Coinbase Monthly Outlook: The liquidity turning point has arrived, and Bitcoin may bottom out in the coming weeks

TechFlow Selected TechFlow Selected

Coinbase Monthly Outlook: The liquidity turning point has arrived, and Bitcoin may bottom out in the coming weeks

Overall, this quarter could mark the annual low point for cryptocurrency prices in 2025.

Author: David Duong, CFA - Global Head of Research

Translation: Tim, PANews

Recent market developments have shaken our confidence in the more positive outlook we previously held for Q1 2025 (a view initially expressed in December 2024), as tightening liquidity and macroeconomic uncertainty have eroded investor sentiment. Market consensus now appears broadly pessimistic—evident in crypto’s total market capitalization falling below pre-U.S. election levels and perpetual contract funding rates declining sharply. We believe the speed and magnitude of this market correction have indeed left many investors disoriented.

The current bearish sentiment is primarily driven by concerns over an unstable trajectory of economic activity, especially after many investors focused heavily in recent months on the "American Exceptionalism 2.0" narrative. In the context of crypto markets, the momentum from sector-specific catalysts appears to have slowed, leaving many market participants anxious. Nevertheless, we view this prevailing pessimism as a strong signal that the market may be nearing a bottom in the coming weeks—laying the foundation for new highs later this year.

Note: American Exceptionalism is one of the core ideologies throughout U.S. history, asserting that the United States possesses uniqueness or even superiority in political systems, values, and development paths compared to other nations. This concept has shaped American national identity and profoundly influenced its domestic and foreign policies.

Global liquidity is beginning to recover, and declining real and nominal interest rates should eventually help lower borrowing costs. We also believe long-term trends are likely to continue supporting global growth. That said, we think crypto markets are unlikely to stage a meaningful rebound before traditional risk assets do, so we are closely watching for signs of capitulation selling in U.S. equities. Earnings season (April) may offer a clearer picture of the true state of U.S. consumers than survey data alone. While we maintain constructive expectations for Q2 2025, we advise investors to remain neutral toward risk assets at present.

When Will It Bottom?

Despite several recent favorable developments in the crypto space—such as the repeal of SAB 121, the formal establishment of a Bitcoin Strategic Reserve, and the SEC dropping multiple lawsuits against crypto entities including Coinbase—the crypto market has remained weak since the start of the year. Additionally, the “Stablecoin Innovation and Consumer Safety Act” may be introduced to the U.S. House and Senate as early as summer 2025.

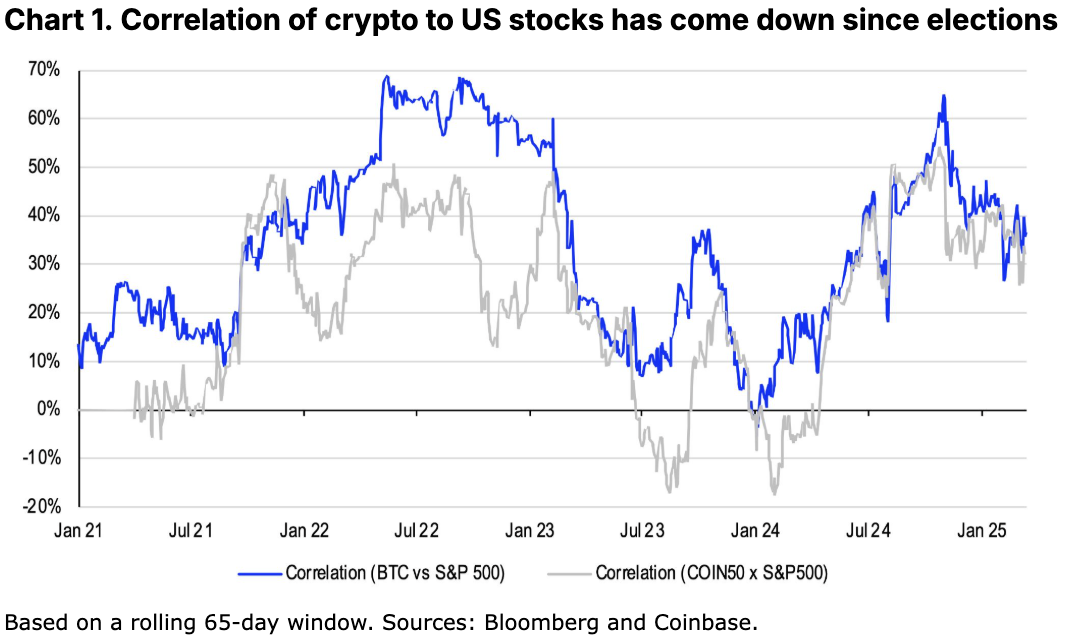

Although regulatory news has turned positive, many market participants worry that crypto-specific catalysts are losing momentum. As a result, macro factors have become dominant, increasing the correlation between crypto and U.S. equities. Indeed, the clear co-movement between traditional risk assets and crypto markets recently indicates that our earlier optimistic outlook for Q1 2025 was clearly mistaken.

