Stablecoin Earnings Roundup in a Bear Market: Which Platform Offers the Best Returns in February When the Market Is Down?

TechFlow Selected TechFlow Selected

Stablecoin Earnings Roundup in a Bear Market: Which Platform Offers the Best Returns in February When the Market Is Down?

Stablecoin wealth management is a "safe haven" amid the current market downturn, but it is not risk-free.

Written by: TechFlow

The recent market downturn has hit hard, catching many off guard like a sudden waterfall.

Altcoins have dropped sharply, making it difficult to find profitable opportunities. Opening leveraged contracts could risk losing everything—while stories of contract comebacks make for exciting reading, they’re not something everyone can replicate.

But if you shift your focus to DeFi yield farming, the outlook suddenly broadens. Especially certain stablecoin yield pools, which have become ideal options for hedging against market declines.

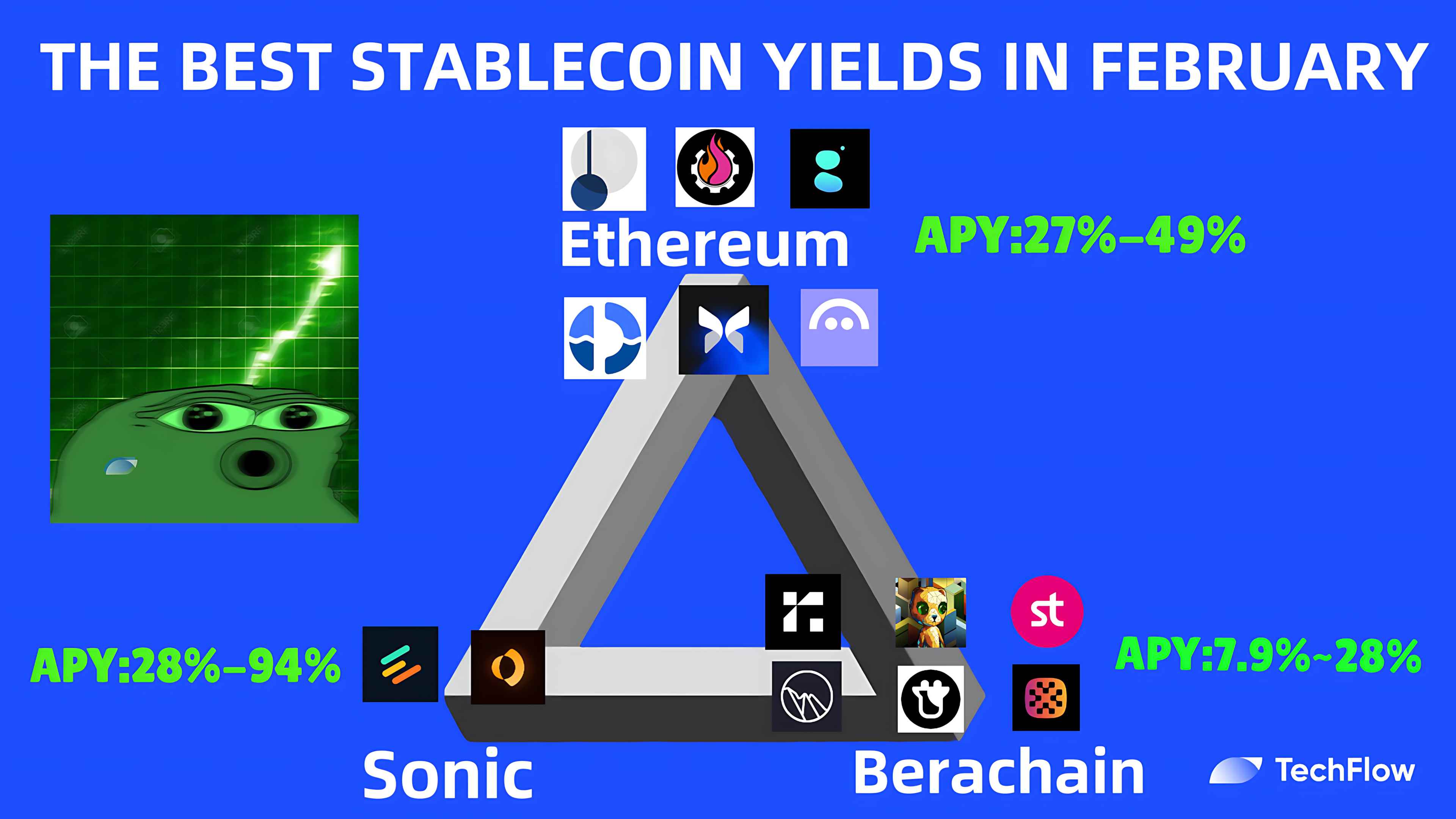

Recently, well-known crypto analyst Stephen | DeFi Dojo (@phtevenstrong) shared a post detailing current on-chain stablecoin yield opportunities across Berachain, Sonic, and major Ethereum protocols.

Now is a good time to turn attention toward stablecoin yield markets. We’ve personally tested these products and compiled the highlights into a practical guide for relatively stable returns.

