When will Bitcoin's downturn end? Watch for regulatory breakthroughs and macro improvements

TechFlow Selected TechFlow Selected

When will Bitcoin's downturn end? Watch for regulatory breakthroughs and macro improvements

Despite ongoing economic uncertainty, the crypto industry continues to benefit from a favorable political environment, as the Trump administration pushes for increasing regulatory clarity, while institutional participation enthusiasm grows steadily.

Author: Bitfinex Alpha

Translation: Tim, PANews

Bitcoin recorded its worst first quarter performance in nearly a decade in 2025. Despite an initial surge to a record high of $109,590 at the beginning of the year, it closed the quarter with a loss of nearly 11%. Market optimism—initially fueled by expectations of Donald Trump’s potential election victory and pro-crypto monetary policies—quickly turned into a textbook "sell-the-news" scenario as substantive regulatory reforms failed to materialize. From its all-time high, Bitcoin fell as low as $77,041, marking a maximum drawdown of nearly 29%, before consolidating within a trading range of $78,000 to $88,000.

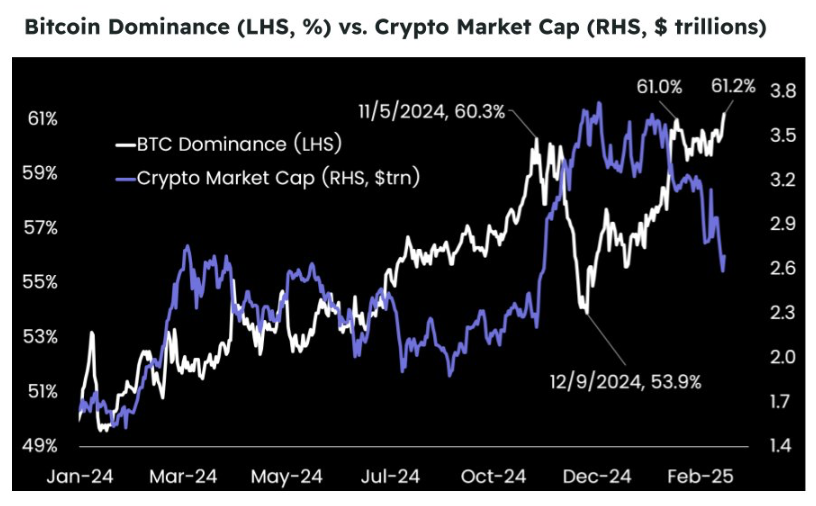

However, market structure remains favorable for Bitcoin. Despite a significant decline in total cryptocurrency market capitalization, Bitcoin’s dominance has risen to over 61%, indicating that amid heightened macro uncertainty, capital is rotating from riskier altcoins into Bitcoin. Altcoins such as Ethereum and Solana have fallen 35%–50% from their cycle highs, further reinforcing Bitcoin’s status as the “reserve asset” of the crypto market.

As the second quarter begins, price movements will remain highly dependent on macroeconomic signals. Federal Reserve policy developments and ETF fund flows will continue to drive market direction. Although signs of panic selling among investors have eased, the market still requires a sufficiently impactful catalyst event to achieve a sustained breakout amid ongoing liquidity tightening.

From a macroeconomic perspective, certain sectors of the U.S. economy are showing resilience—such as a narrowing trade deficit and increased durable goods spending—but these positives are overshadowed by deeper structural concerns. Inflation has accelerated beyond expectations, driven by factors including new tariff policies that have raised import costs. Core inflation rose 0.4% month-over-month in February, the largest monthly increase in over a year, while consumer surveys indicate that elevated inflation may persist for an extended period.