Concerns about a sharp slowdown or even recession in the U.S. economy have caused a sudden deterioration in market sentiment, answering a question we raised in our previous monthly outlook: whether market participants would interpret the impact of tariffs as inflationary or deflationary. Currently, expectations for the federal funds rate have shifted from pricing in just one rate cut in 2025 to three.

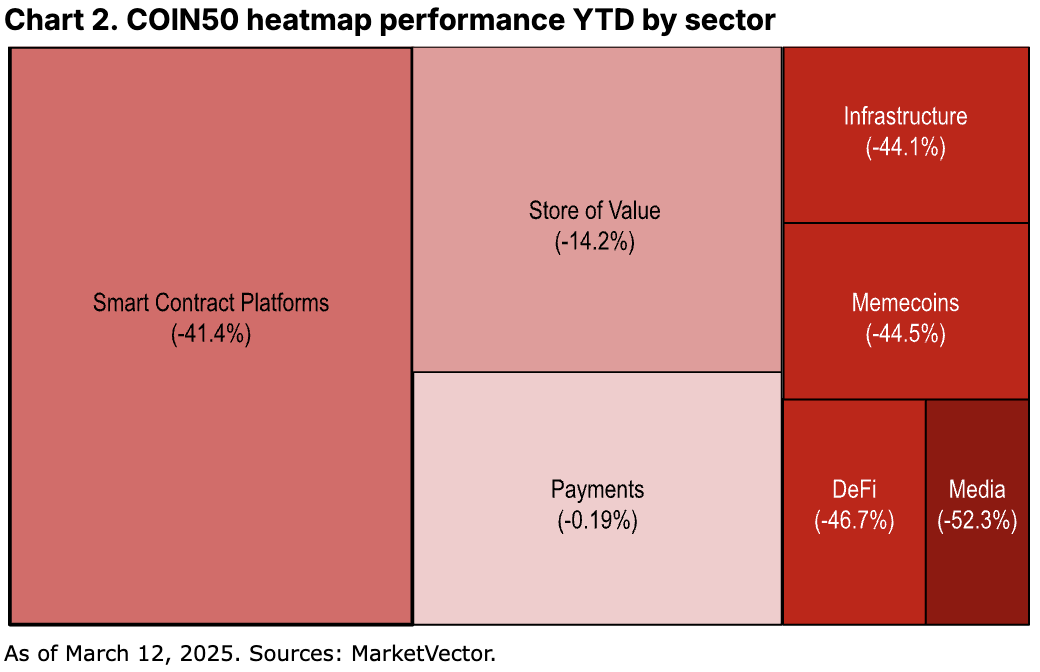

This sell-off has driven our Coinbase 50 (COIN50) index down 25.5% year-to-date, wiping out $532 billion in crypto market value. Interestingly, apart from media and entertainment, there has been little differentiation in the degree of decline across sub-sectors within the index. DeFi, Memecoins, and infrastructure all experienced similarly severe drawdowns. This underscores broad-based risk aversion across the market, with little selective consideration being given to individual project fundamentals or revenue-generating capacity.

Overall, we believe this quarter could mark the annual low point for crypto asset prices in 2025, as structural tailwinds—including tax reductions, regulatory easing, and other fiscal stimulus measures—are likely to materialize later this year. Stablecoin balances have now risen to $229 billion (source: DeFiLlama), reflecting significant investor flight to safety via stablecoins and pushing stablecoins’ share of total crypto market cap up to 8.5% (from 6.3% at the beginning of the year). Furthermore, we believe long-term trends such as artificial intelligence are poised to deliver on their promise of boosting economic productivity in the near term.