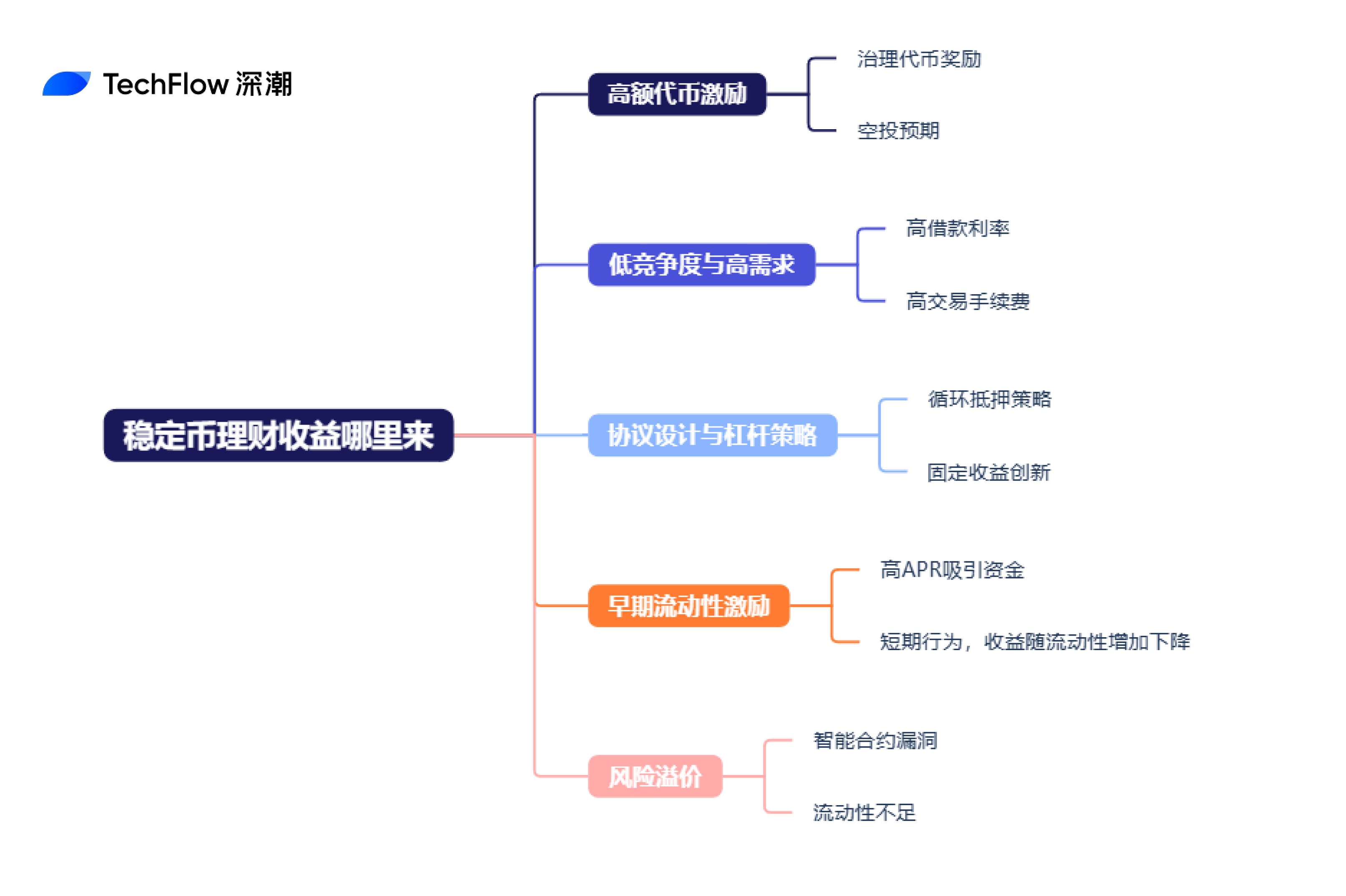

Stablecoin Yield: Understanding the Source of High Returns

"If you don't know where the yield comes from, then you are the yield."

Different chains offer distinct characteristics in their stablecoin yields due to protocol designs and ecosystem differences.

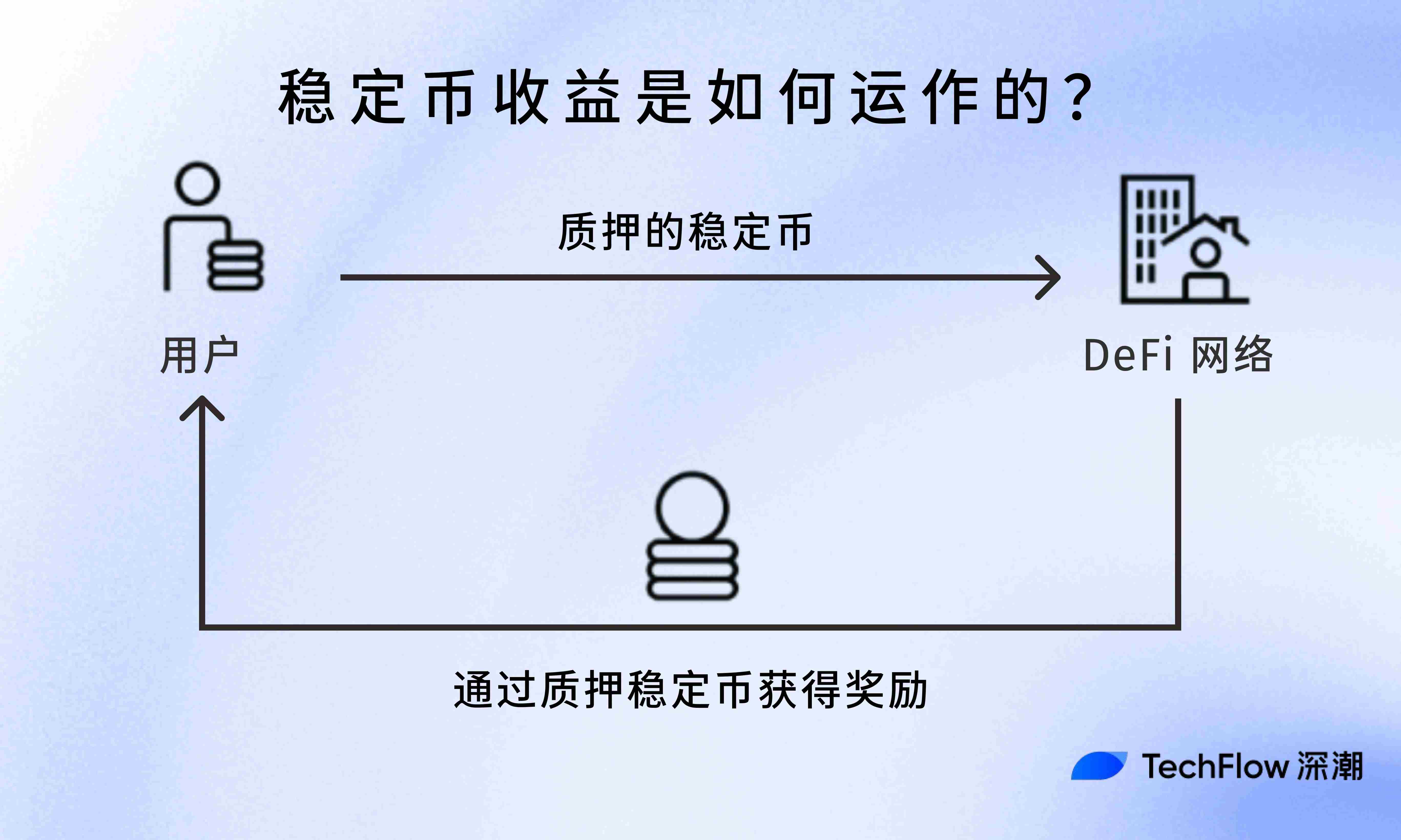

However, sources of stablecoin yield are largely similar—users participate through liquidity provision (LP), lending (e.g., Aave, Compound), or leveraged strategies (such as looping), earning income from protocol transaction fees, protocol incentives (like governance token distributions), or interest rate spreads from borrowing.

