Michael J. Saylor's Strategic Bet: Bitcoin's Premium Issuance and Capital Manipulation

TechFlow Selected TechFlow Selected

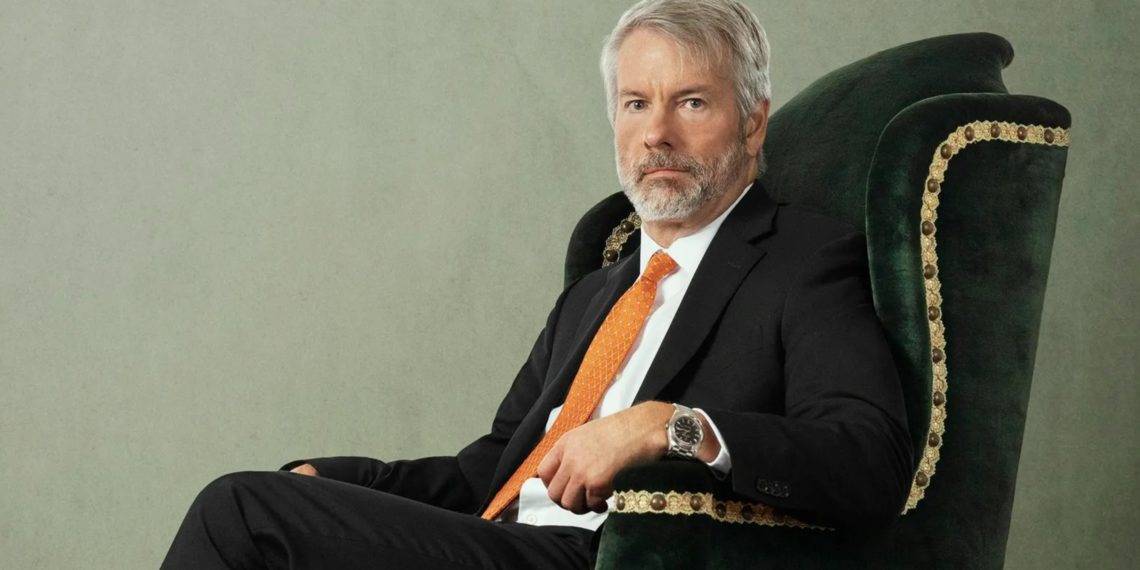

Michael J. Saylor's Strategic Bet: Bitcoin's Premium Issuance and Capital Manipulation

A Möbius-loop cycle: Michael J. Saylor's asset game.

Author: YBB Capital Researcher Ac-Core

I. Introduction:

MicroStrategy was originally an enterprise software company focused on business intelligence solutions, but since 2020, its focus has significantly shifted toward Bitcoin investment. The company raises capital through stock and convertible bond issuance to purchase Bitcoin, making it a focal point in the U.S. stock market. On February 6, 2025, MicroStrategy—the world’s largest publicly traded holder of Bitcoin—officially rebranded as Strategy (referred to hereinafter as MicroStrategy for readability). At that time, Strategy held 471,107 Bitcoins on its balance sheet, approximately 2% of the total global Bitcoin supply. By February 21, 2025, MicroStrategy had accumulated nearly 500,000 Bitcoins, valued at over $40 billion.

In essence, MicroStrategy leverages financial engineering to turn the stock market into a Bitcoin ATM—raising funds via new share or convertible bond issuances to buy more Bitcoin, then using its growing Bitcoin holdings to boost stock valuation, creating a deeply entrenched capital loop tied to crypto assets. Thanks to this uniquely American high-premium financing mechanism, MicroStrategy not only stands out among Bitcoin-related stocks but has also mastered a Wall Street-approved “alchemy” combining equity dilution with price manipulation.

II. What Makes MSTR Stock a Speculative "Magnet"?

Image source: abmedia.io

MicroStrategy's fundraising strategy is highly sophisticated, primarily combining equities and debt instruments. Initially, it relied on debt issuance and internal cash reserves, supplemented by common stock and convertible bonds. However, issuing regular bonds comes with interest payments; although at the time, its positive cash flow from software operations—tens of millions annually—was sufficient to cover these costs.

