IOSG: SIMD 0228, Solana's Growing Pains and Transformation

TechFlow Selected TechFlow Selected

IOSG: SIMD 0228, Solana's Growing Pains and Transformation

Who is actually behind the博弈 in Solana's latest governance proposal, what does it mean, why didn't it pass, and was the process fair and successful? Let's examine each of these questions.

Author | Danny @IOSG

Summary

The SIMD 0228 proposal, a pivotal decision recently capturing the attention of all Solana ecosystem participants, ultimately failed to pass. Voter turnout reached an all-time high in Solana's history (nearly 50% of total token supply), yet the support ratio fell short of the supermajority threshold required for passage (66.67%).

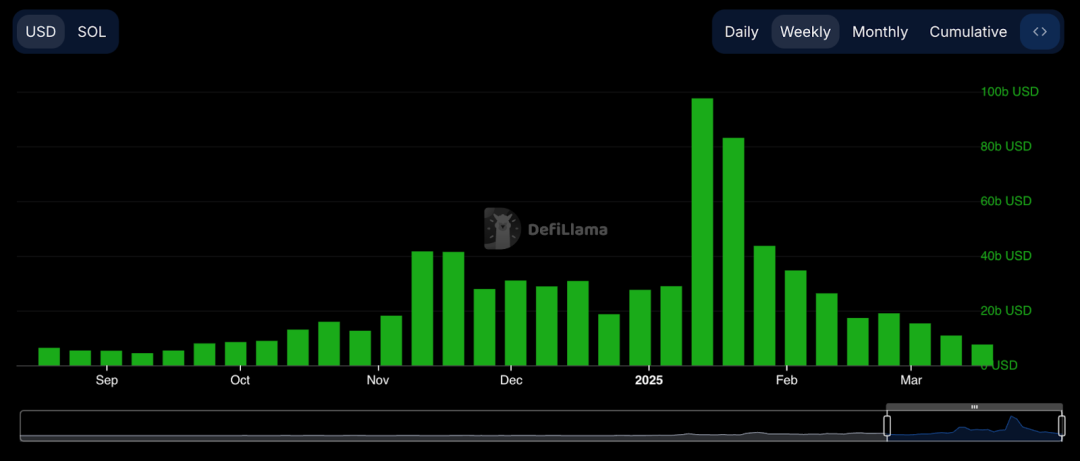

This backdrop coincides with Solana transitioning from the memecoin-driven on-chain frenzy—sparked by Trump’s token launch—into a calmer phase. Weekly trading volume has dropped from nearly $100B at the beginning of the year to under $10B, a 90% decline that now falls below levels seen even before the memecoin surge.

Memecoins propelled Solana into becoming the most successful public blockchain this cycle. As the memecoin wave begins to fade, Solana now faces a transitional period requiring strategic repositioning. At this critical juncture, Multicoin—the largest financial backer of Solana—introduced the 0228 proposal. Its release ignited fierce debate across the community. Twitter became the main battleground, with stakeholders openly declaring positions and lobbying votes until the very last moment.

The debate surrounding the proposal echoed many dynamics previously seen in Ethereum community upgrades. The proposal window was short, combining long-term considerations with immediate fixes, along with several less explicit利益 calculations. However, its transparency allowed us to glimpse the current mindset and strategy of Solana’s leadership.

Despite the rejection, Tushar from Multicoin still called it “a victory,” citing the high voter participation and broad community discussion as proof of Solana’s decentralized governance capabilities.

Who exactly was博弈 behind this governance event? What does it signify? Why did it fail, and was the process fair and successful? Let's examine each aspect.

SIMD 0228 — A Hasty Proposal

What Was the 228 Proposal?

The 228 proposal aimed to dynamically adjust inflation based on staking rates, targeting a stable 50% staking rate while gradually reducing SOL issuance over time.

Solana currently follows a predetermined inflation curve that declines over time. Initially set at 8% when the mainnet launched in March 2019, the current inflation rate is approximately 4.8%, with a long-term target between 1.5% and 2%.

If passed, the proposal would have reduced short-term staking rewards (ranging between 1%–4.5% depending on staking rate) and pushed long-term inflation toward 1.5%.

