March Global Economic Update: Must-Read for Crypto Investors

TechFlow Selected TechFlow Selected

March Global Economic Update: Must-Read for Crypto Investors

The crypto market is highly sensitive to macro trends, and traders adjust their positions based on liquidity, interest rate expectations, and economic conditions. Volatility is expected to increase significantly around the release of major economic data.

Key Highlights

-

– Central bank decisions impact market liquidity: Rate hikes tighten liquidity, putting pressure on cryptocurrencies; pauses or rate cuts may drive speculative capital inflows. Policies from the Federal Reserve (Fed), European Central Bank (ECB), and Bank of England (BoE) will be key market drivers.

-

– Inflation and economic growth determine risk appetite: Cooling inflation and strong economic growth benefit the crypto market, while surging inflation or weak economic data could trigger sell-offs. Key indicators include CPI (Consumer Price Index), PPI (Producer Price Index), GDP (Gross Domestic Product), and employment data.

-

– Geopolitical and regulatory developments add market volatility: Escalation in the Russia-Ukraine war, intensified U.S.-China tensions, or Middle East conflicts may increase risk-averse sentiment. However, positive regulatory progress—such as ETF approvals or MiCA (Markets in Crypto-Assets) implementation—could boost market confidence.

-

– Market sentiment and capital rotation are crucial: The crypto market is highly sensitive to macro trends, with traders adjusting positions based on liquidity, interest rate expectations, and economic conditions. Volatility is expected to rise significantly around major economic data releases.

As the cryptocurrency market matures, macroeconomic events are playing an increasingly significant role in shaping digital asset price movements.

Economic indicators, central bank policy decisions, inflation reports, and geopolitical developments all influence traders’ risk appetite. Whether you’re a short-term crypto trader or a long-term investor, monitoring key economic events in March will help you better navigate market volatility.

In this article, we break down the most important economic events in March—from central bank rate decisions, inflation data, employment reports, to global political dynamics—and analyze how they could impact the crypto market. While crypto asset prices are often uniquely influenced by blockchain technology and innovation in digital assets, the macroeconomic environment still shapes investor confidence and positioning in risk assets like cryptocurrencies.

Table of Contents

Central Bank Meetings and Interest Rate Decisions

-

– U.S. Federal Open Market Committee (FOMC) – March 18–19

-

– European Central Bank (ECB) – March 5–6

-

– Bank of England (BoE) – March 20

-

– Bank of Japan (BoJ) – March 18–19

-

– Other central banks (Bank of Canada BoC, Swiss National Bank SNB, Reserve Bank of Australia RBA)

-

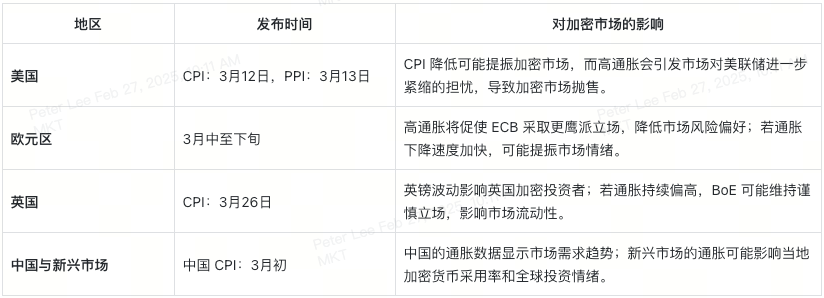

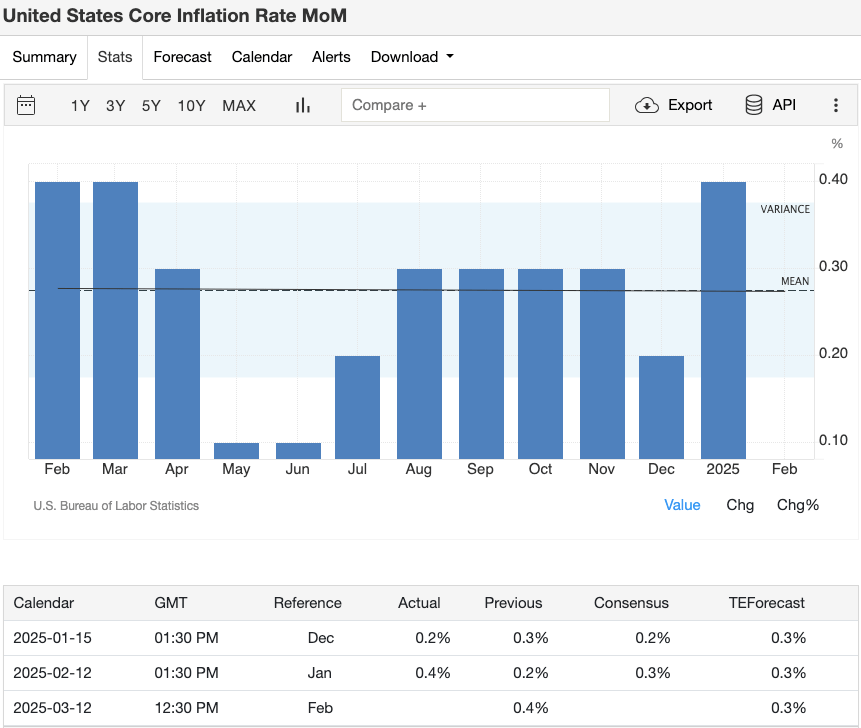

– U.S. inflation data (CPI: March 12, PPI: March 13)

