Crypto Regulation Eased: Overview of Recent Trump Administration Appointments and Legislative Initiatives

TechFlow Selected TechFlow Selected

Crypto Regulation Eased: Overview of Recent Trump Administration Appointments and Legislative Initiatives

Although the short-term market may fluctuate due to macroeconomic factors and the timing of policy implementation, the long-term trend remains positive.

Author: Metrics Ventures

Introduction

Bitcoin has recently experienced a downturn, but its status as a core dollar-denominated asset remains unaffected. With regulatory trends easing, dollar-based assets are expected to maintain a volatile upward trajectory.

The implementation of Trump administration's crypto-friendly policies has ushered in unprecedented opportunities for the U.S. cryptocurrency industry. Key institutions such as the Treasury Department, SEC, and CFTC are now led by officials supportive of digital assets. The White House has established a Digital Assets Working Group, while Congress has formed a Crypto Assets Committee, driving the industry toward legalization and institutionalization. This policy direction has strengthened market confidence and accelerated the entry of mainstream financial institutions.

On the legislative front, the advancement of the FIT21 bill, establishment of stablecoin regulatory frameworks, and the SEC’s softened enforcement stance signal that the crypto industry is moving beyond policy uncertainty and onto a more stable and sustainable development path.

While short-term market fluctuations may still be influenced by macroeconomic factors and policy implementation timelines, the long-term outlook remains positive. The U.S. is accelerating the construction of the world’s most competitive crypto-financial ecosystem, transitioning the industry from the "Wild West" into the mainstream financial system.

1. Trump Administration Appoints Crypto-Friendly Officials, Industry Enters Growth Phase

1. Leadership Changes at Key Regulatory Agencies

The Trump administration has demonstrated a pro-crypto stance through leadership appointments at key financial regulatory agencies:

Treasury Secretary / Scott Bessent: As a hedge fund manager and cryptocurrency advocate, he supports Bitcoin and decentralized finance (DeFi), advocating for relaxed regulation of crypto assets by the Treasury and greater flexibility in tax policies for the industry.

SEC Chair / Paul Atkins: A former SEC commissioner, he supports free-market development and reduced regulatory intervention. His appointment suggests the SEC may scale back enforcement actions and foster freer market growth.

CFTC Chair / Brian Quintenz: A former CFTC commissioner, he advocates for light-touch regulation of crypto derivatives and DeFi. The CFTC is expected to encourage innovation rather than restrict industry development.

These key appointments have bolstered market confidence, with investors anticipating a more open U.S. regulatory environment.

2. White House Digital Assets Working Group

The Trump administration established the Presidential Working Group on Digital Asset Markets, led by White House AI and Crypto Special Advisor David Sacks, with members including heads of the Treasury, Justice Department, SEC, and CFTC.

The working group aims to:

Develop a national cryptocurrency regulatory framework—unifying market structure, consumer protection, and risk management rules.

Evaluate the feasibility of Bitcoin as a national reserve—submitting policy recommendations within 180 days.

Halt CBDC development—explicitly banning the Federal Reserve from developing a central bank digital currency (CBDC) to protect private-sector digital currencies.

The formation of this working group positions the U.S. as a global cryptocurrency hub, enabling more systematic policy advancement.

3. Senate Banking Committee Establishes Digital Assets Subcommittee

On January 23, 2025, the Senate Banking Committee created a Digital Assets Subcommittee chaired by Senator Cynthia Lummis, advancing industry compliance through bipartisan legislation. The subcommittee promotes stablecoin regulation, optimizes market structure, and advocates for Bitcoin as a strategic national reserve asset. It also oversees financial regulators to prevent discriminatory crackdowns on cryptocurrencies, such as "Operation Chokepoint 2.0".

Lummis introduced the Strategic Bitcoin Reserve Act, proposing the sale of part of the Federal Reserve’s gold reserves to purchase one million bitcoins and establish a national Bitcoin reserve—highlighting the Trump administration’s commitment to Bitcoin.

