Everyone is criticizing VC coins—how has this round of VC performed?

TechFlow Selected TechFlow Selected

Everyone is criticizing VC coins—how has this round of VC performed?

Who to follow for investment makes it easier to earn or lose money.

Author: Jiale, BlockBeats;Sai Ge, Crypto Enthusiast

Bull market for trading tokens, bear market for doing research.

This cycle, everyone is criticizing VC tokens. But do you know which VC has the highest token issuance rate? And which one has the highest listing rate on exchanges? If not buying VC tokens, how about farming? Which institutions are worth tracking long-term?

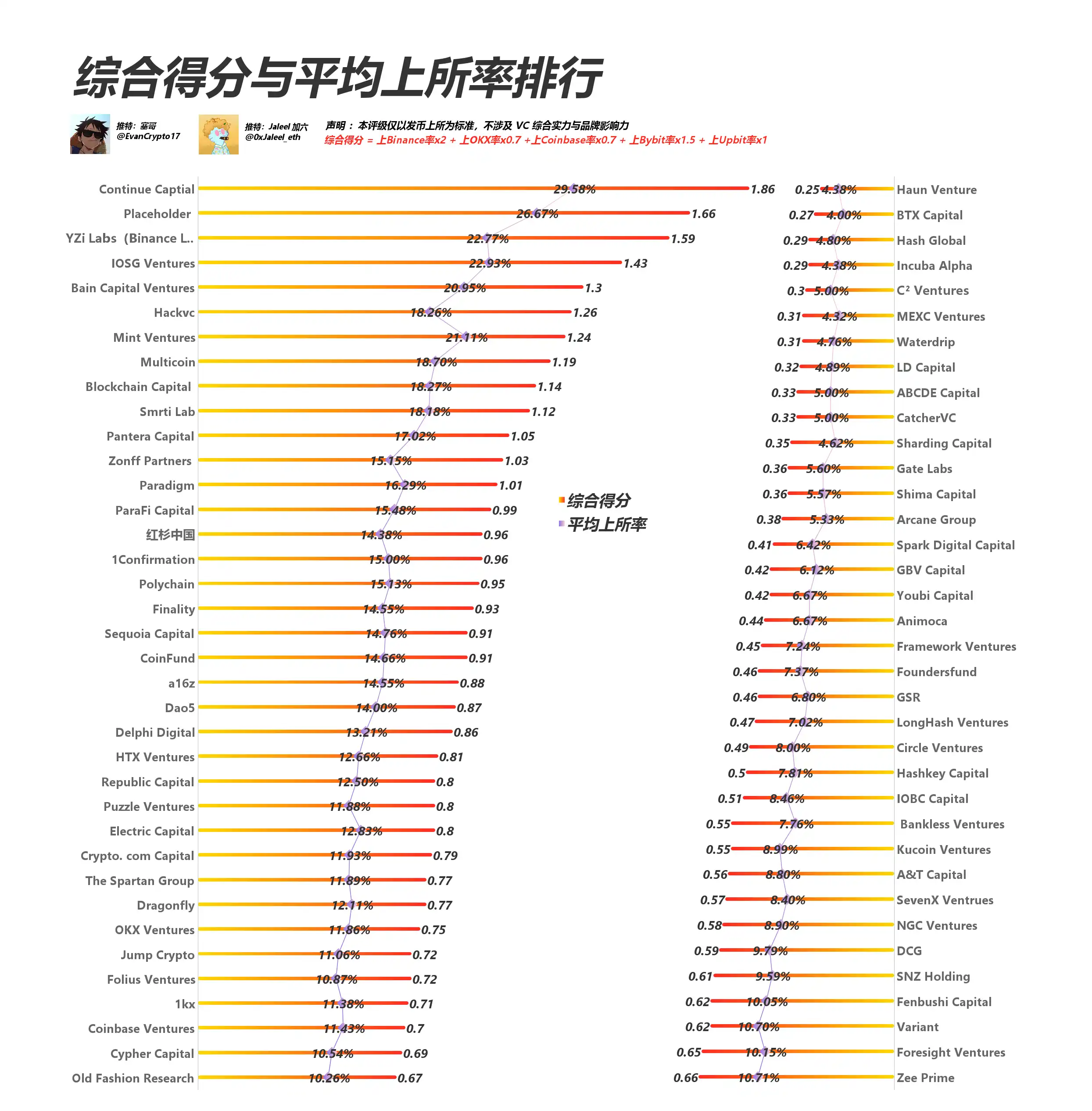

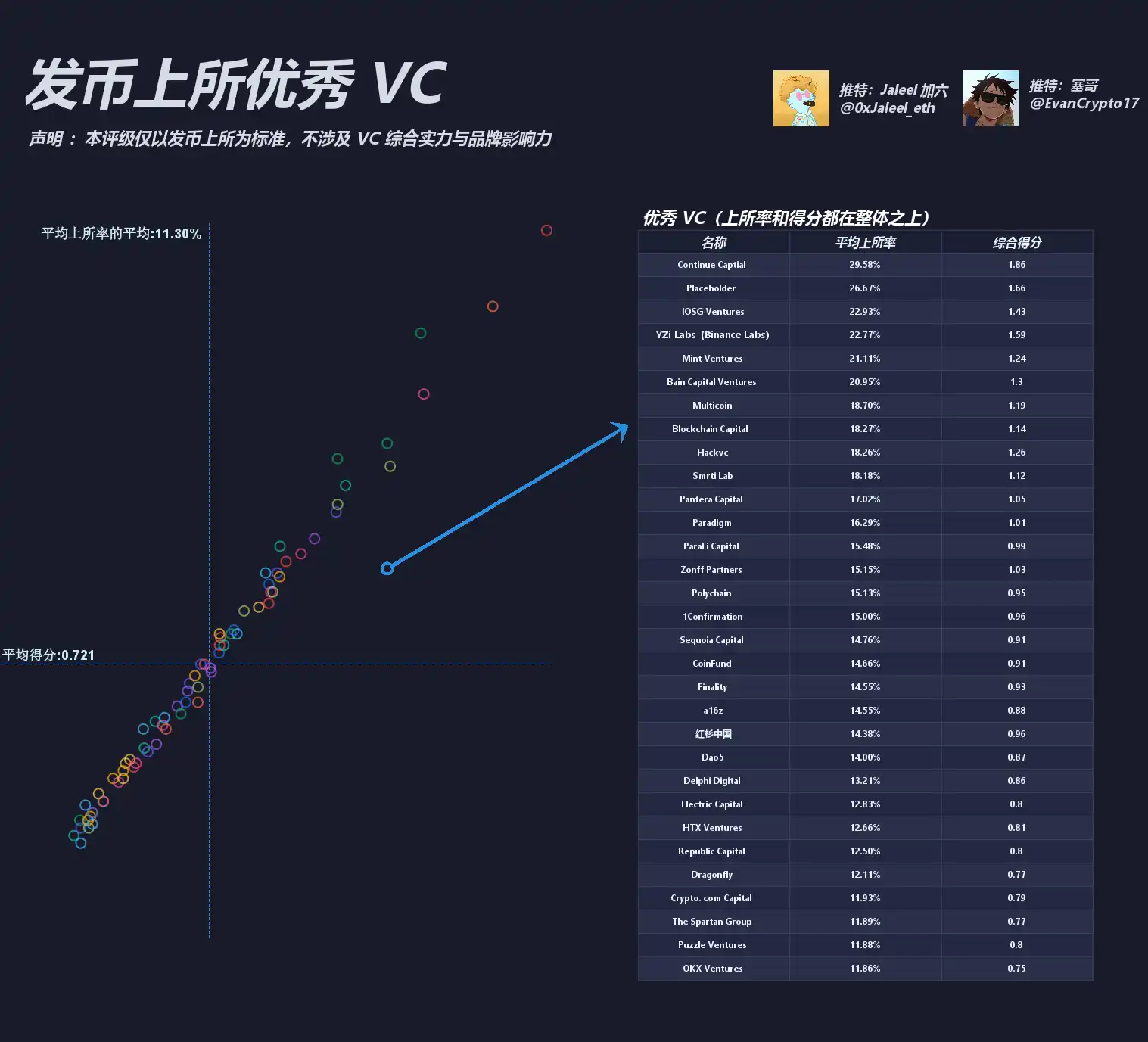

Building upon the core metric of "project listing efficiency," we selected a total of 73 VCs—35 domestic, 30 international, and 8 exchange-affiliated VCs. We analyzed their portfolio projects’ token launches and listings on five major exchanges: Binance, Bybit, Upbit, OKX, and Coinbase. For example, the Binance listing rate = number of projects listed on Binance / total investment count. Additionally, we introduced weighted parameters reflecting current market dynamics: Binance (2), Bybit (1.5), Upbit (1), OKX & Coinbase (0.7 each). The results are visualized through clear, hard-hitting charts to dissect crypto VC performance from this specific angle.

Note: This report focuses solely on the dimension of “project listings on exchanges” and does not provide a comprehensive evaluation of VCs’ overall strength or long-term brand influence. For reference only.

Key Takeaways First

Based on past project listing outcomes and applying weights across the five key platforms—Binance, Bybit, Upbit, OKX, Coinbase—the recalculated rankings reveal several notable shifts:

