Opportunities and Risks: In-Depth Analysis of US Stocks Q4 2024 Earnings and 2025 Outlook

TechFlow Selected TechFlow Selected

Opportunities and Risks: In-Depth Analysis of US Stocks Q4 2024 Earnings and 2025 Outlook

With high policy uncertainty this year, the market's short-term recession expectations will only reverse after more supportive measures are implemented.

Author: Jinze, Pretending to Be on Wall Street

97% of S&P 500 companies' 2024 earnings have been reported and are essentially finalized. Today, I’ll offer readers an early analysis of profitability trends and key investment considerations.

Overall Q4 earnings grew 18.2% year-on-year—the highest quarterly profit growth since 2021. Revenue increased by 5.3%, trailing earnings growth, reflecting expanding corporate profit margins—a very healthy sign. (This article focuses on earnings, which have a greater impact on valuation, so revenue will be largely ignored.)

Market Anomalies

We begin with an unusual phenomenon—strong revenue figures met with negative market reactions.

While most companies beat earnings expectations, revenue surprises were underwhelming:

- 75% of companies reported EPS above analyst forecasts, slightly below the five-year average of 77%;

- Only 63% exceeded revenue expectations, notably lower than the five-year average of 69%.

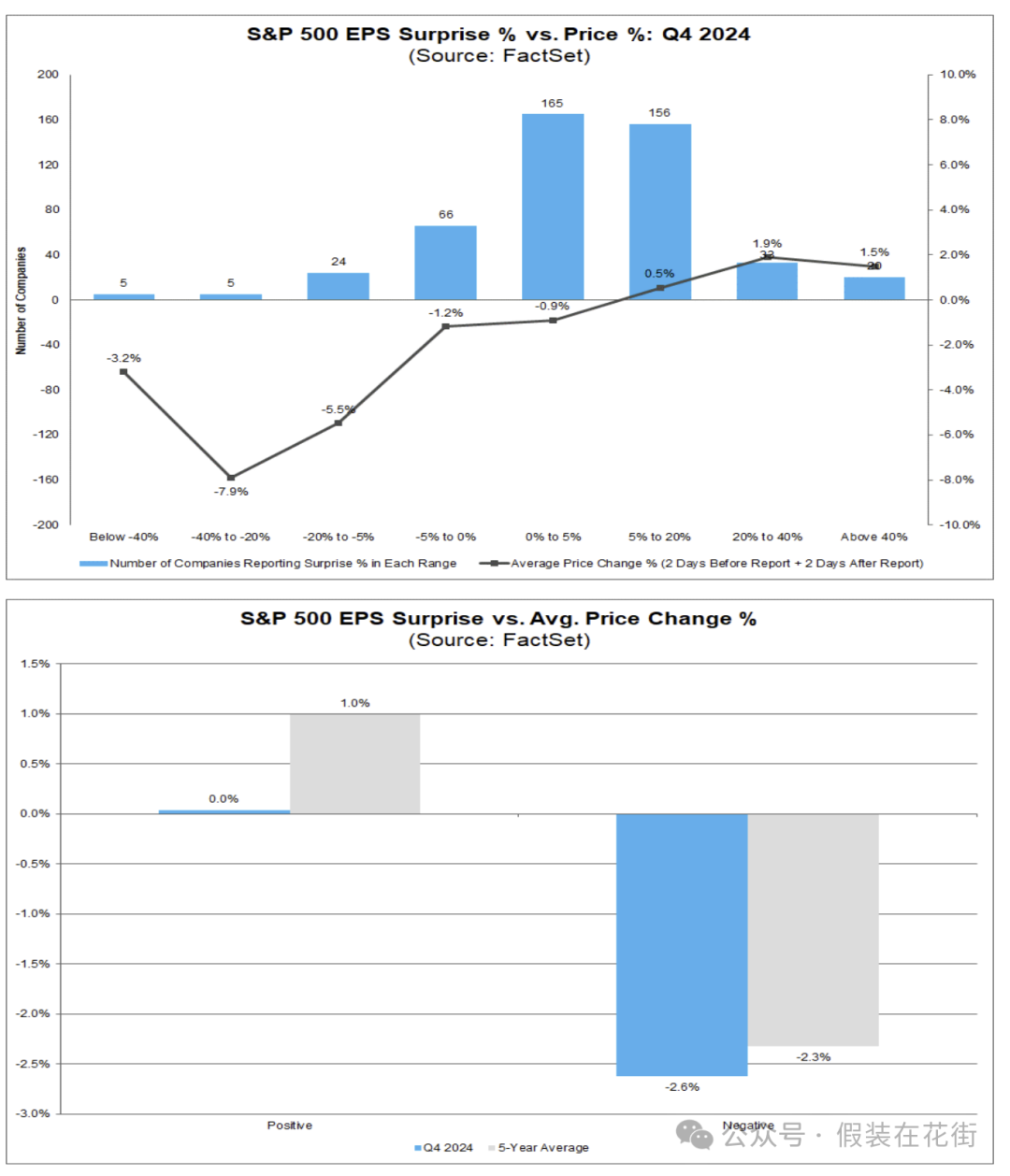

Market reaction was abnormal:

- No premium for good news: Companies that beat expectations saw average stock price change of 0%, below the five-year average (+1.0%).

- Harsher penalties for bad news: Companies missing expectations fell an average of 2.6%, worse than the five-year average (-2.3%).

In other words, investors are skeptical toward positive news but highly sensitive to negative news. This suggests markets had already priced in optimistic expectations, with valuations at elevated levels. When marginal upside is limited, taking profits becomes the preferred strategy.

Currently, tech and discretionary consumption—growth-oriented sectors—enjoy high valuation premiums (forward P/E around 26–27x), the highest among all industries, indicating strong investor hopes for multi-year profit growth ahead. However, high expectations also mean that any shortfall could trigger rapid multiple contraction (as seen in recent weeks).

For example, concerns are resurfacing about tech firms’ heavy AI investments failing to deliver expected returns, putting downward pressure on their inflated stock prices. The market has recently shown punitive reactions to missed expectations (stocks of underperforming firms down 2.6% on average), warning us to be especially cautious with overvalued sectors. Once fundamentals and expectations become "misaligned," high-valuation sectors may face sharp corrections.

