After consecutive sharp declines, reversal signals gradually emerge in U.S. stocks

TechFlow Selected TechFlow Selected

After consecutive sharp declines, reversal signals gradually emerge in U.S. stocks

Short squeeze, seasonal factors, sentiment hitting bottom, pension fund rebalancing, sustained retail buying, and dry powder liquidity may drive a rebound.

A one-sentence summary: Short squeeze, seasonal factors, sentiment bottoming, pension fund rebalancing, retail investors continuing to buy, and dry powder in money markets could drive a rebound.

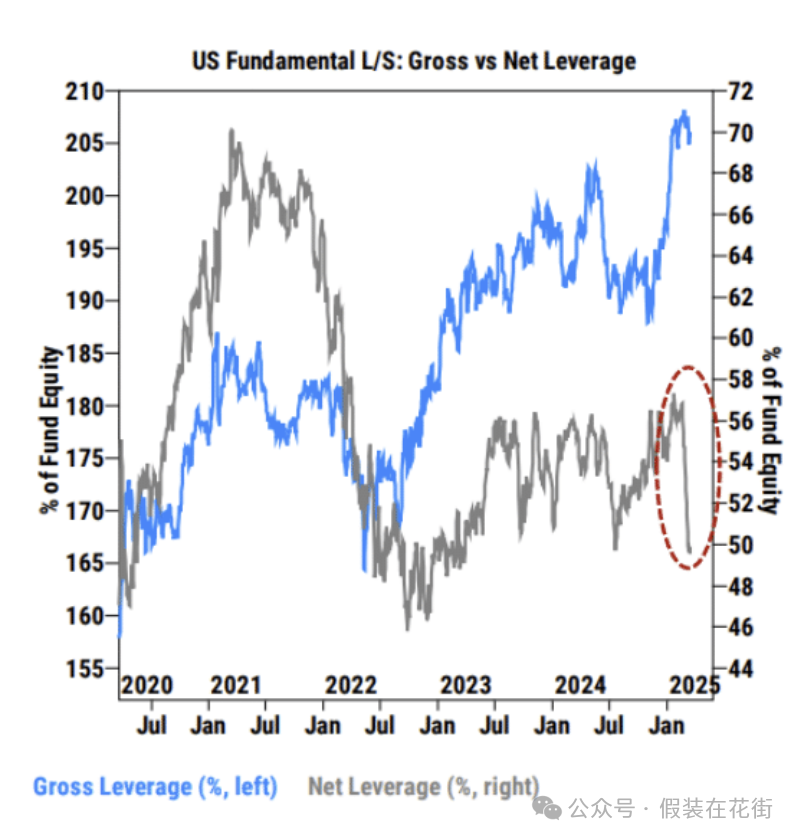

As of March 20, Goldman Sachs trading desk data shows:

The net leverage ratio of U.S. fundamental hedge funds (gray line in the chart above) has dropped sharply to 75.8%, a two-year low;

However, the gross leverage ratio (blue line in the chart above) remains high at 289.4%, the highest level in five years—clearly due to rising short positions;