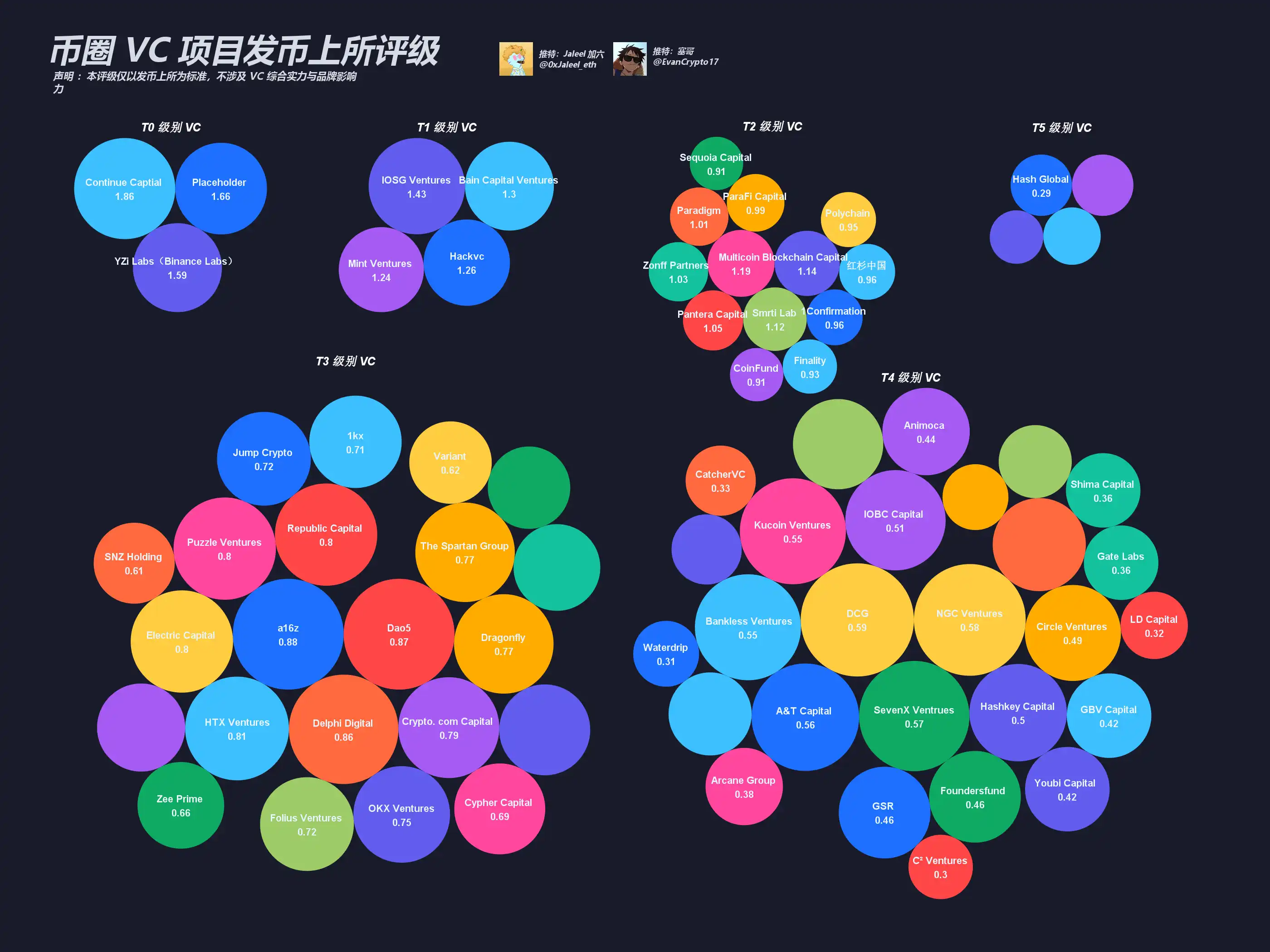

T0 Tier: Continue Capital, Placeholder, YZi Labs (Binance Labs), IOSG Ventures remain at the top, though differences in Bybit or Upbit listing rates cause some divergence in scores and positions.

T1/T2 Tier: Bain Capital Ventures, Mint Ventures, HackVC have entered the high-score matrix; Polychain, Multicoin, Paradigm, Zonff Partners maintain stable performances.

T3/T4 Tier: OKX Ventures, SNZ Holding, The Spartan Group, Animoca, NGC Ventures—VCs previously focused on GameFi or niche sectors—show fluctuations in this ranking.

T5 Tier: Smaller-sized or more regionally focused funds score relatively lower in global listing efficiency, but still hold potential for future breakout.

It should also be noted that newly launched or yet-to-be-tokenized projects are not included in this data. Therefore, VCs focusing on seed rounds or research labs may not have their full potential reflected in these listing metrics.

