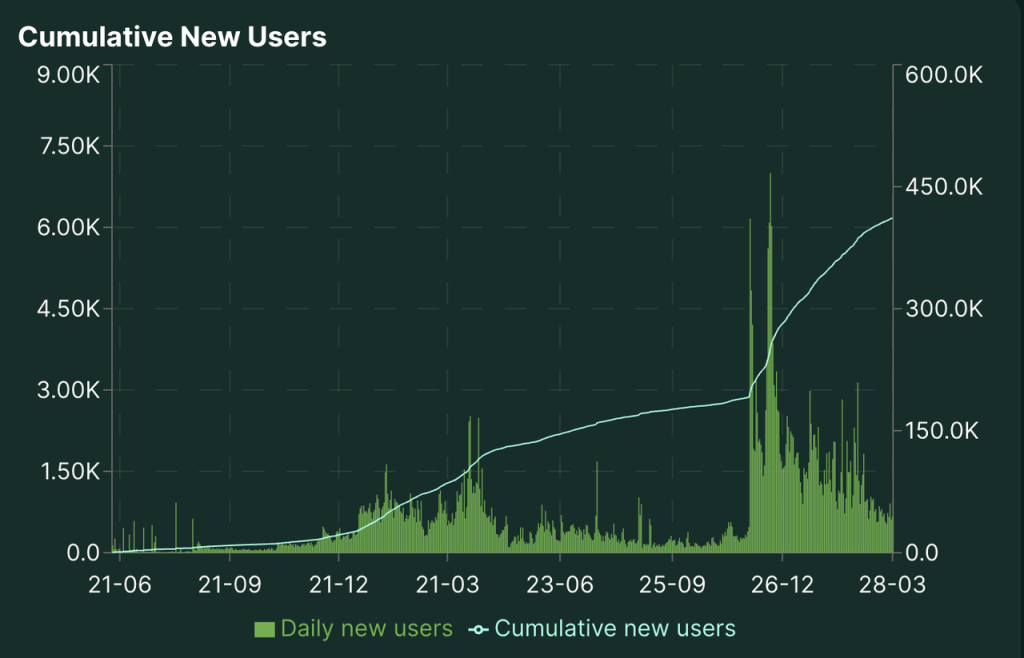

The chart above shows the trend in usage of Metaplex Metadata—which adds supplementary data like images and descriptions to digital assets—across NFTs and FTs.

We can see that at the beginning of 2024, NFTs dominated Metaplex-issued assets, accounting for about 80%. However, starting around April last year, the proportion of FTs began rising rapidly and now exceeds 90%, making them the primary asset type served by Metaplex.

Most of these FTs are meme projects, whose issuers constitute Metaplex’s main customer base and revenue contributors.

This implies that the health of Solana’s meme ecosystem directly influences Metaplex’s business trajectory.

Let’s look at specific performance indicators.

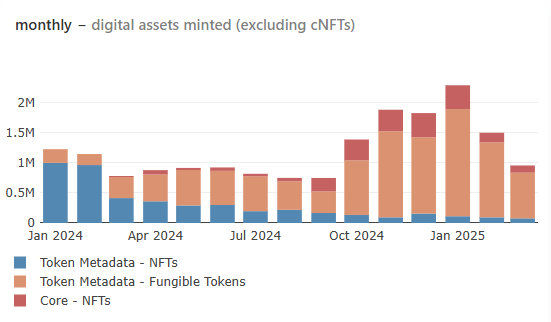

Monthly Assets Minted

Asset minting volume bottomed out in September last year and then surged, peaking in January this year with over 2.3 million assets minted. Since then, activity has gradually declined, returning to levels seen in June last year (~960k assets minted in March). This trend closely mirrors the热度 of meme trading on Solana—higher meme activity leads to more assets being issued through Metaplex.

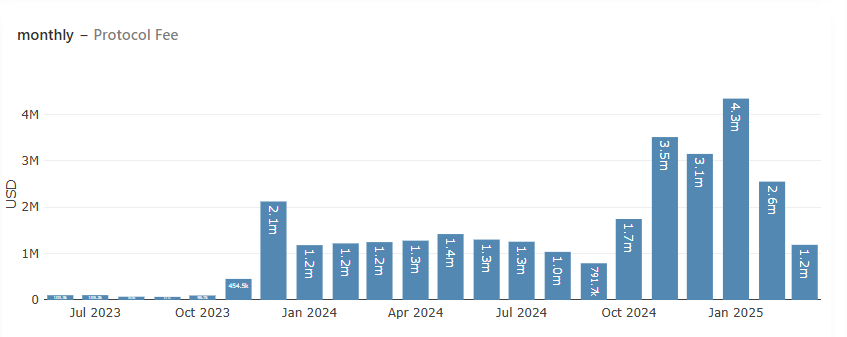

Protocol Revenue

Metaplex’s protocol revenue follows a similar pattern to minting volume, hitting an all-time high of $4.3 million in January. It subsequently dropped sharply, with estimated revenue in March between $1.2M–$1.3M—back to levels seen in the first half of last year.