But why do some newer chains offer surprisingly high stablecoin yields?

1. High Token Incentives

New chains often attract users and capital by offering generous token rewards. These incentives typically take two forms:

-

Governance Token Rewards: Some chains distribute governance tokens (e.g., Berachain’s HONEY) to liquidity providers (LPs) to encourage asset locking.

-

Airdrop Expectations: For new chains that haven’t launched their token yet, users anticipate future airdrops and are willing to join high-risk yield pools.

This incentive model is common in early-stage chains because it effectively boosts liquidity and attracts more users and developers to the ecosystem.

2. Less Competition

Protocols on emerging chains usually face less competition with smaller user bases, yet there's strong demand for liquidity and capital during early development. This supply-demand imbalance leads to several phenomena:

-

Higher Borrowing Rates: Limited capital supply combined with strong borrowing demand pushes up stablecoin borrowing rates, indirectly increasing yield returns.

-

Higher Transaction Fees: On decentralized exchanges (DEXs), low liquidity results in higher slippage and fees, benefiting liquidity providers.

3. Protocol Design and Leverage Strategies

Emerging chain protocols often implement unique mechanisms or high-leverage strategies to attract participation. Examples include:

-

Looping Strategies: As discussed later, Dolomite’s sUSDe looping strategy allows users to amplify returns via low-cost borrowing and leverage (e.g., 5x leverage generating 35% APY).

-

Innovative Yield Models: Some protocols offer fixed-yield products (e.g., Pendle’s 28% fixed return) or liquidity mining mechanisms to deliver higher annualized yields.

4. Early Liquidity Incentives (Liquidity Bootstrapping)

New chains use high yields to bootstrap liquidity and build depth and stability in their trading markets—commonly known as “liquidity bootstrapping”:

-

High Yields Attract Capital: By offering extremely high APRs (e.g., 20%-50%), large amounts of capital are drawn into stablecoin pools.

-

Declining Returns Over Time: These high yields are typically short-term; as liquidity grows and the ecosystem matures, returns gradually decline.

5. Risk Premium

"The price tag for gifts from fate was set long before they were given."

While the above designs significantly boost yields, they actually compensate for the following risks:

-

Smart Contract Vulnerabilities: Protocols on new chains may lack thorough audits and carry potential security flaws.

-

Low Liquidity: Insufficient funds may lead to high slippage or inability to redeem assets smoothly when exiting positions.

-

Ecosystem Uncertainty: The future of emerging chains is uncertain—protocols may fail due to user attrition or technical issues.

With an understanding of how these yields are generated, let’s now look at some of the highest-yielding stablecoin pools currently available.

Berachain

No need for lengthy introductions to Berachain—just know its key assets:

-

BGT: Soulbound governance token used for Proof of Liquidity (PoL) rewards and governance.

-

HONEY: Native USD-pegged stablecoin, mintable from various assets, serving as a stable payment and lending tool within the ecosystem.

-

BYUSD/USDC.e: Other stablecoins such as dollar-pegged tokens or Ethereum-wrapped USDC brought onto Berachain via cross-chain bridges.

Two core DeFi protocols in the Berachain ecosystem—Infrared Finance and Stride Zone—currently offer stablecoin liquidity pools for yield farming.

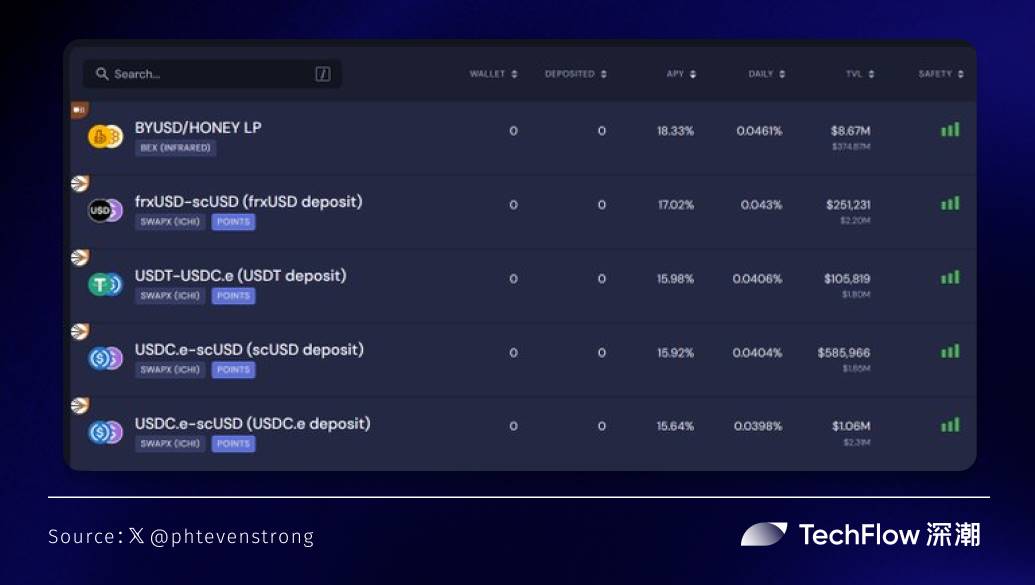

Infrared Finance

Infrared Finance is a key DeFi protocol in the Berachain ecosystem, backed by Binance Labs, focused on simplifying Proof of Liquidity (PoL) participation and helping users maximize returns through its “vaults” product.

Infrared also offers liquid staking products (e.g., iBGT) to enhance user experience and drive growth in the Berachain ecosystem.

As of February 2025, Infrared has not launched its own token, but its liquidity pools are deeply integrated with Berachain’s BGT incentive mechanism.

Stablecoin Yield Mechanism

-

Pairs & Pools: Infrared offers the following stablecoin liquidity pools (BGT-qualifying LPs):

-

HONEY/BYUSD: HONEY is Berachain’s native stablecoin; BYUSD is another stablecoin on Bera.

