Deconstructing Berachain: The Double-Edged Sword Effect of the PoL Flywheel and Risk Mitigation

TechFlow Selected TechFlow Selected

Deconstructing Berachain: The Double-Edged Sword Effect of the PoL Flywheel and Risk Mitigation

From a long-term perspective, Berachain's challenge lies in continuously expanding its ecosystem while also developing a strategy to increase network fees, thereby countering the potential negative feedback loop caused by inflation.

Author: Tranks, Research Analyst at DeSpread

This article does not cover basic information about Berachain. If you are new to Berachain, it is recommended to read the following articles before proceeding.

1. Introduction

As the meme coin market cools down, interest in DeFi is gradually increasing. In this context, the Berachain ecosystem—offering stable token volatility and high yields—is beginning to attract new users.

From the launch of the Berachain mainnet on February 6, 2025, up to the writing of this article on March 4, Berachain's TVL has steadily increased to $3.2 billion, surpassing Base in total TVL rankings and reaching sixth place overall.

Berachain TVL Trend; Source: Defi Llama

Core ecosystem projects such as Kodiak, Yeet, and Ramen Finance have been preparing since the testnet phase and launched陆续 after the mainnet went live. However, these protocols have not yet registered their reward vaults for $BGT distribution. Currently, only providing liquidity to five designated pools within BeraSwap can earn $BGT rewards.

Reward Vaults List; Source: Berahub

Users can provide liquidity to BeraSwap pools, receive LP tokens, and deposit them into protocols like Infrared and Stride that support liquid $BGT, then use the received liquid $BGT tokens across other DeFi protocols. Additionally, users may deposit the same LP tokens into liquidity aggregators like Beradrome to earn its native token $BERO, and by staking $BERA, accumulate additional rewards from Beradrome, enabling various participation strategies within the ecosystem.

Furthermore, Governance Phase One (Governance Phase 1) began requesting protocol registration for reward vaults on February 26. As these requests are integrated and agreement-based rewards paid out to validators, the range of activities within the Berachain ecosystem is expected to become more diverse. During this process, the role of $BGT—which holds rights to receive and allocate network rewards—will grow increasingly significant, and the flywheel mechanism based on Proof of Liquidity (PoL) will be activated, attracting more users and liquidity into Berachain.

In this article, we will examine Berachain’s flywheel structure in detail to help new users manage risk, and discuss potential risks associated with the flywheel along with mitigation measures.

2. Understanding the Berachain Flywheel

Berachain adopts a PoL structure where network participants—including validators, ecosystem protocols, and liquidity providers—must mutually offer and extract value.

All participants form a state of aligned incentives, where growth or decline among roles directly impacts others. When each participant positively influences the rest, the following virtuous flywheel operates:

-

As the ecosystem grows, protocols increase incentives paid to validators.

-

With higher rewards distributed to $BGT holders, demand rises to acquire $BGT via liquidity provision while demand to burn $BGT decreases, leading to reduced issuance of $BERA.

-

Increased liquidity supply further fuels ecosystem expansion.

When this positive flywheel runs, $BERA price, protocol TVL, and overall ecosystem profits rise, benefiting all participants. However, three conditions must be met for the flywheel to function:

-

Protocol cost of reward spending < profit gained from rewarding and guaranteed liquidity

-

Risk exposure from holding ecosystem tokens < profit earned from $BGT via liquidity provision

-

Risk exposure from holding $BERA < yield earned from delegating $BGT

Once all conditions are satisfied, the flywheel begins spinning. Once initiated, each condition reinforces the others, creating self-sustaining momentum—the strength and stability of which depend on how strongly these conditions hold.