Strong Earnings Growth Across the Board—Except Energy

Ten out of eleven S&P sectors posted year-on-year profit growth, with six achieving double-digit gains.

- The financial sector surged +56% YoY, driven by base effects in banking.

- Communication Services and Discretionary Consumption posted ~30% and ~27% profit growth, respectively.

- Information Technology rose ~17.6%, led by large-cap tech earnings.

- Defensive sectors such as Utilities and Healthcare also recorded double-digit growth (~10–16%).

- The sole exception was Energy, where profits declined ~26% due to a high base last year and falling commodity prices.

Note that the financial sector’s extraordinary growth includes one-time factors—banking profits soared 216% YoY, mainly because unusually high FDIC special assessment expenses depressed earnings a year ago. With this low base effect, growth appears exceptionally strong. Excluding banks, financial sector earnings growth drops from 55.9% to 25.3% (still robust).

That said, overall conditions remain favorable for finance: widening net interest margins, equity bull market momentum, and strong consumer borrowing demand amid upbeat spending sentiment. Only insurance within the sector saw shrinking profits, due to higher claims from natural disasters.

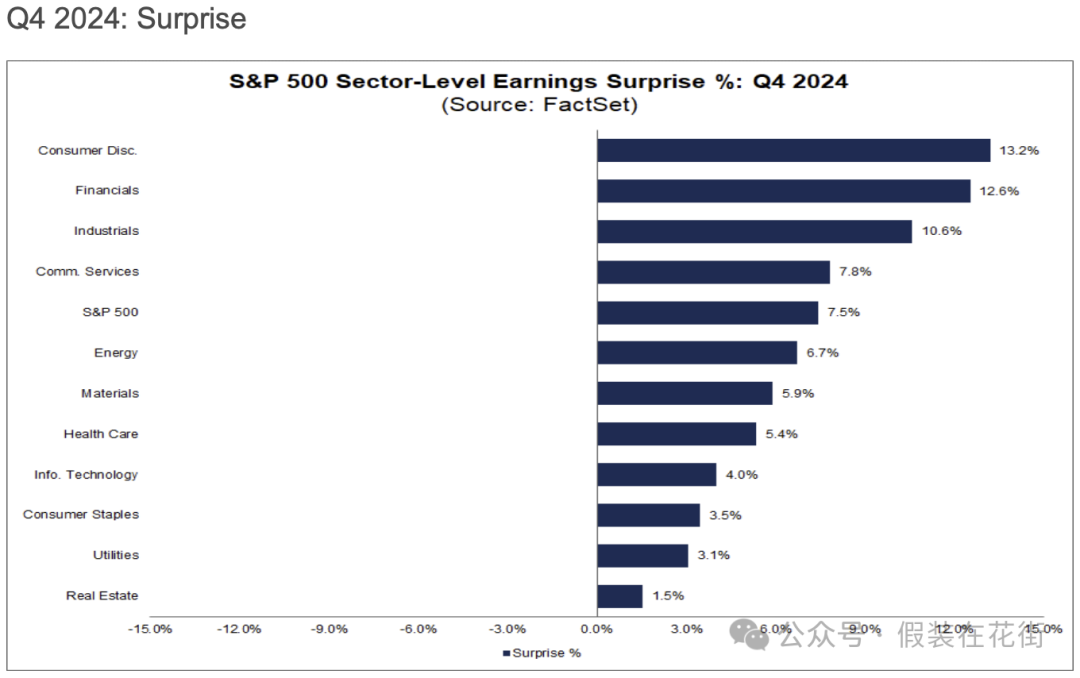

Earnings “Surprise” Trends (Diminishing Marginal Upside)

- Top-performing surprise sector: Discretionary Consumption delivered a +13.2% EPS surprise (actual earnings 13.2% above estimates), leading all sectors.

Several companies stood out: Amazon.com ($1.86 vs. $1.49), Norwegian Cruise Line ($0.26 vs. $0.11), Wynn Resorts ($2.42 vs. $1.34).

- Financials beat forecasts by 12.6% overall, with standout performers including Berkshire Hathaway ($6.74 vs. $4.62), Goldman Sachs ($11.95 vs. $8.21), and Morgan Stanley ($2.22 vs. $1.70).

- Industrial sector EPS surprised by ~+10.6%, with Uber surging ($3.21 actual vs. $0.50 expected), Axon ($2.08 vs. $1.40), GE Aerospace ($1.32 vs. $1.04), Southwest Airlines ($0.56 vs. $0.46).

- Communication Services also performed strongly, beating earnings by ~7.8%, with Disney ($1.76 vs. $1.45) and Meta ($8.02 vs. $6.76) delivering significantly better-than-expected results.

- Lagging sectors: Real Estate and Utilities saw only ~53% of companies beat earnings, well below average.