-

HONEY/USDC.e: USDC.e is the bridged version of Ethereum’s USDC on Berachain.

-

-

How It Works: Users deposit HONEY, BYUSD, or USDC.e into designated pools via Infrared’s DeFi interface, forming liquidity pairs (LP Tokens), and earn trading fees, PoL rewards (BGT), and potential HONEY rewards. Pool yields can be compounded via @beefyfinance to further boost long-term returns.

-

Current APY

-

HONEY/BYUSD: 18.45% APY

-

HONEY/USDC.e: 15% APY

-

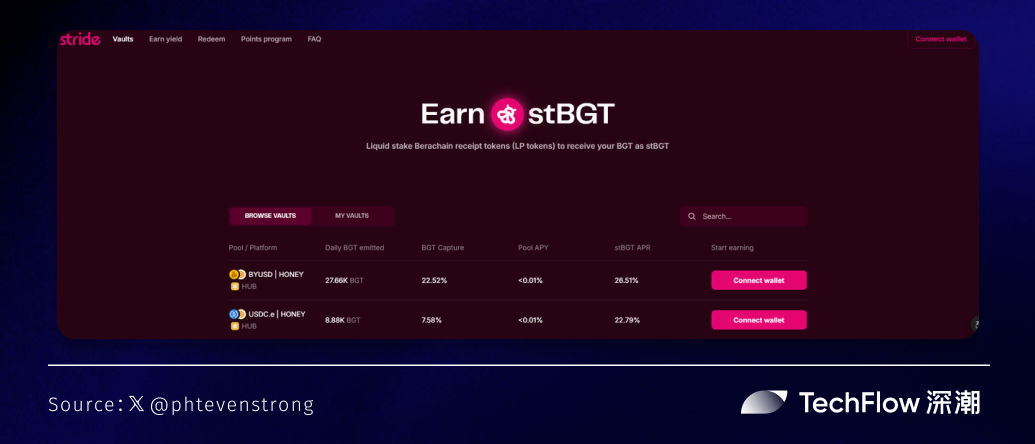

Stride Zone

Stride Zone is a cross-chain liquid staking protocol serving ecosystems including Berachain, Cosmos, and Celestia. By staking Berachain’s BGT into stBGT, Stride allows users to maintain asset liquidity while earning extra yield. Stride supports stablecoin pools on Berachain, optimizing yield streams for DeFi users.

-

Pairs & Pools: Stride offers stablecoin liquidity pools similar to Infrared (BGT-qualifying LPs):

-

HONEY/BYUSD: 22.52% APY

-

HONEY/USDC.e: 7.89% APY

-

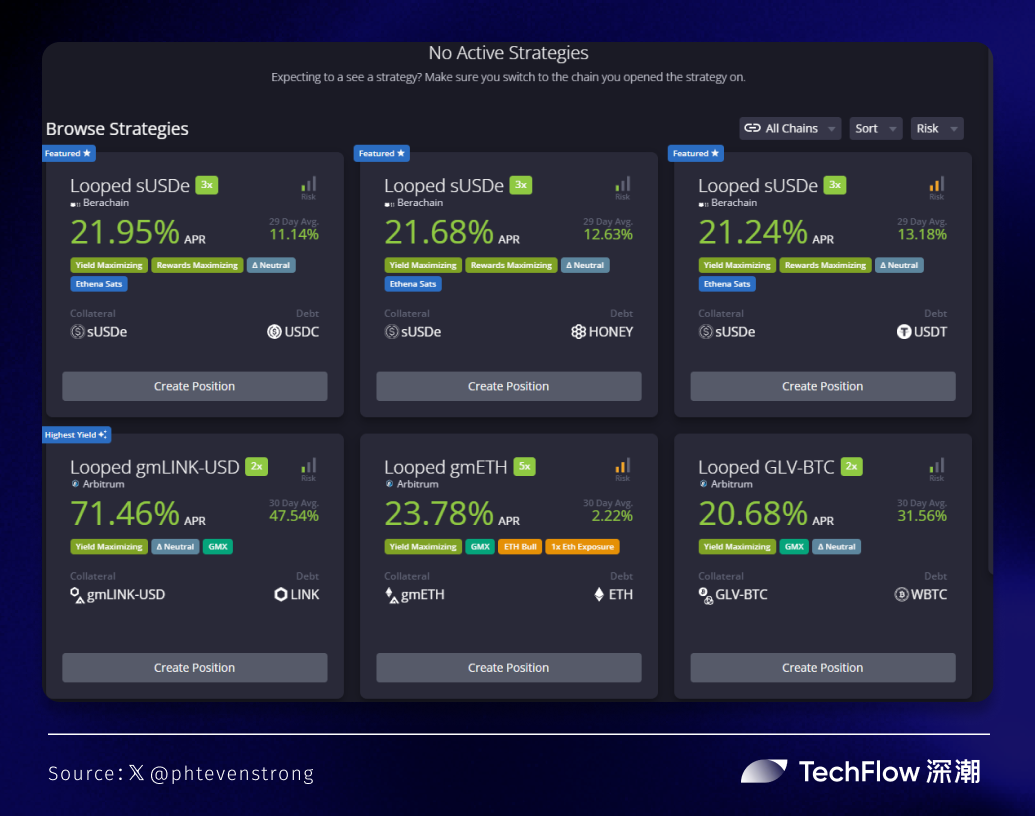

Dolomite

Dolomite (Dolomite.io) is a decentralized finance (DeFi) protocol combining lending and DEX functionality, offering Berachain users high-return opportunities through leveraged looping and automated strategies. Recently, Dolomite has gained attention due to the Boyco campaign, which has driven strong demand for pre-deposits, making its sUSDe strategy on Berachain particularly attractive.

Note: Boyco is a recent on-chain event launched by Berachain, allowing users to deposit assets into liquidity markets before mainnet launch. Total pre-deposits have exceeded $2.19 billion, considered one of the largest on-chain incentive events in history.

-

Assets: Dolomite primarily uses single stablecoin assets for leveraged operations, avoiding traditional liquidity pools and instead optimizing returns through lending and looping strategies:

-

sUSDe: Collateralized stablecoin issued by Ethena Labs, pegged 1:1 to USD, brought onto Berachain via cross-chain bridges (e.g., Wormhole).

