A Brief Analysis of the U.S. Bitcoin Strategic Reserve: Not Below Expectations, Significant Long-Term Impact

TechFlow Selected TechFlow Selected

A Brief Analysis of the U.S. Bitcoin Strategic Reserve: Not Below Expectations, Significant Long-Term Impact

The source of the U.S. strategic reserve is confiscated bitcoins, which the market has long anticipated, so it's not below expectations.

TL;DR

1. The source of U.S. strategic reserves is seized Bitcoin, which the market has long anticipated, so it's not worse than expected.

2. Considering that the U.S. continues its enforcement actions, holding Bitcoin in the future will effectively mean receiving dividends from America’s crackdown on crypto crime.

3. Over the past 10 years, the U.S. has sold over 200,000 BTC; halting further sales is equivalent to a soft lockup, and the scale is larger than imagined.

4. At minimum, this soft lockup lasts 4 years—potentially up to 12 years if顺利 succeeds.

5. A strategic reserve will have significant positive influence on other countries, gradually prompting them to follow suit.

The market should already be pricing in the U.S. decision to hold confiscated Bitcoin as strategic reserves—after all, Trump made this very promise at Bitcoin 2024.

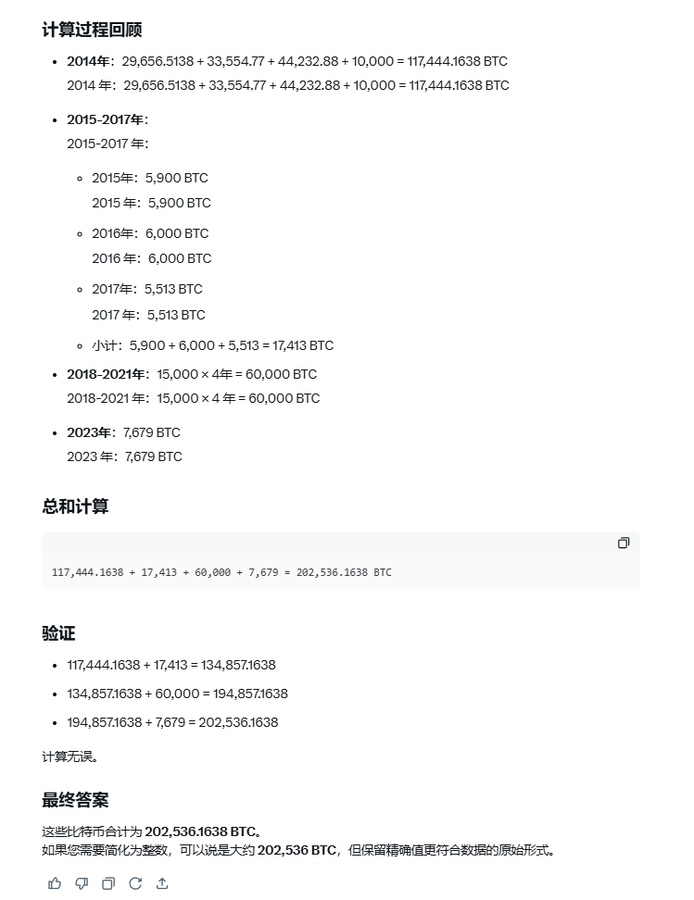

Moreover, simply refraining from selling is already a strong support. According to Grok3’s data, from 2014 until last year, the U.S. had dumped more than 200,000 BTC cumulatively—this was essentially hidden selling pressure.

Even a powerhouse like MicroStrategy, with years of accumulation, could only absorb one-third of the Bitcoin selling pressure generated by U.S. law enforcement.

Now, this selling pressure will remain off the market for at least four years. If Vance successfully takes over, it could become a 12-year hard lockup.

While this isn't as immediately impactful as the U.S. outright buying 1 million BTC, keep in mind that the U.S. may continue enforcement actions, with every new seizure going directly into this reserve.

Over time, this effectively becomes a slow buyback.

As long as you're not the one committing crimes—which I believe applies to 99% of people—holding Bitcoin means sharing in the rewards of America’s fight against crypto crime.

Each time a crypto criminal is taken down, your Bitcoin holdings quietly increase in proportion to the total supply.

Furthermore, as the amount of Bitcoin in this strategic reserve grows, we all know—skin in the game changes minds. The U.S. will increasingly favor Bitcoin.

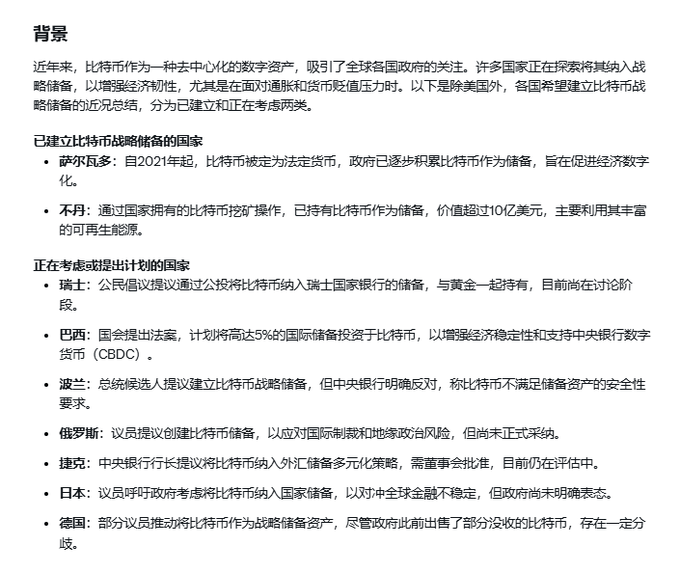

At the same time, this will decisively influence smaller nations’ attitudes. In the next 1–2 years, we may see country after country adopting Bitcoin strategic reserves. There’s a FOMO effect here: the later a nation waits, the higher the cost they’ll face.

I casually had Grok3 compile a list—these countries are already preparing, at various speeds. With the U.S. leading by example, their progress will accelerate significantly.

Stay faithful. Stay patient.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News