Entering this market cycle, MicroStrategy began heavily utilizing an At-the-Market (ATM) share offering mechanism—directly selling shares in the secondary market. Through a hybrid strategy of equity offerings and bond issuance, MicroStrategy executes what amounts to financial alchemy in public markets. When leverage is low, it rapidly issues shares to raise capital for Bitcoin purchases, increasing leverage and amplifying valuation premiums during Bitcoin rallies. During bull runs, its premium一度 reached up to 300%.

However, as investors gradually recognized MicroStrategy’s large-scale share sales, stock prices started to decline, narrowing the valuation premium. As leverage decreased, the company shifted increasingly toward debt-based financing. This transition slowed down Bitcoin accumulation, reducing downstream demand for Bitcoin in the broader market.

Thus, MicroStrategy plays a game of “premium hedging.” It raises funds by selling shares at high premiums to buy Bitcoin, switching to debt financing when premiums shrink. This model provides consistent funding for Bitcoin purchases, even as investor enthusiasm cools amid growing awareness of these tactics.

Overall, across market cycles, MicroStrategy adapts its financing strategies—leveraging stock market premiums while relying on bonds to steadily increase leverage. For Bitcoin, slower accumulation may signal reduced short-term upward momentum; for MicroStrategy, this diversified approach ensures flexibility under varying market conditions.

The reasons behind MSTR's volatile price swings—and how it attracts legions of speculators through Bitcoin investments—are key to understanding its billion-dollar "transmutation" strategy. In short, several critical factors stand out:

1. Non-linear relationship between stock price and Bitcoin: Many assume MicroStrategy’s share price should move in lockstep with Bitcoin, but this isn’t entirely true. For example, during November and December last year, while Bitcoin continued rising, MicroStrategy’s stock had already begun declining. Hence, its stock volatility isn't solely driven by Bitcoin’s price movements.

2. Reaction to shrinking premiums and long-term implications: MicroStrategy’s valuation premium has been gradually contracting. Michael J. Saylor doesn’t promote the intrinsic value of the stock itself but rather emphasizes its volatility. Put simply, he markets MicroStrategy as a high-volatility speculative instrument, particularly appealing to institutional investors who cannot directly access Bitcoin ETFs.

3. Bitcoin as a "proxy investment": Regulatory constraints or internal policies prevent many institutions from directly purchasing Bitcoin or Bitcoin ETFs—especially in countries like South Korea and Germany. Thus, MicroStrategy becomes a viable alternative, offering indirect exposure due to its strong correlation with Bitcoin.

4. Michael J. Saylor's masterful marketing and MicroStrategy’s "self-fulfilling prophecy": Saylor excels at promotion—not just selling shares, but highlighting their leveraged nature. His message: if you believe in Bitcoin’s upside, MicroStrategy offers amplified returns. Moreover, investing in MSTR is safer than leveraged options trading, eliminating concerns about liquidation.

5. MicroStrategy’s uniqueness: Much of its success stems from exceptional fundraising capabilities. Saylor continuously secures capital to acquire more Bitcoin. He is also a brilliant promoter—giving speeches, appearing on YouTube, packaging MicroStrategy as a “super-leveraged tool,” attracting global speculators.

III. “Hold Bitcoin, Never Sell”: Michael J. Saylor’s Crypto Crusade

Image source: blocktempo

Michael J. Saylor’s recent wave of Bitcoin advocacy has profoundly impacted the entire industry. Through constant public appearances, interviews, and speeches, he brought Bitcoin into mainstream discourse and attracted a flood of institutional investors. Arguably, MicroStrategy and Bitcoin ETFs are now the two primary buyers in the Bitcoin market. Interestingly, while ETFs are crucial, MicroStrategy’s actions draw greater attention because it only buys and never sells, unlike ETFs which occasionally offload holdings.

On the marketing front, one of the most striking moments came when Saylor claimed he had written a will instructing the destruction of his personal Bitcoin private keys upon death, permanently removing them from circulation. This “cult-leader-level” gesture symbolizes an eternal contribution to the Bitcoin ecosystem. While no one knows whether he’ll truly follow through, such statements undoubtedly inject excitement into the market.

