What do users want if they neither want VC coins nor meme coins?

TechFlow Selected TechFlow Selected

What do users want if they neither want VC coins nor meme coins?

When will the next bull market be? 2025?

Author: Fu Shaoqing, SatoshiLab, Wandi Island BTC Studio

1. Preface

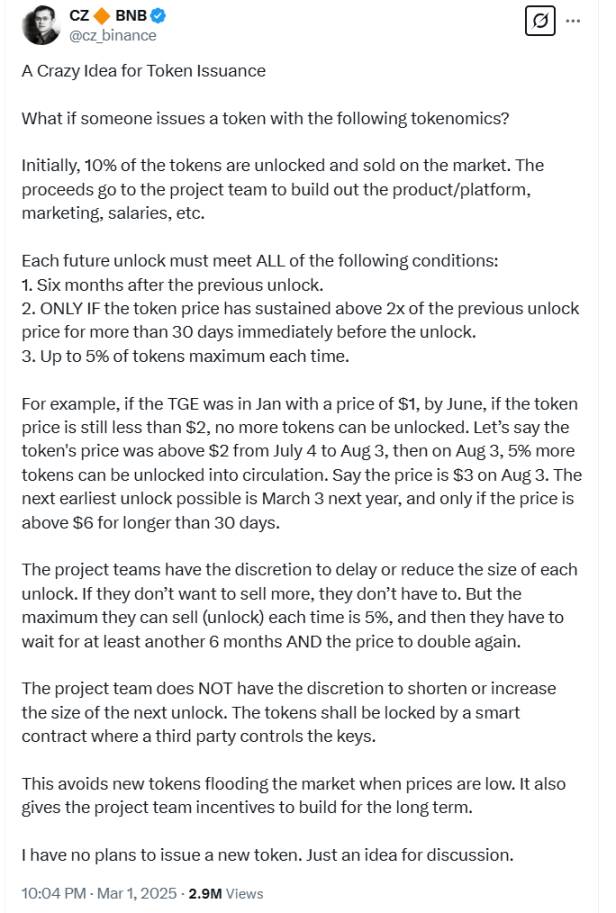

It's not just VC tokens and meme coins that have prompted deeper reflection—many well-known figures in the industry have raised similar concerns, all striving to find solutions. For example, during He Yi’s Twitter Space session discussing her friend’s token, Jason (Chen Jian) questioned whether Binance has mechanisms to prevent project teams from dumping tokens after listing and then abandoning development. Similarly, CZ’s recent article “A Crazy Idea for Token Issuance” attempts to address these systemic issues.

I believe every team genuinely committed to building projects hopes the market rewards real contributors rather than allowing Ponzi schemes, scammers, and speculators to capture the industry's benefits and disrupt its progress.

Given that VC tokens and meme coins offer excellent case studies, this article will analyze both phenomena.

2. The Evolution of VC Tokens

VC tokens did not emerge out of thin air—they arose due to historical circumstances. Although imperfect by today’s standards, they played an important role in early ecosystem development, with most major blockchain projects having received VC backing.

2.1. The Chaos of ICOs in 2017 – A Feeding Frenzy

2017 marked a pivotal year for Initial Coin Offerings (ICOs) in the blockchain space. It is estimated that over $5 billion was raised through ICOs that year alone. Beyond the classic examples discussed below, I personally participated in smaller ICOs, experiencing firsthand the frenzy of that era—an environment so irrational it could truly be described as chaotic. At the time, any project launching an ICO would instantly sell out if someone prominent endorsed it and the whitepaper looked decent—even posting something absurd like a pile of excrement into a group chat might have been snatched up immediately. Skeptics can look up details about MLGB (Ma Le Guo Coin) to see how extreme things got. (This also reflects the immense power of ICOs.)

Based on discussions with DeepSeek and ChatGPT, along with my own understanding, I summarize the reasons behind the explosion as follows:

(1) Mature token issuance technology: Especially with the launch of Ethereum, developers could easily create smart contracts and decentralized applications (DApps), fueling the rise of ICOs.

(2) Other contributing factors included growing market demand, increasing acceptance of decentralization, widespread optimism about the future, and low barriers to entry for investment.

Several notable cases emerged during this period:

(1) Ethereum: While Ethereum conducted its ICO in 2014, 2017 saw its platform widely adopted for new project ICOs via ERC-20 tokens. Overall, Ethereum has proven highly successful and now ranks second only to Bitcoin in the crypto world.

(2) EOS: EOS conducted a year-long, phased ICO in 2017, raising nearly $4.3 billion—one of the largest ICOs at the time. However, the project has since faded into obscurity due to flawed technical direction and poor alignment with market needs.