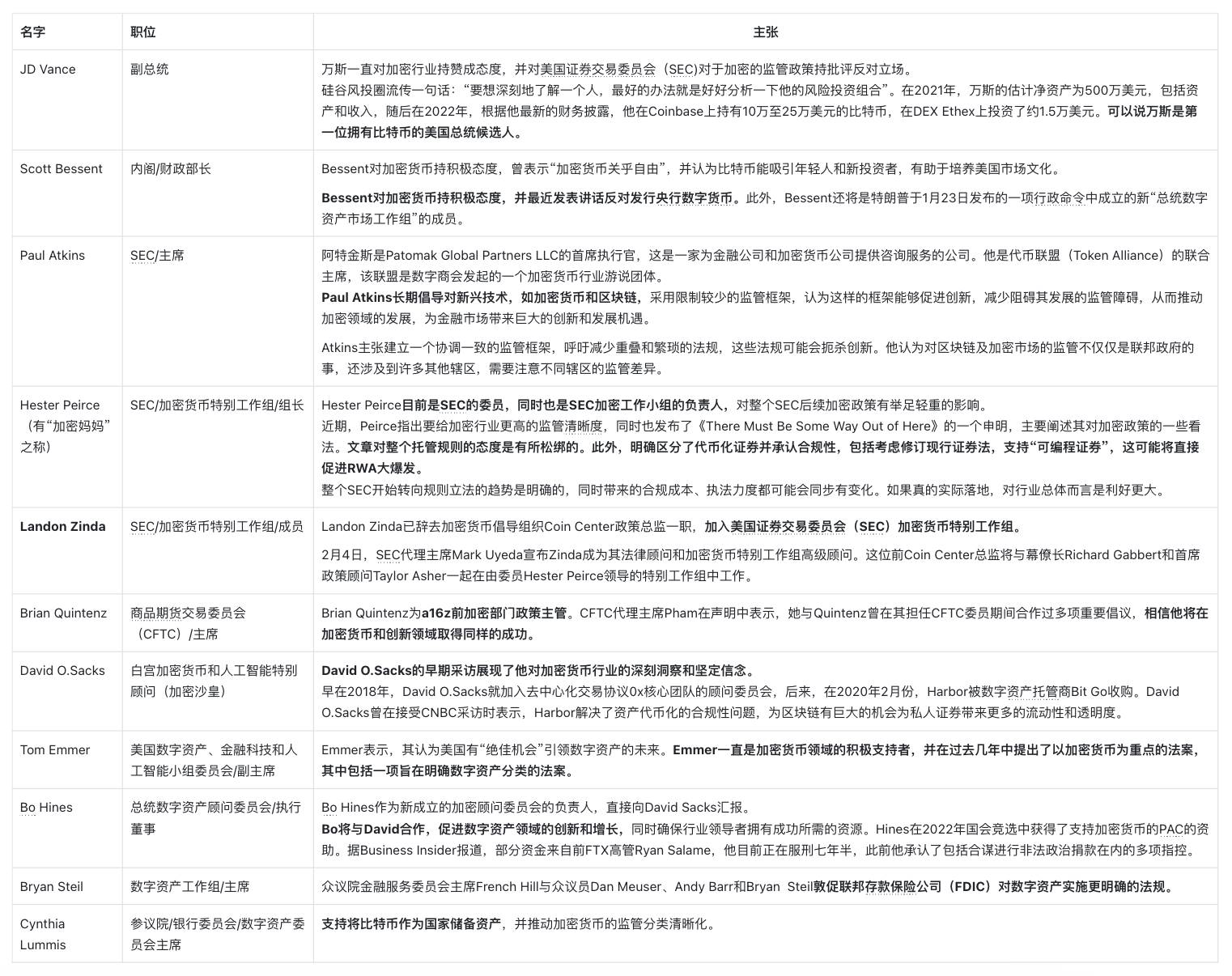

Below is an overview of crypto-related appointments made since Trump took office:

2. U.S. Crypto Legislation Reaches Turning Point: Regulatory Relief Paves Way for Mainstream Adoption

1. SEC Eases Regulation, Providing Breathing Room for Crypto Industry

Recent shifts in SEC policy indicate a softer regulatory stance:

Terminating enforcement actions against major crypto firms: Dropping investigations and lawsuits against Uniswap Labs, Robinhood Crypto, OpenSea, Coinbase, Gemini, and others.

