When SEC Officials Receive Bullets in the Mail: Who Is Managing $744 Million to Go Long on Bitcoin?

TechFlow Selected TechFlow Selected

When SEC Officials Receive Bullets in the Mail: Who Is Managing $744 Million to Go Long on Bitcoin?

Regulation, technology, and the contest for sovereignty are reshaping the power landscape of the crypto world.

By Lawrence

On March 21, 2025, the atmosphere at the U.S. Securities and Exchange Commission’s (SEC) inaugural crypto roundtable was charged with tension. When former SEC enforcement official John Reed Stark bluntly stated that "crypto investors have received death threats," the debate over “security classification” had already evolved beyond a mere legal framework dispute—it became an existential battle for the survival of the entire crypto industry. At the same time, Bitcoin ETFs recorded $744 million in weekly inflows, ending a five-week losing streak, while Ethereum on-chain activity plunged to historic lows. This dual upheaval of regulation and market dynamics is reshaping the power structure of the crypto world.

The SEC's "War for Definition": Regulatory Fractures Behind Death Threats

Members of the first SEC cryptocurrency roundtable panel

On March 21, 2025, during the SEC’s inaugural crypto roundtable, the remarks by former enforcement officer John Reed Stark exploded like a deep-sea mine, igniting a decade-long covert war between regulators and the crypto community: “Every time I publicly advocate for stronger regulation, I receive death threats from crypto investors.” This raw accusation not only exposed the bloody divide between regulators and the crypto community but also pushed the ultimate battle over “security status” to its breaking point.

The fuse for this conflict was lit long ago. Since the SEC launched a series of lawsuits against Coinbase and Binance in 2022, the confrontation between regulators and crypto firms has spilled from courtrooms into public life. Records from SEC Chair Gary Gensler’s office show he received over 200 death threat emails globally between 2023 and 2024. One anonymous letter from Australia even included a photo of a bullet, stating, “Crypto freedom shall not be tainted.” Behind these extreme acts lies a desperate resistance by crypto fundamentalists against the SEC’s strategy of “full securitization”—if 90% of tokens are classified under securities regulations, the very existence of decentralized finance (DeFi) would be strangled.

Yet the SEC’s hardline stance is not acting alone. A newly formed, Republican-led SEC commission is attempting to redraw the crypto power map: the resignation of former Chair Gary Gensler and the establishment of the Crypto Task Force signal that the Trump administration is dismantling Democratic-era policies through a “reallocation of regulatory authority.” Acting Chair Mark Uyeda revealed in a closed-door meeting that the SEC may issue “non-security declarations” to exempt NFTs and utility tokens, a policy shift that could fundamentally alter compliance costs for exchanges like Coinbase and Kraken.

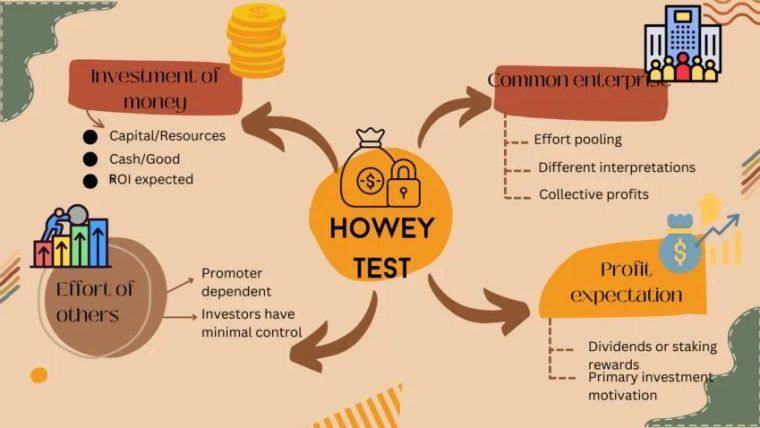

The Howey Test is a legal framework used to determine whether certain crypto assets qualify as securities

The core of this definitional struggle is a head-on collision between the 1930s-era Howey Test and the Fourth Industrial Revolution. Teresa Goody Guillen, partner at BakerHostetler, sharply noted during the roundtable: “As distributed ledger technology (DLT) reshapes global commerce, the SEC attempts to unlock digital-age regulation with a rusty key labeled ‘investment contract.’” This contradiction is especially evident in the NFT space—while the SEC tacitly accepts non-security status for flagship projects like BAYC and CryptoPunks, it simultaneously files successive lawsuits against social tokens and fan economy NFTs, revealing a fragmented and opportunistic regulatory logic.