Moreover, it should be clarified that MicroStrategy’s Bitcoin holdings are not controlled by Saylor personally or directly by the company. Instead, they are custodied by trusted third parties—Fidelity and Coinbase Custody—in compliance with auditing and regulatory requirements for public companies. Concerns about posthumous asset management can thus be put to rest.

Saylor is not merely a Bitcoin advocate—he is, in many ways, more extreme than even early adopters. Long before Bitcoin ETFs existed, he transformed MicroStrategy into something akin to a de facto Bitcoin ETF. His conversations with Elon Musk were pivotal in advancing Bitcoin adoption. Market rumors suggest Musk’s decision for Tesla to buy Bitcoin was largely influenced by Saylor’s advice.

Saylor’s vision extends beyond Bitcoin alone. Some observers note that his latest statements reflect support for the broader digital economy—advocating that the U.S. become a global leader in digital economics and push for all assets to be tokenized and placed on-chain. No longer just a Bitcoin maximalist, he now recognizes blockchain’s potential across diverse sectors—an openness that earns him wider respect within the blockchain community.

Looking ahead to America’s strategic positioning in the digital economy, Saylor has even proposed incorporating Bitcoin into national strategic reserves, further solidifying U.S. leadership in the global digital economy. He champions not just Bitcoin, but a grand vision of a global on-chain economy—one that could reshape the future of finance into a more decentralized structure, potentially leading to a cyber-financial system transcending sovereign borders.

Yet, in this emerging landscape, capital flows and regulation face new challenges. If the U.S. leads this on-chain economic shift, other nations or blocs—such as China, the EU, or South Korea—could face intensified capital outflows. Even if regulators attempt traditional controls, they may prove ineffective against decentralized, borderless systems. On March 25, Trump-affiliated crypto venture World Liberty Financial Inc. (WLFI) announced plans to launch a stablecoin called USD1—a business so lucrative that USD1 will be fully backed by short-term U.S. Treasury bills, dollar deposits, and other cash equivalents. This appears to signal that the U.S. may increasingly rely on stablecoin issuance to alleviate its national debt crisis.

IV. Möbius-Loop Gambit: Michael J. Saylor’s Asset Playbook

Image source: thepaper

Bitcoin currently trades around $87,000, down from recent highs, while MicroStrategy’s average acquisition cost sits at approximately $66,000. A natural question arises: what happens if Bitcoin falls below MicroStrategy’s break-even point?

During the previous bear market, MicroStrategy’s situation was even worse—its net assets turned negative, a rare scenario for any public company. While some firms may temporarily show negative equity due to extraordinary circumstances (e.g., large stock option grants), it typically triggers market panic. Yet MicroStrategy avoided liquidation and forced Bitcoin sales, mainly because its debts have distant maturity dates—no creditor could force immediate action.

A key factor here is that founder Michael J. Saylor holds nearly 48% of voting power, making any liquidation proposal extremely difficult to pass. Even amid financial stress, neither creditors nor minority shareholders can easily initiate dissolution.

So, if Bitcoin does fall below cost basis, would MicroStrategy enter a so-called "death spiral"? This concern emerged during the last bear market, when negative equity and widespread fear rattled markets. Today, however, investors are better seasoned and less likely to react with panic.

Furthermore, Saylor and his team possess flexible tools to manage volatility—they can issue debt, conduct share offerings, or even pledge Bitcoin holdings as collateral for loans. With roughly $40 billion in Bitcoin assets, MicroStrategy can secure financing through collateralization. Even if prices drop, they can maintain loan positions by adding more collateral, avoiding forced sales.

Crucially, their major debts don’t mature until 2028, shielding them from near-term pressure. For now, even with price fluctuations, MicroStrategy faces no imminent financial distress or obligation to sell Bitcoin.

More importantly, a growing number of sovereign wealth funds and institutions are beginning to treat Bitcoin as a reserve asset—a significant macro trend. Rumors suggest Abu Dhabi is already accumulating substantial Bitcoin ETFs, signaling broader national participation ahead. Despite short-term price swings, the long-term trajectory aligns with MicroStrategy’s strategy. Though financial headwinds may emerge in coming months or years, the overall outlook remains resilient.