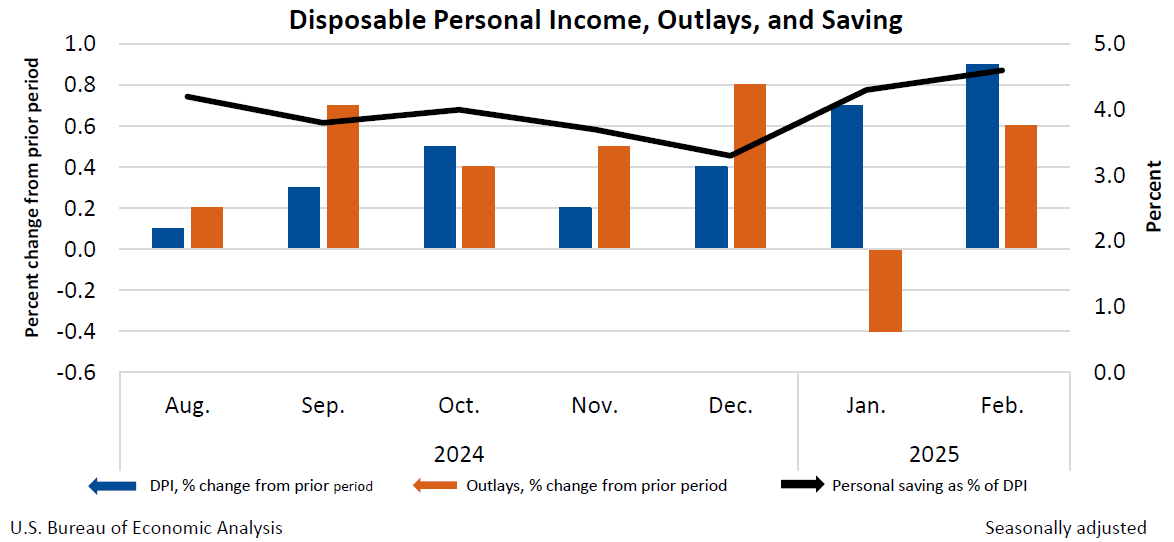

Personal Disposable Income, Spending, and Savings

Economic growth is meanwhile slowing. Real income growth remains weak when excluding government spending, and service sector expenditures—a key economic driver—are already contracting. Consumer confidence continues to erode, with the Conference Board’s Consumer Confidence Index falling to a two-year low. A growing number of Americans expect unemployment to rise. These trends reflect rising household caution, evidenced by a continued increase in the personal savings rate.

Trade policy remains a central pressure point. Recent tariff hikes, along with market expectations of further measures in April and May, are prompting businesses and consumers to adjust behavior—including front-loading purchases, delaying investments, or scaling back hiring. Although the trade deficit narrowed in February, this followed a sharp January surge in imports, which may have already been factored into GDP forecasts. As a result, first-quarter economic growth is expected to slow significantly.

Despite persistent macroeconomic uncertainty, the crypto industry continues to benefit from a supportive political environment. The Trump administration is advancing greater clarity in regulatory frameworks, while institutional participation is steadily increasing.

The U.S. Securities and Exchange Commission (SEC) has officially dropped lawsuits against three major industry players: Kraken, Consensys, and Cumberland DRW. This move marks a shift from the agency’s previous aggressive enforcement stance toward a more collaborative regulatory approach, signaling regulators’ intent to establish clear and constructive rules for the cryptocurrency industry.

To further advance crypto regulation, the SEC’s Digital Assets Task Force has announced four thematic roundtable discussions scheduled between April and June 2025. These sessions will focus on key issues such as crypto exchange regulation, digital asset custody, tokenization, and the future development of decentralized finance (DeFi), bringing together various industry stakeholders. Open to the public, this initiative reflects the SEC’s commitment to transparency and inclusive dialogue in shaping crypto policy.

Meanwhile, Trump Media & Technology Group has announced a partnership with cryptocurrency exchange Crypto.com to launch a series of crypto-focused exchange-traded funds (ETFs). This marks the group’s official entry into financial products, aiming to meet growing market demand for digital asset investment vehicles. While the plan awaits regulatory approval, its successful implementation could significantly elevate the profile of both Trump Media & Technology Group and Crypto.com within traditional finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News