(3) TRON: TRON’s 2017 ICO raised significant funds amid controversies around token swaps and plagiarism allegations. Yet, it developed rapidly afterward and attracted considerable attention. Compared to failed projects, hasn’t Sun Yuchen ("Brother Sun") done relatively well? His grasp of market demands—such as Tron’s stablecoin revenue—is remarkably sharp. There's a stark contrast between Tron’s execution and market responsiveness versus EOS. In fact, holders who swapped HSR (Hshare, jokingly called "Braised Pork") into TRX likely earned more than they would have holding onto their original project.

(4) Filecoin: Filecoin raised over $250 million in 2017, drawing wide interest for its distributed storage concept and a high-profile founding team led by Juan Benet. Whether Filecoin qualifies as a success remains debatable; questions linger about its long-term sustainability.

In my view, non-iconic projects vastly outnumbered the famous ones and had even greater influence—this imbalance is one of the key historical reasons behind the emergence of VC-backed tokens.

Problems exposed:

(1) Lack of regulation: The rapid growth of the ICO market meant many projects operated without oversight, exposing investors to high risk. Fraudulent and Ponzi schemes were rampant—nearly 99% of projects involved exaggeration or outright deception.

(2) Market bubbles: Many projects raised massive sums quickly, but mismanaged these funds. Most lacked real value or feasible use cases, leading even well-intentioned teams to exit prematurely or fail.

(3) Inadequate investor education: Ordinary investors often lacked sufficient knowledge about blockchain and cryptocurrencies, making them vulnerable to manipulation. They had no reliable way to evaluate projects or monitor progress post-investment.

2.2. The Rise of VCs and Their Credibility Backing

The chaos following the ICO boom created a vacuum that venture capital (VC) firms stepped in to fill. By leveraging their reputation and resources, VCs provided more trustworthy support, helping mitigate many of the problems associated with early ICOs. An added benefit was offering users a preliminary layer of project filtering.

Roles of VCs:

-

Addressing grassroots fundraising flaws of ICOs:

– Reducing fraud risk: Through "rigorous due diligence" (assessing team background, technical feasibility, economic models), VCs filtered out "air projects" and reduced whitepaper falsification.

– Standardizing fund management: Using milestone-based funding disbursement and token lock-up periods to prevent teams from cashing out and fleeing.

– Long-term value alignment: VCs typically hold equity stakes or long-term locked tokens, aligning incentives with project success and reducing short-term speculation. -

Empowering project ecosystems:

– Resource integration: Connecting projects with exchanges, developer communities, compliance advisors (e.g., Coinbase Ventures assisting listings).

– Strategic guidance: Helping design tokenomics (e.g., release schedules) and governance structures to avoid economic collapse.

– Reputation endorsement: Brand credibility from top-tier VCs (like a16z or Paradigm) boosts market confidence in new projects.

(3) Promoting regulatory compliance:

VCs encouraged projects to comply with securities laws (e.g., U.S. Howey Test) using compliant frameworks like SAFT (Simple Agreement for Future Tokens), thereby reducing legal risks.

The involvement of VCs represented the most direct response to the shortcomings of early ICO models. Overall, VCs played a crucial role in Web3 project successes by providing capital, resources, credibility, and strategic advice—helping overcome challenges faced during the ICO era and indirectly aiding retail investors through initial screening.

2.3. Problems with VC Tokens

New developments often solve old problems, but once matured, they begin exhibiting their own limitations. VC tokens are a prime example—their later-stage drawbacks became increasingly evident.

Main issues include:

(1) Conflicts of interest:

VCs are profit-driven institutions that may push projects toward excessive tokenization (e.g., heavy unlock pressure) or prioritize their portfolio projects (e.g., exchange-affiliated VCs favoring “in-house” projects).

(2) Inability to ensure sustainable project development.

(3) Collusion between VCs and project teams to deceive retail investors (though larger-name VCs tend to behave better).

VC firms generally focus only on early investment and profitable exits, bearing neither obligation nor capacity—or incentive—to support long-term development. (Would imposing longer vesting periods for VCs help?)

The core problem with VC tokens is the lack of sustained motivation for teams post-listing—both project founders and VCs often dump and leave. This pattern breeds resentment among retail investors, but the root cause lies in inadequate supervision and management, particularly regarding alignment between funding and actual outcomes.

