From conversation assistants to intelligent execution: How will AI Agents break through in the next step?

TechFlow Selected TechFlow Selected

From conversation assistants to intelligent execution: How will AI Agents break through in the next step?

Bittensor is experiencing a new wave of demand growth, with Virtuals and ElizaOS also worth watching.

Author: 0xJeff

Translation: Asher

As global economic uncertainty intensifies and market sentiment remains weak, Web3 AI continues to be one of the most reflexively growing sectors.

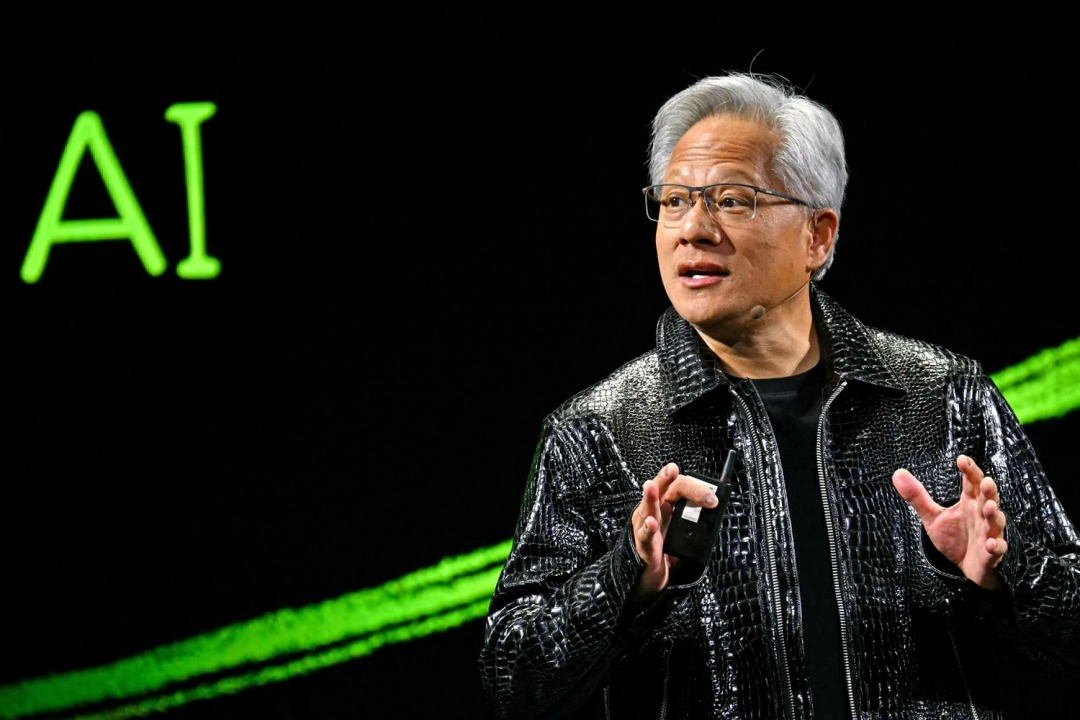

Rapid advancements in AI innovation—driven by major tech players such as OpenAI, Anthropic, DeepSeek, Nvidia, Alibaba, and others—have sustained exceptionally high levels of attention.

The total market capitalization of the AI sector dropped to a low of $4 billion in March but has recently rebounded to $6 billion. Despite ongoing pressure in the broader market, some teams continue exploring AI Agent use cases applicable to the crypto ecosystem. From early floods of conversational AI assistants to today’s more focused solutions targeting real-world problems, several new trends have emerged:

-

Sports analytics and automated betting: AI Agents analyze live event data and autonomously execute wagers;

-

Trading assistance and execution: intelligent AI Agents analyze market trends and carry out complex trades;

-

DeFi yield optimization: agent systems dynamically adjust stablecoin lending strategies to maximize returns.

DeFAI's Evolution: From Abstraction Layer to "Alpha Discovery Layer"

Earlier this year, the DeFAI trend centered on building ChatGPT-style interfaces as interaction layers between users and DeFi protocols. However, practice has shown that merely offering a chat interface does not deliver strong user experiences. The core issue lies in insufficient investment by most teams in the "reasoning layer" (understanding user intent) and the "execution layer" (optimizing execution paths), causing AI Agents to still rely heavily on user judgment when providing strategic advice. For instance, rather than using an AI Agent to select optimal trade routes, it is often more effective to use established tools like Defillama Aggregator, Across, or Pendle.

