Know Yourself, Earn the Right Money: Cryptocurrency Investment Personality Analysis from an MBTI Perspective

TechFlow Selected TechFlow Selected

Know Yourself, Earn the Right Money: Cryptocurrency Investment Personality Analysis from an MBTI Perspective

Personality is the true "destiny code" that determines your investment trajectory.

Written by: TechFlow

Personality determines destiny—and investment as well.

A recent meme about stock market behavior is going viral on social media:

A friend said MBTI types perfectly reflect trading styles:

E (Extraversion) means gathering information everywhere; I (Introversion) means diving into research alone.

N (Intuition) means big-picture storytelling, tech stocks; S (Sensing) means chasing data, consumer stocks.

T (Thinking) means daring to buy the dip—but often selling too early; F (Feeling) means hesitating to buy low, but holding all the way to the final rally.

J (Judging) means diversified positions; P (Perceiving) means going all-in with concentrated bets.

In the crypto world, there's something that surprises most people:

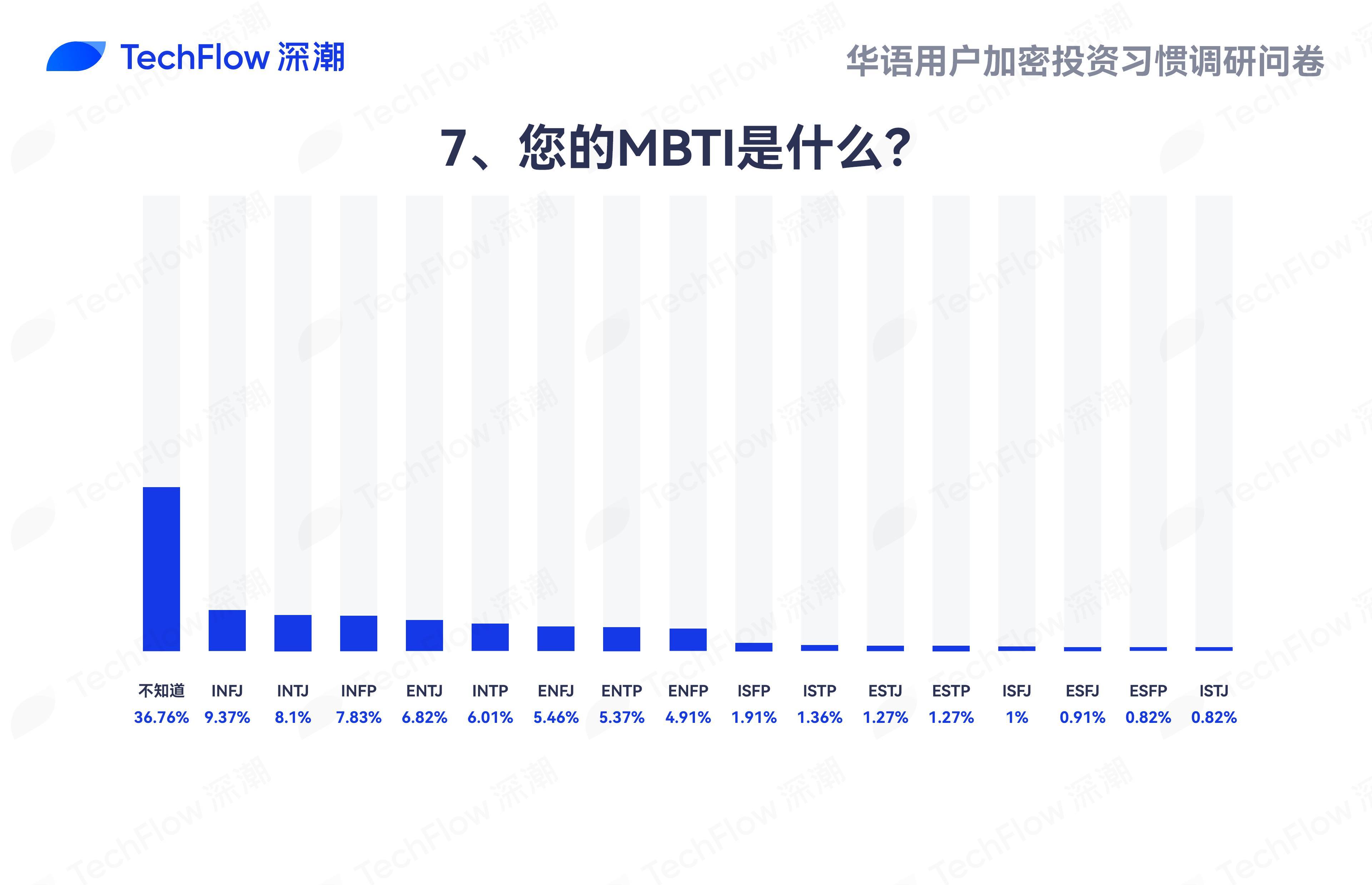

Whether looking at Chinese-language MBTI surveys or overseas studies on cryptocurrency investors, they all point to the same conclusion—crypto is dominated by introverts (I).

In cryptocurrency investing, each of the four MBTI dimensions influences investment styles differently:

-

Extraversion / Introversion (E/I): Introverts (I) prefer independent research and make decisions based on personal analysis; extraverts (E) are more influenced by community trends and are active on social media.

-

Sensing / Intuition (S/N): Sensing types (S) favor established cryptocurrencies like Bitcoin and Ethereum, focusing on current data and facts; intuitive types (N) focus on innovative projects and long-term potential.