3. Inscriptions, Fair Launches, and the Meme Coin Phenomenon

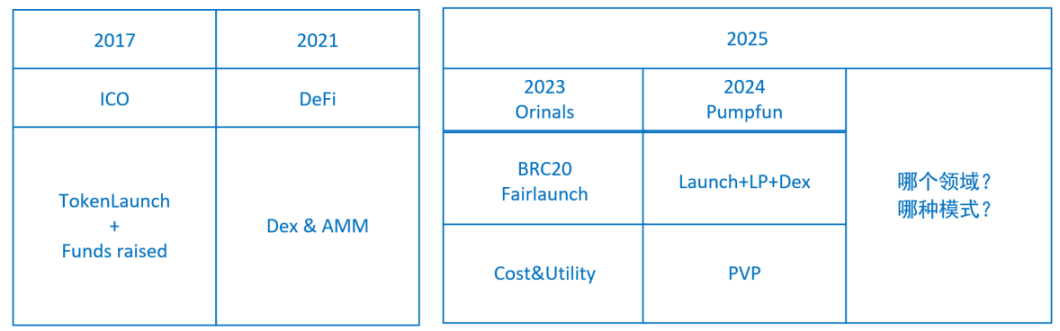

The 2023 inscription boom and fair launches, followed by the 2024 rise of Pump.fun-style meme coin pumps, revealed certain trends while exposing critical issues.

3.1. The Explosion of Inscriptions and Fair Launches

In 2023, two clear trends emerged in the blockchain space: the surge in inscriptions (Inscriptions) and the popularity of fair launch (Fair Launch) models. Both stem from skepticism toward earlier financing methods (such as ICOs and VC dominance). Notably, most VCs reported missing opportunities in the primary markets for inscriptions and hesitated to invest heavily even in secondary markets. This highlights users’ and communities’ desire for decentralization and fairness.

Inscriptions first gained traction on the Bitcoin blockchain, exemplified by BRC-20 tokens such as ORDI and SATS. Several factors contributed to their rise: demand for innovation within the Bitcoin ecosystem, user demand for censorship resistance and decentralization, low entry barriers combined with wealth effects, backlash against VC tokens, and the appeal of fair distribution.

However, inscriptions also brought problems:

- Pseudo-fairness: Many participating addresses may actually be controlled by a few institutions or whales acting under multiple identities;

- Liquidity challenges: High transaction costs and delays when using inscriptions on Bitcoin’s mainnet;

- Value leakage: Massive minting fees go entirely to miners (asset pegging lost), failing to reinvest in the token’s ecosystem;

- Lack of utility: Inscriptions don’t solve the issue of ongoing development—most lack meaningful application scenarios.

3.2. The Rise of Pump.fun and the Meme Coin Craze

Memes originated much earlier as cultural phenomena. The real-world origin traces back to 1993 when Hal Finney proposed the NFT concept. The Counterparty platform, founded in 2014, helped popularize NFTs through Rare Pepes—turning the sad frog meme into digital collectibles. “Meme” translates to “meme,” referring to image macros, phrases, videos, or GIFs.

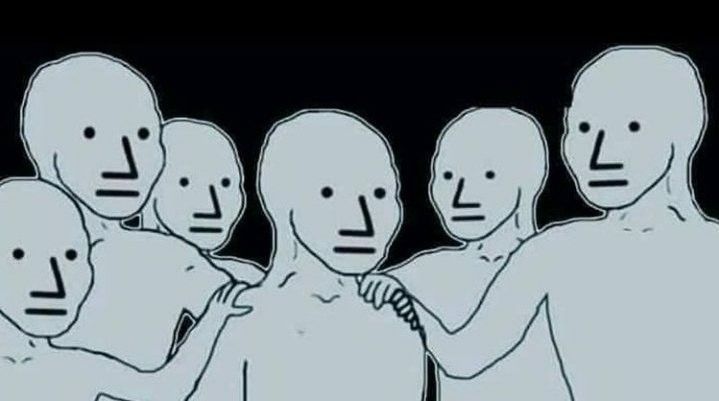

As memes gained traction in the NFT space and supporting technologies matured, meme coins began forming. In 2024, Solana-based Pump.fun rose rapidly as the central hub for meme coin launches. With its streamlined service pipeline combining token creation, liquidity pool setup, and DEX listing, plus built-in speculative mechanics, Pump.fun significantly influenced the market. One of Pump.fun’s key contributions was integrating three previously separate services into a complete loop: token issuance, liquidity provisioning, and DEX listing.

Early on, only 2%-3% of tokens launched on Pump.fun made it to DEXs—a rate known in the industry as “graduation rate”—indicating entertainment value outweighed trading functionality, consistent with meme culture. But at peak times, graduation rates exceeded 20%, turning the platform into a pure speculation engine.