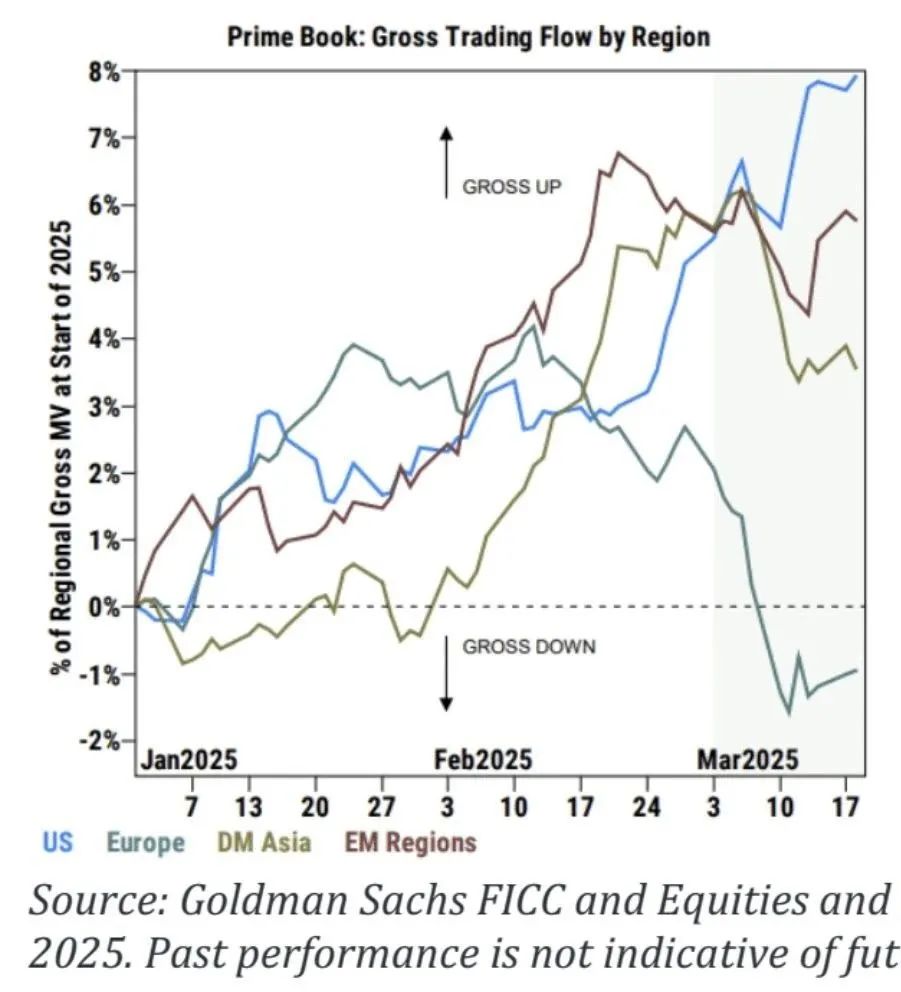

The chart above shows that fund gross leverage surged by 2.5% in March in the U.S., while global ex-U.S. markets saw deleveraging;

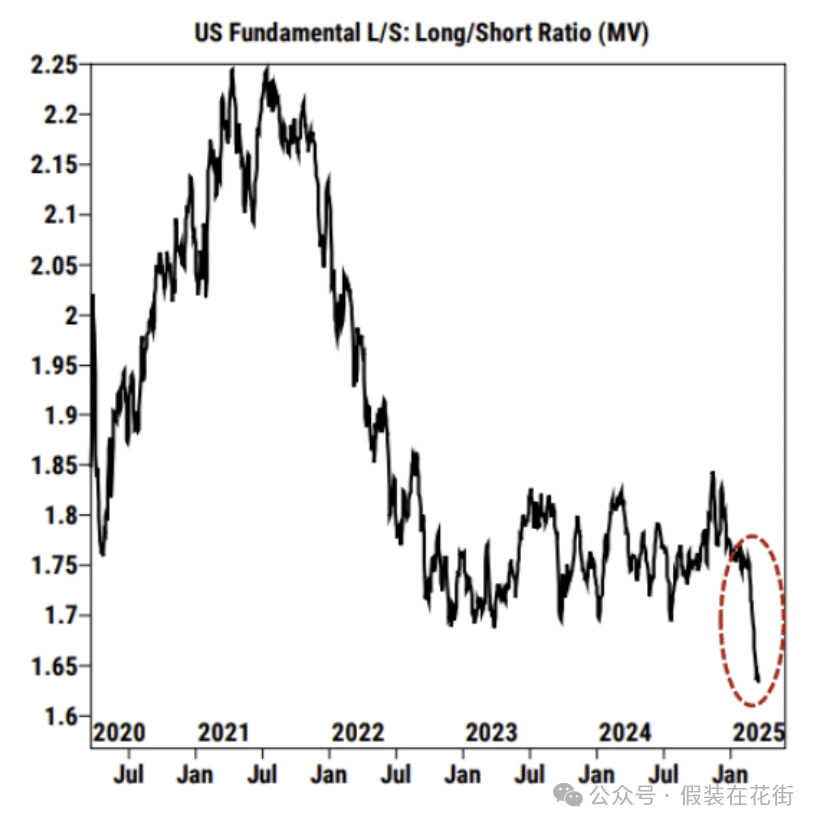

The long/short market value ratio has fallen to 1.64, the lowest level in over five years;

