Community + VC dual-driven financing could become a new paradigm

TechFlow Selected TechFlow Selected

Community + VC dual-driven financing could become a new paradigm

Only by fairly distributing tokens to the community and continuously advancing the technical roadmap can the project achieve value growth.

Author: Kevin, the Researcher at Movemaker

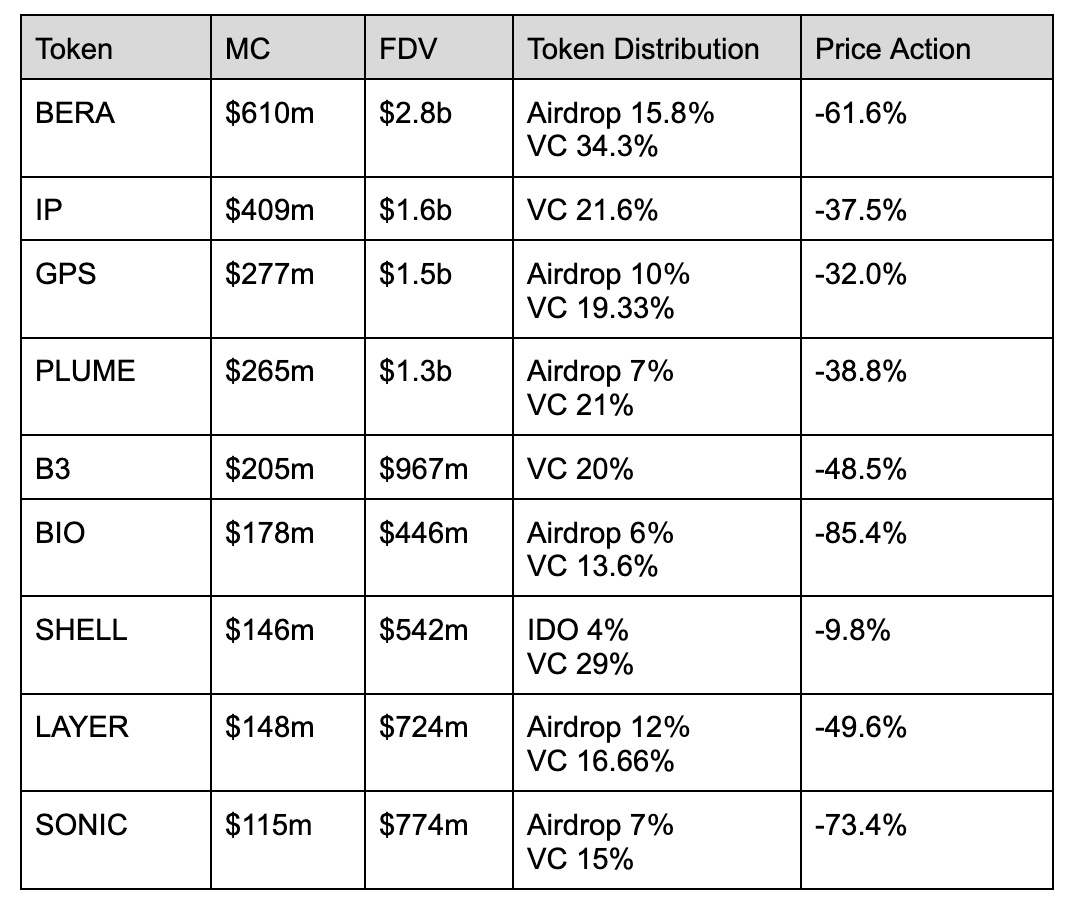

VC allocations in the above projects generally range between 10% and 30%, showing little change compared to the previous cycle. Most projects choose to distribute tokens via airdrops, viewing this as a fair method of community allocation. However, in reality, users do not hold onto airdropped tokens for long and tend to sell immediately. This is because users believe project teams often hide large token reserves during airdrops, resulting in significant selling pressure post-TGE. Concentrated token distribution negatively impacts airdrop effectiveness. This phenomenon has persisted over recent years with minimal changes in token allocation models. Token price performance shows that VC-driven tokens perform poorly, typically entering a one-sided downtrend after issuance.