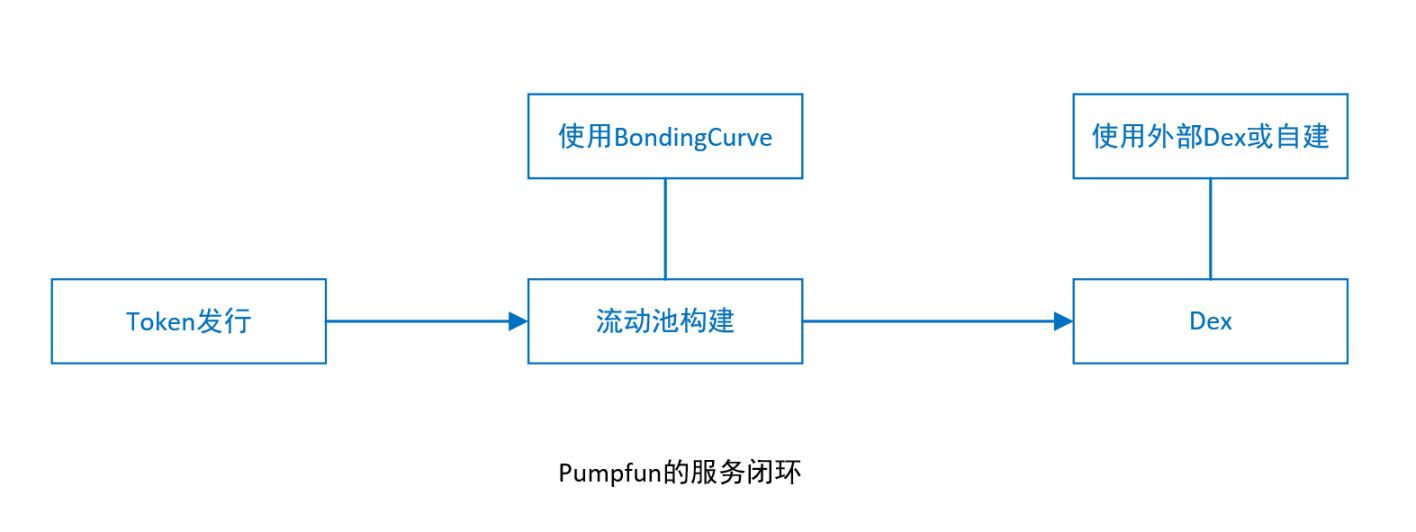

Data shared on Twitter also illustrates structural flaws in the meme coin model. (I haven't verified the accuracy of this data.)

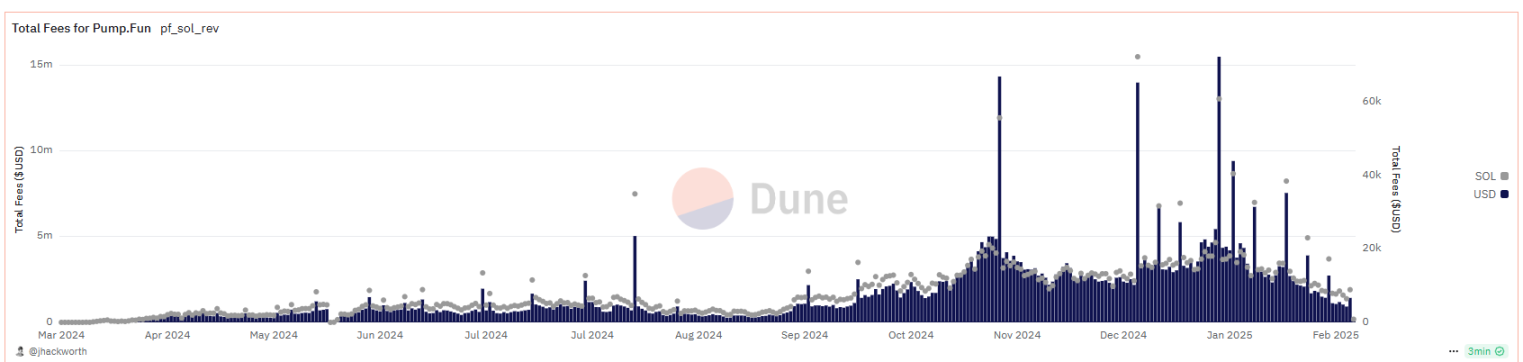

Pump.fun generated nearly $600 million in total revenue, prompting even U.S. President Trump and his family to issue personal tokens—clear signs of the meme coin craze reaching its zenith. As shown in Dune analytics, meme coins follow a lifecycle: emergence, growth, and eventual explosion.