Valuation Levels

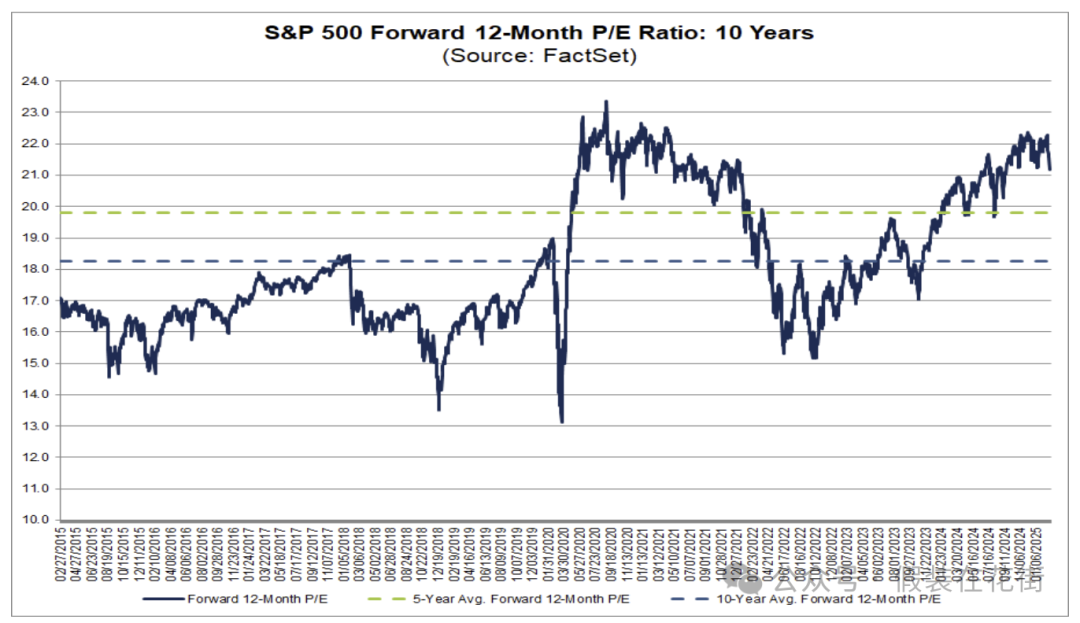

The S&P 500's current forward 12-month P/E ratio stands at approximately 21.2x, above the 5-year average of 19.8x and the 10-year average of 18.3x.

However, compared to year-end, the index’s forward P/E has slightly declined from 21.5x, partly due to falling stock prices this year and partly because future earnings expectations have been revised upward by 1.1%. Profit growth has absorbed some of the valuation expansion.

Recent pullbacks in the 18.3–19.8x range would find historical average support, corresponding to SPX levels of 4964–5371. (Given the March 4 closing level of 5778, a ~7.5% decline could present a relatively safe entry point.)

At the sector level, valuations are diverging:

- Technology (~26.7x) and Discretionary Consumption (~26.5x) have the highest forward P/E ratios, reflecting high growth expectations.

- Energy has the lowest forward P/E at ~14.2x.

- Financials are moderately valued (~16x), while defensive sectors like Utilities and Healthcare trade in the 17–18x range.

- Overall, most sectors are currently trading above their historical valuation averages, requiring sustained earnings growth to justify current prices.

The blue bars in the chart below show current forward P/E, while green and gray bars represent historical averages. For most sectors, current valuations (blue bars) exceed historical norms.

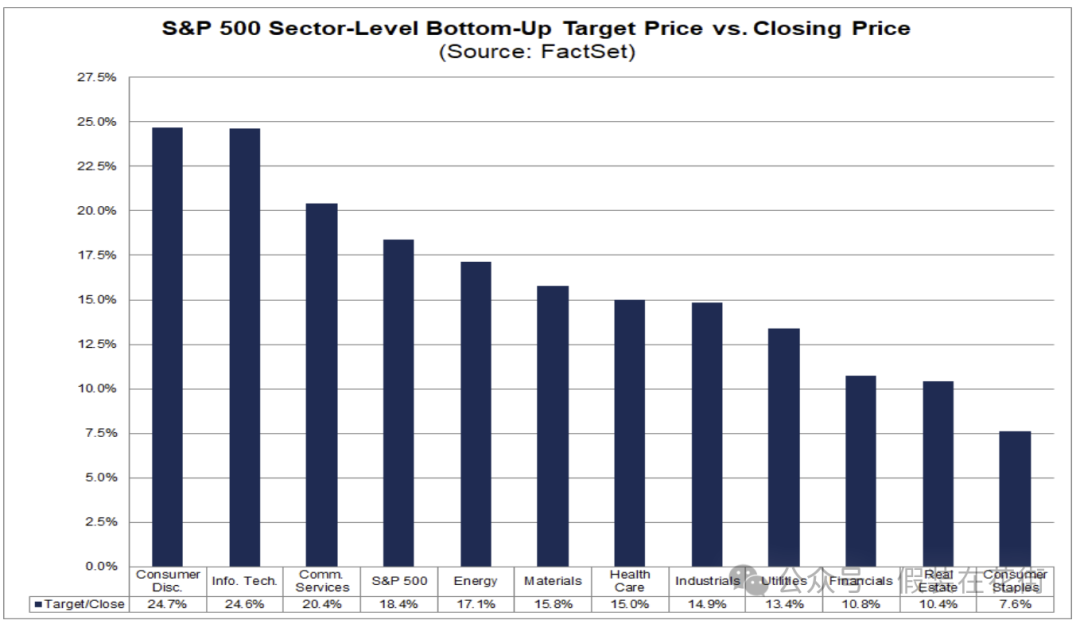

Analysts now target 6938 for the S&P 500, implying 18.4% upside from the February-end close of 5861, with Consumer Services (+24.7%) and Technology (+24.6%) leading. Consumer Staples (+7.6%) have the weakest outlook.

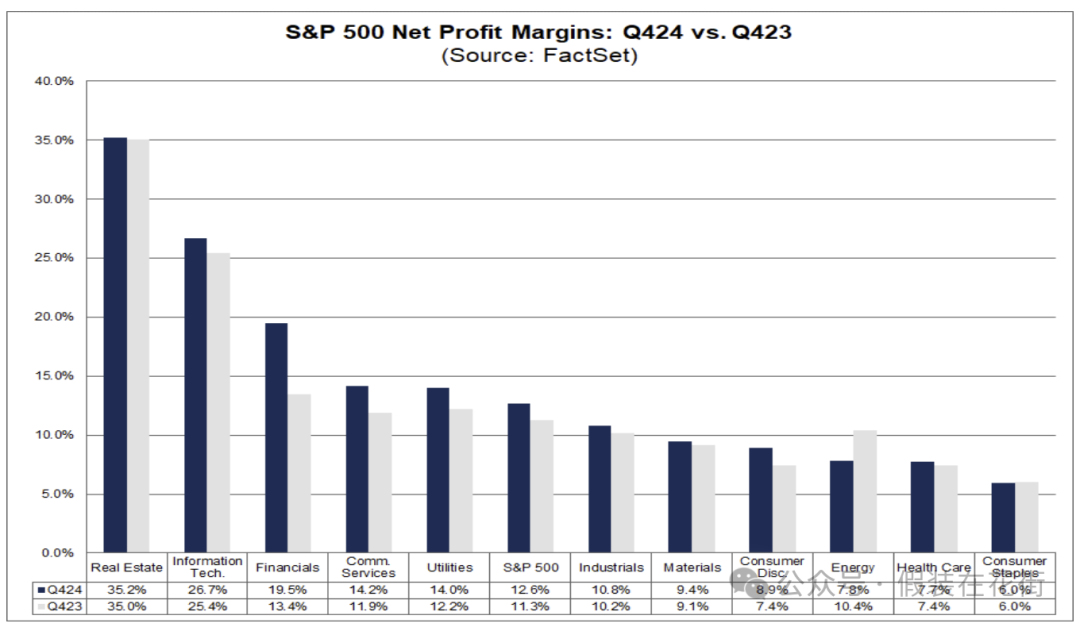

Profit Margin Trends

Improving net profit margins confirm the quality of corporate earnings—and by extension, the U.S. economy.