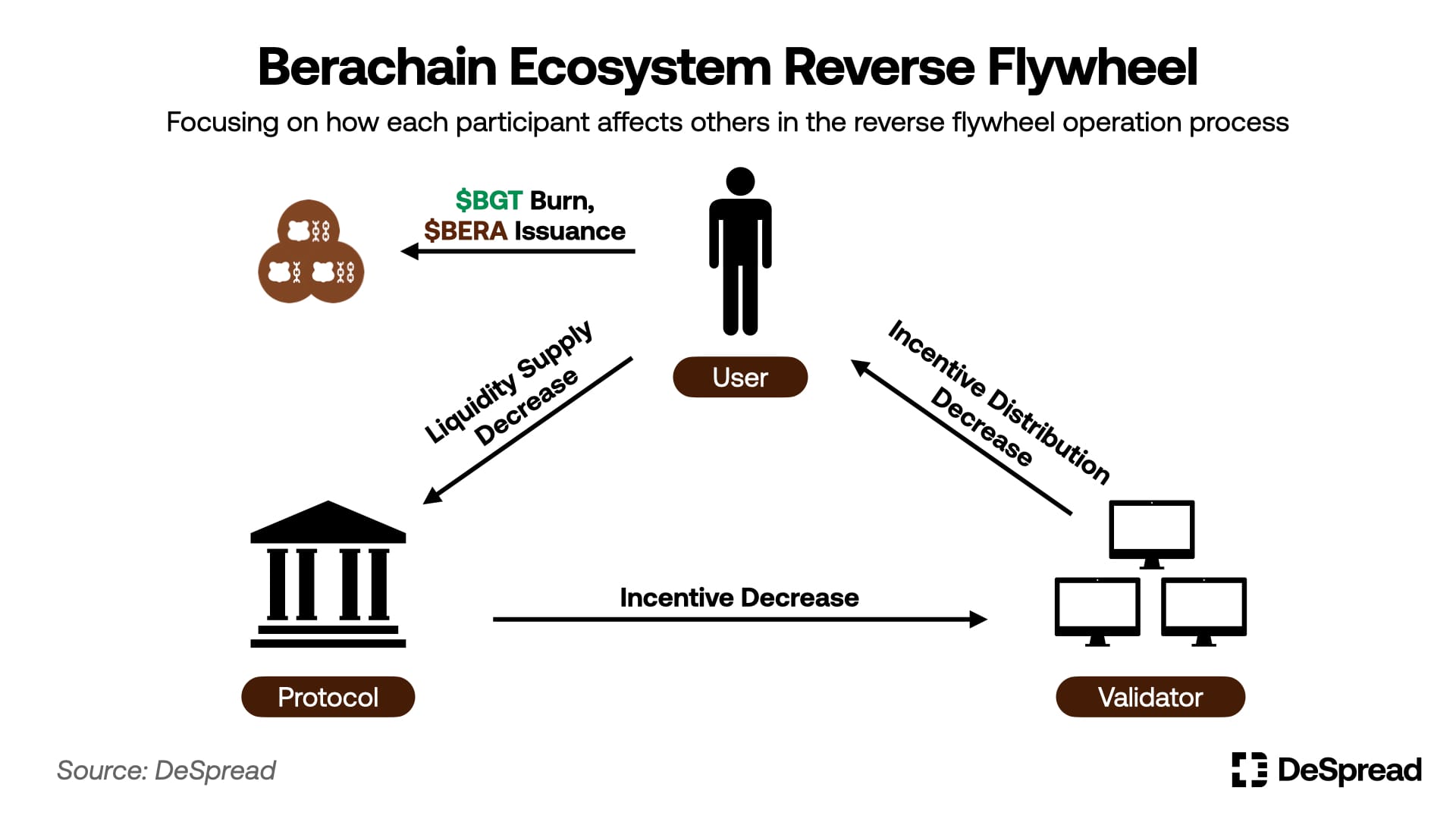

This flywheel structure appears to be a unique feature and advantage compared to traditional PoS models. However, if any one condition fails due to specific reasons and cannot recover in the short term, the conditions begin negatively impacting each other, causing the flywheel to reverse as follows:

-

As the ecosystem contracts, protocols reduce rewards paid to validators.

-

With lower rewards to $BGT holders, demand to earn $BGT via liquidity drops, demand to burn $BGT increases, and $BERA issuance rises.

-

Reduced liquidity leads to further ecosystem contraction.

In this reversed state, $BERA price, protocol TVL, and overall profitability decline until conditions for the positive flywheel are restored.

