When MBTI Meets Blockchain: Can Your Personality Help You Make a Fortune?

TechFlow Selected TechFlow Selected

When MBTI Meets Blockchain: Can Your Personality Help You Make a Fortune?

In the crypto world, it's one in ten thousand, and everyone's an introvert.

When MooDeng skyrocketed to a $400 million market cap in just one week, and GOAT pumped to $800 million within two weeks, more and more people in the community are kicking themselves in regret. Those who sold too early or missed out entirely are agonizing over why their investments went to zero while they failed to catch such golden opportunities. It’s not just meme coins—Bitcoin also approached its all-time high on October 30, briefly touching $73,562, just $160 shy of setting a new record.

After years of trading crypto, one thing becomes clear: due to differences in personality and experience, everyone has unique trading styles, logic, and preferred projects—but most have made money at some point. This year marks a turning point for the crypto industry, with Bitcoin and altcoins moving on completely independent trajectories, while memes have emerged as the dominant narrative. We were curious to understand how different personalities perform under such historically rare market conditions.

As Bitget celebrates its sixth anniversary, we saw an opportunity. Having weathered multiple bull and bear cycles, Bitget offers a user base well-suited for analysis. So we teamed up with them to connect with 100 Bitget users and explore the link between personality and trading behavior. For personality types, we used the popular MBTI framework—16 distinct profiles, offering more nuance than zodiac signs. Our interviews covered trading style, risk appetite, annual returns, and even included hypothetical scenarios to see how each type would react under specific market conditions.