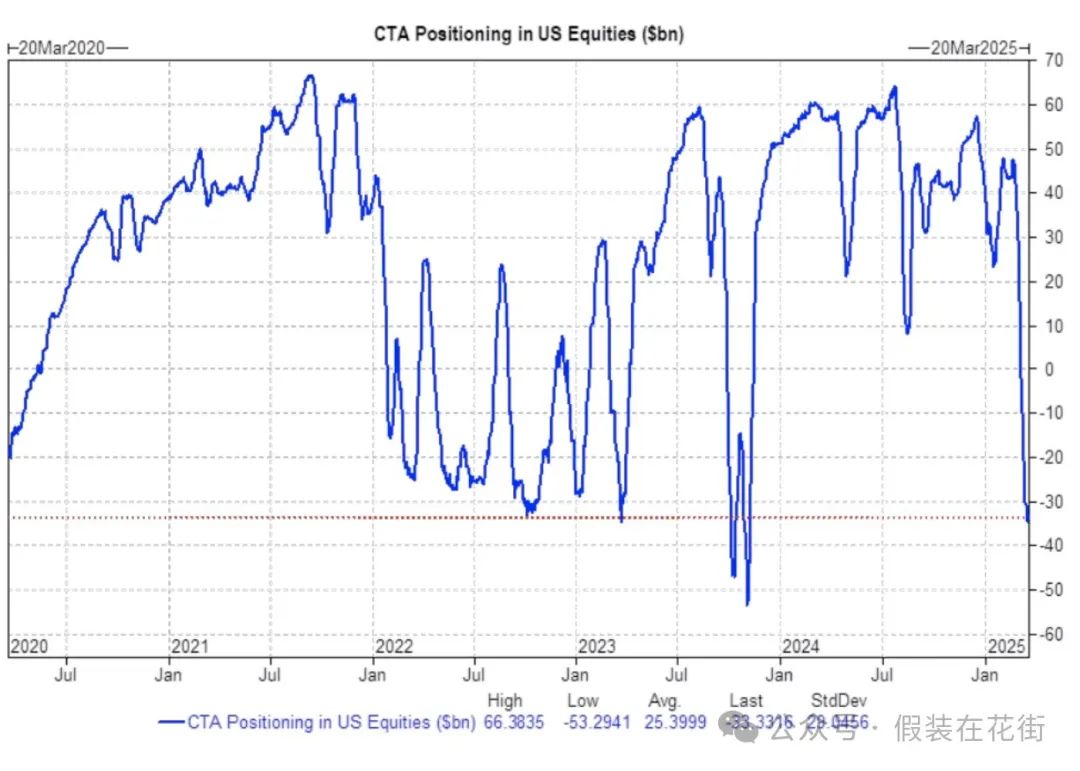

CTA funds have turned net short on U.S. equities for the first time in a year and a half;

CTA funds have turned net short on U.S. equities for the first time in a year and a half;

The above indicates that while some de-leveraging has occurred, there is still room for further de-leveraging ahead of tariff implementations—suggesting we are close to a potential reversal.

The rise in gross leverage is driven by increased leveraged short positions, which could be positive: data suggests hedge funds are reluctant to cut long exposure significantly, instead relying on externally financed short hedges. When market volatility spikes, lenders may issue margin calls, forcing short sellers to cover positions or sell other assets to meet margin requirements—significantly increasing the probability of a short squeeze. If funds choose the latter—selling other assets—it could amplify market volatility.

Note: This does not imply an inevitable rally, but rather that if a rally occurs, it could be amplified by a short squeeze.

