Why did the crypto market lose $900 billion while stablecoin market cap hit a record high?

TechFlow Selected TechFlow Selected

Why did the crypto market lose $900 billion while stablecoin market cap hit a record high?

Fully loaded with USDT, I'm the "Best Trader."

Author: shushu, BlockBeats

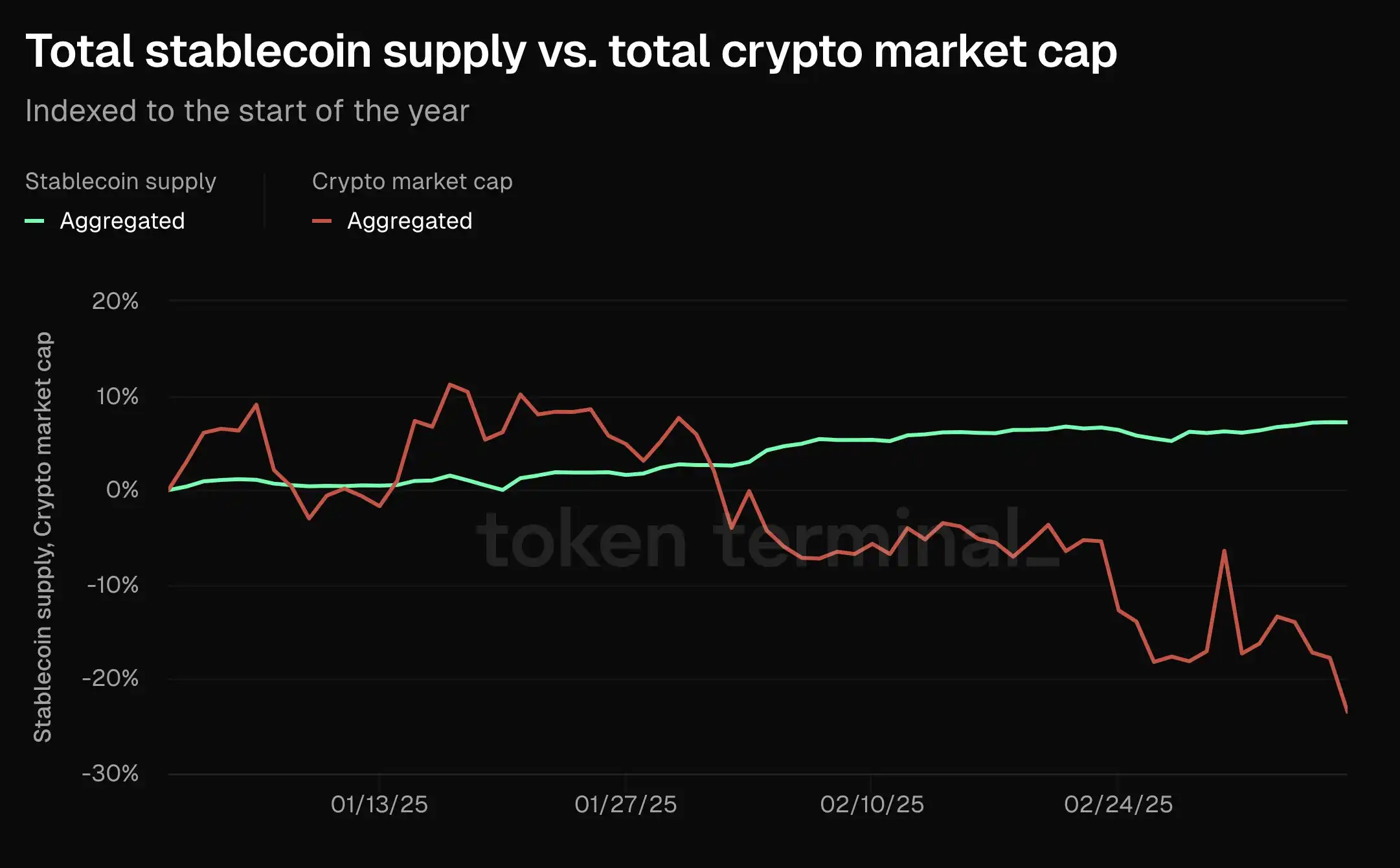

Since Trump took office, the total market capitalization of cryptocurrencies has dropped by nearly $900 billion. However, over the past week, the stablecoin market cap has grown 1.03%, surpassing $227 billion and reaching a new all-time high. This surge has left the community wondering: what factors are driving stablecoin growth amid this downturn?

As stablecoins hit record highs, Frax Finance co-founder Sam commented on Twitter that bear markets are bull markets for stablecoins. He stated, "Another way to describe falling prices is a strengthening dollar. In such conditions, issuers of on-chain dollars stand to gain the most—especially with favorable regulation on the horizon."

Recently, CryptoQuant CEO Ki Young Ju also analyzed that the previous altseason capital cycle is now outdated. "Bitcoin-driven crypto asset rotation has essentially ended, driven by regulation and institutional adoption. New capital will flow through stablecoins or widely adopted altcoins—this is completely different from traditional altseasons."