As a result, many projects are shifting toward becoming an "Alpha Discovery Layer"—helping users uncover the most valuable information in the market. In an environment where information is scarce, identifying the best "gold nuggets" is key. Examples include:

-

On-chain data analysis: tracking smart wallets and fund flows to capture leading signals;

-

Social platform intelligence mining: analyzing trending topics on X, Telegram, and Discord to detect emerging trends;

-

Advanced risk management: services like GigabrainGG provide institutional-grade trading signals.

It remains unproven whether any AI Agent can consistently generate excess alpha, but early results are beginning to demonstrate tangible value.

Multimodal / Multi-Channel AI Agents

Traditional ChatGPT-style interaction models are not suitable for all scenarios. Web3 AI Agents are now exploring new interaction paradigms to seamlessly integrate into users' daily workflows.

-

Direct interaction on X: since cryptocurrency communities are primarily active on X, agents like Clanker and Bankr are delivering services directly through the platform, streamlining user operations;

-

Voice commands in Discord: AgentTank enables users to control AI via voice within Discord to execute on-chain tasks, enhancing collaborative efficiency;

-

Web3 browsing and execution: as many crypto websites lack APIs, computer-use agents can simulate human behavior, automatically navigating across sites, scraping data, and executing transactions.

These multimodal and multi-channel AI Agents are redefining the Web3 user experience, making AI an integral part of trading and research processes.

Virtuals: Core Platform for the AI Agent Ecosystem

Virtuals’ AI Agent tokenization platform has been operational for six months. Although overall ecosystem market cap has declined due to market volatility, the number of agents has grown from 50 to 716, maintaining its leadership in the AI Agent space. Currently, the most active application scenarios on Virtuals include:

-

GambleFAI: agents like Billy Bets excel in AI-driven betting markets, even placing in the top eight of ProphetX prediction contests with a 30% ROI;

-

Sports analytics: HeyTracyAI delivers AI-powered analysis and commentary for NBA games;

-

Robotics and physical AI: SAM is advancing Embodied AI with the goal of building a decentralized AI computing ecosystem similar to Bittensor;

-

Alpha discovery: agents like aixbt and Acolyt focus on on-chain data analysis and trading signal generation.

Virtuals is also developing the Agent Commerce Protocol (ACP), aiming to enable AI Agents to collaborate and build more efficient economic systems. The first two potential applications may be agent-managed hedge funds and agent-run media hubs.

Bittensor as AI Infrastructure

Bittensor, whose native token is Tao, is experiencing renewed demand growth. Previously, many users held TAO solely for staking in the Root Network, but now increasing numbers are allocating TAO into specific subnet tokens to support concrete AI applications.

-

dTAO model launched in February: TAO inflation distribution is now determined by market dynamics rather than validator weight. This means subnets recognized as high-value by the market receive greater TAO incentives;

-

Growing real-world usage: subnets such as SN6, 41, and 44 are supporting consumer-facing AI Agents like Billy Bets and DKING, expanding Bittensor’s practical application footprint.

ElizaOS V2 and New Launchpad Platform Autofun

ElizaOS has long been one of the most popular AI Agent development frameworks. Its upcoming V2 release and the new launchpad platform Autofun—set to go live in two weeks—are poised to accelerate ecosystem growth, with 15 projects already preparing to join.

-

Current status of ElizaOS: it has accumulated 15.3k GitHub stars and 5k forks, with growing market influence;

-

Fund management risks in AI Agents: Sentient recently published research exposing security vulnerabilities in fund management within AI Agents like ElizaOS, highlighting the need for stronger safeguards in this domain.

Despite these challenges, ElizaOS ecosystem growth remains rapid. Its decentralized GPU hosting solution, Comput3 AI, will debut on the Autofun platform.

Conclusion

AI Agents remain one of the most promising sectors in Web3, converging AI and crypto innovation while potentially reshaping industry-wide productivity and work patterns. From AI trading assistants to cross-chain information capture, from yield optimization to autonomous execution, AI is introducing new paradigms to Web3.

This moment feels akin to the internet boom of the 1990s—but larger in scale and deeper in impact. For early adopters, now is the ideal time to get involved.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News