From Signal's Success to FHE: How Privacy Products Can Achieve Self-Sustainability

TechFlow Selected TechFlow Selected

From Signal's Success to FHE: How Privacy Products Can Achieve Self-Sustainability

Privasea, the stop codon of the FHE赛道.

Author: Zuo Ye

The market is neither good nor bad, sentiments are neither ancient nor modern, memes are born and die instantly, and FHE arrives at Privasea.

With the launch of KOL networks, there's been a vague re-education of the FHE sector—people are once again remembering the difference between FHE and ZK, or how DID integrates with NFTs. But none of that matters, because retail investors only care about Binance’s brand effect, crackdowns on market makers, and listing process optimizations.

Not to mention, Privasea is a flagship project backed by Binance in the FHE + DID + AI space. We won't dive into how these components integrate today—because it doesn’t matter.

Caption: YZi invests in Privasea, Image Source: CryptoRank

Crypto + AI is wishful thinking; FHE and DID aren't hot topics either. Combine them and you might summon some market magic, but like Nillion and Arcium, they haven’t found true product-market fit—except for their tokens.

FHE Sector Enters Coma

I’m not saying FHE technology is flawed. Rather, projects in this cycle—including Zama, Inco—have failed to discover application paradigms within crypto. Let me repeat my earlier point:

The integration of ZK with L2/Rollups isn’t driven by privacy needs, but because ZK naturally suits “simple verification” scenarios. When L2/Rollups submit data to L1, ZK proofs allow verification without revealing raw content—the hallmark of “hard to compute, easy to verify.” It’s not that L2s must use ZK; optimistic systems can rely on economic designs (challenge periods).

This is ZK’s real PMF in crypto: enabling more efficient and secure L2/Rollup operations. Re-examining DID, TEE, FHE, and Crypto + AI, we see that beyond tokens, most lack practical use cases or intrinsic value—even ZK hardware faces uncertain prospects.

Back to Privasea’s design: yes, people need privacy-preserving identity verification (DID); yes, users want privacy and encryption when using AI. But that doesn’t mean everyone needs FHE.

In fact, since Zama emerged with massive funding, FHE adoption in crypto has fixated on replicating ZK’s L2 path. Countless products built around Zama’s TFHE library have followed—all merely add-ons to other services.

Privacy is a Feature/Service, But Not a Product.

Privacy Products on the Rise—Signal

There’s both hope and concern. While Privasea offers little excitement, Signal has truly broken through. The U.S. Department of Defense and Vice President Vance are reportedly using it. Compared to Telegram and WhatsApp—both offering E2EE (end-to-end encryption)—Signal enables E2EE by default, whereas the others require manual activation.

Now, even a centralized privacy product is gaining favor from centralized institutions precisely due to its absolute security—proving the viability of privacy-first tools.

More notably, Signal currently runs entirely on donations. It has no ambition to become another Meta or Google, focusing instead on sustainability and pushing technical excellence to the limit.

By 2025, Signal’s annual operating cost could reach $50 million (estimated from 2023 data). For most platforms, growing user data means higher ad revenue. For Signal, it means skyrocketing server costs.

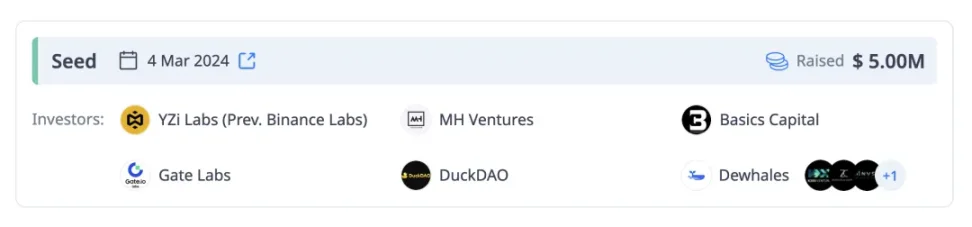

Caption: Signal’s 2013 expense breakdown, Image Source: @signalapp

In 2013, expenses for storage, servers, registration, bandwidth, and miscellaneous items were $1.3M, $2.9M, $6M, $2.8M, and $0.7M respectively. Even though Signal doesn’t permanently store user data, user growth and data volume demand massive infrastructure spending. Whether donations can sustain this long-term remains highly uncertain.

If Signal succeeds purely through donations, its significance would rival Bitcoin’s creation. Previously, tech donations came from big corporations supporting底层 protocols like Linux or Rust—not from small individual contributions sustaining a global consumer-facing social app.

Anticipate new history. I’m bullish on privacy economics taking root in Web2.

History Doesn’t End

Privasea was just a trigger—no deep analysis of profit potential or internal mechanics, and again, it doesn’t matter.

What truly deserves reflection is this: ZK succeeded in B2B crypto applications; end-to-end encrypted social apps like Signal prove sustainable for consumers. Both have passed infancy and entered mass utility. So where does FHE go?

FHE may not be ZK’s next step—but it’s unlikely that FHE *isn’t* ZK’s next step.

Ultimately, the most plausible convergence of FHE and crypto lies in private transactions. Only when the benefits of privacy outweigh the complexity will FHE find its niche.

For example, yesterday Arcium pondered dark pools—large transfers and trades. Entities avoiding secondary market volatility or hackers using alternative channels have real demand here.

Under FHE-enabled transaction paths, whether transferring 1 ETH or trading 1000 WBTC/USDT, nothing is visible—fundamentally mitigating MEV issues. This is far more scientific than Binance simply ordering BNB Chain nodes to disable MEV.

Of course, if it were that simple, Zama would’ve pursued this already instead of laboring over L2/Rollups. The core issue with FHE-based private transactions is ensuring “identity consistency.” On an FHE-powered L2 chain, end-to-end privacy works.

But once those transactions hit Ethereum mainnet, you face a dilemma: keep encryption, and the recipient sees indecipherable gibberish—unable to validate; remove encryption, and congratulations—you never needed FHE in the first place.

How to solve this? The only way is native FHE opcode support at Ethereum’s consensus layer. That would require changes comparable in scale to the PoW-to-PoS transition—essentially impractical.

This likely isn’t the ideal upgrade path. FHE must continue exploring independently.

The Sole Exception

If Ethereum mainnet can’t be modified, then guiding users toward dark pool-style, compliant private transactions (like Railgun) becomes the only viable use case. After the U.S. government lifted sanctions on Tornado Cash, institutional-grade compliant dark pools seem to have regained a sliver of hope.

After Privasea, FHE has rarely been a highlight in project fundraising. FHE-AI/ML/LLM remains academic. I firmly believe blockchain, rooted in cryptography, remains the most fertile ground for FHE innovation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News