Bitcoin ETF's "Fire-and-Ice Reversal": The Hidden Truth Behind $744 Million Weekly Inflows

While regulators remain mired in definitional battles, capital is rewriting the market narrative with real money.

From March 17–21, U.S. Bitcoin ETFs saw $744 million in net weekly inflows, ending five consecutive weeks of outflows. BlackRock’s IBIT alone attracted $105 million in a single day, pushing its total net inflow past $36 billion.

Yet behind this “institutional buying wave,” a hidden arbitrage game is unfolding: the premium rate of Bitcoin futures on the Chicago Mercantile Exchange (CME) has narrowed to below 2%, eliminating the arbitrage spread between spot ETFs and futures contracts. Nearly 40% of the inflows have been verified as unrelated to “genuine demand.”

More concerning is the divergence in market sentiment. Despite Bitcoin trading sideways between $83,000 and $85,500, on-chain data tells a different story: Glassnode shows long-term holders (LTH) accumulated 250,000 BTC—worth about $21 billion—over the past 45 days, while Bitcoin reserves on centralized exchanges dropped to their lowest level since 2021. This growing gap between “institutional accumulation” and “retail withdrawal” suggests the market is building momentum for another volatile surge.

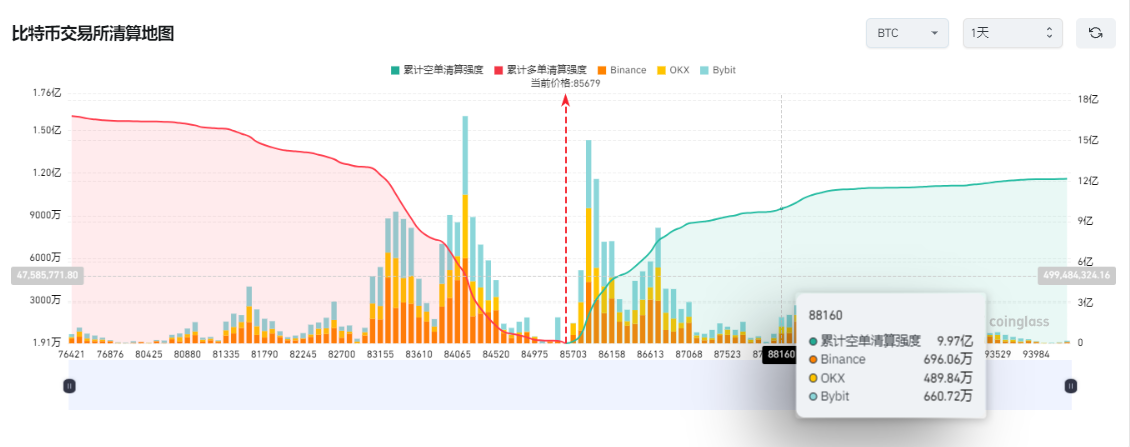

According to Coinglass liquidation data, if Bitcoin surpasses $88,000, approximately $1 billion in short positions could be liquidated.

Ethereum’s "Darkest Hour": Ecosystem Collapse Beneath Layer2 Prosperity

As Bitcoin ETFs regain investor favor, Ethereum’s ecosystem is experiencing an unprecedented winter.

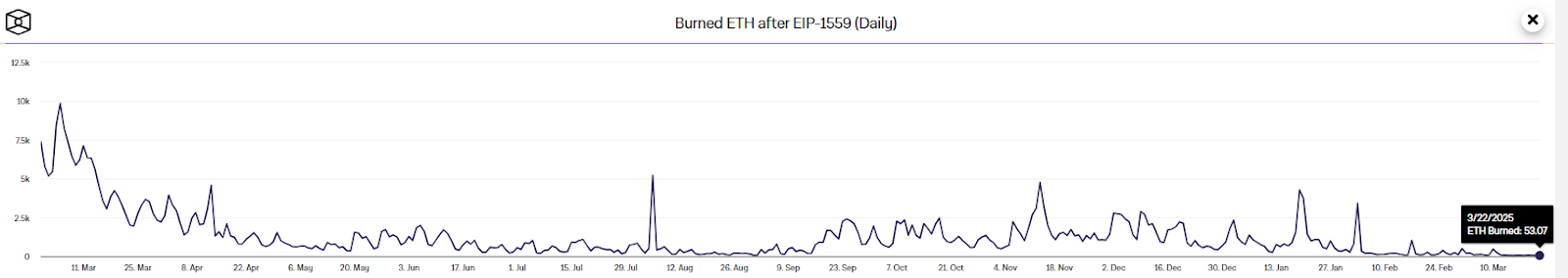

Data from The Block shows that on March 22, Ethereum’s daily burn dropped to just 53.07 ETH (approximately $106,000), down 99% from its 2024 peak. On-chain transaction volume, active addresses, and gas fees all fell to historic lows.