Against the backdrop of volatility in both crypto and U.S. equities, stablecoins are rising against the trend, reinforcing dollar dominance—and may well be the biggest winners in recent market turmoil.

Regulatory Thaw

On February 27, pro-crypto U.S. Senator Cynthia Lummis said during the Senate Banking Committee's first digital assets subcommittee hearing: "We're close to establishing a bipartisan legislative framework for stablecoins and market structure."

At Friday night’s White House crypto summit—where few details were released—Trump expressed his hope to receive a stablecoin legislation bill before Congress adjourns in August, aiming to advance federal regulatory reform for crypto, while reiterating his desire for the dollar to “remain dominant long-term.”

U.S. Treasury Secretary Scott Bessent pledged to use digital assets to strengthen the dollar’s status as the world’s primary reserve currency. He said: "We will deeply consider the stablecoin regime. As President Trump has directed, we will maintain America’s position as the world’s leading reserve currency, and we will use stablecoins to achieve that."

This rhetoric reflects growing concerns within the U.S. government about macroeconomic and geopolitical uncertainties—factors that could reduce foreign demand for U.S. Treasuries and push up Treasury yields. Over the past year, Japan and China—the two largest holders of U.S. debt—have continuously reduced their holdings. To preserve the dollar’s global reserve status, sustained international demand for U.S. bonds must be ensured.

By holding U.S. Treasuries as reserves, stablecoins can help suppress Treasury yields while simultaneously expanding the global circulation of the dollar. Stablecoins require sufficient dollar reserves to meet investor redemption demands. Tether is already one of the largest institutional holders of three-month U.S. Treasury bills.

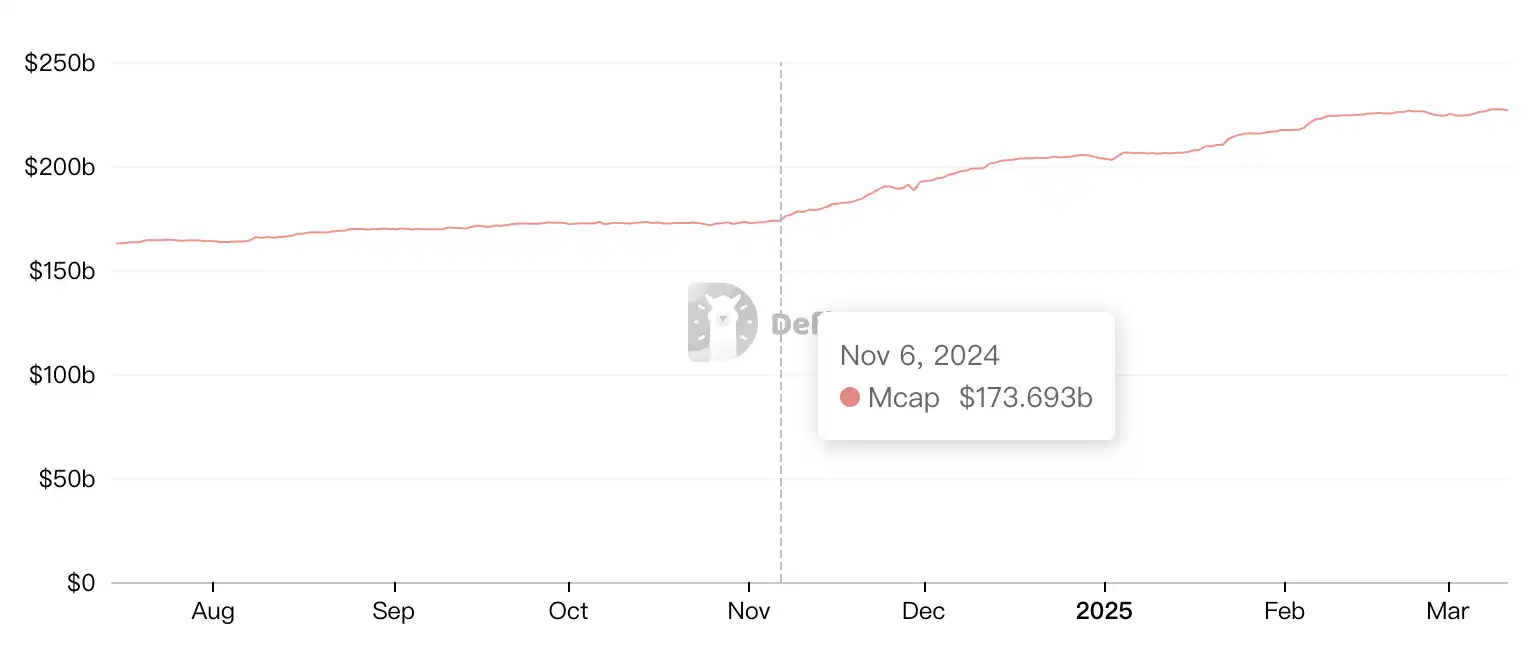

Stablecoin market cap has surged $50 billion since Trump’s election; Source: DeFiLlama

On the policy front, the U.S. has proposed two stablecoin bills: the House’s STABLE Act (Securing Transparent and Accountable Financial Ledgers) and the Senate’s GENIUS Act (Guiding Emerging National Innovation Using Stablecoins). Both aim to regulate stablecoin issuers through licensing requirements, risk management rules, and 1:1 reserve backing.