Considering near-term internal demand alone: 1) many protocols are expected to emerge seeking to issue their own tokens as rewards; 2) since $BGT emissions have just started, farming efficiency per $BGT is high, thus driving strong demand for liquidity provision and $BGT accumulation.

Given these factors, the flywheel is likely to operate during the early post-mainnet period. However, macroeconomic trends and investment flows in other sectors also influence flywheel dynamics, making it difficult to guarantee sustained success.

Next, we explore several risk scenarios that could trigger a reversal of the flywheel.

3. Reverse Flywheel Scenarios

3.1. $BERA Collapse

$BERA plays the following key roles in the Berachain ecosystem:

-

Staked to run validator nodes

-

Guarantees the minimum value of $BGT

-

Used as a deposit asset in various liquidity pools

Therefore, a declining $BERA value equates to weakened network security, reduced floor value for $BGT, and diminished ecosystem liquidity. For Berachain participants, the $BERA price is more critical than mainnet token prices on other networks.

While a smoothly running flywheel can sustain $BERA demand even with moderate price declines—as long as incentive yields remain attractive—a falling $BERA value may harm protocols, lowering effective yields, increasing user motivation to burn $BGT for $BERA redemption, or prompting withdrawal and sale of $BERA from liquidity pools. This could mark the start of a downward spiral, further depressing $BERA value.

Hence, particular attention should be paid to the following situations:

3.1.1. Large-scale $BERA Unlocks

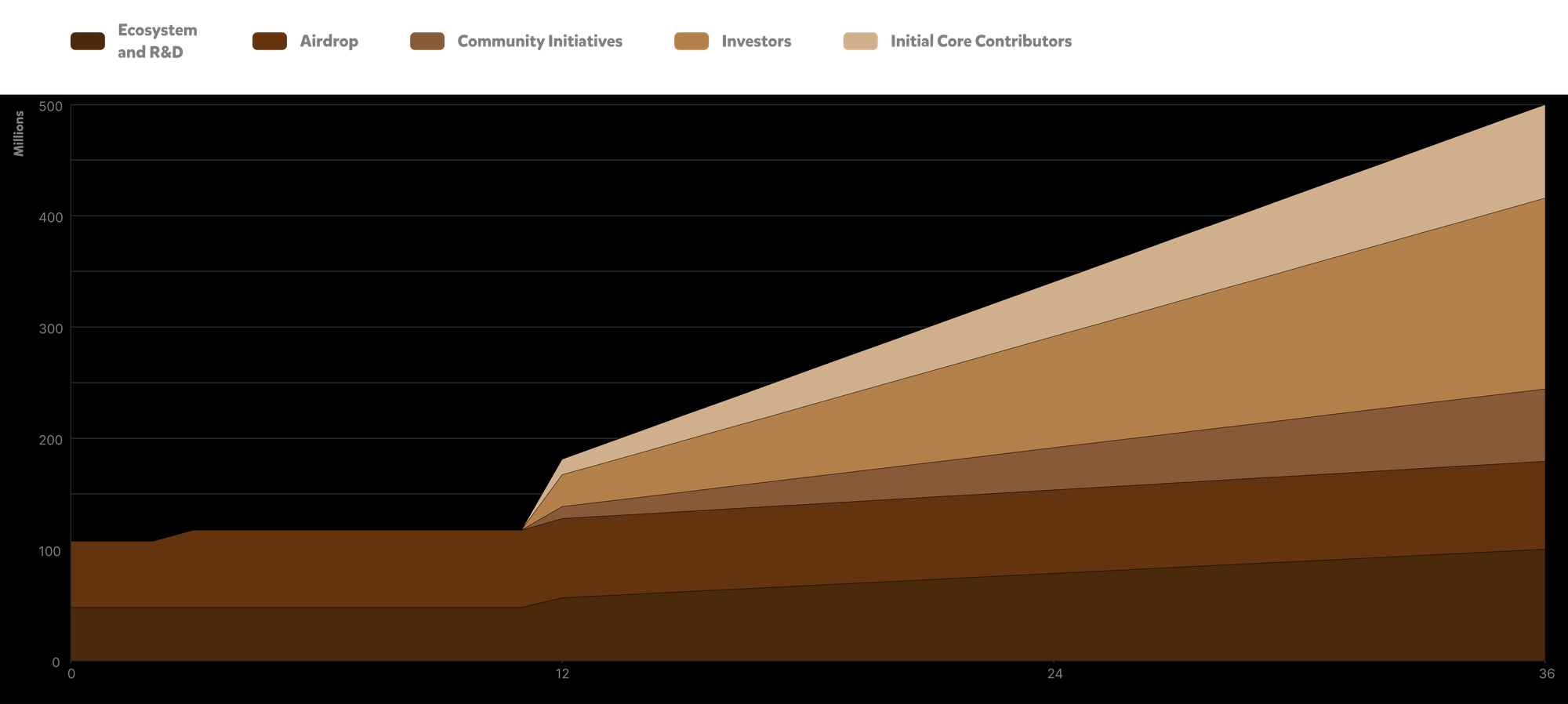

Beyond $BERA issued through $BGT burns, there is a pre-defined unlock schedule totaling 500M $BERA, outlined below:

$BERA Unlock Schedule; Source: Berachain Docs

Linear unlocks for investors, early core contributors, and independent community allocations are scheduled to begin in February 2026—one year after mainnet launch. Prior to that, near-term factors potentially increasing circulating supply and triggering sell-side pressure include:

-

Distributions to protocols and communities via the RFB program (~2.04% of total supply)

-

Allocations to be distributed via the Boyco program (~2% of total supply)

The RFB distributions to users require a minimum 6-month vesting period, and given staggered release timing across protocols, significant immediate market impact is unlikely.

However, Boyco allocations are expected to be distributed in approximately two months, similar in format to existing airdrops. In this case, ~2% of total $BERA supply would enter circulation, potentially exerting notable sell pressure. Moreover, assets deposited into the Boyco program will also be unlocked upon $BERA airdrop distribution, possibly reducing liquidity within the ecosystem. This creates favorable conditions for triggering a reverse flywheel, simultaneously driving down $BERA price and ecosystem liquidity.

Thus, monitoring whether the ecosystem can establish an attractive flywheel before the Boyco program concludes—capable of absorbing released $BERA and retained liquidity—becomes crucial.

3.1.2. Mass Exit and Panic Selling by $BGT Holders

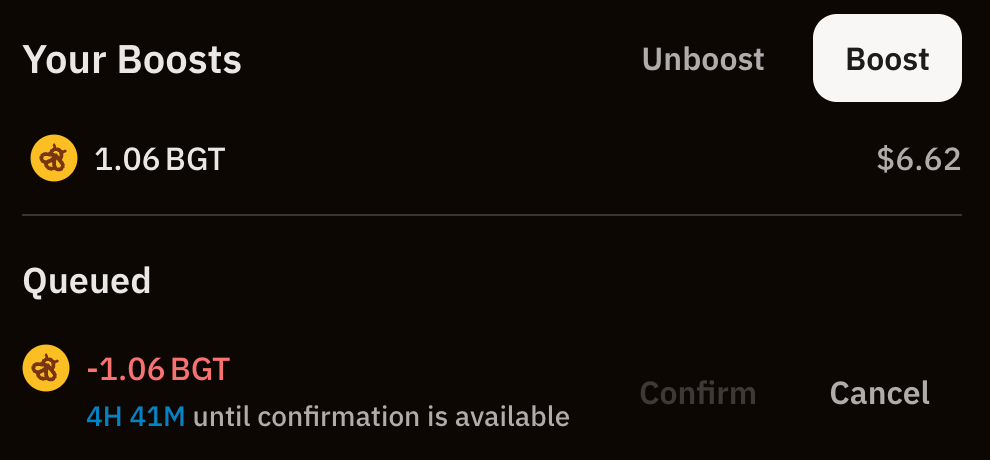

To obtain $BGT, users must provide liquidity to eligible pools and commit time. However, via the BeraHub Redeem function, users can burn delegated $BGT at any time to redeem $BERA for sale, with only a ~5-hour unlocking delay.