Recognizing memecoins as non-securities: Freeing certain tokens from securities regulations and fostering market innovation.

Improving industry engagement: SEC Commissioner Hester Peirce (Uyeda) acknowledged past overreliance on enforcement, pledging greater policy transparency and dialogue with major industry players and leaders.

These measures relieve the U.S. crypto industry from constant enforcement pressure, enabling healthier and more stable growth.

2. Stablecoin Legislation Moves Forward, Boosting Market Confidence

On February 5, Senator Bill Hagerty introduced a stablecoin regulatory bill placing USDT, USDC, and other stablecoins under the Federal Reserve’s oversight framework, providing clear compliance guidelines. Backed by bipartisan lawmakers, this bill marks a critical step toward integrating crypto markets into mainstream finance. Once passed, it will significantly enhance the legality and security of stablecoins, attracting more traditional financial institutions and further advancing the industry.

3. Rescission of SAB 121 Frees Up Crypto Accounting Rules

On January 24, the SEC officially rescinded SAB 121, a crypto accounting policy that previously required custodians to record client crypto assets on their balance sheets—increasing compliance costs and operational burdens. The reversal allows banks, exchanges, and financial institutions greater flexibility in offering crypto custody services, lowering barriers for institutional investors.

4. FIT21 Bill: Clear Regulatory Framework for Crypto Markets

On May 22, 2024, the FIT21 bill passed the House of Representatives, marking a historic breakthrough for the U.S. crypto industry. The bill resolves long-standing jurisdictional disputes between the SEC and CFTC over cryptocurrency regulation and clearly defines:

Delineation of SEC and CFTC authority: Ending fragmented oversight and establishing a unified regulatory framework.

Classification standards for crypto securities vs. commodities: Resolving core legal ambiguities and eliminating regulatory overlap.

Clear rules for token issuance and trading: Providing definitive compliance guidance and reducing uncertainty for market participants.

Promotion of DeFi regulatory research: Facilitating integration between decentralized finance (DeFi) and traditional markets.

The progress of this bill advances the legalization and institutionalization of U.S. crypto markets, strengthens investor confidence, and positions the U.S. as the world’s most competitive crypto-financial center.

4. Conclusion: Crypto Industry Enters Mainstream Era, Poised for Golden Age

Since taking office, the Trump administration has brought fundamental changes to the U.S. crypto policy landscape, shifting regulatory attitudes from suppression to support and dramatically boosting market confidence. Through strategic appointments, creation of the Digital Assets Working Group, and congressional legislative momentum, the administration has clarified the industry’s regulatory framework, delivering a more stable policy environment.

With the SEC easing enforcement, rapid progress on stablecoin regulation, and the FIT21 bill passing the House, the crypto market is rapidly moving toward legalization and institutionalization. As favorable policies continue to roll out, innovation is being encouraged, investor confidence strengthened, and sectors such as stablecoins, DeFi, and custody services are poised for renewed growth.

The U.S. is accelerating its consolidation as the global center of crypto finance. The golden age of the industry is arriving—the integration of cryptocurrency into the mainstream financial system is now an unstoppable trend.

About Us

Metrics Ventures is a data and research-driven secondary market liquidity fund focused on crypto assets, led by a team of seasoned crypto professionals. The team possesses expertise in both primary market incubation and secondary market trading, actively contributing to industry development through deep on-chain and off-chain data analysis. MVC collaborates with influential figures in the crypto community to provide long-term empowerment support to projects, including media and KOL resources, ecosystem partnerships, project strategy, and economic model consulting.

We welcome DMs to share and discuss insights and ideas about crypto asset markets and investments.

Our research is published simultaneously on Twitter and Notion. Follow us for updates.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News