S&P 500 net profit margin rose to 12.6% in Q4, up from 12.2% in the prior quarter and significantly above 11.3% a year earlier.

Most sectors expanded margins YoY. Financials saw the largest jump, rising from 13.4% to 19.5%.

Communication Services and Discretionary Consumption also improved meaningfully (e.g., Communication Services rose from 11.1% to ~14.2%).

In contrast, Consumer Staples net margin held steady at just 6.0%, showing no improvement.

Energy’s net margin dropped from 10.4% to 7.8%, the only sector with a YoY decline.

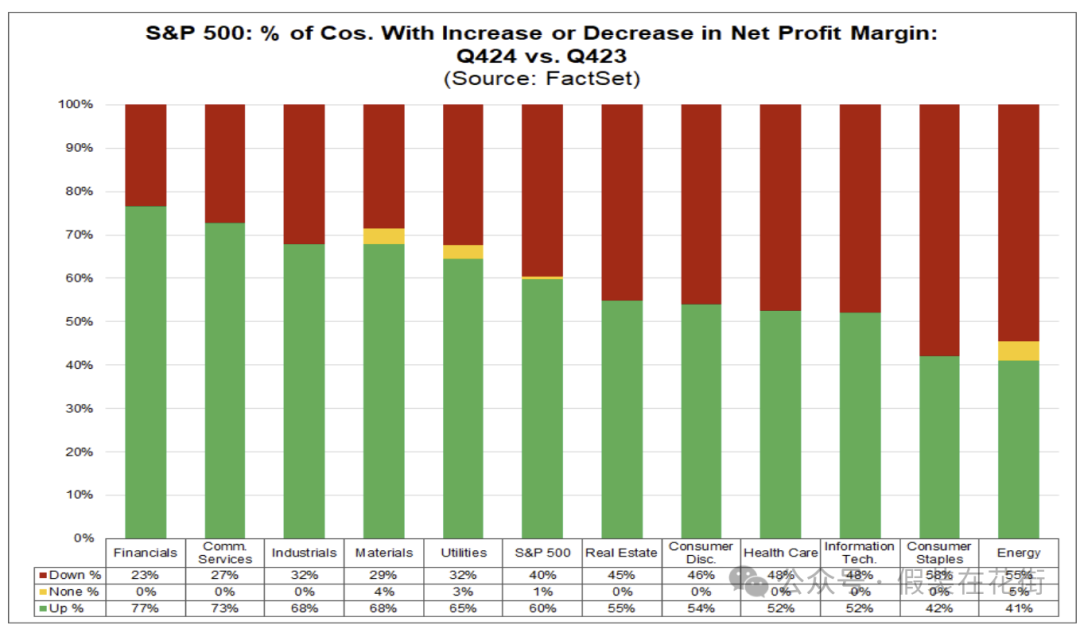

About 60% of S&P 500 companies reported rising margins, while 40% reported declines—mainly concentrated in Consumer Staples and Energy.

Although six sectors still have net margins below their 5-year averages (e.g., Healthcare at 7.7% vs. 9.6% historically), the overall trend is positive: companies broadly improved profitability this quarter through pricing power and cost control.

This margin expansion lays a stronger foundation for future earnings growth. Long-term investors should prioritize industries and firms with rising margins and pricing power.