T0: Composite Score > 1.5

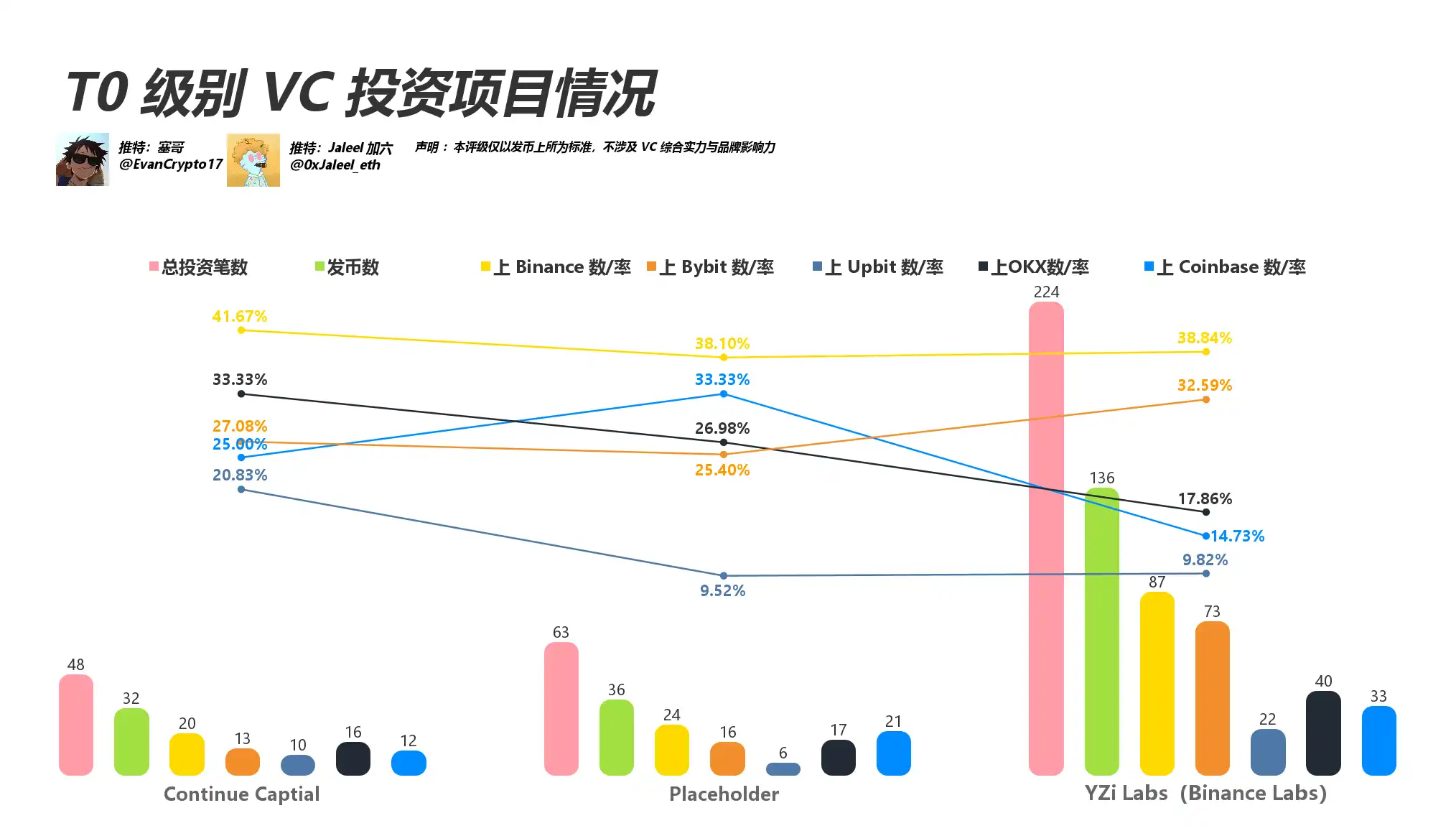

Key Players: Continue Capital; YZi Labs (Binance Labs); IOSG Ventures; Placeholder. As shown in the chart, these four share a distinct "multi-platform, multi-sector" profile:

Continue Capital: Fewer investments, but both ROI and listing rates are outstanding—truly a dark horse. Continue Capital maintains a consistently high Binance listing rate, with solid performance on Bybit as well.

YZi Labs (formerly Binance Labs): No need for much introduction. Although CZ recently claimed that 80% of YZi Labs’ investments are losing money, our data shows they’ve backed the largest number of projects with massive scale in token listings, benefiting greatly from privileged access to their “in-house” channels.

Placeholder: Not many projects, nor particularly high-profile in the industry, but their portfolio listings are remarkably precise. Many investments focus on infrastructure, enabling faster listings across top-tier exchanges post-launch. Their composite score remains firmly in the T0 tier. On a lighter note, Placeholder partner Chris Burniske recently shared his market view: “I still believe this is a mid-cycle correction—the peak hasn’t arrived yet. Even if Bitcoin continues to pull back, it won’t change my outlook. Selling now out of fear is unwise. Those who sell will likely miss the next leg up.”

Summary: T0-tier success stems from hardcore resources and precision targeting of high-quality projects. Some exchange-affiliated VCs can even drive fast-track listings, while pure research-driven firms rise through superior investment analysis.

T1: Composite Score >= 1.2

Representative Firms: Bain Capital Ventures; HackVC; Mint Ventures. In the updated chart, T1-tier VCs show clear consolidation in strength:

Bain Capital Crypto: Strategic, large-scale investments with deep involvement per project. Increasingly strong control over listings on Upbit and Bybit.

HackVC: High volume and diversified investments. With rising market share of Bybit, OKX, and Coinbase, an increasing number of their backed projects are successfully listing.

IOSG Ventures: Known for “broad coverage, deep research,” with listing success rates fluctuating between 20–30%. Notably increased listings on Upbit and Bybit over the past year.

Mint Ventures: Smaller project scale but exceptional efficiency. Achieved over 30% listing rate on Bybit at one point—an exemplar of specialized strategy.

Summary: Most T1-tier projects achieve listing success rates between 15–30%, typically without significant weaknesses across any single platform—exhibiting balanced strengths across multiple exchanges.