Major problems with meme coins:

(1) Systematic fraud and eroded trust: According to Dune data, ~85% of tokens on Pump.fun are scams, with founders cashing out in just 2 hours on average.

(2) Rampant false marketing: Teams fabricate KOL endorsements and fake trading volume (using bot farms); e.g., MOON claimed Elon Musk endorsement, which turned out to be photoshopped.

(3) Distorted market ecology: Liquidity siphoning effect—meme coins consume vast chain resources, squeezing out legitimate projects (e.g., DeFi TVL on Solana dropped 30%). Genuine users get driven out as regular investors cannot compete with bots and insider trading, gradually exiting the market. Some project teams even consider using invested funds to manipulate meme coin prices and flee with profits.

Meme coins evolved from initial entertainment tools into mid-to-late stage PVP (Player vs Player) games, eventually becoming PVB (Player vs Bot)—effectively serving as tools for a select few experts to exploit retail investors. The persistent lack of real value injection remains a fatal flaw—if unaddressed, meme coins will inevitably decline.

4. What Kind of Projects Do Users or Markets Want?

By reviewing the history of Web3 project development, we understand the origins, strengths, and weaknesses of VC and meme tokens. We’ve also briefly analyzed inscription trends and the Pump.fun-driven meme coin phenomenon. These are all products of industry evolution. From this analysis, we identify several persistent challenges in current Web3 development.

Note: Do VC and meme tokens reveal all existing issues—or at least the core ones?

4.1. Summary of Key Issues

From the above discussion, we summarize current Web3 project challenges:

1. Sustained development incentives: No party should receive too much money too early. Token holders and contributors must continue receiving rewards throughout the project lifecycle—otherwise, morale drops and betrayal becomes common.

2. Minimize or eliminate PVP dynamics: Fairness is paramount—reduce manipulative advantages held by insiders. True fair launches are valued, yet post-listing races still reward speed over contribution since early entrants capture fixed pool value.

Solutions:

1. Project governance: Prevent teams or VCs from accessing large amounts of capital too soon. Funds should either be used under regulated conditions or allocated directly to contributors and builders.

2. Sustainable external value injection: This resolves PVP issues and rewards long-term holders and contributors. Continuous external value flow supports genuine builders financially, gives token holders long-term appreciation expectations, and reduces premature dumping.

These simple conclusions don’t fully capture complexity. To properly address governance, we need to examine stakeholder roles across different stages—issuance, circulation, and governance—and dynamically assess potential pitfalls.

4.2. Stakeholders and Management Across Stages

1. Different stakeholders

Economic model design is central to Web3 projects. Key stakeholders usually include project teams, investors, foundations, users and communities, miners, exchanges, market makers, and other ecosystem partners. Economic models aim to define token allocation, vesting rules, and incentive mechanisms tailored to each phase and contributor type. Specific ratios and release schedules vary based on individual project needs and contribution levels—there’s no one-size-fits-all formula. Outside these groups are passive observers (speculators, bounty farmers, scammers, etc.).

We must prevent internal parties (e.g., teams and VCs in VC-backed projects) from capturing disproportionate value early on—leaving insufficient motivation for long-term work—while also protecting against external exploitation (e.g., meme coin speculators).

2. Analyzing issues across issuance, circulation, and governance

(1) Token Issuance

Digital currencies employ various issuance methods. Besides PoW mining, there are ICOs, STOs, IBOs, and giveaways like airdrops (e.g., Ripple). Regardless of method, the main goals are twofold: raising capital and distributing tokens widely to promote usage.

(2) Token Circulation and Management

Token issuance has diversified significantly, enabling broad circulation. However, limited demand and liquidity management tools lead to numerous circulation-related problems. Management often relies on functional applications—such as trading, staking, access thresholds (token/NFT holdings), or consumption within apps (gas fees on L1 chains, ENS registration/renewal fees).

