US Bitcoin reserve policy may be underestimated:解读“budget-neutral strategy”

TechFlow Selected TechFlow Selected

US Bitcoin reserve policy may be underestimated:解读“budget-neutral strategy”

It's not that they can't increase their stake, but rather they need to do so more flexibly.

Written by: TechFlow

Good news: Trump has signed the "Strategic Bitcoin Reserve" plan.

Bad news: It's not the kind of "direct spending to buy more BTC" you might have imagined.

On March 7, former President Trump officially signed an executive order announcing that the United States will establish a "Strategic Bitcoin Reserve."

However, considering the policy details, things may not be as optimistic as expected.

According to the policy, the funding for this Bitcoin reserve will not come from direct purchases, but rather from Bitcoin obtained through criminal or civil asset forfeitures.

In other words, the U.S. government will not use fiscal funds or new taxes to purchase Bitcoin, but instead rely on assets seized during judicial proceedings.

This clause clearly disappointed the market, as it implies the scale and pace of the reserve buildup could be extremely limited—and may even fail to provide any direct boost to the Bitcoin market.

Following the announcement, Bitcoin’s price declined somewhat, and some netizens jokingly remarked that the market was being led around by the nose, creating what they called a "Trump-driven market" ("Chuan Market").

Yet beyond the general sense of underperformance, one should not overlook another key term in the policy—budget neutrality.

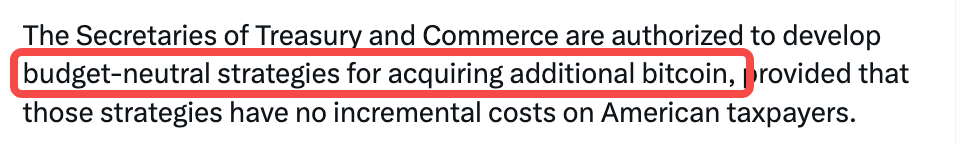

This provision stipulates that the U.S. government must ensure no additional burden is placed on taxpayers when establishing the Bitcoin reserve. However, the Secretary of the Treasury and the Secretary of Commerce are authorized to develop budget-neutral strategies to acquire more Bitcoin.

This may appear restrictive at first glance, but in reality, it opens up broader possibilities for implementation.

Perhaps the real focus of this policy isn’t the widely discussed aspects of “asset forfeiture” or “reserve size,” but rather the greater operational flexibility enabled by the principle of “budget neutrality”:

It's not about whether BTC can be added, but how flexibly it can be added.

Budget Neutrality, Operational Flexibility

What does budget neutrality mean?

Simply put, budget neutrality is a fiscal principle requiring that when implementing new policies, the government must not increase the overall fiscal deficit or taxpayer burden. In other words, if the government spends money on one thing, it must offset that expenditure by cutting elsewhere or increasing revenue.

In the context of this Bitcoin reserve policy, budget neutrality means: The U.S. government cannot directly use its fiscal budget to buy Bitcoin, but must instead follow a “buy-sell balance” approach, ensuring that sources and uses of funds for the reserve offset each other.

This is precisely why the policy specifies that the initial funding for the Bitcoin reserve will come from Bitcoin seized through criminal or civil asset forfeiture.

But importantly, budget neutrality does not mean the government cannot acquire more Bitcoin through other means. To be clear, it’s not “can’t buy,” but rather “how to buy.”

Budget neutrality establishes a “closed-loop” logic for implementation: Any increase in Bitcoin reserves must be achieved through reallocation of other assets or resources. This mechanism creates multiple potential pathways:

-

Asset swaps to achieve reserve goals—for example, exchanging gold

For instance, the government could sell existing reserve assets (such as gold or Treasury bonds) and use the proceeds to purchase Bitcoin. This way, while Bitcoin holdings increase, the total asset size remains unchanged, satisfying budget neutrality requirements.