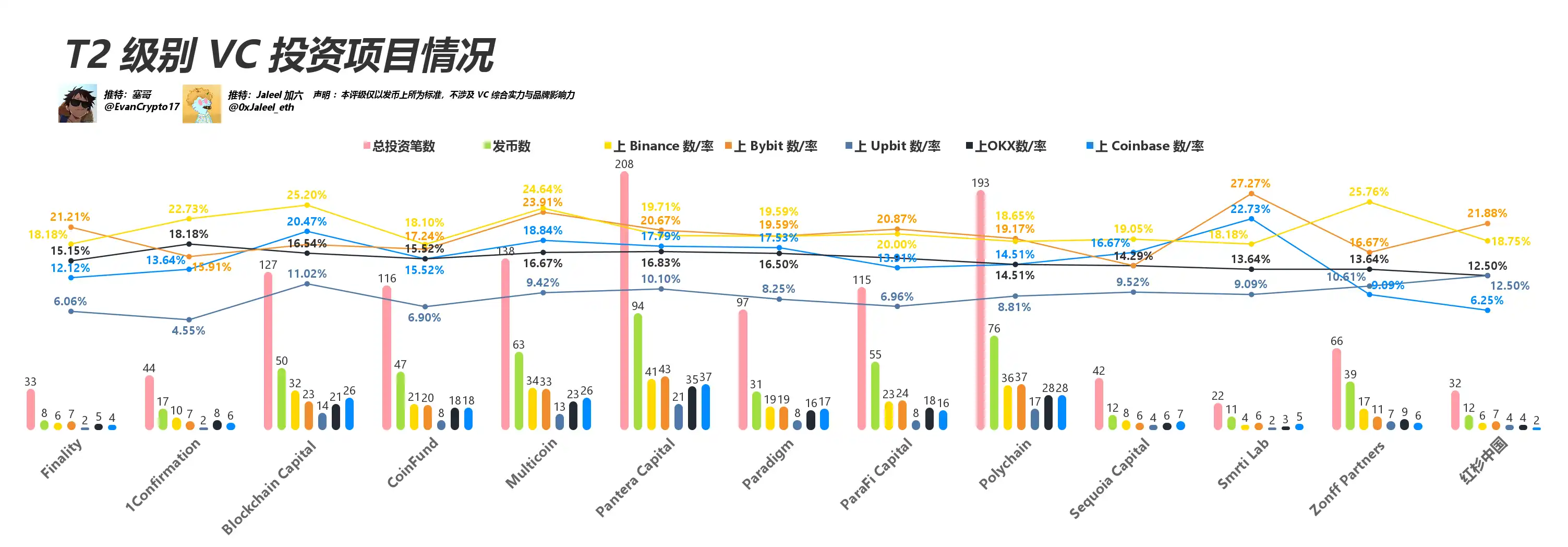

T2: Composite Score >= 0.9

Multicoin & Pantera: Both maintain excellent (>20%) listing rates on Binance and Bybit, with moderate presence on Upbit, OKX, and Coinbase, showing limited differentiation.

ParaFi: Moderate project count, deeply involved in early Ethereum projects like ConsenSys and DeFi pioneers such as Aave. In this analysis, slightly weaker on Upbit, but maintains 15–20% listing rates on OKX and Binance.

Sequoia Capital: Traditional elite VC, follows a “few but elite” strategy. Limited total investments, but relatively high success rate when projects list on major exchanges.