-

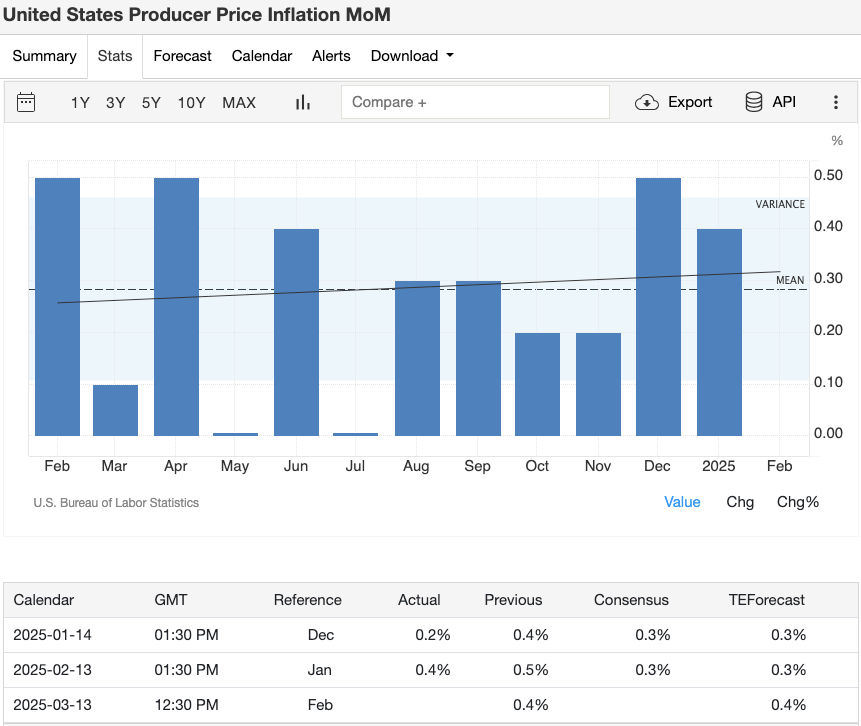

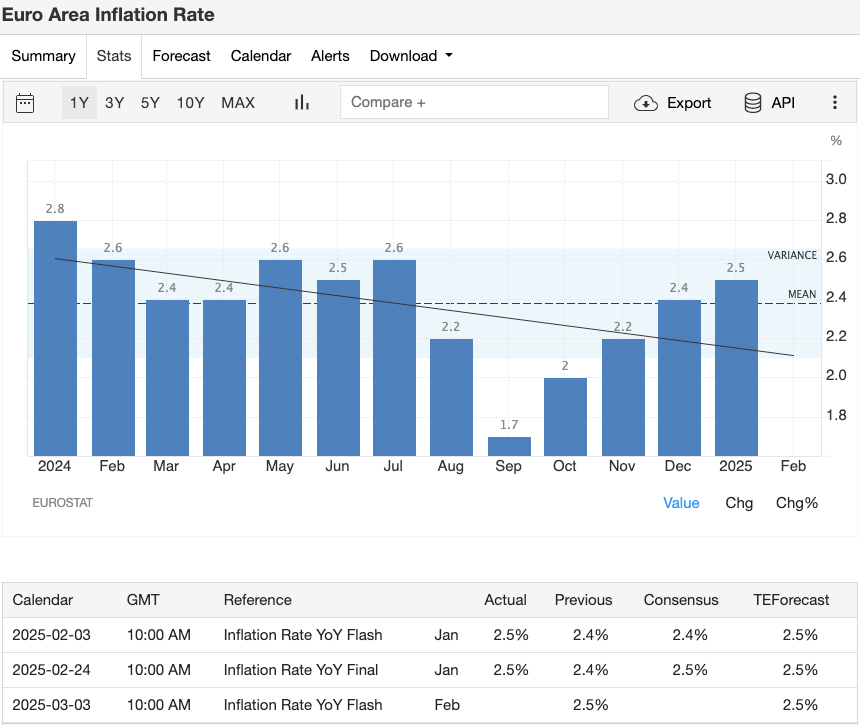

– Eurozone Consumer Price Index (March 3)

-

– UK inflation report (March 26)

-

– China and emerging markets inflation data

-

– U.S. Non-Farm Payrolls (NFP) – March 7

-

– Unemployment rate and wage growth trends

-

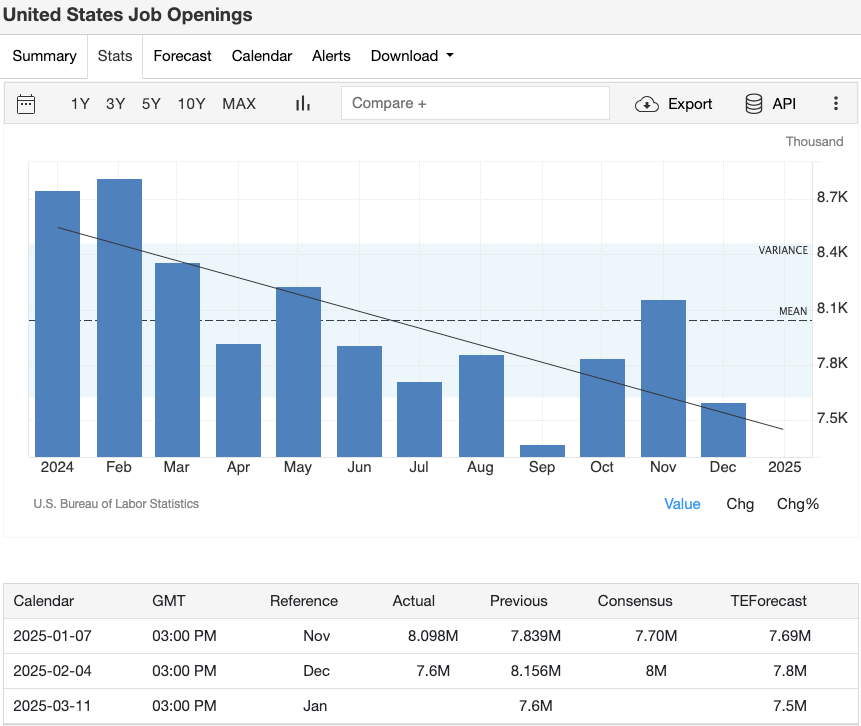

– JOLTS (Job Openings) – March 11

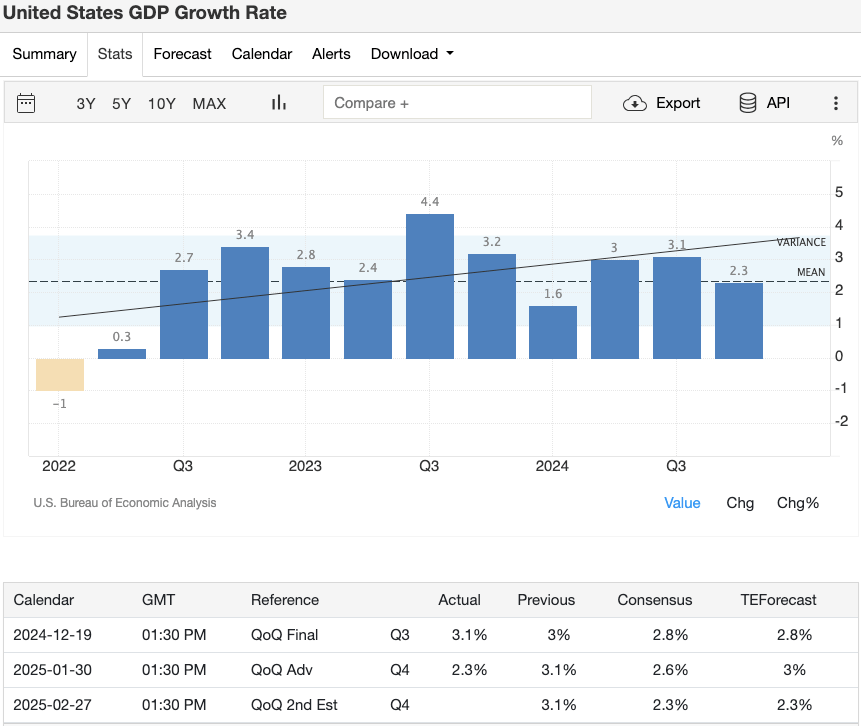

GDP (Gross Domestic Product) Reports

-

– U.S. Q4 2024 final estimate – March 27

-

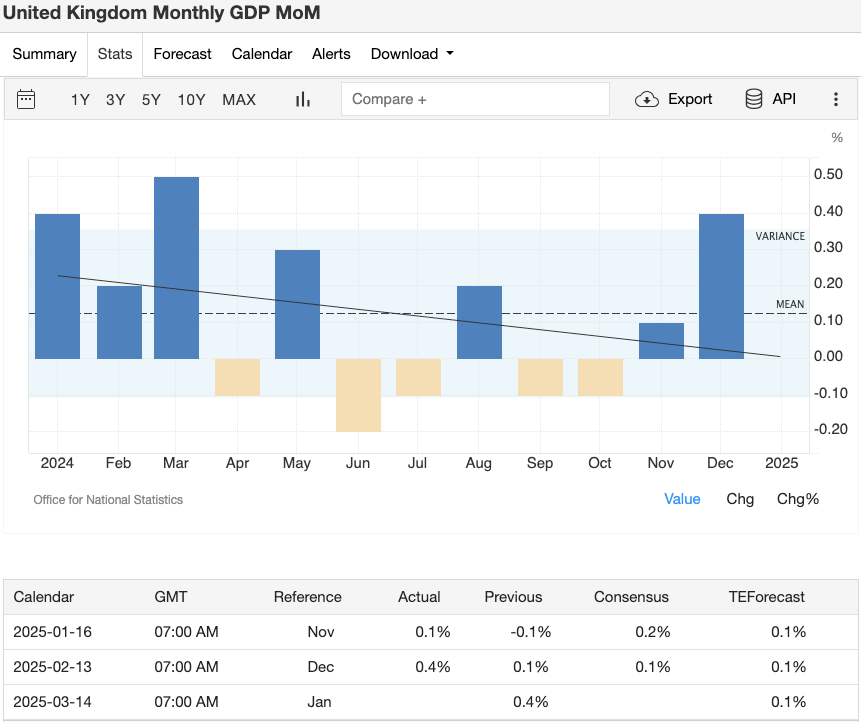

– UK GDP report – March 14

-

– China economic outlook (National People's Congress & Q1 2025 forecast)