Among these, $SHELL differs slightly. It allocated 4% of its tokens through an IDO, with an IDO market cap of just $20 million—distinct among VC-backed tokens. Additionally, Soon and Pump Fun chose to allocate over 50% of total token supply via fair launches, combining limited VC and KOL involvement with substantial community fundraising. This approach of passing benefits to the community may be more readily accepted, while proceeds from community fundraising can be locked early. Although project teams no longer hold large token amounts, they can repurchase tokens via market-making activities, sending positive signals to the community while acquiring tokens at lower prices.

The End of Memecoin Bubble Frenzy: Liquidity Siphoning and Collapse of Market Structure

A shift from market equilibrium dominated by VC-backed builders to a pure "pump" model focused on creating bubbles means these tokens inevitably fall into zero-sum games, benefiting only a few while most retail investors likely exit at a loss. This exacerbates the breakdown of primary and secondary market structures, making recovery or token accumulation a much longer process.

Memecoin market sentiment has reached rock bottom. As retail investors gradually realize that memecoins still remain under control of coordinated groups—including DEXs, capital firms, market makers, VCs, KOLs, and celebrities—memecoin issuance has completely lost fairness. Short-term heavy losses quickly impact user expectations, signaling that this token issuance strategy is nearing a phase of conclusion.

Over the past year, retail investors achieved relatively high profits within the memecoin sector. Although the Agent narrative drove market enthusiasm through open-source community innovation as its cultural core, it ultimately failed to alter the fundamental nature of memecoins. A flood of Web2 individual developers and Web3 rebranded projects rapidly entered the space, leading to numerous AI memecoin projects disguised as "value investments."

Community-driven tokens are controlled by these coordinated groups and manipulated for quick exits. This severely harms long-term project development. Earlier memecoin projects mitigated selling pressure through religious-like devotion or niche community support, enabling acceptable exit processes via market maker operations.

However, when memecoin communities lose such ideological or minority group cover, market sensitivity declines. Retail investors still chase overnight wealth, seeking deterministic tokens and hoping for projects with deep liquidity at launch—precisely the fatal blow coordinated groups deliver to retail. Greater gambling implies higher returns, attracting attention from outside teams. After profiting, these teams won't reinvest stablecoins into cryptocurrencies due to lack of Bitcoin conviction. The drained liquidity will permanently leave the crypto market.

VC Coin Death Spiral: Inertia Trap and Liquidity Strangulation Under Shorting Consensus

Strategies from the last cycle have become ineffective, yet many project teams continue using them out of inertia. **Small token allocations to VCs with high centralization, expecting retail buyers on exchanges—this model has failed, but entrenched thinking prevents project teams and VCs from changing easily.** The biggest flaw of VC-driven tokens is the inability to gain early advantages at TGE. Users no longer expect ideal returns from buying newly issued tokens, perceiving unfair positions due to large token holdings by project teams and exchanges. Meanwhile, VC returns have significantly dropped this cycle, reducing investment amounts. Combined with retail reluctance to buy on exchanges, launching VC coins faces major difficulties.

For VC projects or exchanges, direct listing may not be optimal. Teams behind celebrity or political tokens extract liquidity from the industry without injecting it into other tokens like Ethereum, SOL, or altcoins. Consequently, once VC coins list, contract fees quickly drop to -2%. Teams lack motivation to pump since listing itself becomes the end goal; exchanges won’t pump either, as shorting new coins has become market consensus.

As immediate one-way downtrends after issuance occur more frequently, user perceptions strengthen, leading to "bad money drives out good." Suppose in the next TGE, 70% of projects dump immediately while 30% intend to support price and provide market-making. Under repeated dumping incidents, retail investors begin retaliatory shorting, even knowing the high risks involved. When futures market shorting reaches extremes, both project teams and exchanges must join shorting to compensate for unmet profit targets. When 30% of teams observe this situation, even those willing to support the market hesitate to bridge the massive gap between futures and spot prices. Thus, the proportion of dumping projects further increases, while teams creating wealth effects post-launch gradually decrease.

Unwillingness to relinquish control over tokens causes many VC-backed coins to show no progress or innovation at TGE compared to four years ago. Inertia binds VCs and project teams more strongly than imagined. With fragmented liquidity, long VC unlock periods, and constant turnover among teams and VCs, despite persistent issues with this TGE model, both parties exhibit numbness. Many project teams may be launching their first projects and, facing unfamiliar challenges, often fall into survivorship bias, believing they can create different value.