Protocol Incentives

Unlike many Web3 protocols reliant on subsidies, Metaplex does not subsidize its core operations. Its income stems organically from genuine demand by asset issuers. However, from January to early March this year, Metaplex ran a $1 million token incentive program in collaboration with Orca, Kamino, and Jito to boost liquidity for its MPLX token. The program has now concluded.

Competitive Landscape

As the earliest asset standard setter on Solana, Metaplex currently faces no direct competitors in the domain of asset standards and associated services within the Solana ecosystem.

Competitive Advantages

Metaplex’s advantage lies in its role as the creator and maintainer of Solana’s core digital asset standards. It serves as foundational infrastructure ensuring interoperability and liquidity across NFTs, FTs, RWAs, DePIN assets, game assets, and more.

This means that any project issuing or managing assets via Metaplex would face significant technical, time, and economic costs if attempting to migrate to another protocol.

New developers and projects choosing an asset platform naturally favor Metaplex due to its superior ecosystem compatibility, ensuring seamless integration with wallets, DeFi protocols, and trading interfaces across Solana.

Beyond asset services, Metaplex’s emerging data indexing and data availability offering—Aura Network—has the potential to open a second growth curve. Given that Aura’s target users largely overlap with Metaplex’s existing client base, adoption among current partners is likely to be smoother.

Main Challenges and Risks

-

A continued cooling of Solana meme enthusiasm could lead to sustained declines in asset minting and reduced revenue. This downward trend, evident since January, shows no signs of reversal yet.

-

Metaplex charges a one-time fee per asset type created. Projects with fixed asset structures cannot generate recurring revenue for Metaplex over time.

Valuation Reference

Metaplex’s native token is MPLX, with a total supply of 1 billion.

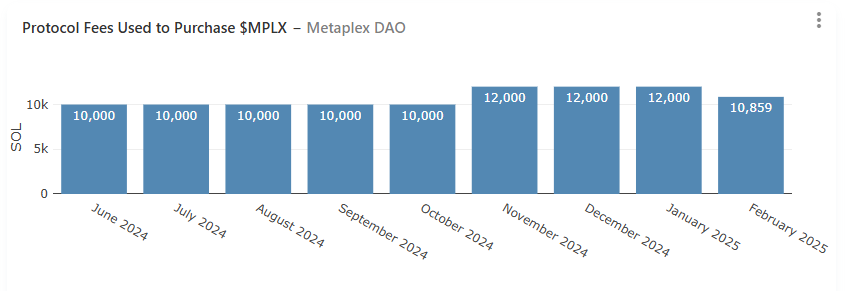

Currently, MPLX is primarily used for governance voting. Additionally, Metaplex announced in March 2024 that 50% of future protocol revenues would be used to repurchase MPLX tokens (though execution has been inconsistent, typically ranging between 10,000–12,000 SOL monthly). Repurchased tokens go into the treasury to support ecosystem development.

To date, monthly buybacks have consistently exceeded 10,000 SOL.

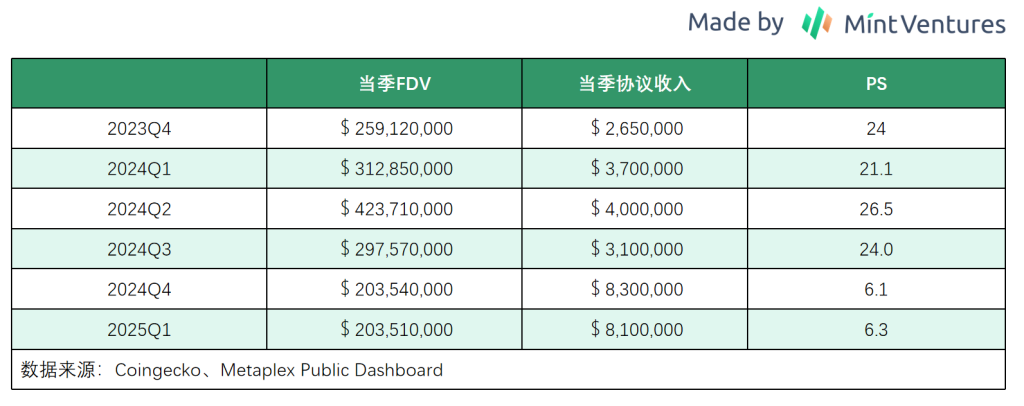

Given the lack of comparable projects, we assess valuation primarily through the ratio of market cap to monthly protocol revenue, analyzed longitudinally.

As of now, Metaplex’s valuation relative to Q1 protocol revenue sits near its lowest level in over a year, reflecting market pessimism about the Solana-based asset issuance market.

5. Hyperliquid: A Derivatives + L1 Platform Facing Headwinds

Hyperliquid stands out as one of the few genuinely useful new projects launched during this cycle. Mint Ventures published an in-depth analysis of Hyperliquid at the end of last year—readers interested in deeper insights are encouraged to refer to it.

Business Overview

Hyperliquid’s operations can be divided into three segments: derivatives exchange, spot exchange, and Layer 1 blockchain. All three components are live, though the derivatives exchange remains Hyperliquid’s core business in terms of volume and influence.

For a derivatives exchange, key metrics are trading volume and open interest.

