BTC keeps falling—why is the SEC giving the green light to interest-bearing stablecoins?

TechFlow Selected TechFlow Selected

BTC keeps falling—why is the SEC giving the green light to interest-bearing stablecoins?

When the yields of interest-bearing stablecoins like YLDS continue to crush bank interest rates, who can foresee how much capital will accelerate into on-chain?

From spot Bitcoin ETFs to the tokenization wave, institutional forces represented by Wall Street are profoundly influencing and reshaping the trajectory of the crypto market. We believe this influence will grow even stronger in 2025. To explore this trend, OKG Research launches the "Wall Street on Chain" research series, continuously tracking traditional institutions' innovations and practices in the Web3 space. How are top-tier institutions like BlackRock and JPMorgan embracing innovation? How will tokenized assets, on-chain payments, and decentralized finance shape the future of finance?

This is the fourth installment of the "Wall Street on Chain" research series.

Previous articles:

1. Wall Street Accelerates Going On-Chain

2. How Much Time Does Hong Kong Have Left for RWA Tokenization?

3. The Power Game Behind Wall Street’s “Going On-Chain” Roadmap

Figure Markets recently received approval from the U.S. Securities and Exchange Commission (SEC) to launch YLDS, the first interest-bearing stablecoin. This move not only signifies regulatory recognition of crypto financial innovation in the United States but also signals that stablecoins are evolving from mere payment tools into compliant yield-generating assets. This could unlock greater potential within the stablecoin sector, possibly making it the next major innovation area capable of attracting large-scale institutional capital after Bitcoin.

Why Did the SEC Approve YLDS?

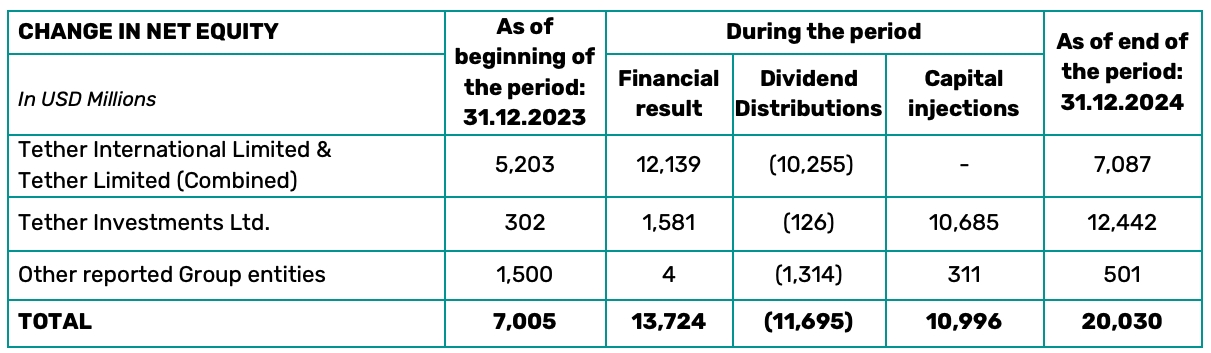

In 2024, Tether, the issuer of the stablecoin USDT, reported annual profits of $13.7 billion—surpassing those of traditional financial giant Mastercard (approximately $12.9 billion). These profits primarily stem from investment returns on reserve assets (mainly U.S. Treasuries), but such gains do not benefit USDT holders, who cannot earn asset appreciation or investment returns through holding USDT. This gap represents a key opportunity for interest-bearing stablecoins to disrupt the current landscape.

Tether's Financial Report (2024)

The core innovation of interest-bearing stablecoins lies in the "redistribution of asset income rights": In the traditional stablecoin business model, users sacrifice the time value of money for stability. Interest-bearing stablecoins maintain price stability while allowing holders to directly receive yields by tokenizing the income rights from underlying assets. More importantly, they address a critical pain point for the "silent majority": although traditional stablecoins can generate yield through staking, complex operations and security or compliance risks hinder widespread adoption. Stablecoins like YLDS, which offer "earn interest just by holding," make yield generation accessible to all, truly achieving "democratization of returns."

Although passing on underlying asset yields reduces issuer profits, it significantly enhances the appeal of interest-bearing stablecoins. Especially amid global economic uncertainty and persistently high inflation, demand for financial products that generate stable returns continues to rise among both on-chain users and traditional investors. Products like YLDS—offering stability alongside yields far exceeding traditional bank rates—are naturally becoming highly attractive investments.

However, these factors were not the primary reasons for SEC approval. The key reason YLDS gained SEC approval is that it sidesteps the central controversies in SEC regulation, aligning clearly with existing U.S. securities laws. Due to the absence of a comprehensive stablecoin regulatory framework, U.S. oversight currently relies on existing legislation. However, agencies including the SEC and CFTC hold differing views on how to classify stablecoins, each seeking dominance over their regulation. This inter-agency competition, along with divergent interpretations between regulators and the market, has created a fragmented and inconsistent regulatory environment. Yet, interest-bearing stablecoins like YLDS resemble traditional fixed-income instruments, falling unambiguously under the definition of "securities" even under current legal frameworks—eliminating regulatory ambiguity. This clarity forms the essential precondition for SEC oversight.

Nevertheless, this approval indicates that while U.S. crypto regulation is becoming increasingly open and adaptive—with regulators like the SEC actively accommodating the fast-evolving stablecoin and crypto markets—and marks a shift from "passive defense" to "proactive guidance," it does not immediately resolve the regulatory challenges facing traditional stablecoins like USDT. Meaningful change will likely require formal passage of a stablecoin regulatory bill by the U.S. Congress, which industry experts expect may occur within the next 1 to 1.5 years.