Dual-Drive Paradigm Shift: On-Chain Transparent Gaming Breaking VC Coin Pricing Deadlock

Why adopt a VC + community dual-drive model? Pure VC-driven models widen pricing gaps between users and project teams, harming early token price performance; fully fair launches are vulnerable to manipulation by hidden interest groups, causing rapid loss of low-cost tokens and full price cycles within a single day—devastating for future project development.

Only by combining both approaches can VCs enter early, providing project teams with proper resources and development planning, reducing early-stage funding needs, avoiding the worst-case scenario of losing all tokens through fair launch while gaining only uncertain returns.

Over the past year, increasing numbers of teams have realized traditional financing models are failing—the old playbook of giving small stakes to VCs, maintaining tight control, and waiting for exchange listings to pump is no longer sustainable. With tighter VC budgets, retail refusal to buy, and rising exchange listing barriers, a new bear-market-adapted model is emerging: partnering with top KOLs and select VCs, launching with large-scale community distribution and low-market-cap cold starts.

Projects like Soon and Pump Fun are pioneering new paths via "large-scale community launches"—securing endorsements from top KOLs, directly distributing 40%-60% of tokens to communities, launching projects at valuations as low as $10 million, and raising millions in funding. This model leverages KOL influence to build consensus and FOMO, locks in early profits, and trades high circulation for market depth. While sacrificing short-term control advantages, teams can later repurchase tokens cheaply during bear markets via compliant market-making mechanisms. Essentially, this represents a structural paradigm shift—from a VC-dominated hot-potato game (institutional buying → exchange dumping → retail absorption) toward transparent, consensus-based pricing driven by community dynamics, forming a new symbiotic relationship between project teams and communities around liquidity premiums.

Recently, Myshell exemplifies a breakthrough attempt between BNB and project teams. It issued 4% of its tokens via IDO at a mere $20 million market cap. To participate, users needed to purchase BNB and operate through exchange wallets, with all transactions directly recorded on-chain. This mechanism brings new users to wallets while offering fair opportunities in a more transparent environment. For Myshell, market makers ensure reasonable price appreciation. Without sufficient market support, token prices cannot sustain healthy levels. As the project evolves, transitioning gradually from low to high market cap with continuously strengthening liquidity, it gains broader market recognition. The conflict between project teams and VCs centers on transparency. Once launching via IDO, project teams no longer depend on centralized exchange listings, resolving transparency conflicts. On-chain token unlocking becomes more transparent, effectively addressing past利益 conflicts. Meanwhile, traditional CEXs face declining trading volumes due to frequent post-listing price crashes. On-chain data transparency allows exchanges and market participants to better assess real project conditions.

Ultimately, the core conflict between users and project teams lies in pricing and fairness. Fair launches or IDOs aim to meet user expectations regarding token valuation. The fundamental problem with VC coins is insufficient buying demand post-listing, primarily due to misaligned pricing and expectations. The solution lies with project teams and exchanges. Only by fairly allocating tokens to communities and consistently advancing technical roadmaps can projects achieve sustainable value growth.

As a decentralized community organization, Movemaker has received multi-million-dollar funding and resource support from the Aptos Foundation. Movemaker will operate with autonomous decision-making power, aiming to efficiently respond to the needs of Chinese-speaking developers and ecosystem builders, promoting Aptos' further expansion in the global Web3 landscape. Movemaker will lead ecosystem development on Aptos using a community+VC dual-drive model, covering DeFi, deep integration of artificial intelligence and blockchain, innovative payments, stablecoins, and RWA.

About Movemaker

Movemaker is the first official community organization authorized by the Aptos Foundation and jointly initiated by Ankaa and BlockBooster, dedicated to advancing the construction and development of the Aptos Chinese-speaking ecosystem. As the official representative of Aptos in the Chinese-speaking region, Movemaker strives to connect developers, users, capital, and various ecosystem partners to build a diverse, open, and thriving Aptos ecosystem.

Disclaimer: This article/blog is for informational purposes only and represents the author's personal views, not the position of BlockBooster. This article does not constitute: (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, involves extremely high risk, with significant price volatility and potential for total loss. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For specific questions, please consult your legal, tax, or investment advisor. Information provided herein (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in preparing such data and charts, but no responsibility is accepted for any factual errors or omissions expressed therein.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News