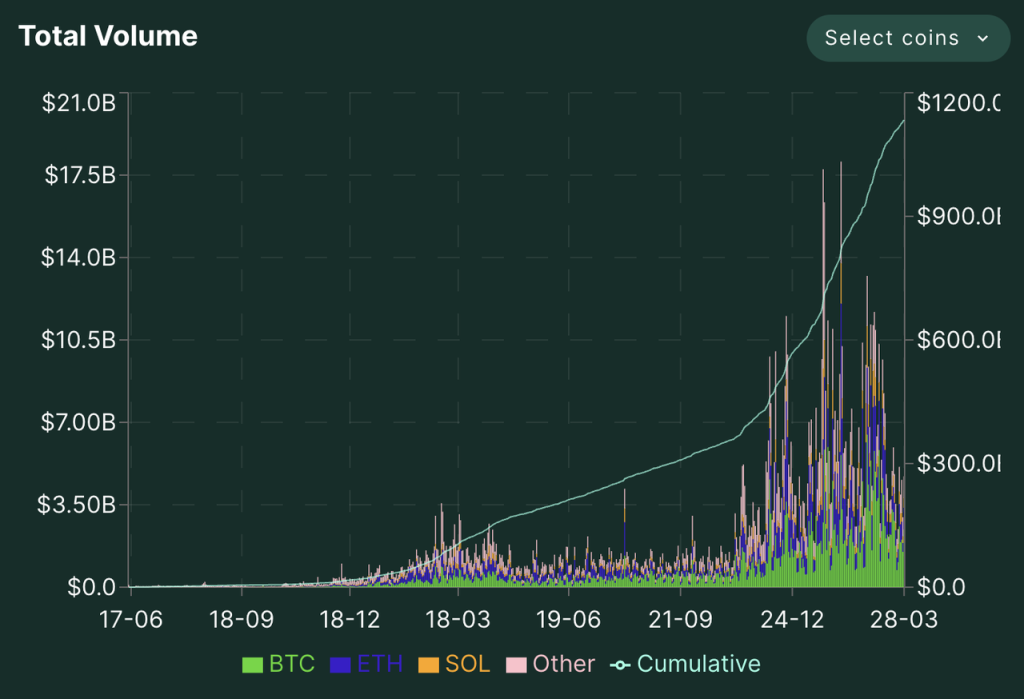

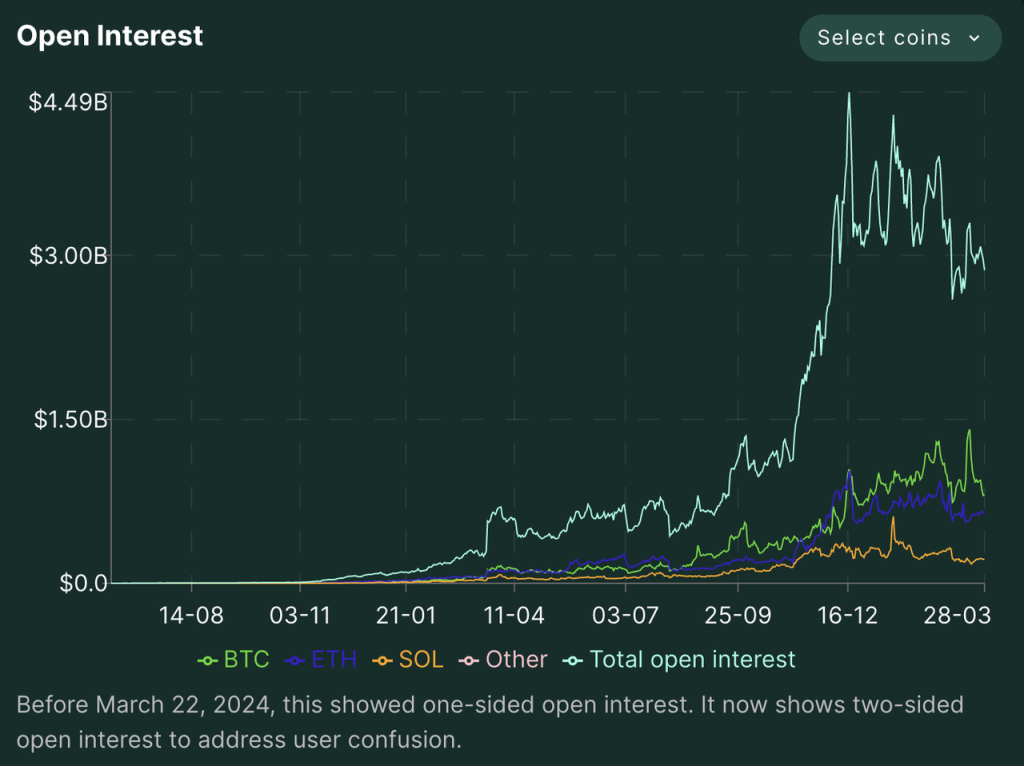

Hyperliquid began cold-launching its derivatives trading in June 2023, started a points campaign in November 2023, and officially distributed its token airdrop by the end of November 2024—after which both trading volume and open interest rose sharply. Since December last year, daily derivatives trading volume has averaged between $4B and $7B, with a peak single-day volume of $18.1B. Open interest has also climbed rapidly, fluctuating between $2.5B and $4.5B since December.