Outlook for 2025

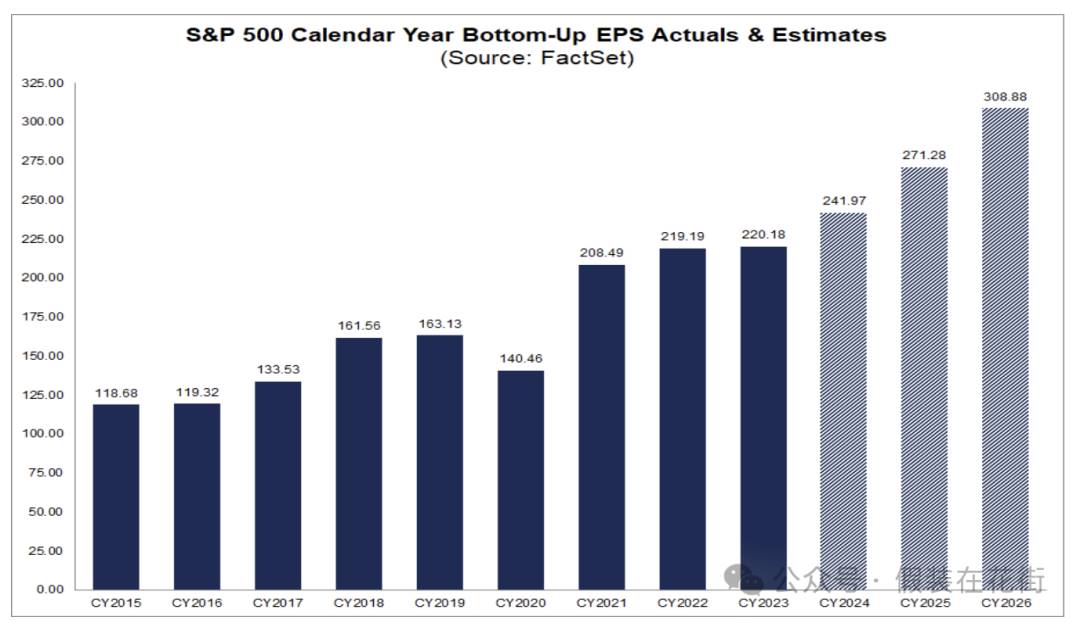

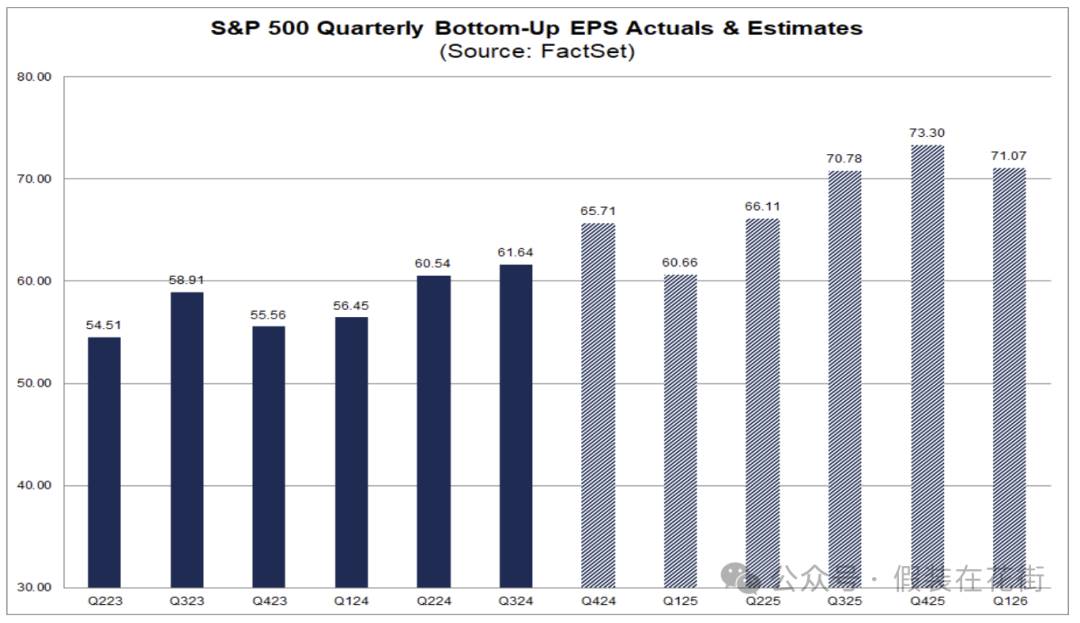

Markets broadly expect S&P 500 earnings growth to remain strong in 2025 and 2026.

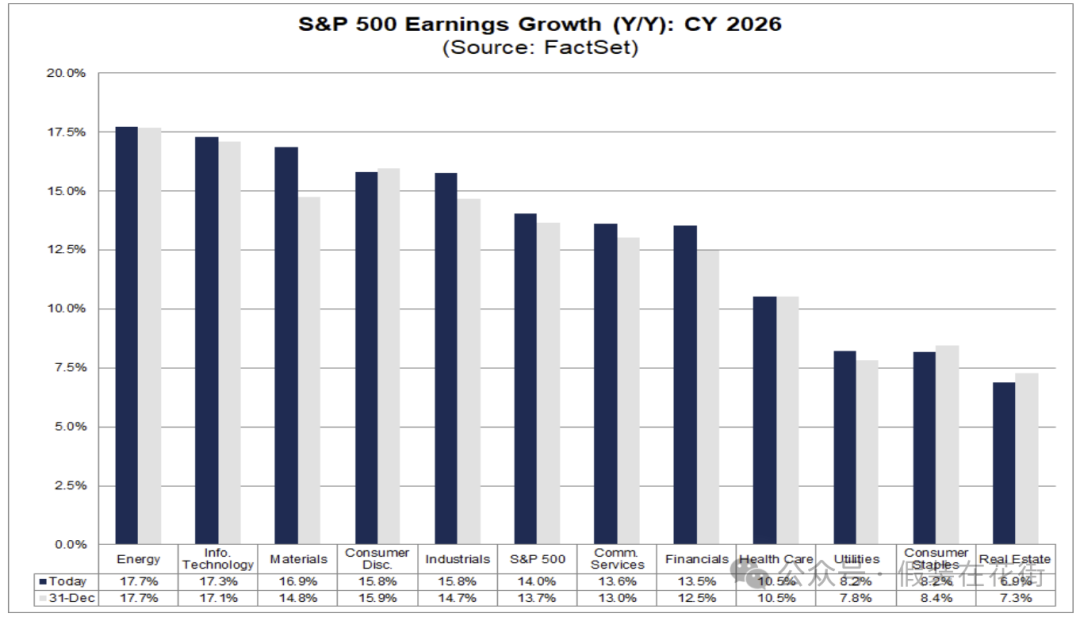

According to consensus forecasts, S&P 500 earnings growth will accelerate from 10.4% in 2024 to ~12% in 2025, then further to ~14% in 2026.

These projections assume the macroeconomy avoids recession and maintains moderate expansion; otherwise, expectations may be revised downward.