Therefore, while Bitcoin volatility may create temporary pressure, considering debt maturities and structural trends, MicroStrategy faces no risk of forced liquidation or asset sales. On the contrary, it may exploit current market conditions to further accumulate Bitcoin, strengthening its position in the crypto space. Behind this dynamic lie deeper questions worth exploring:

Can Bitcoin maintain its current level of volatility?

MicroStrategy fundamentally relies on Bitcoin’s high volatility to function as a leveraged investment vehicle. But as institutional adoption grows and volatility declines, can it sustain its high-return model? With the advent of Bitcoin ETFs, the historical cyclical pattern of Bitcoin prices has been disrupted. Spot prices have stabilized due to financial derivatives and ETF-driven dispersion. Gold’s post-ETF price behavior offers a precedent: once wild swings give way to smoother trends. Similarly, Bitcoin’s era of extreme volatility may be ending, transitioning from radical to moderate.

How long can MicroStrategy’s financing model last?

This buy-and-hold-through-finance model depends heavily on bullish sentiment toward Bitcoin. But if Bitcoin enters a prolonged consolidation or downtrend, can MicroStrategy withstand the strain? Continued debt and equity issuance to fund purchases would shrink investor premiums. Its financing model thrives on market optimism—if that fades, financial pressures mount: ongoing interest obligations, shareholder dilution, and weakening confidence. Additionally, policy shifts matter. The Trump-era regulatory environment offered favorable financing conditions, enabling strategic reserve building. Should those tailwinds fade, MicroStrategy’s ability to raise capital could deteriorate.

Is Michael J. Saylor a Bitcoin idealist or a savvy arbitrager?

Saylor embodies both idealism and opportunism—deeply believing in Bitcoin’s long-term potential while expertly exploiting market mechanics for corporate and personal gain. By leveraging Bitcoin’s volatility, he markets MicroStrategy stock as a “leveraged proxy” for Bitcoin exposure, attracting institutions barred from direct Bitcoin or ETF investments. Rather than being purely a faithful believer, Saylor acts more as a volatility arbitrageur—profiting from market oscillations. Ultimately, MicroStrategy’s success hinges less on Bitcoin’s intrinsic value and more on market sentiment and price performance.

V. Wealth Engine or Crypto Winter?

Image source: X@MicroStrategy

MicroStrategy’s capital strategy emerged at precisely the right moment. But should one invest in MSTR stock? From my perspective, for those within the crypto industry, MSTR offers better risk-reward than direct Bitcoin exposure—it functions essentially as an accelerated version of Bitcoin.

While nominally a data analytics software firm, MicroStrategy operates almost exclusively as a Bitcoin accumulator. MSTR carries built-in leverage: holding vast BTC reserves and potentially borrowing or issuing bonds to buy more, amplifying its sensitivity to Bitcoin price moves. When BTC rises, MSTR tends to rise faster—and vice versa.

The stock surged from $68 at the start of the year to around $400 today, outperforming giants like NVIDIA, Palantir, and Coinbase. What explains this astonishing performance? Some credit Saylor’s “infinite capital cheat code”; others accuse it of resembling a Ponzi scheme, warning it might trigger the next crypto market collapse.

Bitcoin investment gains now vastly exceed revenue from MicroStrategy’s legacy software business. Though software income has stagnated or declined over recent years, the company has boosted overall profitability by continuously issuing debt and diluting equity to fund more Bitcoin purchases. By tightly linking its stock to Bitcoin, MicroStrategy gains advantages—but also assumes significant risks. Its core business generates little profit; its entire future depends on rising Bitcoin prices. Truthfully, no one knows whether Bitcoin will achieve steady growth through financialization, ETFs, and strategic reserves—or face a major "reckoning."

The company further enhanced its funding capacity by issuing zero-coupon convertible notes. These allow investors to convert debt into equity at a future date, albeit at conversion prices far above current levels. While seemingly unfavorable to investors, these notes come with senior liquidation rights, reducing risk. Meanwhile, MicroStrategy uses the proceeds to keep buying Bitcoin, fueling dual appreciation in both its stock and Bitcoin prices.

The brilliance lies in shifting risk off the company’s balance sheet and onto public markets. By raising debt that converts into equity when share prices rise, MicroStrategy avoids repayment—effectively transferring debt obligations to shareholders. As a result, the risk-reward profile in stock markets exceeds that of the crypto market itself.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News