Analyzing Flyingtulip: Adaptive AMM Leads a New DeFi Paradigm

TechFlow Selected TechFlow Selected

Analyzing Flyingtulip: Adaptive AMM Leads a New DeFi Paradigm

Flyingtulip's core innovation lies in introducing an intelligent trading protocol featuring adaptive curve technology.

By DaPangDun

AC @AndreCronjeTech recently updated his bio to include "Founder @flyingtulip_," so I decided to investigate what Flyingtulip actually is.

Positioning

According to its official website, Flyingtulip defines itself as a next-generation DeFi platform—a smart trading protocol that adapts to market conditions, offering improved execution, higher returns, and integrated DeFi services all within a single platform.

"Next-generation DeFi"—this phrase is truly exciting.

I've always been curious: what exactly *is* next-generation DeFi?

I've asked many seasoned DeFi users, but haven't received a clear answer. Can we perhaps find AC's answer by examining Flyingtulip?

Technical Highlights

From the official website and Twitter, we can identify the following technical aspects of the project:

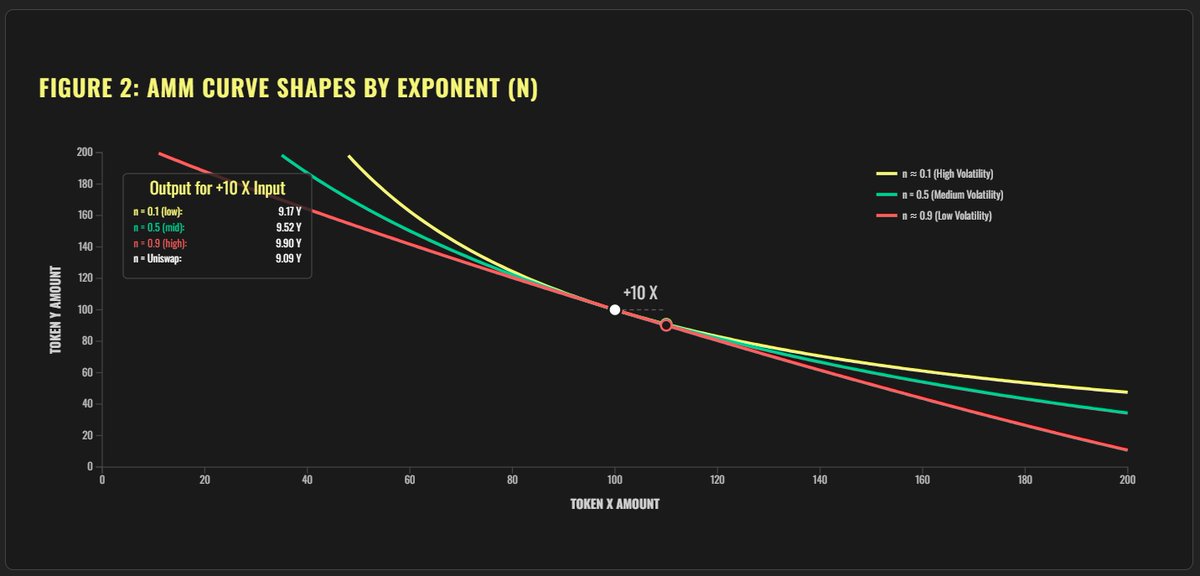

2.1 Adaptive Curve Technology

Unlike conventional AMMs, this dynamic AMM introduces time-weighted volatility. The system automatically adjusts curve parameters based on volatility, improving liquidity efficiency and minimizing impermanent loss.

In theoretical terms:

In low-volatility markets, the curve approaches X+Y=K

In high-volatility markets, the curve approaches X*Y=K

The benefits for traders include lower slippage and reduced impermanent loss during periods of low volatility.

During high volatility, although early impermanent loss may be greater than on Uniswap V3, the significantly higher fee income during transitional periods allows performance to roughly match Uniswap V3. Additionally, position adjustments can be executed automatically.

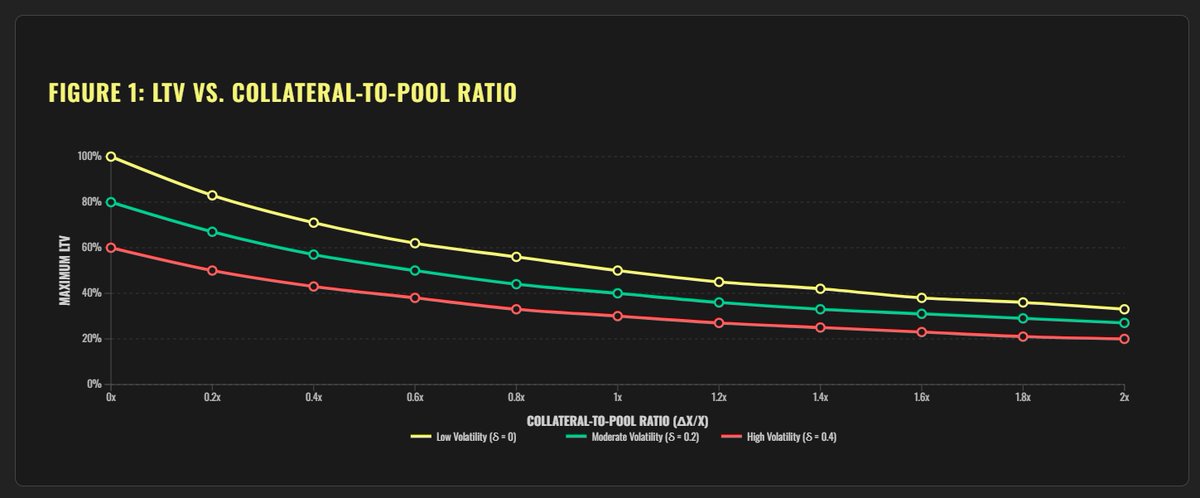

2.2 LTV Model Based on AMM

In traditional lending models, an asset is assigned a fixed Loan-to-Value (LTV) ratio. In contrast, this model operates on the core principle that:

The loan-to-value ratio must be dynamically constrained by market depth and asset risk.

Specifically: Low-volatility assets may have very high LTVs—potentially approaching 100%—while high-volatility assets are assigned lower LTVs, reducing overall systemic risk from new loans.

As volatility increases or expected borrowing size grows, the safe LTV range continuously narrows.

2.3 All-in-One DeFi

With the above models, spot trading, leverage, and perpetuals can be consolidated within a single AMM protocol, eliminating the need to distribute assets across multiple protocols. This effectively solves the problem of fragmented liquidity.

2.4 Other Technical Features

Certainly, there are additional optimizations. Here’s a brief summary:

Dynamic Fees: Fees are no longer fixed but instead adjust dynamically based on volatility.

More Revenue Streams: Since LP positions can now be utilized in more ways, returns naturally increase...

Overall, it feels like AC is attempting to use a volatility-responsive, self-adjusting AMM to unify most aspects of DeFi—not only enhancing user experience (lower slippage, reduced impermanent loss, higher fees), but also greatly promoting asset liquidity and capital efficiency. The product isn't available yet, but I'm highly anticipating it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News