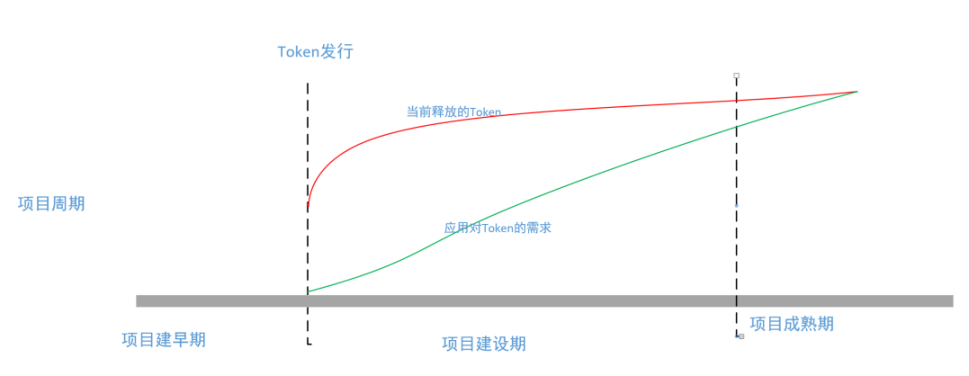

Tokens released too early—i.e., those between the red and green lines—should be subject to liquidity locks to prevent premature extraction by any single stakeholder. Managing these locked tokens and tracking development milestones constitute core governance challenges.

3. Governance Challenges

In Web3 projects, control primarily comes from consensus mechanisms and economic model design—using tokens to regulate resource supply and consumption. While powerful, economic models have limits. Where they fall short, supplementary mechanisms are needed. Community governance fills functional gaps where economic models struggle.

The decentralized nature of blockchain and rule-based networks enabled DAOs and DACs, contrasting sharply with traditional centralized corporate structures and governance.

Combining DAOs with foundation models allows better management of funds and ecosystems, offering flexibility and transparency. DAO members should meet certain criteria and ideally include key stakeholders and third-party institutions. If exchanges act as third parties, could we adopt Jason’s suggestion—granting exchanges supervisory and auditing rights? Indeed, Binance played such a role during the GoPlus and MyShell market maker crash incident.

Could such a structure better implement CZ’s proposal in “A Crazy Idea for Token Issuance”? Let’s analyze CZ’s vision using the diagram below:

(1) Initially, 10% of tokens unlock and sell on the market, with proceeds funding product/platform development, marketing, salaries, etc. (This design works well—but who manages and oversees it? Assigning this task to the project’s DAO, using treasury controls and third-party audits, would be better.)

(2) Future unlocks require meeting specific conditions. (This targets post-initial-phase continuity and liquidity management—DAO-led governance would improve effectiveness here.)

(3) The team can delay or reduce unlock sizes. If they don’t want to sell more, they don’t have to. But each time, they can unlock at most 5%, waiting at least six months before doing so again—only if price doubles. (This decision-making power should shift from team to DAO. Since the team is part of the DAO, side effects would likely remain minimal.)

(4) The team cannot shorten or increase future unlock sizes. Tokens should be locked via smart contracts controlled by third parties, preventing flood sales during downturns and incentivizing long-term building. (This further underscores the need for third-party institutions—offering better controllability and governance than pure code. In fact, CZ implicitly suggests a DAO-like framework.)

Of course, this is just one illustrative example. Real-world governance involves many dimensions. Fortunately, as Web3 evolves, such frameworks will gradually improve and expand in practice, continuously correcting flaws and discovering better approaches.

4.3. Long-Term Project Building (Value Capture & Value Injection)

Without technological and application innovation, current projects relying solely on hype cannot last. Eventually, we’ll see a repeat of VC and meme coin cycles. Actually, Pump.fun offers a reference framework—its rise and likely fall result from missing one critical component: Token Empowerment (also known as value capture and value injection). See figure below:

As shown, after listing, VC-backed projects often achieve substantial returns, removing any incentive for continued development. Post-launch work carries high risk and insufficient reward—“lying flat” becomes optimal. Only a small number of visionary and capable teams persist. Pump.fun’s meme coin model lacks any mechanism for downstream token empowerment, so everyone races to exit first. Why do some meme coins like Dogecoin sustain upward momentum? Multiple factors contribute—I’ll explore this in depth another time.

How can we achieve lasting value injection? What forms can empowerment take?

Looking back at past Web3 examples: How DeFi protocols capture value via liquidity mining, how NFT projects inject external value through royalty systems, or how DAOs accumulate value through community contributions. As Web3 matures, more “use cases” emerge, creating increasing points of value convergence.

Value capture and external value injection are twin pillars of Web3 economic models—retention and inflow, respectively. More popular terms like “value accumulation” and “flywheel effect” highlight their dynamic synergy, while “token empowerment” and “positive externalities” approach from a design perspective.

The core challenge lies in balancing short-term incentives with long-term value, avoiding “paper models” and Ponzi loops.