-

Thinking / Feeling (T/F): Thinkers (T) rely on logic and technical analysis; feelers (F) are influenced by values and emotions, valuing community impact and mission alignment.

-

Judging / Perceiving (J/P): Judgers (J) follow structured investment plans and hold long-term; perceivers (P) are more flexible and may trade frequently.

Here’s how some popular MBTI types approach crypto investing:

INTJ (Introverted, Intuitive, Thinking, Judging) – "The Architect"

-

Investment style: Systematic, visionary.

-

Characteristics: INTJs build complex investment strategies combining technical analysis, fundamental evaluation, and market forecasting. They value independent thinking and are drawn to disruptive projects (e.g., Layer 1 blockchains or AI + crypto).

-

Strengths: Strategic foresight, capable of identifying long-term trends.

-

Weaknesses: May be overconfident and overlook short-term risks.

INFJ (Introverted, Intuitive, Feeling, Judging) – "The Advocate"

-

Investment style: Idealistic, values-driven.

-

Characteristics: INFJs invest in projects whose visions they believe in—such as Ethereum or AI—even through brutal downturns. They tend to HODL long-term and deeply resonate with a project’s sense of purpose and community.

-

Strengths: Patient, willing to wait for value to materialize.

-

Weaknesses: May ignore short-term market signals and miss optimal entry or exit points.

INTP (Introverted, Intuitive, Thinking, Perceiving) – "The Thinker"

-

Investment style: Research-driven, innovation-focused.

-

Characteristics: INTPs are fascinated by technical details and underlying mechanics of crypto (like L1s). They spend significant time analyzing code, market structures, or novel DeFi protocols. Decisions are made rationally, not emotionally.

-

Strengths: Skilled at uncovering undervalued, high-potential projects.

-

Weaknesses: May get lost in theory and lack decisive execution.

ENTJ (Extraverted, Intuitive, Thinking, Judging) – "The Commander"

-

Investment style: Strategic, decisive, dominance-seeking.

-

Characteristics: ENTJs enjoy crafting long-term plans and riding major trends. They may back promising new projects or even lead/participate in crypto communities (e.g., DAOs). Skilled at interpreting macroeconomic shifts and making swift decisions.

-

Strengths: Bold and visionary, able to seize large opportunities.

-

Weaknesses: Overconfidence may lead to underestimating risks and buying at peaks.

ISTJ (Introverted, Sensing, Thinking, Judging) – "The Duty Fulfiller"

-

Investment style: Cautious, detail-oriented, fact-based.

-

Characteristics: ISTJs conduct deep dives into fundamentals—whitepapers, technical specs, team backgrounds. They prefer proven “blue-chip” assets like Bitcoin or Ethereum and avoid high-risk altcoins. Decisions are data-driven and resilient to market sentiment.

-

Strengths: Stable, strong risk management.

-

Weaknesses: May miss fast-rising new projects due to excessive conservatism and slow reaction times.

ENFP (Extraverted, Intuitive, Feeling, Perceiving) – "The Campaigner"

-

Investment style: Enthusiastic, exploratory.

-

Characteristics: ENFPs are curious about novelty and may experiment with niche tokens or NFT projects. Inspired by compelling narratives and vibrant communities, they love being part of “the next big thing.”

-

Strengths: Open-minded, occasionally capture early-mover advantages.

-

Weaknesses: Easily distracted, lacking discipline.

ESTP (Extraverted, Sensing, Thinking, Perceiving) – "The Entrepreneur"

-

Investment style: Risk-taking, short-term trading.

-

Characteristics: ESTPs thrive on speed and excitement—they might be day traders or chase “pump and dump” plays. Skilled at profiting from volatility without necessarily digging deep into projects.

-

Strengths: Agile, quick to capture short-term gains.

-

Weaknesses: Impatient, prone to losses during choppy markets.

ESFP (Extraverted, Sensing, Feeling, Perceiving) – "The Performer"

-

Investment style: Impulsive, trend-chasing, emotional.

-

Characteristics: ESFPs are easily drawn to social media hype (like “Dogecoin mania”) and enjoy joining popular movements. Their investments are guided more by instinct and immediate feelings, often driven by FOMO (fear of missing out).

-

Strengths: Fast reactions, can profit from short-lived booms.

-

Weaknesses: Lack long-term planning, prone to panic-selling during pullbacks.

Be yourself—earn the money that matches your personality

After repeatedly witnessing cycles and shifting narratives in crypto—from DeFi, NFTs, Layer2, to AI and MEMEs—I’ve come to realize one truth: no matter the trend, we all eventually return to investing within our own personalities.

Personality is the real “destiny code” shaping your investment journey.

No matter how much technical analysis you learn, how many tokens you study, or how many KOL insights you consume—in the end, the strategies you actually execute are limited to what your personality allows.

You see others getting rich overnight from a certain token, yet find yourself unable to replicate that kind of “high-risk” play, no matter how hard you try.

In this tempting world of crypto, the key isn’t chasing others’ success, but finding your own “investment code” within your personality’s “comfort zone.” When you accept your limitations, you can actually maximize your strengths within them.

Perhaps the real risk in crypto isn’t missing opportunities—but investing against your nature. Only by being honest with yourself and embracing your investment personality can you survive long-term and earn the wealth truly meant for you—wealth aligned with your character and fate.

In the great filtering process of the crypto markets, those who remain aren’t the ones chasing every trend, but those who stay true to themselves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News