Web3 VC Ultimate Guide: Which VC Should You Follow to Make Money?

TechFlow Selected TechFlow Selected

Web3 VC Ultimate Guide: Which VC Should You Follow to Make Money?

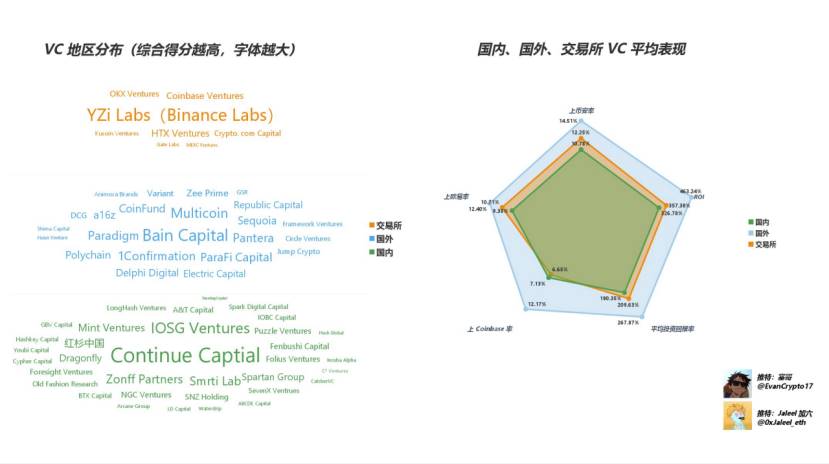

The output from foreign VC investments is higher than that of domestic VCs, while VC investments by exchange-affiliated VCs rank between the two.

Author: Sai Ge (@EvanCrypto17)

Compiled after 48 hours of non-stop work—this is a must-read data compilation for Web3 players.

Among the many VCs in Web3, which ones have the best judgment? Which VC-backed projects deliver the highest returns? For ordinary players, which VCs offer the best cost-performance when joining early? Which projects should you farm from? What are the major domestic and international VCs? Do foreign VCs back higher-potential projects?

These are exactly the questions retail investors care about most—and what primary market participants (farming enthusiasts) want to know.

In this article, we reveal the answers one by one using clear, straightforward data.

All data comes from public disclosures. We screened a total of 65 VCs: 23 overseas VCs, 34 domestic VCs, and 8 exchange-affiliated VCs.

We define success by one key outcome: whether a VC’s backed project gets listed on a top-tier exchange.

We acknowledge that some profitable projects may never issue tokens—but those opportunities aren’t accessible to average retail users.

Therefore, we use the following metrics for evaluation:

Quantitative Metrics:

Total number of investments by the VC

Number of projects issuing tokens

Number of projects listed on Binance

Number of projects listed on OKX

Number of projects listed on Coinbase

Listings Success Rate:

Binance listing rate = Number listed on Binance / Total investments

OKX listing rate = Number listed on OKX / Total investments

Coinbase listing rate = Number listed on Coinbase / Total investments

Evaluation Criteria:

Composite Score = 2 × Binance listing rate + 1 × OKX listing rate + 1 × Coinbase listing rate

Binance carries the largest weight (set at 2) due to its market dominance.

Average Project ROI = 15 × Binance listing rate + 10 × OKX listing rate + 10 × Coinbase listing rate

This ROI model assumes an average return of 15x for projects listed on Binance, 10x for OKX, and 10x for Coinbase. Actual returns vary per project; this is an averaged estimate.

Key Takeaways

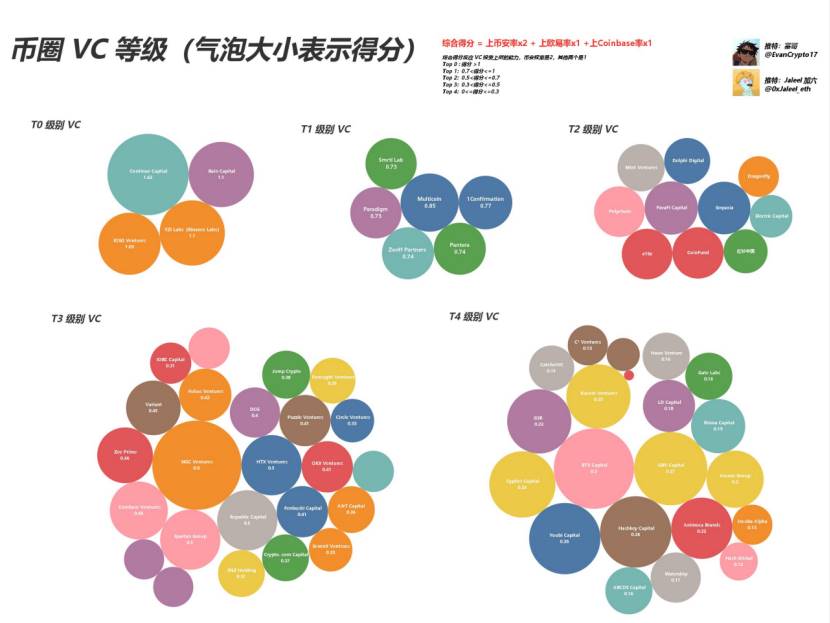

Based on composite scores, we categorize VCs into five tiers: T0, T1, T2, T3, and T4. The higher the tier, the sharper the VC’s investment acumen—and the better the cost-performance for retail users participating in early-stage projects led by these VCs.