YLDS distributes interest income from its underlying assets (primarily U.S. Treasuries and commercial paper) via smart contracts and ties yield distribution to verified identities through strict KYC procedures, mitigating regulatory concerns around anonymity. These compliance-oriented designs provide a reference model for future similar projects seeking regulatory approval. Over the next 1–2 years, we may see more compliant interest-bearing stablecoins emerge, prompting other jurisdictions to reconsider the necessity of developing frameworks for such products. For regions like Hong Kong and Singapore, which have already implemented stablecoin regulations largely treating stablecoins as payment instruments, encountering interest-bearing stablecoins with clear securities characteristics may necessitate either adjusting existing frameworks or limiting the types of permissible underlying assets, thereby bringing them under the regulatory umbrella of tokenized securities.

The Rise of Interest-Bearing Stablecoins Will Accelerate Crypto Market Institutionalization

The SEC's approval of YLDS reflects not only a favorable regulatory stance but also suggests that, within mainstream finance, stablecoins may evolve from being mere "cash substitutes" into new hybrid assets combining both "payment utility" and "yield generation," accelerating the institutionalization and dollarization of the crypto market.

While traditional stablecoins meet cryptocurrency payment needs, most institutions treat them only as short-term liquidity tools due to their lack of interest-bearing features. In contrast, interest-bearing stablecoins generate steady returns and enhance capital efficiency through intermediary-free, 24/7 on-chain transactions, offering significant advantages in fund turnover and instant settlement. Ark Invest’s latest annual report notes that hedge funds and asset managers have already begun incorporating stablecoins into their cash management strategies. With SEC approval, compliance concerns among institutions will further diminish, elevating institutional acceptance and participation in such stablecoins to new levels.

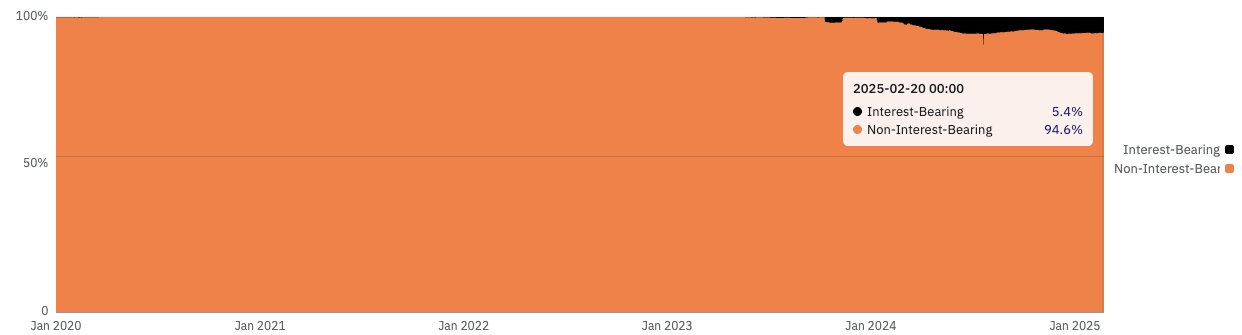

A massive influx of institutional capital will drive rapid growth in the interest-bearing stablecoin market, solidifying its role as an indispensable component of the crypto ecosystem. To meet competitive pressures and market demand, OKG Research optimistically forecasts that interest-bearing stablecoins will experience explosive growth over the next 3–5 years, capturing around 10–15% of the overall stablecoin market share, becoming another crypto asset class—after BTC—to attract significant institutional attention and capital inflows.

Proportion of Interest-Bearing Stablecoins in the Ethereum Ecosystem (@21co, as of 2025/2/20)

The rise of interest-bearing stablecoins will further entrench the U.S. dollar’s dominance in the crypto world. Currently, interest-bearing stablecoins derive returns from three main sources: U.S. Treasury investments, blockchain staking rewards, or structured financial strategies. Although Ethena Labs’ synthetic dollar stablecoin USDe achieved major success in 2024 and became a leading player in the interest-bearing stablecoin market, this does not imply that staking- or strategy-based yield models will become dominant. Instead, we believe Treasury-backed interest-bearing stablecoins will remain the preferred choice for institutional investors.

Despite accelerating de-dollarization in the physical world—China and Japan selling large amounts of U.S. Treasuries in recent years, Saudi Arabia announcing in June 2024 the end of its half-century "petrodollar agreement," decoupling oil from the dollar after gold—digital on-chain systems continue to converge toward the dollar. Whether through widespread adoption of dollar-denominated stablecoins or the tokenization wave led by Wall Street institutions, the U.S. continues to strengthen the influence of dollar-denominated assets in crypto markets, reinforcing this dollarization trend.

This trend is unlikely to reverse in the near term. From the perspectives of liquidity, stability, and market acceptance, there are currently few viable alternatives to U.S. dollar assets—particularly U.S. Treasuries—for tokenization and crypto financial innovation. The SEC’s approval of YLDS clearly signals regulatory greenlighting of Treasury-backed interest-bearing stablecoins, undoubtedly encouraging more projects to launch similar products in the future. Even though we anticipate increasing diversification in yield mechanisms and expansion of reserve assets into real-world assets like real estate, gold, and corporate bonds, we still believe U.S. Treasuries—as risk-free assets—will continue to dominate the underlying asset pools of interest-bearing stablecoins.

Conclusion

The approval of YLDS is not only a compliance breakthrough for crypto innovation but also a milestone in financial democratization. It reveals a simple truth: under controlled risk, the market's demand for "money making money" is eternal. As regulatory frameworks mature and institutional capital flows in, interest-bearing stablecoins may reshape the stablecoin market and reinforce the dollarization trend in crypto financial innovation. However, this process must balance innovation with risk management to avoid repeating past mistakes. Only then can interest-bearing stablecoins truly fulfill the vision of "letting everyone earn money while lying down."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News