-

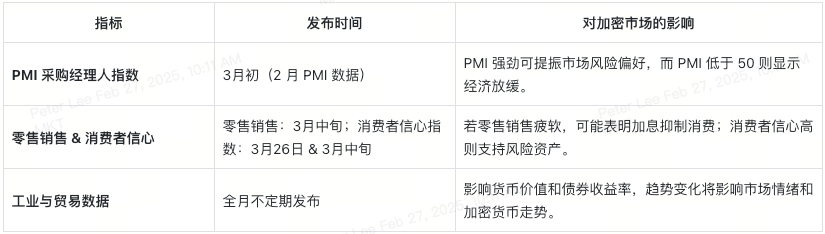

– PMI (Purchasing Managers' Index) (business confidence) – Early March

-

– U.S. retail sales & consumer confidence index – Mid to late March

-

– Industrial production and trade data (output, exports, durable goods orders)

Global Political Developments Impacting the Crypto Market

-

– Russia-Ukraine war and market sentiment

-

– U.S.-China relations and trade war

-

– Middle East and other geopolitical hotspots

Cryptocurrency Regulation and Policy Changes

-

– U.S. SEC regulation & cryptocurrency rules

-

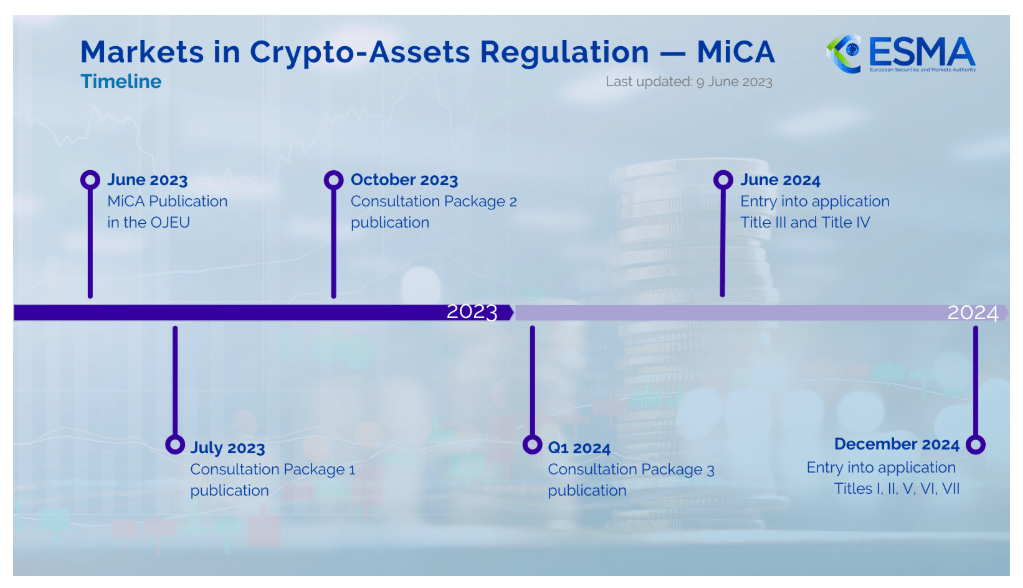

– MiCA framework & European crypto regulations

-

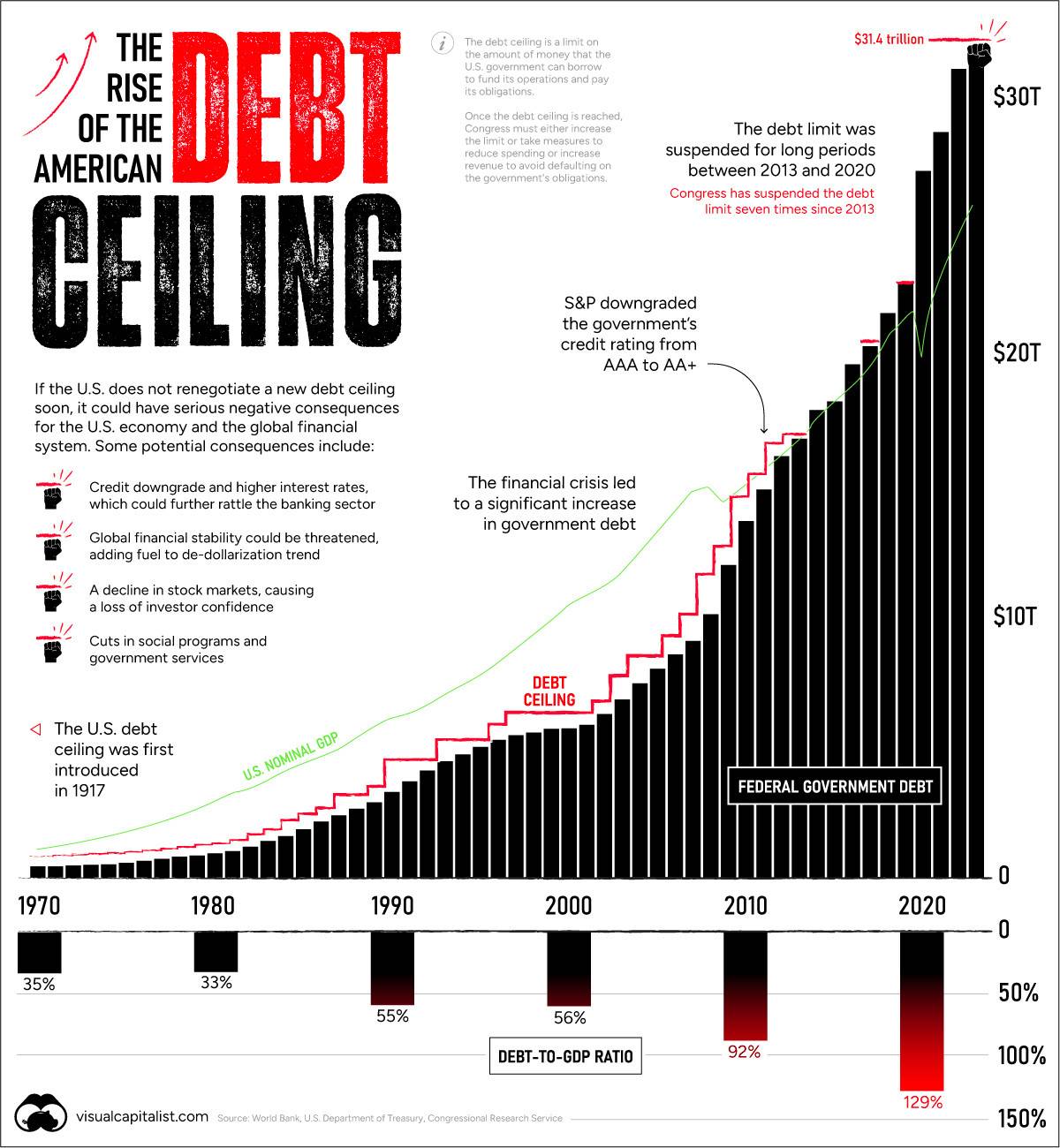

– U.S. debt ceiling and fiscal policy impacts

Major Economies’ Developments and Investor Sentiment

-

– U.S. economic outlook & Fed policy

-

– Eurozone economic balancing strategy

-

– China’s growth targets & stimulus policies

-

– Emerging markets and capital flow trends

Impact on the Cryptocurrency Market in March

Central Bank Meetings and Interest Rate Decisions

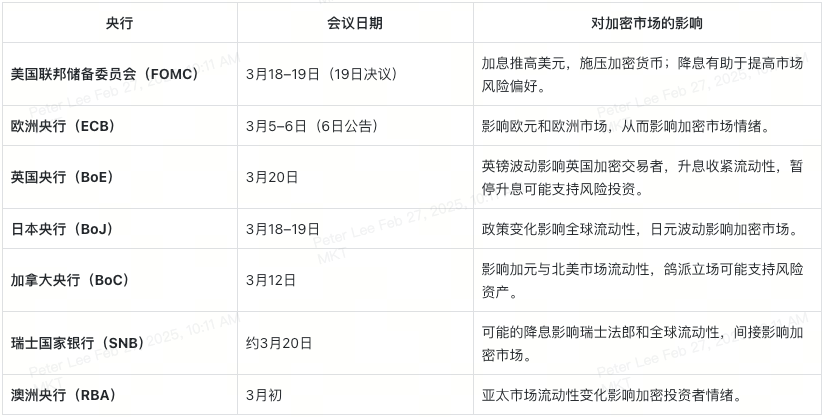

Federal Reserve (FOMC)