-

Borrowed Assets: Users borrow GHO (Aave’s stablecoin) or USDC (via USDC.e), with borrowing costs at 1.66% (GHO) and higher (USDC, exact rate unspecified).

-

Method 1:

-

Manual Leverage Loop (sUSDe Loop): Deposit sUSDe as collateral on Dolomite, borrow GHO or USDC at 5x leverage (LLTV: 83%) to loop sUSDe, earning 8.32% base yield on sUSDe. After deducting 1.66% borrowing cost, net APY can reach up to 35%.

For DeFi newcomers, understand these concepts:

LLTV (Loan-to-Value): Ratio of loan amount to collateral value. Higher LLTV allows larger loans but increases liquidation risk.

An LLTV of 83% means users can borrow up to 83% of their sUSDe collateral value (equivalent to ~5x leverage since 100% ÷ 83% ≈ 5). This amplifies returns but also increases liquidation risk. If sUSDe value drops or borrowing costs rise beyond 83% LLTV, liquidation may occur—part of the collateral sold to repay debt.

-

Example: Suppose you deposit $10,000 worth of sUSDe. With an 83% LLTV, you can borrow $8,300 (83% × $10,000) in GHO or USDC for looping to earn additional returns.

Method 2:

-

Brategy Strategy: A hands-off, low-risk automated strategy (called Brategy), requiring no manual management, delivering approximately 21.95% APY.

Goldilocks Money

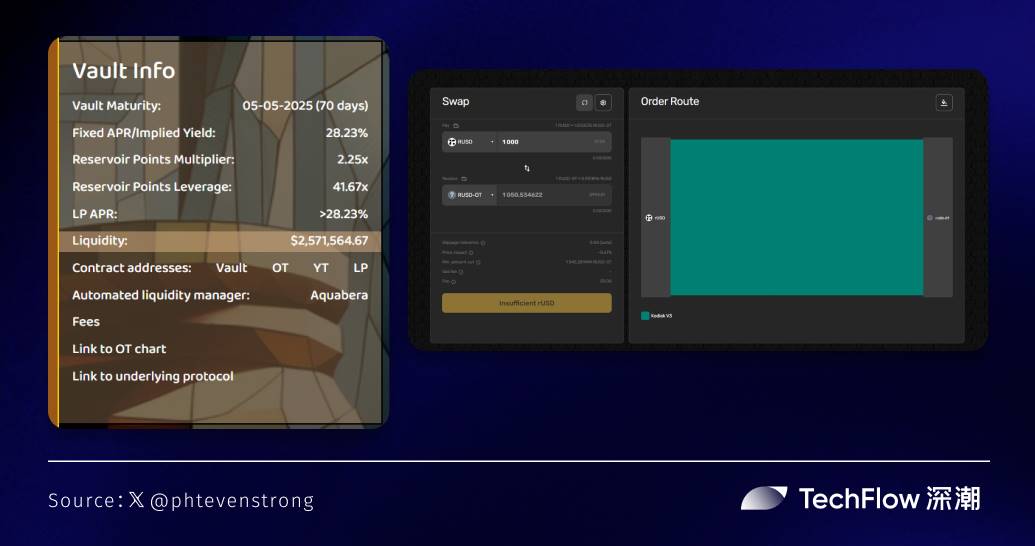

Goldilocks Money is a Berachain-based DeFi protocol modeled after Pendle, offering fixed-rate, fixed-term yield opportunities on stablecoins (e.g., RUSD).

Goldilocks Money has attracted attention due to Berachain’s Proof of Liquidity (PoL) mechanism and growing ecosystem liquidity (over $2 billion by early 2025).

-

Asset: Goldilocks Money focuses on single stablecoin assets for fixed returns, not traditional liquidity pools:

-

RUSD: Collateralized stablecoin issued by Reservoir, pegged 1:1 to USD, bridged onto Berachain.

-

-

How It Works:

-

Deposit RUSD on Goldilocks Money platform into a fixed-term (70-day) fixed-yield market, earning a preset 28% APR.

-

It’s recommended to add RUSD liquidity to pools on Kodiak (1% fee tier) to improve market depth and potential returns, though slippage risk should be noted.

-

-

Current APY:

-

RUSD Fixed Yield: 28% APY (70-day fixed term)

-

Sonic

Formerly Fantom, this L1 designed by DeFi expert Andre Cronje has been rebranded.

Recent data shows continuous net inflows and rising TVL on Sonic, indicating abundant high-yield farming opportunities within its ecosystem.

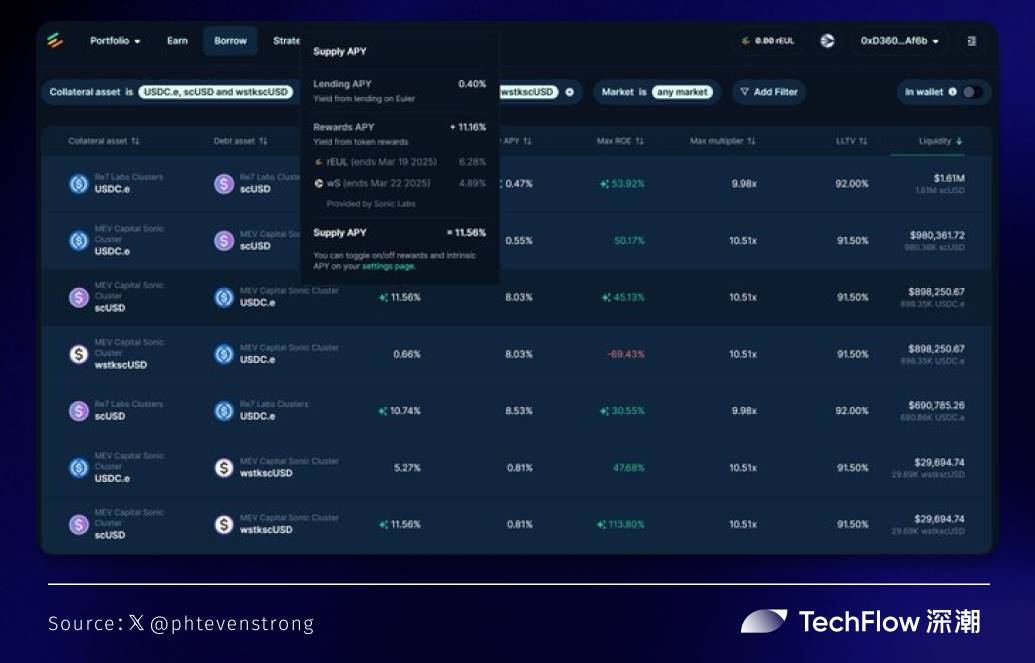

Euler Finance

Euler Finance is a decentralized lending protocol offering high-yield stablecoin lending and looping opportunities.