The two bills propose different frameworks but agree on strict compliance measures. Both support private, dollar-backed stablecoins and ban central bank digital currencies (CBDCs).

Key differences include:

· Regulatory oversight (GENIUS allows states to regulate issuers until market cap reaches $10 billion; STABLE allows opt-out from federal oversight if state regulations meet federal standards)

· Reserve requirements (STABLE permits U.S. Treasuries, bank deposits, and central bank reserves; GENIUS also includes money market funds and reverse repos)

· Consumer protection (GENIUS focuses on transparency and enforcement; STABLE mandates 1:1 reserves and bans algorithmic stablecoins)

Stricter regulations could challenge Tether’s dominance, as both bills require monthly audits, asset segregation, and rigorous reporting—potentially forcing exchanges to delist non-compliant stablecoins, similar to the impact of the EU’s MiCA. At the same time, these laws would pave the way for stablecoin legalization, attract institutional adoption, and create barriers for less transparent issuers. If passed, they would establish clear guidelines for stablecoin issuers, ensuring market stability and compliance.

This morning, FOX Business journalist Eleanor Terrett posted on social media: "To my knowledge, an updated version of Republican Senator Bill Hagerty’s stablecoin bill—the GENIUS Act—will be released tonight (local time). As of this morning, the Senate Banking Committee still plans to amend the bill on Thursday."

The revised draft expands reciprocity clauses for overseas payment stablecoins and adds new provisions on reserve requirements, regulation, anti-money laundering and counter-terrorism measures, sanctions compliance, liquidity requirements, and risk management standards—all aimed at promoting international transactions and interoperability with foreign dollar-denominated payment stablecoins.

Stablecoin FOMO Wave Arrives—What Opportunities Lie Ahead?

In light of Trump’s clear signal that he wants stablecoin legislation finalized by August, efforts toward stablecoin adoption are underway not only in the U.S., but also in countries like Japan and Thailand.

On March 10, Thailand’s Securities and Exchange Commission (SEC) recognized USDT and USDC as compliant cryptocurrencies. This approval paves the way for legal trading of USDT and USDC on regulated Thai platforms and lays the foundation for broader use in payments across Thailand.

On the same day, Japan’s Cabinet approved proposals to reform laws related to crypto brokerage and stablecoins. According to Japan’s Financial Services Agency (FSA), the government adopted a cabinet resolution amending the Payment Services Act. The bill will allow crypto firms to operate as "intermediary businesses," meaning brokers no longer need to obtain licenses of the same type required for crypto exchanges and wallet operators. It also provides greater flexibility for stablecoin issuers regarding the types of assets backing their tokens.

According to the Financial Times, some of the world’s largest banks and fintech firms are rushing to launch their own stablecoins, aiming to capture a share of the cross-border payments market they expect to be reshaped by crypto.

Last month, Bank of America announced its intention to issue its own stablecoin, joining established players like Standard Chartered, PayPal, Revolut, and Stripe in competing with crypto-native giants such as Tether and Circle.

This shift comes six years after regulators strongly opposed Meta’s Libra stablecoin project—and is now being accelerated by strong support for crypto from President Trump. "It’s like selling shovels during a gold rush," said Simon Taylor, co-founder of fintech consultancy 11:FS, comparing it to FOMO.

Beyond Bank of America, other traditional finance (TradFi) heavyweights are preparing for stablecoin expansion.

· Standard Chartered: advancing a Hong Kong dollar stablecoin project

· PayPal: planning to expand PYUSD issuance in 2025

· Stripe: acquired Bridge stablecoin platform for $1.1 billion

· Revolut: exploring possibilities for stablecoin issuance

· Visa: using stablecoins for payments and global operations

In the past, increases in stablecoin supply often preceded rallies in crypto prices, as these tokens were primarily used as short-term holding instruments between trades. Today, stablecoin use cases are moving beyond speculation—SpaceX uses stablecoins to settle Starlink sales proceeds in Argentina and Nigeria; ScaleAI uses them to pay overseas contractors.

The most direct opportunity lies in betting on which blockchains mainstream institutions will choose to issue new stablecoins. Currently, Ethereum, Base, Tron, and Solana are the leading candidates. On February 26, Base protocol lead Jesse Pollak said the plan is to launch stablecoins for all major global currencies on Base this year.

Clearly, both on-chain ecosystems and traditional finance are aligning around U.S.-backed dollar stablecoins. As for altseasons, perhaps, as CryptoQuant’s CEO suggested, the old altseason capital cycle is truly obsolete.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News