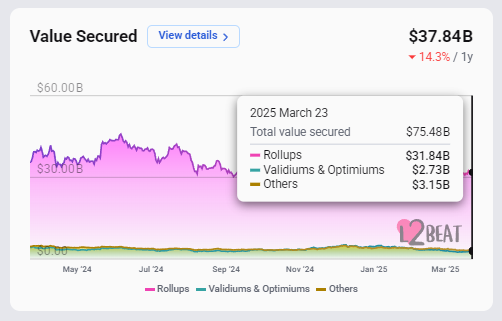

In contrast, the total value locked (TVL) across Layer2 networks rose to $37.8 billion. However, major networks like Base and Arbitrum now account for 80% of DEX trading volume—a paradox of “mainnet hollowing” and “Layer2 dominance” that reveals fundamental flaws in Ethereum’s economic model.

Standard Chartered intensified market concerns by slashing its 2025 Ethereum price target from $10,000 to $4,000, citing the “siphoning effect” of Layer2 on the mainnet: “Base and other Layer2 solutions capture 80% of ecosystem growth but return less than 20% of fee revenue to the mainnet.” This unsustainable revenue split has driven the ETH/BTC exchange rate to a record low of 0.023, underperforming even competing public chains like Solana.

An even deeper impact stems from regulatory uncertainty. While the SEC carved out a safe zone for PoW assets like Dogecoin in its “Meme Coin Statement,” it remained silent on Ethereum and Layer2 tokens.

This ambiguity prompted Grayscale’s ETHE fund to see $102 million in outflows in a single week, with cumulative outflows exceeding $730 million over four consecutive weeks—eroding Ethereum’s foundation as an “institutional-grade asset.”

Paths to Breakthrough: Regulatory Arbitrage, Technological Revolution, and Sovereign Competition

Three variables will determine the ultimate trajectory of the crypto market amid this multi-layered crisis:

1. The End and Rebirth of Regulatory Arbitrage

The SEC’s crackdown on “securitized tokens” has expanded from exchanges to Layer2 protocols. In March 2025, Coinbase announced the acquisition of Deribit and assumed its Dubai license, signaling that U.S. companies are leveraging offshore structures to evade regulatory risk. Yet the Trump administration’s concurrent push for the Stablecoin Act indicates sovereign states won’t tolerate regulatory vacuums—the bill mandates 1:1 cash reserves for stablecoin issuers and bans tech companies from issuing them. This “precision strike” could reshape the $120 billion stablecoin market.

2. The Paradox and Breakthrough of Technological Revolution

Ethereum developers postponed the Prague upgrade for the 153rd time, exposing stagnation in technical progress. In stark contrast, Bitcoin’s ecosystem is booming: the Ordinals protocol drove on-chain NFT trading volume past $1 billion, while the Rune protocol increased BTCFi TVL by 300% in one month. As “Bitcoin programmability” moves from concept to reality, this self-revolution of the “ancient blockchain” could upend the survival logic of so-called “Ethereum killers.”

3. The Rise and Clash of Sovereign Digital Assets

Putin’s declaration that “no one can ban Bitcoin” resonates with Trump’s pro-crypto stance. Russia plans to build a compliant Bitcoin trading system via the Moscow Exchange (MOEX), while India’s digital rupee pilot has drawn back 15% of offshore crypto funds. This “sovereign digital race” is eroding the dominance of dollar-backed stablecoins and may give rise to a new geopolitical financial order.

Conclusion: Seeking Certainty Amid Order Reconstruction

In 2025, the crypto world stands at the fault line where traditional finance collides with decentralized ideals. The SEC’s regulatory battles, the institutional narrative around Bitcoin ETFs, and Ethereum’s ecosystem crisis together paint a highly tense industry landscape. When death threats and trillions in capital flood the same battlefield, when an 89-year-old legal test confronts the Fourth Industrial Revolution, this transformation has long transcended technology—it has become an epic experiment in redefining humanity’s value exchange system.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News