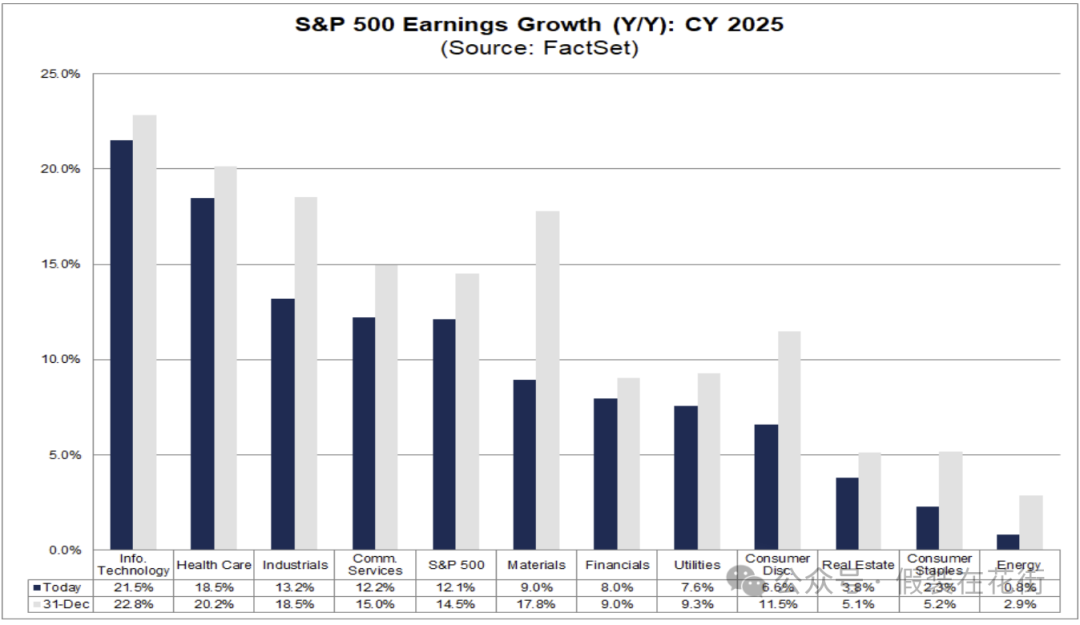

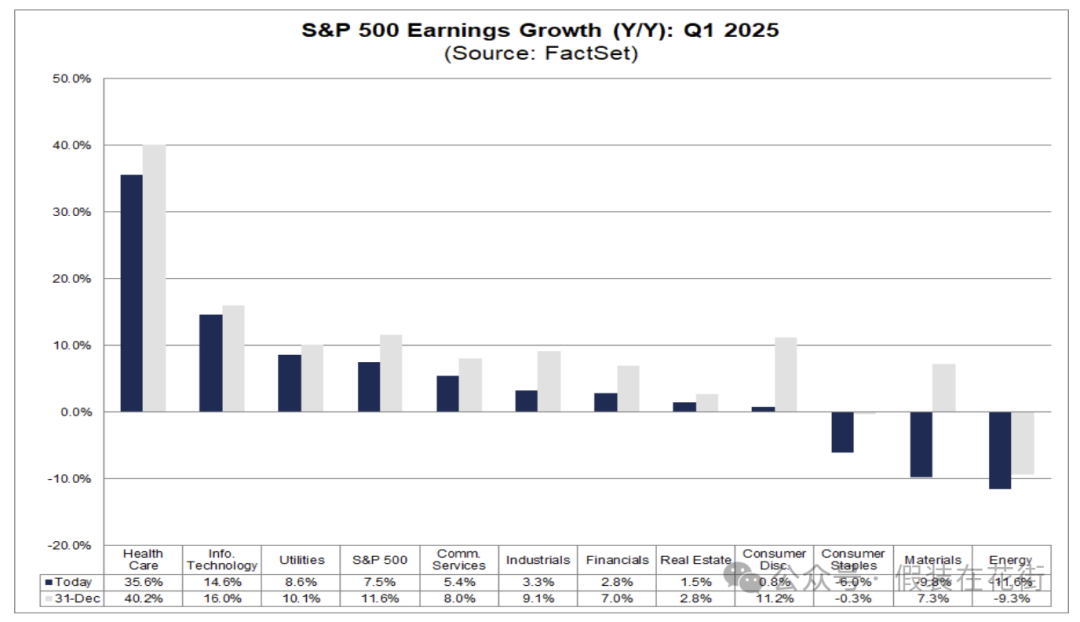

For 2025, analysts are most bullish on IT (+21.5%), Healthcare (+18.5%), and Industrials (+13.2%). All have seen downward revisions from year-end forecasts, with the largest cuts in Materials, Consumer Staples, and Discretionary Consumption:

Notably, despite optimism for the full year, Q1 2025 S&P 500 earnings forecasts are particularly weak. Recent company-provided Q1 guidance has declined by 3.5%, a drop exceeding 5-, 10-, and 15-year averages.

Beyond the seasonal tendency for companies to lower expectations early in the year to later “beat” them, concerns over inflation and tariffs—especially for firms reliant on global supply chains—are evident. The significant downturn in Materials and Consumer sectors supports this view:

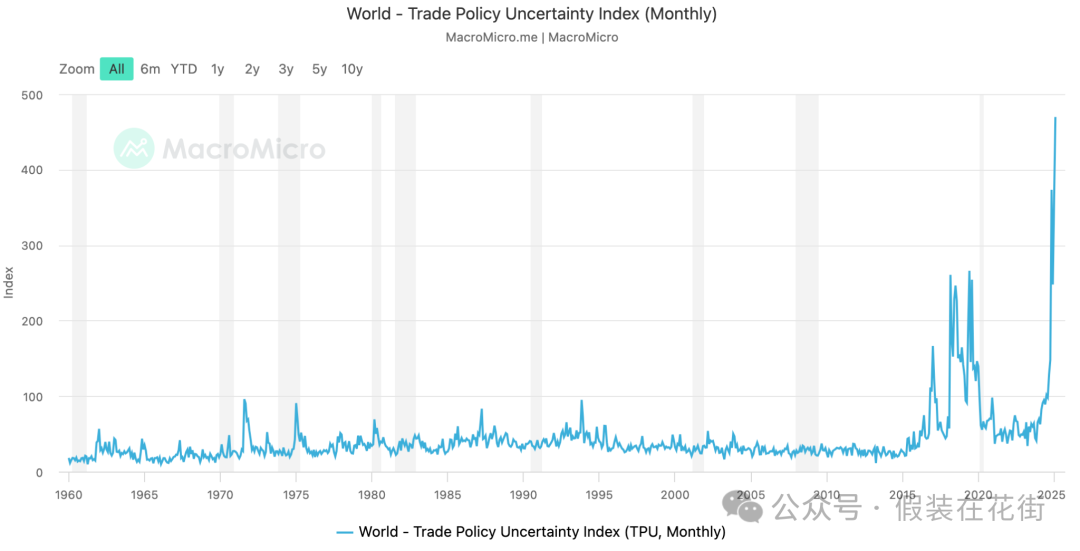

Higher tariffs not only directly raise costs but also introduce uncertainty into supply chains and demand outlooks. Many experts fear that if major economies escalate tit-for-tat tariff actions, corporate earnings could suffer materially. This macro-level tension peaked in Q1 to its highest historical level:

In contrast, analysts remain far more optimistic about 2026. The recent rise in uncertainty hasn’t yet shaken long-term confidence:

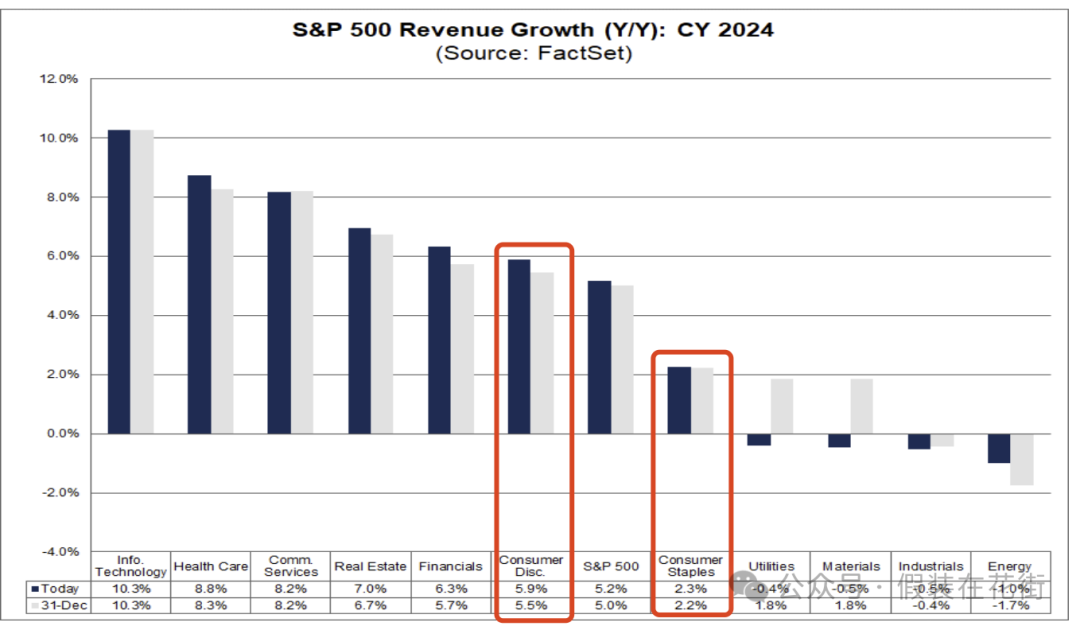

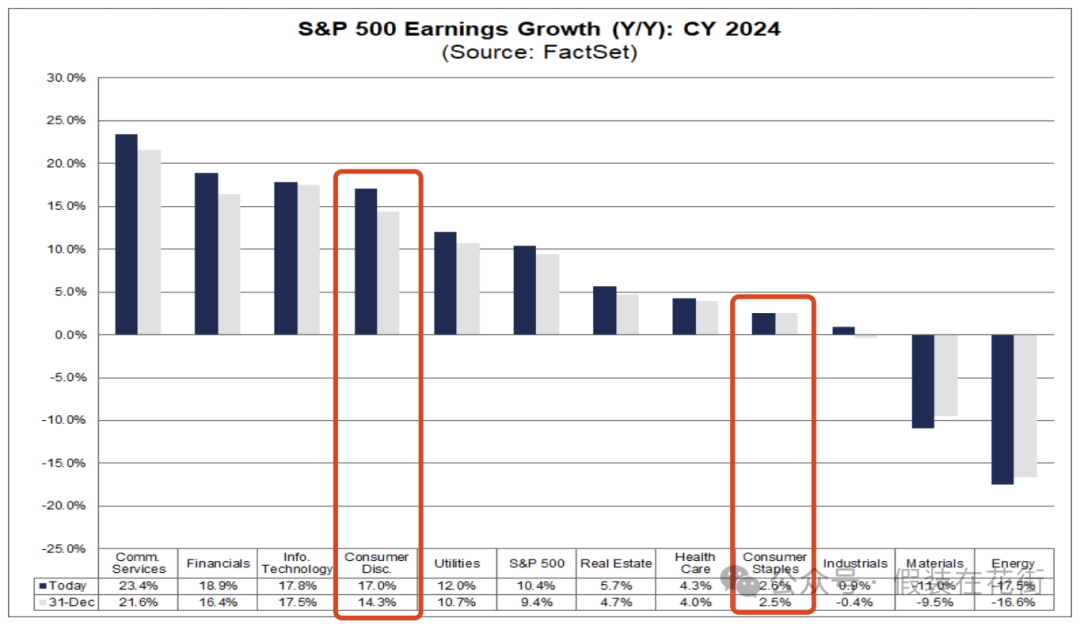

Contradictory Picture: Stagnant Staples vs. Strong Discretionary Spending

Last year’s earnings show Consumer Staples (e.g., food, beverages, household goods) stalled, while Discretionary Consumption (e.g., autos, luxury, entertainment) thrived.

Full-year revenue growth: Discretionary +5.9% vs. Staples +2.3%

Profit growth comparison: Discretionary +17% vs. Staples +2.6%

Individual stocks illustrate this clearly: Pepsi +0.42%, Coca-Cola +3%, Procter & Gamble +2%, Johnson & Johnson +4.3%.

I believe two main factors explain this divergence:

1. Income inequality driving consumption polarization:

Wealthier households, benefiting from rising home and stock values, have seen net worth expand and are more willing to spend on luxuries, travel, and entertainment—fueling sectors like tourism and leisure. For instance, Royal Caribbean and DraftKings delivered strong 2023 performance as consumers shifted spending toward travel and recreation.

Lower-income households, meanwhile, are cutting back on non-essentials amid inflation and debt pressures. In food, cleaning supplies, and other staples, consumers are increasingly opting for cheaper private-label brands over name brands. This limits pricing power for Consumer Staples firms. Despite 2024 wage growth outpacing inflation—boosting real disposable income—consumers are “buying less, buying cheaper,” leaving staple sales sluggish.