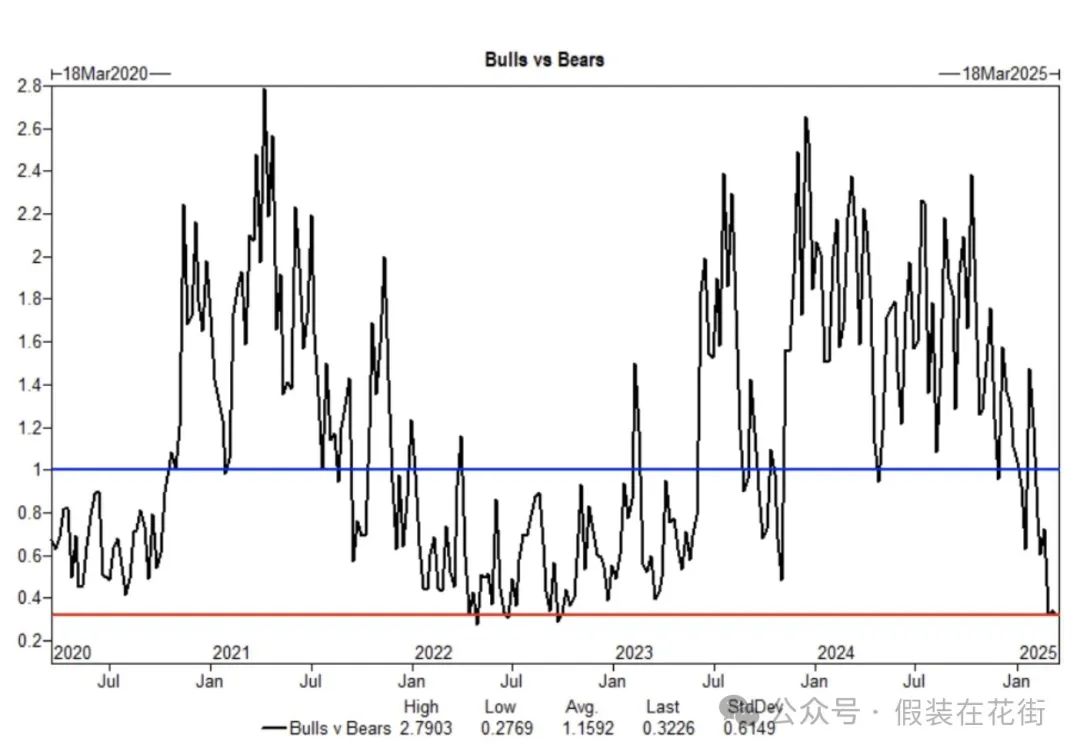

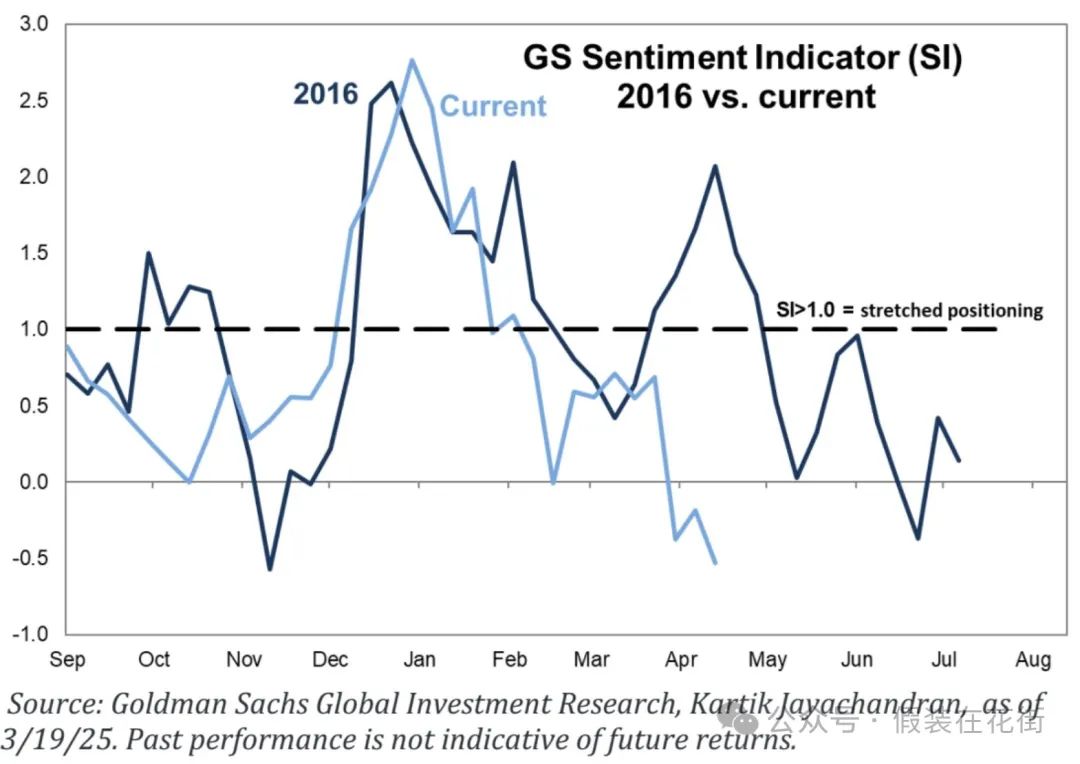

Market sentiment has hit rock bottom, returning to an environment where "good news is treated as good news," suggesting potential for sentiment recovery:

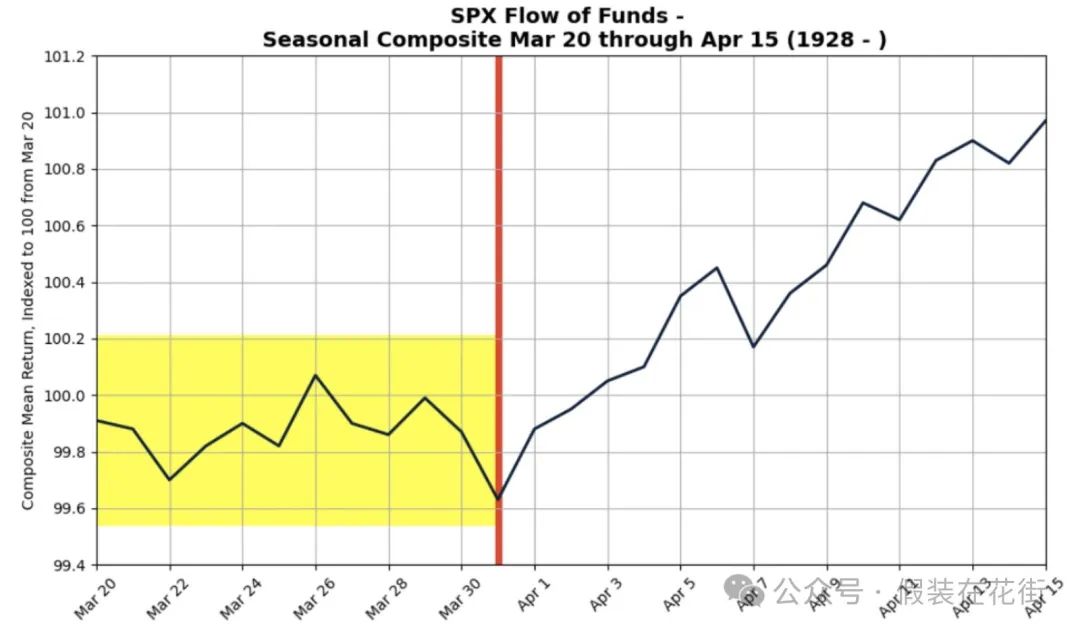

Seasonal headwinds are nearing their end:

Historical data since 1928 shows that the second half of March tends to be volatile—and this year is no exception.

However, the S&P 500 has averaged a 0.92% gain from March 20 to April 15, and 1.1% from the end of March to April 15.

This suggests potential for a seasonal rebound in April, albeit with limited magnitude. After April 2, markets may stabilize barring any major unexpected events.