Berachain requires an Unboost time of about 5 hours; Source: BeraHub

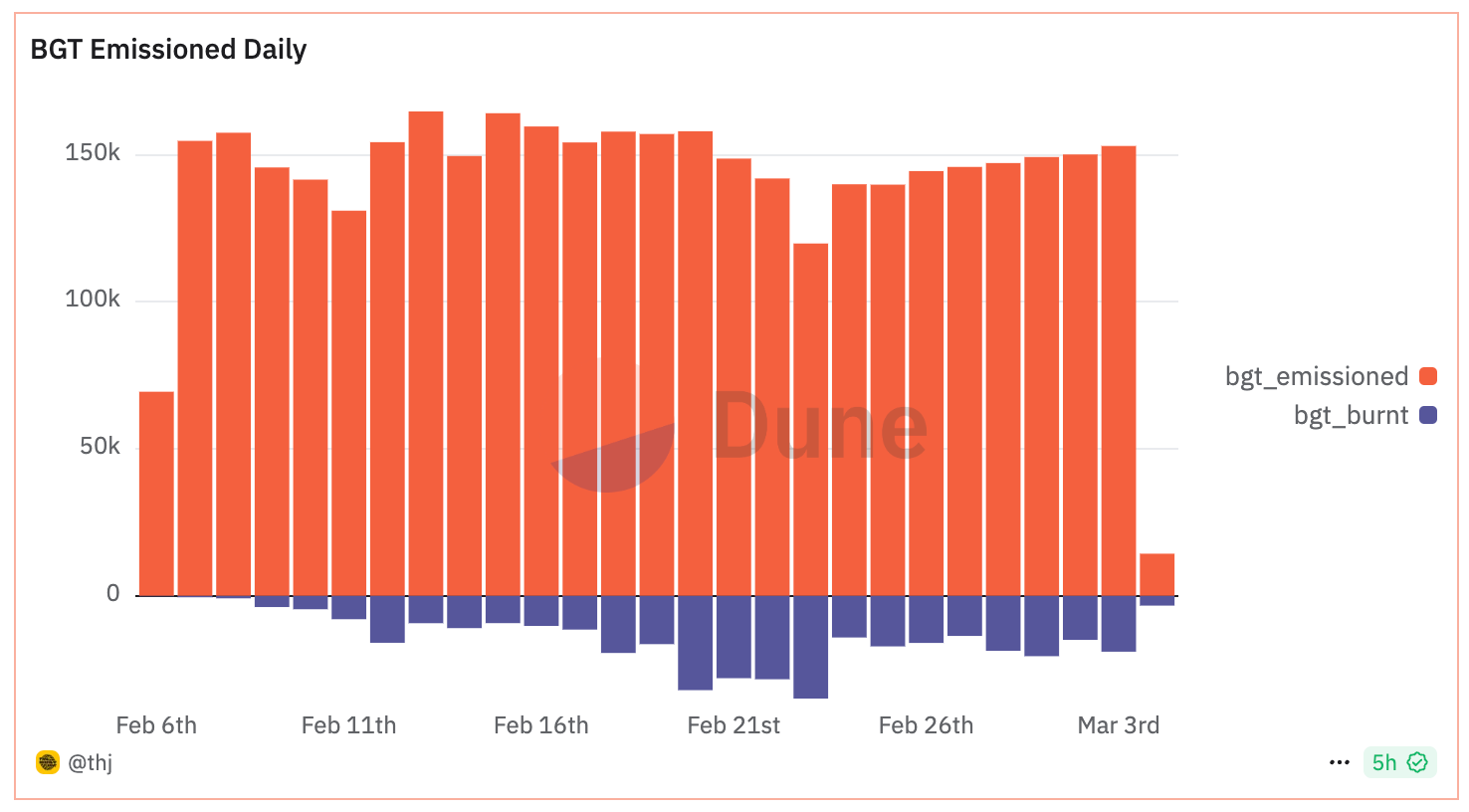

If large $BGT holders exit en masse, circulating $BERA could rapidly increase. Should $BERA price sharply decline as a result, it may trigger panic selling by other $BGT holders and liquidity providers, amplifying the drop. Therefore, tracking $BGT burn volume trends is essential to understanding current ecosystem dynamics.