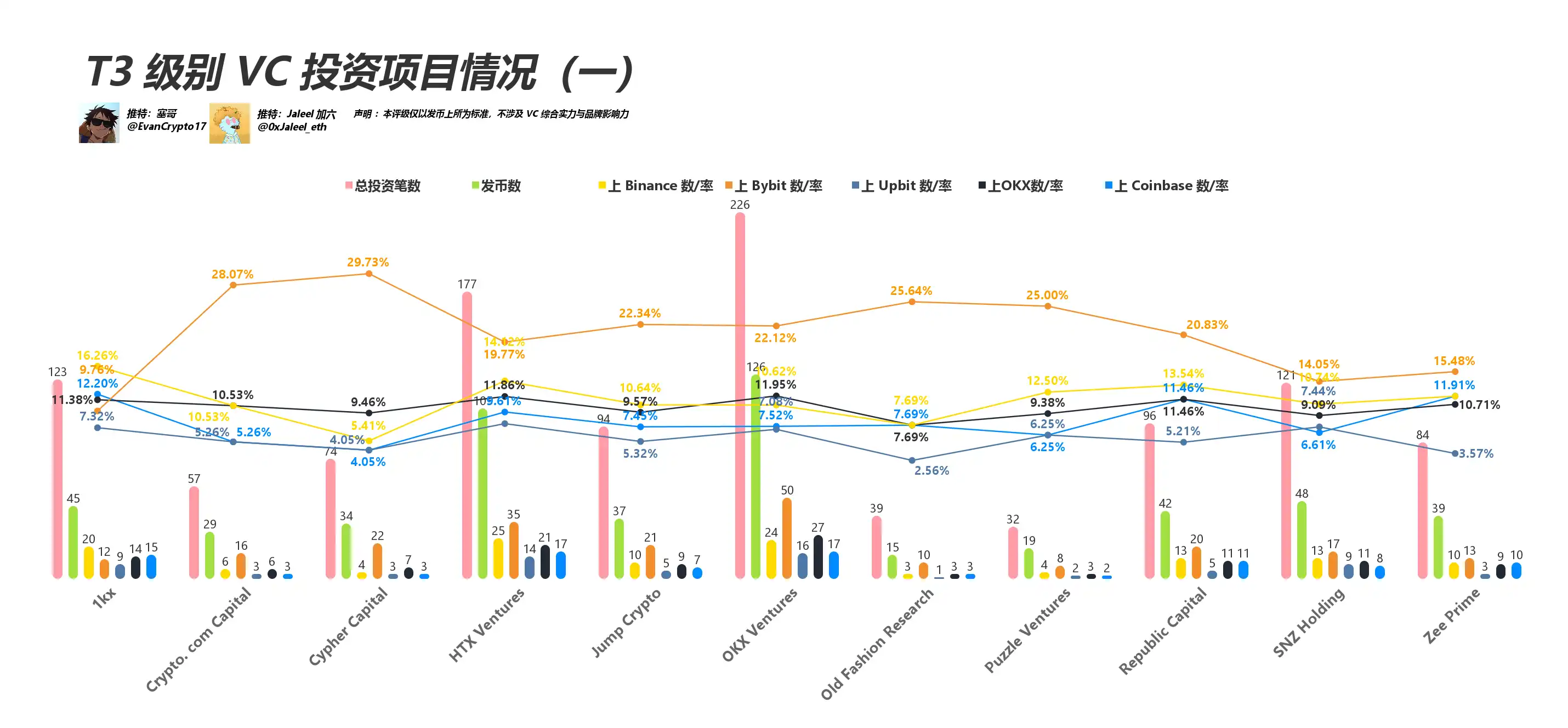

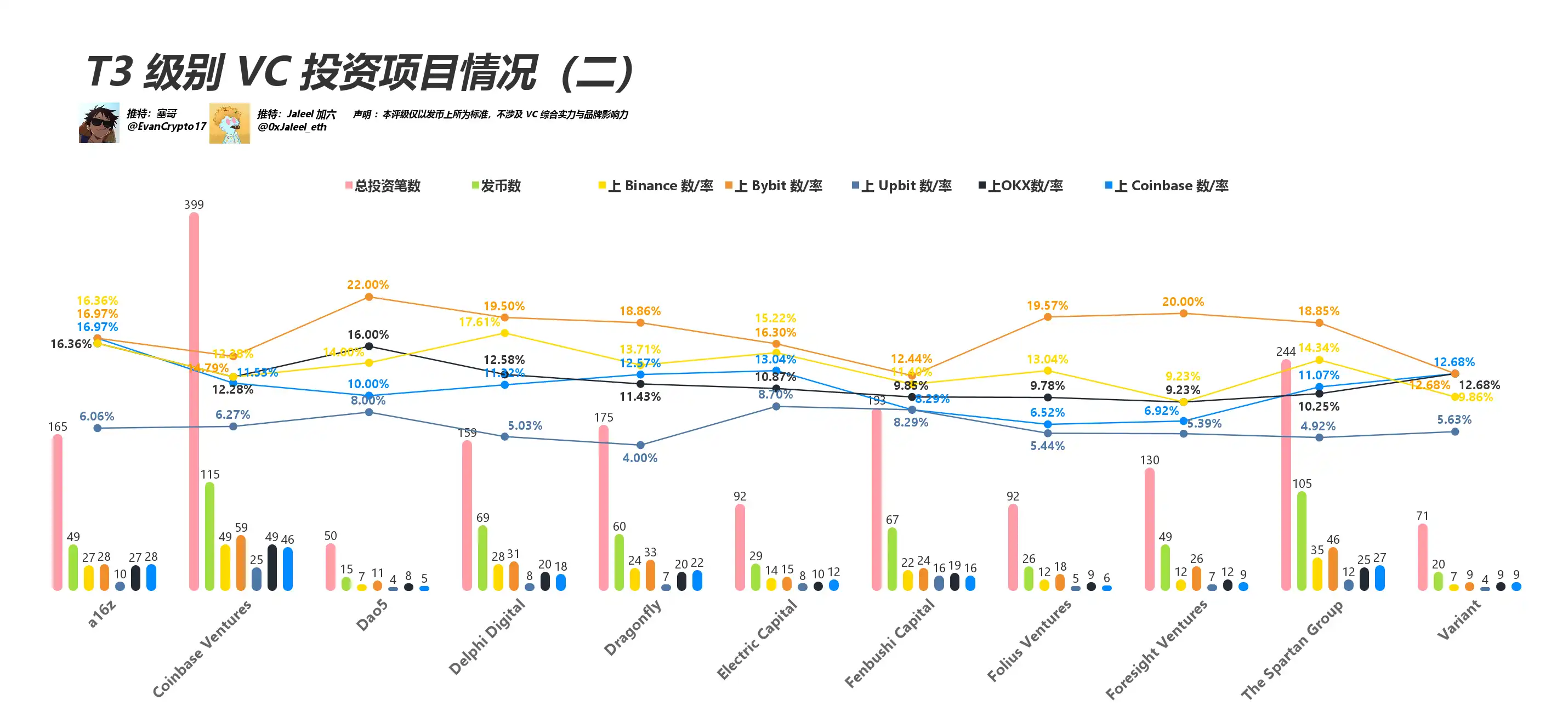

T3: Composite Score >= 0.6

The T3 tier is the most diverse, including well-known giants like a16z, Coinbase Ventures, Dragonfly, as well as Jump Crypto, HTX Ventures (Huobi-linked), Dao5—some exchange-backed, others newer models.

a16z: Extremely broad reach, over 150 investments, with token listing rates fluctuating between 10–20%. Scale dilutes average performance.

Coinbase Ventures: Excluded its own “listing on Coinbase” advantage in this analysis. Even so, maintains over 10% listing rates on Bybit, Binance, and OKX.

Dragonfly: Veteran global fund, focused on early-stage projects, many successful DeFi and infrastructure projects listed on major exchanges.

Jump Crypto, HTX Ventures (Huobi): Backed by exchanges, but here we only count third-party exchange listings, so their true resource advantages aren't fully reflected.

Summary: Numerous T3 institutions, average listing rates mostly within 5–20%. Many prioritize early-stage investing or ecosystem building rather than rapid tokenization and exchange listings.