Background: In DeFi, lending involves using assets (e.g., USDC.e) as collateral to borrow more funds (e.g., other stablecoins) from a protocol (e.g., Euler Finance). Looping refers to reinvesting borrowed funds into the same asset or pool to amplify returns.

-

Assets: Euler Finance on Sonic offers stablecoin lending and looping, not traditional liquidity pools, optimizing returns via lending markets:

How It Works: Deposit USDC.e, stS, or wS as collateral or borrowed assets via Euler Finance’s DeFi interface, perform lending, looping, or staking to earn fees and extra rewards.

Key points:

-

USDC.e: Bridged version of Ethereum’s USDC on Sonic, pegged 1:1 to USD, used as stablecoin for lending or collateral.

-

stS: Staking token in Sonic’s ecosystem linked to native token S, used for providing liquidity or earning extra yield.

-

wS: Wrapped version of token S (wrapped Sonic token), obtained through staking or liquidity provision, distributed as part of user rewards.

-

rEUL: "Restricted" version of Euler Finance’s token (Restricted EUL), a 1:1 mapping of Euler’s governance token EUL. Locking EUL generates rEUL, allowing users to earn extra rewards (e.g., rEUL incentives on Sonic) and participate in governance. Sonic’s rEUL incentive offers a reward pool up to $100,000, attracting DeFi users.

-

wS Points: Reward token in Sonic’s ecosystem. Users accumulate wS points by providing liquidity or conducting lending operations, which may be eligible for future airdrops of Sonic’s native token $S. Players should sort markets by liquidity depth to ensure consistent returns (i.e., choose deeper pools to reduce slippage and maintain yield stability).

-

-

Current Yield: Over 50% APY on USDC.e and other stablecoin lending/looping

You might wonder—why so high?

The high yields stem from early-stage Sonic ecosystem incentives (e.g., rEUL and wS rewards) and Berachain’s Proof of Liquidity (PoL) mechanism, both attracting liquidity providers. But high yields come with high risks, such as low liquidity or market volatility.

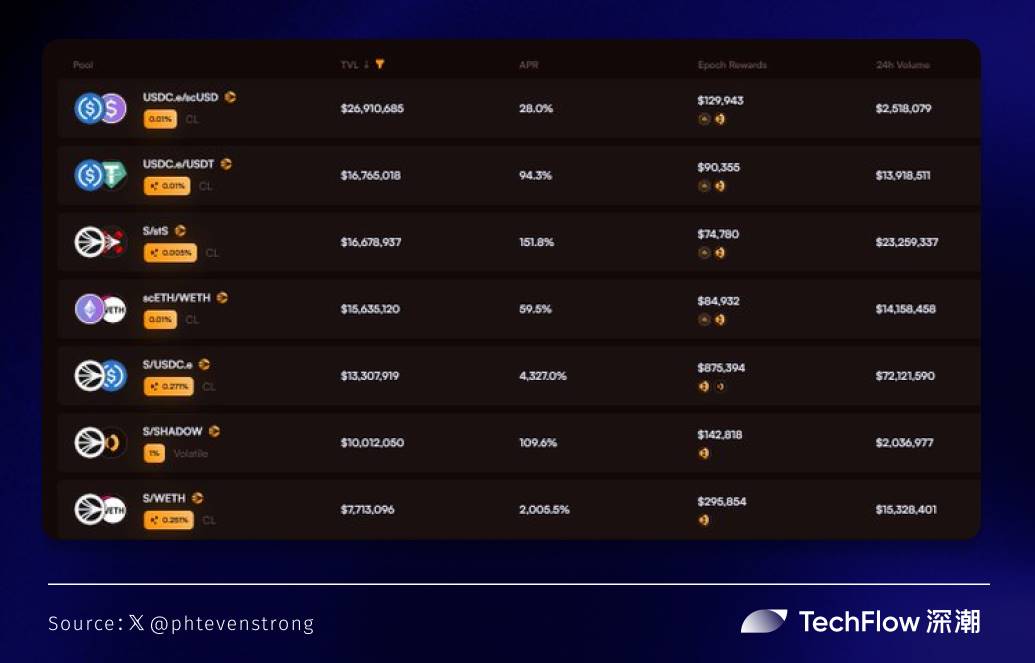

Shadow On Sonic

Shadow is positioned as Sonic’s native concentrated liquidity layer and exchange.

Similar to Solidly, it offers high-yield stablecoin liquidity pools with unique mechanisms like $S airdrop points, Gems rewards, and an x(3,3) incentive model.

Recently, Shadow’s native token has performed well, and the project has gained attention in the DeFi space due to its high APR mining rewards and upcoming $S token airdrop.

-

Pairs & Pools: Shadow offers the following stablecoin liquidity pools (BGT-qualifying LPs), leveraging concentrated liquidity design for capital efficiency and early Sonic incentives:

-

USDC.e/scUSD: USDC.e is the bridged Ethereum USDC on Sonic; scUSD is a stablecoin on ShadowOnSonic or within Sonic’s ecosystem, pegged 1:1 to USD.

-

USDC.e/USDT: USDC.e paired with USDT (Tether’s stablecoin bridged to Sonic) in a liquidity pool.

-

-

How It Works: Deposit USDC.e, scUSD, or USDT into designated pools via ShadowOnSonic’s DeFi interface to form liquidity pairs (LP Tokens) and earn trading fees.

-

Current APY:

-

USDC.e/scUSD: 28% APY (50% immediately available, remainder unlocked via NFT)

-

USDC.e/USDT: 94% APY (50% immediately available, remainder unlocked via NFT)

-

Key Concepts:

-

Concentrated Liquidity: Unlike traditional AMMs, Shadow allows liquidity providers (LPs) to concentrate funds within specific price ranges (e.g., narrow spread between USDC.e and USDT), improving capital efficiency, trade depth, and returns—but also increasing price volatility risk.