5. Analysis of Crypto’s Two Previous Bull Runs and Possibilities for the Next Surge

Earlier sections examined prevalent issues with VC and meme tokens. Could solving these trigger the next bull market? First, let’s revisit the 2017 and 2021 bull runs.

Note: The following draws partly from online research and conversations with DeepSeek and ChatGPT, and partly from my personal experience in both the 2017 and 2021 bull markets. Our team is currently developing products in the Bitcoin ecosystem, so I incorporate subjective insights and judgments.

5.1. The 2017 ICO Mania

The 2017 bull run resulted from multiple converging forces—technological breakthroughs, ecosystem growth, and favorable macro conditions. Based on expert analyses and seminal literature, key drivers include:

(1) ICO (Initial Coin Offering) mania

Ethereum’s ERC-20 standard drastically lowered token issuance barriers, enabling thousands of projects to raise funds (~$5+ billion total in 2017).

(2) Bitcoin forks and scaling debates

Community disagreement over scaling (SegWit vs. bigger blocks) led to hard forks. In August 2017, Bitcoin Cash (BCH) split off, sparking renewed interest in Bitcoin’s scarcity and evolution. BTC rose from ~$1,000 at year-start to a record high of $19,783 in December.

(3) Rise of Ethereum’s smart contract ecosystem

Maturation of smart contract tools and DApp development drew developers. Early DeFi concepts emerged, and apps like CryptoKitties drove mass participation.

(4) Global loose monetary policy and regulatory voids

Low interest rates worldwide pushed capital toward high-risk, high-return assets. Regulatory frameworks for ICOs and crypto were immature, allowing unchecked speculation.

The 2017 bull market laid foundational infrastructure (wallets, exchanges), attracted talent and users, but also exposed rampant ICO fraud and regulatory gaps—prompting post-2018 shifts toward compliance and innovation (e.g., DeFi, NFTs).

5.2. The 2021 DeFi Summer

The 2021 bull market stemmed from confluence of ecosystem maturity, macroeconomic tailwinds, tech innovation, and institutional adoption. Key causes summarized:

(1) DeFi (Decentralized Finance) explosion and maturation

- Ethereum smart contracts matured; Layer 2 scaling solutions (Optimism, Arbitrum) entered testing, lowering fees and latency. Result: Uniswap V3, Aave, Compound saw TVL grow from $1.8B to $25B, attracting capital and devs.

- Yield farming: High APYs lured retail and institutional arbitrageurs. Yield Finance (YF, nicknamed “Big Uncle”) briefly surpassed BTC in price.

(2) NFT mainstream breakout

- Beeple’s NFT artwork sold for $69M at Christie’s. CryptoPunks, Bored Ape Yacht Club (BAYC) reached multi-billion dollar valuations. Platforms like OpenSea surged.

(3) Institutional capital influx

- Tesla announced $1.5B BTC purchase and BTC payment acceptance.

- MicroStrategy kept accumulating BTC (held 124,000 BTC by end-2021).

- Canada approved first Bitcoin ETF (Purpose Bitcoin ETF, Feb 2021).

- Coinbase direct-listed on Nasdaq (valued at $86B).

(4) Macroeconomic and monetary policies

- Flood of liquidity: Fed maintained zero rates and QE, pushing funds into risky assets.

- Inflation hedge narrative: U.S. CPI hit 7%, driving some to view Bitcoin as “digital gold.”

(5) Rising mainstream acceptance

- Payment expansion: PayPal enabled crypto trading; Visa allowed USDC settlements.

- El Salvador adopted Bitcoin as legal tender (Sept 2021).

- Celebrity influence: Musk, Snoop Dogg frequently promoted crypto/NFTs.

(6) Multi-chain competition and innovation

- New L1s rose: Solana, Avalanche, Polygon attracted users/devs with low fees and high TPS.

- Cross-chain advances: Cosmos, Polkadot protocols enabled asset interoperability.

(7) Meme coins and community culture

- Viral hits: DOGE and SHIB soared via social media hype (DOGE up >12,000% annually).

- Retail frenzy: Reddit’s WallStreetBets and TikTok drove mass retail participation.

Impact on subsequent markets:

The 2021 rally accelerated institutionalization, regulation, and technical diversification in crypto, but also exposed DeFi hacks and NFT bubbles. Post-bull market focus shifted to:

- Regulatory compliance: SEC intensified scrutiny on stablecoins and security-like tokens.

- Sustainable development: Ethereum transitioned to PoS (“The Merge”), Bitcoin mining explored clean energy.

- Web3 narratives: Metaverse and DAOs became new focal points.