Source: Hyperliquid official site

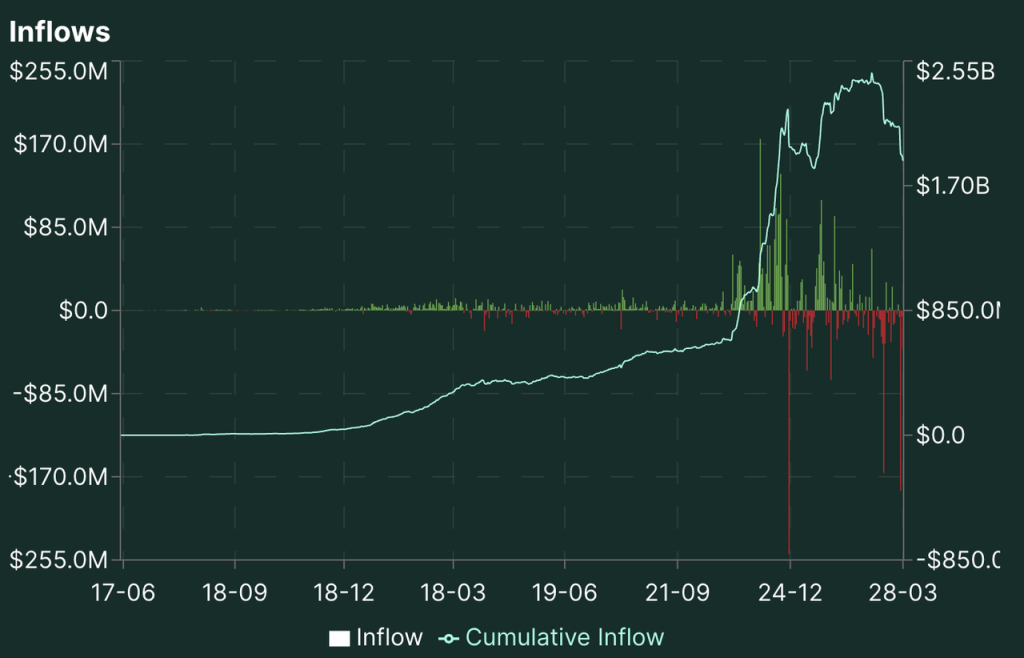

Platform capital surged from November onward, hovering around $2B, but recently dropped from $2.5B to $1.8B due to consecutive security incidents.

On the user front, the number of unique addresses has grown quickly, with nearly 400,000 cumulative trading addresses to date.

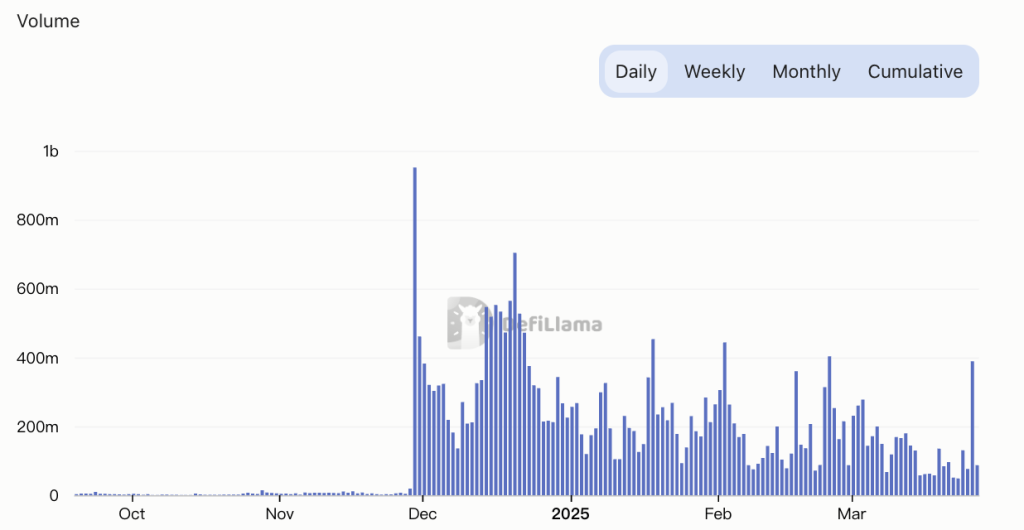

In spot trading, Hyperliquid initially supported only native assets on its L1 chain, with HYPE itself dominating trading volume. In February this year, however, Hyperliquid launched uBTC—a decentralized BTC spot trading solution tailored for its platform. Nonetheless, BTC spot trading volume averages just $20M–$50M daily, representing a small fraction of Hyperliquid’s overall ~$200M average daily spot volume.