Meeting Dates: March 18–19 (Decision Announcement: March 19)

Impact Analysis:

The Federal Reserve's interest rate policy is a major driver of global markets and directly impacts the cryptocurrency market. Investors will closely watch for any shifts in policy direction.

Why It Matters?

-

– Hawkish policy: Maintaining high rates strengthens the dollar and pressures the crypto market.

-

– Dovish policy: If the Fed pauses or cuts rates, bond yields may fall, attracting speculative capital into risk assets such as Bitcoin.

-

– The Fed’s statement and press conference typically trigger significant market volatility.

Image Credit: Trading Economics

European Central Bank (ECB)

Meeting Dates: March 5–6 (Decision Announcement: March 6)

Impact Analysis:

The ECB is striving to balance inflation control with economic recovery.

Why It Matters?

-

– ECB policy directly affects the euro and European markets, indirectly influencing crypto market sentiment.

-

– If the ECB signals a pause in rate hikes, investor risk appetite may improve.

-

– Continued rate hikes or a hawkish stance from the ECB could pressure the crypto market.

Image Credit: Trading Economics

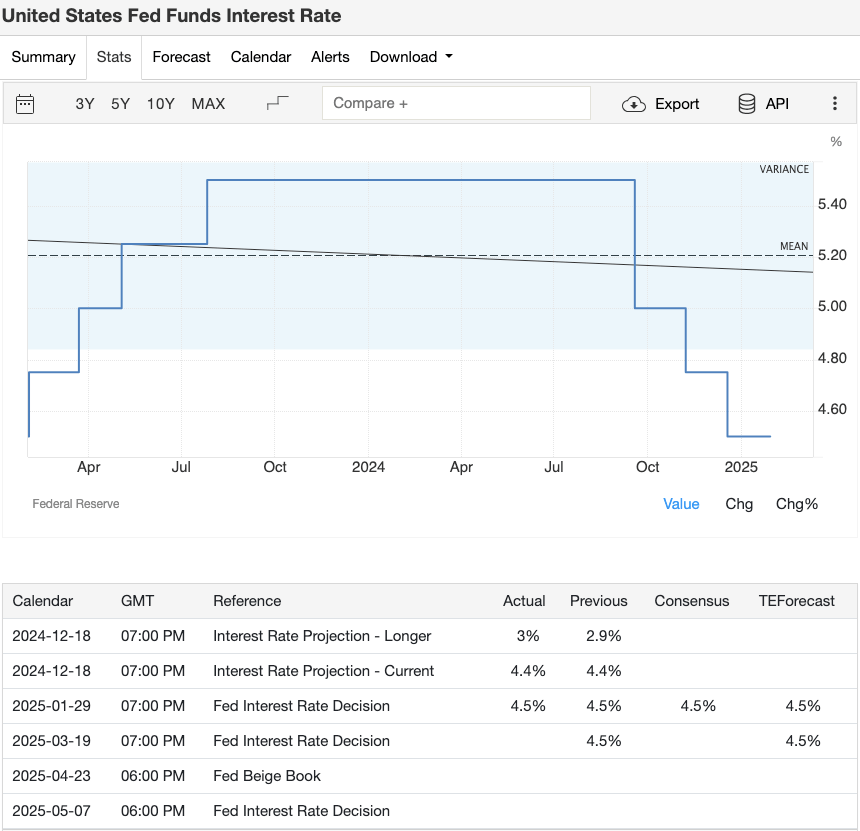

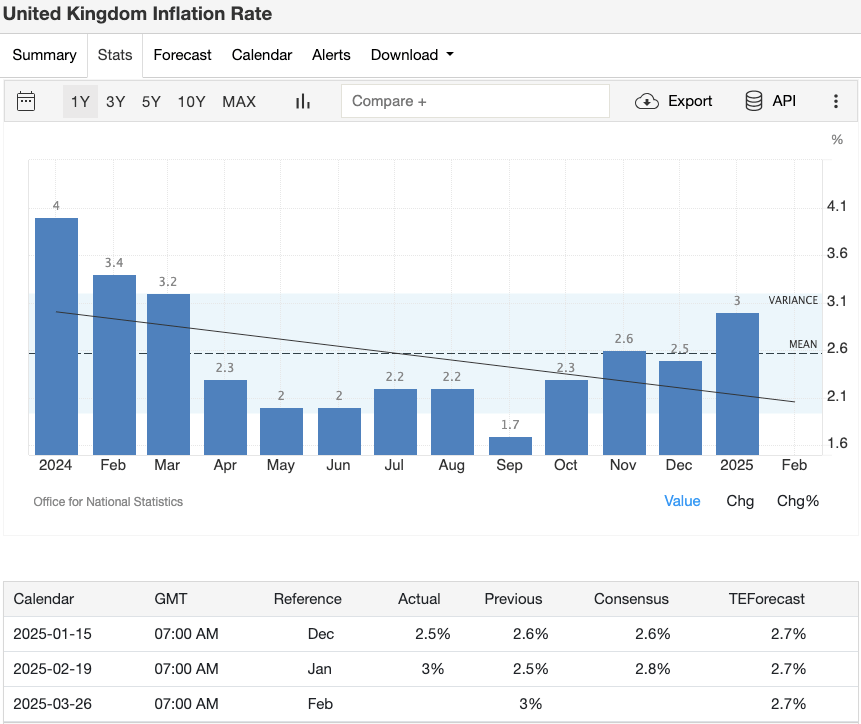

Bank of England (BoE)

Meeting Date: March 20

Impact Analysis:

UK inflation remains elevated, forcing the central bank to decide whether to continue tightening.

Why It Matters?

-

– Fluctuations in the pound affect UK-based crypto traders.

-

– A BoE rate hike tightens market liquidity, potentially reducing investment interest in crypto assets.

-

– A pause in rate hikes by the BoE could encourage more capital inflows into risk assets, including cryptocurrencies.