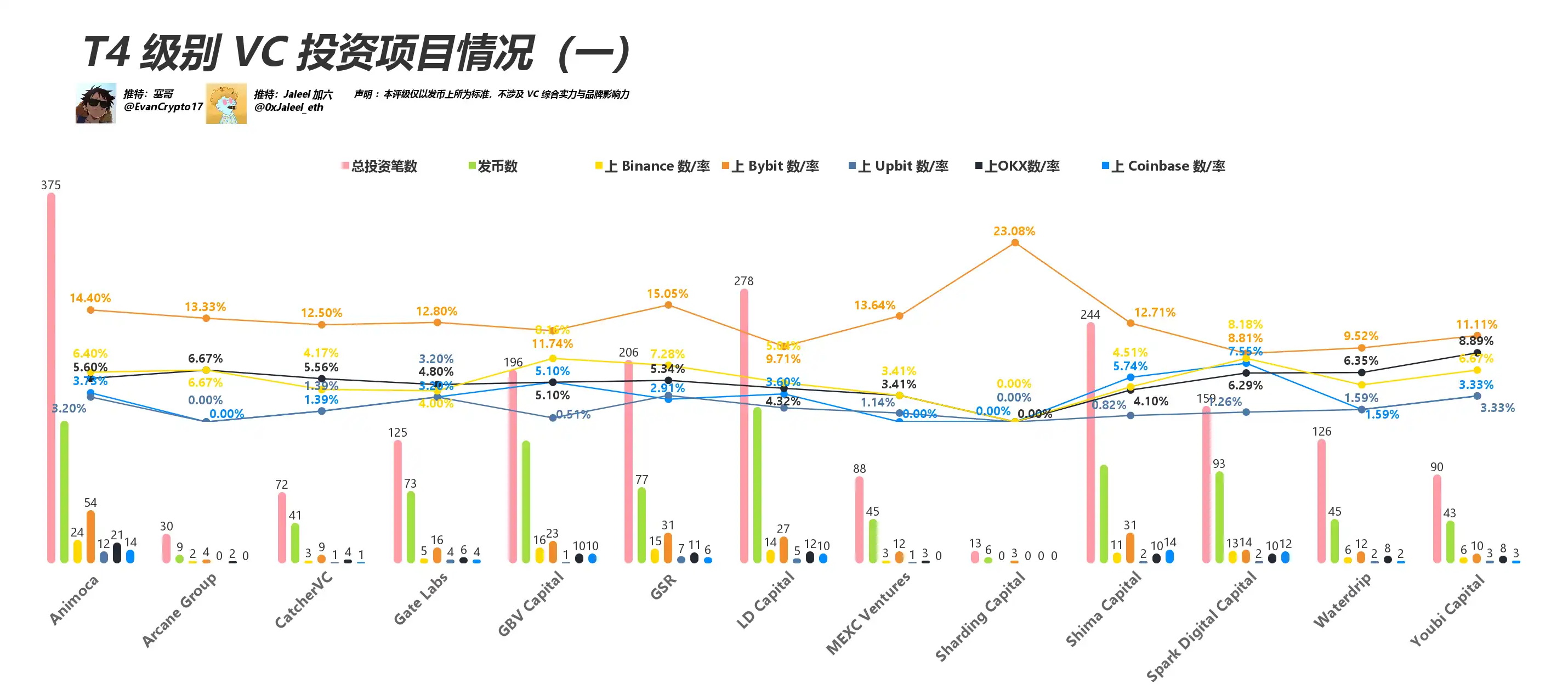

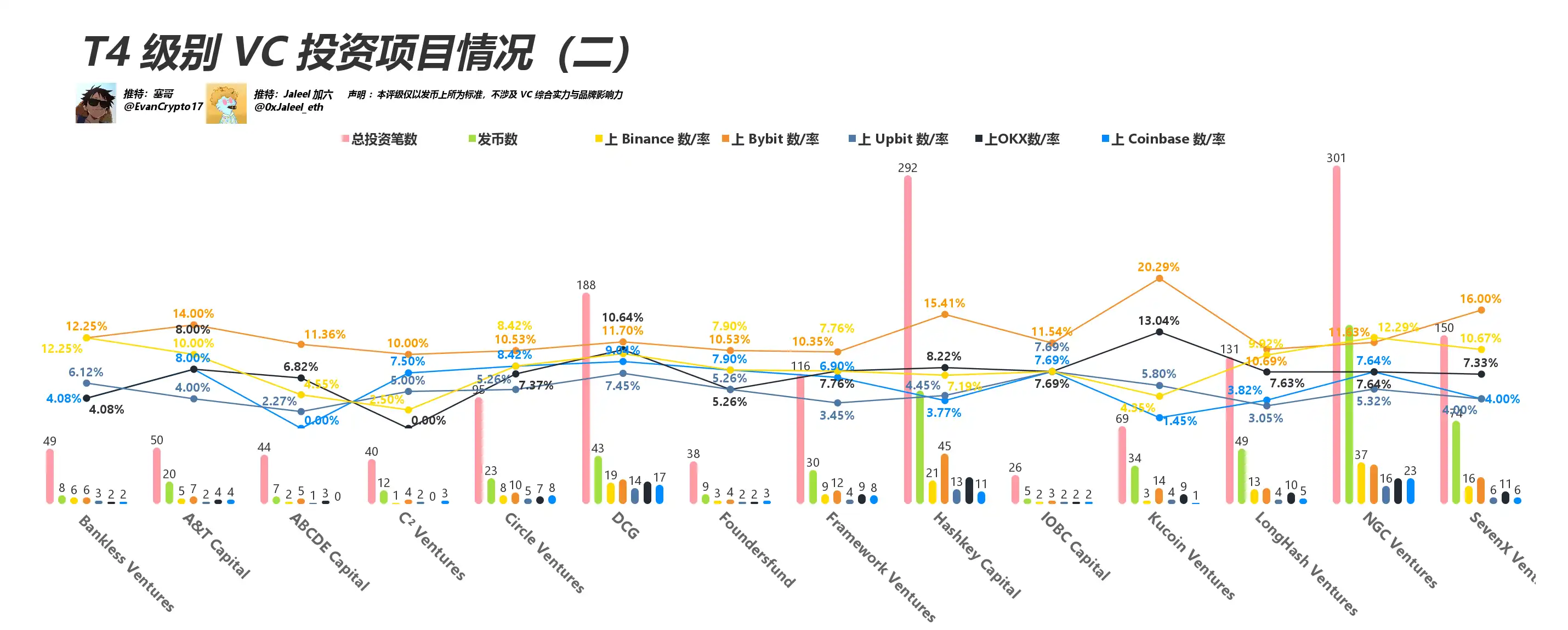

T4: Composite Score >= 0.3

T4-tier VCs often appear underwhelming on the single metric of "listing efficiency," yet some possess unique strengths in specific domains or regions:

Animoca: Pioneer fund in GameFi/NFT space, hundreds of investments—many not急于 listing or active only on DEXs.