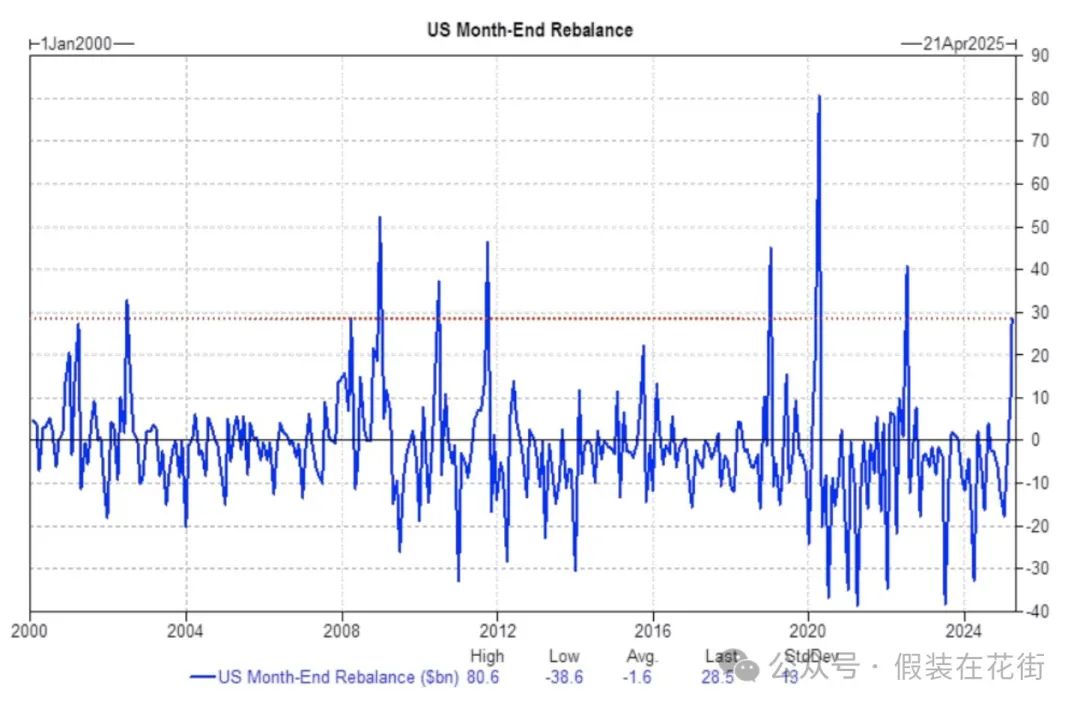

U.S. pension funds are expected to buy $29 billion in U.S. equities at quarter-end, placing this figure at the 89th percentile of absolute values over the past three years and the 91st percentile since January 2000. This could provide some market support:

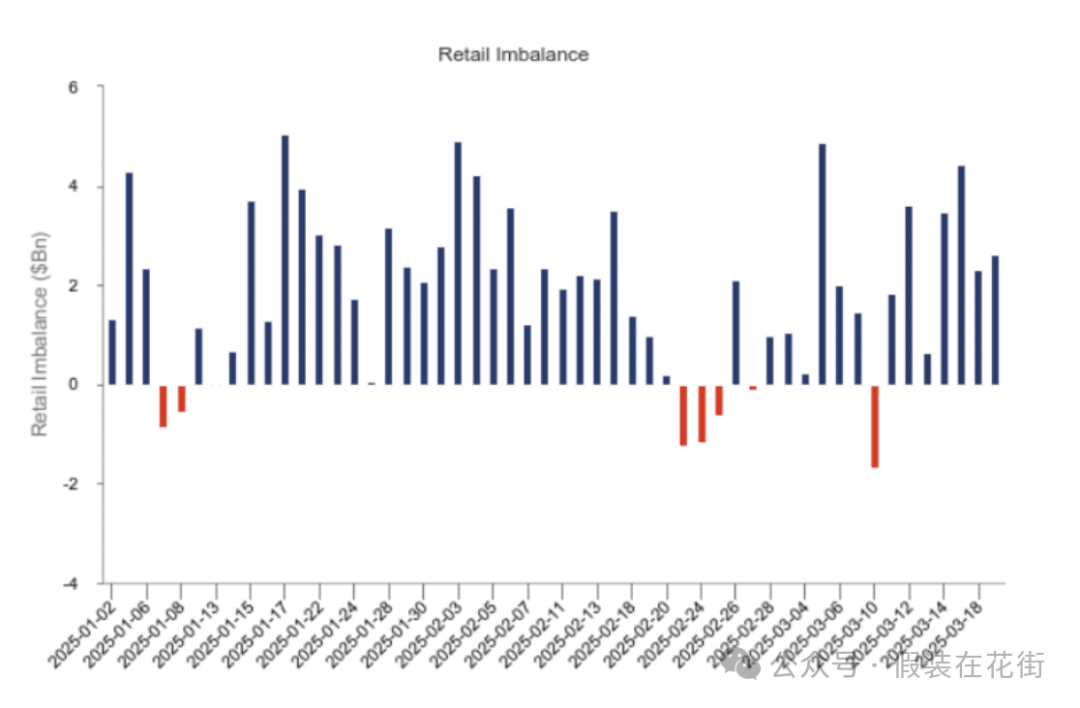

Despite market volatility, retail investor participation has remained stable. In 2025 to date, retail investors have seen net selling on only 7 trading days, with cumulative net buying reaching $1.56 trillion.

In addition, money market funds (MMFs) in the U.S. continue to grow, now holding $8.4 trillion in assets—representing cash reserves from retail and other investors. Once market sentiment improves or investment opportunities emerge, this dry powder could quickly translate into equity buying power.

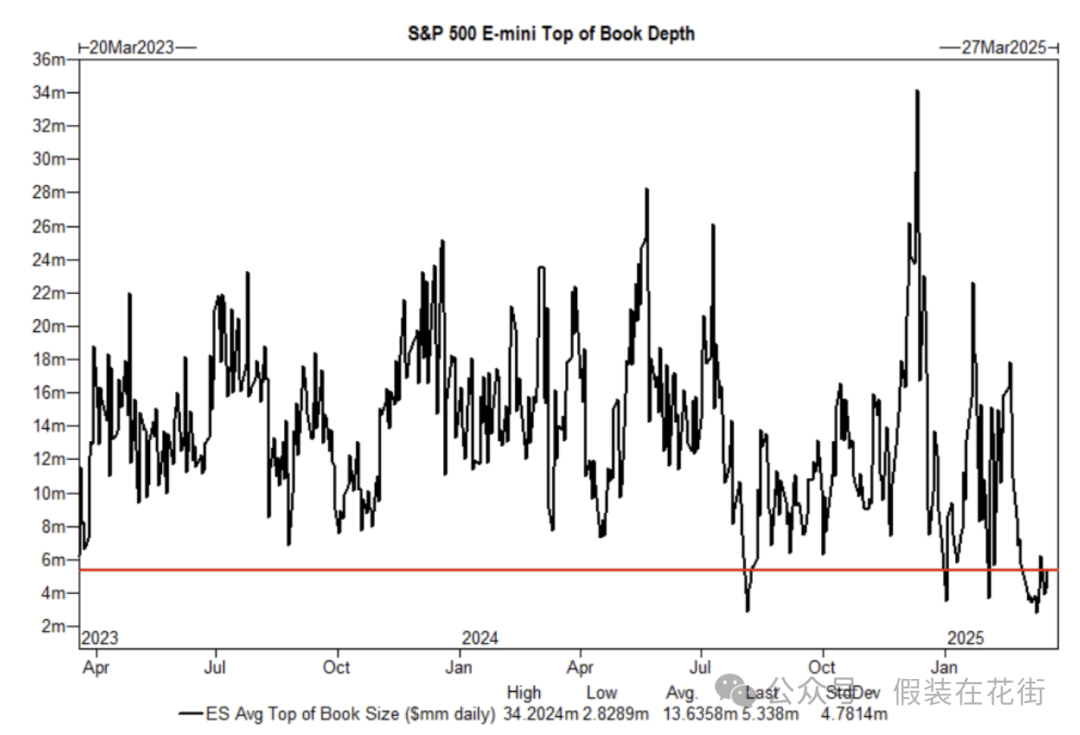

Market liquidity remains thin, explaining why intraday volatility is often so high—risk awareness is critical:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News