5.3. When Will the Next Bull Market Come? 2025? What Will Drive It?

Below is a predictive analysis of potential drivers for a 2025 crypto bull market, combining current trends, tech innovation, and macro backdrop:

(1) Mass Adoption of Web3 and User Sovereignty

Real-world adoption: Decentralized social (e.g., Nostr, Lens Protocol), on-chain gaming (AAA GameFi), and decentralized identity (DID) go mainstream, reshaping data ownership and revenue models from traditional internet.

Key events: Tech giants like Meta and Google integrate blockchain, enabling cross-platform data portability.

Enabling tech: Zero-knowledge proofs (ZKP) and fully homomorphic encryption (FHE) mature, ensuring privacy and compliance.

(2) Deep Integration of AI and Blockchain

Decentralized AI networks: Blockchain-based compute markets (e.g., Render Network) and data ownership platforms (e.g., Ocean Protocol) tackle centralized AI monopolies.

Autonomous agent economy: AI-powered DAOs (e.g., AutoGPT) autonomously execute trades and governance, boosting efficiency and spawning new business models.

(3) Interoperability Between CBDCs and Stablecoins

Policy momentum: Major economies launch CBDCs (digital euro, digital dollar), interconnecting with compliant stablecoins (USDC, EUROe) into hybrid payment networks.

Cross-border settlement: BIS leads development of CBDC interoperability protocols, positioning crypto as a key conduit for international payments.

(4) Bitcoin Ecosystem Revival and Layer 2 Innovation

Bitcoin L2 explosion: Lightning Network capacity hits new highs; Taproot Assets and RGB enable asset issuance on Bitcoin; Stacks brings smart contracts to Bitcoin.

Institutional custody upgrade: BlackRock, Fidelity launch Bitcoin ETF options and lending services, unlocking financial utility of BTC.

(5) Clear Regulation and Full Institutional Onboarding

Global compliance: U.S. and EU pass MiCA-like regulations, defining token classifications and exchange licensing.

Traditional finance integration: JPMorgan, Goldman Sachs roll out crypto derivatives and structured products; pension funds allocate >2% to crypto.

(6) Geopolitical Tensions and De-Dollarization Narrative

Safe-haven demand: Escalating conflicts (Ukraine, Taiwan Strait) boost crypto as neutral settlement medium.

Reserve diversification: BRICS nations jointly issue blockchain-based trade settlement tokens; some sovereign debt denominated in BTC.

(7) Meme Culture 3.0 and Community DAO-ification

Next-gen meme coins: AI-generated content (AIGC) and dynamic NFTs power new meme projects (e.g., AI-driven “immortal dog” characters), with IP direction decided via DAO votes.

Fan economy transformation: Celebrities like Taylor Swift and BTS issue fan tokens, unlocking exclusive content and profit-sharing.

Note: The above includes extensive possibilities to avoid omissions.

By summarizing the 2017 and 2021 bull markets and analyzing 2025 prospects, we can make informed projections:

Regarding models:

The 2023 inscription trend and 2024 Pump.fun phenomenon may signal early signs of a coming bull market. If their inherent flaws are resolved and superior models emerge, certain sectors could catalyze a broader rally. Likely centered around asset creation and trading.

Regarding domains:

Two areas stand out:

(1) Pure Web3 domain

(2) AI + Web3 convergence

Detailed assessment:

(1) Mass Web3 adoption and user sovereignty: Infrastructure remains incomplete, and wealth effects are modest. Unlikely to drive the next bull market alone or serve as its primary engine.

(2) AI + Web3 deep integration: The power of AI is undeniable. Could this become a foundational driver? Hard to say—it feels early. But surprises happen: DeepSeek, Manus, etc., show how fast AI can explode. What happens when AI enhances DeFi?

(4) Bitcoin revival and L2 innovation: Bitcoin performed strongly in both prior bull markets. Currently holds ~60% of total crypto market cap—wealth effect is strong. With the right combination of novel models and solid tech implementation, this area has high potential to spark a bull run.

(7) Meme Culture 3.0 and community DAO-ification: If meme culture solves PVP and achieves continuous value injection, could it drive a bull market? Wealth effect seems unlikely.

Others—(3), (5), (6)—will accelerate change and add momentum, but individually lack strength to ignite a full bull cycle.

If 2025 brings a bull market, the most likely catalysts are:

Innovation in the Bitcoin ecosystem and L2s, enabling new models for asset issuance and trading

AI + Web3 integration, especially AI-enhanced trading paradigms

Beyond domain and model predictions, timing depends heavily on external macro conditions.

All views expressed are personal opinions and do not constitute investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News