Hyperliquid spot trading volume, source: DeFillama

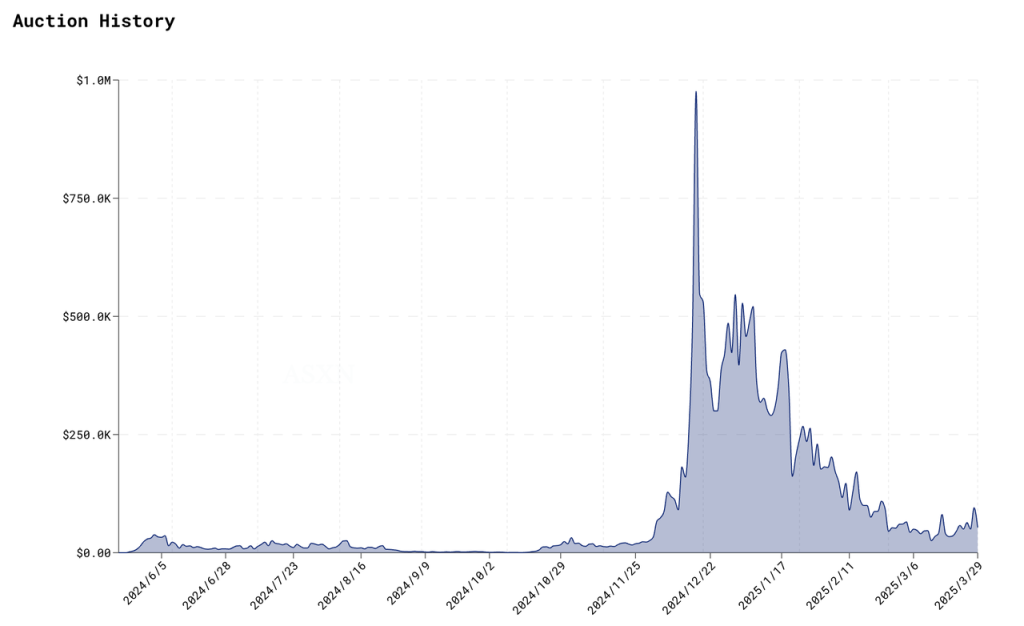

Additionally, Hyperliquid uses a decentralized approach (HIP-1) for listing new spot assets—anyone can bid in public auctions for listing rights. These auction proceeds function effectively as “listing fees,” with historical prices shown below:

Historical auction prices for Hyperliquid spot listings, source: ASXN

The listing fees have been highly volatile—peaking near $1M in December—but have since declined to around $50,000 amid waning market interest in altcoins.

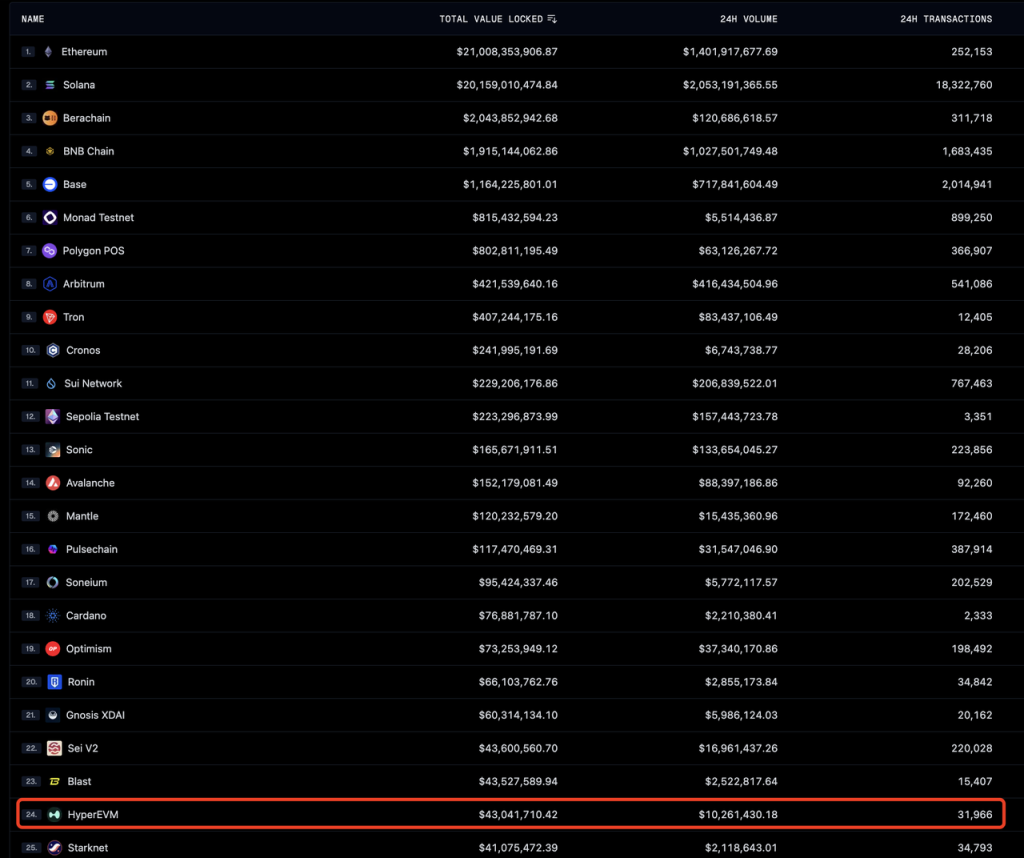

HyperEVM, the EVM-compatible component of Hyperliquid, went Alpha on February 18 and completed integration with HyperCore on March 26. However, due to many EVM protocols not yet being deployed, incomplete bridges, and lack of incentives, HyperEVM’s overall activity remains limited. In terms of TVL, trading volume, and transaction count, it ranks roughly 20th among all chains.