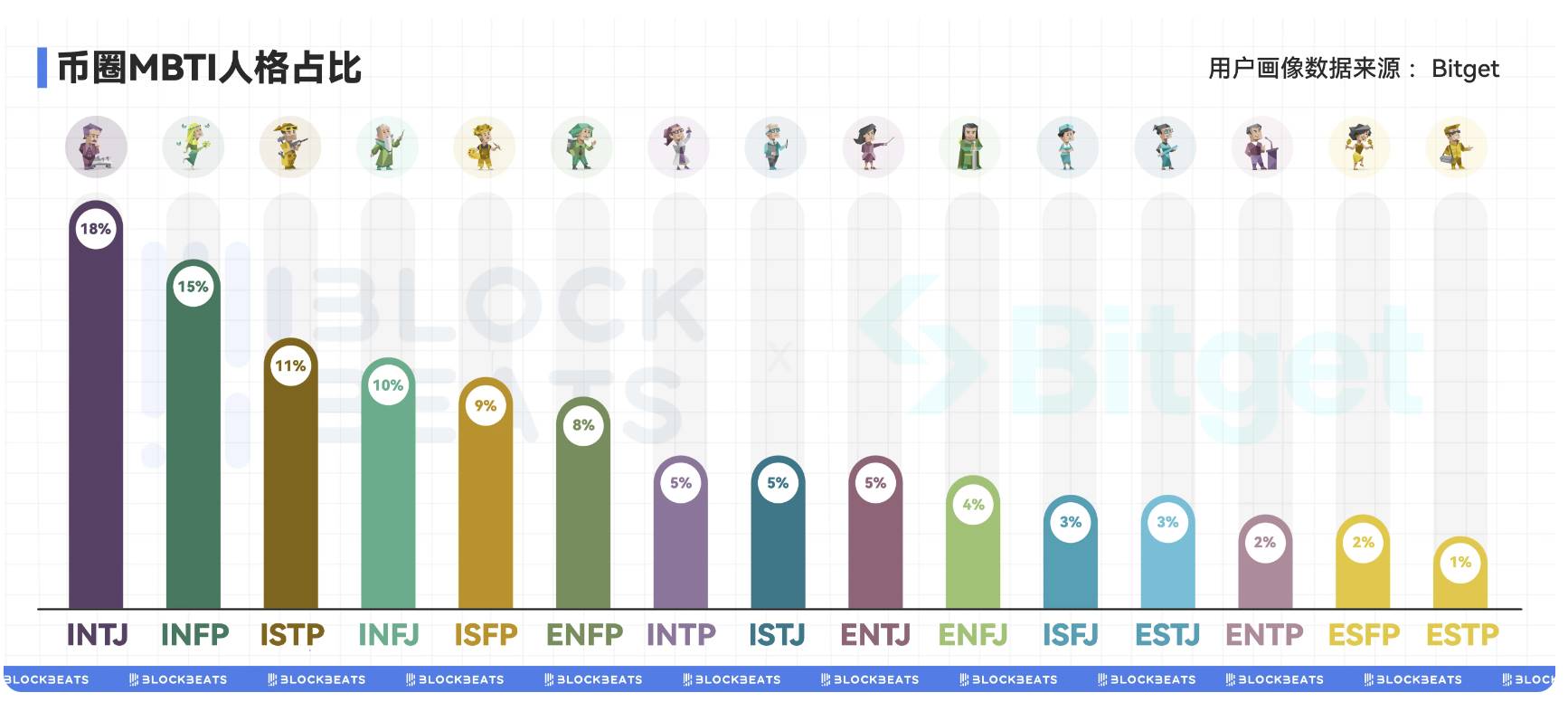

Based on our in-depth survey and interviews with these 100 Bitget users, it's evident that introverted (I) types dominate the crypto space, making up 76% of the sample, while extroverted (E) types account for only 24%. INTJ was the most common type at 18%, followed by INFP, ISTP, and INFJ. One MBTI type wasn’t represented at all in this sample.

It’s important to note that this study is based on a small sample of 100 individuals and may not fully represent the broader crypto community. Now, let’s dive into the trading mindsets of each MBTI type—and see if you’re the “outlier.”

INTJ: Insight

INTJs love diving deep into technical details and crafting long-term investment strategies. They’re drawn to disruptive technologies like Layer 2 solutions and cross-chain protocols—who wouldn’t want to ride the next big tech wave? In fact, 86.67% of INTJs adopt a long-hold strategy, focusing on a project’s long-term value. After all, financial freedom requires patience, not get-rich-quick schemes. They believe true wealth lies in deeply understanding a project’s innovation and real-world application.

In terms of returns: 46.67% of INTJs achieved gains between 0–10% this year, embodying steady, conservative growth; 40% posted losses, possibly because their deep technical focus caused them to overlook market volatility; 13.33% earned returns of 30–50%, proving their research-driven approach can yield solid results. An INTJ’s mindset can be summed up as: “While others are still searching for treasure, I’ve already started digging.” They favor left-side trading, entering positions before the market takes notice, which makes them early adopters of Bitget’s pre-market trading and launchpad features. By the time a coin becomes mainstream, they’re already onto the next opportunity.

INTJs aren’t very active on social media and rarely spread unverified rumors. 46.67% discuss trades only with a few close friends or colleagues—not exactly crowd pleasers. Their preferred spaces are professional forums and technical communities. If you’re looking for one at a party, check the corner where someone’s typing on a laptop. They value high-quality information and trust verified sources like academic papers, whitepapers, and technical reports. Gossip? No thanks. If a project’s innovation isn’t compelling enough to keep them up late researching, next.

INFP: Idealism

If you spot someone in a café corner sipping a latte while reading philosophy books and pondering how blockchain can change the world, congratulations—you’ve found a crypto INFP. Filled with ideals and emotions, they see cryptocurrency not just as an investment tool but as a path toward societal transformation.

INFPs invest in projects that align with their values. Nothing excites them more than supporting initiatives that make the world better. Data shows 90% of INFP investors consider a project’s impact on the industry when choosing where to put their money. They believe their capital can drive positive change, which is why they often contribute to public goods projects and live as digital nomads.

Their investment philosophy? “Where the heart leads, go barefoot.” They rely heavily on intuition and personal values, leaning toward right-side trading. When a project resonates emotionally, they jump in without hesitation. Regarding risk, 70% are willing to take risks for causes they believe in, though they manage exposure based on gut feeling. Passion doesn’t mean recklessness. On returns, 60% of INFPs earned 0–10% this year—solid, perhaps overly cautious.

ISTP: Spontaneity

ISTPs lean toward right-side trading. When a project sparks their interest, they charge in immediately. Yet despite their spontaneous nature, they’re often lucky—surrounded by expert traders and analysts who share valuable insights and “wealth codes.” They tend to trust these tips, applying light filtering before copying trades.

For ISTPs, investing is less about pure profit and more about experience and meaning. They accept moderate risk if it brings satisfaction and excitement. When it comes to new projects, they’re both picky and impulsive—nearly half decide case-by-case. As for meme coins, ISTPs show mixed feelings: 53.33% are interested but invest cautiously, likely due to their curiosity about market psychology.

Return-wise, results vary widely—big wins and big losses. Sometimes they strike gold on a trending meme; other times, personal taste causes them to miss key moves. Still, 40% of ISTPs achieved 30%+ returns this year.

One ISTP Bitget user admitted reflecting on his flawed system—he’s insensitive to data and often relies on others’ advice, sometimes forgetting what he owns. This leads to delayed exits and accidental “diamond hands,” holding through crashes and even zero-outs. Now, his go-to tool is Bitget Copy Trading—following reliable traders via automated execution ensures timely entries and exits.