Cognitive Bias

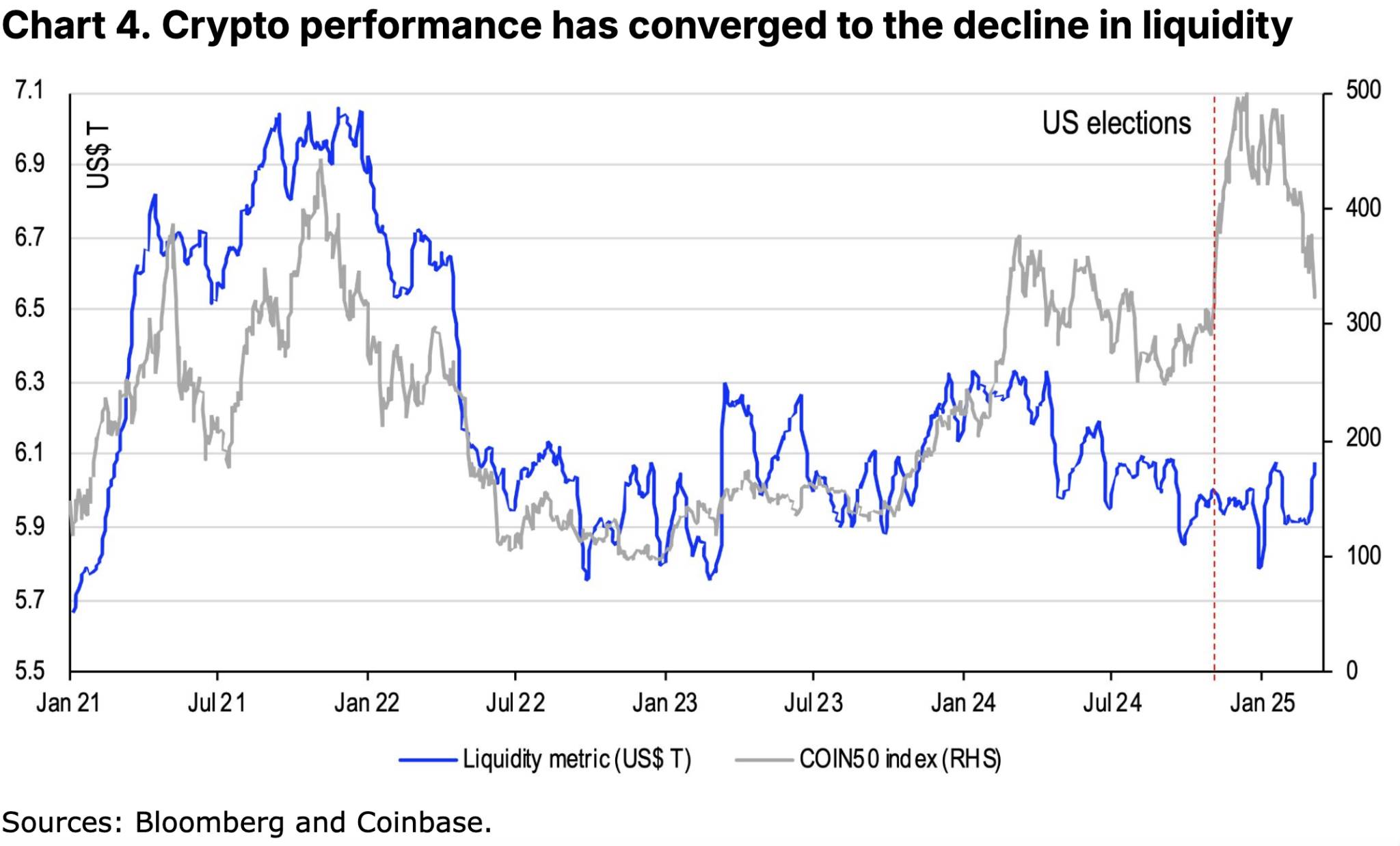

We also do not see the recent weakness in crypto markets as anomalously disconnected from today’s tight macro conditions. Rather, the actual divergence occurred between November 2024 (U.S. election) and January 20, 2025 (inauguration), when crypto assets decoupled from traditional risk assets. Despite gradually tightening liquidity conditions starting in H2 2024, the COIN50 index rose over 67% during that period (see Chart 3).

If we focus on the Federal Reserve's total assets minus reverse repurchase agreements (reverse repos) and the Treasury General Account (TGA) balance as a proxy for market liquidity, this indicator has declined from approximately $6.2 trillion in early June 2024 to nearly $5.7 trillion at the start of 2025—a drop of over $500 billion (see Chart 4). Generally, expansion of the Fed's balance sheet injects liquidity into markets, while reverse repo operations absorb excess banking system liquidity, and increases in TGA balances reduce available cash in the financial system.

Liquidity is the lifeblood of any market, facilitating investor participation, leverage, and efficient price discovery, thereby channeling savings to borrowers. Conversely, liquidity contraction tends to suppress trading activity and can lead to heightened price volatility. However, despite declining liquidity in H2 2024, the key driver behind surging crypto prices during that period was market anticipation of a major shift in U.S. regulatory policy—the U.S. election represented a pivotal event with relatively binary outcomes for investors. In our view, the recent crypto sell-off largely reflects a reversion of prices to reflect lower liquidity conditions.

In our view, this may actually be a potential positive signal. Over the past two months, the Treasury General Account (TGA) balance has declined from $745 billion at the end of 2024 to $500 billion as of March 12, helping push aggregate liquidity back above $6 trillion. Moreover, current bank reserve levels stand near 10–11% of GDP, widely considered sufficient to maintain financial stability. This suggests the Federal Reserve could potentially pause or even terminate quantitative tightening at the FOMC meeting on March 18–19.

All these signals suggest that market liquidity may be returning. The yield on the U.S. 10-year Treasury is likely to move lower, as Treasury Secretary Bessent has clearly stated the administration is committed to reducing long-term interest rates. We believe it is unwise to question his policy resolve. From the perspective of Fed models, lower yields increase the present value of future cash flows for risk assets like equities—an effect that could also lift crypto asset prices.

Conclusion

Crypto markets have faced significant challenges recently due to heightened volatility and macroeconomic uncertainty. Nonetheless, we remain constructive on the prospects for the coming months, supported by accelerating regulation and growing institutional participation. Moreover, following nearly six months of liquidity tightening, the shift toward looser conditions may lead crypto asset prices to bottom faster than most market participants anticipate. Therefore, we take a constructive stance on the crypto market for Q2 2025. That said, near-term positive catalysts remain limited, and caution remains warranted for now.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News