TVL, volume, and TX data across chains, source: Geckoterminal

On revenue distribution: all protocol income—including derivatives and spot trading fees, plus listing auction proceeds—is allocated after paying HLP (Hyperliquid Liquidity Providers). The remainder is used by the Assistance Fund (AF) to repurchase $HYPE tokens.

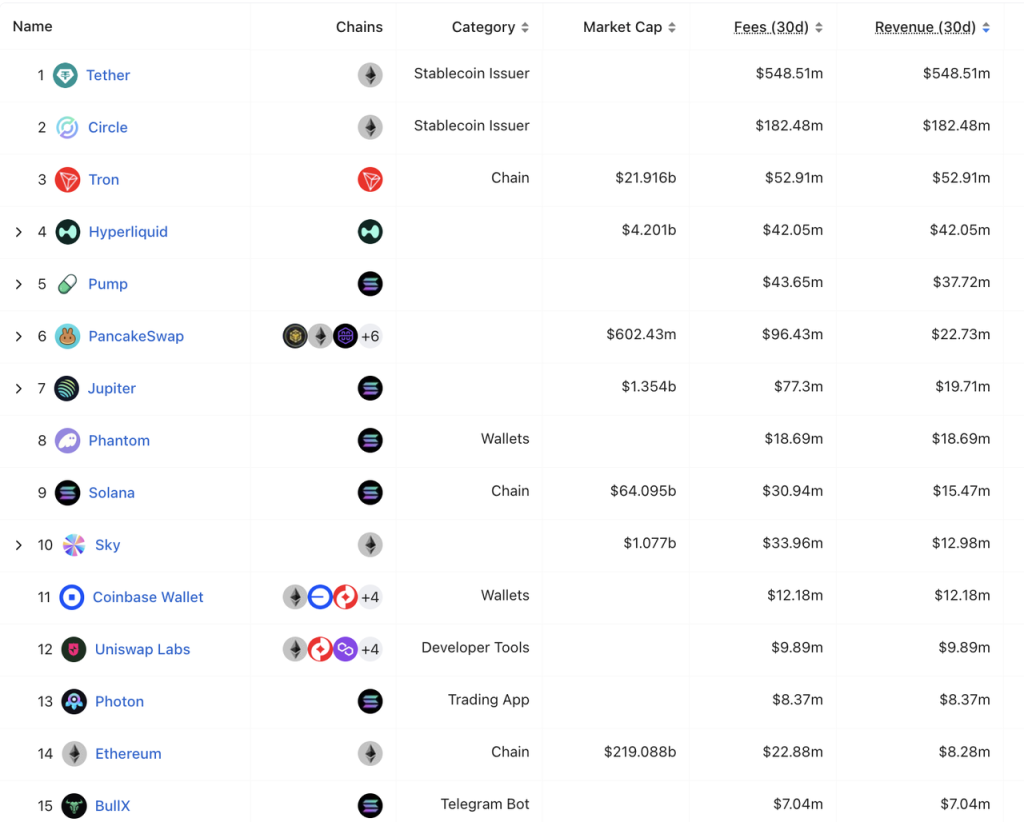

Hyperliquid generated $42.05M in revenue over the past 30 days—ranking behind only Tether, Circle, and Tron, and ahead of major L1s like Solana and Ethereum, as well as popular apps such as Pump Fun and PancakeSwap. Except for Tron, none of the other protocols tie their revenue directly to a native token (or even have one).

30-day revenue ranking across all protocols, source: DeFillama

Competitive Landscape

Since HyperEVM is still in a state akin to “live testing,” we analyze competition separately for derivatives and spot exchanges.

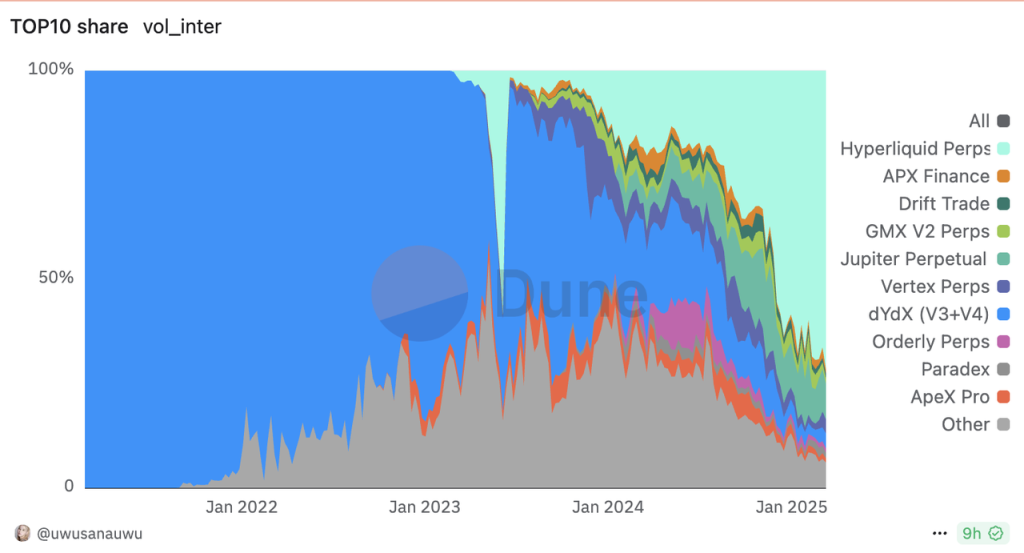

Market share of decentralized derivatives exchanges, source: Dune

Hyperliquid currently holds a dominant position among decentralized derivatives exchanges.