INFJ: Vision

Crypto INFJs are idealists, filled with visions of a brighter future.

They back projects capable of transforming the world—think Layer 2s earlier this year. They care deeply about mission and vision, believing blockchain can revolutionize society. According to data, 85% of INFJ investors evaluate projects based on their potential positive social impact.

INFJs identify hidden trends using intuition and deep analysis, blending left- and right-side trading. They enter early and add during confirmed uptrends, actively participating in Bitget Launchpad and Launchpool—but almost never touch derivatives. On risk, 70% assess whether a project’s purpose justifies the gamble. Return-wise, 60% earned 10–30%, prioritizing sustainable long-term growth over short-term swings.

75% enjoy sharing insights within tight-knit circles or specialized communities. They avoid public debates, preferring meaningful, constructive discussions. They trust intuitive, thought-provoking content—deep dives, industry reports, and KOL perspectives.

ISFP: Agility

Crypto ISFPs are doers—hands-on problem solvers who thrive on action. Naturally attuned to numbers and tech, they prioritize practicality. They love novel projects they can test, use, and improve firsthand. And they’re skilled chart readers.

Professionally diverse, 26.67% come from finance/investing; 26.67% are full-time traders treating investing as a career; 13.33% work in IT/internet—as part of the coder brigade. Beyond crypto, many also trade A-shares,港股 (Hong Kong stocks), and other financial markets.

One ISFP Bitget user shared that his days split between K-line analysis and competitive cycling. Though both deliver adrenaline rushes, he avoids chasing constant thrills, instead valuing inner calm and disciplined execution. Whitepapers and hype news can be fabricated, but volume and market cap data are mostly real. So he prefers analyzing markets alone, studying charts independently, avoiding news cycles and community chatter. He trusts personal experience, intuition, and judgment above all. His favorite Bitget product? Futures contracts—mainly on BTC, ETH, SOL—guided by 200-day MA, volume, and market cap, with strict stop-loss rules.

His motto: “Action first—opportunities vanish fast.” He reacts swiftly to real-time shifts, favors right-side trading, short-term plays, and frequent contract use. Returns fluctuate—he might earn big quickly or lose due to overconfidence. But for him, learning matters more than outcomes.

ENFP: Enthusiasm

If at a blockchain conference you meet someone passionately chatting about the bright future of crypto, chances are you’ve found an ENFP. They radiate energy and optimism.

ENFPs gravitate toward innovative concepts with massive upside. Right-side traders by nature, once a project captures their imagination, they rush in—afraid of missing the next big wave.

On risk, most embrace high-risk, high-reward opportunities. Returns swing wildly—sometimes huge wins from catching trends, sometimes losses from excessive optimism. But for them, the journey outweighs the destination.

Social butterflies, 90% of ENFPs are active on social media and community platforms. They love sharing thoughts, sparking discussions, and organizing online/offline events. To them, connection creates greater value.

INTP: Logic

INTPs make decisions grounded in rigorous theory and logic, particularly attracted to innovative projects.

In execution and risk tolerance, they prefer independent thinking and rational choices, leaning toward left-side trading. INTPs understand risk logically—70% will moderately engage in high-return bets, but strictly control allocation. They accept calculated risks for outsized rewards, reducing uncertainty through theoretical validation and logical reasoning. On returns, almost all INTPs achieved 0–10% this year—calm, stable, and rational. They don’t chase overnight riches but focus on long-term value accumulation.

Still, exceptions exist—one Bitget user told us his best trade this year was BOME—an area outside his usual expertise. But noticing a mismatch between pool size and market cap, plus seeing few others discussing it, he entered with a small position. As price surged, he scaled up. He held until major exchanges listed it.

60% prefer discussing ideas with a small circle of like-minded peers. Active in niche communities, they enjoy sharing research findings.

ISTJ: Discipline

If you see someone checking market data daily, logging price movements, and executing trades strictly according to plan—congratulations, you’ve met a crypto ISTJ. Rule-followers through and through, detail-oriented and orderly.

ISTJs favor stable strategies and mature projects like Bitcoin and Ethereum. They believe long-term holding is the optimal path, unfazed by market noise. Beyond BTC and ETH, their favorite is Bitget’s financial products—especially BGSOL, Bitget’s liquid staking solution. Staking SOL earns BGSOL tokens, currently offering ~30.15% APY. It lets them generate yield from idle assets without putting all eggs in one basket.