-

x(3,3) Incentive Model: Uses Sonic’s x(3,3) mechanism (an improved ve(3,3) model). By locking $SHADOW tokens to generate xSHADOW, users earn protocol fees, voting rewards, and extra incentives (e.g., $S points and Gems), encouraging long-term liquidity and ecosystem growth.

-

$S Points: Reward points within Sonic’s ecosystem. Users accumulate $S points by providing liquidity, which may be used for future airdrops of Sonic’s native token $S, enhancing long-term yield potential.

-

Gems Rewards: Additional rewards from ShadowOnSonic, similar to points. Accumulating Gems increases eligibility for more $S airdrop shares, though note that part of the reward (e.g., 50% of the 94% APR) is unlocked via NFT and may require waiting.

Ethereum

Same place, same game, new yields.

Contango

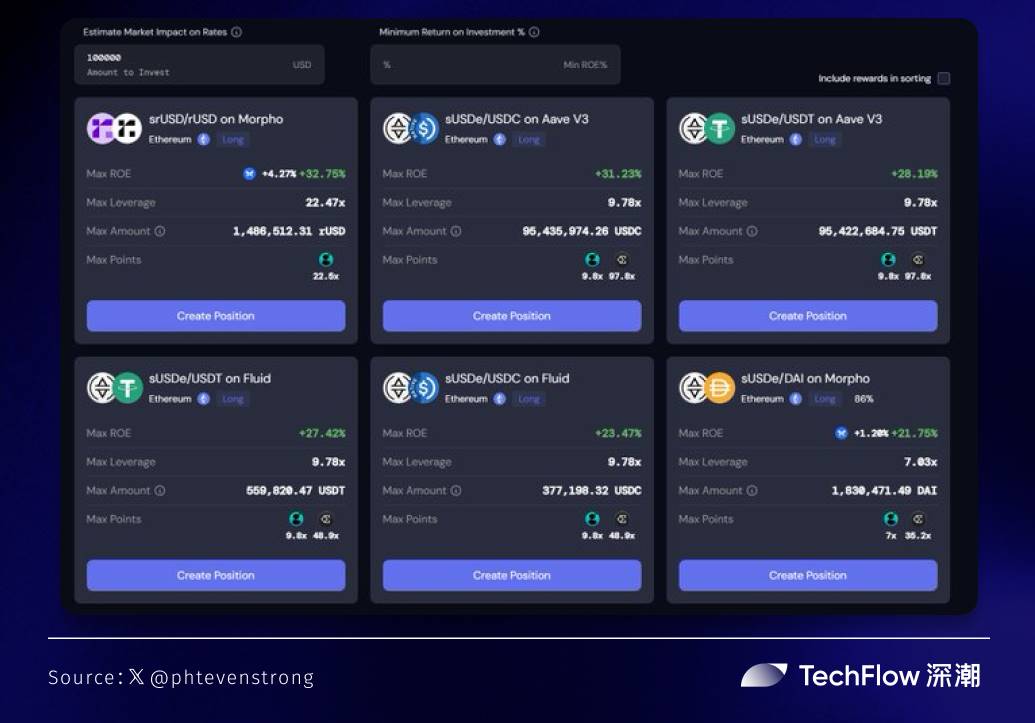

Contango (contango.xyz) operates on Ethereum, offering users high-yield leveraged strategies on stablecoins.

Users deposit stablecoins (e.g., sUSDe, srUSD, or rUSD) into Contango as collateral or lending base, then borrow more funds via Morpho, Aave, and 0xFluid protocols to loop these assets and amplify returns.

These protocols provide deep liquidity pools and low borrowing costs. Contango uses automation or manual execution to loop funds across these protocols, earning base yields and leveraging total returns.

-

Pairs & Assets:

-

srUSD/rUSD: srUSD (Savings rUSD) and rUSD (Reservoir USD) are stablecoins issued by Reservoir Protocol, pegged 1:1 to USD. srUSD is the staked version of rUSD, earning extra yield by locking rUSD in Reservoir’s protocol.

-

sUSDe/USDC: sUSDe is Ethena Labs’ staked stablecoin, pegged 1:1 to USD; USDC is Circle’s mainstream stablecoin operating on Ethereum.

-

sUSDe/USDT: sUSDe paired with USDT (Tether’s stablecoin on Ethereum) for leveraged strategies.

-

-

How It Works: Deposit srUSD, sUSDe, or USDT as collateral or borrowed assets via Contango’s DeFi interface, use Morpho, Aave, and 0xFluid for leveraged looping or staking to earn base yield and extra rewards.

-

TANGO Rewards: Point-based rewards within Contango’s ecosystem. Users accumulate TANGO points by participating in leveraged strategies, potentially redeemable for future Contango tokens or ecosystem benefits, enhancing long-term yield.

Notably, the original poster suggests these strategies require at least $100,000 in capital to avoid diluted returns from small positions (a pro-level play).

-

Current APY:

-

srUSD/rUSD (Morpho Labs): 36% APY (including TANGO rewards)

-

sUSDe/USDC (Aave): 31% APY (including TANGO rewards)

-

sUSDe/USDT (0xFluid): 27% APY (including TANGO rewards)

-

-

Why So High? High yields come from early Ethereum ecosystem incentives (e.g., TANGO rewards) and optimized mechanisms in underlying protocols (e.g., Morpho, Aave), attracting users to leveraged strategies. However, high yields entail high risks—liquidation, low liquidity, or market volatility.