VC Tier Classification:

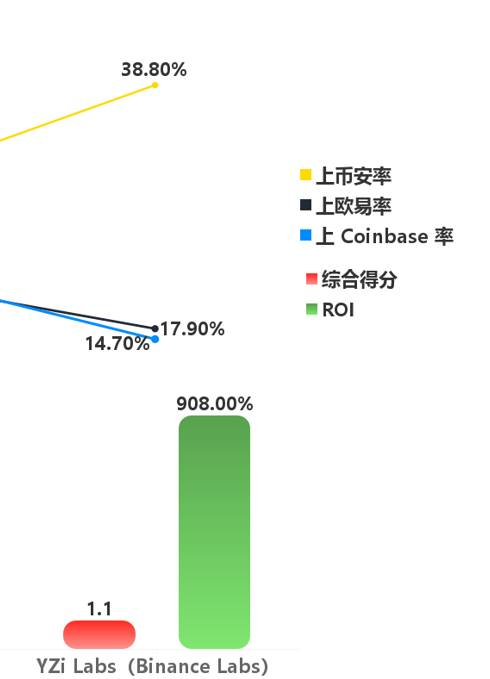

T0 VCs: YZi Labs (formerly Binance Labs), Continue Capital, IOSG Ventures, Bain Capital

T1 VCs: Multicoin, Pantera, 1Confirmation, Smrti Lab, Zonff Partners

T2 VCs: Polychain, ParaFi Capital, Dragonfly, Sequoia China, Delphi Digital, Electric Capital, Mint Ventures, CoinFund

T3 VCs: Framework Ventures, NGC Ventures, SNZ Holding, Coinbase Ventures, OKX Ventures, etc.

T4 VCs: Animoca Brands, GSR, Hashkey Capital, Waterdrip, LD Capital, etc.

Regional & Affiliation-Based VC Performance Ranking:

Overseas VCs > Exchange-affiliated VCs > Domestic VCs

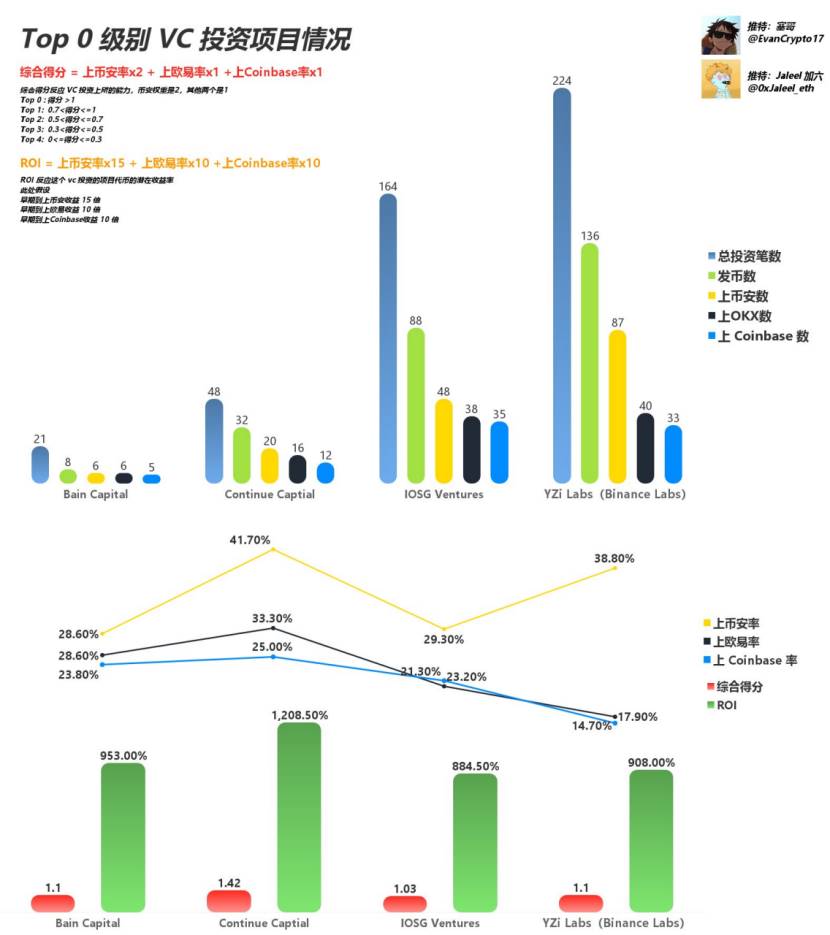

T0 VCs

T0 VCs include YZi Labs (formerly Binance Labs), Continue Capital, IOSG Ventures, and Bain Capital.