ISTJs lean toward left-side trading—buying at fair prices and holding long-term. Risk-averse by nature, 80% prefer low-risk, stable returns. They conduct thorough due diligence on fundamentals, scrutinizing whitepapers and team backgrounds. Facts and data trump everything. Independent thinkers, 70% analyze markets solo, though they consult experts when needed. Rarely active on social media, they prefer reading professional reports and updates.

ENTJ: Leadership

ENTJs seek projects with massive potential and grand visions. They track industry trends, hunting for game-changing opportunities. Often, they’re not just investors but leaders and drivers behind projects.

Like others, ENTJs favor left-side trading—positioning themselves before others spot the chance. They assess risk rationally—60% willingly take high risks for high rewards. Skilled at macro analysis and trend forecasting, they build long-term strategies. Short-term swings don’t distract them—they focus on lasting value.

85% are active at industry conferences, expert forums, and on social media, networking with top players and expanding influence.

ENFJ: Sharing

90% of ENFJs are active in communities, on social media, and at offline events. Generous sharers and attentive listeners, they’re the “soul” of any group. They lean toward left-side trading, backing visionary projects early. On risk, 70% accept moderate risks to support meaningful initiatives, emphasizing interaction with teams and communities, seeking deep alignment with a project’s ethos and values.

ISFJ: Guardianship

Crypto ISFJs value stability and reliability, favoring proven, secure projects and mainstream coins.

Hence, they prefer right-side trading—acting only after trends are confirmed. Cautious by nature, 85% opt for low-risk investments, aiming for consistent, modest returns. They spend time evaluating security and trustworthiness, avoiding overly complex or risky ventures.

Not very social, 60% discuss investments only with close friends or family. Trust and dependable relationships matter most.

ESTJ: Execution

ESTJs are go-getters—efficient executors who back projects with clear business models and profitability. They focus on real-world utility and market potential, favoring tokens that deliver tangible returns.

Right-side traders, they base decisions on market data and trends. 75% have defined risk controls, pursuing steady profits. They love financial products, allocating part of their portfolio to Bitget’s stablecoin savings plans. ESTJs master technical analysis and metrics, prioritizing efficiency and discipline over emotion. 80% attend industry summits, expert forums, and business events—networking is key.

ENTP: Efficiency

ENTPs invest in disruptive, innovative ventures. Drawn to new ideas and tech frontiers, 90% enjoy posting opinions on social platforms, joining debates, sharing views, and exchanging ideas with others.

They lean toward left-side trading, positioning early before mass attention. Open to risk, 65% accept high-risk/high-reward propositions. Natural debaters, they analyze markets from multiple angles, spotting overlooked opportunities.

ESFP, ESFJ, ESTP: Optimism, Unity, Adventure

These three types generally favor right-side trading, embrace high risk for high reward. Due to their scarcity in our sample, they’re among the rarest “species” in crypto today.

Overall, we observe that crypto investors exhibit far higher risk tolerance than traditional ones, indirectly highlighting platform-specific user traits. For example, Bitget’s rapid listing pace and quick rollout of new products correlate with users showing greater market sensitivity and forward-thinking behavior.

Introverted (I) investors excel at deep thinking, favoring technical analysis and long-term planning—they’re the “researchers” of the market. Extroverted (E) investors leverage social intelligence, uncovering alpha at community frontiers and riding market waves.

This offers a fascinating lens into how different personalities navigate the volatile crypto landscape, providing self-awareness and guidance—helping each individual align their trading strategy and product choices with their inherent traits.

Diving into this “MBTI & Crypto Trading” topic reminded us how long it’s been since we last spoke directly with so many everyday crypto users. Beyond diversity, we witnessed platform evolution and innovation. Over the years, projects have exploded—from one per month to thousands daily—and exchanges continuously adapt to shifting environments.

Take pre-market trading, now one of the hottest trends—it originated with Bitget, marking the first significant innovation since the 2022 industry collapse. The space desperately needs such breakthroughs.

On Bitget’s sixth birthday, looking ahead to the next six years, perhaps RWA, stablecoins, and other high-potential sectors will push the industry to new scales. May Bitget maintain its innovative edge, creating fresh trading experiences and products tailored to diverse needs. After all, the winner takes all belongs to those who win user trust. The highest praise a trading platform can receive isn’t just “it helps retail traders profit,” but that it provides diverse products meeting the needs of every investor type.

Finally, as the U.S. election approaches next week with Trump’s odds rising, crypto may be heading toward an even more explosive bull peak. Regardless of your personality type, we wish everyone success in finding the right strategy—maximizing returns while managing risk wisely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News