Image Credit: Trading Economics

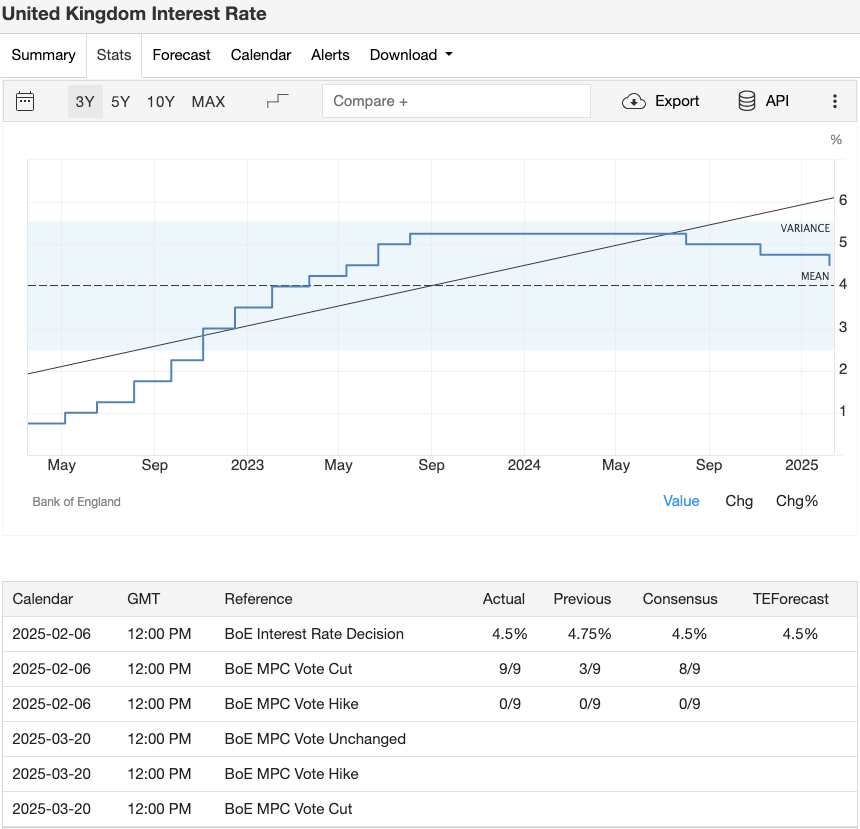

Bank of Japan (BoJ)

Meeting Dates: March 18–19

Impact Analysis:

The BoJ is gradually shifting away from its ultra-loose monetary policy, which will impact global liquidity.

Why It Matters?

-

– A stronger yen could affect global market liquidity and short-term crypto market volatility.

-

– Policy adjustments may trigger fluctuations in yen-related trading pairs, affecting international capital flows.

Image Credit: Trading Economics

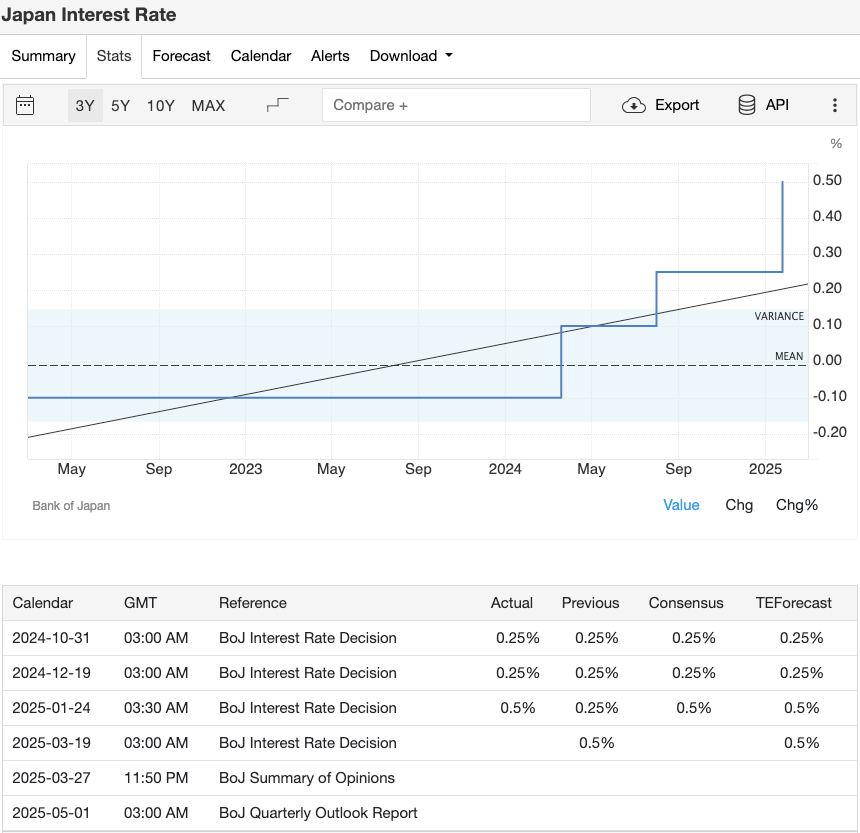

Other Central Bank Updates

-

– Bank of Canada (BoC): Interest rate decision on March 12.

-

– Swiss National Bank (SNB): Around March 20, possible policy adjustment.

-

– Reserve Bank of Australia (RBA): Meeting early March.

If multiple central banks adopt dovish stances (rate cuts or pauses), financial conditions may loosen, supporting risk assets including cryptocurrencies. Conversely, continued hawkish policies (rate hikes or tightening signals) could further tighten liquidity, pressuring digital assets.

Inflation Reports (CPI, PPI)

U.S. Inflation Data

Release Dates:

-

– CPI (Consumer Price Index): March 12

-

– PPI (Producer Price Index): March 13

U.S. inflation data is critical for market rate expectations. Lower-than-expected CPI may boost confidence in a Fed pause, stimulating risk assets. Conversely, higher CPI or PPI could signal persistent inflation, raising concerns about further Fed tightening and prompting capital outflows from crypto markets.

Why It Matters?

-

– Markets typically rally when inflation cools, signaling potential rate stability.

-

– High inflation may trigger sell-offs in both stock and crypto markets.

-

– Volatility tends to spike around these data releases.

Image Credit: Trading Economics

Eurozone Consumer Price Index (CPI)

Release Date: March 3

Eurozone inflation has been high but recently trending downward.

Why It Matters?

-

– Persistently high inflation may prompt the ECB to continue hiking, suppressing market risk appetite.

-

– Faster disinflation could boost investor confidence, indirectly benefiting the crypto market.

Image Credit: Trading Economics

UK Inflation Data

Release Date: March 26

The UK continues to battle high inflation, influencing the BoE’s rate decisions.

Why It Matters?

-

– Pound volatility affects crypto trading strategies of UK investors.

-

– Sustained high inflation may force the BoE to maintain a tight stance, weakening market liquidity.

Image Credit: Trading Economics

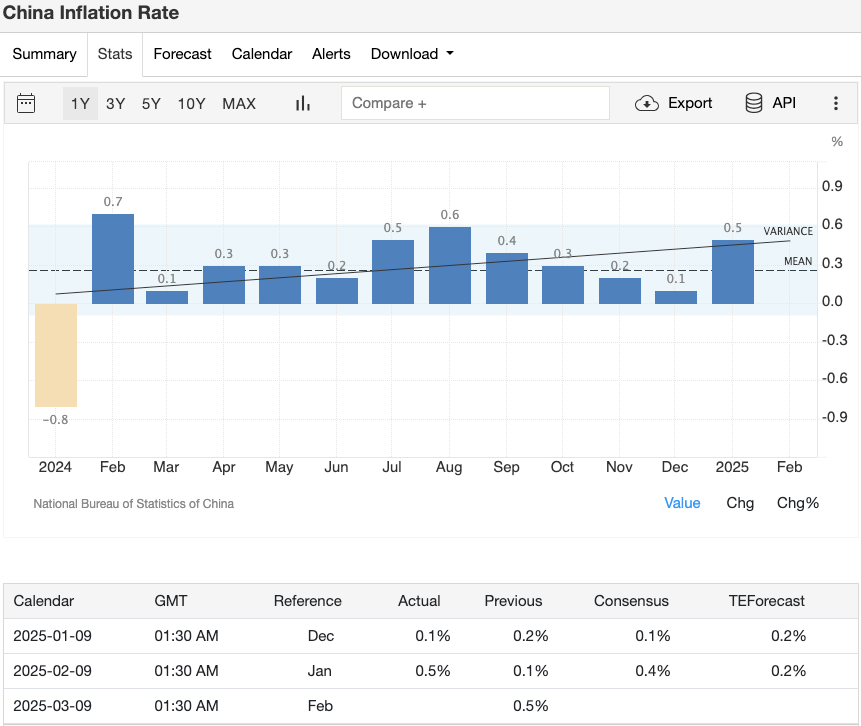

China and Emerging Markets Inflation Data

China CPI (Release: Early March)

China’s inflation reflects domestic demand, while inflation trends in emerging markets (e.g., Turkey, Brazil) influence local crypto adoption and global investor sentiment.