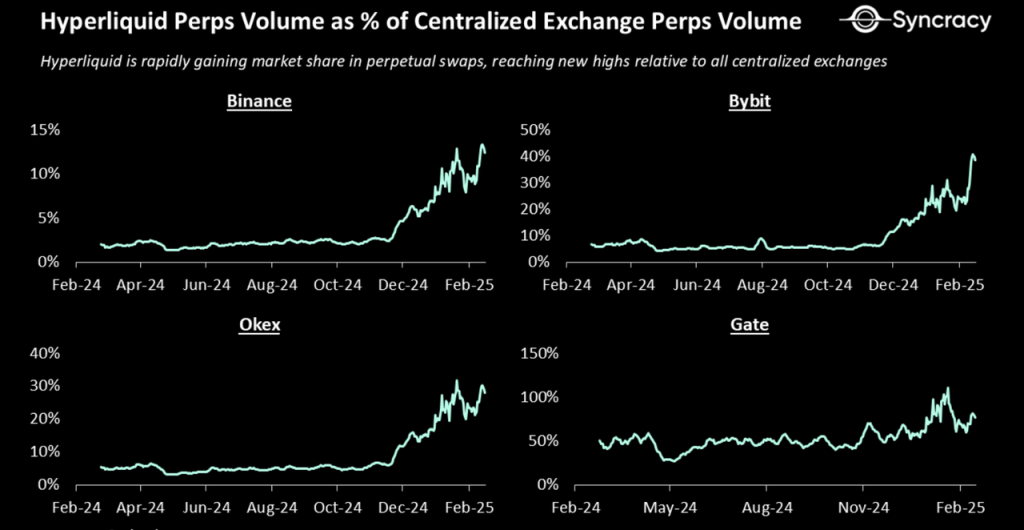

Compared to top centralized exchanges, Hyperliquid’s trading volume is growing rapidly. The chart below compares Hyperliquid’s futures volume against Binance, Bybit, OKX, and Gate:

Ratio of Hyperliquid futures volume to centralized exchange futures volume, source: Syncracy report

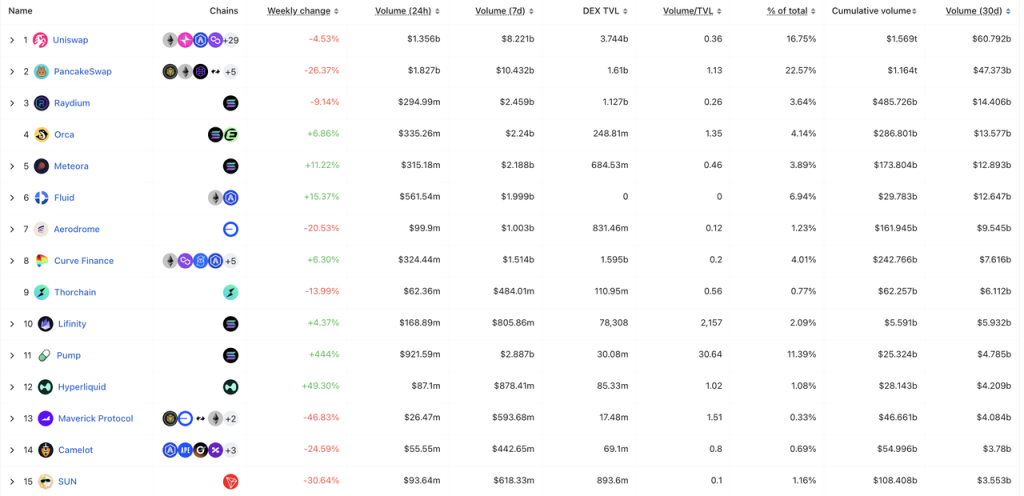

In spot trading, Hyperliquid averaged around $180M in daily volume over the past month, placing it 12th among all DEXs.

Top 15 DEX spot trading volume rankings, source: DeFillama

Hyperliquid’s Competitive Advantages

Hyperliquid’s rapid rise in derivatives trading can be attributed to several factors:

1. Adoption of the order book model—widely proven in traditional trading—enables a smooth user experience similar to centralized exchanges and facilitates easier integration with market makers;

2. More aggressive contract listing strategy. Hyperliquid pioneered pre-launch token contracts and listed pure DEX token futures early. It swiftly lists trending tokens, making it the venue with best liquidity for many new assets;

3. Lower fees. Compared to GMX’s ~0.1% total cost (including ~0.06%–0.08% trading fee plus slippage and funding costs), Hyperliquid charges only ~0.0225% (source: Mint Ventures)—giving Hyperliquid a clear fee advantage.