$BGT Emission & Burn Trend; Source: @thj

Additionally, liquidity provision reward rates and $BGT yield trends are the most critical determinants of $BGT burning and delegation demand. Continuously observing these indicators allows partial prediction of the aforementioned risk scenarios and assessment of the flywheel’s recovery potential in the event of mass $BGT burns.

Meanwhile, demand for liquid $BGT tokens rises with higher incentive rates, pushing prices up—and falls with lower rates, dragging prices down. Thus, when historical reward and yield data are hard to assess, the premium trend of liquid $BGT relative to $BERA—which reflects $BGT’s intrinsic value—can serve as a proxy metric.

iBGT/BERA Price Chart; Source: Dex Screener

However, liquid $BGT token prices are influenced not only by $BGT’s intrinsic value but also by liquidity protocol incentive designs and other protocol-specific factors, which should also be considered.

3.2. Inflation and Growth Slowdown

Beyond the 500M $BERA distributed to network participants over the first three years post-mainnet, Berachain maintains an annual inflation rate of approximately 10% for $BGT. While part of network fees are burned, Berachain’s primary activity—depositing assets into liquidity pools to earn yield—makes significant fee burn unlikely.

This implies that even if Berachain establishes a positive flywheel within three years (by which point all $BERA unlocks are complete), sustaining it annually requires attracting external capital inflows exceeding the inflation rate.

Berachain founder Smokey The Bera, in an interview with Bell Curve interview, mentioned they are developing a dynamic inflation model that adjusts based on $BGT reward distribution rates to address this issue.

While this feature may help regulate flywheel acceleration and improve sustainability, so long as "inflation" persists, a reverse flywheel—driven by $BERA depreciation and ecosystem contraction—is inevitable at certain stages. Hence, even from a long-term perspective, continuous monitoring of the aforementioned ecosystem metrics remains essential for diagnosing health.

Moreover, simply holding $BERA spot without active participation in the ecosystem is an inefficient investment strategy, failing to offset value dilution caused by inflation. Therefore, for users aiming to build positions in $BERA, actively depositing into ecosystem protocols to generate yield is a crucial strategy.

For users seeking to build long-term, stable positions within the ecosystem, conservatively accumulating $BGT or performing compound deposits using assets less affected by flywheel-driven price swings (e.g., $BTC, $ETH, stablecoins) may prove effective.

3.3. $BGT Monopolization

In most recently launched PoS networks, entities with larger stakes receive disproportionately higher rewards. This consolidates validator share concentration, posing centralization risks.