Image Credit: Trading Economics

Employment Data Releases

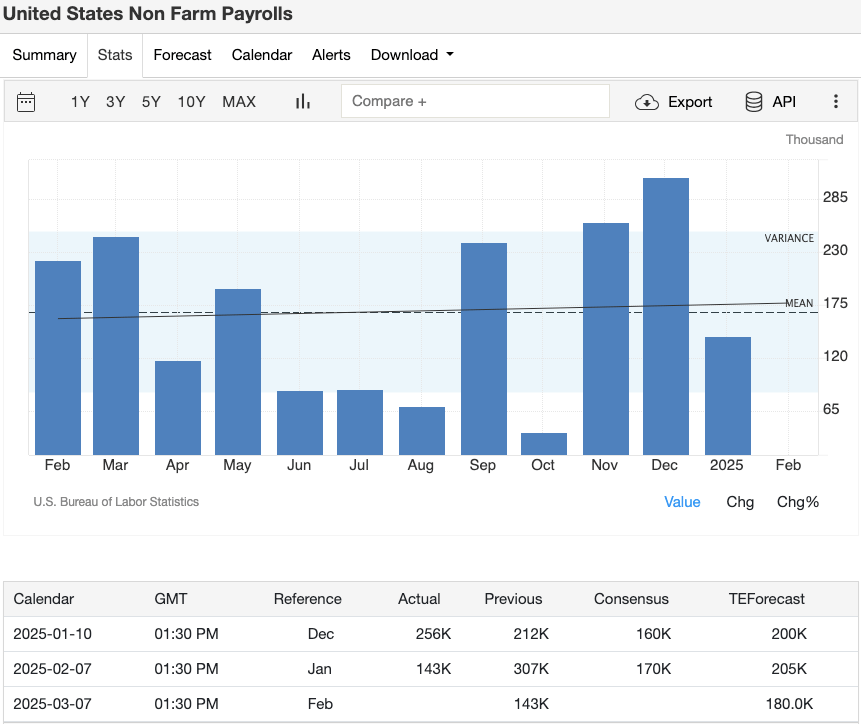

U.S. Non-Farm Payrolls (NFP)

Release Date: March 7 (08:30 ET)

NFP is a key gauge of U.S. economic health, covering job growth, unemployment, and wages.

Why It Matters?

-

– Strong NFP (high job growth, low unemployment): May lead the Fed to maintain tight policy, strengthening the dollar and pressuring crypto markets.

-

– Weak NFP (low job growth, rising unemployment): Could boost expectations of Fed rate cuts, benefiting risk assets such as Bitcoin.

-

– Extremely weak data may spark recession fears, causing short-term flight to safe-havens like the dollar and gold, rather than crypto.

Image Credit: Trading Economics

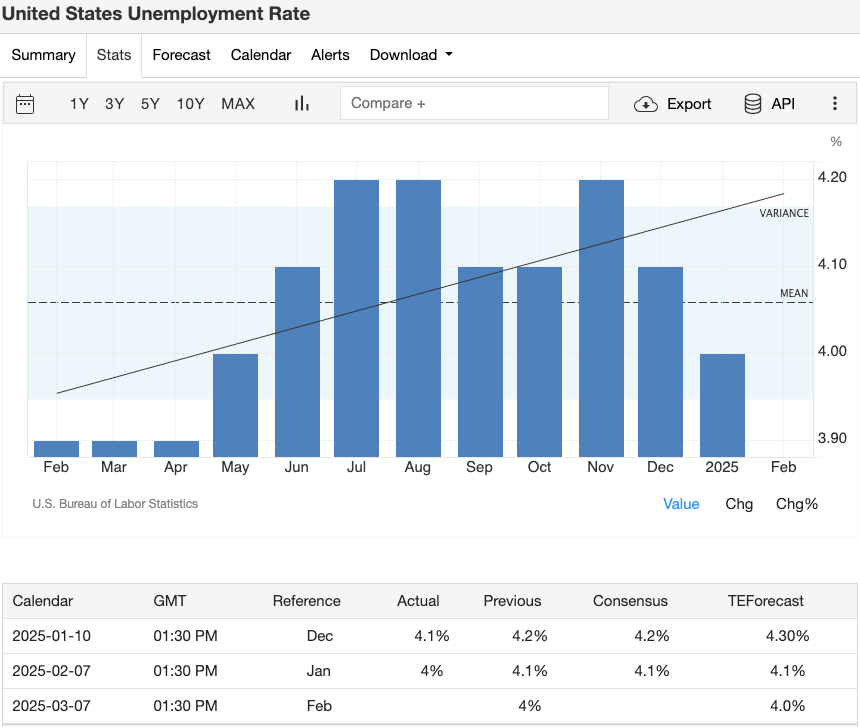

Unemployment Rate and Wage Growth

Changes in unemployment and average hourly earnings shape inflation and monetary policy expectations.

Why It Matters?

-

– Rapid wage growth: Could fuel inflation, prompting the Fed to keep rates high, negatively impacting crypto.

-

– Rising unemployment: May signal economic slowdown, undermining confidence, but could force the Fed toward looser policy, benefiting risk assets.

Image Credit: Trading Economics

JOLTS (Job Openings)

Release Date: March 11

JOLTS data reflects labor demand in the U.S. and influences bond markets and policy expectations.

Why It Matters?

-

– Declining job openings: Indicates labor market weakness, possibly prompting Fed rate cuts—positive for crypto—but sharp drops may raise recession fears.

-

– Rising job openings: Suggests economic strength, lowering rate cut expectations, negatively impacting crypto.

Image Credit: Trading Economics

GDP (Gross Domestic Product) Releases

U.S. GDP (Q4 2024 Final Estimate)

Release Date: March 27 (08:30 ET)

While GDP is a lagging indicator, final revisions can still shift market sentiment.

Why It Matters?

-

– Downward revision may heighten recession fears, undermining investor confidence in risk assets including crypto.

-

– Upward revision suggests economic resilience, boosting market sentiment.

-

– Crypto markets aren’t directly tied to GDP, but monitor consumer spending and corporate profits within it to assess shifts in risk appetite.

Image Credit: Trading Economics

UK GDP (January 2025 Data)

Release Date: March 14

Why It Matters?

-

– Eurozone GDP trends affect global investor sentiment. Slowing growth may suppress demand for risk assets.

-

– GDP exceeding expectations could stabilize markets and boost investor interest in crypto.

Image Credit: Trading Economics

China GDP (Q1 2025 Data)

Release Date: April (Growth target set during March NPC session)

Why It Matters?

-

– Strong Chinese economic growth: Could lift commodities and emerging markets, indirectly driving capital into crypto.

-

– Despite banning domestic crypto trading, Beijing’s policy signals still influence global liquidity and investor risk appetite.