LD Capital, GBV: Gained significant visibility during the last bull run, but highly scattered investments, resulting in overall listing rates of 5–10%.

MEXC Ventures: Exchange-affiliated, but this analysis focuses only on third-party exchanges, hence naturally lower listing efficiency.

Shima Capital, Arcane Group: More oriented toward incubation and regional markets, fewer token launches, many still pre-Centralized Exchange stage.

Summary: T4 doesn’t mean low value—it reflects broader, earlier-stage strategies, or projects self-sustaining without relying on CEX listings. These could very well孕育 the next wave of breakout stars. Once certain projects tokenize and list successfully, their scores could surge dramatically.

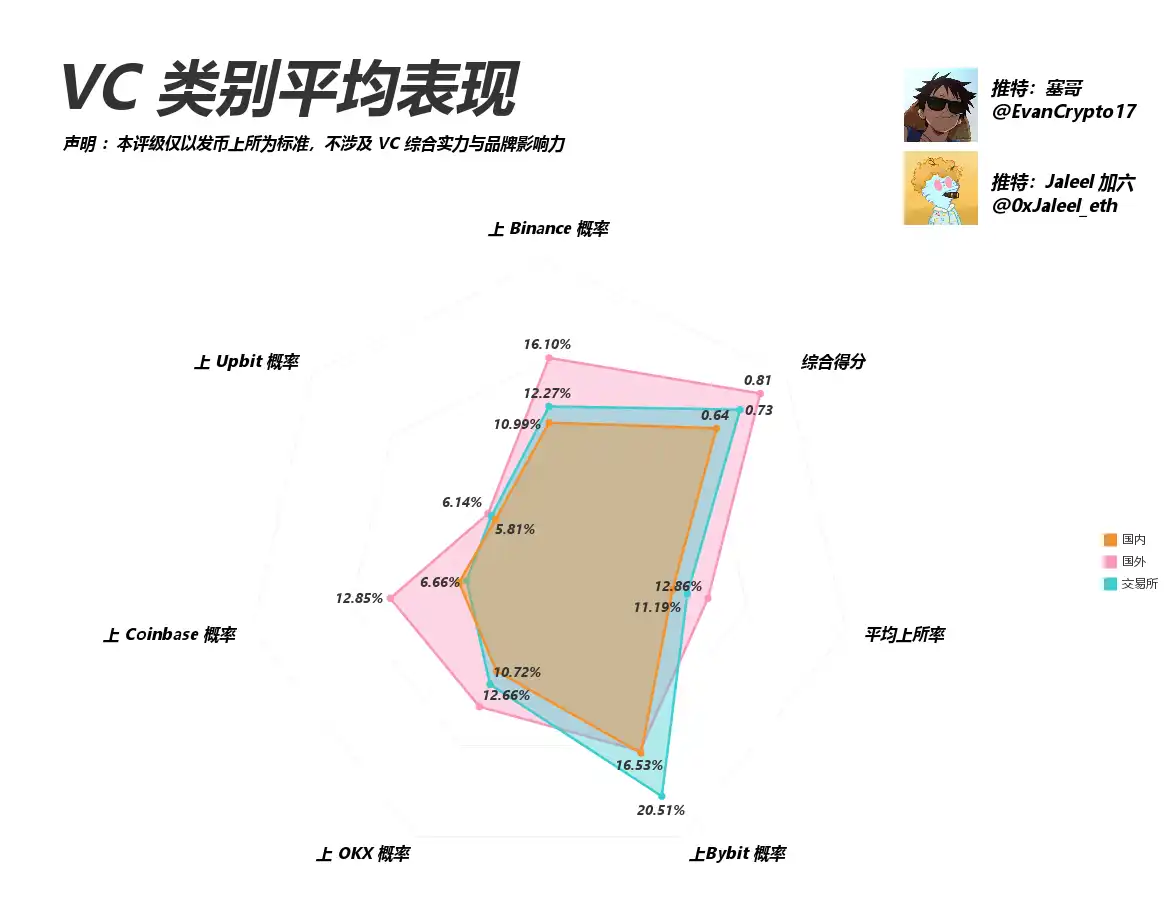

VC Regional Distribution: Who Is Going Global?

In the new "VC Regional Distribution" chart, we reorganized VCs into three groups—exchange-affiliated, overseas, and domestic—revealing the following:

Exchange-affiliated: BN, HTX, OKX, Cryptocom continue to stand out, with YZi Labs being the most prominent.

Overseas VCs: Established names like Sequoia, Multicoin, Paradigm, Delphi Digital remain concentrated in the West, though some emerging cross-regional players are gaining traction.

Domestic VCs: Continue Capital, IOSG Ventures, Sequoia China, Puzzle Ventures are increasingly breaking boundaries, participating in global co-investment trends.

Under the applied weighting (Binance: 2, Bybit: 1.5, Upbit: 1, OKX & Coinbase: 0.7), both domestic and international VCs gain scoring flexibility if they quickly list projects on rising platforms like Bybit and Upbit.

VCs focused on independent Layer 1 ecosystems or tokenized real-world assets may see their value capture underestimated under this metric system.

Therefore, listing rate alone cannot fully reflect VC quality. This analysis emphasizes only one dimension—"exchange listing"—and does not represent actual project quality or long-term returns. Other dimensions such as project revenue, token liquidity, or percentage of failed projects are not captured in this weighted ranking.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News