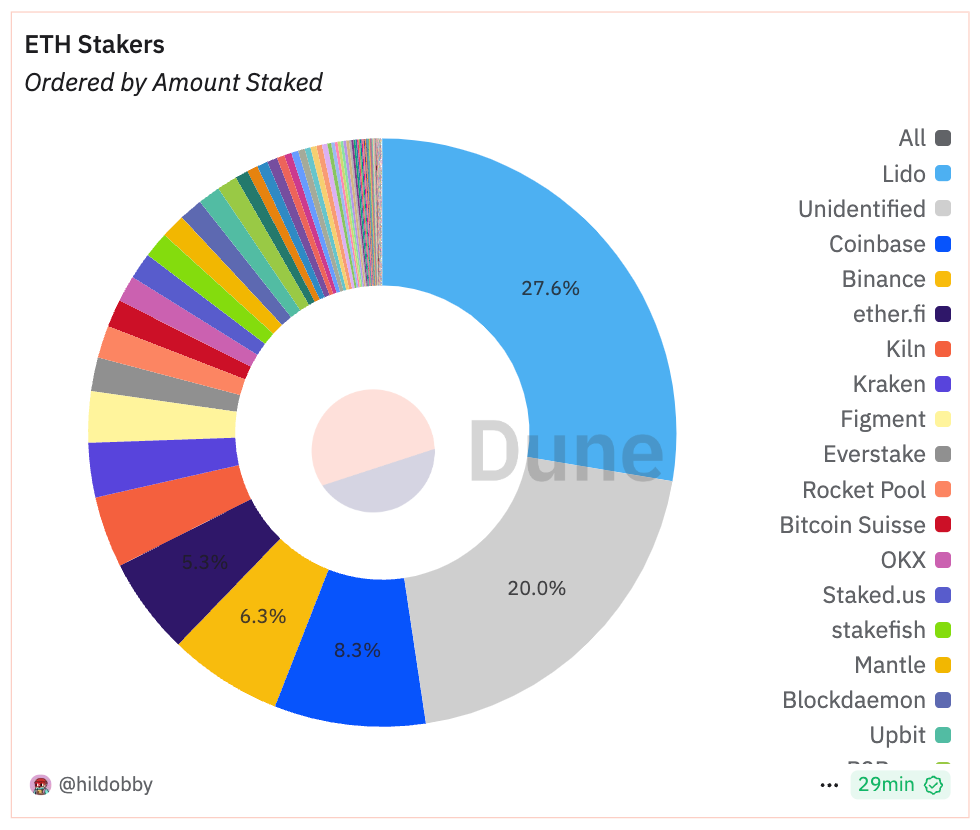

Validator Staking Market Share in the Ethereum Network; Source: @hildobby

Berachain, built on a modified PoS foundation, has experienced similar phenomena. Furthermore, in Berachain, validators holding large amounts of $BGT can directly intervene in the ecosystem, unilaterally designing structures favorable to themselves. Thus, $BGT monopolization leads to ecosystem control, presenting greater token centralization risk compared to standard PoS networks.

To mitigate this, the team capped $BERA stake influencing block production at 10M and introduced diminishing returns for Boosting as $BGT voting power per block increases. However, these limits can be circumvented by operating multiple nodes under one entity or collusion among validators.