With the current staking rate at 70%, adoption of 228 would have meant lower near-term returns for stakers, reduced long-term token emissions, and real-time adjustments to staking yields based on network-wide staking levels.

Unlike proposals such as SIMD 0123, where validators can opt in voluntarily, 0228 was mandatory—meaning once activated, it would directly impact every stakeholder.

Supporting Arguments

The proposal was introduced by Tushar and Vishal of Multicoin Capital, supported by Anza and Max, a former Consensys researcher. Their rationale included:

# Reduce unnecessary token emissions and inflationary costs

Solana’s current fixed inflation model represents “dumb emissions” because it fails to account for actual economic activity or security needs of the network. At the start-of-2025 inflation rate of 4.8%, approximately $3.82 billion worth of new SOL would be issued annually (based on an $80B market cap). This high inflation effectively dilutes existing SOL holders, especially given the current staking rate of 65.7%—where network security is already robustly ensured.

Adopting this proposal signifies a shift in philosophy—from “overpaying for security” to “finding the minimum necessary payment.”

Ironically, this mirrors arguments previously made by certain Solana KOLs criticizing Ethereum’s economic security model—namely, that excessive capital supports what they deem a “meme-based” economy.

# Unlock capital to fuel DeFi ecosystem growth

The current high staking rate (65.7%) locks up vast amounts of SOL, restricting liquidity flow within the DeFi ecosystem. Marius, founder of Kamino, noted, “Staking encourages hoarding but reduces financial activity,” similar to how high interest rates suppress investment in traditional finance.

Notably, key supporters of major DeFi protocols on Solana are also backed by the same VCs pushing this proposal, making the motivation to inject liquidity into DeFi undeniable.

# Mitigate the “leaky bucket effect” and enhance ecosystem autonomy

The leaky bucket effect refers to significant value leakage during economic activities within the ecosystem. Since newly minted SOL is treated as ordinary income—and thus taxable in the U.S.—inflation-driven emissions extract proportional value from the entire system. On Solana, this has led to roughly $650 million in taxes and about $305 million in exchange fees flowing out of the ecosystem.

From first principles, Solana has entered a mature phase where the initial, arbitrarily set inflation model no longer makes sense. As blockchain development should center on boosting economic activity, corresponding improvements in inflation design are warranted.

Chris, partner at Placeholder, summarized: true yield should stem from demand-side overflow benefiting the supply side, rather than relying on fixed inflation models designed for cold starts. In the long run, proponents’ arguments hold merit. Once a public chain moves past its bootstrap phase, more idealized economic structures become necessary to sustain development.

Opposing Views

Led by Lily, Chair of the Solana Foundation, a faction opposed passing the proposal. Their primary concern centered not on the idea itself, but on implementing such a transformative change within an extremely short timeframe. Proposals with massive implications for asset characteristics affect various stakeholders differently—network-layer engineers, product-layer developers, and institution-led economic actors. While core network and product teams were heavily involved in discussions, voices from more distant groups—especially institutions and downstream builders—were underrepresented. Therefore, rushing approval without thorough validation was deemed inappropriate.

Many opponents expressed concerns about losing small validators. Smaller nodes lack economies of scale and bargaining power compared to large operators; thus, reduced inflation would disproportionately impact them, potentially undermining Solana’s decentralization. However, after speaking with several Solana node operators, I found most still supported the proposal, largely due to ongoing subsidies and strong belief in SOL’s intrinsic value appreciation. There’s a palpable sense of cohesion within the Solana community—a side note, but telling.

Clearly, both sides agree the current inflation model is flawed and requires improvement. The dispute lies in whether such a change should be rushed through in just two weeks.

Beyond stated reasons,利益 considerations likely played a role. For instance, large SOL holders—particularly those earning high yields from non-staking ecosystems like DeFi—naturally prefer lower inflation. The archetypal beneficiaries here are Solana-backed VCs and their portfolio projects.

Solana is also actively pursuing institutional adoption, including ETFs and traditional finance use cases. Stakeholders focused on institutional onboarding tended to oppose the proposal. Whether SIMD 0228 would benefit institutional uptake remains debatable: proponents argue traditional institutions dislike highly inflationary assets, while opponents believe institutions are more wary of assets with dynamic, unpredictable inflation mechanisms.