-

Direct inclusion of Bitcoin seized through judicial actions into the reserve

The government could utilize Bitcoin confiscated via legal proceedings as a source for the reserve. This avoids fiscal spending, though the scale depends entirely on the volume of seizures, introducing significant uncertainty.

-

Monetizing resources or reallocating earnings

The government could also monetize other resources (such as energy or land) and use the proceeds to build Bitcoin reserves. For example, using idle energy resources for Bitcoin mining, or selling non-core assets to acquire Bitcoin.

This “buy-sell” logic serves both as a constraint on fiscal discipline and as a space for operational flexibility. It ensures the government won’t increase the fiscal deficit by acquiring Bitcoin, while also designing multiple avenues for practical execution.

Is the impact of not directly buying BTC underestimated?

You might ask: If the U.S. government truly wants to build a strategic reserve, why not simply increase the budget to buy BTC directly? Why go through such complicated procedures?

First, it may be to avoid market panic.

If the government directly used fiscal funds to massively purchase Bitcoin, it could trigger concerns over the credibility of the U.S. dollar and potentially fuel inflationary pressures. Budget neutrality, with its “buy-sell offset” mechanism, avoids the risks associated with new fiscal spending and allows for a smoother policy rollout.

Second, exploring possibilities for asset restructuring

Budget neutrality offers the government opportunities to restructure its current asset portfolio. For example, swapping gold reserves for Bitcoin, or exchanging other resource reserves for Bitcoin, enables more flexible adjustments based on market prices and geopolitical dynamics—achieving optimized asset allocation and enhancing strategic agility in international competition.

The key point is: Budget neutrality does not rule out active government accumulation of Bitcoin; it merely requires achieving reserve targets through forms of “trading old for new” or “exchanging small for large.”

The current market disappointment likely stems from overlooking the hidden flexibility within budget neutrality. In fact, this clause doesn't restrict policy execution—it expands it.

Given Trump’s history of unconventional moves, this also gives him more room to claim, “The interpretation rights belong to me.”

For now, however, market reactions suggest limited enthusiasm for the policy, with both gold and Bitcoin prices falling after the announcement.

Peter Chung, Research Director at Presto Research, posted: “BTC did not react positively, suggesting there was a notable presence of ‘Buy the Rumor, Sell the News’ behavior in the market.”

Beneath this short-term volatility may lie a misunderstanding of the policy’s logic.

The market had hoped the U.S. government would directly use its budget to buy Bitcoin—a move that would rapidly expand the reserve and create strong buying pressure, pushing prices higher. Instead, the adoption of a “budget-neutral” approach has been interpreted in the short term as “insufficient strength,” triggering sell-offs.

In reality, budget neutrality doesn’t equate to weaker policy impact—it enhances execution flexibility. As stated in the policy, the Treasury and Commerce Secretaries are empowered to design various strategies for acquiring Bitcoin. These “trade-old-for-new” or “exchange-small-for-large” methods could unlock significant potential in the future.

In the short term, markets focus heavily on the scale and speed of Bitcoin reserve accumulation, so the lackluster price reaction is understandable.

But long-term macro shifts cannot be ignored.

If the U.S. government gradually accumulates Bitcoin through budget-neutral means, it sends a powerful signal: Bitcoin is transitioning from a “speculative asset” to a “reserve asset.” Such a signal could prompt other countries to follow suit, accelerating Bitcoin’s global adoption.

Especially if the U.S. government actually begins exchanging gold for Bitcoin, this kind of asset swap would further solidify Bitcoin’s status as “digital gold,” laying the foundation for its role in global reserve portfolios.

As a bellwether, U.S. government actions could trigger ripple effects worldwide, with other nations possibly adopting similar models, driving diversification across global reserve assets.

When it becomes widely accepted that Bitcoin should be part of reserve holdings, the specific method of acquisition may no longer matter.

From niche geek experiments to where we stand today, the crypto industry has come a long way. Moving into the mainstream amid controversy is exactly what every BTC holder should celebrate.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News