Composite score >1, with average ROI between 8–12. Focusing efforts on early-stage projects backed by these VCs typically leads to significant outcomes. The probability of hitting individual token gains at A7–A8 levels ("earning massively") is very high.

Detailed data shown below:

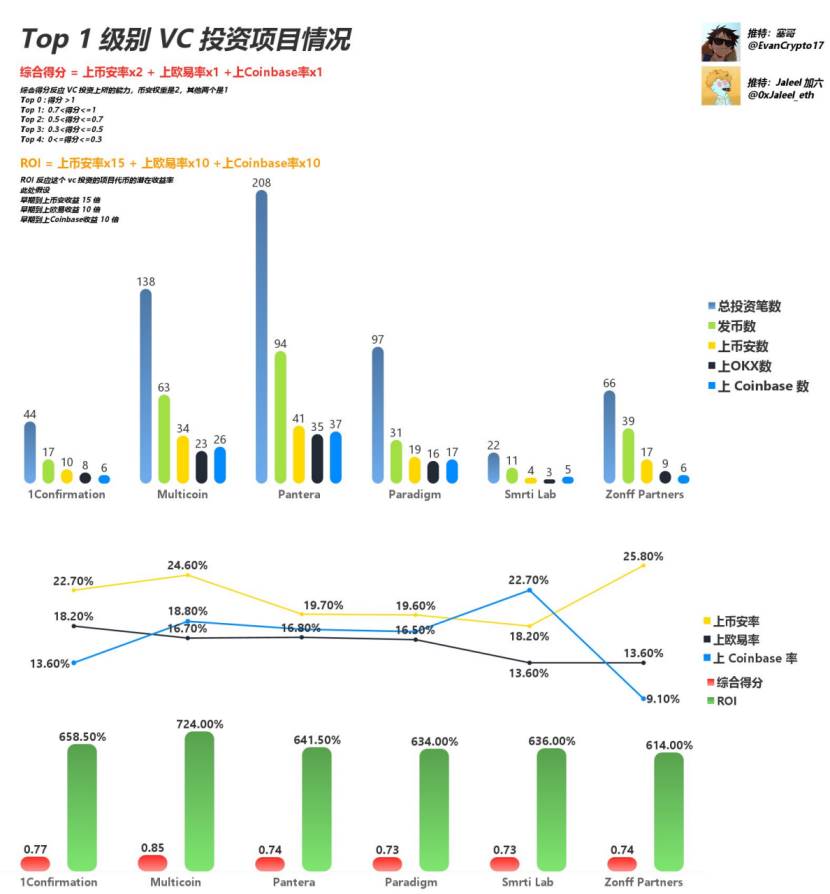

T1 VCs

T1 VCs include Multicoin, Pantera, 1Confirmation, Smrti Lab, and Zonff Partners.

Composite score between 0.7–1, average ROI between 6–7.5. Projects backed by these VCs also offer strong returns. Achieving A6.5-level gains is considered a solid result.

Detailed data shown below:

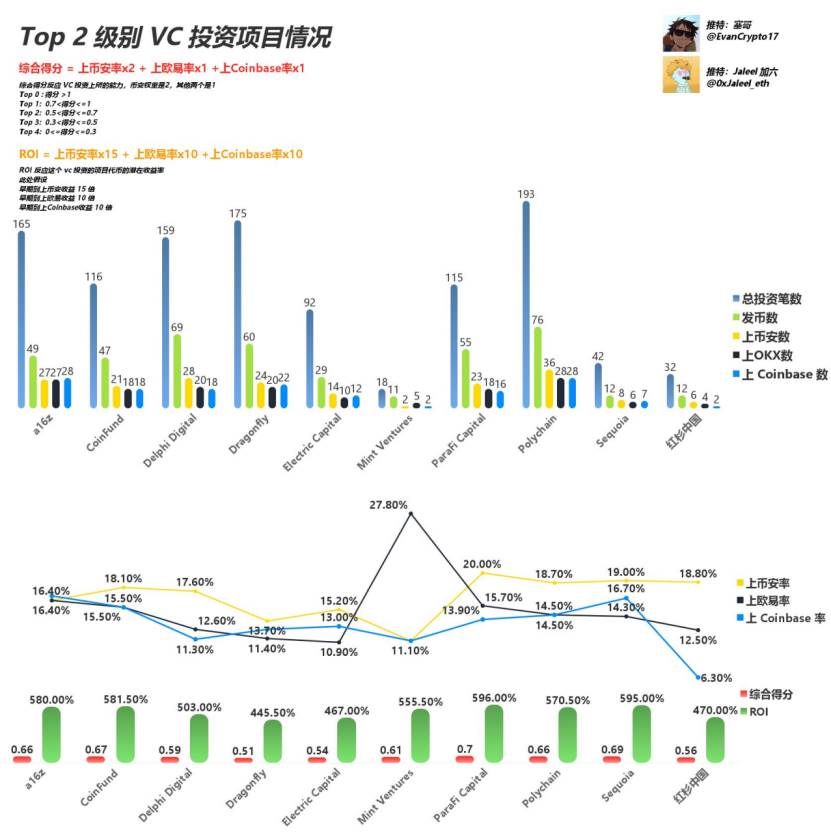

T2 VCs

T2 VCs include Polychain, ParaFi Capital, Dragonfly, Sequoia China, Delphi Digital, Electric Capital, Mint Ventures, and CoinFund.

Composite score between 0.5–0.7, average ROI between 4–6. Returns here are less consistent, but there may still be worthwhile opportunities worth exploring.

Detailed data shown below:

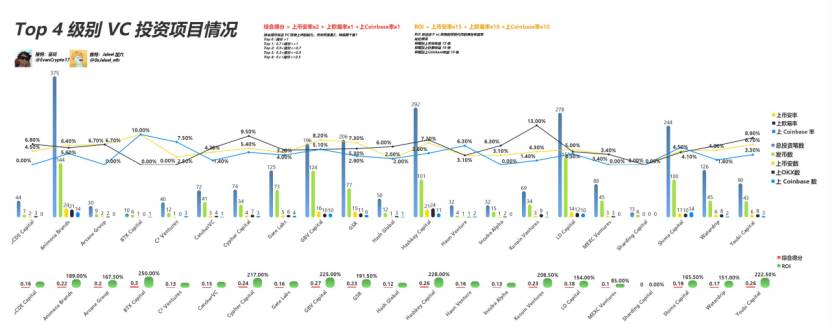

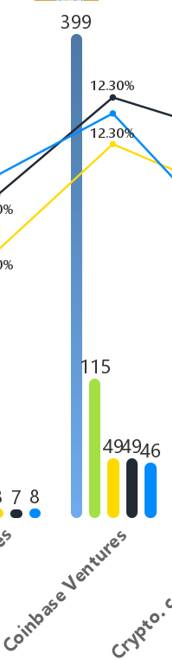

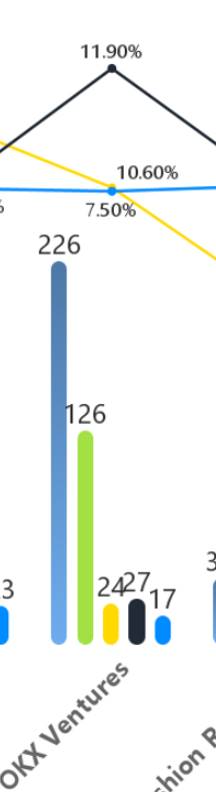

T3 VCs

T3 VCs include Framework Ventures, NGC Ventures, SNZ Holding, Coinbase Ventures, OKX Ventures, etc.

Composite score between 0.3–0.5, average ROI between 2.5–4.5. Early participation in their backed projects yields unstable returns and relatively low profitability.

Detailed data shown below:

T4 VCs

T4 VCs include Animoca Brands, GSR, Hashkey Capital, Waterdrip, LD Capital, etc.

Composite score below 0.3, average ROI between 0–2.5. Participation in early rounds of their backed projects shows poor outlooks and low chances of top exchange listings.

Detailed data shown below:

Bonus Insight:

Projects invested in by Binance or OKX have slightly higher probabilities of being listed on their own exchanges.

Coinbase-invested projects show roughly equal likelihoods of being listed across the "Big Three" exchanges.

Summary

Data analysis reveals that some VCs widely perceived as influential—such as a16z, Coinbase, Dragonfly, and Polychain—actually offer little practical reference value for average users.

Sometimes, projects heavily promoting their "prestigious VC backing" may actually be traps targeting retail investors.

In reality, only projects backed by T0 and T1 tier VCs should be the true focus and priority for retail participation.

Overseas VCs generate higher output than domestic ones, while exchange-affiliated VCs fall in between.

When evaluating whether an early-stage project is worth joining, examine which VC tiers are involved and assess the corresponding data points comprehensively. This approach provides substantial guidance for navigating the primary market.

Once again, this article focuses solely on comparing returns for retail players following VCs and ranks them accordingly. It does not address the overall corporate strength, brand reputation, or other aspects of the VCs themselves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News