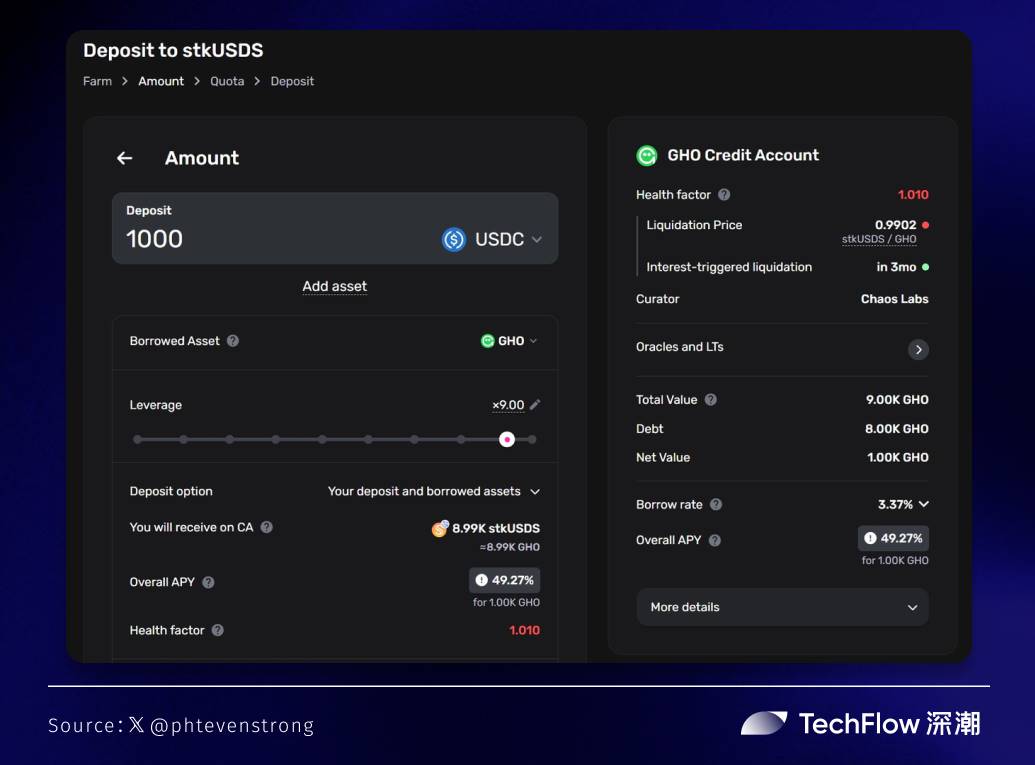

Gearbox Protocol

A decentralized leveraged lending protocol on Ethereum, allowing users to borrow assets at up to 10x leverage for DeFi activities such as trading or liquidity mining to generate yield.

Note: Gearbox offers leveraged looping strategies on Ethereum, amplifying yield potential for stablecoins (e.g., sUSDe). Users deposit stablecoins (e.g., sUSDe) as collateral, then borrow more funds via Aave and Uniswap to loop or invest in sUSDe, optimizing returns.

-

Assets: Gearbox offers stablecoin leveraged looping strategies, not traditional liquidity pools:

-

sUSDe: Staked stablecoin issued by Ethena Labs, pegged 1:1 to USD, generated by locking USDe, earning base yield (~8%-10% APY). Users borrow GHO or USDC via Gearbox to loop or invest in sUSDe, amplifying returns.

-

Borrowed Assets: Users borrow GHO (Aave’s decentralized stablecoin) or USDC (Circle’s mainstream stablecoin on Ethereum) for leveraged looping.

-

-

Current APY:

-

sUSDe Leverage Loop (borrow GHO): ~49% APY (historical data, consistently over 30% for several weeks)

-

sUSDe Leverage Loop (borrow USDC): ~30% APY (historical data, consistently over 30% for several weeks)

-

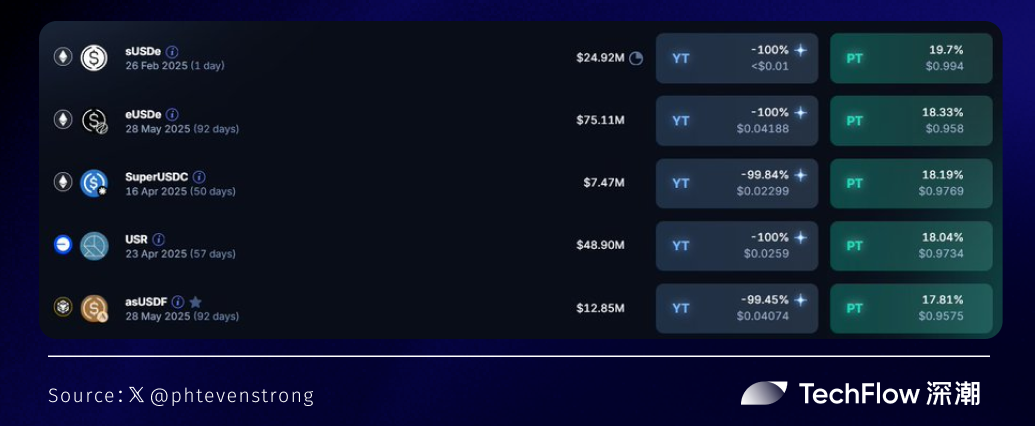

Pendle

An old friend, no lengthy intro needed.

Pendle’s fixed-income markets and composability continue to attract on-chain users.

-

Assets: Pendle offers stablecoin fixed-yield and liquidity strategies, not traditional pools:

-

asUSDF: Staked stablecoin from Aave ecosystem, generated by locking USDF, fixed yield of 18% APY, 92-day term.

-

eUSDe: Staked stablecoin from Ethena Labs, generated by locking USDe, fixed yield of 18.3% APY, 92-day term.

-

Liquidity Provision (LP): Users provide asUSDF or eUSDe liquidity via Uniswap or Pendle’s AMM to earn trading fees (~15% APY) and bonus points (e.g., Syrup, Astherus).

-

-

How It Works: Deposit asUSDF or eUSDe as base assets via Pendle’s DeFi interface, participate in fixed-term markets or provide liquidity to earn base yield and extra rewards.

Key concept to know:

-

Fixed-Yield Market: Pendle allows users to tokenize stablecoins (e.g., eUSDe) into Principal Tokens (PT, representing principal) and Yield Tokens (YT, representing future yield). Users can lock eUSDe for 92 days to earn fixed yield (e.g., 18.3% APY), or trade YT for leveraged yield exposure.

Through our research and hands-on testing, we find stablecoin yield farming serves as a "safe haven" amid current market downturns—but it’s not risk-free.

We recommend starting with small test amounts, monitoring protocol audits, yield sustainability, and liquidation risks. Prioritize low-risk strategies on mature chains (e.g., Pendle’s fixed yield) or high-yield pools on emerging chains (e.g., ShadowOnSonic’s 94% APY), and diversify investments to reduce risk.

A more conservative option is choosing CEX-offered flexible stablecoin yield services. Due to space constraints, we won’t list them here—the logic and operation are simpler, backed by CEX reputation for relatively manageable risk, though returns generally lag behind the projects listed above.

Finally, before the market fully recovers, stablecoin yield farming may be a wise choice for steady progress. But never ignore the “price behind the yield”—risk and reward always go hand in hand.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News