These factors helped Hyperliquid establish a solid foothold in decentralized derivatives. The points program starting in November 2023, followed by a generous airdrop, further strengthened user loyalty—leaving it without meaningful competition in the space today.

However, these advantages are not durable. Competitors can easily replicate Hyperliquid’s design, listing strategies, and fee structure. What truly sets Hyperliquid apart today are:

1. A lean, ambitious team with consistent delivery capability. With only 10–20 members, Hyperliquid has innovatively launched three major products—derivatives exchange, spot exchange, and L1—in under two years. Despite imperfections, the team’s execution and innovation stand out in the space.

2. Strong brand recognition. Despite recent issues involving ETH and JELLY contracts, Hyperliquid still enjoys superior brand equity compared to rivals and remains the preferred choice for on-chain derivatives traders.

3. Network effects and scale. Its leading market position since H2 2024 has enabled Hyperliquid to accumulate deeper liquidity than competitors—an increasingly valuable moat.

It’s worth noting that full data transparency is not necessarily a competitive strength for Hyperliquid. While generally beneficial for users, this feature may do more harm than good in both short and long term. We’ll elaborate on this in the context of the JELLY incident below.

Main Challenges and Risks

Derivatives Mechanism Risks: Hyperliquid has recently faced two major incidents:

The first involved a 50x leveraged whale long position in ETH being liquidated, resulting in a $4M loss to HLP—primarily due to flawed maintenance margin rules, now patched. The second was the JELLY contract incident, caused by inappropriate position size caps for low-market-cap assets. When JELLY launched, its market cap was close to $200M, so Hyperliquid set a standard $30M position cap. But by the time of the incident, JELLY’s market cap had fallen below $10M while the cap remained unchanged—creating an exploitable gap. This led to peak losses approaching $15M for HLP (24% of HLP’s historical profits). Ultimately, Hyperliquid settled trades based on pre-spike prices, sparking debate about its decentralization claims.

Both events exposed vulnerabilities in Hyperliquid’s core trading logic. Although effective post-event fixes were implemented, the combination of “fully transparent positions (size and liquidation prices)” and “HLP acting as sole counterparty in liquidations” creates theoretically infinite attack vectors. Under human-defined rules, edge cases will always exist—ripe for exploitation by malicious actors in the blockchain’s “dark forest.” As long as these two core mechanisms remain unchanged, Hyperliquid remains vulnerable to future attacks. This is currently the market’s biggest concern.

Security Risks: Most of Hyperliquid’s funds are currently held in its bridge contract on Arbitrum. The security of this smart contract—and the multisig controlling all funds—is therefore critical. In December, North Korean hackers reportedly tested Hyperliquid’s contract, causing funds to drop from $2.2B to $1.9B.

EVM Development Lagging: A significant portion of HYPE’s valuation still hinges on expectations around HyperEVM. However, progress since launch has been underwhelming. If this continues, the L1-related premium in HYPE’s valuation will erode. Given that L1 valuations are inherently much higher than those of derivatives platforms, a re-rating based solely on derivatives performance would suggest HYPE is already fairly valued (see below).

Valuation Reference

Hyperliquid’s revenue currently comes from derivatives and spot trading fees, plus spot listing auction proceeds. This revenue pool is shared: after compensating HLP, the rest is used by the AF (Assistance Fund) to repurchase HYPE. Therefore, we apply P/S and even P/E models to value HYPE—where buyback amounts serve as both revenue and a proxy for token holder net profit.

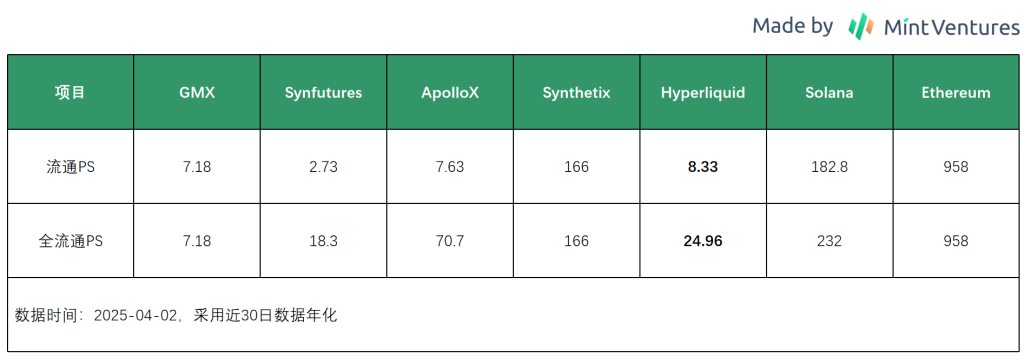

Hyperliquid generated $42.05M in revenue over the last 30 days, implying an annualized run rate of $502M. With a current circulating market cap of $4.2B, its circulating P/S ratio is 8.33, and fully diluted P/S is 24.96. On a circulating basis, Hyperliquid’s valuation aligns closely with GMX and ApolloX among derivatives platforms. However, compared to typical L1 valuations, it remains relatively low.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News