In my view, mechanism uncertainty could hinder institutional adoption—while institutions can assess asset properties under a fixed framework, frequent changes create evaluation barriers. Hence, from an institutional standpoint, either fast-track implementation or delay until early adoption milestones are achieved, then negotiate collectively—though later coordination may prove even harder due to increased利益 entanglements.

Why Now?

This raises the question: why push such a significant proposal so urgently?

Possibly because Solana still retains substantial transaction volume amid the fading memecoin hype, keeping validator fee and MEV income elevated. Thus, adjusting staking incentives won’t spark major backlash—at least for now. In 2024, Solana generated $675 million in MEV revenue, showing a clear upward trend. By Q4, node MEV earnings even surpassed inflation rewards. Consequently, validators are currently less sensitive to short-term reductions in inflation income. If this proposal had come during a complete on-chain slowdown, the compounded revenue loss would surely provoke resistance from stakers.

Solana’s restaking era is about to begin, with Renzo, Jito, and others emerging. Looking at Ethereum’s history, liquid staking and restaking introduce substantial supplementary income for validators, reducing reliance on inflation rewards.

The Ethereum Foundation proposed a similar inflation adjustment last mid-year—anchoring staking rates to a fixed level to reduce excess staking. The argument then was that, with economic security already far exceeding requirements, releasing more liquidity could also diminish Lido’s LST dominance over ETH. That proposal sparked brief discussion—an OG reevaluation of PoS economic mechanics post-transition from PoW. Though well-supported by modeling and analysis, it stalled due to unresolved theoretical questions. Ethereum’s experience may have informed 228, but also highlighted how difficult it is to pass proposals that cut established利益 streams.

The outcome was predictable. Perhaps under Foundation guidance, validators developed bearish sentiment toward the proposal, influenced by concerns over institutional adoption. Or perhaps the move felt too abrupt, preventing consensus formation among validator ranks. Alternatively, smaller validators may have collectively perceived short-term income pressure and voted against it. Wide discussion doesn't necessarily mean deep discussion—without depth,分歧 emerge. The rushed nature of the proposal reveals unclear alignment across Solana stakeholders regarding the chain’s current stage and future direction, reflecting growing pains after the memecoin supercycle.

The Governance Process Was a Victory

While undeniably hasty, the proposal triggered remarkably transparent and open debates within just a few weeks. Both sides spoke candidly on Twitter, taking clear pro/con stances with detailed reasoning. This format enabled everyone to understand opposing viewpoints. At peak intensity, stakeholders even hosted a Twitter Space for direct dialogue.

Another highlight was the inclusion of broader community input. Numerous Solana project founders and builders shared balanced perspectives on Twitter, receiving responses and being invited into the Space discussions. The proposal evolved from an abstract formula into a living conversation shaped by community voices. One common criticism—that token stakers cannot directly vote—created internal tension for large validators, forcing them to reconcile diverse stakeholder opinions before casting final votes. This is a challenge all blockchains must confront; Solana brought it into sharp focus for the first time.

Despite the controversy, 74% of staked supply participated, demonstrating strong community engagement. SIMD’s clearly defined voting rules and thresholds made the decision-making process transparent and predictable. In contrast, Ethereum’s upgrade process relies mainly on informal developer consensus, lacking formal voting mechanisms.

Finally, there's efficiency. Even if criticized as too rushed, completing the full cycle—from proposal submission to voting conclusion—in under two months underscores the speed at which ideas are executed across the Solana ecosystem. This is precisely why Tushar views the episode as a win.

Conclusion

Overall, the SIMD228 proposal reflects Solana’s transition beyond the boom phase of reinventing asset issuance, entering a new era defined by institutional adoption and continued development of consumer-facing dApps. The emergence of conflicting interests served as the catalyst for this event.

Proponents sought to leverage the current period of on-chain vitality to push reforms swiftly through minor friction—but the haste resulted in intense yet insufficient discourse, inadequate outreach and education for smaller validators, and fragmented validator consensus. Despite its brief lifecycle, the proposal showcased Solana’s execution capability and openness, setting a benchmark in decentralized governance worthy of emulation by other ecosystems.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News