Other Key Economic Indicators

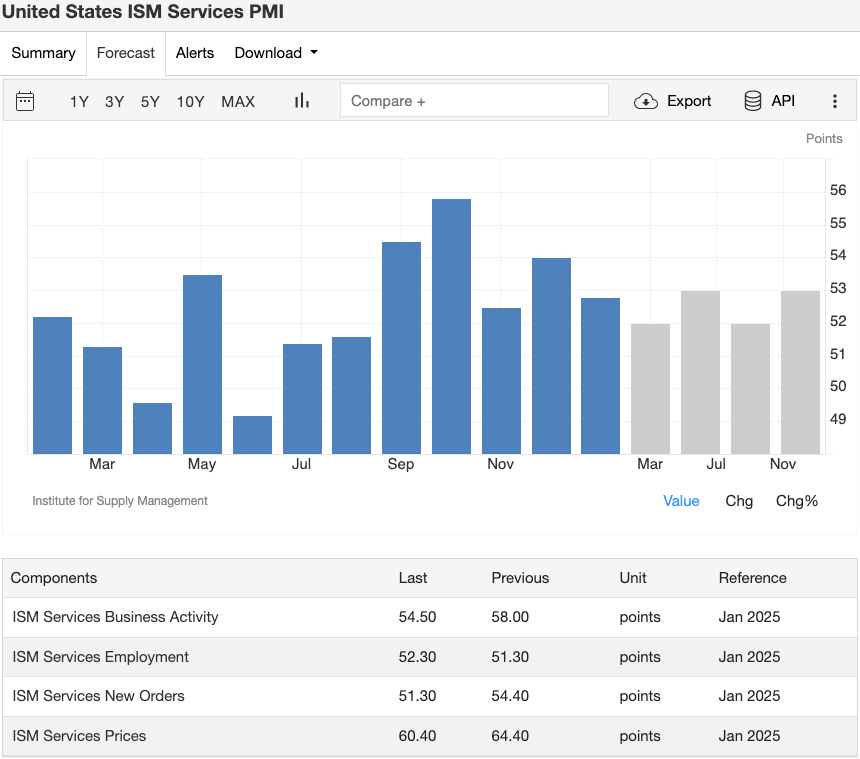

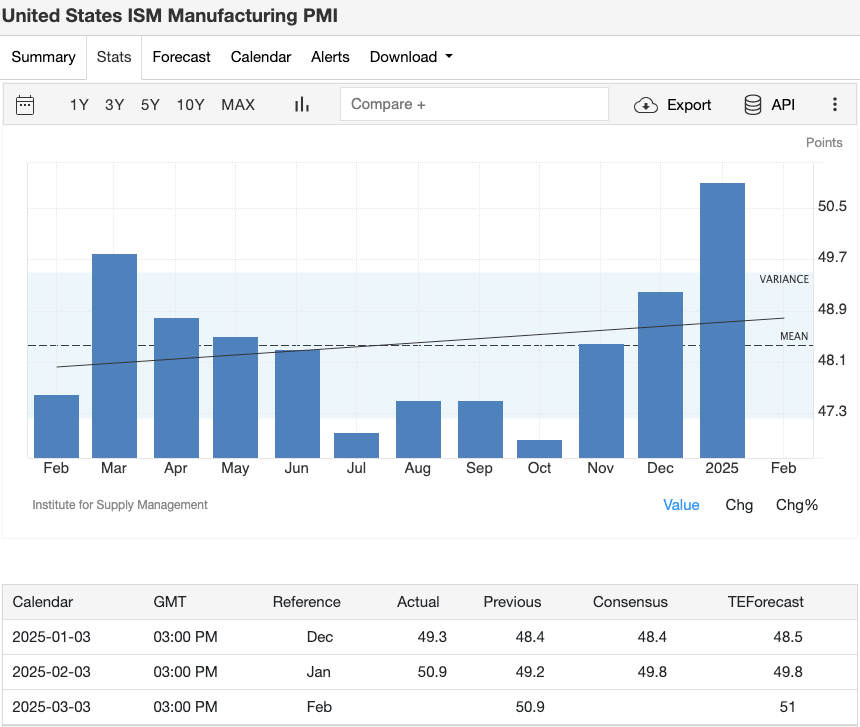

PMI (Purchasing Managers’ Index) Surveys

Release Date: Early March (February PMI data)

PMI measures business confidence in manufacturing and services. Readings above 50 indicate expansion; below 50 suggest contraction.

Why It Matters?

-

– Strong PMI (>50): Boosts risk appetite, potentially increasing capital inflows into crypto markets.

-

– Weak PMI (<50): Signals economic slowdown, potentially undermining confidence and demand for high-risk assets like Bitcoin.

-

– Key data includes U.S. ISM Manufacturing PMI, Eurozone PMI, and China’s official PMI.

Image Credit: Trading Economics

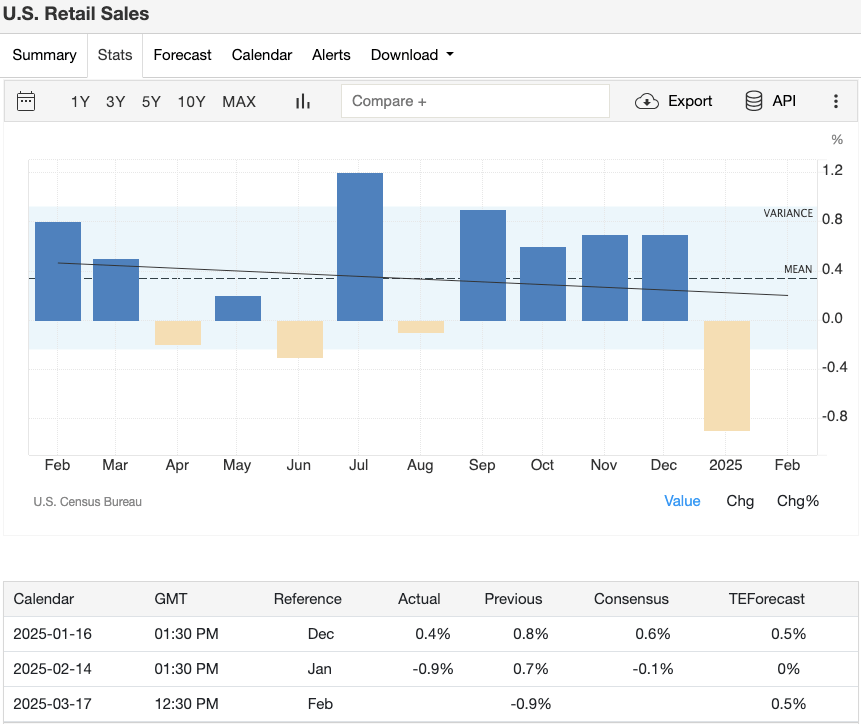

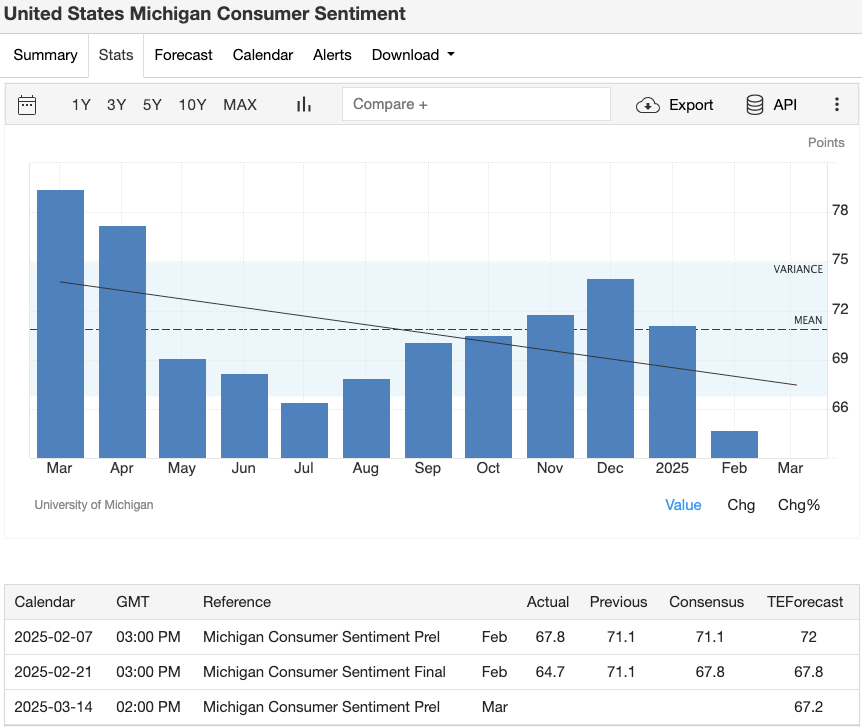

Retail Sales and Consumer Confidence Index

Release Dates:

U.S. Retail Sales (February data): Mid-March

Consumer Confidence Index:

-

– Conference Board: March 26

-

– University of Michigan: Mid-March

Why It Matters?