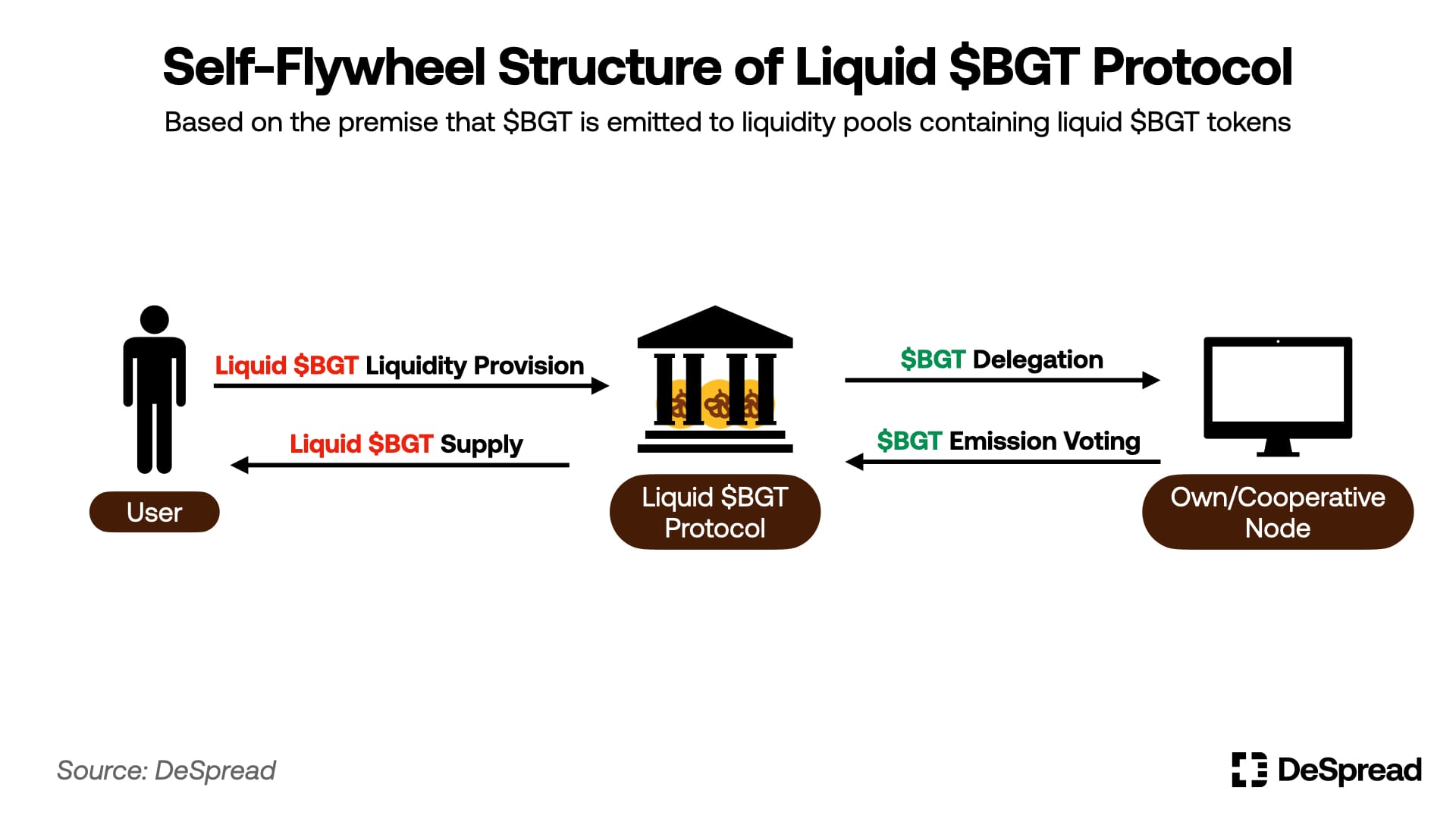

Notably, liquid $BGT protocols hold advantages in attracting liquidity for Berachain reward vaults due to the high latent value of “liquidity.” They can represent users by depositing received liquidity into reward vaults, directly accumulating $BGT. By recycling this $BGT to nodes they operate or partner with, such protocols gain substantial $BGT emission voting power without needing coordination with other ecosystem players.

If these protocols direct extra $BGT emissions toward liquidity pools containing liquid $BGT tokens, they can create independent flywheels—increasing demand for their provided liquidity without issuing separate rewards.

In such cases, the strength of a liquid $BGT protocol’s flywheel scales with its ratio of held $BGT to total $BGT emitted in the ecosystem. If multiple liquid $BGT protocols accumulate large $BGT shares and continuously prioritize boosting liquidity solely for their own liquid $BGT tokens, they may suppress liquidity growth for other protocols, hinder new protocol launches, limit ecosystem diversification, ultimately shrink the ecosystem, and trigger a reverse flywheel.

As previously noted, structural constraints on $BGT monopolization can be implemented via protocol design, but complete prevention is difficult. Therefore, the best safeguard against entity monopolization is achieving broad participant consensus on ecosystem sustainability before monopolistic structures solidify—requiring ongoing community vigilance and collective effort.

4. Conclusion

So far, we’ve explored how Berachain’s flywheel operates, its required conditions, and potential reverse flywheel scenarios. Beyond the cases discussed, if any of the three core conditions fail, the reverse flywheel will activate. Hence, continuously monitoring network and ecosystem metrics to assess flywheel status is vital on Berachain.

Additionally, the unfamiliar PoL mechanism combined with various DeFi protocols leveraging it is giving rise to complex derivatives and synthetic assets that are difficult to intuitively understand. Users must proactively understand their portfolio structures and anticipate overlapping structural and security risks.

In the long run, Berachain’s challenge lies in expanding the ecosystem while developing strategies to increase network fees—necessary to counteract inflation-driven reverse flywheel risks. Close attention must be paid to whether consumption-oriented applications such as Perp DEXs or on-chain games can take root, generating genuine user traffic beyond simple “deposit-and-earn” behavior.

We hope this article clearly helps users understand the Berachain ecosystem and enables effective responses when a reverse flywheel emerges.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News