2024 U.S. retail data shows high-income households’ spending rose sharply—after inflation adjustment, their goods spending is nearly 17% above pre-pandemic levels, versus only +7.9% for low-income households.

Thus, while inflation suppresses lower-tier demand, economic growth fuels upper-tier spending. The macro environment favors Discretionary Consumption and weighs on Staples.

2. Corporate profitability and pricing strategies:

Consumer Staples face constrained pricing power. Initially, they boosted profits via price hikes during inflation, but by 2024, consumer resistance limited further increases. For example, General Mills saw volume drop 3% in first half FY2024, barely offset by 4% price hikes to achieve 1% revenue growth—and it had to revise full-year guidance down to flat or 1%. This shows the “price over volume” model is unsustainable—volume declines are eroding pricing gains. Cost pressures and promotional competition have left margins stagnant, halting profit growth.

In contrast, Discretionary Consumption enjoys greater earnings elasticity. 2024 demand recovery restored pricing power and scale economies. Amazon, for instance, earned $1.86 per share in Q4, far above $1.00 a year earlier and well above expectations. Beyond Amazon, the sector broadly improved: general retailers’ profits surged 87% YoY, auto sector up 13%. Discretionary Consumption’s Q4 revenue rose ~6%, but profits jumped 26%—indicating successful cost pass-through and margin expansion. Many firms boosted unit margins via price hikes or cost controls. Even in price-sensitive areas, recovering demand created operating leverage (e.g., cruise lines and airlines turning from losses to profits), significantly improving margins.

Investment Implications

- Adjust return expectations, prioritize cash flow: After two consecutive years of +20% returns, future U.S. equity gains may moderate. Valuations are already high, making another surge driven by multiple expansion unlikely. Investors should lower return expectations for 2025 and focus more on earnings growth and dividends—“organic” returns. Market performance will increasingly depend on whether companies can deliver the double-digit earnings growth Wall Street anticipates.

Policy uncertainty remains elevated this year, particularly with Trump-era policies posing short-term economic headwinds:

- Tariffs, layoffs, spending cuts, decoupling, and restrictions on low-skilled labor—all being implemented;

- Pro-growth measures, however, remain mostly rhetorical or slow-moving:

- Further corporate tax cuts, exempting tips/overtime pay from taxes, or broad personal income tax reductions—only limited deregulation in energy and tech, offering limited overall benefit;

- More tangible pro-growth policies must materialize to reverse near-term recession fears. Otherwise, if valuations keep contracting and offset earnings gains, equities could deliver zero or negative returns. Investors should prepare mentally: stay cautiously optimistic, avoid relying on bull market inertia, and adopt longer holding periods to wait for earnings realization. Also, shift focus from capital appreciation to balanced dividend income to secure stable cash flow in volatile markets.

Sector-Specific Opportunities and Risks

- Utilities: Short-term earnings pressure and rate sensitivity. As a high-dividend defensive sector, Utilities are highly sensitive to interest rates. In a potential rate-cutting environment, their dividend appeal may rebound. But if rates rise further or AI demand expectations cool, they could face dual pressures.

- Consumer Staples: Growth stagnation, lacking catalysts. Profits in this sector (food, daily necessities) are largely flat, with Q4 earnings slightly down (~-1%) and no margin improvement (steady at 6.0%). Analysts assign the lowest “Buy” rating proportion (~41%) among sectors. Amid inflation, tariffs, and job cuts, Staples firms struggle to pass through costs, limiting profit expansion. However, if the economy slows markedly or enters recession, their stable cash flows and counter-cyclical nature could provide downside protection. With valuations pulled back, some blue-chip stocks now offer attractive dividend yields, suitable for long-term defensive positioning.

- Financials: High earnings growth and sharply expanding margins, with forward P/E of ~16x—low relative to other sectors. Solid fundamentals combined with relatively low valuations make Financials attractive long-term, even if rates dip slightly.

- Information Technology: Large-cap tech likely to continue leading earnings growth. Strong results from chip and software giants like NVIDIA and Microsoft support the sector. Though valuations are high (~26.7x forward), tech boasts high-quality earnings and strong moats. Long-term digital transformation and AI trends should sustain growth. Dipping into top-tier tech leaders during pullbacks could generate strong long-term returns.

- Healthcare: Defensive sector stabilizing. Healthcare returned to double-digit profit growth in Q4, with 82% of firms beating revenue expectations. Large pharma and medical device firms benefited from recovering demand and a weaker dollar. While net margins (7.7%) remain below historical levels, healthcare’s rigid demand makes earnings resilient and counter-cyclical. During market volatility, it offers stable returns and deserves a core allocation in long-term portfolios.

- Discretionary Consumption:消费升级 (consumption upgrade) is a long-term trend with high earnings elasticity. Q4 profits surged 27% YoY, marking several quarters of strong rebound. Spending recovery in travel, entertainment, and luxury lifted cruise lines, casino resorts, and branded retailers (e.g., Norwegian Cruise Line, Wynn Resorts both delivered >80% earnings surprises). Though forward P/E exceeds 26x, robust growth may partially justify valuations if the economy stays healthy and employment/income trends remain positive.

High-quality discretionary stocks still hold potential for excess returns over time, though consumer confidence and macro conditions require close monitoring. Like tech, the sector is short-term pressured but long-term promising. If the Fed begins cutting rates in H2 2025, big-ticket spending on autos and home improvement could rebound.

But sustainability hinges on consumer financial health: U.S. excess savings have sharply declined, and restarting student loan payments and soaring credit card rates may dampen demand in 2025. Watch for early signs of weakening consumption and maintain some Staples exposure to hedge risks.

- Industrials & Materials: Cyclical resilience emerging. Industrials were initially expected to post a profit decline in Q4 but instead achieved slight growth (+2.7% vs. -3.3% expected), signaling stronger-than-feared economic resilience. Some firms (e.g., aviation, manufacturing) delivered earnings beats via cost control and demand recovery. Materials saw margin expansion (10.2% vs. 8.3% YoY), suggesting relief along the manufacturing chain. If the economy achieves a soft landing without escalating tariffs, these cyclicals could see both valuation and earnings expansion. With forward P/E around 18x, they offer potential for value re-rating.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News