-

– Weak retail sales may show that rate hikes are dampening consumer spending, weakening market confidence.

-

– High consumer confidence may signal economic stability, helping drive growth in risk assets like crypto.

Image Credit: Trading Economics

Image Credit: Trading Economics

Industrial and Trade Data

Covers: Industrial production, durable goods orders, and trade balance

Why It Matters?

-

– These indicators affect currency values and bond yields.

-

– Consistently strong or weak data may shift overall market sentiment, impacting crypto trends.

Global Political Developments Impacting Crypto Markets

Russia-Ukraine War

The Russia-Ukraine conflict has lasted nearly three years, with markets highly sensitive to escalation or peace talks. When geopolitical risks rise, capital typically flows into safe-haven assets like the dollar and gold, while risk assets (like Bitcoin) face pressure.

Potential impacts on crypto markets:

-

– Expanded sanctions: If the U.S. or EU impose new sanctions on Russia, global market liquidity may be affected, indirectly impacting crypto prices.

-

– Military escalation: Increased warfare may heighten risk-averse sentiment, weakening investor confidence in crypto.

-

– Diplomatic breakthrough: Ceasefire agreements or peace progress could revive market risk appetite, benefiting risk assets like Bitcoin.

Image Credit: Latest News and Updates

U.S.-China Relations and Trade War

Ongoing U.S.-China trade tensions, tech sanctions, and Taiwan Strait dynamics continue to impact global markets. Recent U.S. tariff hikes on Chinese imports have increased uncertainty, amplifying volatility in risk assets including cryptocurrencies.

Why It Matters?

-

– Escalating trade war: May increase inflationary pressure, affecting Fed policy and thus impacting risk assets like Bitcoin.

-

– Supply chain disruptions: Could undermine global economic stability, generally negative for crypto markets.

-

– Bitcoin as a hedge: Some investors view Bitcoin as an inflation hedge, but historically, trade war uncertainty tends to depress crypto markets in the short term.

-

– Progress in U.S.-China trade talks or new agreements could restore market confidence, benefiting digital assets.

Image Credit: International Relations Edu

Middle East and Other Regional Conflicts

Geopolitical flashpoints in the Middle East—such as tensions between Israel and Iran, OPEC+ oil production decisions, and energy supply disruptions—could drive up oil prices, exacerbating inflation and pushing investors toward safe-havens.

Why It Matters?

-

– Soaring oil prices: Typically boost inflation, prompting tighter monetary policy, unfavorable for risk assets like crypto.

-

– Rising risk aversion: Investors may reduce exposure to speculative assets like Bitcoin.

-

– Crypto use in high-risk regions: In extreme cases, crypto has been used for cross-border transactions or as a financial haven in countries with currency depreciation or unstable financial systems.

Image Credit: Arabian Business

Cryptocurrency Regulation and Policy Changes

Recent regulatory changes in the U.S. and Europe are affecting institutional adoption, enforcement actions, and investor confidence.

Cryptocurrency Regulatory Updates

U.S. Regulatory Updates:

-

– On February 20, 2025, the U.S. Securities and Exchange Commission (SEC) launched the Cyber and Emerging Technologies Unit (CETU), replacing the former Crypto Assets and Cyber Unit, focusing on fraud prevention and retail investor protection.

-

– The SEC concluded investigations into OpenSea and Coinbase, suggesting a potentially softer regulatory stance toward the crypto industry.

European Regulatory Updates:

-

– MiCA (Markets in Crypto-Assets framework) is advancing. The EU released technical standards on February 20, 2025, with full implementation set for March 12, 2025, aiming to unify crypto regulations across Europe.

Why It Matters?

-

– A potentially softer SEC stance may benefit crypto innovation, though CETU’s formation indicates ongoing enforcement focus.

-

– MiCA’s rollout will standardize European regulations, increasing institutional capital inflows into crypto markets.

Image Credit: The News Crypto

Key Legislative Changes Affecting Markets

U.S. Debt Ceiling Issue:

On January 2, 2025, the U.S. government reset the debt ceiling to $36.1 trillion, but political disputes remain, increasing market uncertainty.

Why It Matters?

-

– Fiscal policy uncertainty intensifies market volatility.

-

– Bitcoin is seen as a hedge, but historically, debt crises first trigger broad market sell-offs before stabilizing.

Image Credit: Visual Capitalist

Policy Changes in Major Economies

Luxembourg New Law:

On February 6, 2025, Luxembourg passed a new law integrating EU crypto regulations with green bond rules, reinforcing its leadership in digital asset regulation.

Why It Matters?

-

– Luxembourg’s regulatory model may influence other jurisdictions, promoting global harmonization of crypto frameworks.

Regulatory changes will continue to impact market stability, capital flows, and crypto adoption—staying informed is essential.

Major Economies’ Developments and Investor Sentiment

U.S. Economy

Markets are watching whether the Fed can control inflation without triggering a recession.

-

– Strong labor market + cooling inflation: Positive for stock and crypto markets.

-

– Weak economic data: May trigger risk-off sentiment, driving capital into the dollar and gold, unfavorable for crypto assets.

-

– Future rate cut expectations: If markets believe the Fed will ease policy, risk assets like Bitcoin may gain momentum.

European Economy

The Eurozone is balancing inflation control with economic growth.

If the ECB signals a pause in rate hikes, markets may rebound.

Energy prices remain key:

-

– Escalation in Russia-Ukraine war: Higher energy prices may reignite inflation concerns.

-

– Stable energy markets: Support European growth, positive for crypto markets.

Chinese Economy

The National People's Congress (NPC) will set the 2025 growth target in March.

-

– Potential stimulus: Infrastructure investment, loose monetary policy, etc., could boost commodities and emerging markets.

-

– Despite restrictions on domestic crypto trading, China’s economic growth still affects global risk appetite, indirectly influencing crypto prices.

Emerging Markets

If major central banks pause rate hikes, capital may flow into emerging markets, lifting risk assets and benefiting crypto.

-

– Risks: Debt crises or political instability may trigger risk-off sentiment, leading to capital outflows.

Impact on the March Crypto Market

Interest Rates and Market Liquidity

Central bank decisions will directly impact crypto markets:

-

– Rate hikes: Tighten market liquidity, pressuring Bitcoin and altcoins.

-

– Pausing or cutting rates: May release capital into markets, boosting speculation and driving crypto prices higher.

Inflation and the "Store of Value" Narrative

-

– Cooling inflation: Reduces concerns about further rate hikes, supporting crypto market growth.

-

– Rising inflation: May prompt central banks to stay hawkish, weakening risk appetite, negative for crypto.

-

– Bitcoin as "digital gold": Long-term inflation may strengthen Bitcoin’s store-of-value appeal, but markets still prioritize rate expectations.

Economic Growth and Risk Appetite

-

– GDP growth and strong labor markets: Generally positive for risk assets, including crypto.

-

– Economic slowdown: May trigger short-term sell-offs, but if markets expect rate cuts, it could provide long-term support for crypto.

Geopolitical Safe-Haven Flows

-

– During crises, rising risk aversion typically hurts crypto markets.

-

– Persistent instability may highlight crypto’s advantages as a decentralized asset, attracting some capital inflows.

Regulatory Developments and Market Confidence

-

– ETF approvals, clear regulations, or favorable policies may drive market rallies.

-

– Bans or lawsuits may increase uncertainty, causing sharp price swings.

Market Sentiment and Capital Rotation

-

– Shifts in market liquidity affect capital flows between crypto and stock markets.

-

– Traders should anticipate heightened volatility around key economic data, with sharp price moves likely in the short term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News